American Woodmark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

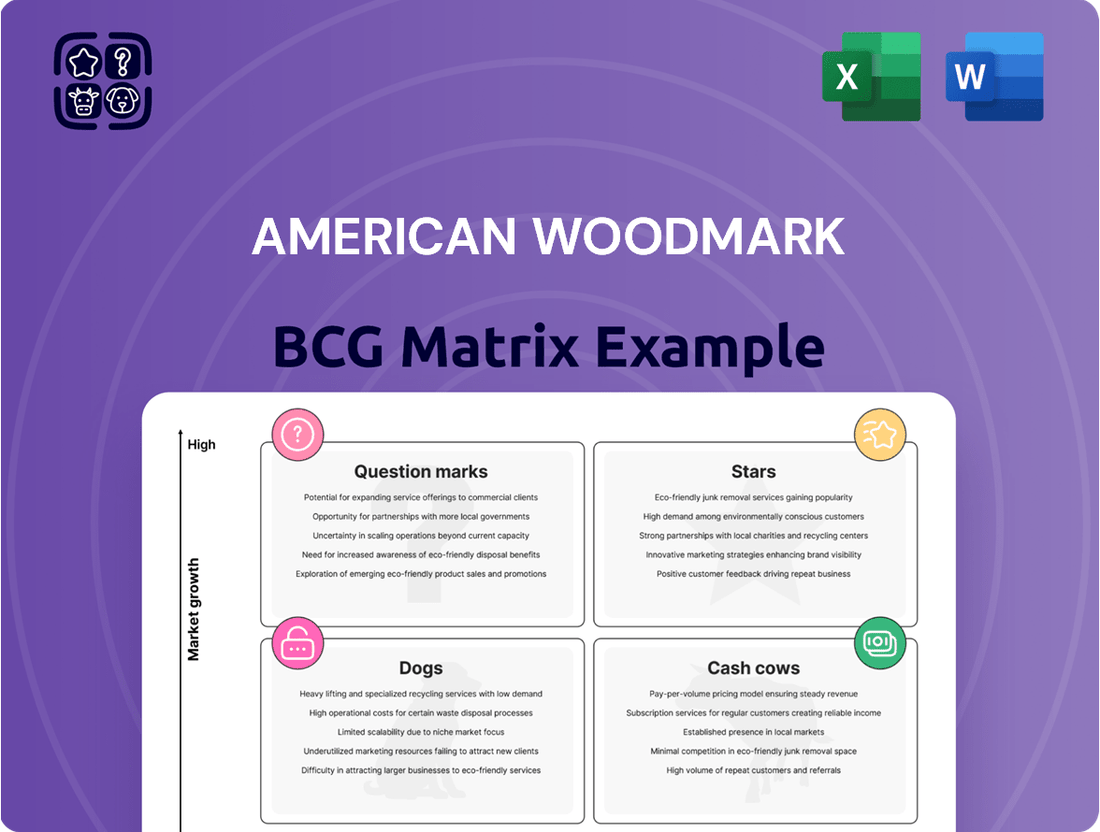

Curious about American Woodmark's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of potential and challenge. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to unlock actionable strategies, purchase the full BCG Matrix report.

Stars

American Woodmark is strategically positioned within the U.S. home remodeling market, with a keen focus on the kitchen and bath segments. These areas are anticipated to show steady growth, with projections indicating continued expansion through 2025 and into the foreseeable future. This robust market environment offers significant opportunities for American Woodmark's product lines to capture greater market share and boost sales.

The custom and semi-custom cabinetry market is a bright spot, showing robust expansion. Even as the overall cabinet sector faced headwinds, custom cabinets saw year-over-year growth, demonstrating resilience and strong consumer interest in tailored solutions.

American Woodmark is well-positioned to capitalize on this trend. Their focus on custom and semi-custom options directly addresses the rising consumer desire for personalized home interiors, enabling them to secure a greater portion of this lucrative and expanding market segment.

The new home construction market is indeed showing promising signs of recovery. Following some earlier dips, forecasts for 2024 indicate a strengthening trend, with projected increases in housing starts. This rebound is expected to drive significant spending in residential improvement and repair as well.

As a major supplier to home builders, American Woodmark's offerings for new construction are well-positioned. The company's products stand to benefit directly from this anticipated upturn and the ongoing demand within the new housing sector.

Strategic Digital Transformation Initiatives

American Woodmark is making significant strides in its digital transformation journey. A key initiative involves the rollout of a new CRM sales solution, designed to streamline customer interactions and enhance sales force effectiveness. This is complemented by an ongoing ERP cloud implementation, which promises to boost operational efficiency across the organization.

These technological investments are strategically aligned with the company's goal of capturing greater market share and fostering sustained growth. By leveraging digital tools, American Woodmark aims to create more personalized customer experiences and develop innovative product and service offerings that resonate with evolving market demands.

- CRM Sales Solution Launch: Enhancing customer engagement and sales productivity.

- ERP Cloud Implementation: Driving operational efficiency and data integration.

- Digitalization for Growth: Positioning technology as a core driver for future market opportunities.

- Customer Loyalty Focus: Utilizing digital tools to strengthen relationships and improve service.

Product Innovation and On-Trend Offerings

American Woodmark is actively refreshing its product catalog to include the latest design preferences and functional enhancements. This includes introducing new door styles, such as the Remy collection, and popular finishes like Cherry Clove, catering to evolving consumer tastes. The company is also adapting to cabinet trends by offering new heights that facilitate stacked installations, a growing demand in modern kitchens.

The company's dedication to staying current with design trends, particularly the move towards minimalist aesthetics and the incorporation of natural materials, ensures its product lineup remains attractive and competitive. This focus on innovation and market alignment is crucial for maintaining momentum in a dynamic market. For instance, in fiscal year 2023, American Woodmark reported net sales of $2.3 billion, underscoring the importance of their product strategy in driving revenue.

- Product Refresh: Introduction of new door styles like Remy and finishes such as Cherry Clove.

- Trend Alignment: Focus on streamlined aesthetics and natural elements in designs.

- Functional Innovation: Offering new cabinet heights to support stacked cabinet trends.

- Market Competitiveness: Commitment to innovation keeps offerings relevant and poised for growth, contributing to their significant net sales.

Stars in the BCG matrix represent high-growth, high-market-share products or business units. For American Woodmark, their custom and semi-custom cabinetry lines, benefiting from strong consumer demand for personalized home interiors, can be considered stars. The company's strategic investments in digital transformation, including a new CRM sales solution and ERP cloud implementation, further solidify their position to nurture these high-potential segments and drive future growth.

What is included in the product

This BCG Matrix overview for American Woodmark details its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights and recommendations for investment, holding, or divestment based on market share and growth.

The American Woodmark BCG Matrix provides a clear, visual representation of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

American Woodmark's dominant home center sales channel, exemplified by its deep ties with giants like Home Depot and Lowe's, serves as a significant cash cow. These relationships are not just transactional; they represent a stable, high-volume distribution network.

In fiscal year 2024, these major home centers were responsible for a substantial 41.6% of American Woodmark's total net sales. This consistent revenue stream from established retail partners underpins the cash-generating power of this segment.

American Woodmark's stock cabinetry segment, largely distributed through home centers, is a bedrock of its operations, consistently generating revenue. This segment benefits from a mature market landscape where the company commands a substantial market share.

The mature nature of the stock cabinetry market, coupled with American Woodmark's strong position, translates into a reliable cash flow. In fiscal year 2023, American Woodmark reported net sales of $2.1 billion, with the stock cabinetry segment being a primary contributor, underscoring its cash cow status.

American Woodmark's investments in expanding its Made-to-Stock manufacturing, including the Monterrey, Mexico facility and the Hamlet, North Carolina expansion, bolster efficiency and capacity for high-volume production. This strategic focus on operational excellence within its core product lines directly translates into strong profit margins and consistent cash flow from its established product categories.

Core Kitchen and Bath Cabinetry Portfolio

American Woodmark's core kitchen and bath cabinetry portfolio represents its established Cash Cows. These foundational product lines consistently meet widespread consumer demand for essential home renovation and construction needs, driving significant and reliable revenue streams for the company.

These offerings are the bedrock of the business, providing a stable income source. For instance, in fiscal year 2023, American Woodmark reported net sales of $2.4 billion, with cabinetry products forming the vast majority of this revenue. This demonstrates the enduring strength and consistent demand for their core kitchen and bath solutions.

- Broad Appeal: The fundamental kitchen and bath cabinetry caters to a wide range of consumers, from new homeowners to those undertaking renovations.

- Consistent Revenue: These product lines are essential in the housing market, ensuring a steady and substantial revenue generation regardless of market fluctuations.

- Market Share: American Woodmark holds a significant position in the cabinetry market, benefiting from brand recognition and established distribution channels for its core products.

- Profitability: As Cash Cows, these segments are expected to generate strong profits with relatively low investment needs, contributing significantly to the company's overall financial health.

Stable Builder Segment Revenue

American Woodmark's direct-to-builder segment is a strong contributor, making up about 42.4% of their net sales in fiscal year 2024. This direct relationship with builders offers a steady and predictable revenue source for the company.

This segment's performance is tied to the broader housing market, specifically housing starts. However, it consistently demonstrates demand for American Woodmark's cabinetry, acting as a reliable generator of cash flow for the business.

- Direct-to-Builder Sales: Accounted for 42.4% of net sales in FY2024.

- Revenue Stability: Provides a significant and relatively stable revenue stream.

- Market Influence: Performance is influenced by housing starts.

- Cash Generation: Contributes reliably to overall cash flow.

American Woodmark's core kitchen and bath cabinetry, particularly its stock cabinetry, functions as a significant cash cow. This segment benefits from established distribution channels, notably through major home centers like Home Depot and Lowe's, which accounted for 41.6% of total net sales in fiscal year 2024.

The direct-to-builder segment also represents a key cash cow, contributing approximately 42.4% of net sales in fiscal year 2024. This channel provides a stable and predictable revenue stream, closely tied to housing market activity.

These product lines are characterized by high volume, mature market positions, and consistent demand, allowing them to generate substantial profits with relatively low investment requirements, thereby fueling the company's overall financial health.

| Segment | FY2024 Net Sales Contribution | Key Characteristics |

| Stock Cabinetry (via Home Centers) | 41.6% | High volume, stable distribution, mature market |

| Direct-to-Builder | 42.4% | Predictable revenue, tied to housing starts |

Preview = Final Product

American Woodmark BCG Matrix

The American Woodmark BCG Matrix preview you are currently viewing is precisely the same comprehensive document you will receive immediately after purchase. This means you'll get the fully formatted, analysis-ready report without any alterations or watermarks, ensuring you have the exact strategic tool you need for informed decision-making.

Dogs

Certain older or less popular product lines within American Woodmark's extensive portfolio might be experiencing a decline. These could be products with a low market share in mature, low-growth segments, struggling to capture consumer interest. For instance, if a particular cabinet style, popular a decade ago, now sees significantly reduced demand, it would fit this category.

These legacy products may not align with current consumer preferences or offer enough unique features to stand out. This lack of appeal can lead to stagnant sales and a minimal impact on the company's overall profitability. Without access to specific internal sales figures for each product line, identifying these exact underperformers remains speculative, but the general trend of evolving consumer tastes is a constant factor in the home furnishings market.

Non-strategic or niche offerings in American Woodmark's portfolio might include highly specialized custom cabinetry lines or products designed for very specific, limited markets. For instance, a line of cabinetry tailored for a particular type of RV manufacturer that has since seen its demand plummet would fit this category. These items often require dedicated production runs and inventory management, consuming resources without generating substantial revenue. In 2024, American Woodmark reported that its Specialty segment, which often encompasses such niche products, experienced a decline in net sales, highlighting the challenges of maintaining profitability in less broadly appealing product categories.

While American Woodmark is actively upgrading its operations, some older facilities may still operate with less efficient machinery or outdated processes. This can lead to higher production costs for the products manufactured in these plants. For instance, if a significant portion of a product line relies on these older facilities, its profit margins could be squeezed, making it a less competitive offering in the market.

Products with Low Brand Differentiation

Products with low brand differentiation, like many basic cabinetry lines, face intense competition. In 2024, the U.S. cabinet market was valued at approximately $13.9 billion, with a significant portion driven by price-sensitive consumers. These offerings often struggle to command premium pricing, impacting profitability.

The challenge for these products is their similarity to numerous competitors. Without a distinct brand story or unique features, they tend to be perceived as commodities. This forces companies to compete primarily on cost, which can erode margins, especially in a market where input costs, like lumber, saw fluctuations throughout 2024.

- Low Brand Identity: These products often lack a memorable brand name or a clear unique selling proposition.

- Price Competition: Competitors frequently engage in price wars, squeezing profit margins for all players.

- Limited Growth Potential: In saturated markets, undifferentiated products find it difficult to expand market share significantly.

- Vulnerability to Market Shifts: Economic downturns can disproportionately affect these products as consumers prioritize lower-cost options.

Segments Impacted by Persistent Market Softness

American Woodmark's portfolio, like many in the building products sector, faces challenges in segments experiencing persistent market softness. Areas heavily reliant on the new construction of entry-level or moderately priced homes, which have seen a slowdown due to affordability concerns and interest rate sensitivity, could be disproportionately affected. For instance, the company's stock experienced a notable decline in early 2024, reflecting broader market anxieties about the housing sector's trajectory.

Specific product categories within American Woodmark's offerings, particularly those catering to the remodeling segment that is sensitive to discretionary consumer spending, might also be under pressure. If these segments continue to face headwinds without a clear path to recovery or strategic investment, they may underperform relative to other parts of the business.

- Impacted Segments: Products tied to new, lower-priced home construction and discretionary remodeling projects.

- Market Headwinds: Rising interest rates and affordability issues impacting demand for entry-level housing.

- Financial Indicator: American Woodmark's stock price movements in early 2024 indicated market concerns about housing demand.

- Strategic Consideration: Continued underperformance in these areas necessitates evaluation for strategic adjustments or investment.

These are American Woodmark's products with low market share in slow-growing or declining markets. They may include older cabinet styles or niche offerings that no longer resonate with consumers. For example, a specific line of laminate countertops, once popular but now superseded by newer materials, could be classified as a Dog. These products often face intense price competition and have limited potential for growth.

In 2024, the U.S. cabinet market, valued at approximately $13.9 billion, saw increased competition in the mid-to-lower price segments, where undifferentiated products struggle. These Dogs consume resources without contributing significantly to profitability and may require divestment or a strategic repositioning to regain relevance.

| Product Category Example | Market Share (Estimated) | Market Growth Rate (Estimated) | Profitability Concern |

|---|---|---|---|

| Legacy Laminate Countertops | Low | Declining | High price sensitivity, low margins |

| Outdated Cabinet Finishes | Low | Stagnant | Lack of consumer demand, high inventory costs |

| Specialty RV Cabinetry | Very Low | Declining | Niche market contraction, specialized production |

Question Marks

The 1951 Cabinetry brand, introduced in March 2024, is strategically positioned to serve distribution customers with a flexible range of products. This new venture targets a burgeoning market segment, emphasizing superior craftsmanship at an accessible price.

While 1951 Cabinetry benefits from operating in a growth channel, its current market share remains modest as it establishes its footprint. Significant financial commitment towards marketing and expanding its distribution network is crucial for its transition from a Question Mark to a Star within the BCG Matrix.

The sustainable and eco-friendly cabinetry market is a burgeoning sector, with projections indicating substantial growth. This presents a clear emerging opportunity for companies like American Woodmark. For instance, the global green building materials market, which includes sustainable cabinetry, was valued at over $280 billion in 2023 and is expected to reach over $500 billion by 2030, demonstrating a strong upward trend.

American Woodmark has recognized the revenue potential within this environmentally conscious segment. However, their current market share in sustainable cabinetry is estimated to be relatively low, placing it in a position that aligns with a question mark in the BCG Matrix. This suggests that while the market is attractive, the company's penetration is still developing.

To capitalize on this growing demand, American Woodmark should consider significant investment in research and development for eco-friendly materials and manufacturing processes. A robust marketing strategy focused on sustainability credentials could help them capture a larger portion of this expanding market, potentially shifting their position from a question mark to a star in the BCG Matrix.

The integration of smart home technology presents a significant opportunity for American Woodmark. As consumers increasingly seek connected living experiences, demand for kitchen and bath cabinetry with smart features, like integrated lighting, charging ports, or voice control, is on the rise. This aligns with the high-growth potential of the smart home market, which is projected to reach $157 billion globally by 2024, according to Statista.

American Woodmark's entry into this space, potentially with cabinetry incorporating energy-efficient technologies or smart storage solutions, would likely place it in a 'Question Mark' category within a BCG Matrix framework. This signifies a high-growth market where the company's current market share may be minimal, necessitating considerable investment in research and development, product innovation, and market education to capture significant adoption.

Targeting 'Pro' Segment with Low-SKU Offerings

American Woodmark's strategic move in fiscal 2024 to introduce a low-SKU, high-value product line in home centers specifically for professional contractors is a key initiative. This targeted approach aims to capture a larger share of the professional market, a segment recognized for its significant growth potential.

This new offering, while promising, currently represents a small fraction of the overall professional market share. Consequently, it requires substantial investment to achieve meaningful scale and compete effectively.

The company's focus on this segment aligns with broader industry trends where specialized, efficient solutions for professionals are in high demand. For example, in 2023, the professional segment of the cabinetry market showed robust growth, outpacing the retail segment.

- Fiscal 2024 Launch: American Woodmark introduced a focused, high-value product assortment designed for professional contractors in home centers.

- National Expansion: This initiative was rolled out nationally, signaling a commitment to the pro segment.

- Market Opportunity: The professional market represents a high-growth area for American Woodmark.

- Current Market Share: As a new offering, it currently holds a low market share, necessitating aggressive investment for growth.

Expansion into Untapped Regional Markets

American Woodmark's strategic expansion into untapped regional markets, particularly those with robust population growth and rising renovation demand, represents a significant opportunity for future growth. For instance, the Southeastern U.S. has seen consistent population increases, with states like Florida and Texas leading the nation in net migration in recent years. This demographic shift directly correlates with increased housing demand and subsequent renovation activity, creating fertile ground for American Woodmark to expand its market share.

These emerging regions, while offering high growth potential, necessitate substantial upfront investment to build brand awareness, establish efficient distribution networks, and tailor product offerings to local preferences. For example, entering a new market might involve setting up new showrooms, forging partnerships with local contractors, and investing in targeted marketing campaigns. The company's ability to successfully navigate these initial challenges will be crucial in capitalizing on the long-term benefits of these expansions.

- Targeted Regions: Focus on areas with above-average population growth and a strong housing renovation market.

- Investment Requirements: Significant capital needed for market entry, including distribution, marketing, and sales infrastructure.

- Potential Returns: High growth potential due to unmet demand and increasing consumer spending on home improvements.

- Competitive Landscape: Analyze existing competitors in these new markets to tailor a competitive strategy.

The 1951 Cabinetry brand, launched in March 2024, targets distribution customers with a flexible product range, aiming for superior craftsmanship at an accessible price point. While operating in a growth channel, its current market share is modest, requiring significant investment in marketing and distribution to evolve from a Question Mark to a Star.

American Woodmark's foray into sustainable cabinetry positions it as a Question Mark, operating in a high-growth market with substantial projected expansion, such as the global green building materials market valued over $280 billion in 2023. Capturing a larger share necessitates investment in R&D for eco-friendly materials and targeted marketing emphasizing sustainability.

The company's introduction of a low-SKU, high-value product line for professional contractors in home centers during fiscal 2024 represents a Question Mark. This initiative targets the high-growth professional market, but currently holds a low market share, demanding aggressive investment to achieve scale and compete effectively.

Expansion into untapped regional markets with strong population growth and renovation demand, like the Southeastern U.S., also places American Woodmark in a Question Mark position. These areas offer high growth potential but require substantial upfront investment for brand building and distribution network establishment.

BCG Matrix Data Sources

Our American Woodmark BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.