American Woodmark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

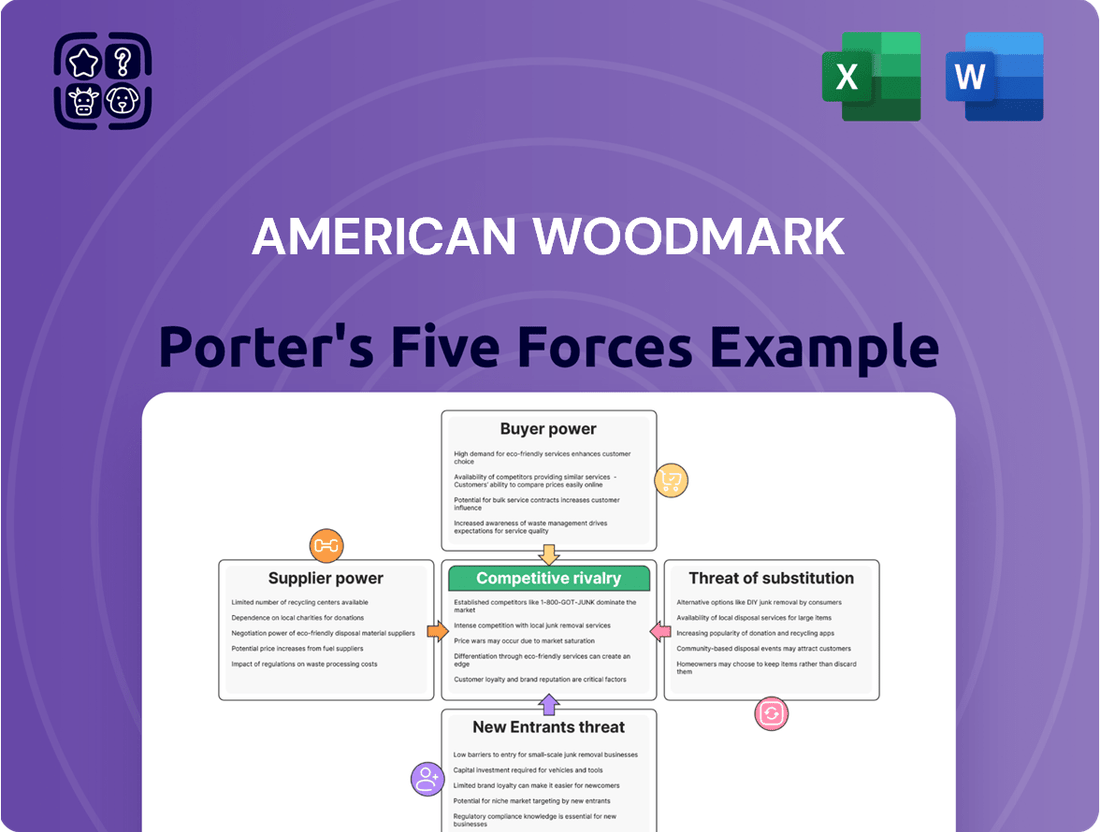

American Woodmark operates in a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes for custom cabinetry. Understanding these dynamics is crucial for navigating the market effectively.

The full Porter's Five Forces Analysis reveals the real forces shaping American Woodmark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the bargaining power of suppliers for American Woodmark. For instance, the market for hardwood lumber, a crucial input, has seen consolidation. In 2024, reports indicated that the top five hardwood lumber suppliers controlled a significant portion of the domestic market, giving them leverage.

The availability of substitute inputs significantly influences the bargaining power of suppliers for American Woodmark. If American Woodmark can easily switch between various wood species like maple, cherry, oak, or birch, or even consider alternative materials such as bamboo or textured laminates, it diminishes the leverage held by any single supplier. For instance, in 2024, the lumber market saw fluctuating prices for different hardwoods, making the ability to source from multiple wood types a strategic advantage for cabinet manufacturers.

American Woodmark's reliance on specific suppliers can influence their bargaining power. If a supplier's business is heavily dependent on American Woodmark, accounting for a substantial portion of their revenue, that supplier's ability to dictate terms may be diminished. For example, if a key lumber supplier derives over 20% of its annual sales from American Woodmark, it's less likely to push for significantly higher prices or less favorable payment terms.

Cost of Switching Suppliers

The costs associated with switching suppliers can significantly influence the bargaining power of those suppliers. For American Woodmark, these switching costs might include retooling manufacturing processes, qualifying new materials, or facing potential disruptions to their supply chains. These expenses can make it less attractive to change suppliers, thereby strengthening the position of existing ones.

American Woodmark aims to mitigate these potential supplier advantages by standardizing its raw material inputs and production processes. This standardization helps reduce logistical requirements and allows the company to achieve economies of scale in its sourcing activities. For instance, by consolidating purchases of specific wood types or hardware components, American Woodmark can negotiate better terms due to the volume of its orders.

- High Switching Costs: If American Woodmark faces substantial costs to change suppliers, existing suppliers gain leverage.

- Standardization Benefits: American Woodmark's standardization of materials and processes aims to lower these switching costs.

- Economies of Scale: Bulk purchasing through standardization enhances American Woodmark's negotiating power with suppliers.

Threat of Forward Integration by Suppliers

If suppliers of raw materials, like lumber or hardware, possess the credible threat of integrating forward into cabinet manufacturing themselves, it can significantly diminish American Woodmark's bargaining power. This means suppliers could potentially start producing cabinets, directly competing with their customers.

However, the high capital requirements and operational complexity inherent in cabinet manufacturing likely serve as a substantial deterrent for most suppliers. Establishing and running a successful cabinet production facility demands significant investment in machinery, skilled labor, and distribution networks, which may outweigh the potential benefits for many raw material providers.

- Supplier Forward Integration Threat: Suppliers moving into cabinet production limits Woodmark's leverage.

- Barriers to Entry for Suppliers: High capital and operational complexity in cabinet making reduce this threat.

- Industry Dynamics: As of early 2024, the cabinet industry continues to see consolidation, potentially increasing the scale of some suppliers, but the fundamental barriers to entry remain.

The bargaining power of suppliers for American Woodmark is influenced by several factors, including supplier concentration, availability of substitutes, and switching costs. In 2024, the lumber market, a key input, experienced consolidation, with a few major suppliers holding significant market share. This concentration can give these suppliers more leverage in price negotiations.

American Woodmark's ability to substitute materials, such as using different wood species or alternative materials like engineered wood products, can mitigate supplier power. However, significant switching costs, including potential retooling or supply chain adjustments, can make it challenging to change suppliers, thereby strengthening existing supplier positions.

| Factor | Impact on Supplier Bargaining Power | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | Higher concentration = Greater power | Top 5 hardwood lumber suppliers controlled a significant portion of the domestic market. |

| Availability of Substitutes | More substitutes = Lower power | Ability to switch between maple, cherry, oak, or engineered wood products reduces leverage. |

| Switching Costs | Higher costs = Greater power for existing suppliers | Retooling, material qualification, and supply chain disruption risks increase supplier leverage. |

What is included in the product

This analysis of American Woodmark examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the cabinet manufacturing industry.

Instantly assess competitive pressures with a visually intuitive Porter's Five Forces analysis, streamlining strategic planning for American Woodmark.

Customers Bargaining Power

American Woodmark's reliance on a few large home centers, such as Home Depot and Lowe's, significantly impacts its bargaining power. These key customers represented about 40.8% of the company's net sales in fiscal year 2025. This concentration means these major retailers hold considerable sway in negotiations, potentially driving down prices or dictating terms.

For individual homeowners, the cost to switch cabinet brands before a purchase is generally low, as they can easily compare options. However, for larger entities like home builders and major retailers, the switching costs are significantly higher. These costs include integrating new suppliers into existing logistics and supply chains, retraining staff, and the potential disruption to project timelines.

Customer price sensitivity is a significant factor for American Woodmark, particularly in the remodeling and new home construction sectors. Economic uncertainties and volatile raw material costs can heighten this sensitivity, pushing buyers towards more budget-friendly choices.

The growing popularity of Ready-to-Assemble (RTA) cabinets directly illustrates this trend, as consumers actively seek cost-effective solutions. In 2023, for instance, the cabinetry market saw continued demand for value-oriented products, reflecting a cautious consumer spending environment amidst persistent inflation.

Availability of Substitute Products

The availability of substitute products significantly enhances customer bargaining power for American Woodmark. Consumers can readily choose from a wide array of cabinet manufacturers, each offering comparable products. This means if American Woodmark's pricing or quality doesn't meet expectations, customers have numerous alternatives to consider, diminishing the company's pricing leverage.

Furthermore, the rise of custom cabinet makers and even non-traditional storage solutions like open shelving presents additional substitutes. These options cater to diverse customer needs and budgets, further fragmenting the market and empowering buyers. For instance, in 2024, the home renovation market saw continued growth, with consumers actively seeking value and exploring various material and design options, including DIY solutions that bypass traditional cabinet suppliers.

- Broad Market Options: Customers can select from numerous national and regional cabinet manufacturers.

- Customization and DIY: The availability of custom builders and DIY-friendly alternatives provides further choice.

- Price Sensitivity: A wide range of substitutes makes customers more sensitive to price fluctuations from American Woodmark.

- Market Trends: In 2024, consumer interest in diverse and cost-effective home improvement solutions remained high, increasing the threat of substitutes.

Threat of Backward Integration by Customers

Large home improvement retailers and major builders possess the potential to engage in backward integration, essentially producing their own cabinetry. This is a significant undertaking, requiring substantial capital investment. For instance, a large national home builder might consider establishing its own cabinet manufacturing facilities to control costs and supply chains.

The existence of private label brands by retailers is a clear indicator of this threat. When a retailer like Lowe's or Home Depot offers its own branded cabinets, it demonstrates their capacity and willingness to bypass traditional manufacturers. In 2024, private label brands continued to gain market share across various retail sectors, reflecting a growing trend of retailers taking more control over their product offerings.

- Capital Intensity: Establishing cabinet manufacturing facilities requires significant upfront investment in machinery, facilities, and skilled labor, acting as a deterrent to many potential integrators.

- Retailer Private Labels: The proliferation of private label cabinetry by major retailers signals their capability and intent to exert greater control over product sourcing and margins.

- Supply Chain Control: Backward integration allows customers to gain direct control over the quality, cost, and availability of cabinets, reducing reliance on external suppliers like American Woodmark.

American Woodmark faces significant customer bargaining power due to its reliance on a few large home centers, which accounted for approximately 40.8% of its net sales in fiscal year 2025. This concentration gives these major retailers considerable leverage in price negotiations and setting terms. Furthermore, the low switching costs for individual homeowners and the availability of numerous substitute products, including custom builders and DIY solutions, empower customers. The trend towards value-oriented products, exemplified by the demand for Ready-to-Assemble cabinets in 2023, underscores customer price sensitivity.

| Customer Type | Switching Costs | Bargaining Power Factor |

|---|---|---|

| Large Home Centers (e.g., Home Depot, Lowe's) | High (logistics, integration, project timelines) | Significant due to sales concentration |

| Major Home Builders | High (supply chain, project continuity) | Moderate to High |

| Individual Homeowners | Low (easy comparison of options) | High due to numerous alternatives |

| DIY Enthusiasts | N/A (self-supply) | Very High (direct bypass) |

Same Document Delivered

American Woodmark Porter's Five Forces Analysis

This preview shows the exact American Woodmark Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This in-depth analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The U.S. cabinetry market is a crowded space, characterized by a significant number of manufacturers vying for market share. This intense competition stems from relatively low barriers to entry in certain segments of the industry.

American Woodmark faces formidable rivals, including large, diversified players like UFP Industries and TopBuild, which have broad product portfolios extending beyond cabinetry. Additionally, dedicated cabinetry manufacturers such as MasterBrand represent direct and substantial competition, often possessing strong brand recognition and extensive distribution networks.

The cabinetry market is poised for expansion, with projections indicating the global cabinet market could reach $12.1 billion by 2024. This growth, estimated to be around a 3% to 6% compound annual growth rate from 2022 to 2027, generally tempers the intensity of competitive rivalry.

However, if growth slows unexpectedly, companies like American Woodmark might face more aggressive competition as players fight harder for a larger piece of a shrinking pie. This dynamic can lead to price wars or increased marketing spend.

American Woodmark differentiates itself through a broad product range, encompassing stock and semi-custom cabinetry across various styles and price tiers. This diverse portfolio, including brands like KraftMaid and Merillat, aims to capture a wide customer base. The effectiveness of this differentiation in the eyes of consumers directly influences how intensely competitors vie for market share.

Exit Barriers

High fixed costs in manufacturing, such as those for specialized equipment and extensive facilities, act as significant exit barriers. These costs can trap companies in the market even when profitability is low, thereby intensifying competitive rivalry. American Woodmark's strategic investments, including a new manufacturing plant in Mexico and an expansion of its North Carolina facility, exemplify these substantial capital outlays.

These substantial investments in physical assets mean that exiting the market would involve significant losses on depreciated or unrecoverable capital. This economic reality encourages companies like American Woodmark to continue operating, even in challenging market conditions, to spread these fixed costs over a larger production volume and avoid outright asset write-offs. This prolonged presence, driven by exit barriers, naturally fuels ongoing competition among players in the wood products industry.

- High Fixed Costs: Specialized manufacturing equipment and extensive plant infrastructure represent substantial sunk costs for companies in the wood products sector.

- Investment in Facilities: American Woodmark's recent investments, such as its Mexico facility and North Carolina expansion, underscore the capital-intensive nature of the industry.

- Intensified Rivalry: The presence of high exit barriers compels companies to remain operational, leading to sustained competition as they seek to cover their fixed costs.

Market Share and Pricing Strategies

American Woodmark's competitive rivalry is shaped by significant market share battles and aggressive pricing strategies. The company's financial performance, including net sales and adjusted EBITDA, has been notably impacted by prevailing market conditions, underscoring the intensity of competition and the resulting pricing pressures.

For fiscal year 2025, American Woodmark is projecting low single-digit growth in net sales, acknowledging the persistent challenges and competitive landscape it anticipates. This cautious outlook reflects the ongoing need to navigate a market where price is often a key differentiator among competitors.

- Intense Competition: The cabinet and countertop industry is fragmented, leading to constant competition for market share.

- Pricing Pressures: Competitors frequently engage in price wars, forcing companies like American Woodmark to adjust their pricing strategies to remain competitive, impacting profit margins.

- Market Share Goals: American Woodmark's stated aim for low single-digit net sales growth in FY2025 indicates a focus on steady, albeit modest, market share expansion in a challenging environment.

American Woodmark operates in a highly competitive environment, facing numerous rivals ranging from large conglomerates to specialized cabinetry manufacturers. This intense rivalry is exacerbated by relatively low entry barriers in some market segments, leading to constant battles for market share and frequent pricing adjustments. The company's strategy of offering a diverse product range, from stock to semi-custom options, aims to capture a broad customer base amidst this competitive pressure.

| Key Competitors | Market Position | Product Focus |

| UFP Industries | Diversified player | Broad product portfolio, including cabinetry |

| TopBuild | Diversified player | Extensive product offerings beyond cabinetry |

| MasterBrand | Dedicated cabinetry manufacturer | Strong brand recognition and distribution |

SSubstitutes Threaten

The threat of substitutes for American Woodmark's core products, kitchen and bath cabinets, is significant. Consumers increasingly opt for alternatives like open shelving, which can offer a more modern aesthetic and potentially lower cost. Freestanding furniture pieces designed for storage also present a viable alternative, providing flexibility and a different design approach. Custom built-ins, often crafted by local carpenters or specialized millworkers, offer bespoke solutions that may bypass traditional cabinet manufacturers altogether.

Shifting consumer tastes present a significant threat. For instance, a growing preference for minimalist aesthetics and specialized spaces like 'posh' pantries, along with integrated storage, could steer buyers away from American Woodmark's traditional cabinet offerings. This trend highlights the potential for substitute products that cater to these evolving design preferences.

Furthermore, the increasing consumer demand for sustainable and eco-friendly materials poses another challenge. As buyers seek alternatives to conventional wood products, companies offering recycled materials or innovative bio-based composites could capture market share, directly impacting the demand for American Woodmark's core products.

The threat of do-it-yourself (DIY) solutions for American Woodmark is growing. The increasing availability of ready-to-assemble (RTA) cabinets and a wealth of online tutorials empower consumers to tackle cabinetry projects themselves. This trend directly challenges the need for professionally manufactured and installed solutions.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitutes is a significant factor for American Woodmark. If alternative storage solutions or DIY options are considerably cheaper, they present a stronger competitive threat. For example, Ready-to-Assemble (RTA) cabinets are gaining traction specifically because of their affordability and ease of use, directly impacting the demand for traditionally manufactured cabinets.

This trend is particularly relevant in 2024. The increasing availability and marketing of RTA cabinets, often sold through online retailers and big-box stores, provide consumers with lower-cost alternatives. This can pressure American Woodmark to either match these price points, potentially impacting margins, or differentiate its products further on quality and service.

- RTA Cabinets: A growing segment offering lower price points than fully assembled cabinets.

- DIY Solutions: Consumers opting for shelving units or custom builds can bypass traditional cabinet manufacturers.

- Price Sensitivity: Economic conditions in 2024 may heighten consumer focus on cost, making cheaper substitutes more attractive.

Technological Advancements in Other Industries

Technological advancements in adjacent sectors present a significant threat of substitutes for American Woodmark's cabinetry. Innovations in smart home technology, for instance, are paving the way for integrated solutions that could diminish the demand for standalone cabinetry. Imagine a future where kitchens and living spaces are designed with built-in, modular storage systems that are part of a larger smart home ecosystem, reducing the need for traditional cabinet units.

Furthermore, the rise of new construction methods and materials could also offer alternative solutions. Think about pre-fabricated modular homes or advanced wall systems that incorporate storage directly into their design, bypassing the need for separate cabinet installations. This trend is already visible with the emergence of smart cabinetry itself, featuring integrated lighting, charging stations, and even digital displays, offering enhanced functionality that traditional cabinets may lack.

- Smart Home Integration: Emerging smart home platforms are increasingly incorporating organizational and storage features, potentially reducing reliance on traditional cabinetry.

- Modular Construction: Advances in modular and pre-fabricated building techniques often include integrated storage solutions, offering an alternative to custom cabinetry.

- Functional Enhancements: New cabinetry designs are incorporating technology like built-in LED lighting and wireless charging, directly competing with the basic function of storage cabinets.

The threat of substitutes for American Woodmark's cabinet products is substantial, driven by evolving consumer preferences and cost-consciousness. Ready-to-Assemble (RTA) cabinets, a key substitute, are gaining popularity due to their affordability, with the RTA segment experiencing steady growth. In 2024, economic pressures may further amplify the appeal of these lower-cost alternatives, forcing manufacturers like American Woodmark to consider price competitiveness or enhanced value propositions.

| Substitute Category | Key Characteristics | Potential Impact on American Woodmark |

|---|---|---|

| RTA Cabinets | Lower price point, DIY assembly | Direct price competition, potential market share loss if not matched on value |

| Open Shelving/Modular Storage | Modern aesthetic, flexibility, potentially lower cost | Shift in design preferences away from traditional cabinets |

| Custom Built-ins (Local Carpenters) | Bespoke solutions, unique craftsmanship | Bypasses mass-market manufacturers for niche segments |

Entrants Threaten

The high capital requirements for setting up a cabinet manufacturing business present a significant hurdle for potential new entrants. Establishing the necessary infrastructure, including advanced machinery for production and a robust distribution network, demands a considerable upfront investment. For instance, American Woodmark has consistently invested in expanding and modernizing its facilities, demonstrating the ongoing need for capital in this industry.

Existing large manufacturers like American Woodmark leverage significant economies of scale in production, raw material sourcing, and distribution networks. This cost advantage makes it exceptionally challenging for new companies to enter the market and compete on price. For instance, American Woodmark's streamlined manufacturing processes and bulk purchasing of standardized inputs contribute to lower per-unit costs.

American Woodmark's established relationships with major home improvement retailers like Home Depot and Lowe's, along with its extensive network of independent dealers and builders, create a significant barrier for new entrants. These long-standing partnerships are crucial for securing shelf space and reaching a broad customer base, making it difficult for newcomers to gain comparable market access.

Brand Loyalty and Customer Relationships

American Woodmark's established brand loyalty and deep-rooted customer relationships present a significant barrier to new entrants. The company has cultivated trust over time through its diverse brand portfolio, making it difficult for newcomers to quickly establish a comparable level of credibility and market penetration. For instance, in fiscal year 2024, American Woodmark continued to emphasize its customer-centric approach, which is a key factor in retaining its existing client base and deterring potential competitors from easily acquiring market share.

New companies entering the market face the considerable challenge of replicating American Woodmark's established customer rapport. Building that level of trust and loyalty requires substantial investment in marketing, product quality, and service over an extended period. This long-term commitment is often a deterrent for potential entrants who may not have the resources or patience to compete against such entrenched relationships.

- Brand Equity: American Woodmark's recognized brands reduce the perceived risk for customers when choosing their products.

- Customer Retention: Long-standing relationships with builders and distributors translate into consistent sales volume, making it harder for new players to secure initial orders.

- Switching Costs: For many customers, the effort and potential disruption involved in switching to a new supplier outweigh the perceived benefits, further solidifying American Woodmark's market position.

Regulatory and Environmental Hurdles

The cabinetry industry, including companies like American Woodmark, navigates a landscape shaped by stringent regulations concerning materials, manufacturing, and environmental impact. These compliance requirements can impose significant upfront costs and ongoing operational complexities, acting as a substantial barrier for potential new entrants seeking to establish a foothold in the market.

For instance, evolving environmental standards, such as those pertaining to volatile organic compound (VOC) emissions from finishes and adhesives, necessitate investment in specialized equipment and formulations. Companies must ensure adherence to regulations like the California Air Resources Board (CARB) standards, which dictate formaldehyde emissions from composite wood products, directly impacting raw material sourcing and production methods.

- Regulatory Compliance Costs: New entrants must budget for obtaining certifications and ensuring products meet standards for safety and environmental impact.

- Environmental Standards: Adherence to VOC limits and formaldehyde emission regulations requires specific manufacturing processes and material choices.

- Capital Investment: Meeting these standards often demands significant investment in updated machinery and research and development for compliant materials.

The threat of new entrants for American Woodmark is moderate, primarily due to substantial capital requirements for manufacturing and distribution, alongside established brand loyalty and distribution networks. While the industry offers attractive margins, the significant upfront investment in plant, equipment, and marketing makes it difficult for smaller players to gain traction. For example, the cost of advanced CNC machinery and setting up a national distribution system can easily run into millions of dollars.

American Woodmark benefits from its established economies of scale, which allow for lower per-unit production costs compared to potential new entrants. Their long-standing relationships with major retailers like Home Depot and Lowe's, secured through consistent quality and reliable delivery, create significant barriers to market access for newcomers. In fiscal year 2024, American Woodmark's focus on operational efficiency and customer relationships continued to solidify its competitive position.

| Barrier to Entry | Impact on New Entrants | Example for American Woodmark |

|---|---|---|

| High Capital Requirements | Significant financial hurdle for establishing production and distribution. | Investment in advanced manufacturing facilities and logistics. |

| Economies of Scale | New entrants struggle to match cost efficiencies of established players. | Bulk purchasing of raw materials and optimized production lines. |

| Brand Loyalty & Customer Relationships | Difficult for new brands to gain consumer trust and secure initial orders. | Long-term partnerships with builders and retailers. |

| Distribution Network Access | Securing shelf space and reaching customers is challenging for new entrants. | Extensive network of dealers and home improvement store partnerships. |

Porter's Five Forces Analysis Data Sources

Our American Woodmark Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, annual reports from industry leaders, and insights from reputable market research firms. We also incorporate data from trade associations and economic indicators to ensure a comprehensive understanding of the competitive landscape.