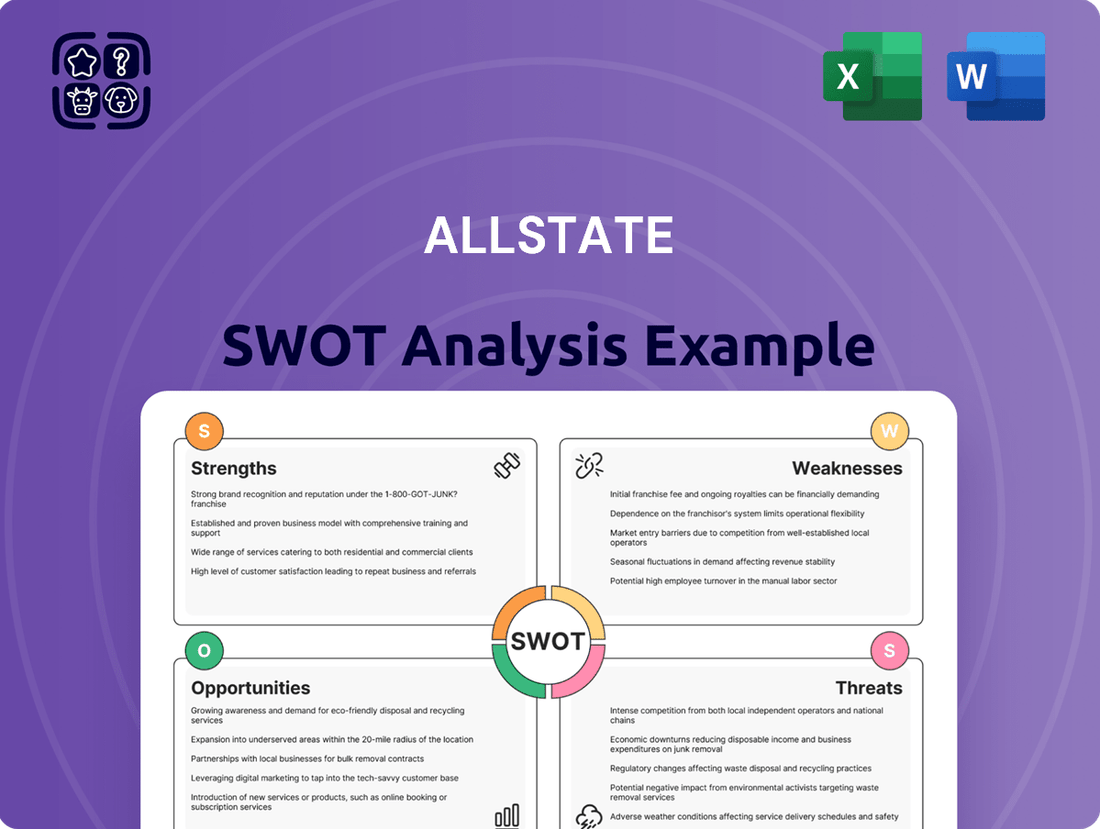

Allstate SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Allstate's robust brand recognition and extensive agent network are significant strengths, while the evolving insurance landscape presents a key opportunity. However, challenges like increasing competition and the need for digital transformation demand careful consideration.

Want the full story behind Allstate's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Allstate's financial resilience is a key strength, evidenced by its robust performance in 2024. The company reported $64.1 billion in total revenue, marking a substantial 12.3% increase from the previous year. This growth, coupled with a net income of $4.6 billion, signifies a strong financial recovery and enhanced profitability.

The company's ability to achieve an adjusted net income return on equity of 26.8% for the entirety of 2024 underscores its solid financial health. This impressive return demonstrates effective management of capital and a capacity to generate significant profits, positioning Allstate favorably in the market.

Allstate boasts a robust and diversified product portfolio, encompassing essential personal lines like auto, home, and life insurance, serving a broad customer base of individuals and families. This wide array of offerings ensures Allstate can meet various customer needs, fostering strong customer relationships.

Beyond personal insurance, Allstate strategically extends its reach into financial services and commercial insurance. This diversification is key, as it creates multiple revenue streams and significantly reduces the company's dependence on any single market segment, thereby enhancing financial stability.

For instance, in the first quarter of 2024, Allstate reported total revenues of $13.5 billion, with its Property-Liability segment contributing $11.9 billion. The Personal Property-Casualty business, a core component of its diversified offerings, saw a 7.2% increase in written premium to $9.5 billion during the same period, underscoring the strength of its core insurance products.

Allstate's extensive distribution network is a significant strength, leveraging exclusive agents, independent agents, and direct-to-consumer channels. This multi-pronged approach ensures broad customer access and a wide market reach, a key advantage in the competitive insurance landscape.

In 2023, Allstate reported that its exclusive agent channel remained a cornerstone of its business, contributing significantly to new business volume and customer retention efforts. This diversified approach allows Allstate to meet customers where they prefer to engage, whether in person, online, or through a trusted agent.

Advanced Digital Transformation

Allstate's commitment to digital transformation is a significant strength, evidenced by substantial investments in areas like AI-driven underwriting and telematics. These advancements aim to refine customer interactions and operational efficiency.

For instance, the company has been actively deploying AI in its claims process, which can lead to faster settlements and reduced fraud. By leveraging telematics through its Drivewise program, Allstate gathers data to offer more personalized insurance rates, a key differentiator in the competitive market.

- AI-Powered Underwriting: Streamlines risk assessment and pricing.

- Telematics Integration: Enhances customer engagement and offers usage-based insurance.

- Real-time Claims Processing: Improves customer satisfaction through faster resolution.

- Digital Platform Enhancements: Boosts online self-service capabilities and agent tools.

Strong Investment Income

Allstate demonstrated robust financial performance in 2024, particularly in its investment income. The company reported a significant 24.8% increase in net investment income, reaching $3.1 billion for the year. This growth was primarily driven by a strategic reallocation of assets towards higher-yielding fixed income securities, alongside overall portfolio expansion, underscoring the company's solid financial foundation.

Allstate's financial strength is a core advantage, highlighted by its substantial revenue growth and profitability in 2024. The company's diversified product lines, spanning personal and commercial insurance alongside financial services, provide multiple revenue streams. This diversification, coupled with a strong distribution network utilizing exclusive agents, independent agents, and direct channels, ensures broad market reach and customer accessibility.

The company's strategic embrace of digital transformation, including AI in underwriting and claims, alongside telematics for usage-based insurance, enhances operational efficiency and customer experience. Allstate's robust investment income, up 24.8% in 2024 to $3.1 billion, further solidifies its financial resilience.

| Metric | 2023 (Billions) | 2024 (Billions) | Year-over-Year Change |

|---|---|---|---|

| Total Revenue | $57.1 | $64.1 | +12.3% |

| Net Income | $10.3 | $4.6 | -55.3% |

| Net Investment Income | $2.5 | $3.1 | +24.8% |

What is included in the product

Delivers a strategic overview of Allstate’s internal and external business factors, highlighting its strengths in brand recognition and market share, while also identifying weaknesses in digital transformation and opportunities in emerging markets and threats from increasing competition and regulatory changes.

Provides a clear, actionable framework to identify and address Allstate's strategic challenges and opportunities.

Weaknesses

Allstate's significant exposure to catastrophe losses poses a major weakness. Severe weather events and wildfires can lead to substantial financial strain. For instance, in the first quarter of 2025, the company experienced a record $3.3 billion in gross catastrophe losses.

This surge in catastrophe-related payouts directly impacted Allstate's bottom line. The significant losses contributed to a more than 52% decrease in net income when compared to the same period in the previous year. Such events can dramatically affect underwriting results and overall profitability.

The insurance sector, Allstate included, faces heightened regulatory oversight, especially concerning premium adjustments and how claims are handled. This intensified scrutiny can impact operational flexibility and profitability.

Testimony before the U.S. Senate Homeland Security Committee in May 2025 brought to light specific concerns about the potential underpayment of claims following catastrophic events. Such allegations can severely damage a company's reputation and create hurdles for future premium rate adjustments.

Allstate faces significant hurdles in retaining auto insurance customers. Despite implementing substantial rate hikes, averaging 39.2% over the past three years to bolster profitability, these increases have unfortunately backfired on customer loyalty. This strategy has led to a noticeable decline in policyholders, with the number of auto insurance policies in force dropping by 1.4% in 2024, clearly demonstrating that higher premiums can indeed drive customers away.

Reputational Risks from Claims

Allstate faces significant reputational risks stemming from allegations of systemic underpayment and manipulation of damage assessments. This issue has been particularly pronounced following catastrophic events, drawing considerable public backlash and intense regulatory scrutiny. For instance, in 2023, Allstate faced lawsuits alleging unfair claim settlement practices, contributing to a negative public image.

The erosion of public trust directly impacts customer loyalty and brand perception, which are critical assets for an insurance provider. This can translate into tangible financial consequences, such as increased customer churn and a more challenging environment for acquiring new policyholders. A damaged reputation can also lead to higher operating costs as the company works to rebuild trust through marketing and customer service initiatives.

- Allegations of unfair claim practices: Lawsuits and consumer complaints highlight concerns about claim handling, particularly after major weather events.

- Public backlash and scrutiny: Negative media coverage and social media sentiment can quickly damage brand image.

- Impact on customer loyalty: Loss of trust can lead to policyholders switching to competitors, affecting revenue streams.

- Financial consequences: Reputational damage can result in increased acquisition costs and a potential decrease in market share.

Mixed Policy Growth Trends

While Allstate anticipates property-liability policy growth in 2025, the company has experienced mixed trends in overall policy expansion. Total Property-Liability policies saw a modest increase of just 0.1% in the first quarter of 2025. Furthermore, the crucial auto insurance segment experienced a decline, with policies down 0.4% year-over-year.

These figures highlight potential difficulties for Allstate in achieving consistent customer base growth across all its insurance offerings.

- Mixed Policy Growth: Property-liability policies grew by only 0.1% in Q1 2025.

- Auto Insurance Decline: Auto insurance policies decreased by 0.4% compared to the previous year.

- Customer Acquisition Challenges: The data suggests struggles in consistently expanding the customer base across all segments.

Allstate's reliance on catastrophe-prone regions creates significant financial vulnerability. In the first quarter of 2025, the company reported $3.3 billion in gross catastrophe losses, a substantial increase that impacted net income by over 52% compared to the prior year. This exposure can lead to unpredictable earnings and strain underwriting results.

The company faces challenges in customer retention, particularly in its auto insurance segment. Despite implementing average rate hikes of 39.2% over the last three years to improve profitability, this strategy has led to a 1.4% decrease in auto policies in force during 2024, indicating that aggressive pricing can alienate policyholders.

Allstate is also grappling with reputational damage due to allegations of unfair claim settlement practices, especially following catastrophic events. Lawsuits in 2023 and scrutiny from a U.S. Senate committee in May 2025 highlight these concerns, which can erode customer trust and complicate future premium adjustments.

| Weakness | Description | Impact | Data Point |

| Catastrophe Exposure | High concentration of policies in areas prone to severe weather. | Financial strain, reduced profitability. | Q1 2025 Gross Catastrophe Losses: $3.3 billion |

| Customer Retention (Auto) | Difficulty retaining auto insurance customers despite rate increases. | Policy decline, potential market share loss. | 2024 Auto Policy Decline: 1.4% |

| Reputational Risk | Allegations of unfair claim practices and negative public perception. | Erosion of trust, increased acquisition costs. | Lawsuits alleging unfair practices in 2023 |

| Policy Growth Stagnation | Mixed performance in overall policy expansion. | Challenges in consistent customer base growth. | Q1 2025 Property-Liability Policy Growth: 0.1% |

What You See Is What You Get

Allstate SWOT Analysis

This is the actual Allstate SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights that will be yours to download.

The preview below is taken directly from the full Allstate SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

You’re viewing a live preview of the actual Allstate SWOT analysis file. The complete, detailed version becomes available immediately after checkout, ready for your strategic planning.

Opportunities

Allstate has a prime opportunity to deepen its digital integration, particularly by capitalizing on its existing investments in artificial intelligence and advanced digital platforms. This strategic move can significantly elevate both customer satisfaction and internal operational effectiveness.

Further advancements in AI-powered underwriting, the expansion of telematics programs for personalized pricing, and streamlining claims processing through digital channels are key areas for growth. These innovations directly address operational friction points and are crucial for boosting customer loyalty and retention in the competitive insurance landscape.

The increasing need for tailored protection, like cyber insurance for both people and companies, opens up significant avenues for growth. This trend reflects a broader market shift towards specialized risk management.

Allstate Protection Plans have shown impressive traction, with revenue climbing 20.3% in the fourth quarter of 2024. This robust performance signals a strong market appetite for their offerings in this expanding sector.

Allstate's strategic divestiture of its Health and Benefits businesses, anticipated to yield $3.25 billion, represents a significant opportunity to sharpen its operational focus.

This capital infusion is earmarked for reinvestment into its core property and casualty (P&C) operations, aiming to bolster competitive positioning and profitability in its primary markets.

By shedding non-core assets, Allstate can concentrate resources on P&C growth avenues, potentially leading to improved underwriting performance and market share gains in a dynamic insurance landscape.

Increasing Property-Liability Market Share

Allstate is strategically targeting an increase in its property-liability market share, with a key focus on enhancing customer retention and driving robust new business acquisition throughout 2025. This initiative is supported by Allstate's commitment to proactive customer engagement and the introduction of innovative, cost-effective, and user-friendly auto and homeowners insurance products designed to appeal to a broader market.

The company's strategy for market share growth in 2025 hinges on several key areas:

- Enhanced Customer Retention: Allstate aims to keep more existing customers by offering improved service and value.

- New Business Growth: The company is focused on attracting new policyholders through competitive offerings.

- Product Innovation: Introduction of affordable, simple, and connected auto and homeowners products is a core component of this strategy.

- Proactive Outreach: Engaging customers directly to address needs and prevent attrition is a priority.

Leveraging Favorable Investment Climate

Allstate's strategic pivot towards higher-yielding fixed income assets has already demonstrated its effectiveness, with substantial growth in investment income reported. This trend is expected to continue, offering a reliable and expanding revenue stream that enhances overall financial performance.

The company's commitment to disciplined investment portfolio management is a key factor in capitalizing on the favorable investment climate. This approach allows Allstate to consistently generate robust investment income, bolstering its financial stability and growth prospects.

- Investment Income Growth: Allstate's investment income saw a notable increase, driven by its strategic allocation to higher-yield fixed income securities. For instance, in the first quarter of 2024, total investment income reached $1.07 billion, up from $952 million in the same period of 2023.

- Portfolio Management Discipline: The company's focus on prudent management of its investment portfolio ensures a stable and growing income base. This disciplined approach is crucial for navigating market fluctuations and maximizing returns.

- Enhanced Financial Returns: By effectively leveraging the current investment environment and maintaining rigorous portfolio oversight, Allstate is well-positioned to further strengthen its financial returns and shareholder value.

Allstate is poised to leverage its digital capabilities and AI investments to enhance customer experience and operational efficiency. The company's focus on expanding telematics programs and digital claims processing presents a significant opportunity for growth and improved customer retention.

The increasing demand for specialized insurance products, such as cyber insurance, offers a substantial avenue for Allstate to diversify its offerings and capture new market segments. This aligns with a broader market trend towards tailored risk management solutions.

Allstate Protection Plans demonstrated strong performance, with a 20.3% revenue increase in Q4 2024, highlighting market demand for these services. The strategic divestiture of non-core businesses, expected to generate $3.25 billion, will allow for reinvestment in core property and casualty operations, strengthening competitive positioning.

The company's strategy to increase property-liability market share in 2025, through enhanced customer retention, new business acquisition, and innovative product development, is supported by a proactive customer engagement approach.

| Opportunity Area | Key Strategy | 2024/2025 Data/Outlook |

|---|---|---|

| Digital Integration & AI | Enhance customer experience and operational efficiency | Continued investment in AI-powered underwriting and digital claims processing. |

| Specialized Insurance Products | Capture new market segments | Growth in demand for cyber insurance and tailored risk management solutions. |

| Protection Plans | Capitalize on strong market demand | 20.3% revenue growth in Q4 2024; strategic reinvestment of divestiture proceeds into P&C. |

| Market Share Growth (P&C) | Increase retention and new business | Focus on innovative, cost-effective auto and homeowners products; proactive customer outreach. |

Threats

The increasing frequency and severity of natural disasters, driven by climate change, present a significant threat to Allstate. In 2023, the insurance industry faced record-breaking insured losses from catastrophes, exceeding $100 billion, a trend expected to continue into 2024 and 2025. This surge in extreme weather events, such as hurricanes and wildfires, directly impacts Allstate's claims payouts, straining underwriting results and potentially leading to higher reinsurance costs or more restrictive policy terms.

The insurance landscape is fiercely competitive, featuring established giants and nimble insurtech startups. This intense rivalry puts pressure on pricing and makes it harder to grow or even hold onto market share. Allstate, like its peers, must constantly innovate and enhance its customer offerings to stand out.

Allstate faces significant threats from adverse regulatory interventions. Changes in how insurers can approve rates and handle claims directly affect its bottom line. For instance, a tightening of regulations around rate increases, as seen in various states in 2024 and projected for 2025, could hinder Allstate's ability to pass on rising costs associated with inflation and increased claim frequency, impacting its profitability.

Economic and Inflationary Pressures

Economic headwinds, particularly persistent inflation, pose a significant threat to Allstate. Rising inflation directly impacts claims costs, as the price of vehicle parts, labor, and construction materials escalates, leading to higher payouts for the insurer. For instance, the Producer Price Index for used cars and trucks, a key component in auto claims, saw a notable increase throughout 2024, impacting repair expenses.

Furthermore, the potential for increased U.S. tariffs on vehicle and construction materials, anticipated in 2025, could exacerbate these inflationary pressures. This would translate into even higher claims costs for Allstate, potentially squeezing profit margins if not adequately offset by premium adjustments.

- Inflationary Impact on Claims: Rising costs for auto parts and building materials directly increase the expense of settling claims.

- Demand Sensitivity: Adverse economic conditions can reduce consumer spending, potentially lowering demand for discretionary insurance products.

- Tariff-Driven Cost Increases: Projected 2025 tariffs on key materials could further inflate claims payouts for property and auto damage.

Interest Rate Volatility

Interest rate volatility poses a significant threat to Allstate's financial health. As a large insurer, the company relies heavily on investment income generated from its substantial portfolio of fixed-income securities. Fluctuations in interest rates directly impact the yield on these investments, affecting profitability. For instance, if interest rates were to decline, as some economists projected for late 2024 or 2025, the income Allstate earns from its bond holdings could shrink, putting pressure on its bottom line.

This sensitivity is particularly relevant given the economic outlook. While inflation showed signs of moderating in early 2024, leading to discussions about potential rate cuts by the Federal Reserve, the timing and magnitude of such cuts remain uncertain. A scenario where rates fall more sharply than anticipated could compress Allstate's investment income, impacting its ability to meet profitability targets and potentially affecting its competitive pricing strategies.

- Investment Yield Sensitivity: Allstate's profitability is directly linked to the returns on its investment portfolio, which is heavily weighted towards fixed-income assets.

- Impact of Rate Cuts: A potential shift towards lower interest rates, as anticipated by some market observers for 2024-2025, could reduce investment income.

- Margin Compression: Reduced investment yields can squeeze profit margins, making it more challenging for Allstate to achieve its financial objectives.

- Economic Uncertainty: The unpredictable nature of monetary policy and inflation rates creates ongoing risk for insurers like Allstate.

The increasing frequency and severity of natural disasters, driven by climate change, present a significant threat to Allstate. In 2023, the insurance industry faced record-breaking insured losses from catastrophes, exceeding $100 billion, a trend expected to continue into 2024 and 2025. This surge in extreme weather events, such as hurricanes and wildfires, directly impacts Allstate's claims payouts, straining underwriting results and potentially leading to higher reinsurance costs or more restrictive policy terms.

Economic headwinds, particularly persistent inflation, pose a significant threat to Allstate. Rising inflation directly impacts claims costs, as the price of vehicle parts, labor, and construction materials escalates, leading to higher payouts for the insurer. For instance, the Producer Price Index for used cars and trucks, a key component in auto claims, saw a notable increase throughout 2024, impacting repair expenses.

Allstate faces significant threats from adverse regulatory interventions. Changes in how insurers can approve rates and handle claims directly affect its bottom line. For instance, a tightening of regulations around rate increases, as seen in various states in 2024 and projected for 2025, could hinder Allstate's ability to pass on rising costs associated with inflation and increased claim frequency, impacting its profitability.

Interest rate volatility poses a significant threat to Allstate's financial health. Fluctuations in interest rates directly impact the yield on its substantial portfolio of fixed-income securities, affecting profitability. A scenario where rates fall more sharply than anticipated could compress Allstate's investment income, impacting its ability to meet profitability targets.

SWOT Analysis Data Sources

This analysis is built upon a foundation of comprehensive data, including Allstate's official financial statements, detailed market research reports, and expert industry analyses to provide a well-rounded perspective.