Allstate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Unlock the critical external factors shaping Allstate's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the insurance giant. Equip yourself with actionable intelligence to refine your own strategies and gain a competitive edge. Download the full PESTLE analysis now for immediate, expert-level insights.

Political factors

Allstate navigates a complex web of government regulations, with state and federal agencies like the National Association of Insurance Commissioners (NAIC) setting the rules. These regulations, covering everything from solvency to consumer protection, directly influence Allstate's ability to set prices and manage its capital. For example, discussions around federal oversight of insurance solvency, a key topic in early 2025, could introduce new compliance burdens.

Shifts in insurance policy, such as proposed changes to risk-based capital requirements being debated in various state legislatures throughout 2024 and 2025, can significantly affect Allstate's financial health and strategic planning. Increased capital demands might necessitate adjustments to investment strategies or even limit the company's capacity for growth in certain markets.

Regulatory enforcement actions, like the fines levied against insurers for data privacy violations, pose a direct financial and reputational risk. Allstate, like its peers, must remain vigilant in adhering to evolving consumer data protection laws, a growing area of focus for regulators in 2025.

Government policies focused on consumer protection significantly shape Allstate's business. For instance, mandates for specific insurance coverages, like expanded auto liability requirements in states such as California or New York, directly impact product development and pricing strategies. In 2024, we see ongoing discussions around data privacy and its implications for insurance underwriting, a key area where Allstate monitors and influences policy.

Allstate actively participates in the political arena, advocating for policies that align with its operational framework. This engagement aims to strike a balance between managing risk and ensuring profitability, particularly in areas like climate-related insurance regulations. For example, the company's lobbying efforts in 2024 have focused on advocating for responsible building codes and disaster mitigation policies that can reduce long-term insurance costs and improve consumer protection.

Changes in international trade policies and tariffs, especially those impacting auto and home repair materials, directly influence Allstate's expenses for claims. This can necessitate adjustments to their pricing strategies to maintain profitability.

For instance, Allstate has previously signaled its readiness to increase insurance rates to counteract escalating repair and rebuild costs, a move potentially driven by anticipated U.S. automotive tariffs. In 2024, the automotive industry continues to grapple with supply chain disruptions and fluctuating material costs, making such rate adjustments a critical component of their financial planning.

Political Stability and Geopolitical Events

Political instability and significant geopolitical events can create ripples throughout the economy and capital markets, directly impacting Allstate's investment portfolio and overall financial health. For instance, escalating international tensions in 2024 could lead to market volatility, potentially affecting the value of Allstate's holdings in stocks and bonds. While the immediate impact on personal lines insurance, like auto or home coverage, might not be as pronounced, these events can foster widespread uncertainty, influencing consumer spending habits and their willingness to purchase new policies or invest in additional coverage.

The ongoing geopolitical landscape presents several key considerations for Allstate:

- Global Economic Impact: Geopolitical shifts, such as trade disputes or regional conflicts, can disrupt global supply chains and inflation, indirectly affecting the cost of claims and the overall economic environment in which Allstate operates. For example, a significant escalation in a major trade region could lead to increased material costs for auto repairs, impacting claims expenses.

- Market Volatility: Events like sudden political changes in key economies or unexpected international crises can trigger sharp movements in financial markets. In 2024, major elections in several large economies could introduce periods of heightened market volatility, requiring Allstate to actively manage its investment strategies to mitigate potential losses.

- Consumer Confidence: Heightened geopolitical uncertainty often translates into reduced consumer confidence. This can lead individuals to postpone major purchases, including new vehicles or home renovations, which in turn can dampen demand for related insurance products.

ESG Regulations and Standards

The evolving landscape of Environmental, Social, and Governance (ESG) regulations and standards presents a significant political factor for Allstate. Regulators are increasingly scrutinizing corporate ESG practices, with potential for both supportive and restrictive rules impacting how Allstate operates and reports its sustainability efforts. For instance, the Securities and Exchange Commission (SEC) has been considering new climate-related disclosure rules, which could significantly alter reporting requirements for insurers like Allstate.

Allstate actively manages its ESG risks and opportunities by embedding these principles into its core strategy. This proactive approach aims to build long-term value by aligning business practices with growing societal and investor expectations. In 2023, Allstate reported significant progress in its diversity and inclusion initiatives, with women holding 48% of management positions and underrepresented groups comprising 37% of the workforce, demonstrating a commitment to the social aspect of ESG.

The company's commitment to ESG is further evidenced by its sustainability reports, which detail progress on environmental targets, social impact, and governance structures. For example, Allstate has set goals to reduce its operational greenhouse gas emissions by 30% by 2030 compared to a 2019 baseline, showcasing a tangible environmental commitment that aligns with global climate initiatives.

The political climate surrounding ESG can create both challenges and opportunities. Shifts in government policy, such as potential changes to climate-related legislation or financial regulations impacting sustainable investments, could directly influence Allstate's operational costs, investment strategies, and market positioning. Consequently, Allstate's ability to adapt to these dynamic political pressures is crucial for its sustained success.

Government regulations heavily influence Allstate's operations, covering pricing, capital management, and consumer protection. For instance, state and federal bodies like the NAIC set standards, and proposed changes to risk-based capital requirements in 2024-2025 could impact Allstate's financial strategies.

Political advocacy and lobbying are key for Allstate, particularly concerning climate-related insurance regulations and disaster mitigation policies. Their engagement in 2024 aimed to influence building codes and reduce long-term insurance costs for consumers.

Geopolitical events and trade policies can create market volatility and affect claims expenses. For example, international tensions in 2024 could impact Allstate's investment portfolio, while trade disputes might increase material costs for repairs, necessitating rate adjustments.

Evolving ESG regulations, such as potential SEC climate disclosure rules, present both challenges and opportunities. Allstate's commitment to ESG is shown by its diversity initiatives, with women holding 48% of management positions in 2023, and its goal to reduce operational greenhouse gas emissions by 30% by 2030.

What is included in the product

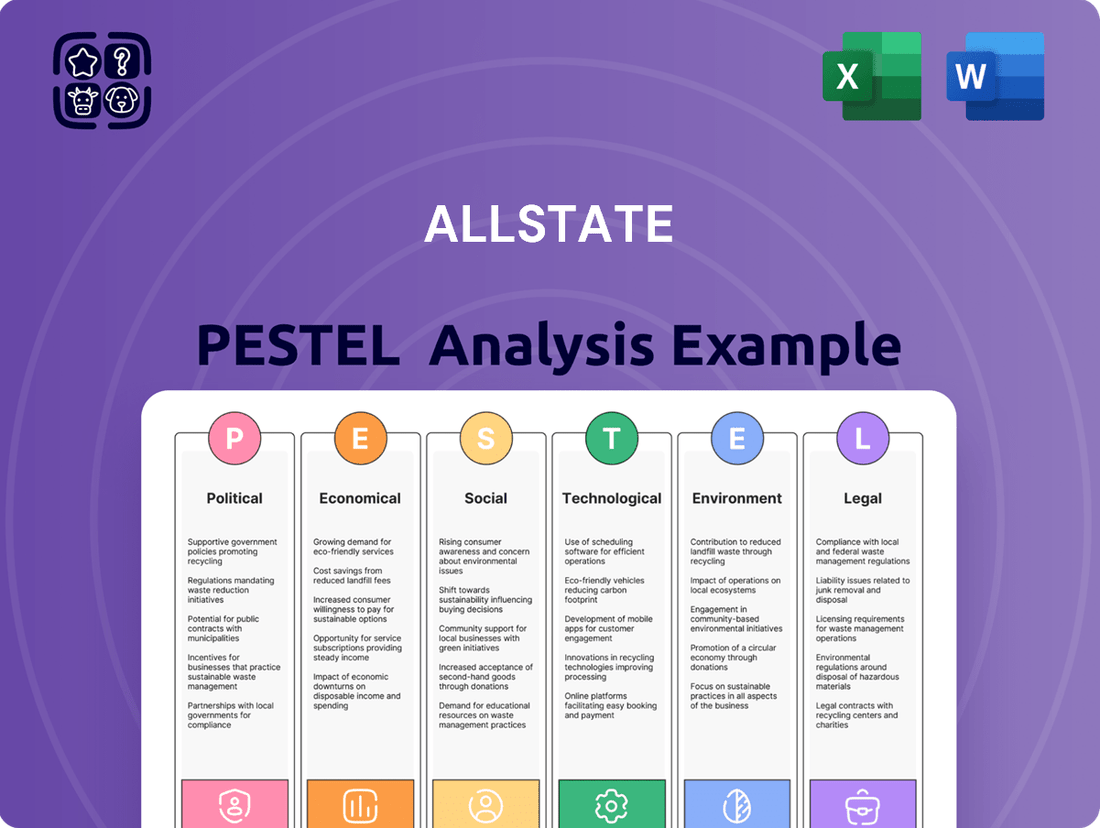

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Allstate, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Allstate's strategic discussions.

Economic factors

Inflation directly impacts Allstate's claims costs. For instance, the Consumer Price Index (CPI) for auto repair and maintenance saw a notable increase in 2024, reflecting higher costs for parts and labor. This trend continued into early 2025, putting pressure on the company's ability to manage claim payouts efficiently.

Allstate's investment income is closely tied to interest rate movements. As of mid-2025, the Federal Reserve maintained a policy stance that supported higher interest rates compared to previous years. This generally benefits Allstate by increasing the yield on its substantial investment portfolio, thereby boosting overall profitability.

The increasing frequency and severity of natural disasters, such as hurricanes and wildfires, directly impact Allstate's underwriting results. In 2023, Allstate reported $7.2 billion in catastrophe losses, a significant figure that highlights the financial strain these events can impose on insurers. This trend is expected to continue, making effective risk management crucial.

To manage these substantial losses, Allstate relies on reinsurance, which transfers a portion of its risk to other insurance companies. However, the cost of reinsurance has been on the rise globally due to higher catastrophe losses experienced by reinsurers themselves. This escalation in reinsurance premiums directly affects Allstate's profitability and can lead to higher insurance rates for consumers.

Consumer spending habits significantly influence demand for insurance. During economic downturns, a reduction in disposable income often leads consumers to cut back on non-essential purchases, which can include certain insurance coverages or opting for less comprehensive policies. This directly impacts Allstate's policy sales and can increase customer churn.

Allstate's strategy to counter these economic pressures involves a strong focus on affordability and demonstrating customer value. By offering competitive pricing and highlighting the benefits and security its products provide, the company aims to retain existing customers and attract new ones, even in challenging economic climates. For instance, in the first quarter of 2024, Allstate reported a combined ratio of 92.3%, indicating improved underwriting profitability which can support more competitive pricing.

Market Competition and Pricing Trends

The insurance industry is highly competitive, forcing companies like Allstate to constantly adjust their pricing to remain attractive. In 2024, Allstate has been implementing substantial auto insurance rate hikes, with some states seeing increases of over 10%, to combat rising claims costs and improve profitability. Despite these necessary adjustments, the company is committed to offering competitive pricing to both retain existing customers and attract new ones.

This dynamic pricing strategy is crucial for Allstate's market share. For instance, in the first quarter of 2024, Allstate reported that its average auto insurance premium increased by approximately 15% compared to the previous year, a direct response to inflationary pressures on repair costs and accident frequency. The goal is to balance the need for higher premiums with the imperative to maintain a strong policyholder base amidst aggressive competition from other major insurers.

- 2024 Auto Rate Increases: Allstate has approved or filed for auto insurance rate increases in numerous states, with average hikes often exceeding 10% to address profitability challenges.

- Competitive Pricing Goal: Despite rate adjustments, Allstate aims to keep its pricing competitive to support policy growth and market share.

- Profitability Restoration: The rate increases are a strategic move to restore profitability in the auto insurance segment, which has faced significant headwinds.

Investment Performance and Capital Management

Allstate's robust financial performance is significantly influenced by its investment portfolio. In the first quarter of 2024, Allstate reported net investment income of $1.03 billion, a notable increase driven by strategic asset allocation and a focus on higher-yielding fixed-income securities. This demonstrates the company's ability to generate substantial returns from its invested capital, even amidst fluctuating market conditions.

The company's capital management strategies are designed to enhance shareholder value. Allstate returned $1.1 billion to shareholders in the first quarter of 2024 through share repurchases and dividends. This commitment to capital return underscores management's confidence in the company's financial health and its ability to generate consistent earnings.

- Investment Income Growth: Allstate's net investment income reached $1.03 billion in Q1 2024, up from $848 million in Q1 2023.

- Shareholder Returns: In Q1 2024, Allstate repurchased $600 million of its common stock and paid $500 million in dividends.

- Portfolio Strategy: The company continues to strategically adjust its investment portfolio, favoring fixed-income assets with improved yields.

Economic factors like inflation and interest rates directly shape Allstate's operational costs and investment returns. Rising inflation, particularly in auto repair and building materials, increases claims expenses, while higher interest rates, as maintained by the Federal Reserve through early 2025, boost investment income. Consumer spending also plays a crucial role, affecting demand for insurance products, with economic downturns potentially leading to reduced coverage or policy cancellations.

| Economic Factor | Impact on Allstate | Data Point/Trend (2024-2025) |

| Inflation | Increased claims costs (auto repair, building materials) | CPI for auto maintenance up; continued pressure into early 2025. |

| Interest Rates | Higher investment income | Federal Reserve policy supported higher rates mid-2025, boosting yields. |

| Consumer Spending | Influences demand for insurance | Economic downturns can reduce disposable income, impacting policy sales and retention. |

| Catastrophic Events | Increased underwriting losses | $7.2 billion in catastrophe losses reported in 2023; trend expected to continue. |

Preview Before You Purchase

Allstate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Allstate PESTLE analysis covers all key external factors impacting the company, providing valuable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of Allstate's operating environment.

Sociological factors

Demographic shifts, like the aging U.S. population, are reshaping insurance needs. By 2030, all baby boomers will be 65 or older, increasing demand for health and long-term care coverage. Allstate is responding by broadening its portfolio beyond traditional auto and home insurance, venturing into areas like identity protection and financial services to capture these evolving consumer preferences.

The rise of remote work and flexible schedules, accelerated by events in 2024, has significantly altered how people use their vehicles. This shift means fewer daily commutes for many, potentially lowering accident frequency but also changing driving patterns. For instance, a 2024 survey indicated that over 30% of American workers were still primarily working from home, a substantial increase from pre-pandemic levels.

Allstate is adapting by utilizing telematics, which tracks driving behavior. This allows them to offer usage-based insurance (UBI) programs, rewarding safer, less frequent drivers. The company's 2024 financial reports show continued investment in data analytics to better understand and price for these evolving mobility trends, aiming to retain customers by offering personalized policies that reflect their new lifestyles.

Public trust is the bedrock of the insurance industry, and Allstate is no exception. Recent years have seen increased scrutiny on claims processing and corporate ethics, making a strong brand reputation paramount. For instance, a 2024 survey indicated that 68% of consumers consider a company's reputation a key factor when choosing an insurance provider.

Allstate recognizes this, investing in initiatives to enhance customer experience and foster community resilience. Their efforts to streamline claims and support disaster recovery aim to build long-term trust. In 2023, Allstate reported a 92% customer satisfaction score for its claims handling process, a testament to their focus on rebuilding confidence.

Health and Wellness Trends

Societal shifts towards prioritizing health and wellness are significantly impacting employer-provided benefits. This heightened awareness drives demand for comprehensive health services, pushing companies to adapt their offerings. For instance, the global corporate wellness market was valued at approximately $58.3 billion in 2023 and is projected to grow, reflecting this trend.

Allstate Benefits has responded by enhancing its portfolio to include virtual care options and mental health support. This strategic expansion directly addresses the growing societal emphasis on holistic well-being, making these services increasingly attractive to both employers and employees. The demand for telehealth services, in particular, saw a substantial surge, with a study indicating a 38-fold increase in telehealth visits in early 2024 compared to pre-pandemic levels.

- Increased Demand for Virtual Care: Telehealth adoption continues to rise, with a significant percentage of the workforce now expecting virtual health options.

- Mental Health Support Integration: Employers are increasingly offering mental health resources as part of their benefits packages to address growing awareness and destigmatization of mental health issues.

- Focus on Preventative Health: There's a growing societal push for preventative care and wellness programs, influencing the types of insurance benefits that are most valued.

- Employee Expectations: Employees are actively seeking employers who offer robust health and wellness benefits that support their overall well-being.

Community Engagement and Corporate Social Responsibility

Societal expectations for companies to actively engage with their communities and demonstrate corporate social responsibility (CSR) are growing, directly impacting Allstate's public image and how it manages relationships with customers, employees, and investors. This trend means Allstate needs to show it's a good corporate citizen, not just a provider of insurance.

Allstate's commitment to sustainability and its philanthropic work through The Allstate Foundation are key components of its CSR strategy. These efforts aim to build stronger communities and tackle important social challenges, which in turn can foster greater trust and loyalty from stakeholders.

- In 2023, The Allstate Foundation invested $34.6 million in grants and programs, supporting initiatives focused on economic empowerment, domestic violence prevention, and disaster relief.

- Allstate employees contributed over 70,000 volunteer hours in 2023, demonstrating a direct commitment to community involvement.

- The company's sustainability report for 2024 highlighted a 20% reduction in its operational carbon footprint compared to 2020 levels, aligning with environmental social governance (ESG) expectations.

Societal values are increasingly emphasizing mental well-being, leading to a greater demand for comprehensive mental health coverage within insurance plans. This shift is evident as the global corporate wellness market, which includes mental health support, was valued at approximately $58.3 billion in 2023 and continues to expand. Allstate Benefits is responding by integrating virtual care and mental health resources into its offerings, directly addressing this growing societal priority and employee expectation for holistic support.

There's a heightened societal expectation for corporations to demonstrate strong corporate social responsibility (CSR) and engage actively with their communities. This focus influences public perception and stakeholder relationships, making Allstate's commitment to sustainability and its philanthropic efforts through The Allstate Foundation crucial for its brand image. In 2023 alone, The Allstate Foundation invested $34.6 million in grants and programs, underscoring a tangible commitment to social impact.

The insurance industry's reliance on public trust is paramount, with a 2024 survey indicating that 68% of consumers consider a company's reputation a key factor in their purchasing decisions. Allstate is actively working to reinforce this trust by enhancing its customer experience and community support initiatives. Their focus on streamlining claims and aiding disaster recovery aims to build lasting confidence, as evidenced by their reported 92% customer satisfaction score for claims handling in 2023.

Technological factors

Allstate is actively pursuing digital transformation, aiming to modernize its operations and customer interactions. This involves significant investment in new technology, with a focus on automation to boost efficiency and streamline processes across the company. For instance, in 2023, Allstate reported a substantial increase in its technology investments, reflecting this strategic shift towards digital-first solutions.

Allstate is increasingly leveraging Artificial Intelligence (AI) and Machine Learning (ML) to enhance its operations. These technologies are transforming key areas like underwriting, where AI can analyze vast datasets to more accurately assess risk, and claims processing, by automating tasks and speeding up settlements. For instance, in 2023, the insurance industry saw significant investment in AI for fraud detection, a trend Allstate is certainly participating in to improve efficiency and customer experience by proactively identifying needs and resolving issues faster.

Telematics in auto insurance, a key technological factor for Allstate, allows for the collection of real-time driving data. This data fuels more precise risk assessment and enables personalized pricing for policyholders, a significant shift from traditional broad-stroke methods.

Advanced data analytics are crucial for Allstate, providing deep insights into evolving market trends and granular customer behavior patterns. This analytical capability supports agile pricing adjustments, ensuring Allstate remains competitive and responsive to dynamic market conditions.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount as Allstate increasingly relies on digital platforms and handles vast amounts of customer data. The company's commitment to safeguarding sensitive information is reflected in its ongoing investments in advanced security measures. For instance, in 2023, Allstate reported spending over $300 million on technology, a significant portion of which is allocated to enhancing cybersecurity infrastructure and protocols.

Allstate actively monitors and adapts to the dynamic landscape of privacy regulations, ensuring compliance with evolving legal frameworks. This proactive approach is crucial given the growing regulatory scrutiny on data handling practices globally. The company's focus on privacy is not just about compliance; it's about building and maintaining customer trust in an era where data breaches can have severe repercussions.

Key technological considerations for Allstate include:

- Robust Data Encryption: Implementing strong encryption for data both in transit and at rest to prevent unauthorized access.

- Threat Detection and Response: Utilizing advanced analytics and AI to identify and mitigate cyber threats in real-time.

- Compliance with Regulations: Adhering to standards like GDPR and CCPA, which dictate how customer data can be collected, stored, and used.

- Employee Training: Continuously educating staff on cybersecurity best practices to minimize human error, a common vector for breaches.

Cloud Computing and Infrastructure Modernization

Allstate's strategic pivot towards modern technology stacks, particularly embracing cloud computing, is a significant technological factor influencing its operations. This shift aims to bolster agility, scalability, and overall efficiency across the organization. By leveraging cloud infrastructure, Allstate can more rapidly develop and roll out innovative products and services, keeping pace with evolving customer demands and market dynamics. This modernization is crucial for maintaining a competitive edge in the insurance sector.

The company has been actively investing in its digital transformation. For instance, in 2023, Allstate continued to focus on modernizing its core systems, with a significant portion of its IT budget allocated to cloud migration and data analytics capabilities. This strategic investment is designed to streamline operations, improve customer experience through enhanced digital platforms, and enable more sophisticated risk assessment and pricing models. The move to the cloud also supports Allstate's efforts in cybersecurity and disaster recovery, ensuring business continuity.

- Cloud Adoption: Allstate is increasingly migrating its applications and data to cloud platforms to enhance flexibility and reduce operational costs.

- Infrastructure Modernization: Investments are being made in upgrading legacy systems to more agile and scalable architectures, supporting faster innovation cycles.

- Data Analytics: The technological shift enables more advanced data analytics, crucial for personalized customer offerings and improved underwriting.

- Digital Service Enhancement: Cloud infrastructure underpins Allstate's commitment to providing seamless digital experiences for policyholders, from quoting to claims processing.

Allstate's technological advancements are heavily focused on digital transformation, aiming to enhance efficiency and customer engagement. Investments in AI and machine learning are optimizing underwriting and claims processing, with the insurance industry seeing substantial AI investment in 2023 for fraud detection. Telematics is enabling more precise risk assessment and personalized auto insurance pricing.

The company is prioritizing cybersecurity and data privacy, investing over $300 million in technology in 2023, with a significant portion dedicated to security infrastructure. Allstate is also embracing cloud computing to improve agility and scalability, which supports faster innovation and better digital service delivery.

| Area | 2023 Investment Focus | Impact |

|---|---|---|

| Digital Transformation | Modernizing operations and customer interactions | Increased efficiency, streamlined processes |

| AI/ML | Underwriting, claims processing, fraud detection | Enhanced risk assessment, faster settlements |

| Telematics | Real-time driving data collection | Precise risk assessment, personalized pricing |

| Cybersecurity | Safeguarding customer data | Mitigating threats, ensuring compliance |

| Cloud Computing | Migrating applications and data | Improved agility, scalability, cost reduction |

Legal factors

Allstate operates within a stringent regulatory environment, facing oversight from numerous state insurance departments and federal bodies. These regulations cover critical areas like financial solvency, consumer protection, and fair market practices. For instance, the National Association of Insurance Commissioners (NAIC) sets standards that influence state-level regulations, ensuring a baseline of consumer safety and insurer stability.

Compliance is non-negotiable, as failure to adhere to these rules can lead to substantial financial penalties and reputational damage. In 2023, for example, various insurers faced fines for violations ranging from improper claims handling to data privacy breaches, underscoring the high stakes involved in regulatory adherence.

Consumer protection laws significantly shape Allstate's business, particularly in how it handles claims and communicates with policyholders. Regulations against unfair claims practices and deceptive advertising directly influence Allstate's operational procedures and marketing. For instance, in 2024, the insurance industry faced increased scrutiny over claims handling, with some states enacting stricter guidelines to prevent delays and unfair denials.

Allegations of systemic underpayment of claims can trigger substantial legal challenges and intense regulatory oversight. Such issues can result in hefty fines and reputational damage. For example, in late 2023 and early 2024, several major insurers faced investigations and settlements related to claims processing practices, underscoring the critical importance of compliance.

Data privacy laws like GDPR and CCPA are becoming stricter, requiring companies like Allstate to invest heavily in compliance. For instance, GDPR fines can reach up to 4% of global annual turnover, a significant risk. This means Allstate must ensure its data handling practices are transparent and secure to avoid penalties and maintain customer trust.

Litigation and Legal Actions

Allstate navigates a landscape fraught with litigation risks, including claims disputes, class-action suits, and regulatory enforcement. These legal challenges can significantly impact financial performance and operational stability. For instance, the aftermath of Hurricane Katrina saw extensive litigation concerning claims handling and payouts, underscoring the potential financial and reputational damage from such events.

The company's exposure to legal actions is a constant consideration. In 2023, Allstate reported approximately $1.6 billion in litigation reserves, reflecting ongoing and anticipated legal costs. This figure highlights the substantial financial commitment required to manage and resolve legal disputes. Such reserves are crucial for absorbing potential losses arising from adverse judgments or settlements.

- Claims Disputes: Ongoing disagreements over policy coverage and claim settlements represent a persistent source of litigation.

- Class-Action Lawsuits: Allstate, like other major insurers, is susceptible to class-action suits alleging widespread misconduct or unfair practices.

- Regulatory Actions: Fines and sanctions from state and federal regulators can arise from non-compliance with insurance laws and consumer protection statutes.

- Historical Precedents: Past litigation, such as that following major natural disasters, informs current risk management strategies and legal preparedness.

Antitrust and Competition Law

Allstate, as a major player in the insurance industry, navigates a complex landscape governed by antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a fair marketplace for consumers and other businesses. For instance, in 2024, regulatory bodies continue to scrutinize mergers and acquisitions within the financial services sector, impacting Allstate's potential growth strategies and market consolidation efforts.

These legal frameworks directly influence Allstate's operational decisions, from how it prices its diverse insurance products to its strategies for entering new geographic markets or forming strategic alliances. Failure to comply can result in significant fines and operational restrictions, making adherence paramount. The ongoing focus on consumer protection and market fairness means Allstate must continuously review its practices to avoid any perception of anti-competitive behavior.

- Pricing Scrutiny: Antitrust laws require Allstate to ensure its pricing strategies are not predatory or designed to eliminate competitors.

- Market Expansion Restrictions: Regulatory approval may be needed for significant market entries or acquisitions to prevent undue market concentration.

- Partnership Compliance: Alliances and partnerships must be structured to avoid stifling competition or engaging in collusive practices.

- Enforcement Actions: Companies like Allstate are subject to investigations and potential penalties for violations of competition law, impacting financial performance and strategic flexibility.

Allstate faces significant legal and regulatory hurdles, with compliance a constant operational focus. In 2023, the company maintained substantial litigation reserves, reporting approximately $1.6 billion to cover ongoing and anticipated legal costs, highlighting the financial impact of legal challenges. Stricter data privacy laws, such as GDPR, pose a risk, with potential fines up to 4% of global annual turnover, necessitating robust data security measures.

Environmental factors

Climate change is a significant environmental factor for Allstate, directly increasing the frequency and intensity of natural disasters like wildfires, hurricanes, and severe storms. These events lead to higher claims payouts, impacting Allstate's financial performance.

In 2023, Allstate reported significant catastrophe losses, with $5.2 billion in pretax catastrophe losses, a notable increase from previous years, underscoring the direct financial impact of severe weather.

Allstate is actively working to bolster its climate resilience and is a proponent of improved disaster preparedness measures, recognizing the long-term implications of these environmental shifts on its business operations and profitability.

Allstate is navigating a landscape of tightening environmental regulations and growing public demand for corporate sustainability, which directly impacts its operational strategies and investment decisions.

The company has set ambitious goals, aiming for net zero emissions across its direct, indirect, and value chain operations by 2030. Furthermore, Allstate is targeting a net zero investment portfolio by the close of 2025, reflecting a significant commitment to sustainable finance.

Resource scarcity, particularly for materials like lumber and metals used in construction and vehicle repairs, directly impacts Allstate's claims expenses. For instance, disruptions in the supply of critical components can drive up repair costs, affecting the insurer's bottom line.

Allstate's significant supply chain spend, encompassing claims services and third-party repair networks, makes it particularly vulnerable to these environmental shifts. The availability and cost of skilled labor for repairs also fall under this umbrella, with shortages potentially increasing claim payout durations and costs.

In 2024, continued inflationary pressures and geopolitical events have exacerbated supply chain bottlenecks, leading to an estimated 5-10% increase in auto repair costs for many insurers, a trend Allstate is undoubtedly navigating.

Pollution and Environmental Liability

While pollution isn't a direct concern for Allstate's core personal auto and home insurance, the increasing focus on environmental, social, and governance (ESG) factors impacts its commercial lines and investment strategies. Stricter regulations around emissions and waste management can lead to higher operational costs for businesses Allstate insures, potentially increasing claims or affecting their financial stability. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, which can impose significant fines on non-compliant businesses.

Allstate's investment portfolio can also be exposed to environmental risks. Companies with poor environmental track records or those heavily reliant on fossil fuels may face devaluation due to changing market sentiment and potential regulatory crackdowns. As of early 2025, many institutional investors are divesting from carbon-intensive industries, a trend that could impact the value of Allstate's holdings.

- Increased environmental regulations: Businesses insured by Allstate face growing compliance costs and potential liabilities from stricter pollution controls, as seen with ongoing EPA enforcement in 2024.

- Investment portfolio risk: Allstate's investments may be affected by the market's shift away from carbon-intensive industries, a trend accelerating in 2024-2025.

- Indirect impact on claims: Environmental events, such as severe weather exacerbated by climate change, can lead to higher claims payouts for Allstate's property and casualty insurance products.

Natural Hazard Risk Assessment and Mitigation

Allstate actively enhances its natural hazard risk assessment models, incorporating data on climate change and its impact on severe weather events. This continuous refinement directly influences their underwriting and pricing strategies for property insurance. For instance, in 2024, Allstate's investment in advanced catastrophe modeling tools aims to better predict the financial implications of events like hurricanes and wildfires.

The company is committed to fostering more resilient communities, recognizing that proactive mitigation efforts reduce overall risk and potential losses. This includes initiatives that encourage stronger building codes and community preparedness programs. In 2024, Allstate continued its support for programs promoting flood mitigation and wildfire defensible space, aiming to lessen the severity of damage from these natural hazards.

- Enhanced Risk Modeling: Allstate's 2024 focus on advanced catastrophe modeling improves accuracy in predicting losses from natural disasters.

- Community Resilience: The company's 2024 initiatives support community-level mitigation efforts against severe weather.

- Underwriting and Pricing: Evolving risk assessments directly impact how Allstate underwrites and prices policies, reflecting increased natural hazard exposure.

Allstate faces escalating costs due to climate change, with 2023 pretax catastrophe losses reaching $5.2 billion, highlighting the direct financial impact of severe weather. The company is actively investing in advanced catastrophe modeling, with a 2024 focus on better predicting losses from events like hurricanes and wildfires, which directly influences underwriting and pricing strategies.

Resource scarcity, particularly for construction materials, is increasing repair costs, a trend exacerbated by 2024 inflationary pressures and supply chain issues, potentially raising auto repair costs by 5-10%. Allstate's commitment to sustainability includes a 2030 net-zero emissions goal and a target net-zero investment portfolio by the close of 2025.

Environmental regulations, such as those enforced by the EPA in 2024, can increase operational costs for businesses Allstate insures, impacting their financial stability and potentially leading to higher claims. Furthermore, the market shift away from carbon-intensive industries in 2024-2025 poses a risk to Allstate's investment portfolio.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Allstate draws from a diverse range of sources, including government regulatory filings, economic indicators from agencies like the Bureau of Labor Statistics, and industry-specific reports from insurance and financial sector analysts. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.