Allstate Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

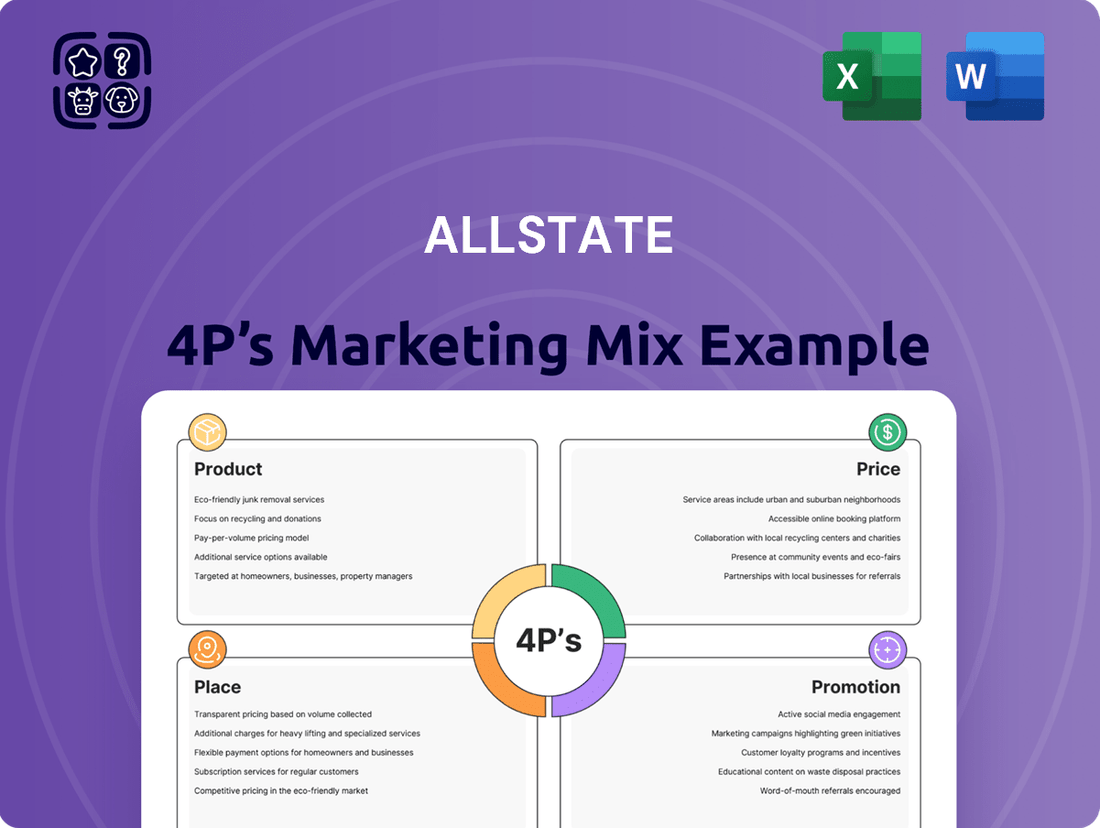

Allstate's marketing success hinges on a carefully orchestrated 4Ps strategy, from its diverse insurance product portfolio to its competitive pricing and widespread distribution. Understanding how they leverage promotion to build trust and brand loyalty is key to their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Allstate's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Allstate's core business revolves around personal lines insurance, providing essential coverage for individuals and families. Their offerings prominently feature auto, home, and life insurance policies, designed to meet diverse customer needs. For instance, in 2024, Allstate continued to focus on expanding its reach in these key personal lines segments.

The company is actively innovating with new product introductions, aiming for an 'Affordable, Simple and Connected' approach to auto and home insurance. This strategic rollout is slated to cover most of the nation in 2025, signaling a significant push towards modernizing their personal insurance products and enhancing customer experience.

Allstate's auto insurance, a cornerstone of their personal lines, includes valuable features that go beyond basic coverage. Options like rental reimbursement, which helps cover costs when a vehicle is being repaired, and new car replacement, offering a significant benefit in case of a total loss of a new vehicle, are designed to provide added peace of mind to policyholders.

Allstate extends its offerings beyond personal auto and home insurance to include a robust commercial insurance segment. This division provides a range of business insurance solutions designed to meet the diverse needs of various industries, ensuring companies have the protection they require to operate smoothly and securely.

Through its subsidiary National General, Allstate further strengthens its commercial insurance portfolio. This strategic integration allows Allstate to broaden its market reach and cater to a wider array of commercial clients, offering specialized products and services that address specific business risks and operational challenges.

In 2023, Allstate's commercial lines segment contributed significantly to its overall financial performance, demonstrating the growing importance of this market. While specific figures for commercial lines alone are often integrated within broader segment reporting, the company's consistent investment in and expansion of its commercial offerings signals a commitment to this vital sector of the insurance market.

Allstate's Protection Services segment significantly broadens its customer value proposition by offering a suite of complementary protection products. This includes Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside assistance, and Allstate Identity Protection, alongside insights from its telematics venture, Arity. These offerings aim to provide comprehensive security and convenience, integrating seamlessly into customers' lives and existing Allstate policies.

The strategic inclusion of these protection services allows Allstate to capture a larger share of customer spending and deepen relationships. For instance, Arity's telematics data, gathered from millions of driving events, provides valuable insights for personalized insurance pricing and risk assessment, contributing to more competitive product development. This expansion moves beyond traditional insurance to encompass a wider spectrum of risk management and assistance services.

Financial Services and Retirement Solutions

Allstate's product offering extends to robust financial services and retirement solutions. These products, including annuities and various retirement plans, are crafted to assist individuals in effectively managing their accumulated savings for long-term financial security.

The scale of Allstate's commitment to retirement solutions is substantial. As of 2024, the company reported total assets under management specifically for its retirement solutions segment amounting to $94.8 billion, highlighting significant client trust and market presence in this crucial area.

- Product Focus: Annuities and retirement plans for savings management.

- 2024 AUM: $94.8 billion in retirement solutions assets under management.

- Objective: To empower individuals in securing their financial future.

Digital and Innovative s

Allstate is aggressively pursuing digital and innovative strategies to redefine customer engagement and operational efficiency. Significant investments are being channeled into transforming their digital landscape, aiming to create seamless and personalized experiences. This focus on innovation is a core element of their marketing approach.

The company's commitment to technology is evident in several key areas. For instance, Allstate is implementing AI-powered tools designed to expedite and improve the accuracy of claims processing, a critical touchpoint for policyholders. Furthermore, they are expanding their suite of usage-based insurance (UBI) products, such as Drivewise and Milewise, which leverage telematics to offer more personalized pricing based on driving behavior. This data-driven approach allows for more competitive offerings and fosters a stronger connection with customers.

Allstate's innovative product development extends to emerging risks, notably through their cyber protection offerings. These solutions are tailored for both individuals and small businesses, addressing the growing need for digital security in an increasingly interconnected world. This proactive stance on cyber threats positions Allstate as a forward-thinking insurer.

- AI-Driven Claims: Enhancing speed and accuracy in processing customer claims.

- Usage-Based Insurance (UBI): Products like Drivewise and Milewise offer personalized rates based on driving habits.

- Cyber Protection: Solutions designed for individuals and small businesses to safeguard against digital threats.

- Digital Transformation Investment: Allstate continues to prioritize significant financial commitment to technological advancements across its operations.

Allstate's product strategy centers on providing comprehensive personal lines insurance, with a strong emphasis on auto and home coverage. They are actively innovating with new offerings designed to be affordable, simple, and connected, with a nationwide rollout planned for 2025. Beyond core insurance, Allstate offers a broad range of protection services, including roadside assistance and identity protection, alongside financial and retirement solutions, demonstrating a commitment to holistic customer security.

What is included in the product

This analysis provides a comprehensive examination of Allstate's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics to offer actionable insights for understanding their market positioning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for Allstate's marketing teams.

Place

Exclusive agents are a cornerstone of Allstate's marketing strategy, acting as the primary interface for customers. These agents are not just salespeople; they are trained to offer personalized advice and build relationships, which is crucial for retaining clients. Allstate's exclusive agent model allows for the effective bundling of various insurance products, such as auto, home, and life insurance, creating a comprehensive financial safety net for policyholders and increasing customer lifetime value.

Allstate's distribution strategy heavily relies on its independent agents, a network significantly bolstered by the 2020 acquisition of National General. This move expanded Allstate's footprint, bringing in approximately 2.2 million auto policies and adding a substantial number of agents to its roster. This expansion directly addresses the 'Place' element of the marketing mix by increasing accessibility to Allstate's products.

The integration of National General’s independent agents has been a pivotal factor in driving new business growth for Allstate. By leveraging this larger, more diverse agent network, Allstate can now reach a wider array of customer segments and geographic areas. This strategic expansion of its distribution channels is crucial for capturing market share and reinforcing its presence in the insurance landscape.

Allstate leverages its direct channels, including its website and call centers, to reach customers seeking a streamlined, self-service insurance purchasing experience. This approach aligns with a growing preference for digital interactions, allowing for greater customer control and convenience.

The company has reported a significant uptick in direct channel applications, underscoring the effectiveness of this strategy. Allstate's ambition to position itself as a low-cost digital provider is directly supported by these direct sales, which can reduce overhead compared to traditional agent-based models.

Voluntary Benefits Brokers and Major Retailers

Allstate leverages voluntary benefits brokers and major retailers as key distribution channels for specific products, particularly in the health and benefits sector. This strategy is crucial for reaching a wide customer base and offering convenient access to their diverse product portfolio.

This multi-channel approach is vital for maximizing market penetration. For instance, in 2024, the voluntary benefits market in the US was projected to exceed $100 billion, highlighting the significant opportunity for Allstate to capture market share through these partnerships.

- Brokers: Specialized brokers facilitate the sale of voluntary benefits to employers, who then offer them to employees as supplemental coverage.

- Retailers: Partnerships with major retailers allow for the promotion and sale of certain Allstate products directly to consumers at points of purchase.

- Market Reach: This dual strategy expands Allstate's footprint beyond traditional insurance agents, tapping into new customer segments and increasing product visibility.

- Product Diversification: It effectively supports the distribution of specialized offerings like accident insurance, critical illness coverage, and other supplemental health plans.

Strategic Expansion and Market Penetration

Allstate is actively pursuing strategic expansion and market penetration by focusing on key geographic regions and optimizing its diverse distribution network. This approach is designed to capture a larger share of the insurance market.

The company's objective for 2024 and into 2025 is to increase its total property-liability policies. This growth will be driven by enhancing customer retention rates and consistently achieving robust new business sales across all its sales channels.

- Geographic Focus: Allstate is targeting specific, high-growth geographic markets for concentrated expansion efforts.

- Distribution Channel Optimization: The company is leveraging its multiple channels, including agents, direct-to-consumer, and partnerships, to reach a wider customer base.

- Customer Retention Goal: A key metric for success is improving customer loyalty and reducing churn in the property-liability segment.

- New Business Sales Targets: Allstate aims for sustained strong performance in acquiring new policyholders across its entire distribution spectrum.

Allstate's 'Place' strategy is multifaceted, encompassing exclusive agents, independent agents (significantly expanded through the National General acquisition), direct-to-consumer channels, and partnerships with voluntary benefits brokers and retailers. This multi-channel approach aims to maximize market penetration and customer accessibility across diverse segments.

The company's 2024-2025 objective is to grow its property-liability policies by enhancing customer retention and driving new business sales through these varied distribution channels. For instance, the voluntary benefits market in the US, a key area for Allstate's broker and retailer partnerships, was projected to exceed $100 billion in 2024.

Allstate's distribution network is designed for broad market reach, from personalized service via exclusive agents to the convenience of digital platforms and specialized access through brokers. This strategic placement ensures Allstate products are available where and how consumers prefer to purchase them.

| Distribution Channel | Key Characteristics | Recent Growth/Impact |

|---|---|---|

| Exclusive Agents | Personalized advice, relationship building, product bundling | Core to Allstate's customer interface |

| Independent Agents (incl. National General) | Expanded geographic reach, increased policy count | Acquisition added ~2.2 million auto policies |

| Direct Channels (Website, Call Centers) | Self-service, digital interaction, cost efficiency | Significant uptick in applications, supports low-cost digital provider ambition |

| Voluntary Benefits Brokers & Retailers | Access to supplemental insurance, broader customer base | Taps into a market projected over $100 billion in 2024 |

Preview the Actual Deliverable

Allstate 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Allstate 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and confidence in your purchase.

Promotion

Allstate significantly invests in advertising, notably through its memorable 'Mayhem' campaign, to boost brand recognition and highlight its insurance offerings. This strategic approach aims to connect with consumers and clearly communicate the value proposition of its products.

The company is strategically increasing its advertising expenditure in key areas to fuel new customer acquisition and drive business growth. For instance, in the first quarter of 2024, Allstate reported a 7.4% increase in total advertising expenses compared to the same period in 2023, reaching $345 million, reflecting this commitment.

Allstate actively enhances its digital presence, leveraging its website and a recently updated mobile app to drive customer engagement. The app now features useful tools like a gas finder and a data breach checker, making it a more valuable resource for policyholders.

These digital platforms are vital for Allstate's customer acquisition strategy, offering a streamlined onboarding process. Furthermore, they empower customers with self-service capabilities, improving overall satisfaction and operational efficiency.

Allstate actively cultivates a positive public image and demonstrates its commitment to social responsibility through its robust public relations and community involvement efforts. A cornerstone of this is The Allstate Foundation, which champions critical social causes.

In 2023, The Allstate Foundation continued its impactful work, investing significantly in programs designed to empower young people, enhance workforce readiness, and combat relationship abuse. For instance, their support for youth empowerment initiatives reached over 100,000 young individuals, providing them with essential skills and opportunities for future success.

These community-focused activities are not merely philanthropic; they are strategic investments in building brand loyalty and trust. By actively participating in and supporting the communities it serves, Allstate reinforces its brand as a responsible corporate citizen, fostering goodwill that translates into stronger customer relationships and a more resilient brand reputation.

Sales s and Discounts

Allstate actively uses sales promotions and discounts to draw in and keep customers. These incentives are a key part of their strategy to offer value and encourage loyalty. For example, customers can save significantly by bundling multiple policies, often seeing discounts of up to 25%.

The company also heavily promotes safe driving habits through programs like Drivewise, which can reward policyholders with savings of up to 40%. Beyond driving, Allstate offers incentives for vehicles equipped with safety features and for students who maintain good academic standing, further broadening their appeal.

- Bundling Discounts: Up to 25% savings for multiple policies.

- Safe Driving Rewards: Drivewise program can offer up to 40% off.

- Vehicle & Student Incentives: Discounts for safety features and good grades.

Agent-Led Communication and Personalized Recommendations

Allstate leverages its extensive network of exclusive and independent agents to deliver personalized insurance solutions. These agents are instrumental in communicating the value of Allstate's products and guiding customers toward the best coverage options. Their expertise in bundling policies, such as auto and home insurance, creates a more comprehensive and cost-effective experience for policyholders.

This agent-led approach fosters trust and allows for tailored recommendations that address individual needs. For instance, agents can identify opportunities for discounts and explain the benefits of specific endorsements, directly impacting customer satisfaction and retention. This human element remains a cornerstone of Allstate's marketing strategy, differentiating it in a competitive market.

- Agent Network: Allstate boasts a significant number of exclusive and independent agents across the United States.

- Personalization: Agents are trained to understand customer needs and offer customized insurance packages.

- Bundling Benefits: Policy bundling, facilitated by agents, often leads to cost savings and increased customer loyalty.

- Customer Engagement: The direct interaction with agents enhances the overall customer experience and builds brand trust.

Allstate's promotional efforts extend beyond advertising to encompass direct sales promotions and loyalty-building incentives. These tactics are designed to attract new customers and retain existing ones by offering tangible value. For example, bundling auto and homeowners insurance can yield savings of up to 25%, while the Drivewise program incentivizes safe driving with potential discounts of up to 40%.

Further incentives are provided for vehicles equipped with advanced safety features and for students demonstrating academic achievement, broadening the appeal of Allstate's offerings. These promotions are key to communicating value and fostering customer loyalty.

| Promotion Type | Benefit | Example |

|---|---|---|

| Bundling Discounts | Up to 25% savings | Combining auto and home insurance |

| Safe Driving Rewards | Up to 40% savings | Drivewise program |

| Vehicle & Student Incentives | Reduced premiums | Safety features, good grades |

Price

Allstate's pricing strategy aims for competitiveness, balancing market share with profitability, particularly in auto insurance. In recent years, the company implemented notable auto insurance rate hikes to address escalating loss costs, a move that contributed to a 13.8% increase in net written premiums for its auto segment in the first quarter of 2024 compared to the prior year.

Looking ahead, Allstate anticipates a moderation in the need for such significant price adjustments. This outlook is informed by a projected stabilization of loss cost trends, suggesting that future rate increases may be more incremental, allowing for continued competitive positioning without sacrificing financial health.

Allstate's pricing policies are designed to reflect the value customers perceive in their insurance products, carefully aligning with their market positioning as a reliable provider. They employ advanced rating plans, often incorporating factors like driving behavior and policy features, to ensure competitive and fair pricing.

A key aspect of their strategy includes offering telematics options, such as Drivewise, which allow policyholders to potentially lower their premiums by demonstrating safe driving habits. For instance, in 2024, Allstate continued to emphasize these data-driven approaches to personalize pricing, aiming to reward responsible behavior and attract cost-conscious consumers.

Allstate strategically employs discounts and savings programs to enhance product appeal and affordability. For instance, bundling multiple policies can yield savings of up to 25%, demonstrating a significant incentive for customer loyalty.

Further savings are available for policyholders who equip their vehicles with safety features like anti-lock brakes or anti-theft devices. New car discounts and incentives for adopting convenient payment methods such as the EZ pay plan and paperless billing also contribute to making Allstate's offerings more attractive to a broad customer base.

Usage-Based Insurance Pricing

Allstate leverages usage-based insurance (UBI) as a key component of its pricing strategy. Programs like Drivewise and Milewise directly reward safe driving habits and lower mileage, offering tangible premium reductions. This approach aligns with the 4Ps by providing a customer-centric pricing model that incentivizes desired behaviors.

Drivewise, for instance, has been shown to offer discounts of up to 40% for participants who demonstrate good driving practices, such as avoiding hard braking and maintaining moderate speeds. This data-driven pricing allows Allstate to more accurately assess risk and pass those savings onto policyholders. Milewise, a pay-per-mile option, is specifically tailored for individuals who drive less frequently, providing a more equitable cost structure.

- Drivewise Discounts: Potential savings up to 40% for safe driving.

- Milewise Suitability: Ideal for low-mileage drivers, offering pay-per-mile flexibility.

- Risk-Based Pricing: UBI allows for more accurate premium calculation based on actual usage and behavior.

- Customer Incentives: Encourages safer driving and reduced mileage, benefiting both the customer and insurer.

Premium Adjustments and External Factors

Allstate's premium adjustments are keenly influenced by external market dynamics. This includes closely monitoring competitor pricing to remain competitive, understanding how fluctuating market demand impacts the need for insurance, and assessing broader economic conditions. For instance, potential U.S. automotive tariffs in 2024/2025 could directly increase the cost of vehicle repairs and rebuilds, necessitating premium recalibrations.

The company actively adjusts its rates to ensure sustained profitability and to adapt to evolving market landscapes. This proactive approach allows Allstate to respond effectively to changes that could otherwise erode its financial stability.

- Competitor Pricing: Allstate benchmarks its rates against key competitors to maintain market share.

- Market Demand: Shifts in consumer demand for specific insurance products influence pricing strategies.

- Economic Conditions: Broader economic factors, including inflation and interest rates, are critical inputs for rate setting.

- Tariff Impact: Potential tariffs on auto parts in 2024/2025 could raise repair costs, leading to premium adjustments.

Allstate's pricing strategy is dynamic, aiming to balance competitive market positioning with profitability. The company has implemented significant auto insurance rate increases, such as the 13.8% rise in net written premiums for its auto segment in Q1 2024, to counter rising loss costs.

Looking ahead, Allstate anticipates a stabilization in loss cost trends, suggesting that future rate adjustments will likely be more moderate. This approach supports their goal of maintaining competitiveness without compromising financial health.

Allstate's pricing reflects the perceived value of its products, aligning with its brand as a dependable insurer. They utilize sophisticated rating plans that consider factors like driving behavior and policy specifics to ensure fair and competitive pricing.

The company actively uses discounts and savings programs to boost product appeal and affordability. For example, bundling policies can offer savings up to 25%, encouraging customer loyalty.

Allstate's pricing is significantly impacted by external market factors, including competitor pricing and economic conditions. For instance, potential U.S. automotive tariffs in 2024/2025 could increase repair costs, prompting premium adjustments.

| Pricing Strategy Element | Description | Impact/Example |

|---|---|---|

| Rate Adjustments | Responding to loss costs and market conditions | 13.8% increase in auto net written premiums (Q1 2024) |

| Usage-Based Insurance (UBI) | Rewarding safe driving and low mileage | Drivewise discounts up to 40%; Milewise for low-mileage drivers |

| Discounts & Incentives | Enhancing affordability and loyalty | Up to 25% savings for bundled policies; new car discounts |

| Market Responsiveness | Adapting to competitor pricing and economic factors | Potential premium adjustments due to 2024/2025 auto tariffs |

4P's Marketing Mix Analysis Data Sources

Our Allstate 4P’s analysis leverages a comprehensive blend of data, including official company reports, investor communications, and publicly available financial disclosures. We also incorporate insights from industry analyses and competitive benchmarking to provide a robust understanding of their marketing strategies.