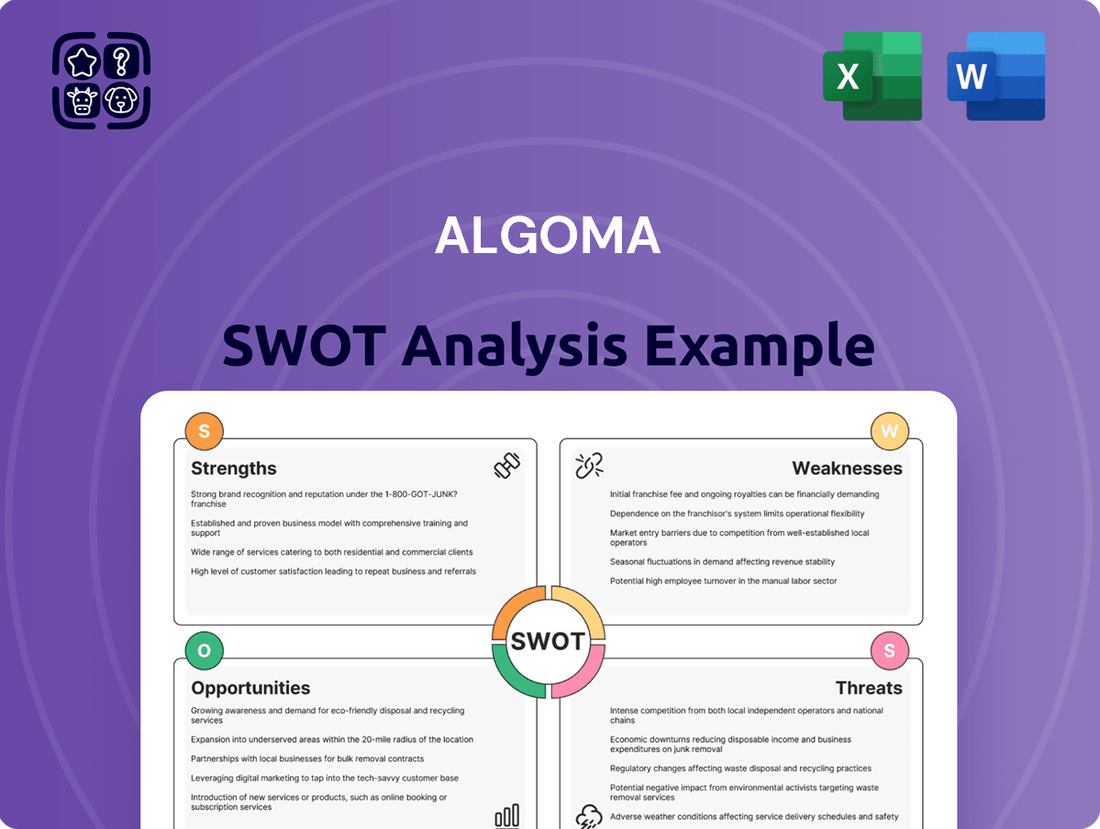

Algoma SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Algoma's strategic position is multifaceted, revealing key strengths in its operational efficiency and market presence, alongside potential weaknesses that require careful navigation.

Unlock the complete picture behind Algoma's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Algoma Central Corporation commands a dominant market position within the Great Lakes and St. Lawrence Seaway, operating the largest fleet of dry and liquid bulk carriers in this crucial North American trade corridor. This extensive fleet, comprising vessels like the Algoma Conveyor and the Algoma Equinox, allows them to efficiently move essential commodities such as iron ore, grain, and coal, vital for numerous industries. Their established infrastructure and operational scale create a significant competitive advantage, making it difficult for new entrants to challenge their leadership in this key market.

Algoma Central Corporation boasts a significantly modernized fleet, a key strength driving its operational efficiency. The company has actively invested in renewing its fleet, notably introducing the Equinox Class vessels and environmentally conscious product tankers. This strategic renewal is evidenced by the construction of 23 vessels since 2013, with an additional 12 vessels either on order or currently under construction. In the first quarter of 2025, Algoma successfully delivered four new vessels, underscoring their commitment to fleet expansion and technological advancement.

Algoma Central Corporation boasts a strong advantage with its diversified service offerings, extending beyond its primary Great Lakes and St. Lawrence Seaway operations. This strategic diversification includes significant involvement in international short-sea shipping and commercial real estate ventures, creating multiple, robust revenue streams. For instance, in the first quarter of 2024, Algoma reported total revenue of $174.6 million, with its Global Short Sea Shipping segment contributing $31.7 million, showcasing the impact of its international reach.

Strong Customer Relationships and Reliable Service

Algoma's strength lies in its deep-rooted customer relationships, built on a foundation of resilient and reliable service. By catering to diverse major industrial sectors such as iron and steel, aggregates, cement, salt, and agriculture, the company ensures a broad and stable demand for its fleet. This unwavering commitment to customer satisfaction fosters long-term partnerships, translating into consistent utilization and revenue streams.

The company's ability to consistently meet the needs of these critical industries is a significant advantage. For instance, in 2024, Algoma reported a strong performance in its domestic dry-bulk segment, driven by robust demand from key customers in the construction and manufacturing sectors. This reliability is a cornerstone of their enduring client loyalty.

- Diverse Industrial Base: Serves iron and steel, aggregates, cement, salt, and agriculture sectors.

- Customer-Centric Approach: Focus on resilient and reliable service fosters strong, sustained relationships.

- Consistent Demand: High customer satisfaction ensures steady fleet utilization and predictable revenue.

Strategic Investments in Newbuilds and Joint Ventures

Algoma's strategic investments in newbuilds and joint ventures are a significant strength, enhancing its operational capabilities and market presence. The company's commitment to modernizing its fleet, evidenced by orders for new vessels, directly contributes to improved efficiency and sustainability. For example, the FureBear joint venture with Furetank Rederi AB, launched in 2023, aims to operate eco-friendly vessels, aligning with growing environmental demands.

These ventures, including the NovaAlgoma partnership focused on offshore and international markets, expand Algoma's geographic reach and service offerings. By securing newbuilds and forming strategic alliances, Algoma is proactively positioning itself to capitalize on emerging market opportunities and strengthen its competitive standing. This forward-looking approach is crucial for long-term growth and resilience in the dynamic shipping industry.

- Fleet Modernization: Orders for new vessels enhance efficiency and sustainability.

- Strategic Partnerships: Joint ventures like FureBear and NovaAlgoma expand market reach.

- Market Expansion: Access to new regions like Northern Europe and North American coasts.

- Operational Enhancement: Investments aim for greater stability, reliability, and efficiency.

Algoma Central Corporation’s primary strength lies in its unparalleled dominance of the Great Lakes and St. Lawrence Seaway, operating the largest fleet in this vital North American trade route. This extensive operational scale and established infrastructure create a formidable barrier to entry for competitors. Their commitment to fleet modernization, with 23 new vessels delivered since 2013 and 12 more on order or under construction as of early 2025, significantly boosts efficiency and environmental performance.

The company's diversified revenue streams, including global short-sea shipping and commercial real estate, provide resilience against sector-specific downturns. For instance, in Q1 2024, Global Short Sea Shipping contributed $31.7 million to total revenues of $174.6 million. Furthermore, Algoma's deep customer relationships, serving essential industries like agriculture and construction, ensure consistent demand and fleet utilization, as demonstrated by strong domestic dry-bulk performance in 2024.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Market Dominance | Largest fleet in Great Lakes/St. Lawrence Seaway | Operates the most vessels in this critical trade corridor. |

| Fleet Modernization | Investment in new, efficient vessels | 23 new vessels since 2013; 12 on order/under construction (early 2025). Q1 2025 saw 4 new vessel deliveries. |

| Diversified Revenue | Multiple income streams beyond core operations | Global Short Sea Shipping revenue of $31.7M in Q1 2024 (out of $174.6M total). |

| Customer Relationships | Strong ties with diverse industrial clients | Serves key sectors like agriculture and construction, ensuring consistent demand. |

What is included in the product

Delivers a strategic overview of Algoma’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses, transforming potential roadblocks into actionable solutions.

Weaknesses

Algoma Central Corporation's domestic dry-bulk fleet faces significant operational limitations during the first quarter of each year. The closure of the Great Lakes – St. Lawrence Seaway system due to winter weather conditions effectively halts most domestic operations. This enforced seasonal downtime directly impacts revenue generation and often results in net losses, as was the case in Q1 2025 when the company reported a net loss of $1.5 million.

The extended period of inactivity during the first quarter not only reduces potential earnings but also incurs substantial lay-up costs for the vessels. These costs, associated with maintaining the fleet during its non-operational period, further erode profitability and negatively affect the company's overall financial performance for the year. Fleet utilization rates plummet during these months, creating a consistent challenge for consistent year-round revenue.

Planned dry-dockings, essential for maintaining Algoma's fleet, directly impact operational capacity. These maintenance periods reduce the number of revenue-generating days, thereby affecting overall earnings.

For example, an increase in dry-docking days during the first quarter of 2025 negatively affected revenue and operating earnings in key segments like Product Tankers and Ocean Self-Unloaders. This illustrates the short-term financial strain these necessary upkeep cycles impose.

Algoma's business is heavily tied to the movement of key commodities such as iron ore, grain, coal, and salt. When demand for these goods dips, whether due to global economic slowdowns or specific industry challenges, it directly affects the amount of cargo Algoma carries and, consequently, its earnings. For instance, a noticeable drop in coal shipments through the St. Lawrence Seaway occurred in 2024, and projections for the construction sector indicate a flat demand environment for 2025, directly impacting Algoma's potential cargo volumes.

Intense Competition in Certain Segments

While Algoma Central Corporation holds a strong position in its primary Canadian Great Lakes market, it encounters significant competition in other areas, particularly in global short-sea shipping. This competitive pressure comes from various marine transportation companies, potentially impacting Algoma's pricing power and market share. Staying ahead requires constant attention to competitor strategies and evolving market conditions.

For instance, in 2024, the global shipping market saw increased capacity in certain segments, intensifying the competitive environment for companies like Algoma. Key competitors in short-sea shipping often leverage economies of scale and diverse fleet capabilities, presenting a challenge to Algoma's regional strengths. The company's ability to adapt its service offerings and cost structures will be crucial for navigating these competitive waters.

- Intense competition in global short-sea shipping segments.

- Pressure on pricing and market share from other marine transportation firms.

- Need for continuous monitoring of competitor activities and market dynamics.

- Challenges posed by competitors with larger scale or diverse fleets.

Dependency on Infrastructure and Canal Systems

Algoma's significant reliance on the Great Lakes – St. Lawrence Seaway and the Soo Locks represents a key weakness. These vital waterways are the arteries of its shipping operations, and any disruption, whether planned maintenance or unforeseen weather events, can directly halt or severely restrict cargo movement. For instance, the Soo Locks are crucial for vessels transiting between Lake Superior and the lower Great Lakes, and their operational status directly impacts Algoma's ability to serve key markets.

The potential for closures, even with ongoing infrastructure investments like those seen in the Seaway system, introduces a considerable vulnerability. These dependencies mean that Algoma's operational efficiency and profitability are intrinsically tied to the reliability of external infrastructure, creating a point of inherent risk that can lead to significant operational losses if not managed proactively.

- Infrastructure Dependency: Algoma's core business relies heavily on the Great Lakes – St. Lawrence Seaway and the Soo Locks.

- Operational Disruption Risk: Closures for maintenance or weather can halt shipping, causing direct financial losses.

- Vulnerability to External Factors: Reliance on these systems makes Algoma susceptible to factors beyond its direct control.

Algoma's fleet modernization efforts, while necessary, represent a significant capital expenditure. The ongoing investment in newer, more efficient vessels, such as the new dual-purpose Supramax and Ultramax vessels, requires substantial financial commitment. This focus on upgrading means a considerable portion of capital is allocated to asset renewal rather than potentially higher-return investments or returning capital to shareholders.

The company's debt levels, while managed, are a direct consequence of these significant capital outlays for fleet renewal. For example, as of Q1 2025, Algoma reported total debt of $470 million. This debt burden necessitates consistent interest payments, which can impact profitability, especially during periods of lower revenue or higher operating costs.

The reliance on specific commodities means Algoma is exposed to the cyclical nature of these industries. Fluctuations in demand for iron ore, grain, and coal can lead to periods of underutilization for its fleet, impacting revenue predictability. For instance, a projected slowdown in construction in 2025 suggests potentially lower demand for materials Algoma transports.

| Metric | Q1 2025 | Q1 2024 |

| Total Debt ($ millions) | 470.0 | 455.5 |

| Net Loss ($ millions) | 1.5 | 0.8 |

| Fleet Utilization (%) | 65.0% | 70.0% |

Same Document Delivered

Algoma SWOT Analysis

The preview you see is the actual Algoma SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Algoma SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

You’re viewing a live preview of the actual Algoma SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

Algoma is strategically positioned to benefit from a projected uptick in demand across several vital industrial sectors. The company anticipates improved fleet utilization in the domestic dry-bulk market for 2025, driven by new contracts within the burgeoning domestic steel industry and a resurgence in salt transportation volumes.

Furthermore, robust shipment forecasts for the agriculture sector underscore a strong demand outlook for the commodities Algoma specializes in transporting, reinforcing its growth potential.

Algoma's strategic fleet expansion, with numerous new vessels slated for delivery between 2025 and 2027, presents a substantial opportunity to boost carrying capacity. This modernization initiative directly addresses growing market demand by introducing more efficient and environmentally friendly vessels, potentially unlocking new contract opportunities and improving the company's competitive edge.

Algoma's strategic international joint ventures and new vessel deliveries are paving the way for entry into new geographical markets. This includes expansion into Northern Europe and the vital Canadian and U.S. east coasts, broadening their reach and customer base.

The Global Short Sea Shipping segment is particularly well-positioned to capitalize on this opportunity. By focusing on specialized equipment like cement carriers and mini-bulkers, Algoma can tap into diverse niche marine transportation markets, further diversifying its operational footprint and revenue streams.

Leveraging Sustainability Initiatives for Competitive Advantage

Algoma's proactive stance on sustainability, including its target of a 40% reduction in greenhouse gas emissions by 2030 and achieving net-zero by 2050, positions it favorably. This commitment to decarbonization directly addresses growing environmental regulations and a clear market demand for eco-friendly shipping. By highlighting these initiatives, Algoma can attract clients and investors who prioritize environmental, social, and governance (ESG) factors, thereby enhancing its competitive edge in the market.

The company's investments in decarbonization technologies and practices can translate into tangible benefits. For instance, as of early 2024, shipping companies globally are facing increasing pressure to adopt cleaner fuel alternatives and operational efficiencies. Algoma's strategic alignment with these trends allows it to potentially capture market share from less environmentally proactive competitors.

- Attracting ESG-focused Investors: Algoma's sustainability targets resonate with a growing pool of investors prioritizing ESG performance, potentially leading to increased capital availability and favorable valuations.

- Securing Environmentally Conscious Clients: The company's green initiatives can be a key differentiator, attracting businesses that are themselves committed to reducing their carbon footprint throughout their supply chains.

- Navigating Regulatory Landscapes: By proactively meeting and exceeding environmental standards, Algoma can better navigate evolving regulations, mitigating potential compliance risks and associated costs.

- Enhancing Brand Reputation: A strong commitment to sustainability can bolster Algoma's brand image, fostering trust and loyalty among stakeholders and the broader public.

Potential for Increased Freight Rates and Favorable Market Conditions

Algoma anticipates a steady rate environment for its product tankers, projecting strong vessel utilization for its Canadian-flagged fleet. This stability, despite economic uncertainties, points to potential for growth across key sectors.

Favorable market conditions, driven by increased demand and Algoma's investment in a modernized fleet, are expected to translate into higher freight rates. For instance, in the first quarter of 2024, Algoma reported a significant increase in revenue, partly attributed to strong performance in its product tanker segment.

- Steady Rate Environment: Continued stability in freight rates for product tankers.

- Strong Vessel Utilization: High occupancy rates expected for Canadian-flagged vessels.

- Demand Growth: Increased market demand contributing to positive outlook.

- Fleet Modernization: A newer fleet supports efficiency and competitive positioning, potentially driving higher rates.

Algoma's strategic fleet expansion, with new vessels entering service between 2025 and 2027, will significantly increase its carrying capacity. This growth is well-timed to meet anticipated demand increases in key sectors like domestic dry-bulk and agriculture transport. For example, Algoma's 2025 projections indicate improved fleet utilization, driven by new contracts in the steel industry and increased salt shipments.

The company's commitment to sustainability, aiming for a 40% greenhouse gas emission reduction by 2030, positions it to attract ESG-focused investors and clients. This proactive approach to environmental regulations can also mitigate compliance risks and enhance brand reputation.

Algoma's expansion into new geographical markets, including Northern Europe and the U.S. East Coast, diversifies its customer base and revenue streams. The Global Short Sea Shipping segment, with its specialized vessels, is poised to capitalize on niche markets.

The product tanker segment is expected to experience a steady rate environment with strong vessel utilization for its Canadian-flagged fleet. This stability, coupled with increased demand and fleet modernization, is projected to drive higher freight rates, as evidenced by strong Q1 2024 revenue growth.

| Opportunity Area | Key Driver | Expected Impact |

|---|---|---|

| Fleet Expansion & Capacity Increase | New vessel deliveries (2025-2027) | Enhanced market share, ability to meet growing demand |

| Sustainability Initiatives | 40% GHG reduction target by 2030 | Attract ESG investors, secure eco-conscious clients, mitigate regulatory risk |

| Geographic Market Expansion | Entry into Northern Europe, U.S. East Coast | Diversified customer base and revenue streams |

| Product Tanker Segment Strength | Steady rates, high utilization | Stable revenue, potential for increased freight rates |

Threats

Global economic uncertainties and the potential for market disruptions present a substantial threat to Algoma's operations. A widespread economic slowdown could significantly dampen demand for the bulk commodities Algoma transports, directly affecting cargo volumes and freight rates, thereby impacting overall revenue streams.

The company's financial performance in Q1 2025 underscores this vulnerability, as it reported a net loss attributed, in part, to prevailing global economic uncertainties. This indicates that market conditions are already exerting pressure on Algoma's profitability.

Algoma's profitability is directly tied to the volatile nature of fuel prices, a critical component of marine transportation. When bunker fuel costs surge, like the average global price per tonne which saw significant increases throughout 2024, Algoma's margins can shrink rapidly if these higher expenses can't be fully reflected in customer rates.

Beyond fuel, a broader rise in operating costs, encompassing everything from crewing expenses to dry-docking and repairs, presents another significant threat. For instance, a general inflation rate impacting labor and parts, as observed in many global economies in late 2024 and early 2025, directly squeezes Algoma's bottom line, potentially hindering its ability to invest in fleet modernization or expansion.

Algoma faces significant threats from evolving regulatory landscapes, particularly concerning environmental compliance. Increasingly stringent regulations focused on reducing emissions and promoting sustainability are likely to translate into higher operational costs. For instance, the push towards decarbonization in the shipping industry, as seen in International Maritime Organization (IMO) 2020 and upcoming regulations, necessitates substantial investment in cleaner fuels and potentially fleet modernization.

While Algoma is proactively investing in greener technologies, the potential for unforeseen or more aggressive regulatory shifts presents a considerable risk. Such changes could mandate significant, unplanned capital expenditures for fleet upgrades or operational adjustments, potentially impacting the company's profitability and financial flexibility in the 2024-2025 period and beyond. The cost of compliance, especially with evolving sulfur caps and future greenhouse gas reduction targets, remains a key concern.

Infrastructure Limitations and Disruptions in Waterways

Algoma's heavy reliance on the Great Lakes and St. Lawrence Seaway system presents a significant threat. Prolonged closures or disruptions, whether from severe weather, accidents, or essential infrastructure maintenance like the Soo Locks, can cripple operations. For instance, the 2024 Soo Locks closure for repairs, though planned, highlights the vulnerability of this critical artery. Such disruptions directly translate to substantial delays, escalating operational costs, and ultimately, a loss of revenue for Algoma.

These waterway limitations can manifest in several ways:

- Operational Delays: Extended transit times due to ice, low water levels, or congestion, impacting Algoma's shipping schedules.

- Increased Costs: Higher freight rates, demurrage charges, and potential rerouting expenses when waterways are compromised.

- Supply Chain Interruptions: Difficulty in receiving raw materials or shipping finished goods, affecting production and customer fulfillment.

- Reduced Competitiveness: Competitors with more resilient logistics networks may gain an advantage during these disruptions.

Intensified Competition and Pricing Pressure

The marine transportation sector is inherently competitive, and any expansion in capacity by rivals or aggressive pricing tactics could significantly squeeze freight rates. Algoma's strong position in its primary markets might be challenged by more intense competition in its international operations, potentially impacting its profitability and market share.

For instance, in 2024, the global shipping market experienced fluctuating demand, with certain routes seeing increased vessel availability, which historically correlates with rate declines. While specific 2025 data is still emerging, analysts project continued pressure on bulk carrier rates due to ongoing geopolitical factors and global economic outlooks.

- Increased vessel supply from competitors could dilute market share.

- Aggressive pricing strategies may erode profit margins.

- International segments face greater competitive intensity.

Algoma faces significant threats from global economic downturns, which directly impact demand for its commodity transport services and can lead to reduced freight rates, as evidenced by its Q1 2025 net loss. Volatile fuel prices and rising operational costs, including labor and maintenance, further squeeze profit margins, especially when these increases cannot be fully passed on to customers. For example, bunker fuel prices saw notable increases throughout 2024, impacting shipping companies' profitability.

The company is also vulnerable to increasingly stringent environmental regulations, which may necessitate costly fleet upgrades and compliance investments. For instance, the ongoing push for decarbonization in the maritime sector, including potential future greenhouse gas reduction targets, presents a significant financial challenge. Furthermore, disruptions to the critical Great Lakes and St. Lawrence Seaway system, such as those caused by severe weather or infrastructure maintenance like the Soo Locks closure in 2024, can severely hamper operations and lead to substantial revenue losses.

Intensified competition, both domestically and internationally, poses another threat, with rivals potentially employing aggressive pricing strategies that could erode Algoma's market share and profitability. Analysts project continued pressure on bulk carrier rates in 2025 due to geopolitical factors and economic outlooks, exacerbating this competitive pressure.

SWOT Analysis Data Sources

This Algoma SWOT analysis is built upon a robust foundation of data, including Algoma Steel's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.