Algoma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Algoma's competitive landscape is shaped by powerful forces. Understanding buyer bargaining power and the threat of new entrants is crucial for strategic positioning. The full analysis reveals the complete picture of these dynamics.

Ready to move beyond the basics? Get a full strategic breakdown of Algoma’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The price of marine fuel is a major expense for Algoma Central Corporation, directly influencing their profitability. Global crude oil prices, geopolitical events, and decisions by OPEC+ significantly sway the cost of VLSFO and MGO, key fuels for their fleet.

Looking ahead to 2025, new regulations like FuelEU Maritime will add to effective fuel expenses for ships in European waters through carbon emission charges, further impacting operational costs.

The cost of constructing new vessels, including dry and liquid bulk carriers, has climbed significantly. In 2024, the average price for a new ship hit record highs, reflecting robust demand. This surge in newbuild prices directly impacts Algoma Porter's operating expenses, as acquiring new or replacing existing vessels becomes more capital-intensive.

Shipyards are currently experiencing exceptionally high demand, leading to fully booked order books and extended delivery lead times. This situation grants shipbuilders considerable bargaining power. For Algoma, this means that securing new vessels, particularly those with specialized designs or advanced green technologies, will likely come at a premium and require longer planning horizons.

Access to skilled labor and crew is absolutely vital for any marine transportation company like Algoma. The availability of experienced mariners directly impacts operational efficiency and safety.

While Algoma's Great Lakes contracts are distinct from East Coast and Gulf Coast dockworker unions, the broader maritime labor market can still exert influence. Potential labor shortages, which have been a growing concern in skilled trades globally, or escalating wage demands from crewing agencies and maritime unions could significantly increase Algoma's operating costs, granting these entities considerable bargaining power.

Specialized Equipment and Technology Providers

Algoma's commitment to upgrading its fleet and adopting greener technologies significantly bolsters the bargaining power of suppliers offering specialized marine equipment, advanced navigation systems, and fuel efficiency solutions. The increasing demand for these high-tech components means Algoma has fewer alternatives, giving these suppliers more leverage in price negotiations and contract terms.

The marine fuel optimization market, projected to grow substantially due to stringent environmental regulations and the pursuit of operational cost savings, highlights the growing influence of technology providers. For instance, companies specializing in advanced ballast water treatment systems or innovative hull coatings, critical for efficiency and compliance, are in a strong position. The global marine scrubber market alone was valued at approximately USD 3.5 billion in 2023 and is expected to see robust growth through 2030, underscoring the value and demand for such specialized equipment.

- Increased Reliance on Specialized Suppliers: Algoma's investments in modernizing its fleet and adopting sustainable practices necessitate reliance on a limited number of suppliers for cutting-edge marine equipment and technologies.

- Growing Fuel Optimization Market: The expanding market for fuel optimization technologies, driven by efficiency demands and environmental regulations, empowers suppliers in this niche segment.

- Supplier Leverage in Negotiations: The unique nature of specialized equipment and the growing importance of fuel efficiency solutions give these suppliers greater bargaining power when dealing with Algoma.

Port and Infrastructure Services

The bargaining power of suppliers in port and infrastructure services for a company like Algoma can be significant, particularly in specialized regions. While ports generally cater to numerous shipping lines, the actual provision of essential services such as pilotage and docking involves a limited number of specialized suppliers. This concentration of power is amplified in geographically constrained areas like the Great Lakes and St. Lawrence Seaway, where ongoing infrastructure development and maintenance require substantial investment. For instance, capital expenditures on port infrastructure and upgrades along the St. Lawrence Seaway have been substantial, with significant investments announced and underway through 2024 and beyond to modernize facilities and improve navigational capabilities.

This supplier concentration translates into pricing power and the ability to influence terms. Companies operating in these waterways must contend with the fees and availability of these critical services. The ongoing need for specialized equipment and highly trained personnel to manage these operations further solidifies the suppliers' position.

- Concentrated Power: Specialized port services like pilotage and docking are often provided by a limited number of suppliers.

- Geographic Constraints: Areas like the Great Lakes and St. Lawrence Seaway have fewer alternative suppliers, increasing their leverage.

- Infrastructure Investment: Ongoing capital expenditures on port and waterway infrastructure by suppliers can justify higher service fees.

- Operational Dependence: Shipping companies are highly reliant on these specialized services for safe and efficient navigation.

Suppliers of specialized marine equipment and fuel optimization technologies hold considerable sway over Algoma. This is due to Algoma's strategic investments in fleet modernization and environmental compliance, which narrow its supplier options for advanced systems. The growing market for fuel-saving solutions, driven by regulations and cost-efficiency goals, further strengthens the negotiating position of these niche providers.

The bargaining power of suppliers for essential port and infrastructure services, particularly in constrained regions like the Great Lakes and St. Lawrence Seaway, is substantial. Limited providers of critical services such as pilotage and docking, coupled with significant ongoing infrastructure investments by these suppliers through 2024, allow them to command higher fees and dictate terms.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Algoma |

|---|---|---|

| Marine Fuel | Global oil prices, OPEC+ decisions, geopolitical events, new environmental regulations (e.g., FuelEU Maritime from 2025) | Directly impacts operating costs and profitability. Increased compliance costs due to regulations. |

| Shipbuilding | High demand for new vessels in 2024, shipyard capacity, specialized design requirements | Increased capital expenditure for fleet acquisition and upgrades, longer lead times. |

| Specialized Equipment & Technology | Demand for advanced navigation, fuel efficiency solutions, and green technologies; limited alternative suppliers | Higher prices for critical components, less flexibility in sourcing, potential for increased operational efficiency and compliance. |

| Port & Infrastructure Services | Concentration of specialized service providers (pilotage, docking), geographic constraints, infrastructure investment by suppliers | Higher service fees, dependence on limited providers for essential operations, particularly in the Great Lakes and St. Lawrence Seaway. |

What is included in the product

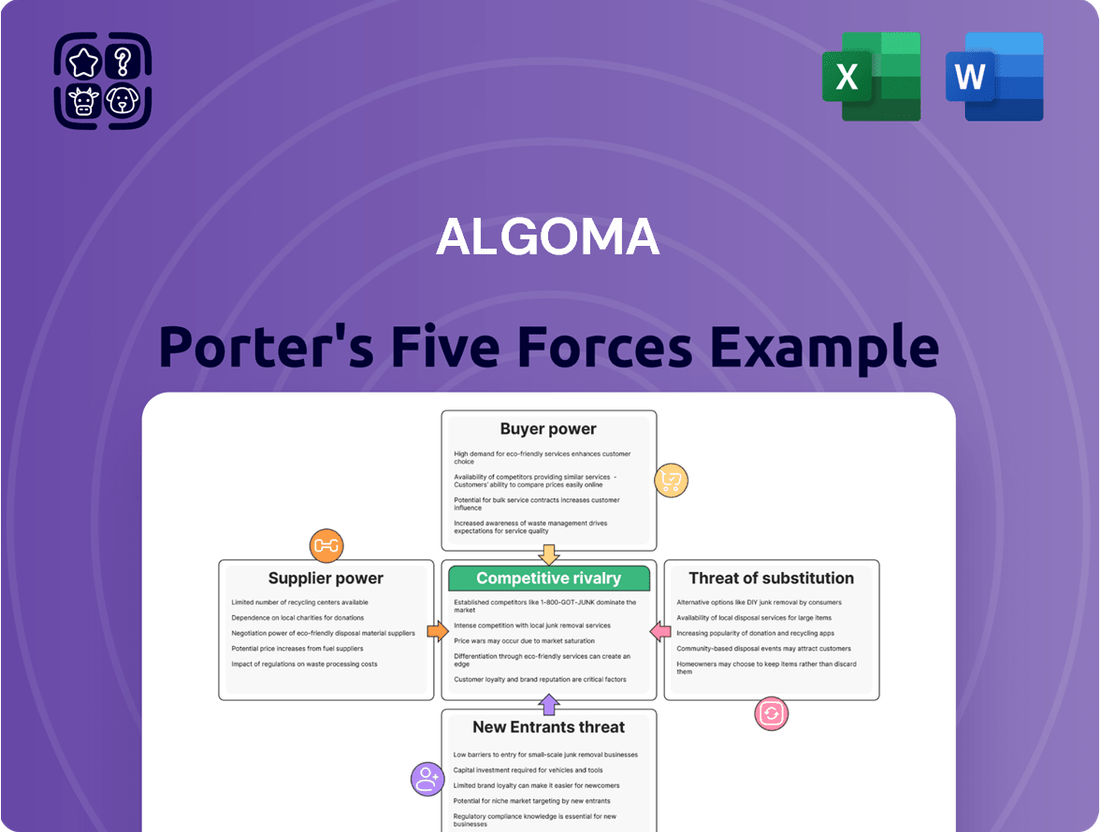

This analysis dissects the competitive forces impacting Algoma, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the steel industry.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Algoma's customer base is concentrated within specific industrial sectors, primarily those involved in bulk commodity transportation. These clients, such as those moving iron ore, grain, coal, and salt, often operate on tight margins, making them sensitive to shipping costs.

The potential for a few major industrial clients to represent a significant portion of Algoma's revenue is a key factor in their bargaining power. If these large customers account for a substantial percentage of Algoma's total business, they can leverage this dependency to negotiate lower freight rates or demand more favorable contract terms, directly impacting Algoma's profitability.

For large-volume industrial clients, the decision to switch marine transportation providers can be a complex undertaking. These clients often face significant logistical hurdles, including the need to reconfigure supply chains and manage potential disruptions. This complexity inherently lowers their bargaining power, as the effort and risk associated with changing providers are substantial.

However, the bargaining power of these customers is not absolute. If readily available alternatives exist, whether through other marine carriers or entirely different transportation methods, their leverage increases. For instance, if Algoma Central Corporation's competitors offer similar routes and pricing with minimal integration challenges, customers gain more options, thereby strengthening their position.

Customer price sensitivity for Algoma, a steel producer, is heavily influenced by the criticality of steel in various industries and prevailing economic conditions. When steel is a significant cost component for manufacturers, or during economic downturns, customers become more attuned to price fluctuations, amplifying their bargaining power.

For instance, the automotive and construction sectors, major consumers of steel, often operate with tight margins. In 2024, the automotive industry faced ongoing supply chain challenges and rising input costs, making them more likely to seek competitive pricing for steel. Similarly, the construction industry's sensitivity to interest rates and project financing directly impacts their ability to absorb higher material costs, further empowering them to negotiate better terms with suppliers like Algoma.

Availability of Alternative Transportation

Customers possess significant bargaining power when readily available alternative transportation options exist. For instance, in 2024, the trucking industry continued to be a major competitor to Great Lakes shipping, handling a substantial portion of North American freight. The cost-effectiveness and speed of trucking versus waterborne transport for certain goods directly influence shipper leverage.

The viability of these alternatives, however, is highly dependent on the specific cargo. Bulk commodities like iron ore or grain, often shipped in large volumes over long distances, find Great Lakes shipping competitive. Yet, for higher-value or time-sensitive goods, trucking or even rail might be preferred, granting those customers more bargaining power.

Consider the following:

- Modal Shift Potential: Shippers can threaten to move their cargo to rail or truck if shipping rates increase, especially for goods where transit time is less critical or where infrastructure allows for easy intermodal transfer.

- Cost Sensitivity: The relative cost per ton-mile between water, rail, and truck is a primary driver of customer choice and thus their bargaining power. For example, in 2023, the average cost to ship by truck was often higher than by Great Lakes vessels for bulk materials.

- Geographic Limitations: The bargaining power of customers is also constrained by the origin and destination of their goods. If a commodity's supply chain is intrinsically linked to Great Lakes ports, the availability of viable alternatives diminishes, reducing customer leverage.

- Volume and Frequency: Large-volume shippers who frequently utilize the Seaway have more negotiating power than smaller, less frequent users, as their business represents a more significant revenue stream for the shipping companies.

Customer Demand and Market Conditions

Customer demand for Algoma's transported commodities significantly shapes their bargaining power. When demand is robust, and shipping capacity is tight, customers find themselves with less leverage. Conversely, a slowdown in commodity markets can empower customers, as they may have more options or be able to negotiate more favorable terms.

For instance, in 2024, the global demand for steel, a key commodity Algoma transports, experienced fluctuations. While certain sectors saw recovery, overall industrial production growth remained moderate, potentially giving larger customers more room to negotiate rates.

- High commodity demand typically reduces customer bargaining power due to limited vessel availability.

- Low commodity demand can increase customer leverage as they seek cost savings.

- Market conditions in 2024 indicated a mixed demand for bulk commodities, influencing rate negotiations.

- Algoma's customer base includes large industrial players who can exert significant influence when market conditions favor them.

Algoma's customers, primarily in bulk commodity transportation, hold considerable bargaining power due to their significant volume and price sensitivity.

Large clients, such as those in the automotive and construction sectors, can leverage their substantial steel purchases to negotiate better terms, especially when economic conditions tighten, as seen with rising input costs in the automotive industry in 2024.

The availability of alternative transportation, like trucking, directly impacts shipper leverage, though its competitiveness varies by cargo type and distance, with trucking often being more expensive per ton-mile than Great Lakes shipping for bulk materials.

Customer bargaining power is also influenced by commodity demand; in 2024, moderate industrial production growth for steel meant larger customers had more room to negotiate rates.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High for large clients | Key industrial sectors sensitive to costs |

| Switching Costs | Low to moderate for some clients | Logistical complexity can limit power |

| Alternative Transportation | High when viable | Trucking remains a significant alternative |

| Price Sensitivity | High during economic downturns | Automotive and construction sectors faced cost pressures |

| Commodity Demand | Low demand increases leverage | Mixed demand for steel impacted negotiations |

Preview the Actual Deliverable

Algoma Porter's Five Forces Analysis

This preview provides a comprehensive overview of Algoma's competitive landscape through a Porter's Five Forces analysis. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, detailing threats from new entrants, buyer power, supplier power, the threat of substitutes, and the intensity of rivalry within Algoma's industry. Rest assured, there are no placeholders or samples; what you preview is your complete, ready-to-use deliverable.

Rivalry Among Competitors

Algoma Central navigates a competitive marine transportation market. While a significant player on the Great Lakes and St. Lawrence Seaway, it contends with various regional and international shipping firms, though some listed rivals operate in distinct sectors.

For instance, in 2024, the global maritime shipping industry, which includes segments relevant to Algoma's operations, saw continued activity from major carriers like Seaspan Corporation and COSCO Shipping, each managing substantial fleets and diverse service offerings.

The growth rate of the Great Lakes and St. Lawrence Seaway shipping market directly impacts competitive rivalry. While specific cargo segments like grain and potash have shown robust activity, with some projections for continued strength through 2024 and into 2025, the overall market expansion can fluctuate. This variability influences how intensely companies compete for market share.

Algoma Central's focus on differentiating its services, such as through specialized vessels designed for specific cargo needs or its commitment to reliable scheduling, can effectively lessen intense price competition. The company's strategic investments in modern, fuel-efficient vessels, like the new Equinox class, directly enhance this differentiation by offering superior performance and potentially lower operating costs for clients.

Exit Barriers

Algoma's competitive rivalry is significantly influenced by high exit barriers. These barriers, like the substantial capital tied up in specialized fleets and port infrastructure, make it difficult and costly for companies to leave the market. In 2024, the shipping industry, including bulk carriers like those operated by Algoma, continued to see high fixed costs associated with vessel maintenance and regulatory compliance, reinforcing these exit challenges. This means that even when market conditions are unfavorable, carriers are compelled to stay operational, often leading to intensified competition. For instance, if demand falters, companies might resort to aggressive price cuts or enhanced service offerings to maintain market share, rather than exiting the industry.

The persistence of players due to these exit barriers can lead to a more cutthroat environment. Companies might absorb losses for longer periods, impacting profitability across the sector. This situation forces strategic decisions focused on efficiency and market adaptation rather than a simple withdrawal.

- High Capital Investment: Specialized shipping fleets require immense upfront and ongoing capital, making divestment difficult.

- Infrastructure Lock-in: Investments in port facilities and related infrastructure create further commitment to the industry.

- Operational Continuity: Companies often continue operations through downturns to avoid substantial asset write-downs.

- Market Presence: Maintaining a presence, even at lower profitability, can be seen as crucial for future market recovery.

Market Concentration

The steel industry, including Algoma, is characterized by a moderate level of market concentration. While there are several players, a few large companies often hold a significant portion of the market share. This can lead to a less aggressive rivalry compared to highly fragmented markets where numerous small competitors vie for customers.

For instance, in North America, the steel market sees major players like Cleveland-Cliffs and Nucor alongside companies like Algoma. This concentration means that strategic decisions by these larger entities can have a substantial impact on overall market dynamics and competitive intensity.

- Market Concentration: The steel sector, where Algoma operates, exhibits moderate concentration, with a few key players dominating market share.

- Rivalry Dynamics: This concentration tends to temper direct competitive rivalry, as major players often engage in strategic pricing and production decisions rather than price wars.

- Algoma's Position: As a significant North American producer, Algoma's market share contributes to this concentration, influencing the competitive landscape.

- Impact on Competition: A concentrated market can lead to more stable pricing and a focus on product differentiation and efficiency rather than aggressive price competition among the leading firms.

Algoma Central faces a competitive landscape on the Great Lakes and St. Lawrence Seaway, contending with both regional and international shippers. While specific cargo segments like grain and potash showed robust activity in 2024, market expansion can fluctuate, directly impacting how intensely companies vie for market share. Algoma's strategy of service differentiation, bolstered by investments in modern, fuel-efficient vessels, helps mitigate direct price competition.

SSubstitutes Threaten

For bulk commodities such as iron ore, grain, and coal, rail transportation presents a considerable substitute, particularly for inland destinations or when waterways freeze. The economic viability of rail versus marine transport is heavily influenced by factors like distance, shipment volume, and existing infrastructure. In 2024, North American Class I railroads moved approximately 1.5 billion tons of freight, showcasing the scale of this alternative.

Trucking transportation presents a notable threat of substitution, particularly for shorter hauls and smaller cargo volumes where its flexibility and direct door-to-door delivery often outweigh the cost efficiencies of marine transport. For instance, in 2024, the U.S. trucking industry moved approximately 11.5 billion tons of freight, highlighting its significant role in domestic logistics.

While less cost-effective for bulk goods over long distances compared to Algoma Porter's core business, trucking's ability to provide agile, last-mile solutions makes it a viable alternative for specific segments of the market. This inherent adaptability means that businesses requiring rapid or specialized deliveries might opt for trucking, even if it means a higher per-unit cost.

Pipelines represent a significant threat to Algoma's product tanker business, especially for liquid bulk commodities like crude oil and refined products. These pipelines offer a continuous and often more economical transportation alternative, directly impacting the demand for tanker services in these specific markets. For instance, the expansion of pipeline infrastructure in North America has historically diverted significant volumes of crude oil that would otherwise have moved via rail or water, including by tankers.

Changes in Industrial Processes or Material Sourcing

A significant threat to Algoma's business arises from shifts in its clients' industrial processes or material sourcing. If clients fundamentally alter how they operate, reducing their need for the raw materials Algoma transports, demand for its services will naturally decline.

For instance, a move towards local sourcing by manufacturing clients could bypass the need for long-haul shipments of commodities like iron ore or coal. This trend directly impacts Algoma's core business model, as it relies on these bulk movements. A hypothetical scenario where a major steel producer, a key Algoma customer, significantly increases its reliance on domestic scrap metal over virgin iron ore would directly reduce the volume of iron ore shipments Algoma handles.

- Reduced Demand: Changes in client industrial processes can decrease reliance on transported commodities.

- Local Sourcing: A shift to local material sourcing bypasses traditional shipping routes.

- Commodity Specific Impact: For example, a decline in domestic steel production reduces iron ore shipment needs.

- Algoma's Vulnerability: Algoma's business is directly tied to the volume of these commodity movements.

Intermodal Solutions

The threat of substitutes for Algoma Porter's services is growing as intermodal transportation solutions become more efficient and integrated. Combining rail, trucking, and marine services offers customers greater flexibility and potentially optimized logistics, presenting an alternative to purely waterborne transport. For instance, in 2024, the North American intermodal freight volume saw a notable increase, with trucking companies expanding their intermodal capabilities to capture market share.

These evolving intermodal options can directly compete by offering faster transit times or more comprehensive door-to-door delivery. Customers might opt for these integrated solutions if they provide a more cost-effective or time-sensitive alternative to traditional shipping methods. The continued investment in intermodal infrastructure, such as new rail yards and expanded port connections, further strengthens this substitute threat.

- Increased Efficiency: Intermodal transport leverages the strengths of different modes, such as rail for long-haul and trucking for last-mile delivery, to create a more streamlined process.

- Customer Flexibility: Shippers can tailor their logistics needs by selecting the most appropriate combination of transport modes, offering greater control over transit times and costs.

- Cost Optimization: By strategically combining transport modes, businesses can potentially reduce overall shipping expenses compared to relying on a single mode.

- Growing Infrastructure: Investments in intermodal hubs and technology are continuously improving the speed and reliability of these substitute solutions.

The threat of substitutes for Algoma's services is multifaceted, encompassing various transportation modes and shifts in client operations. Rail and trucking offer alternatives, particularly for shorter distances or specific cargo types, as seen in the substantial freight volumes they handle. Pipelines pose a direct threat to liquid bulk transport. Furthermore, changes in industrial processes, such as increased local sourcing, can significantly reduce the demand for bulk commodity shipping.

| Substitute Mode | Key Advantages for Substitutes | 2024 Data/Context |

|---|---|---|

| Rail Transportation | Cost-effective for bulk, inland destinations | North American Class I railroads moved ~1.5 billion tons of freight. |

| Trucking Transportation | Flexibility, door-to-door, shorter hauls | U.S. trucking moved ~11.5 billion tons of freight. |

| Pipelines | Continuous, economical for liquids | Pipeline infrastructure expansion diverts oil volumes. |

| Intermodal Solutions | Efficiency, flexibility, cost optimization | Growing intermodal capabilities and infrastructure. |

| Industrial Process Shifts | Reduced reliance on transported materials | Increased local sourcing bypasses long-haul needs. |

Entrants Threaten

Launching a new dry and liquid bulk carrier fleet demands immense upfront capital. Think billions for shipbuilding, port infrastructure, and ongoing maintenance, making it a formidable hurdle for potential newcomers. For instance, the average cost of a new Panamax dry bulk carrier can easily exceed $30 million, with larger vessels costing significantly more.

The Great Lakes and St. Lawrence Seaway system is governed by intricate regulatory frameworks, encompassing environmental standards and navigation protocols. New companies must secure various licenses and permits, a process that can be both time-consuming and costly, thereby deterring potential entrants.

New entrants face significant hurdles in securing essential distribution channels and port access. Algoma, with its established presence, likely holds long-term contracts and preferential agreements for key ports and loading facilities along the Great Lakes and St. Lawrence Seaway. This makes it difficult for newcomers to gain the necessary infrastructure to operate efficiently.

Economies of Scale and Experience

Existing players in the shipping industry, such as Algoma Central, leverage significant economies of scale. This advantage is evident in their ability to negotiate better rates for fuel, maintenance, and port services due to their large fleet size and consistent demand. For instance, in 2024, Algoma Central's substantial operational volume allowed for more efficient cargo consolidation and route optimization, directly reducing per-unit shipping costs.

New entrants would face considerable challenges in matching these cost efficiencies. Building a fleet of comparable size and establishing the necessary operational experience to achieve similar levels of efficiency would require massive upfront investment and time. This barrier is amplified by the learning curve associated with navigating complex global shipping regulations and securing reliable, cost-effective supply chain partners.

- Economies of Scale: Algoma Central benefits from bulk purchasing of fuel and supplies, leading to lower per-unit costs.

- Operational Experience: Years of experience have allowed Algoma to optimize routes and vessel utilization, enhancing efficiency.

- Capital Investment: New entrants need substantial capital to build a fleet and achieve operational scale, making market entry difficult.

- Cost Disadvantage: Without scale, new companies will operate at a higher cost base than established players like Algoma.

Brand Loyalty and Reputation

Algoma Central benefits from a deeply entrenched brand loyalty and a strong reputation, built over decades of consistent and reliable cargo delivery within its operational regions. This established trust is a significant barrier for potential new entrants. For instance, Algoma's long-standing presence means customers are accustomed to their service quality and dependability.

Developing a comparable level of brand recognition and customer allegiance would demand substantial investment in marketing, operational excellence, and time for any new competitor attempting to enter the market. This makes it difficult for newcomers to gain immediate traction against an incumbent with such a solid reputation.

Consider the impact of this loyalty: in 2024, Algoma Central continued to leverage its brand strength to secure long-term contracts, a testament to the trust placed in them by major shippers. This loyalty directly translates into reduced price sensitivity for Algoma and increased switching costs for customers.

- Established Reputation: Algoma Central has cultivated a reputation for reliability in cargo transportation over many years.

- Customer Trust: This long history fosters significant customer trust, making it difficult for new players to gain market share.

- High Switching Costs: For customers, the effort and potential disruption involved in switching to an unknown entity represent considerable costs.

- Brand Loyalty as a Barrier: The ingrained loyalty acts as a powerful deterrent, effectively raising the barrier to entry for new shipping companies.

The threat of new entrants for Algoma Central is moderate. While the capital-intensive nature of shipbuilding and stringent regulations create significant barriers, established players benefit from economies of scale and strong brand loyalty.

Newcomers face substantial upfront capital requirements, with the cost of a single Panamax dry bulk carrier exceeding $30 million in 2024. Navigating complex regulatory environments and securing port access also present considerable challenges, as evidenced by the time-consuming and costly licensing processes required for operations on the Great Lakes and St. Lawrence Seaway.

Algoma's established economies of scale, allowing for better negotiation on fuel and maintenance, coupled with decades of operational experience, create a cost advantage that new entrants would struggle to match. Furthermore, their strong brand reputation and customer loyalty, reinforced by consistent service in 2024, translate into high switching costs for clients, making market penetration difficult.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for fleet acquisition and infrastructure. | Significant deterrent due to massive upfront investment. |

| Regulatory Hurdles | Complex licensing and environmental standards. | Time-consuming and costly, increasing operational complexity. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | New entrants face a cost disadvantage until achieving similar scale. |

| Brand Loyalty & Reputation | Established trust and customer relationships. | Makes customer acquisition challenging and increases switching costs. |

Porter's Five Forces Analysis Data Sources

Our Algoma Porter's Five Forces analysis is built upon a robust foundation of data, including Algoma Steel's annual reports, industry-specific market research from firms like IHS Markit, and relevant government trade data to assess competitive dynamics.