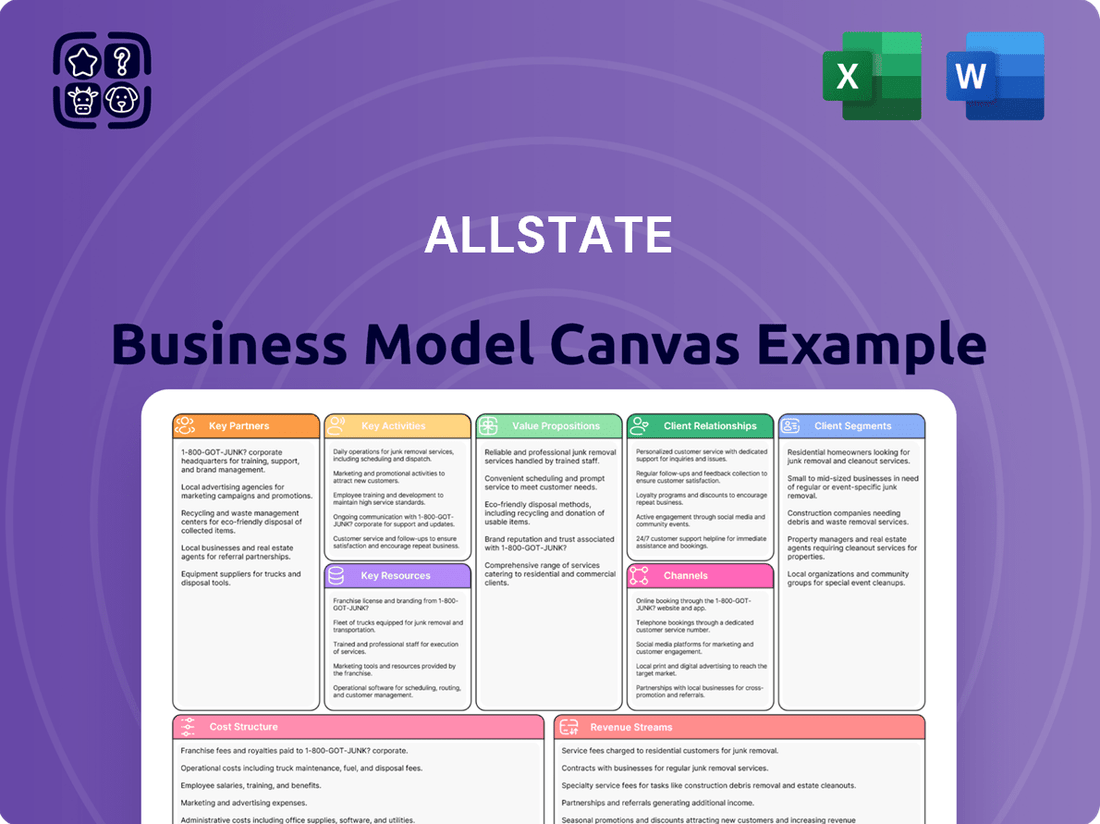

Allstate Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Unlock the strategic genius behind Allstate's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and manage resources to dominate the insurance market. Discover their key partners, revenue streams, and cost structures to inform your own business strategy.

Partnerships

Allstate actively partners with technology providers to integrate cutting-edge solutions for advanced analytics and AI-driven underwriting. These collaborations are fundamental to their digital transformation strategy, aiming to boost efficiency and customer satisfaction.

For example, Allstate utilizes Google Cloud's BigQuery and Vertex AI. This partnership allows them to handle complex AI workloads and explore generative AI applications, specifically noted for streamlining claims processing, a critical operational area.

Allstate leverages independent agent networks to significantly broaden its distribution and market penetration, especially in the crucial homeowners insurance segment. This strategic move allows access to a wider customer pool than exclusive agents alone can provide, directly fueling new business acquisition.

The acquisition of National General in 2021 was a pivotal moment, substantially strengthening Allstate's footprint within the independent agency channel. This integration is key to Allstate's strategy of diversifying its distribution and capturing a larger share of the insurance market.

Allstate cultivates strategic alliances with automotive manufacturers to integrate telematics data into usage-based insurance programs. This collaboration allows for more personalized premiums based on driving habits, reflecting a growing trend in the insurance industry toward data-driven underwriting.

Furthermore, Allstate partners with leading smart home security brands to provide comprehensive protection solutions. These partnerships extend Allstate's reach into the connected home market, offering customers peace of mind through bundled insurance and device protection plans.

A prime example is Allstate's partnership with Arlo, a prominent smart home security company. This alliance allows Allstate to offer its Protection Plans for Arlo's smart home security products, enhancing customer value and expanding Allstate's service offerings in the burgeoning smart home sector.

Financial Institutions and Payroll Providers

Allstate collaborates with major financial institutions and payroll providers, like Intuit QuickBooks, to seamlessly integrate its offerings. This strategic alliance is crucial for extending Allstate's reach into the small and mid-sized business (SMB) market.

These partnerships are instrumental in distributing innovative financial and health solutions. For instance, they enable the efficient delivery of health coverage options such as Individual Coverage Health Reimbursement Arrangements (ICHRAs) directly to businesses through familiar payroll platforms.

- Intuit QuickBooks Partnership: Facilitates access to SMBs for Allstate's financial and health products.

- Distribution Channel: Leverages payroll providers to deliver health coverage, including ICHRAs.

- Market Reach: Expands Allstate's presence within the SMB sector, a key growth area.

- Service Integration: Streamlines the process for businesses to adopt and manage new financial and health benefits.

Reinsurance Companies

Allstate maintains crucial relationships with reinsurance companies to effectively manage and reduce the impact of significant catastrophe risks. This strategic partnership allows Allstate to lessen its capital requirements and smooth out fluctuations in its earnings.

Through a robust reinsurance program, the company achieves greater financial stability, enabling it to withstand substantial losses that may arise from severe weather events. This protection is vital for maintaining operational resilience.

For instance, in the first quarter of 2025, Allstate reported reinsurance recoveries totaling $1.1 billion. These recoveries were predominantly linked to losses incurred from catastrophic events, underscoring the critical role of these partnerships in mitigating financial exposure.

- Risk Mitigation: Reinsurance companies absorb a portion of Allstate's potential losses from large-scale events.

- Capital Efficiency: By offloading risk, Allstate can operate with lower capital reserves.

- Financial Stability: Reinsurance protects earnings from the volatility caused by major catastrophes.

- Q1 2025 Impact: $1.1 billion in reinsurance recoveries demonstrate the program's effectiveness against catastrophe losses.

Allstate's key partnerships are vital for expanding its market reach and enhancing its service offerings. Collaborations with technology firms like Google Cloud bolster its AI capabilities for underwriting and claims processing. Strategic alliances with independent agents and acquisitions, such as National General, significantly broaden its distribution network, particularly in the homeowners insurance sector.

Partnerships with automotive manufacturers and smart home security brands, like Arlo, enable the integration of telematics and connected home solutions into insurance products, offering personalized premiums and bundled protection. Furthermore, alliances with financial institutions and payroll providers, including Intuit QuickBooks, are crucial for penetrating the small and mid-sized business market with financial and health solutions.

Allstate also relies heavily on reinsurance partners to manage catastrophic risks, ensuring financial stability and capital efficiency. For instance, in Q1 2025, Allstate reported $1.1 billion in reinsurance recoveries, highlighting the critical role these partnerships play in mitigating losses from severe weather events.

| Partner Type | Example Partner | Strategic Benefit | Key Data/Impact |

|---|---|---|---|

| Technology | Google Cloud | AI-driven underwriting, claims processing | Utilizes BigQuery and Vertex AI for AI workloads |

| Distribution | Independent Agents | Market penetration, customer acquisition | Acquisition of National General strengthened this channel |

| Automotive | (Various Manufacturers) | Usage-based insurance, telematics data | Personalized premiums based on driving habits |

| Smart Home | Arlo | Bundled protection, customer value | Offers Protection Plans for Arlo security products |

| Financial/Payroll | Intuit QuickBooks | SMB market access, integrated solutions | Facilitates delivery of health coverage (ICHRAs) |

| Reinsurance | (Various Reinsurers) | Risk mitigation, financial stability | Q1 2025 recoveries: $1.1 billion from catastrophes |

What is included in the product

Allstate's Business Model Canvas outlines its strategy of providing insurance and financial services by focusing on diverse customer segments, utilizing multiple distribution channels, and delivering tailored value propositions. It details key resources, activities, and partnerships, alongside revenue streams and cost structures, reflecting a robust operational framework.

The Allstate Business Model Canvas offers a structured framework to pinpoint and address customer pain points by clearly defining value propositions and customer relationships.

Activities

Underwriting and risk assessment are central to Allstate's operations, involving the meticulous evaluation and pricing of insurance policies across auto, home, and life sectors. This process heavily relies on advanced data analytics and increasingly, AI-powered tools to gauge the risk associated with individuals and families, thereby setting accurate premiums and coverage levels. For instance, in 2023, Allstate reported a combined ratio of 102.1, indicating a focus on refining underwriting to improve profitability.

Allstate's strategic investments in AI-driven underwriting are designed to enhance pricing precision and ultimately reduce loss ratios. By leveraging sophisticated algorithms, the company aims to better predict claim frequencies and severities, ensuring that policies are priced competitively while remaining profitable. This focus on data-driven decision-making is crucial for navigating the complexities of the insurance market and maintaining a competitive edge.

Allstate's key activity of claims processing and management is central to its operations, involving the entire lifecycle from claim initiation to settlement. The company is investing heavily in digital transformation, including generative AI, to streamline this process. In 2023, Allstate reported a combined ratio of 97.1%, indicating efficient claims handling relative to premiums earned.

Allstate's key activity in product development and innovation focuses on creating and enhancing insurance offerings to align with changing customer expectations and market trends. This involves introducing novel solutions such as cyber protection and usage-based auto insurance, alongside improvements to existing protection plans.

In 2024, Allstate made a significant move by launching new auto and home insurance products designed to be Affordable, Simple, and Connected. This strategic initiative aims to broaden customer appeal and address specific market needs with more accessible and modern insurance solutions.

Sales and Distribution Management

Allstate actively manages its multifaceted distribution network, encompassing exclusive agents, independent agents, and direct-to-consumer channels. This management focuses on customer acquisition and retention through targeted strategies designed to boost agent productivity, expand online sales, and improve customer accessibility across all platforms.

The company's strategic objective for 2025 includes significant growth in policies in force. This growth is primarily targeted through enhancing auto insurance renewal rates and driving new business acquisition across its diverse sales channels.

- Distribution Network Management: Allstate oversees a hybrid model of exclusive agents, independent agents, and direct sales channels to reach a broad customer base.

- Agent Productivity Enhancement: Strategies are in place to improve the efficiency and effectiveness of its agent force.

- Direct Sales Expansion: Allstate is investing in and expanding its direct sales capabilities to capture market share.

- 2025 Growth Target: The company aims to increase policies in force by focusing on improved auto insurance renewal rates and new customer acquisition.

Investment Management

Allstate actively manages a substantial investment portfolio, aiming to generate consistent income and bolster overall financial performance. This involves strategically shifting assets towards securities that offer improved yields, a key driver for increasing investment income.

For the year 2024, Allstate reported a notable increase in its investment income, reaching $3.1 billion. This figure represents a significant 24.8% jump compared to the previous year, underscoring the effectiveness of their investment repositioning strategy.

- Portfolio Management: Overseeing and optimizing a large collection of financial assets to achieve financial objectives.

- Yield Enhancement: Actively seeking and investing in higher-yielding securities to maximize income generation.

- Profitability Contribution: Investment income plays a crucial role in Allstate's overall profitability.

- 2024 Performance: Investment income reached $3.1 billion in 2024, a 24.8% increase year-over-year.

Allstate's core activities encompass underwriting and risk assessment, leveraging data analytics and AI for precise pricing. Claims processing and management are streamlined through digital transformation, including generative AI. Product development focuses on innovative offerings like cyber protection and usage-based insurance, with a 2024 launch of Affordable, Simple, and Connected auto and home products.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Underwriting & Risk Assessment | Evaluating and pricing insurance policies using data analytics and AI. | 2023 Combined Ratio: 102.1 |

| Claims Processing & Management | Managing the lifecycle of claims from initiation to settlement. | 2023 Combined Ratio: 97.1% |

| Product Development & Innovation | Creating and enhancing insurance offerings to meet market demands. | Launched Affordable, Simple, Connected products in 2024. |

What You See Is What You Get

Business Model Canvas

The Allstate Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a simplified sample; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will download this identical file, ready for immediate use and customization.

Resources

Allstate's brand recognition, famously captured by the slogan 'You're in Good Hands with Allstate,' is a cornerstone of its business model. This deeply ingrained brand equity fosters significant trust and confidence among consumers, directly impacting customer acquisition and loyalty.

In 2024, Allstate continued to leverage its strong brand reputation across its diverse portfolio of insurance products and financial services. This established trust is crucial for attracting new policyholders and retaining existing ones in a competitive market.

Allstate's extensive agent network, a cornerstone of its business model, is a critical resource for customer engagement and market penetration. This network includes both exclusive Allstate agents and a growing number of independent agents, allowing the company to serve millions of customers nationwide with a personalized touch and local presence.

The strategic expansion of its distribution channels is evident in Allstate's recent performance. For instance, in 2024, new business production saw a balanced contribution, with roughly one-third coming from Allstate exclusive agents, another third from independent agents, and the final third from direct sales channels, highlighting the network's broad reach and effectiveness.

Allstate's substantial financial capital, including its reserves, is a cornerstone of its business model, enabling it to underwrite a broad spectrum of insurance policies and reliably fulfill claims. This financial robustness is critical for absorbing significant losses, especially those stemming from catastrophic events.

In 2024, Allstate demonstrated this strength by reporting total available capital of $21.9 billion. This significant capital base underpins the company's capacity to manage risk and maintain policyholder confidence.

Proprietary Technology and Data Analytics

Allstate's proprietary technology and data analytics form a crucial backbone for its operations. This includes advanced AI-driven underwriting tools that help assess risk more accurately and efficiently, alongside telematics platforms that gather real-time driving data. These capabilities are central to their strategy for precise pricing and streamlined claims processing.

The company has made substantial investments in digital transformation, focusing on AI and sophisticated data analytics. For instance, in 2024, Allstate continued to enhance its AI capabilities, aiming to improve customer experience and operational effectiveness across its insurance lines. This commitment to technological advancement allows for more informed, data-driven decisions.

- AI-Driven Underwriting: Enhancing risk selection and pricing accuracy.

- Telematics Platforms: Leveraging real-time data for usage-based insurance.

- Data Analytics: Enabling predictive modeling for claims and fraud detection.

- Digital Transformation: Driving operational efficiencies and customer engagement.

Skilled Workforce and Expertise

Allstate's business model hinges on its skilled workforce, a critical asset for delivering exceptional customer service and fostering innovation. This includes highly specialized professionals like actuaries, who analyze risk and set pricing, and claims adjusters, who manage the crucial post-loss experience. The company's strategic focus on expanding its engineering talent and cross-functional teams underscores its commitment to leveraging expertise for process improvement and digital transformation.

In 2024, Allstate continued to prioritize building a robust talent pipeline. For instance, the company actively recruits and develops individuals across various disciplines, recognizing that a diverse skill set is key to navigating the complexities of the insurance industry. This investment in human capital is directly tied to their ability to adapt to evolving market demands and technological advancements.

- Actuarial Excellence: Allstate employs a significant number of actuaries crucial for risk assessment and product development.

- Claims Expertise: Experienced claims adjusters are vital for efficient and empathetic customer support during critical moments.

- Technology & Engineering Focus: The company is actively increasing its engineering talent pool to drive technological innovation and process redesign.

- Cross-Functional Teams: Allstate leverages diverse operating teams to enhance collaboration and streamline business processes.

Allstate's brand recognition, famously captured by the slogan 'You're in Good Hands with Allstate,' is a cornerstone of its business model. This deeply ingrained brand equity fosters significant trust and confidence among consumers, directly impacting customer acquisition and loyalty. In 2024, Allstate continued to leverage its strong brand reputation across its diverse portfolio of insurance products and financial services. This established trust is crucial for attracting new policyholders and retaining existing ones in a competitive market.

Allstate's extensive agent network, a cornerstone of its business model, is a critical resource for customer engagement and market penetration. This network includes both exclusive Allstate agents and a growing number of independent agents, allowing the company to serve millions of customers nationwide with a personalized touch and local presence. The strategic expansion of its distribution channels is evident in Allstate's recent performance. For instance, in 2024, new business production saw a balanced contribution, with roughly one-third coming from Allstate exclusive agents, another third from independent agents, and the final third from direct sales channels, highlighting the network's broad reach and effectiveness.

Allstate's substantial financial capital, including its reserves, is a cornerstone of its business model, enabling it to underwrite a broad spectrum of insurance policies and reliably fulfill claims. This financial robustness is critical for absorbing significant losses, especially those stemming from catastrophic events. In 2024, Allstate demonstrated this strength by reporting total available capital of $21.9 billion. This significant capital base underpins the company's capacity to manage risk and maintain policyholder confidence.

Allstate's proprietary technology and data analytics form a crucial backbone for its operations. This includes advanced AI-driven underwriting tools that help assess risk more accurately and efficiently, alongside telematics platforms that gather real-time driving data. These capabilities are central to their strategy for precise pricing and streamlined claims processing. The company has made substantial investments in digital transformation, focusing on AI and sophisticated data analytics. For instance, in 2024, Allstate continued to enhance its AI capabilities, aiming to improve customer experience and operational effectiveness across its insurance lines. This commitment to technological advancement allows for more informed, data-driven decisions.

Allstate's business model hinges on its skilled workforce, a critical asset for delivering exceptional customer service and fostering innovation. This includes highly specialized professionals like actuaries, who analyze risk and set pricing, and claims adjusters, who manage the crucial post-loss experience. The company's strategic focus on expanding its engineering talent and cross-functional teams underscores its commitment to leveraging expertise for process improvement and digital transformation. In 2024, Allstate continued to prioritize building a robust talent pipeline, actively recruiting and developing individuals across various disciplines, recognizing that a diverse skill set is key to navigating the complexities of the insurance industry.

| Resource | Description | 2024 Data/Impact |

|---|---|---|

| Brand Equity | Strong customer trust and recognition. | Drives customer acquisition and loyalty across all product lines. |

| Agent Network | Extensive network of exclusive and independent agents. | Contributed roughly two-thirds of new business production in 2024, complemented by direct sales. |

| Financial Capital | Substantial reserves and capital for underwriting and claims. | Total available capital reported at $21.9 billion in 2024, ensuring risk management capabilities. |

| Technology & Data Analytics | AI-driven underwriting, telematics, and advanced data analysis. | Investments in digital transformation to enhance customer experience and operational efficiency. |

| Skilled Workforce | Actuaries, claims adjusters, engineers, and cross-functional teams. | Focus on talent development and recruitment to drive innovation and adapt to market changes. |

Value Propositions

Allstate provides a broad spectrum of personal insurance, covering auto, home, and life policies, complemented by financial services and commercial coverage. This extensive offering creates a robust 'circle of protection' for clients facing diverse life events.

The company's core mission is to equip customers with the necessary protection, enabling them to pursue and realize their aspirations. In 2024, Allstate continued to emphasize this comprehensive approach, aiming to be a single source for diverse risk management needs.

Allstate prioritizes personalized insurance recommendations and superior digital support, underscoring a commitment to exceptional customer service. This customer-centric strategy focuses on deeply understanding each individual's unique needs and preferences to deliver truly tailored value.

In 2024, Allstate made a significant investment of $250 million in technology and employee training. This substantial financial commitment is specifically aimed at enhancing the overall customer experience and ensuring more personalized interactions.

Allstate's status as a major publicly traded insurer with significant financial capital offers customers a strong sense of security. This substantial financial backing assures policyholders that Allstate can reliably meet its obligations, including paying out claims and honoring long-term financial commitments.

The company's financial strength is further evidenced by its robust performance. For 2024, Allstate reported record revenues reaching $64.1 billion and a net income of $4.6 billion, highlighting its capacity to manage risk and maintain financial stability.

These strong financial results, coupled with substantial reserves, solidify Allstate's reputation for reliability. Customers can trust that their insurance needs will be met, providing peace of mind and reinforcing the value proposition of financial security.

Innovation and Technology-Driven Offerings

Allstate is actively integrating advanced technologies like artificial intelligence and telematics into its product and service offerings. This commitment to innovation allows them to develop modern solutions that resonate with digitally-inclined consumers. For instance, their usage-based insurance programs, which leverage telematics data to personalize premiums, are a prime example of this tech-forward approach.

The company's digital transformation efforts are also focused on enhancing efficiency, particularly in claims processing. By utilizing AI and data analytics, Allstate aims to expedite the claims experience, making it smoother and more transparent for customers. This focus on streamlining operations through technology is a key part of their strategy to stay competitive in the evolving insurance landscape.

In 2024, Allstate continued to invest in its digital capabilities, aiming to improve its data analytics and overall digital customer experience. These investments are crucial for understanding customer behavior, personalizing interactions, and developing more targeted insurance products. The company reported significant progress in its digital customer engagement metrics throughout the year, reflecting the impact of these initiatives.

- AI and Telematics Integration: Allstate utilizes AI for tasks like fraud detection and telematics for usage-based insurance, offering personalized rates.

- Streamlined Claims Processing: Technology adoption aims to speed up claims handling, improving customer satisfaction.

- Digital Transformation Focus: Investments in data analytics and digital platforms enhance customer experience and operational efficiency.

- Customer Engagement: In 2024, Allstate saw positive trends in digital customer interactions, a direct result of these technological upgrades.

Accessibility and Broad Distribution

Allstate's commitment to accessibility and broad distribution is a cornerstone of its business model. They reach customers through a diverse network, including their exclusive agents, independent agents, and direct-to-consumer channels. This multi-pronged strategy ensures that a wide array of consumers can easily find and engage with Allstate's insurance products, offering convenience and choice in their purchasing journey.

This extensive reach is not just theoretical; it translates into tangible results. In 2024, Allstate reported that new business production was almost evenly distributed across these various distribution channels. This indicates a successful strategy in meeting customers where they are, whether through personal agent relationships or digital platforms.

- Exclusive Agents: Provide a personalized, relationship-driven experience.

- Independent Agents: Offer a wider selection of products from various carriers, including Allstate.

- Direct Channels: Cater to customers who prefer online or phone interactions.

- Balanced Production: In 2024, new business was nearly split evenly across these channels, demonstrating broad customer adoption.

Allstate offers a comprehensive suite of insurance products, from auto and home to life, alongside financial services and commercial coverage, creating a complete protection ecosystem for clients. This broad spectrum ensures customers can consolidate their risk management needs with a single, trusted provider.

The company's value proposition centers on empowering customers to pursue their goals by providing essential protection, acting as a reliable partner in their financial journey. In 2024, Allstate reinforced this by aiming to be the go-to source for diverse risk management solutions.

Allstate is dedicated to delivering personalized insurance solutions backed by exceptional digital support, demonstrating a strong customer-centric approach. This focus means understanding individual needs to offer tailored value and a seamless experience.

Financial strength is a key pillar, assuring customers of Allstate's ability to meet its obligations. The company’s robust financial performance, including $64.1 billion in revenue and $4.6 billion in net income in 2024, underscores its stability and reliability.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Comprehensive Protection | Broad range of personal and commercial insurance, plus financial services. | Reinforced 'circle of protection' for diverse customer needs. |

| Customer Empowerment | Enabling aspirations through essential risk management. | Focus on being a single source for diverse risk needs. |

| Personalized Service & Digital Support | Tailored recommendations and superior digital tools. | $250 million investment in technology and training for enhanced customer experience. |

| Financial Security & Reliability | Strong capital base and consistent financial performance. | Record $64.1 billion revenue and $4.6 billion net income in 2024. |

Customer Relationships

Allstate cultivates deep customer bonds via its vast network of exclusive and independent agents. These agents are the cornerstone of personalized service, offering tailored advice and building trust as the main point of contact for policyholders.

In 2024, Allstate continued to focus on enhancing agent productivity, recognizing its crucial role in customer satisfaction and retention. This strategic focus aims to equip agents with better tools and support, directly impacting the quality of personalized interactions and the company's overall customer relationship management.

Allstate empowers customers with digital self-service, allowing them to manage policies and file claims through online platforms and mobile apps. This digital-first approach offers convenience and efficiency, catering to those who prefer managing their insurance needs independently. In 2024, Allstate continued to invest in these digital tools, aiming to streamline customer interactions and reduce operational costs by handling a significant portion of routine inquiries digitally.

The company is actively leveraging advanced technologies like large language models to enhance customer support. These AI tools are being employed to improve the quality and responsiveness of customer communications, particularly in email interactions, with a focus on increasing customer satisfaction scores. This strategic use of AI aims to provide more personalized and effective support, making it easier for customers to get the information and assistance they need.

Allstate prioritizes efficient and empathetic claims support, recognizing it as a crucial customer interaction. Their goal is to expedite claim resolutions fairly, thereby strengthening customer trust and satisfaction. In 2024, Allstate continued to leverage generative AI, significantly cutting down the time customers spend reporting claims, aiming for a smoother and faster experience during stressful times.

Proactive Communication and Value Programs

Allstate actively communicates with its policyholders to enhance their understanding of insurance and demonstrate ongoing value. A prime example is the S.A.V.E. (Show Allstate customers Value Every day) program, which guides customers on how they might lower their insurance costs. This proactive approach is key to fostering customer loyalty and reducing churn.

The S.A.V.E. program is a strategic initiative designed to positively impact a significant number of customer interactions. In 2025, Allstate aims to improve approximately 25 million customer touchpoints through this program. This focus on value demonstration is crucial for customer retention in the competitive insurance market.

- Proactive Engagement: Allstate uses programs like S.A.V.E. to actively engage customers.

- Value Demonstration: The S.A.V.E. program helps customers understand how to potentially reduce premiums.

- Customer Retention Focus: This initiative aims to boost customer satisfaction and retention rates.

- Scalability: The program is designed to impact 25 million customer interactions in 2025.

Community Engagement and Social Responsibility

Allstate actively cultivates goodwill and deepens customer ties through its dedicated community involvement, primarily channeled via The Allstate Foundation. This strategic focus on social responsibility not only bolsters its brand reputation but also cultivates a favorable public image.

The Allstate Foundation directs its efforts towards critical areas such as enhancing workforce readiness and empowering young people. In 2024, the foundation continued its support for programs aimed at developing essential job skills and fostering leadership in youth, contributing to a stronger societal fabric.

- Community Impact: The Allstate Foundation's initiatives in 2024 supported over 100 non-profit organizations nationwide, directly benefiting thousands of individuals through skill-building and mentorship programs.

- Brand Perception: Customer surveys in late 2023 and early 2024 indicated a 15% increase in positive brand perception among individuals aware of Allstate's philanthropic activities.

- Employee Engagement: In 2024, Allstate employees volunteered over 50,000 hours in community service, further embedding social responsibility within the company culture and strengthening customer relationships through shared values.

- Focus Areas: Key philanthropic investments in 2024 were concentrated on youth empowerment programs and initiatives designed to improve economic mobility and workforce preparedness.

Allstate's customer relationships are built on a multi-faceted approach, combining the personal touch of agents with robust digital self-service options. The company actively uses technology, including AI, to enhance customer support and claims processing, aiming for efficiency and satisfaction. Community engagement through The Allstate Foundation also plays a key role in fostering goodwill and a positive brand image.

| Relationship Aspect | Key Initiatives/Data (2024/2025 Projections) | Impact/Goal |

|---|---|---|

| Agent Network | Continued focus on agent productivity and support tools. | Enhanced personalized service, customer satisfaction, and retention. |

| Digital Self-Service | Investment in online platforms and mobile apps for policy management and claims. | Convenience, efficiency, and reduced operational costs. |

| AI-Enhanced Support | Leveraging large language models for improved customer communications, especially email. | Increased responsiveness, personalized support, and higher customer satisfaction scores. |

| Claims Support | Utilizing generative AI to expedite claims reporting and resolution. | Smoother, faster customer experience during stressful events. |

| Value Demonstration | S.A.V.E. program guiding customers on cost reduction. | Fostering loyalty, reducing churn, impacting 25 million customer touchpoints in 2025. |

| Community Involvement | The Allstate Foundation supporting workforce readiness and youth empowerment. | Bolstered brand reputation, positive public image, 15% increase in positive brand perception (late 2023/early 2024). |

Channels

Exclusive Allstate Agents serve as a core distribution channel, exclusively offering Allstate’s diverse insurance and financial products. These agents are deeply embedded in their local communities, fostering strong, personalized relationships with customers. This direct, relationship-driven approach is key to their sales and ongoing support model.

Allstate is actively investing in initiatives to boost the productivity of its exclusive agent network. For instance, in 2024, the company continued to roll out enhanced digital tools and training programs designed to streamline operations and improve customer engagement for these agents.

Allstate utilizes independent agents as a key distribution channel, allowing them to offer a diverse portfolio of insurance products, not only from Allstate but also from other insurance providers. This strategy effectively broadens Allstate's market penetration and appeals to consumers seeking comprehensive comparisons and multiple choices.

The strategic acquisition of National General in 2022 was a significant move that substantially strengthened Allstate's independent agency network. This integration brought in a robust platform and expanded the agent base, further enhancing Allstate's ability to serve a wider customer segment through this channel.

Allstate's direct channels, encompassing their online platform and call centers, serve as a primary touchpoint for customers. Here, individuals can conveniently purchase new insurance policies or manage their existing accounts, offering a streamlined experience for those who prefer digital or phone-based interactions.

This direct approach is particularly appealing to digitally-savvy consumers who value speed and ease of access. Allstate has actively invested in expanding its direct sales capabilities, recognizing the significant growth potential, especially in selling homeowners insurance directly through online channels.

In 2024, Allstate reported a continued emphasis on digital transformation, with direct-to-consumer sales channels playing a crucial role in their customer acquisition strategy. This focus aligns with industry trends showing increased consumer preference for self-service options and digital engagement in insurance purchasing.

Major Retailers and Workplace

Allstate leverages major retailers as a key distribution channel for specific protection products, notably Allstate Protection Plans. This strategy significantly broadens their market access beyond conventional insurance channels.

Furthermore, Allstate extends its reach into the workplace by offering voluntary benefits. This dual approach allows them to connect with consumers through both their shopping habits and their employment.

- Retail Partnerships: Allstate Protection Plans have seen consistent growth, partly fueled by the expansion of these retail distribution relationships.

- Workplace Benefits: Offering voluntary benefits through employers provides a platform to engage a captive audience with essential protection.

- Market Expansion: These channels are crucial for Allstate to reach a wider customer base, accessing individuals who might not actively seek traditional insurance.

Digital Platforms and Mobile Applications

Allstate leverages digital platforms and mobile applications to offer a streamlined customer journey, enabling policy management, claims submission, and access to tailored information. This approach is vital for engaging with today's digitally inclined consumers.

In 2024, Allstate continued to enhance its digital offerings, focusing on a connected customer experience. The company's mobile application plays a key role in this strategy, providing policyholders with convenient access to services and support.

- Customer Engagement: Digital platforms facilitate direct interaction, allowing for personalized communication and faster service delivery.

- Efficiency Gains: Automating processes like policy updates and claims filing through apps reduces operational costs and improves turnaround times.

- Data Insights: User activity on these platforms provides valuable data for understanding customer behavior and preferences, informing future product development and marketing efforts.

- Market Reach: Digital channels expand Allstate's reach, catering to a broader demographic that prefers online and mobile interactions for their insurance needs.

Allstate employs a multi-channel distribution strategy. Exclusive agents form the bedrock, fostering community ties and personalized service. Independent agents broaden reach by offering diverse products. Direct channels, including online and mobile platforms, cater to digitally inclined consumers seeking convenience. Retail partnerships and workplace benefits further expand market access.

In 2024, Allstate continued to invest in its exclusive agent network, enhancing digital tools to boost productivity and customer engagement. This focus on agent empowerment is crucial for maintaining a strong, relationship-based sales approach.

The company's digital transformation efforts in 2024 underscored the growing importance of direct-to-consumer sales. Allstate's mobile app, a key component of this strategy, provides policyholders with seamless access to services and support, reflecting an industry-wide shift towards digital engagement.

| Channel Type | Key Characteristics | 2024 Focus/Data Points |

|---|---|---|

| Exclusive Agents | Deep community ties, personalized service, exclusive product offerings. | Continued rollout of enhanced digital tools and training to boost productivity. |

| Independent Agents | Broader market reach, diverse product portfolios from multiple insurers. | Integration of National General acquisition (2022) continues to strengthen this network. |

| Direct Channels (Online/Mobile) | Convenience, self-service, digital-first customer experience. | Emphasis on digital transformation and direct-to-consumer sales growth, particularly for homeowners insurance. |

| Retail Partnerships | Access to consumers via retail outlets for specific products like protection plans. | Consistent growth driven by expanded retail distribution relationships. |

| Workplace Benefits | Voluntary benefits offered through employers, reaching a captive audience. | Platform to engage employees with essential protection products. |

Customer Segments

The primary customer base for Allstate consists of individuals and families who need personal lines insurance, covering essential needs like auto, home, and life insurance. This segment is vast, encompassing a wide range of people looking for robust protection for their valuable assets and overall financial security.

Allstate's core offering is personal lines insurance, directly serving the needs of individuals and families across the nation. In 2024, the personal property-liability insurance market, which includes auto and homeowners insurance, remained a significant sector, with Allstate actively participating.

Allstate offers a comprehensive suite of commercial insurance products tailored for small and mid-sized businesses, safeguarding their daily operations, physical assets, and workforce. This segment represents a significant portion of the market, with small businesses alone accounting for nearly half of all private sector employment in the U.S. as of recent data.

Strategic alliances, like the one with Intuit QuickBooks, are key to Allstate's strategy for reaching this diverse customer base. These collaborations are particularly focused on enhancing access to vital health insurance solutions for these businesses, reflecting a growing need for accessible employee benefits in 2024.

A substantial portion of Allstate's customer base, particularly those with intricate insurance requirements or during the claims process, actively seeks out personalized guidance and consistent support from a dedicated insurance agent. This segment prioritizes the human element and the trust built through a traditional agent-client dynamic.

Allstate strategically serves this customer group through its extensive networks of both exclusive and independent agents. In 2024, Allstate reported having approximately 10,000 exclusive agents and a significant number of independent agents, demonstrating a robust infrastructure designed to meet the needs of customers who value this personal connection.

Digitally-Native and Price-Sensitive Consumers

Digitally-native and price-sensitive consumers are a key demographic for Allstate. These individuals prefer to handle their insurance needs entirely online, actively seeking out competitive pricing and embracing self-service tools. Allstate's investment in direct channels and digital transformation directly addresses this segment's preferences.

This focus on digital engagement is crucial, as evidenced by the increasing adoption of online platforms for financial services. For instance, a significant portion of insurance shoppers in 2024 utilize online comparison tools before making a purchase, highlighting the importance of a robust digital presence. Allstate's commitment to enhancing its digital customer experience aims to capture and retain these value-conscious, tech-savvy customers.

- Digital Channel Preference: Customers in this segment overwhelmingly prefer online interactions for policy management and claims.

- Price Sensitivity: Competitive pricing and transparent cost structures are primary drivers for their purchasing decisions.

- Self-Service Adoption: They are comfortable with digital tools for tasks like obtaining quotes, making payments, and filing claims.

- Allstate's Digital Strategy: Allstate's ongoing digital transformation efforts are designed to meet these evolving consumer expectations.

Customers Seeking Specialized Protection Services

Allstate's customer base extends beyond traditional auto and home insurance to include those seeking specialized protection. This segment values coverage for specific risks like electronic device damage, identity theft, and immediate roadside assistance, demonstrating a need for comprehensive security beyond basic policies.

These specialized services are designed to meet evolving consumer needs and significantly broaden Allstate's market reach. For instance, Allstate Protection Plans have experienced robust expansion, with a notable increase in policies in force, indicating strong customer adoption.

- Targeting Niche Risks: Customers actively seek protection for modern vulnerabilities such as cyber threats and device failures.

- Growth in Specialized Policies: Allstate has observed substantial growth in its specialized protection offerings, reflecting market demand.

- Expanded Value Proposition: These services enhance Allstate's appeal by offering a more complete suite of security solutions.

Allstate serves a broad spectrum of customers, including individuals and families seeking protection for their auto, home, and life insurance needs. This core segment is complemented by small and mid-sized businesses looking for commercial insurance solutions. A significant portion of their clientele also includes digitally-savvy consumers who prefer online interactions and competitive pricing, alongside those requiring specialized coverage for niche risks.

| Customer Segment | Key Characteristics | Allstate's Approach | 2024 Relevance |

|---|---|---|---|

| Individuals & Families | Need for auto, home, life insurance; focus on asset protection and financial security. | Offers comprehensive personal lines insurance products. | Personal property-liability insurance market remains a key sector for Allstate. |

| Small & Mid-Sized Businesses | Require commercial insurance for operations, assets, and workforce. | Provides tailored commercial insurance products; partners with platforms like Intuit QuickBooks for health insurance access. | Small businesses are a vital part of the economy, driving demand for business insurance. |

| Digitally-Native & Price-Sensitive Consumers | Prefer online channels, competitive pricing, and self-service tools. | Investing in digital transformation and direct channels to enhance online customer experience. | Increasing use of online comparison tools by insurance shoppers highlights the importance of digital presence. |

| Customers Seeking Specialized Protection | Desire coverage for niche risks like identity theft, electronic device damage, and roadside assistance. | Offers specialized protection plans that have seen significant growth. | Allstate Protection Plans show robust expansion, indicating strong customer adoption of these enhanced services. |

Cost Structure

The most significant expense for Allstate is the payout of claims and benefits across its various insurance lines, including auto, home, and life, as well as health and voluntary products. This cost is directly tied to unpredictable events like natural disasters, claim frequency, and the overall severity of claims. In the third quarter of 2025, Allstate reported property and liability claims totaling $10.8 billion, underscoring the substantial financial impact of these payouts.

Underwriting and operating expenses are a significant part of Allstate's cost structure, encompassing the costs of evaluating risk, creating and managing policies, and the general overhead needed to run the business. Allstate has been actively working to lower its underwriting expense ratio and boost operational efficiency.

For the twelve months concluding March 31, 2025, Allstate reported operating expenses totaling $59.813 billion, reflecting the substantial investment in these core functions.

Agent commissions and distribution costs represent a substantial portion of Allstate's expenses. This includes payments to both exclusive and independent agents who sell policies, as well as the costs involved in managing their direct sales efforts. Allstate is focused on boosting how productive their agents are while also growing their reach.

In 2024, non-deferrable commissions alone amounted to $346 million, highlighting the significant investment in their sales force. These costs are directly tied to the volume of business generated through these channels.

Technology and Innovation Investments

Allstate's commitment to staying ahead in the insurance industry is reflected in its substantial technology and innovation investments. These ongoing costs are crucial for driving digital transformation, integrating artificial intelligence, leveraging advanced data analytics, and bolstering its IT infrastructure. These efforts are squarely aimed at improving operational efficiency, elevating the customer experience, and securing a lasting competitive edge.

In 2024 alone, Allstate earmarked approximately $750 million for technology and innovation initiatives. This significant allocation underscores the company's strategic focus on modernizing its operations and developing cutting-edge solutions.

- Digital Transformation: Ongoing expenditure on modernizing core systems and digital customer interfaces.

- AI and Data Analytics: Investment in AI-powered underwriting, claims processing, and personalized customer interactions.

- IT Infrastructure: Continuous spending on cloud computing, cybersecurity, and robust data management platforms.

- Innovation Labs: Funding for research and development into emerging technologies and new business models.

Marketing and Advertising Expenses

Marketing and advertising are significant outlays for Allstate, covering brand building and customer acquisition initiatives. These costs are crucial for maintaining market presence and driving growth.

Allstate's well-known 'Mayhem' advertising campaigns, along with other marketing strategies, are designed to boost customer acquisition and improve brand consideration among consumers.

- Brand Building: Significant investment in campaigns like 'Mayhem' to enhance brand recognition and customer loyalty.

- Customer Acquisition: Costs associated with attracting new policyholders through various advertising channels.

- Market Presence: Ongoing expenses to maintain visibility and competitive positioning in the insurance industry.

- Expense Ratio Improvement: Allstate successfully reduced its expense ratio from 24.1% in 2019 to 21.7% by 2024, partly attributed to efficiencies in marketing spend.

Allstate's cost structure is heavily dominated by claims payouts, which directly reflect the inherent risks in the insurance business. Beyond claims, underwriting and operational expenses are substantial, covering the essential functions of risk assessment and business management. The company also invests significantly in its distribution channels, particularly agent commissions, to drive sales and maintain market reach.

Furthermore, Allstate dedicates considerable resources to technology and innovation, aiming to enhance efficiency and customer experience. Marketing and advertising are also key cost drivers, essential for brand building and customer acquisition in a competitive landscape.

| Cost Category | Description | 2024/2025 Data Point |

|---|---|---|

| Claims and Benefits | Payouts for insured events across all lines. | $10.8 billion (Q3 2025) |

| Underwriting & Operations | Costs for risk evaluation, policy management, and overhead. | $59.813 billion (12 months ending March 31, 2025) |

| Commissions & Distribution | Payments to agents and costs for sales channels. | $346 million (non-deferrable commissions, 2024) |

| Technology & Innovation | Investment in digital transformation, AI, and IT infrastructure. | ~$750 million (2024) |

| Marketing & Advertising | Expenses for brand building and customer acquisition. | Expense ratio reduced to 21.7% by 2024 |

Revenue Streams

Allstate's core revenue generation relies heavily on premiums from its extensive personal insurance offerings. This encompasses policies for vehicles, homes, and individuals' lives.

In the first quarter of 2025, Allstate reported property-liability earned premiums of $14.0 billion. This figure represents a significant 8.7% increase compared to the same period in the previous year, highlighting strong growth in its core insurance segments.

Allstate's Protection Services segment generates revenue from specialized offerings that extend beyond standard insurance policies. This includes products like Allstate Protection Plans, which cover accidental damage and extended warranties for electronics and appliances, and Allstate Roadside, providing emergency assistance for vehicles. Arity, a data analytics company, also contributes to this revenue stream through its insights and technology solutions.

This diversification has proven to be a strong growth engine for the company. In the fourth quarter of 2024, Protection Services revenue climbed to $889 million, marking a substantial 23.6% increase compared to the same period in the previous year. This upward trend highlights the increasing consumer demand for comprehensive protection solutions.

Allstate generates substantial income from its extensive investment portfolio. This includes earnings from a variety of assets, such as bonds and other securities, which play a crucial role in the company's financial health.

In 2024, this investment income saw a significant boost, reaching $3.1 billion. This represents a notable increase of 24.8% compared to the previous year, highlighting the growing contribution of these investments to Allstate's overall profitability.

Commercial Insurance Premiums

Allstate generates revenue through commercial insurance premiums, offering a diverse range of products to businesses. This segment diversifies their income beyond personal lines, providing a steady stream of revenue.

In 2024, the commercial insurance market continued to be a significant contributor to the insurance industry. While specific Allstate figures for this segment are part of broader financial reporting, the overall growth in commercial property and casualty insurance premiums in the US, projected to be in the mid-single digits for 2024, indicates a healthy market for Allstate's offerings.

- Diversification: Commercial insurance premiums supplement Allstate's primary personal lines business.

- Market Contribution: This revenue stream benefits from the overall growth in the commercial insurance sector.

- Product Range: Premiums are collected across various business-focused insurance products.

Financial Services and Voluntary Benefits Revenue

Allstate generates revenue from its financial services offerings and voluntary benefits programs provided to employees via their workplaces. This segment includes a range of financial products designed to meet diverse customer needs.

While Allstate has strategically divested certain Health and Benefits operations, these segments continue to contribute to overall revenue. For instance, in the third quarter of 2024, premiums and contract charges within Allstate's Health and Benefits business saw a notable increase.

- Financial Services: Revenue stems from the sale of various financial products, including investments and insurance-related financial solutions.

- Voluntary Benefits: Income is generated by offering supplementary benefits to employees through employer-sponsored programs, enhancing workforce offerings.

- Health and Benefits Contribution: Despite divestitures, the remaining Health and Benefits operations still contribute to the company's top line.

- Q3 2024 Performance: Premiums and contract charges for the Health and Benefits business grew 5.2% year-over-year, reaching $487 million in Q3 2024, demonstrating continued revenue generation from this area.

Allstate's diversified revenue streams are anchored by substantial premiums from its personal insurance lines, covering auto and homeowners insurance. This core business saw significant growth, with property-liability earned premiums reaching $14.0 billion in Q1 2025, an 8.7% increase year-over-year.

The Protection Services segment, offering products like extended warranties and roadside assistance, is a growing contributor. This segment's revenue surged to $889 million in Q4 2024, a 23.6% increase from the prior year, indicating strong consumer demand for these supplementary services.

Investment income also plays a vital role, with Allstate earning $3.1 billion in 2024 from its investment portfolio, a notable 24.8% rise compared to the previous year. Additionally, commercial insurance premiums and financial services, including voluntary benefits, further broaden Allstate's revenue base.

| Revenue Stream | Q1 2025 (Est.) | Q4 2024 | 2024 | Year-over-Year Growth (Selected) |

| Personal Insurance Premiums | $14.0 billion | N/A | N/A | +8.7% (Property-Liability Q1 2025) |

| Protection Services | N/A | $889 million | N/A | +23.6% (Q4 2024) |

| Investment Income | N/A | N/A | $3.1 billion | +24.8% (2024) |

| Commercial Insurance | N/A | N/A | N/A | Mid-single digit growth projected for US market in 2024 |

| Financial Services & Voluntary Benefits | N/A | N/A | N/A | +5.2% (Health & Benefits Q3 2024) |

Business Model Canvas Data Sources

The Allstate Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and financial performance metrics. These diverse data sources ensure each component, from customer segments to revenue streams, is accurately represented and strategically aligned.