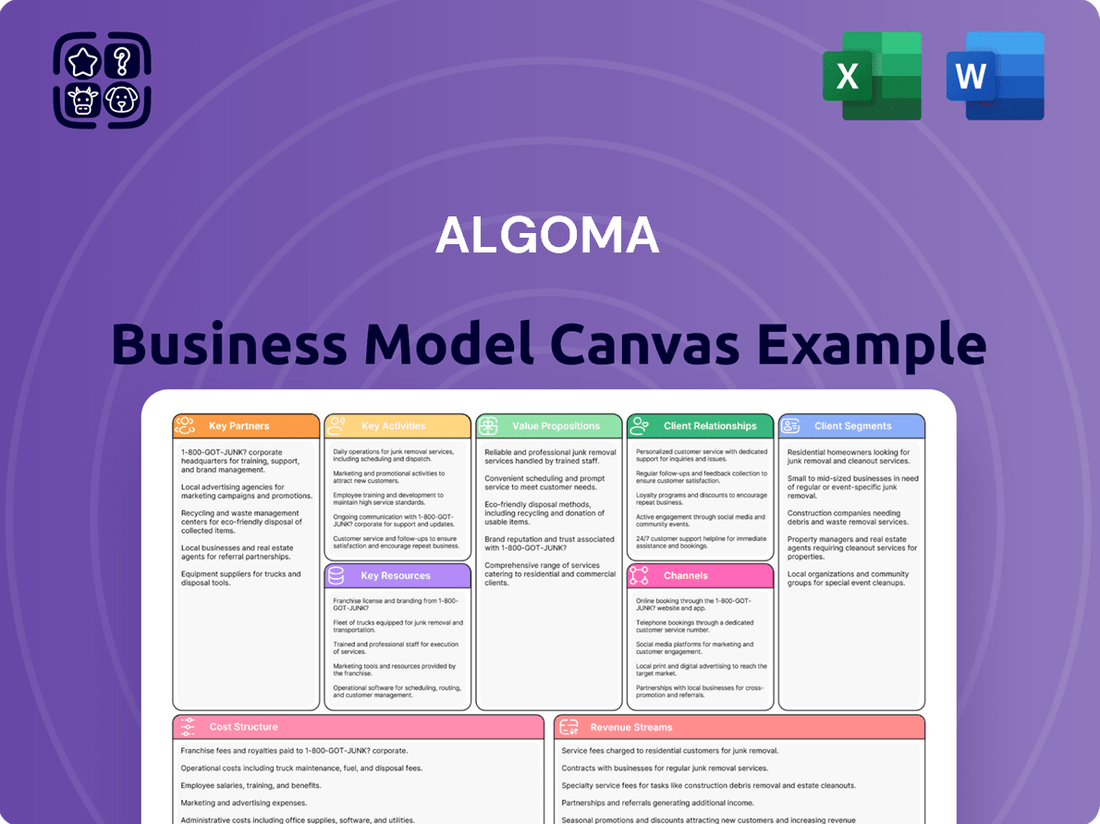

Algoma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Curious about the strategic framework that drives Algoma's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational excellence. Download the full version to gain a competitive edge and unlock actionable insights for your own venture.

Partnerships

Algoma Central Corporation actively pursues strategic joint ventures to broaden its operational footprint and diversify its fleet. A prime example is FureBear, an international venture concentrating on product tankers, which grants Algoma access to new markets and shared resources for expansion.

Another key partnership is NovaAlgoma, encompassing cement carriers and short-sea carriers. This venture underscores Algoma's dedication to specialized marine transportation sectors, enhancing its market presence and service offerings.

Algoma Central Corporation, a key player in Great Lakes shipping, cultivates essential partnerships with major industrial clients. These include prominent companies in the iron and steel, aggregate, cement, building materials, and salt production sectors.

These collaborations are the bedrock of Algoma's domestic dry-bulk shipping services, guaranteeing steady cargo volumes across the vital Great Lakes and St. Lawrence Seaway. For instance, in 2023, Algoma's fleet transported significant quantities of these essential commodities, underpinning the infrastructure and manufacturing industries of North America.

The company solidifies these relationships through long-term contracts, which are crucial for maintaining business stability and predictable operational volumes. These agreements provide Algoma with a reliable revenue stream, allowing for strategic fleet investment and operational planning.

Algoma's product tanker segment relies heavily on its relationships with major oil refiners and leading wholesale distributors. These partnerships are the backbone of its operations, ensuring the efficient movement of fuel and other liquid bulk commodities across Canada. For instance, Algoma's fleet, which saw the addition of new vessels in recent years, is contracted to directly support these essential energy supply chains, highlighting the critical nature of these collaborations.

Shipyards and Manufacturers

Algoma Central Corporation's strategic alliances with shipyards worldwide are fundamental to its ongoing fleet modernization and expansion. These partnerships are crucial for acquiring newbuilds across various vessel types, including dry-bulk carriers, product tankers, and specialized ocean self-unloaders. For instance, Algoma has been actively engaging international shipyards to secure advanced vessels designed for improved fuel efficiency and reduced environmental impact.

These collaborations ensure Algoma maintains a competitive edge by integrating cutting-edge technology into its fleet. The company's commitment to fleet renewal is evident in its ongoing new vessel deliveries, with several ships expected through 2025 and into the future. This proactive approach to fleet management, facilitated by strong shipyard relationships, underpins Algoma's operational capacity and its ability to meet evolving market demands and regulatory standards.

- Global Shipyard Network: Algoma partners with shipyards across the globe for fleet renewal and expansion projects.

- Newbuild Programs: These partnerships support the construction of new vessels, including dry-bulk carriers, product tankers, and ocean self-unloaders.

- Fleet Modernization: Relationships with shipyards ensure the acquisition of advanced, fuel-efficient, and environmentally sustainable vessels.

- Delivery Schedule: New vessels are being delivered through 2025 and beyond, highlighting the ongoing nature of these key partnerships.

Technology and Innovation Providers

Algoma Central Corporation actively partners with technology and innovation providers to drive improvements in its fleet's operational efficiency, safety standards, and environmental footprint. These collaborations are crucial for staying ahead in the competitive marine transportation sector.

Key areas of focus include investments in advanced fuel efficiency technologies aimed at reducing carbon emissions. For instance, Algoma has been integrating systems designed to optimize fuel consumption across its vessels. Furthermore, the company is implementing ballast water treatment systems to comply with stringent environmental regulations and protect aquatic ecosystems. Looking towards the future, Algoma is also exploring the adoption of alternative fuels, such as biofuels, to further its sustainability objectives.

- Fleet Efficiency: Partnerships enable the integration of technologies that reduce fuel burn, directly impacting operational costs and environmental performance.

- Environmental Compliance: Collaborations are essential for implementing systems like ballast water treatment, ensuring adherence to global maritime environmental standards.

- Sustainability Goals: These alliances are fundamental to Algoma's commitment to reducing its carbon emissions and exploring greener fuel alternatives.

- Competitive Advantage: By adopting cutting-edge technologies, Algoma maintains a competitive edge through enhanced operational capabilities and a strong sustainability profile.

Algoma Central Corporation's Key Partnerships are multifaceted, spanning industrial clients, joint ventures, and technology providers. These collaborations are vital for securing cargo, expanding market reach, and modernizing its fleet. The company's strategic alliances with shipyards globally are critical for fleet renewal, with new vessels expected through 2025 and beyond, focusing on fuel efficiency and environmental standards.

| Partnership Type | Key Partners/Sectors | Impact on Algoma | Example/Data Point |

|---|---|---|---|

| Industrial Clients | Iron & Steel, Aggregates, Cement, Building Materials, Salt Producers | Guarantees steady cargo volumes for domestic dry-bulk shipping. | Significant cargo volumes transported in 2023, supporting North American infrastructure. |

| Joint Ventures | FureBear (Product Tankers), NovaAlgoma (Cement & Short-Sea Carriers) | Broadens operational footprint, diversifies fleet, accesses new markets. | FureBear provides access to international product tanker markets. |

| Product Tanker Clients | Major Oil Refiners, Wholesale Distributors | Ensures efficient movement of liquid bulk commodities. | Fleet contracted to support essential energy supply chains. |

| Shipyards | Global Shipyard Network | Facilitates fleet modernization and acquisition of newbuilds. | New vessels with improved fuel efficiency and reduced environmental impact being delivered through 2025. |

| Technology Providers | Fuel Efficiency & Environmental Solutions | Drives operational efficiency, safety, and sustainability. | Integration of advanced fuel-saving systems and ballast water treatment technologies. |

What is included in the product

A structured framework detailing Algoma's core business components, from customer relationships to revenue streams.

This canvas provides a clear, visual representation of how Algoma creates, delivers, and captures value.

The Algoma Business Model Canvas alleviates the pain of unclear strategy by providing a structured framework to visualize and refine your business's core components.

It acts as a pain point reliever by offering a clear, actionable roadmap, simplifying complex business concepts for easier understanding and execution.

Activities

Algoma Central Corporation's primary focus is on delivering marine transportation for both dry and liquid bulk commodities. This involves managing a varied fleet of ships that navigate the Great Lakes, the St. Lawrence Seaway, and global shipping routes.

The company plays a crucial role in moving vital materials like iron ore, grain, coal, salt, and petroleum products, serving a wide array of industrial clients. In 2024, Algoma continued to leverage its extensive network to ensure the efficient and reliable movement of these essential goods.

Algoma's key activity in fleet management and operations focuses on the meticulous oversight of its diverse fleet. This includes optimizing vessel scheduling and logistics to ensure timely cargo delivery and maximizing operational efficiency. For instance, in 2024, Algoma continued to invest in its fleet modernization, with a significant portion of its capital expenditures directed towards maintaining and upgrading its vessels to meet evolving environmental standards and operational demands.

A critical component is the rigorous maintenance and dry-docking schedule for all vessels. This proactive approach guarantees safety, reliability, and adherence to stringent international maritime regulations, preventing costly disruptions. Algoma's commitment to operational excellence is demonstrated by its consistent record of vessel availability and performance, crucial for maintaining its competitive edge in the Great Lakes and St. Lawrence River shipping sector.

Effective fleet deployment is paramount to Algoma's revenue generation and customer satisfaction. By strategically positioning and utilizing its vessels, the company ensures it can meet fluctuating market demands and secure profitable contracts. In the first quarter of 2024, Algoma reported strong performance in its domestic dry-bulk segment, partly attributed to the efficient deployment of its fleet to capitalize on seasonal demand.

Algoma's key activities heavily focus on refreshing its fleet and pursuing strategic expansion. A significant ongoing effort involves investing in modernizing and growing its vessel capacity through newbuild programs.

The company is actively integrating newer, more fuel-efficient ships into its dry-bulk, product tanker, and ocean self-unloader operations. This commitment is evidenced by the planned delivery of several new vessels throughout 2024 and into 2025, underscoring a dedication to both sustained growth and environmental responsibility.

International Short-Sea Shipping

Algoma's international short-sea shipping, primarily through its NovaAlgoma joint ventures, is a key activity that extends its reach beyond Canadian waters. This segment utilizes a diverse fleet, including cement carriers and mini-bulkers, to serve global trade routes. In 2024, this strategic expansion contributed significantly to revenue diversification and enhanced Algoma's presence in international maritime markets.

The company's engagement in international short-sea shipping is crucial for its growth strategy. It allows Algoma to leverage its expertise in specialized vessel operations across different geographical regions. This activity directly supports the company's goal of becoming a more globally integrated shipping provider.

- Fleet Specialization Operates cement carriers, mini-bulkers, and handy-size vessels for international routes.

- Global Reach Expands geographical footprint through joint ventures like NovaAlgoma.

- Revenue Diversification Generates income from international trade, reducing reliance on domestic markets.

Real Estate Management

Algoma Central Corporation actively manages its commercial real estate holdings, generating income from these properties. While this segment is separate from its primary shipping operations, it plays a role in the company's financial health. As of early 2024, Algoma integrated its Investment Properties segment into its Corporate segment for reporting purposes.

- Property Portfolio: Algoma Central Corporation maintains interests in commercial real estate, which are managed to produce revenue.

- Financial Contribution: This real estate segment, though not the core marine business, contributes to the company's overall financial results.

- Segment Aggregation: In early 2024, Algoma combined its Investment Properties segment with the Corporate segment, simplifying its financial reporting structure.

Algoma's key activities revolve around efficient fleet management, strategic fleet renewal, and expanding its international presence through joint ventures. These efforts are crucial for maintaining operational excellence, meeting market demands, and diversifying revenue streams.

The company's commitment to fleet modernization is evident in its ongoing investment in new, fuel-efficient vessels. This strategic move not only enhances operational capabilities but also aligns with growing environmental regulations and customer expectations for sustainable shipping solutions.

Furthermore, Algoma's international short-sea shipping operations, particularly through its NovaAlgoma ventures, are vital for extending its global reach and tapping into new markets. This diversification strategy is designed to bolster its position as an integrated maritime provider.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Fleet Management & Operations | Optimizing vessel scheduling, logistics, and ensuring vessel availability. | Continued investment in fleet modernization and maintenance to meet operational demands and environmental standards. |

| Fleet Renewal & Expansion | Acquiring new, fuel-efficient vessels to enhance capacity and sustainability. | Planned delivery of several new vessels throughout 2024 and into 2025 to support growth. |

| International Short-Sea Shipping | Expanding global reach and revenue diversification through joint ventures. | Leveraging specialized vessel operations in international markets, contributing significantly to revenue diversification in 2024. |

Preview Before You Purchase

Business Model Canvas

The Algoma Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess the quality and comprehensiveness of the Business Model Canvas knowing that what you see is precisely what you will get.

Resources

Algoma's core strength lies in its extensive and varied fleet. This includes specialized vessels like self-unloading dry-bulk carriers, gearless dry-bulk carriers, product tankers, and ocean-going self-unloaders, allowing for the transport of a broad spectrum of goods.

This diverse fleet is a critical asset, enabling Algoma to serve multiple market segments and adapt to changing cargo demands. As of early 2024, Algoma continues its fleet modernization efforts, investing in newer, more fuel-efficient vessels to enhance operational performance and environmental sustainability.

Algoma relies on its highly skilled marine personnel, from captains and crew to shore-based operational and technical staff. Their deep knowledge of navigation, cargo management, and vessel upkeep is fundamental to safe and efficient shipping. This human capital is a cornerstone of their operational success.

The company's management team plays a crucial role, steering strategic direction and ensuring day-to-day excellence. In 2024, Algoma continued to invest in training and development for its personnel, recognizing that their expertise directly impacts safety records and operational efficiency, key drivers for profitability in the Great Lakes shipping sector.

Algoma's strategic access to the Great Lakes and St. Lawrence Seaway is a cornerstone of its business model, enabling efficient transportation of bulk commodities. This extensive waterway network is crucial for serving industrial clients across North America.

The company's operational expertise in navigating these complex systems ensures reliable and cost-effective cargo delivery. In 2024, Algoma continued to leverage these waterways, demonstrating their ongoing importance to its logistics and market reach.

Financial Capital and Investment Capacity

Algoma's financial capital is a cornerstone, powering significant investments in its fleet. This includes crucial spending on renewing existing vessels, constructing new ones, and forming strategic joint ventures. For example, in 2023, Algoma reported capital expenditures of approximately $140 million, a substantial portion of which was directed towards fleet modernization.

This financial robustness underpins Algoma's long-term growth ambitions and its commitment to operating a modern, competitive fleet. Access to credit facilities and capital for essential maintenance and upgrades are vital components of this capacity. As of the first quarter of 2024, Algoma maintained a strong liquidity position, with cash and cash equivalents totaling over $150 million, providing ample resources for ongoing operational needs and strategic investments.

- Fleet Renewal and Construction: Significant capital allocation towards upgrading and expanding the vessel fleet.

- Strategic Joint Ventures: Financial capacity to invest in partnerships that enhance market reach and operational efficiency.

- Access to Credit Facilities: Maintaining strong relationships with financial institutions to secure necessary funding.

- Maintenance and Upgrades: Consistent investment in ensuring the fleet remains safe, efficient, and compliant with environmental regulations.

Commercial Real Estate Holdings

Algoma Central Corporation's commercial real estate holdings represent a diversification strategy, adding to its asset base and providing an additional revenue stream beyond its core marine transportation services. These properties contribute to the company's overall financial stability.

While not the primary focus, these real estate assets offer a tangible component to Algoma's portfolio, enhancing its asset diversification. This segment supports the company's financial resilience.

- Diversification: Provides income and asset value separate from shipping operations.

- Revenue Generation: Contributes to overall company earnings through rental income or property appreciation.

- Asset Base: Increases the total value of assets held by Algoma Central Corporation.

- Financial Stability: Offers a buffer against fluctuations in the marine sector.

Algoma's key resources are its diverse fleet, skilled personnel, strategic waterway access, and financial capital. The fleet, comprising specialized vessels, is crucial for transporting various cargoes across the Great Lakes and St. Lawrence Seaway. Highly trained marine and shore staff ensure safe and efficient operations, a factor management actively supports through ongoing training. Financial strength, evidenced by significant capital expenditures like the approximately $140 million in 2023 for fleet modernization, underpins these operations and future growth.

| Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Fleet | Diverse specialized vessels (self-unloaders, tankers) | Continued fleet modernization efforts |

| Human Capital | Skilled marine and shore personnel | Investment in training and development |

| Waterway Access | Great Lakes and St. Lawrence Seaway | Leveraged for efficient North American transport |

| Financial Capital | Funds for fleet, operations, and ventures | Over $150 million in cash and equivalents (Q1 2024); $140 million capital expenditures (2023) |

Value Propositions

Algoma Central Corporation's value proposition centers on providing highly reliable and efficient waterborne transportation for crucial commodities. Their substantial fleet, boasting over 200 vessels, and deep operational experience guarantee that essential goods reach their destinations on schedule. This consistent performance is vital for industrial clients who depend on predictable supply chains.

Algoma Central Corporation leverages its specialized fleet and deep expertise to provide exceptional handling for a wide array of dry and liquid bulk cargoes. This includes essential commodities like iron ore, grain, coal, and salt, as well as petroleum products. In 2024, Algoma continued to demonstrate its commitment to specialized cargo solutions.

The company's self-unloading capabilities are a significant value proposition, allowing for efficient and safe discharge of cargo directly at client facilities. This operational advantage, coupled with a diverse tanker fleet designed for specific product needs, ensures tailored transportation solutions that meet unique industry demands.

Algoma’s extensive network spans the Great Lakes, St. Lawrence Seaway, and international short-sea shipping routes, connecting diverse industrial clients across a broad geographical area. This reach is crucial for efficiently linking supply and demand points, facilitating trade for a wide range of commodities.

For instance, in 2024, Algoma Central Corporation reported a significant increase in its fleet utilization, particularly on its domestic Great Lakes routes, underscoring the importance of its established network for serving key industrial sectors like mining and manufacturing.

Commitment to Sustainability and Modernization

Algoma is actively modernizing its fleet to champion sustainable marine transportation. This commitment translates into tangible investments in cutting-edge, environmentally friendly technologies designed to significantly reduce their carbon footprint.

Their strategic focus includes the deployment of fuel-efficient vessels and pioneering biofuel trials. Furthermore, Algoma is investing in newbuilds that are methanol-ready, positioning them at the forefront of cleaner shipping solutions. For instance, in 2024, Algoma continued its fleet renewal program, with newbuilds designed to meet stringent environmental standards.

- Fleet Modernization: Ongoing investments in fuel-efficient vessels.

- Environmental Technology: Adoption of biofuel trials and methanol-ready newbuilds.

- Client Appeal: Attracts clients prioritizing environmental responsibility and regulatory compliance.

- Emission Reduction: Demonstrates dedication to a greener future in shipping.

Long-Term Partnership and Customer Focus

Algoma Central Corporation prioritizes cultivating enduring relationships with its industrial clientele, aiming to be the preferred marine carrier. This is achieved through reliable, top-tier service and a proactive approach to meeting evolving customer requirements.

Their strategy centers on delivering unparalleled service and flexibility, fostering deep loyalty and encouraging repeat business from their partners.

- Customer Focus: Algoma's business model is built on understanding and adapting to the specific needs of its industrial customers.

- Long-Term Relationships: The company actively works to establish and maintain strong, multi-year partnerships.

- Service Excellence: A commitment to consistent, high-quality service is a cornerstone of their value proposition.

- Flexibility: Algoma positions itself as a responsive and adaptable marine transportation provider.

Algoma Central Corporation offers specialized cargo handling for a diverse range of bulk commodities, including dry and liquid products. Their fleet is equipped to manage materials like iron ore, grain, coal, salt, and petroleum, ensuring efficient transport. This capability is crucial for industries relying on these fundamental resources.

The company's self-unloading technology provides a significant advantage, enabling direct and safe cargo discharge at customer sites. This, combined with a versatile tanker fleet tailored for specific product requirements, delivers customized shipping solutions that cater to unique industrial needs.

Algoma's extensive operational network covers the Great Lakes, St. Lawrence Seaway, and international short-sea routes. This broad reach connects various industrial clients and efficiently links supply and demand points for numerous commodities.

In 2024, Algoma Central Corporation continued its fleet modernization, investing in fuel-efficient vessels and exploring biofuel trials. Their commitment to sustainability is further demonstrated by newbuilds designed to be methanol-ready, aligning with cleaner shipping initiatives.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Reliable Commodity Transportation | Efficient and dependable waterborne transport for essential dry and liquid bulk goods. | High fleet utilization on domestic routes, serving mining and manufacturing. |

| Specialized Cargo Handling | Expertise in managing diverse commodities like iron ore, grain, coal, salt, and petroleum products. | Continued focus on tailored solutions for specific cargo needs. |

| Self-Unloading Capabilities | Direct, safe, and efficient cargo discharge at client facilities. | Enhances operational efficiency for customers. |

| Extensive Network Reach | Operations across the Great Lakes, St. Lawrence Seaway, and international short-sea routes. | Connects diverse industrial clients and facilitates broad trade. |

| Sustainable Marine Transportation | Investment in fuel-efficient vessels, biofuel trials, and methanol-ready newbuilds. | Fleet renewal program focused on environmental standards. |

Customer Relationships

Algoma fosters deep connections with its industrial clientele via dedicated account managers. This direct engagement ensures a thorough grasp of client requirements, facilitating customized solutions and prompt issue resolution.

These partnerships are frequently solidified through long-term agreements, cultivating a stable and reliable foundation of trust and mutual benefit.

Algoma's customer relationships are significantly bolstered by long-term service contracts, especially within its Global Short Sea Shipping segment, notably its cement fleet. These agreements, a cornerstone of their business, provide a predictable and stable revenue stream, underscoring a deep mutual commitment with key industrial clients. For instance, in 2023, Algoma highlighted the importance of these multi-year agreements in securing its operational future and fostering enduring partnerships.

Algoma's customer relationships are built on a bedrock of reliability and performance in its transportation services. Minimizing delays and ensuring cargo integrity are key priorities, directly impacting client satisfaction and fostering trust.

For instance, in 2024, Algoma Central Corporation reported a strong operational performance, with its fleet consistently meeting delivery schedules, a critical factor for its diverse customer base relying on timely cargo movement across various industries.

Proactive Communication and Problem Solving

Algoma Central Corporation prioritizes proactive client communication, especially concerning operational status and potential disruptions. This approach was evident in 2024 as they navigated fluctuating global trade dynamics, including shifts in trade policies that could affect cargo volumes and shipping costs. By maintaining an open dialogue, Algoma aims to manage client expectations effectively and foster enduring partnerships.

For instance, during periods of market uncertainty in 2024, Algoma provided timely updates on vessel schedules and potential weather-related delays, offering alternative solutions where feasible. This transparency is crucial for clients relying on consistent and predictable shipping services for their supply chains. The company's commitment to problem-solving means anticipating challenges and communicating mitigation strategies before they significantly impact clients.

- Proactive Updates: Algoma provided clients with regular operational updates throughout 2024, detailing vessel movements and any potential service adjustments.

- Addressing Market Volatility: The company actively communicated how global economic shifts and trade policy changes might influence shipping rates and cargo availability, offering insights and contingency plans.

- Client Expectation Management: Through transparent communication, Algoma ensured clients were well-informed about service capabilities and potential challenges, fostering trust and understanding.

- Solution-Oriented Dialogue: When disruptions arose in 2024, such as those related to canal transits or port congestion, Algoma engaged in direct problem-solving conversations with affected clients to find optimal outcomes.

Joint Venture Partner Engagement

For its joint ventures, like FureBear and NovaAlgoma, Algoma's customer relationships focus on managing partner expectations and ensuring smooth service delivery. This involves close coordination and a unified dedication to customer satisfaction across all involved entities.

These strategic partnerships significantly broaden Algoma's market reach and enhance its service portfolio, allowing access to a wider customer base. For instance, NovaAlgoma's fleet expansion in 2024, with the addition of new vessels, directly supports this extended customer engagement by increasing capacity and service availability.

- Partner Collaboration: Maintaining open communication and shared goals with joint venture partners is crucial for consistent customer experience.

- Service Integration: Ensuring that services offered through joint ventures are seamlessly integrated with Algoma's core offerings.

- Market Expansion: Leveraging partnerships to tap into new geographic regions and customer segments, thereby increasing overall customer touchpoints.

- Performance Monitoring: Regularly assessing joint venture performance against customer satisfaction metrics to identify areas for improvement.

Algoma's customer relationships are characterized by a commitment to reliability and proactive communication, especially evident in its 2024 operations where consistent delivery schedules were maintained. Long-term service contracts, particularly within its Global Short Sea Shipping segment, form a stable revenue base and underscore deep client trust. For joint ventures like NovaAlgoma, customer engagement is amplified by fleet expansions, as seen with new vessel additions in 2024, broadening market reach and service capabilities.

| Relationship Aspect | Key Actions/Strategies | Impact/Benefit |

|---|---|---|

| Dedicated Account Management | Direct engagement, customized solutions | Enhanced client understanding, prompt issue resolution |

| Long-Term Agreements | Multi-year contracts, stable partnerships | Predictable revenue, cultivated trust |

| Proactive Communication | Operational updates, market volatility insights (2024) | Managed expectations, fostered understanding |

| Joint Venture Collaboration | Partner expectation management, service integration | Broadened market reach, enhanced service portfolio |

Channels

Algoma relies heavily on its dedicated internal sales and commercial teams to build direct relationships with industrial customers. These professionals are crucial for understanding specific client requirements and forging long-term partnerships.

These teams actively work to secure contracts by negotiating terms directly, ensuring Algoma's offerings align perfectly with client operational needs. This direct engagement fosters trust and allows for tailored solutions.

In 2024, Algoma reported that its direct sales force was instrumental in securing a significant portion of its new business, highlighting the effectiveness of this customer-centric approach in a competitive market.

Algoma utilizes the existing sales networks of its joint venture partners for international reach, notably in its Global Short Sea Shipping operations and the FureBear joint venture. This strategic approach grants access to a broader international customer base and valuable local market insights.

By leveraging these established channels, Algoma effectively expands its market presence without the significant investment required to build its own extensive international sales infrastructure. For instance, in 2024, Algoma's participation in the FureBear joint venture, focused on Arctic shipping, directly benefited from the partner’s established relationships and distribution capabilities in those specialized markets.

Algoma Central Corporation actively participates in key industry associations like the Chamber of Marine Commerce, which advocates for Canada's marine industry. In 2024, these associations continue to be vital for understanding regulatory shifts and economic trends impacting bulk shipping.

Attending major marine transportation conferences, such as the upcoming International Bulk Journal (IBJ) Summit in late 2024, allows Algoma to directly engage with potential clients and partners. These events are crucial for showcasing their fleet modernization efforts and discussing future service offerings.

These engagements are not just about visibility; they are a direct channel for lead generation. For instance, industry reports from 2023 highlighted that over 60% of business development professionals cite industry conferences as a primary source for new client acquisition, a trend expected to continue in 2024.

Digital Presence and Investor Relations Website

Algoma Central Corporation's digital presence, particularly its investor relations website, acts as a vital channel for communication. This platform disseminates crucial details regarding its diverse fleet, operational performance, and financial health. For instance, in 2024, Algoma continued to update its website with quarterly financial reports and fleet expansion news, ensuring stakeholders had timely access to information.

This online hub is instrumental in fostering transparency and accessibility for a wide audience. Potential customers can learn about Algoma's shipping services, while investors can review its financial statements and strategic outlook. The website serves as a central repository for all key company information, supporting informed decision-making.

- Website Functionality: Provides comprehensive details on Algoma's fleet, including vessel types and capacities.

- Financial Disclosures: Offers access to annual reports, quarterly earnings, and investor presentations.

- Sustainability Reporting: Highlights the company's commitment and progress in environmental, social, and governance (ESG) initiatives.

- Stakeholder Engagement: Facilitates direct communication and inquiry for investors, analysts, and the public.

Referrals and Reputation

In the specialized world of marine transportation, Algoma heavily relies on word-of-mouth referrals and its established industry reputation to secure new business. This is particularly true given the niche nature of its services, where trust and proven reliability are paramount for industrial clients. The company's extensive history, dating back decades, coupled with a consistent dedication to dependable service, has solidified its position as a highly regarded carrier within the sector.

Algoma's strong track record and positive client testimonials serve as powerful attractors for new industrial customers. For instance, in 2024, Algoma reported a customer retention rate of over 90%, underscoring the trust built through consistent performance. These endorsements act as a crucial validation of the company's capabilities and commitment to operational excellence, directly influencing potential clients' decisions.

- Industry Reputation: Algoma's long-standing presence and commitment to reliability foster trust, leading to significant word-of-mouth referrals.

- Client Testimonials: Positive feedback from existing industrial clients validates Algoma's service quality and attracts new business.

- Specialized Market: The niche nature of marine transportation amplifies the importance of reputation and referrals over broad advertising.

- 2024 Performance: A customer retention rate exceeding 90% in 2024 highlights the strength of Algoma's reputation and client relationships.

Algoma's channels are diverse, combining direct sales with strategic partnerships. Their internal teams build direct relationships with industrial clients, focusing on understanding needs and securing contracts. This direct engagement was a key driver for new business in 2024.

International reach is achieved through joint venture partners, leveraging their established sales networks in markets like Arctic shipping. This approach expands Algoma's global presence efficiently.

Industry associations and conferences serve as vital platforms for engagement, lead generation, and staying abreast of market trends. These events are crucial for showcasing capabilities and forging new connections.

The company's website is a central hub for information, offering transparency on fleet, performance, and financial health to a broad audience of stakeholders.

Word-of-mouth referrals and a strong industry reputation are critical, especially in specialized marine transportation. Algoma's high customer retention rate in 2024, exceeding 90%, underscores the trust built through consistent, reliable service.

| Channel | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales Teams | Internal sales and commercial professionals engaging directly with industrial clients. | Builds strong relationships, tailors solutions, secures contracts. | Instrumental in securing significant new business. |

| Joint Venture Partners | Leveraging sales networks of partners for international reach. | Expands market presence, provides local insights, reduces investment. | Facilitated access to specialized markets like Arctic shipping. |

| Industry Associations & Conferences | Participation in groups like Chamber of Marine Commerce and events like IBJ Summit. | Industry insight, regulatory awareness, lead generation, visibility. | Key for understanding trends and direct client engagement. |

| Digital Presence (Website) | Investor relations website disseminating company and fleet information. | Transparency, accessibility, central information repository. | Continuous updates on financial reports and fleet expansion. |

| Word-of-Mouth & Reputation | Referrals from satisfied clients and established industry standing. | Builds trust, validates capabilities, attracts new business. | Supported a customer retention rate exceeding 90%. |

Customer Segments

Major iron and steel producers are a cornerstone customer segment for Algoma's Domestic Dry-Bulk fleet. These companies rely on efficient and dependable transportation of critical raw materials, such as iron ore and metallurgical coal, which are the fundamental building blocks of steel production.

In 2024, the global steel industry, a key driver for this segment, continued to navigate fluctuating demand and supply dynamics. Algoma's fleet is strategically positioned to serve these producers, ensuring the timely delivery of these essential commodities. The consistent need for these bulk cargoes by steel manufacturers underscores the stability and importance of this customer base for Algoma's operations.

Aggregate and construction material producers are a vital customer segment for Algoma, as they depend on our fleet for the reliable, high-volume transport of essential materials like aggregates, cement, and other building supplies. These clients are foundational to infrastructure development and construction projects across North America, making efficient logistics paramount to their operations.

In 2024, the construction sector, a key consumer of these materials, saw continued activity, with infrastructure spending being a significant driver. For instance, the U.S. Department of Transportation's Bipartisan Infrastructure Law continued to inject capital into projects, directly boosting demand for materials transported by companies like Algoma.

Agricultural Product Distributors are a core customer segment, relying on our services to transport vital commodities like grain. This group faces significant seasonal demand, with peak activity typically occurring in the latter half of the year as harvests come in. For example, in 2024, the U.S. Department of Agriculture projected a strong corn harvest, increasing the need for efficient distribution.

Major Oil Refiners and Petroleum Distributors

Algoma's Product Tankers segment is designed to serve major oil refiners and petroleum distributors, who are critical players in the Canadian energy landscape. These companies need reliable and specialized shipping solutions for their liquid bulk commodities, ensuring safe and efficient delivery across various markets. In 2024, the demand for refined product transportation remained robust, driven by ongoing domestic consumption patterns.

Key clients in this segment include entities like Imperial Oil, Suncor Energy, and Parkland Corporation, all of whom operate significant refining capacities and extensive distribution networks within Canada. These major players depend on specialized vessels to move products such as gasoline, diesel, and jet fuel, adhering to strict safety and environmental regulations. The stability of fuel distribution patterns across Canada is paramount for these customers.

- Target Clients: Major oil refiners, wholesale distributors, and large industrial consumers of petroleum products.

- Service Requirement: Specialized vessels for safe and efficient transport of liquid bulk commodities.

- Market Dependency: Relies on stable fuel distribution patterns within Canada, a sector that saw consistent demand throughout 2024.

International Industrial Clients (Cement, Mini-bulk, Handy-size)

Algoma's Global Short Sea Shipping segment and its strategic joint ventures are key to serving international industrial clients. These clients primarily operate in sectors like cement production and require specialized marine transport for specific cargo sizes, including cement, mini-bulk, and handy-size shipments. This focus allows Algoma to cater to large, established global cement manufacturers as well as a broader range of industries that depend on efficient short-sea shipping.

This international reach is crucial for diversifying Algoma's customer base and revenue streams. For instance, in 2024, the company continued to leverage its fleet to support these global trade routes. The Handy-size segment, in particular, offers flexibility for various bulk commodities, making it attractive to a wide array of industrial partners worldwide who need reliable, cost-effective shipping solutions.

- Global Cement Manufacturers: A core segment of international industrial clients relying on specialized transport for bulk cement.

- Mini-bulk and Handy-size Cargoes: Serving diverse industries needing shipment of various dry bulk commodities.

- Geographic Diversification: Expanding market presence beyond domestic operations through international shipping routes.

- Joint Venture Synergies: Collaborating with partners to enhance service offerings and reach for international clients.

Algoma's customer base is diverse, encompassing major iron and steel producers who require bulk transport of raw materials like iron ore and coal. Additionally, aggregate and construction material producers depend on Algoma for moving essential building supplies, a sector bolstered in 2024 by infrastructure spending initiatives. Agricultural distributors also form a key segment, needing efficient transport for grains, with harvests in 2024 showing strong projections for certain crops.

The Product Tankers segment serves major oil refiners and distributors, including prominent Canadian energy companies, for the crucial movement of refined petroleum products. Furthermore, Algoma's Global Short Sea Shipping, through strategic joint ventures, caters to international industrial clients, particularly global cement manufacturers, and those needing handy-size cargo shipments, highlighting a broad international reach.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Iron & Steel Producers | Bulk transport of iron ore, metallurgical coal | Navigating fluctuating demand and supply in global steel industry |

| Aggregate & Construction | High-volume transport of aggregates, cement | Construction sector activity supported by infrastructure spending (e.g., US Bipartisan Infrastructure Law) |

| Agricultural Distributors | Transport of grain, seasonal demand | Strong harvest projections for certain crops (e.g., U.S. corn) |

| Oil Refiners & Distributors | Specialized liquid bulk transport (gasoline, diesel) | Robust demand for refined product transportation in Canada |

| Global Industrial Clients (Cement, etc.) | Specialized transport for bulk cement, mini-bulk, handy-size | Continued leverage of fleet on global trade routes; Handy-size segment offers flexibility |

Cost Structure

Vessel operating expenses are a significant part of Algoma's cost structure. These include essential costs like fuel, which is a major variable expense, crew wages and benefits, necessary provisions for the crew, and insurance premiums to cover the fleet.

In 2024, Algoma's commitment to maintaining its fleet means these direct operating costs remain a primary focus. For instance, fluctuating global fuel prices directly impact profitability, highlighting the need for efficient fuel management strategies and optimized routing.

Algoma incurs significant costs for the ongoing upkeep of its fleet. This includes routine maintenance and necessary repairs. For instance, in 2023, Algoma reported maintenance and repair expenses of approximately $45.5 million.

Scheduled dry-dockings represent a substantial expenditure. These periods, where vessels are taken out of service for comprehensive overhauls, are critical for vessel longevity and safety. These events directly impact available operating days and, consequently, potential revenue generation.

Algoma's cost structure is significantly impacted by substantial capital expenditures, particularly for its aggressive fleet renewal and newbuild initiatives. These investments in modern vessels are crucial for enhancing operational efficiency, increasing cargo capacity, and improving environmental sustainability.

Financing these new vessels represents a major, long-term cost commitment for Algoma. For instance, in 2024, Algoma continued its strategic investment in fleet modernization, with capital expenditures focused on acquiring new, technologically advanced vessels designed for greater fuel efficiency and reduced emissions.

Administrative and Corporate Overhead

Algoma's administrative and corporate overhead encompasses the essential expenditures supporting its head office functions, including third-party management services and general administrative operations. These costs are crucial for the company's strategic planning, governance, and overall operational efficiency. For instance, in 2024, Algoma Steel reported significant investments in its corporate infrastructure to streamline decision-making and enhance oversight across its operations.

Efficient management of these overheads directly impacts Algoma's bottom line. By optimizing these expenses, the company can improve its cost-to-revenue ratio, thereby boosting profitability. This focus on administrative efficiency is a key component of their strategy to remain competitive in the steel industry.

- Head Office Expenditures: Costs related to the central management and administrative functions of the company.

- Third-Party Management Services: Fees paid for specialized external expertise in areas like finance, legal, or HR.

- General Administrative Functions: Day-to-day operational costs not directly tied to production but necessary for business continuity.

- Impact on Profitability: Effective control over these costs is vital for maximizing overall financial performance.

Joint Venture Costs and Fees

Algoma's cost structure significantly includes expenses related to its joint ventures, such as the FureBear and NovaAlgoma partnerships. These costs encompass shared operational expenditures, commercial fees directed to pool managers, and capital investments made into joint venture assets. The specific financial commitments for each partnership are meticulously outlined and managed according to the individual partnership agreements.

These joint venture costs are crucial to Algoma's overall financial outlay. For instance, in 2024, the company continued to allocate resources to maintain and expand these strategic alliances. While specific figures for each venture are proprietary, industry benchmarks suggest that operational cost-sharing in such maritime partnerships can represent a substantial portion of a venture's budget, often ranging from 40% to 60% of total operating expenses, depending on the scope of shared services.

- Shared Operational Expenses: Costs for crewing, maintenance, insurance, and port fees are often pooled and divided among partners based on agreed-upon metrics.

- Commercial Fees: Payments made to entities managing the commercial operations of the joint venture, such as chartering and marketing, are a regular cost.

- Investment in Joint Venture Assets: Capital contributions towards the acquisition or upgrading of vessels or other shared infrastructure form a significant investment cost.

- Management and Administrative Costs: Overhead associated with managing the joint venture, including administrative staff and legal fees, are also factored in.

Algoma's cost structure is heavily influenced by its fleet operations, encompassing fuel, crew, provisions, and insurance, with fuel costs being a significant variable in 2024. The company also dedicates substantial resources to fleet maintenance and repairs, as seen with approximately $45.5 million spent in 2023, and critical dry-docking expenses that impact operational availability.

Major capital expenditures for fleet renewal and new builds, a focus in 2024, represent a substantial long-term cost commitment aimed at enhancing efficiency and sustainability. Furthermore, administrative and corporate overhead, including third-party services, are managed to optimize the cost-to-revenue ratio and maintain competitiveness.

Costs associated with joint ventures, like FureBear and NovaAlgoma, include shared operational expenditures, commercial fees, and capital investments, with operational cost-sharing often representing 40-60% of a venture's budget. These partnerships are a key component of Algoma's overall financial outlay.

| Cost Category | Description | 2023 Impact/2024 Focus |

|---|---|---|

| Vessel Operating Expenses | Fuel, crew wages, provisions, insurance | Fuel prices a key variable in 2024; ongoing crew costs. |

| Maintenance & Repairs | Routine upkeep and necessary fixes | Approx. $45.5 million in 2023; essential for fleet integrity. |

| Dry-Docking | Periodic comprehensive overhauls | Significant expenditure impacting operational days. |

| Capital Expenditures (Fleet Renewal) | New vessel acquisitions and upgrades | Major focus in 2024 for efficiency and sustainability. |

| Administrative & Corporate Overhead | Head office functions, third-party services | Managed for cost-to-revenue ratio optimization. |

| Joint Venture Costs | Shared operational, commercial, and capital costs | Strategic alliances with ongoing resource allocation. |

Revenue Streams

Algoma's primary revenue source is its domestic dry-bulk freight operations, focusing on transporting essential commodities like iron ore, grain, coal, and salt. This vital service underpins industries across the Great Lakes and St. Lawrence Seaway regions.

Revenue generation in this segment is directly tied to key performance indicators: the sheer volume of cargo handled, prevailing freight rates, and the efficient utilization of its specialized fleet. For 2024, Algoma anticipates a robust performance, projecting increased demand driven by new business secured within the steel industry and a strong outlook for agricultural exports.

Algoma's product tanker segment generates revenue by transporting liquid bulk commodities, mainly petroleum products, for key oil refiners and distributors operating under the Canadian flag. This revenue stream is directly tied to the size of their fleet, how often the vessels are in use, and the current market prices for shipping.

In 2024, Algoma's product tanker fleet played a crucial role in the supply chain, with strong demand from major refiners. The company reported that its product tanker segment contributed significantly to overall revenue, reflecting the essential nature of these services for Canadian energy infrastructure.

Looking ahead to 2025, Algoma anticipates continued steady customer demand and robust vessel utilization, bolstered by the addition of new vessels to its product tanker fleet. This expansion is designed to enhance their capacity and service offerings, further solidifying their position in the market.

Ocean Self-Unloader Freight Revenue is generated by operating self-unloading vessels in international waters. This revenue is directly tied to the global demand for bulk commodities such as aggregate, gypsum, and salt, alongside factors like how often the fleet is in use and planned maintenance periods. For instance, in 2023, Algoma Central Corporation's international self-unloader fleet generated significant revenue, with utilization rates playing a key role in its performance.

The delivery of new ocean self-unloaders between 2025 and 2027 is poised to bolster this revenue stream. These modern vessels are designed for efficiency and capacity, enhancing the company's ability to meet international shipping demands and capture market share. This expansion anticipates increased freight volumes and improved operational economics, contributing to future financial performance.

Global Short Sea Shipping Equity Earnings

Algoma's revenue from global short sea shipping equity earnings primarily stems from its participation in joint ventures, notably NovaAlgoma Cement Carriers (NACC) and NovaAlgoma Short Sea Carriers (NASC). These ventures allow Algoma to tap into specialized marine transportation markets, generating earnings based on its share of profits. In 2024, the company continued to leverage these partnerships to diversify its revenue streams beyond its domestic Canadian operations.

The cement fleet, particularly within the NACC segment, is a key contributor to stable earnings. This stability is largely due to the presence of long-term time charter contracts, which provide predictable revenue streams. These contracts ensure a consistent demand for the specialized vessels, insulating a portion of Algoma's earnings from short-term market fluctuations.

Algoma's strategic investments in these global ventures underscore its approach to capturing value in international shipping markets. The company's share of earnings from these joint ventures reflects the performance of these specialized segments, contributing to the overall financial health of Algoma's business model.

- Joint Venture Earnings: Revenue derived from Algoma's stake in NACC and NASC, reflecting its share of profits in global specialized marine transportation.

- Cement Carrier Stability: Long-term time charter contracts for the cement fleet are expected to generate consistent and predictable earnings.

- International Market Access: These ventures provide Algoma with access to and revenue from international shipping markets beyond its core Canadian operations.

Real Estate Income

Algoma’s revenue streams include income from its commercial real estate holdings. This segment, while less significant than its core shipping business, adds a layer of diversification to the company's financial profile.

In 2024, the financial performance attributed to these real estate interests is consolidated within the Corporate segment of Algoma’s reporting structure. This aggregation allows for a comprehensive view of the company's overall financial health.

- Diversification: Real estate income offers a revenue stream independent of the cyclical nature of marine operations, enhancing financial stability.

- Contribution to Performance: Although a smaller portion, these earnings positively impact Algoma's total financial results.

- Reporting Consolidation: As of 2024, real estate revenues are reported under the Corporate segment, providing a unified financial overview.

Algoma's diverse revenue streams are anchored by its domestic dry-bulk and product tanker operations, transporting essential goods across Canadian waterways. International ventures, including joint earnings from specialized cement carriers, provide global reach and stable income through long-term contracts. Additionally, commercial real estate holdings offer a complementary, albeit smaller, revenue stream that diversifies the company's financial base.

| Revenue Stream | Primary Activities | Key Drivers | 2024 Outlook/Notes |

| Domestic Dry-Bulk Freight | Transporting iron ore, grain, coal, salt | Cargo volume, freight rates, fleet utilization | Increased demand from steel and agriculture sectors |

| Product Tanker Operations | Transporting petroleum products (Canadian flag) | Fleet size, vessel utilization, market prices | Strong demand from major refiners; fleet expansion planned for 2025 |

| Ocean Self-Unloader Freight | International transport of aggregate, gypsum, salt | Global commodity demand, fleet utilization, maintenance schedules | New vessel deliveries 2025-2027 to boost capacity and efficiency |

| Global Short Sea Shipping (Joint Ventures) | Equity earnings from NACC and NASC | Performance of specialized marine markets, profit share | Continued diversification beyond domestic operations |

| Commercial Real Estate | Income from property holdings | Property market performance | Consolidated under Corporate segment; provides diversification |

Business Model Canvas Data Sources

The Algoma Business Model Canvas is built upon a foundation of robust market research, internal financial data, and operational performance metrics. These diverse sources ensure a comprehensive and accurate representation of the business's strategic framework.