Allstate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Uncover the strategic positioning of Allstate's offerings with our comprehensive BCG Matrix analysis. See which products are market leaders (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs). This preview offers a glimpse into the power of strategic product portfolio management.

Don't miss out on the full picture! Purchase the complete Allstate BCG Matrix to gain actionable insights, detailed quadrant breakdowns, and data-driven recommendations. Empower your decision-making and drive future growth by understanding precisely where Allstate's portfolio stands in the competitive landscape.

Stars

Allstate is actively pursuing growth in the auto insurance sector by introducing new product lines like Affordable, Simple, and Connected, alongside the Custom360 product tailored for independent agents. This strategy targets a substantial and expanding market, aiming to capture a larger share. The company's reported increase in auto policies in force as of April 2025 demonstrates tangible success in attracting new customers.

Allstate's homeowners insurance segment is a clear star in its portfolio. The company experienced a solid 2.4% growth in policies in force during 2024, reflecting strong demand and effective market penetration. This growth is a testament to Allstate's established brand reputation and its ability to differentiate its offerings in a competitive landscape.

Allstate Protection Plans are a strong performer within the Allstate portfolio. Their revenue saw a robust 16.4% jump in the first quarter of 2025, fueled by successful expansion efforts both at home and abroad. This growth signals a healthy market position.

The number of items covered by these plans reached 160 million in 2024, marking a 10% increase. This substantial growth in protected items highlights strong market acceptance and adoption in an expanding service sector.

Strategic Investments in Technology and AI

Allstate is making substantial investments in technology and AI, a key move for its future growth. These strategic investments are designed to make operations smoother and customer interactions better. For instance, their focus on AI-driven underwriting helps them assess risk more accurately and efficiently.

The company is also heavily involved in telematics, which uses data from vehicles to personalize insurance and potentially lower premiums for safe drivers. In 2024, Allstate continued to expand its digital capabilities, aiming to process claims faster and more transparently through real-time updates.

These innovations are not just about efficiency; they are about creating a more competitive edge in the insurance market. Allstate's commitment to digital transformation positions it well for future success by leveraging data to understand and serve its customers more effectively.

- Digital Transformation Investments: Allstate has allocated significant capital towards modernizing its technology infrastructure and developing AI-driven solutions.

- AI-Driven Underwriting: The company utilizes artificial intelligence to enhance the accuracy and speed of its risk assessment processes.

- Telematics Expansion: Allstate is actively deploying telematics technology to gather driving data, enabling personalized insurance offerings.

- Real-Time Claims Processing: Investments are focused on streamlining the claims handling experience for customers through advanced digital platforms.

Property-Liability Business (Overall Growth Strategy)

Allstate's property-liability business is central to its overall growth strategy, aiming to capture a larger slice of the personal insurance market. This involves developing a cost-effective digital insurer that reaches a wide customer base.

The company is actively pursuing higher market share, supported by recent premium adjustments and enhancements to its combined ratios, which reflect improved operational efficiency. This positions Allstate to capitalize on the steady expansion observed within the property-liability sector.

- Focus on Digital Transformation: Allstate is investing in a low-cost digital insurance platform to attract and retain customers in a competitive market.

- Market Share Expansion: The company's strategy includes increasing its penetration in the personal property-liability segment, a generally growing industry.

- Financial Performance Indicators: Recent premium increases and an improving combined ratio signal a commitment to profitable growth and market leadership.

- Industry Growth Tailwinds: The property-liability insurance market continues to show resilience and expansion, providing a favorable environment for Allstate's strategic initiatives.

Allstate Protection Plans are a clear star, exhibiting exceptional growth. Their revenue surged by 16.4% in Q1 2025, with the number of covered items increasing by 10% to 160 million in 2024. This segment benefits from successful domestic and international expansion, demonstrating strong market demand.

| Business Segment | 2024 Performance Metric | 2025 Q1 Performance Metric | BCG Matrix Category |

|---|---|---|---|

| Allstate Protection Plans | 160 million items covered (10% growth) | 16.4% revenue increase | Star |

What is included in the product

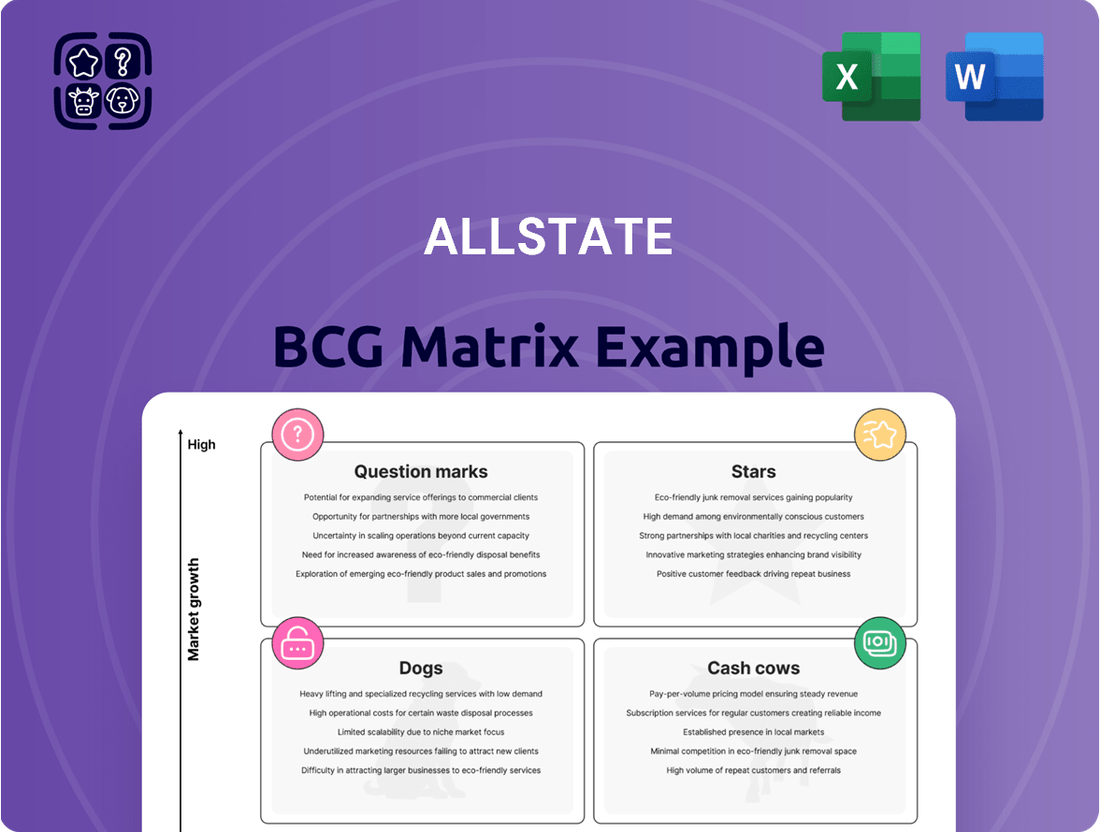

The Allstate BCG Matrix provides a visual framework for analyzing its business units based on market share and growth potential.

It categorizes units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment and resource allocation.

Clear visualization of Allstate's portfolio, identifying growth opportunities and areas needing divestment.

Cash Cows

Allstate's established auto insurance portfolio, while a mature segment, acts as a significant cash cow. This large, existing customer base commands a high market share in a stable industry. In 2024, this segment was a powerhouse, generating approximately $13.5 billion in net written premiums, underscoring its consistent ability to produce substantial underwriting income and robust cash flow for the company.

Allstate's established homeowners insurance portfolio is a prime example of a Cash Cow within its business. In 2024, Allstate commanded the second-largest share of the U.S. home insurance market, holding 8.9%. This signifies a stable, mature market where the company has a strong, established presence.

Despite facing challenges like catastrophe-related losses, this segment consistently delivers robust underlying margins and generates underwriting profits. This reliable profitability fuels other areas of Allstate's business.

Allstate's investment portfolio, a significant asset, was valued at $66.68 billion in 2023. This substantial holding is a key driver of the company's net investment income, providing a consistent and reliable cash flow.

The company's strategic shift towards higher-yielding fixed-income securities has been instrumental in boosting its interest income. This deliberate repositioning ensures that the investment portfolio remains a stable and robust source of cash for Allstate's operations and growth initiatives.

Direct and Exclusive Agent Channels

Allstate's direct and exclusive agent channels function as a significant Cash Cow within its BCG Matrix. This established network generates a steady and predictable inflow of premiums, forming a core component of the company's financial stability.

These distribution methods, characterized by their maturity, require minimal new investment for upkeep while consistently contributing to Allstate's substantial cash flow. For instance, in 2024, Allstate continued to leverage its extensive agent base, which has historically been a primary driver of its market share and revenue generation.

The reliance on these channels highlights their role in providing a reliable financial foundation for the company.

Key aspects of these Cash Cows include:

- Consistent Premium Generation: The exclusive agent network ensures a stable and predictable revenue stream.

- Low Investment Needs: Mature distribution channels require less capital for growth or maintenance compared to newer ventures.

- Significant Cash Flow Contribution: These channels are primary drivers of Allstate's overall profitability and cash generation.

- Market Stability: The established presence of exclusive agents provides a resilient foothold in the insurance market.

Arity (Data and Analytics for Insurers)

Arity, Allstate's data and analytics arm, focuses on leveraging telematics data to serve the insurance industry. Its revenue streams primarily come from selling leads and offering other data-driven services to insurers.

While Arity has seen some operating losses, its recurring revenue model and strategic positioning within the growing insurance telematics sector indicate strong potential. The company's ability to extract value from driving data positions it to become a substantial cash cow as the market for these services matures.

- Revenue Streams: Primarily lead sales and data services to insurance companies.

- Market Position: Operates within the expanding insurance telematics and data analytics space.

- Growth Potential: Expected to capitalize on increasing demand for data-driven insurance solutions.

- Financial Outlook: Despite initial losses, the business model is geared towards future profitability as the market matures.

Allstate's established auto and homeowners insurance segments are significant cash cows. In 2024, the auto insurance portfolio generated approximately $13.5 billion in net written premiums, showcasing its consistent profitability. Similarly, Allstate held the second-largest share in the U.S. home insurance market at 8.9% in 2024, demonstrating stability and strong underlying margins.

These mature segments require minimal new investment but consistently produce substantial underwriting income and robust cash flow, which are vital for supporting other business areas and growth initiatives.

Allstate's investment portfolio, valued at $66.68 billion in 2023, also acts as a cash cow. Strategic shifts toward higher-yielding fixed-income securities have boosted its net investment income, ensuring a reliable cash flow.

The company's direct and exclusive agent channels are also key cash cows, providing a steady and predictable inflow of premiums with low investment needs for upkeep.

| Business Segment | BCG Category | 2024 Data/Key Metric | Significance |

|---|---|---|---|

| Auto Insurance | Cash Cow | ~$13.5 billion net written premiums | High market share, stable industry, consistent profit |

| Homeowners Insurance | Cash Cow | 8.9% U.S. market share | Mature market, strong presence, reliable profitability |

| Investment Portfolio | Cash Cow | $66.68 billion (2023 valuation) | Drives net investment income, stable cash flow |

| Direct & Exclusive Agents | Cash Cow | Established distribution network | Steady premium generation, low investment needs |

Full Transparency, Always

Allstate BCG Matrix

The Allstate BCG Matrix preview you are currently viewing is the identical, fully functional document you will receive immediately after completing your purchase. This means no watermarks, no incomplete sections, and no demo content – just the comprehensive, analysis-ready BCG Matrix report ready for your strategic planning.

Dogs

Allstate's Employer Voluntary Benefits business, recently sold for $2.0 billion in early 2025, likely represented a Question Mark or Dog in its BCG Matrix. This divestiture suggests the segment was not a high-growth area for Allstate, with the company prioritizing its core insurance operations.

The sale indicates that the voluntary benefits segment was likely experiencing lower returns and growth compared to other Allstate businesses. By shedding this asset, Allstate aimed to streamline its portfolio and allocate resources more effectively towards areas with greater potential for profitability and expansion.

Allstate's Group Health business was a strategic divestiture, sold to Nationwide for $1.25 billion in 2025. This move signals a clear intention to exit segments perceived as non-core and offering lower returns on capital. The company is focusing its resources on its primary insurance operations and growth opportunities.

In the realm of commercial insurance, Allstate's presence in certain segments, particularly commercial auto, seems to be facing significant competition. By 2024, Allstate had fallen outside the top 25 rankings for commercial auto insurance market share, indicating a relatively smaller footprint in this area. This positioning suggests these specific commercial lines might be categorized as ‘Dogs’ within the BCG matrix framework.

Underperforming Regional Markets (Property-Liability)

Allstate has identified specific regional markets within its property-liability segment that are currently underperforming. These areas, often characterized by significant regulatory hurdles or substantial environmental risks, are presenting considerable challenges to profitability and growth. For instance, the California homeowners insurance market is a prime example, where Allstate has publicly stated its difficulties in navigating the complex regulatory landscape and the increasing frequency of natural disasters.

These underperforming regions can be viewed as the 'Dogs' in the Allstate BCG Matrix. They typically exhibit low market share and low market growth, leading to consistently poor profitability. This situation demands careful strategic consideration, as these segments may not warrant significant investment and could even be candidates for divestiture or restructuring.

In 2024, Allstate's financial reports indicated that certain geographic segments were indeed weighing on overall performance. While specific figures for individual underperforming regions are often aggregated, the company has highlighted the impact of these challenges on its combined ratio. For example, Allstate has been actively managing its exposure in markets like Florida and California, where regulatory pressures and escalating claims, particularly from severe weather events, have impacted underwriting results.

- California Homeowners Insurance: Facing regulatory constraints and increased catastrophe losses, impacting profitability.

- Florida Property Insurance Market: Similar to California, this market presents challenges due to litigation environments and weather-related risks.

- Low Profitability Metrics: These regions consistently show higher combined ratios compared to the company's average, indicating losses on underwriting.

Individual Health Business (Remaining after Divestitures)

Allstate's Individual Health business, following the divestiture of its Employer Voluntary Benefits and Group Health segments, could be classified as a 'Dog' in the BCG matrix. This classification would apply if the business exhibits low market share and low growth potential, and is not a core strategic priority for the company. Allstate's stated intention to either retain or merge this segment suggests a potential lack of significant future investment or expansion plans.

The financial performance of this remaining business segment would be key to its BCG classification. For instance, if the Individual Health segment in 2024 showed stagnant or declining revenue, and its contribution to Allstate's overall profit was minimal, it would further solidify its 'Dog' status. Without substantial growth drivers or a clear competitive advantage, it represents a less attractive business unit.

- Low Growth Potential: The individual health insurance market can be mature, with limited organic growth opportunities unless significant innovation or market expansion occurs.

- Limited Market Share: Post-divestitures, the remaining individual health business might hold a smaller market share compared to Allstate's other, more dominant lines of business.

- Strategic Re-evaluation: Allstate's decision to retain or merge this business indicates it's not a primary growth engine, potentially leading to its classification as a 'Dog' requiring careful management or eventual divestment.

Allstate's presence in certain commercial insurance lines, such as commercial auto, positions these segments as 'Dogs' in their BCG Matrix. By 2024, the company's market share in commercial auto insurance had fallen outside the top 25, indicating a weak competitive standing and limited growth prospects in these specific areas.

Geographic regions within Allstate's property-liability segment, like California and Florida, are also considered 'Dogs'. These markets face significant regulatory challenges and a high incidence of natural disasters, leading to consistently low profitability and higher combined ratios compared to the company average. For instance, the California homeowners market, with its complex regulations and increasing catastrophe losses, negatively impacted underwriting results.

The Individual Health business, following divestitures of other health segments, may also be classified as a 'Dog'. If this business shows stagnant revenue and minimal profit contribution in 2024, coupled with low market share and growth potential, it aligns with the characteristics of a 'Dog' requiring strategic re-evaluation.

| Segment/Region | BCG Classification | Rationale | Key Metrics (2024 Data/Trends) |

| Commercial Auto Insurance | Dog | Low Market Share, Low Growth | Outside top 25 market share ranking |

| California Homeowners Insurance | Dog | Low Market Share, Low Growth, High Risk | High combined ratio, regulatory constraints, increased catastrophe losses |

| Florida Property Insurance | Dog | Low Market Share, Low Growth, High Risk | Litigation environment, weather-related risks impacting underwriting results |

| Individual Health Business | Potential Dog | Low Market Share, Low Growth Potential (if applicable) | Stagnant/declining revenue, minimal profit contribution (if applicable) |

Question Marks

Allstate's new 'Affordable, Simple, Connected' auto and home insurance products represent a strategic push into new market segments. The auto product is launching in 36 states, with a companion homeowners product in 6 states, indicating a focused expansion strategy.

These offerings are designed to capture market share by appealing to a broader customer base seeking value and modern features. Such new ventures typically require substantial investment to build brand awareness and customer adoption, positioning them as potential Stars in the BCG matrix if successful.

The Custom360 Auto product, Allstate's offering targeted at the middle market and distributed via independent agents, operates in 31 states. This strategic move aims to broaden Allstate's reach and tap into market segments not fully served by its existing direct channels, positioning it as a potential growth driver.

As a relatively new venture, Custom360's performance is still being evaluated within the Allstate portfolio. Its classification in the BCG matrix would depend on its current market share and growth rate; if it's gaining traction in a growing market, it might be a rising star. For example, Allstate's overall auto insurance market share in 2024 was around 9.6%, indicating a competitive landscape where new products need significant growth to stand out.

Allstate is strategically enhancing its direct sales channels, aiming to offer more competitive pricing. This move is designed to capture a larger slice of the market, especially against rivals already strong in direct-to-consumer sales.

The direct channel is a key growth area for Allstate, but its success in consistently outperforming established direct competitors positions it as a Question Mark within the BCG framework. This means it demands careful evaluation and ongoing investment to determine if it can become a Star.

In 2024, Allstate's direct-to-consumer channel continued to be a focus, with the company investing in digital platforms and marketing to drive growth. While specific market share gains against direct competitors in this channel weren't always dramatic, the potential for significant expansion remains, justifying the strategic attention and resources allocated.

Telematics Offerings

Allstate's strategic push into telematics reflects a significant investment in a sector poised for substantial growth. These offerings, designed to reward safe driving with potential savings for customers, simultaneously generate valuable data crucial for more accurate risk assessment. This dual benefit positions Allstate favorably in a dynamic market, but the precise market penetration and profitability of these telematics-focused products are still in development, characteristic of a 'Question Mark' in the BCG matrix.

The telematics market itself is expanding rapidly, with projections indicating continued strong growth through 2024 and beyond. For instance, the global usage-based insurance (UBI) market, heavily reliant on telematics, was valued at approximately $30 billion in 2023 and is expected to reach over $100 billion by 2028, demonstrating the high-growth potential Allstate is tapping into.

- High Growth Potential: Telematics aligns with consumer demand for personalized insurance and cost savings, driving market expansion.

- Data-Driven Insights: The data collected enhances Allstate's ability to underwrite risk more precisely, potentially improving loss ratios.

- Evolving Profitability: While investment is high, the long-term profitability and market share of specific telematics products are still being established.

- Strategic Investment: Allstate's commitment signifies a belief in telematics as a future cornerstone of its business, despite current uncertainties.

International Expansion of Protection Plans

Allstate's Protection Plans, while a strong performer domestically, are positioned as a potential Star in the international arena. This represents a significant opportunity for growth, with the company actively investing to capture a larger share of the global market.

The acquisition of Kingfisher in 2023, a move aimed at bolstering capabilities in mobile device protection abroad, underscores this strategic focus. This acquisition is a clear indicator of Allstate's ambition to expand its footprint in high-growth international markets.

While the domestic market for Protection Plans is mature and successful for Allstate, the international expansion phase is characterized by a lower existing market share. This means there's substantial room for Allstate to grow and establish itself as a dominant player in these emerging regions.

- International Protection Plan Market Growth: The global market for device protection plans is experiencing robust growth, driven by increasing smartphone penetration and consumer demand for extended warranties and accidental damage coverage.

- Allstate's Strategic Acquisitions: The 2023 acquisition of Kingfisher was a key step in Allstate's international strategy, enhancing its ability to offer competitive mobile protection plans in new territories.

- Market Share Potential: Despite investments, Allstate's market share in these newly targeted international regions is likely still nascent, presenting a significant opportunity for rapid expansion and market penetration.

- Focus on Emerging Markets: Allstate's international expansion efforts are likely concentrated on regions with high smartphone adoption rates and a growing middle class, indicating a strategic approach to market selection.

Allstate's direct-to-consumer channel is a prime example of a Question Mark in the BCG matrix. While Allstate is actively investing in its digital platforms and marketing efforts to boost this channel, its market share gains against established direct competitors in 2024 were not always substantial.

This segment requires ongoing evaluation and significant investment to determine if it can achieve a leading market position. The potential for expansion is evident, but the current performance necessitates careful strategic consideration to transform it into a Star performer.

The telematics-focused products also fall into the Question Mark category. Allstate is investing heavily in this area, which offers high growth potential due to increasing consumer interest in usage-based insurance. However, the long-term profitability and market share of these specific telematics offerings are still being established.

The global usage-based insurance market, which telematics underpins, was valued at approximately $30 billion in 2023 and is projected to exceed $100 billion by 2028. This highlights the significant opportunity, but also the current uncertainty surrounding Allstate's precise position within it.

| BCG Category | Allstate Business Unit/Product | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Direct-to-Consumer Channel | High (Digital Insurance Adoption) | Low to Medium (vs. Competitors) | Requires significant investment and strategic focus to increase market share and potentially become a Star. |

| Question Mark | Telematics-Focused Products | Very High (UBI Market Growth) | Low to Medium (Product Specific) | High investment needed to capture market share; data insights are key to future profitability. |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of Allstate's financial disclosures, internal performance metrics, and external market research to provide a clear strategic overview.