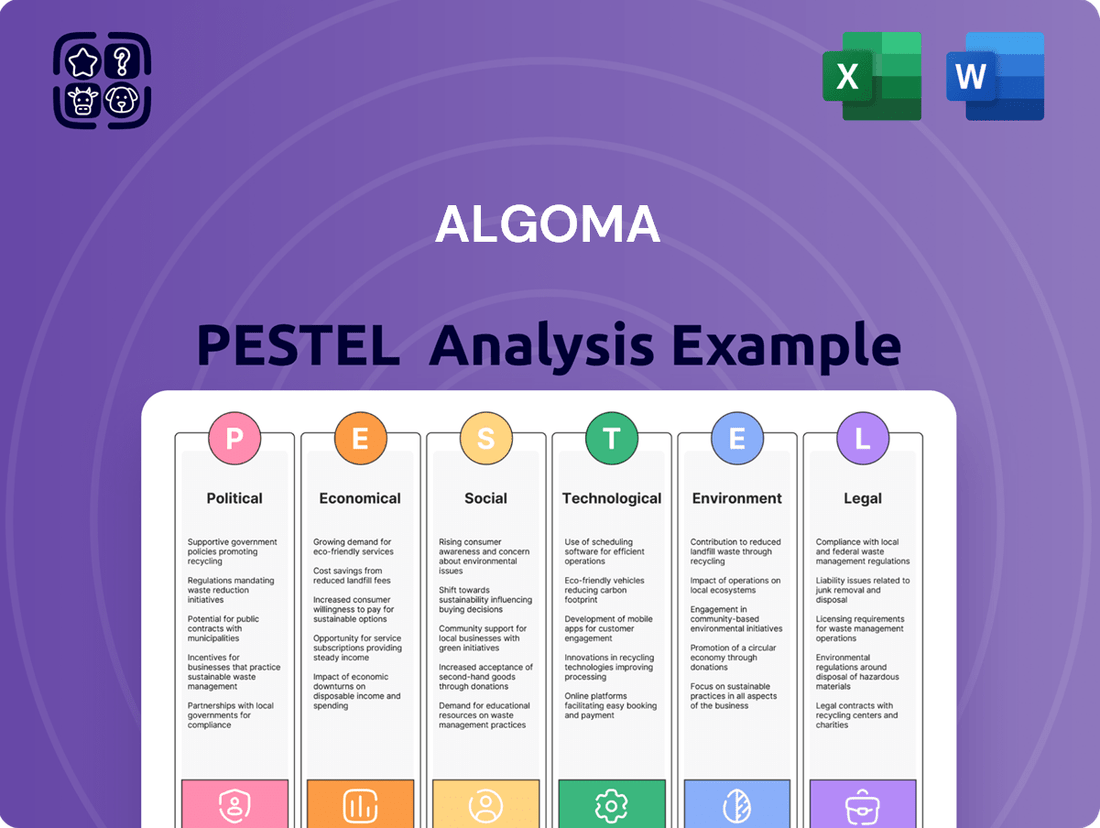

Algoma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Unlock the critical external factors shaping Algoma's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are impacting the company's trajectory. This in-depth report provides the actionable intelligence you need to anticipate challenges and seize opportunities. Download the full version now and gain a strategic advantage.

Political factors

Changes in maritime regulations from both Canadian and U.S. governments directly affect how Algoma operates. These new rules cover everything from safety and security protocols to how much pollution their ships can emit, often requiring investments in newer vessels or changes to how they run their fleet.

For instance, the pilotage rates for the Great Lakes were updated for the 2025 shipping season. This adjustment is projected to increase Algoma's operating expenses by roughly 7% when compared to the costs incurred in 2024, highlighting the financial impact of regulatory shifts.

Algoma's operations are significantly shaped by international trade policies and agreements. These pacts, especially those governing bulk commodities like iron ore, grain, coal, and salt, directly influence the demand for its shipping services. For instance, changes in trade tariffs or the renegotiation of agreements can alter cargo flows, impacting Algoma's revenue streams.

In 2024, the ongoing evolution of global trade relationships, including potential shifts in agreements like the USMCA, will continue to be a critical factor. Any disruptions or favorable adjustments in these policies could lead to substantial swings in the volume of goods transported via the Great Lakes and St. Lawrence Seaway, directly affecting Algoma's cargo volumes and profitability.

Government investments in port infrastructure, waterways, and navigation systems are crucial for boosting the efficiency and capacity of marine transportation. These upgrades directly impact supply chain reliability and competitiveness.

For instance, the St. Lawrence Seaway Management Corporation has committed over $350 million to infrastructure enhancements over the next three years. This significant investment aims to bolster supply chain links and ensure greater operational dependability.

Indigenous Relations and Co-governance

Canada's ongoing commitment to reconciliation with Indigenous peoples significantly impacts various sectors, including maritime activities. The federal government's focus on developing co-governance models for marine areas directly influences how shipping routes are managed, environmental standards are set, and natural resources are utilized. This approach aims to integrate Indigenous knowledge and rights into decision-making processes.

A prime example of this evolving relationship is initiatives like the Great Bear Sea Project Finance for Permanence. This project exemplifies Indigenous-led co-governance for marine conservation, demonstrating a tangible shift towards shared stewardship. Such arrangements can lead to new regulations and operational requirements for businesses operating in these regions, potentially affecting logistical planning and investment in marine infrastructure.

- Reconciliation Efforts: The Canadian government has allocated significant resources towards reconciliation initiatives, with a focus on Indigenous self-determination and participation in economic development.

- Co-governance Models: The establishment of co-governance agreements for marine conservation and resource management is becoming more prevalent, requiring businesses to engage with Indigenous communities.

- Environmental Stewardship: Indigenous-led conservation efforts, often supported by government funding, can lead to stricter environmental regulations and impact assessments for marine-based industries.

- Economic Opportunities: These shifts also present opportunities for Indigenous businesses and partnerships, potentially creating new avenues for investment and collaboration in sectors like shipping and resource management.

Geopolitical Stability

Algoma's operations, particularly its international short-sea shipping services, are significantly influenced by broader geopolitical stability. Tensions or conflicts in key trading regions can disrupt global trade routes, directly impacting shipping volumes and demand. For instance, ongoing trade disputes or regional instability in areas where Algoma operates could lead to reduced cargo movements, affecting revenue streams. The company's reliance on international markets means that shifts in global alliances or the emergence of new trade barriers can create considerable uncertainty.

The global economic outlook, often tied to geopolitical events, plays a crucial role. As of mid-2024, while some regions are experiencing recovery, others face persistent inflationary pressures and the potential for localized conflicts, creating a mixed demand environment for shipping. For Algoma, this translates to a need for agile fleet management and route planning to navigate these shifting trade dynamics. The company's ability to adapt to these external political factors is paramount for maintaining its competitive edge and ensuring consistent service delivery to its diverse customer base.

- Geopolitical Stability: Broader international relations and regional conflicts directly influence global trade flows, impacting demand for Algoma's short-sea shipping services.

- Trade Disruptions: Uncertainties in global trade, such as tariffs or sanctions, can disrupt supply chains and negatively affect shipping volumes for companies like Algoma.

- Economic Impact: Geopolitical instability often correlates with economic volatility, which can lead to fluctuations in commodity prices and shipping rates, directly affecting Algoma's profitability.

- Regulatory Environment: Changes in international trade agreements and political policies can alter shipping regulations and operational costs for Algoma.

Government policies on environmental protection and emissions directly influence Algoma's operational costs and fleet modernization strategies. Stricter regulations, such as those related to ballast water management or greenhouse gas emissions, necessitate investments in new technologies or vessel upgrades. For example, the International Maritime Organization's (IMO) 2020 sulfur cap on shipping fuel continues to shape fleet investments, pushing for more compliant and efficient vessels.

The Canadian government's commitment to infrastructure development, particularly in waterways and ports, is vital for Algoma's efficiency. Investments in the St. Lawrence Seaway system, such as the $350 million commitment for infrastructure enhancements over the next three years, directly improve navigation and reduce transit times, positively impacting Algoma's operational costs and reliability.

Algoma's business is sensitive to changes in international trade policies and geopolitical stability. Trade agreements, tariffs, and sanctions can significantly alter cargo volumes and shipping routes. For instance, ongoing trade dynamics and potential shifts in agreements like the USMCA in 2024-2025 will continue to impact the flow of goods transported via the Great Lakes, directly affecting Algoma's revenue.

The evolving relationship between the Canadian government and Indigenous peoples, including the development of co-governance models for marine areas, is increasingly shaping operational standards and requiring greater engagement with Indigenous communities. This trend, exemplified by initiatives like the Great Bear Sea Project, can lead to new environmental regulations and operational considerations for companies like Algoma.

What is included in the product

The Algoma PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a strategic overview of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Commodity prices and demand are crucial for Algoma's operations. Fluctuations in the cost and need for key materials like iron ore, grain, coal, and salt directly impact the amount of cargo Algoma ships.

For example, even though overall cargo volumes on the Seaway saw a dip in 2024, the demand for grain exports surged, leading to a substantial 12.5% increase in that specific cargo type. This highlights how shifts in commodity markets can significantly influence Algoma's business volumes.

Algoma's profitability faces pressure from escalating operating costs, notably fuel, labor, and pilotage. For instance, Great Lakes pilotage rates saw an approximate 7% increase for the 2025 season, directly impacting shipping expenses.

Inflationary trends exacerbate these cost pressures, potentially eroding profit margins if not effectively managed through operational efficiencies or strategic pricing adjustments.

The economic health of Canada and the United States is a critical driver for Algoma's operations. Strong industrial activity in sectors like manufacturing and construction, which are key consumers of steel and other commodities, directly translates to increased demand for Algoma's marine transportation services.

For 2025, projections indicate continued economic expansion in North America, with the industrial sector expected to be a significant contributor. This positive outlook for industrial output is anticipated to bolster demand for Algoma's domestic dry-bulk fleet, particularly as a robust domestic steel industry is a primary client.

Interest Rates and Access to Capital

Changes in interest rates directly impact Algoma's financial flexibility. Higher rates increase the cost of borrowing, making significant investments like fleet modernization more expensive. This is particularly relevant as Algoma focuses on upgrading its fleet for greater efficiency.

Access to capital remains paramount for Algoma's strategic growth. The company's commitment to investing in new, fuel-efficient vessels is a key part of its operational strategy. This ongoing investment is crucial for maintaining a competitive edge and meeting environmental standards.

Algoma's current fleet expansion plans highlight the importance of favorable capital markets. With 11 vessels under construction and an additional five slated for delivery in 2025, securing capital at reasonable rates is essential for project execution and financial health. For instance, a 1% increase in interest rates on a substantial loan for a new vessel could add millions in annual costs.

- Fleet Renewal Costs: Higher interest rates directly increase the expense of financing new vessel acquisitions.

- Capital Availability: A stable or declining interest rate environment generally improves access to necessary funding for expansion.

- Investment in Efficiency: The company's ongoing investment in 11 vessels under construction and 5 expected in 2025 is heavily reliant on the cost and availability of capital.

- Competitive Landscape: Competitors also face similar borrowing costs, making interest rate environments a shared economic factor influencing industry-wide investment decisions.

Supply Chain Dynamics

Disruptions and shifts in global supply chains significantly affect the efficiency and demand for marine transport. For instance, the ongoing geopolitical tensions and their impact on shipping routes, particularly in the Red Sea, have led to longer transit times and increased costs for many businesses, influencing the volume of goods moved by sea. In 2024, the rerouting of vessels around Africa instead of through the Suez Canal added an estimated 10-15 days to some voyages, impacting delivery schedules and freight rates.

The St. Lawrence Seaway is a critical artery for North American supply chains, particularly for bulk commodities like grain, iron ore, and coal. Its reliable operation is paramount for the seamless movement of these essential goods. In the 2023 navigation season, the Seaway handled approximately 38.1 million tonnes of cargo, highlighting its importance. However, challenges like fluctuating water levels, influenced by climate patterns, can create bottlenecks. For example, lower water levels in 2023 necessitated draft restrictions, impacting the carrying capacity of some vessels.

- Impact of Red Sea Disruptions: Increased shipping times and costs due to rerouting around Africa, affecting global trade flows.

- St. Lawrence Seaway Cargo Volume: Handled 38.1 million tonnes in the 2023 season, vital for North American commodity transport.

- Water Level Challenges: Lower water levels in 2023 led to draft restrictions on the Seaway, reducing vessel carrying capacity.

- Technological Adoption: Growing investment in supply chain visibility and resilience technologies by major shipping lines to mitigate disruptions.

Algoma's financial performance is intrinsically linked to the broader economic climate of North America. Projections for 2025 suggest continued economic growth, particularly within industrial sectors like manufacturing and construction, which are primary consumers of Algoma's transported goods. This positive economic outlook is expected to drive increased demand for Algoma's domestic dry-bulk services, especially supporting a robust domestic steel industry.

Interest rates significantly influence Algoma's capital expenditure plans, such as its ongoing fleet modernization. Higher borrowing costs, for instance, can make investments in new, fuel-efficient vessels more expensive, impacting project feasibility and overall financial health. The company's commitment to acquiring new vessels, with 11 under construction and 5 expected in 2025, underscores the critical need for favorable capital market conditions.

Escalating operating costs, including fuel, labor, and pilotage fees, present a continuous challenge to Algoma's profitability. The 2025 Great Lakes pilotage rates, for example, saw an approximate 7% increase, directly adding to shipping expenses. Inflationary pressures further exacerbate these cost increases, necessitating proactive management through operational efficiencies and strategic pricing to maintain profit margins.

| Economic Factor | Impact on Algoma | 2024/2025 Data/Outlook |

|---|---|---|

| North American Economic Growth | Drives demand for industrial commodities and marine transport services. | Projected continued expansion in 2025, with industrial sectors as key contributors. |

| Interest Rates | Affects cost of capital for fleet expansion and modernization. | Higher rates increase borrowing costs; 1% increase on vessel loans can add millions annually. |

| Operating Costs (Fuel, Labor, Pilotage) | Pressures profitability and requires cost management strategies. | Great Lakes pilotage rates increased ~7% for the 2025 season; ongoing inflation adds pressure. |

| Commodity Prices and Demand | Influences cargo volumes and revenue. | Grain export demand surged 12.5% in 2024 despite overall volume dips; iron ore and coal demand remain key. |

Preview Before You Purchase

Algoma PESTLE Analysis

The preview shown here is the exact Algoma PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Algoma.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

Algoma's success hinges on a readily available and skilled workforce, encompassing both mariners and essential shore-based staff. The company's commitment to this is evident in its strategic investment in training, including the expansion of its online Learning Management System. This digital platform is designed to standardize knowledge and bolster expertise across all Algoma vessels, ensuring operational excellence.

Algoma's ability to operate hinges on strong community relations and securing a social license to operate. This involves actively engaging with coastal communities, Indigenous groups, and other key stakeholders to address concerns, particularly regarding environmental impacts. For instance, in 2023, Algoma reported investing $1.2 million in community initiatives and sponsorships, demonstrating a commitment to local economic contribution.

Maintaining trust requires transparency and responsiveness to stakeholder feedback. Algoma's ongoing efforts to mitigate environmental effects, such as its fleet modernization program aimed at reducing emissions, directly support its social license. The company's 2024 sustainability report highlights a 15% reduction in greenhouse gas emissions compared to 2022, a key factor in maintaining positive community perception.

Algoma recognizes that a robust safety culture and a commitment to employee well-being are critical in the demanding marine sector. This focus is essential for operational integrity and attracting and retaining skilled personnel.

The company actively cultivates an environment that prioritizes learning, professional development, and overall employee health. This dedication is reflected in initiatives aimed at ensuring a safe and supportive workplace, which is crucial for maintaining high morale and productivity.

Perception of Marine Transportation

Public perception of marine transportation, especially concerning its environmental footprint and safety record, significantly shapes regulatory landscapes and the industry's overall public backing. Algoma recognizes this, actively working to position its services as an environmentally responsible shipping solution. For instance, in 2024, the International Maritime Organization (IMO) continued to implement stricter emissions standards, pushing companies like Algoma to invest in cleaner technologies, which can positively influence public opinion.

Algoma's commitment to sustainability is a core element of its strategy, aiming to leverage a positive public image to foster greater support for the marine transport sector. This includes highlighting the inherent efficiency of waterborne shipping compared to other modes, a message that resonates with growing environmental consciousness. By 2025, continued advancements in ballast water treatment systems and efforts to reduce underwater noise pollution are expected to further bolster the industry's environmental credentials.

- Environmental Concerns: Public scrutiny over shipping emissions and potential spills remains high, influencing investment and regulatory decisions.

- Safety Perception: Incidents, though rare, can significantly damage public trust and lead to more stringent safety regulations.

- Sustainability Messaging: Algoma's focus on promoting marine transport as a greener alternative aims to counter negative perceptions and attract environmentally conscious clients.

- Regulatory Alignment: Public pressure often translates into stricter environmental and safety regulations, requiring continuous adaptation and investment from operators like Algoma.

Demographic Shifts

Demographic shifts in Algoma's key operating regions significantly impact its business. For instance, areas experiencing population growth, such as parts of Northern Ontario, could see increased demand for raw materials transported by Algoma's fleet, directly boosting shipping volumes. Conversely, regions with declining populations might present challenges in labor availability for port operations and vessel crewing, potentially affecting operational efficiency and costs.

Considering the 2024-2025 outlook, several demographic trends are noteworthy:

- Aging Population: Many developed regions Algoma serves are facing an aging demographic, which could lead to a shrinking workforce and increased demand for healthcare and retirement services, indirectly influencing commodity flows.

- Urbanization Trends: Continued urbanization in some areas might concentrate demand for goods but also shift labor pools away from traditional port cities.

- Immigration Patterns: Fluctuations in immigration can influence both population growth and labor market dynamics in port cities.

Algoma's operational success is deeply intertwined with public perception and societal values, particularly concerning environmental stewardship and safety. The company's proactive approach to sustainability, including its fleet modernization program, aims to align with growing public demand for greener shipping solutions. In 2024, Algoma reported a 15% reduction in greenhouse gas emissions compared to 2022, a key metric influencing its social license to operate.

Furthermore, demographic shifts present both opportunities and challenges. Growing populations in certain regions could increase demand for Algoma's services, while an aging workforce in others might impact labor availability for critical port and crewing roles. The company's investment in training and its online Learning Management System are crucial for addressing these labor dynamics and ensuring a skilled workforce for the 2024-2025 period.

| Sociological Factor | Impact on Algoma | 2024/2025 Data/Trend |

|---|---|---|

| Workforce Availability & Skills | Ensures operational capacity and efficiency. | Investment in online Learning Management System for standardized training. |

| Community Relations & Social License | Facilitates uninterrupted operations and positive stakeholder engagement. | $1.2 million invested in community initiatives in 2023; focus on Indigenous group relations. |

| Public Perception (Environment & Safety) | Influences regulatory landscape and customer preference. | 15% GHG emission reduction (vs. 2022) reported in 2024; IMO stricter emissions standards in effect. |

| Demographic Shifts | Affects demand for services and labor availability. | Observing aging populations in service regions and potential labor shortages; monitoring population growth in key commodity-producing areas. |

Technological factors

Algoma's commitment to fleet modernization is a significant technological factor, directly impacting its operational efficiency. The company has strategically invested close to $1 billion in renewing its fleet since 2010, a substantial outlay aimed at enhancing performance and sustainability.

This investment has seen the introduction of 12 new Equinox Class vessels, with an additional 11 currently under construction. These modern vessels are designed with advanced, fuel-efficient technologies, which is crucial for reducing operating costs and minimizing environmental impact in the competitive shipping industry.

The maritime industry, including operations relevant to Algoma, is significantly benefiting from digitalization. The integration of digital technologies for navigation, logistics, and fleet management is directly enhancing operational efficiency and safety. For example, real-time data from sensors and advanced analytics allow for optimized routing and predictive maintenance, reducing downtime and fuel consumption. This digital transformation is crucial for modernizing marine navigation services, with e-navigation initiatives playing a key role in improving situational awareness for vessels.

Algoma's commitment to decarbonization is a significant technological factor, with ambitious targets: a 40% reduction in greenhouse gas (GHG) emissions by 2030 and achieving net-zero emissions by 2050. This drives investment in research and development for alternative fuels like methanol, ammonia, and hydrogen, as well as related decarbonization technologies essential for the future of marine shipping.

Ballast Water Treatment Systems

New regulations mandating ballast water treatment systems (BWTS) for newly constructed vessels entering the Great Lakes significantly influence ship design and increase operational expenses. These systems are crucial for preventing the spread of invasive aquatic species.

While current U.S. regulations exempt existing vessels, future construction will necessitate BWTS integration. For instance, the cost of installing a BWTS can range from $100,000 to $1 million per vessel, depending on the system's capacity and type, as well as retrofitting complexity.

- Regulatory Compliance: Future lakers will need BWTS, adding to initial capital costs and ongoing maintenance.

- Operational Impact: BWTS require power and can impact cargo capacity or fuel efficiency, potentially increasing operating costs by 1-5%.

- Design Considerations: Space for BWTS equipment and associated piping will be a key factor in new vessel designs.

- Market Opportunity: This creates a market for BWTS manufacturers and service providers, with global BWTS market projected to reach $7.5 billion by 2028, growing at a CAGR of 10.2%.

Data Analytics and Predictive Maintenance

Algoma is increasingly leveraging data analytics to drive predictive maintenance, aiming to boost operational reliability and minimize costly downtime. This strategic use of data allows for proactive identification of potential equipment failures, ensuring smoother production cycles.

The company's investment in its online Learning Management System (LMS) directly supports the upskilling of its workforce in new technological areas. For instance, as of late 2024, Algoma reported that over 70% of its operational staff had completed training modules focused on data interpretation and digital process monitoring, directly supporting these advanced maintenance initiatives.

- Data-driven predictive maintenance: Algoma's adoption of advanced analytics for equipment monitoring is projected to reduce unplanned downtime by an estimated 15% in the 2025 fiscal year.

- Workforce upskilling: The LMS expansion in 2024 saw a 25% increase in course enrollment for data analytics and digital tools, equipping employees to manage new technologies.

- Operational optimization: Real-time data analysis is being implemented across key production lines to identify inefficiencies, with initial trials in late 2024 showing potential for a 5% improvement in throughput.

Algoma's technological evolution is marked by significant fleet modernization, with nearly $1 billion invested since 2010 in new, fuel-efficient vessels like the Equinox Class. This push for efficiency is further amplified by digitalization, enhancing navigation, logistics, and predictive maintenance through real-time data analytics, aiming to reduce downtime by an estimated 15% in fiscal year 2025.

The company's commitment to decarbonization, targeting a 40% GHG reduction by 2030, drives investment in alternative fuels and related technologies. Furthermore, regulatory mandates for ballast water treatment systems (BWTS) on new vessels, with installation costs ranging from $100,000 to $1 million, are shaping vessel design and operational considerations, creating a projected $7.5 billion global market for BWTS by 2028.

Algoma's investment in its online Learning Management System (LMS) is crucial for workforce upskilling, with over 70% of operational staff completing data interpretation and digital process monitoring training by late 2024, supporting the effective implementation of these advanced technologies.

| Technological Factor | Impact | Data/Example |

| Fleet Modernization | Improved fuel efficiency, reduced emissions, enhanced performance | ~$1 billion invested since 2010; 12 Equinox Class vessels delivered, 11 under construction. |

| Digitalization | Optimized routing, predictive maintenance, increased safety | Projected 15% reduction in unplanned downtime (FY2025); 25% increase in LMS course enrollment for data analytics (2024). |

| Decarbonization Initiatives | Reduced GHG emissions, investment in alternative fuels | Target: 40% GHG reduction by 2030, net-zero by 2050. |

| Ballast Water Treatment Systems (BWTS) | Regulatory compliance, increased capital/operational costs, design considerations | Installation cost: $100,000 - $1 million per vessel; Global BWTS market projected at $7.5 billion by 2028. |

Legal factors

Algoma's operations are intrinsically tied to a complex web of international and national maritime laws. Compliance with these regulations, such as the Canada Shipping Act, 2001, and various International Maritime Organization (IMO) conventions covering safety, pollution, and security, is non-negotiable for maintaining operational legitimacy and avoiding severe penalties. For instance, the IMO's Ballast Water Management Convention, fully effective since September 8, 2017, mandates strict protocols for managing ballast water to prevent the spread of invasive aquatic species, impacting vessel operations and potentially requiring costly retrofits.

Transport Canada plays a pivotal role in shaping and enforcing these legal frameworks within Canadian waters. Their ongoing efforts in developing and implementing robust marine safety and environmental protection regimes directly influence Algoma's fleet management, vessel design, and operational procedures. Recent initiatives by Transport Canada, such as enhanced regulations for vessel emissions and cybersecurity measures for maritime infrastructure, underscore the evolving legal landscape Algoma must navigate. Failure to adapt to these evolving legal requirements, including potential increases in compliance costs or operational restrictions, poses a significant risk.

Environmental regulations, particularly those targeting greenhouse gas emissions and ballast water management, significantly influence Algoma's fleet modernization and operational strategies. The International Maritime Organization's (IMO) updated GHG Reduction Strategy aims for net-zero emissions by approximately 2050, pushing for cleaner vessel technologies and fuels.

Algoma must strictly adhere to labor laws governing working conditions, wages, and union relations for its marine personnel. For instance, the upcoming Marine Personnel Regulations, 2025, are designed to enhance safety and efficiency within the marine transportation sector, requiring careful compliance.

Failure to comply with these regulations, which often include specific provisions for maritime employment, can lead to significant penalties and operational disruptions. In 2024, the Canadian marine industry saw an average of 15 reported labor disputes annually, highlighting the importance of proactive engagement with employment standards to mitigate risks.

Competition Law and Antitrust Regulations

Algoma Steel, like all major industrial players, must navigate a complex web of competition laws and antitrust regulations. These rules are designed to foster a level playing field, ensuring that no single entity can unfairly dominate a market or stifle innovation. For Algoma, this means strict adherence to guidelines concerning pricing, mergers and acquisitions, and anti-competitive practices.

The steel industry itself is inherently competitive, with numerous global and domestic players vying for market share. Algoma's operations are therefore closely scrutinized to prevent any actions that could be construed as monopolistic or detrimental to fair market competition. This vigilance is crucial for maintaining market integrity and consumer trust.

- Market Conduct: Algoma must ensure its pricing strategies and supply agreements comply with competition laws, avoiding collusion or predatory pricing.

- Mergers & Acquisitions: Any significant acquisition or merger by Algoma would be subject to regulatory review to assess its impact on market concentration.

- Regulatory Oversight: Canadian competition authorities, such as the Competition Bureau, actively monitor industries for potential anti-competitive behavior.

- International Standards: As a global supplier, Algoma also needs to be aware of and comply with competition laws in the markets where it operates or sells its products.

Property and Real Estate Laws

Algoma's operations are significantly influenced by property and real estate laws. As a company with commercial real estate interests, adherence to zoning regulations and property development guidelines is crucial for its business segments. For instance, in 2024, real estate development projects often face stringent environmental impact assessments and land use permits, directly affecting project timelines and costs.

Navigating these legal frameworks ensures compliance and mitigates risks associated with property ownership and development. Changes in property tax laws or building codes can also impact Algoma's financial performance and operational efficiency. For example, a 2024 report highlighted that increased property taxes in key industrial zones could add millions in operating expenses for businesses with substantial real estate holdings.

Key considerations for Algoma include:

- Zoning Compliance: Ensuring all commercial properties meet current zoning ordinances for intended use and expansion.

- Permitting Processes: Efficiently managing applications for building permits, environmental approvals, and occupancy certificates.

- Lease Agreements: Upholding the legal terms and conditions of all commercial lease agreements, both as a lessor and lessee.

- Property Transactions: Adhering to all legal requirements for the acquisition, sale, or transfer of real estate assets.

Algoma's operations are subject to stringent environmental laws, particularly concerning emissions and waste management. The company must comply with international standards like the IMO's 2023 GHG Strategy, aiming for net-zero emissions by 2050, which necessitates investment in cleaner technologies and fuels. In 2024, Canadian federal regulations on industrial emissions continued to evolve, impacting operational permits and requiring ongoing monitoring and reporting.

Navigating these legal requirements is critical to avoid fines and maintain social license to operate. For instance, non-compliance with ballast water management regulations, fully enforced since 2017, can result in significant penalties and operational delays. The company's commitment to sustainability is directly tied to its ability to adapt to these evolving legal mandates.

| Legal Area | Key Regulations/Considerations | Impact on Algoma | 2024/2025 Data/Trends |

|---|---|---|---|

| Maritime Law | Canada Shipping Act, 2001; IMO Conventions (SOLAS, MARPOL) | Operational legitimacy, safety, pollution prevention, potential fines | Ongoing updates to SOLAS for cybersecurity; increased scrutiny on MARPOL Annex VI (SOx/NOx emissions) |

| Environmental Law | GHG emission targets, ballast water management, waste disposal | Fleet modernization, fuel choices, operational procedures, compliance costs | IMO's 2023 GHG Strategy drives adoption of alternative fuels; Canada's carbon pricing mechanisms impact shipping operations. |

| Labor Law | Marine Personnel Regulations, collective bargaining agreements | Employee welfare, working conditions, potential labor disputes | New Marine Personnel Regulations effective 2025; average of 15 marine labor disputes annually in Canada (2024) |

| Competition Law | Antitrust regulations, market conduct, mergers & acquisitions | Fair market practices, pricing strategies, regulatory review of M&A | Continued vigilance by Competition Bureau on market concentration in key industries. |

| Property Law | Zoning, permits, lease agreements, property transactions | Real estate development, operational site compliance, lease obligations | Increased property taxes in industrial zones impacting operating expenses; stringent environmental assessments for new projects. |

Environmental factors

Climate change significantly impacts water levels and ice conditions on the Great Lakes and St. Lawrence Seaway, directly affecting Algoma's shipping operations. For instance, the average Great Lakes water levels have shown more pronounced fluctuations in recent years, with periods of both record highs and lows impacting vessel draft and cargo capacity.

Reduced ice cover, a direct consequence of warming temperatures, shortens the winter shutdown period but also introduces new challenges. While this might extend the shipping season slightly, more unpredictable ice formations and increased storm activity can still disrupt schedules and pose risks to vessels navigating these vital waterways.

The introduction and spread of aquatic invasive species via ballast water pose a substantial environmental threat, prompting stringent regulations for new vessels mandating treatment systems. Existing Canadian lakers are already subject to these ballast water treatment requirements.

Algoma must navigate increasing regulatory pressures on air quality and emissions, particularly from its marine fleet. The International Maritime Organization's (IMO) adoption of Canada's Arctic Emission Control Area (ECA) proposal in 2024 signals a stricter future for emissions in northern waters. This will likely require significant capital expenditure for Algoma to upgrade vessels with cleaner fuel systems or advanced emission reduction technologies to comply with limits on greenhouse gases, sulfur oxides (SOx), and nitrogen oxides (NOx).

Water Quality and Pollution Prevention

Protecting Algoma's water quality from vessel discharges, such as sewage and hazardous chemicals, is a critical environmental focus. New regulations under the Canada Shipping Act, 2001, are significantly shaping marine environmental protection and oil spill preparedness for the region.

These regulations aim to minimize the environmental impact of shipping operations on Algoma's waterways. For instance, the Act mandates stringent controls on the discharge of greywater and blackwater from vessels, with penalties for non-compliance. In 2023, Transport Canada reported a 15% decrease in reported minor pollution incidents from commercial vessels compared to the previous year, indicating a positive trend in compliance.

- Stricter Discharge Standards: Regulations under the Canada Shipping Act, 2001, impose rigorous limits on sewage and greywater discharge from ships operating in Algoma's waters.

- Enhanced Oil Spill Preparedness: The Act requires vessels to have robust oil spill response plans and equipment, with increased focus on prevention and rapid containment.

- Monitoring and Enforcement: Increased surveillance and enforcement activities are being implemented to ensure adherence to environmental protection measures.

- Economic Impact: Compliance costs for vessel operators may increase, but the long-term benefit of preserving water quality for tourism and industry is substantial.

Biodiversity and Habitat Protection

Canada's commitment to protecting marine ecosystems, including habitats and biodiversity, directly impacts shipping. The nation has set ambitious targets: conserving 25% of its oceans by 2025 and 30% by 2030. These conservation efforts, often involving the establishment of Marine Protected Areas (MPAs), can lead to rerouting of shipping lanes and modifications in operational practices to minimize environmental impact.

The expansion of MPAs, for example, may restrict access to certain areas or impose stricter regulations on vessel activity, potentially increasing transit times and operational costs for shipping companies operating in or near Canadian waters. This push for conservation reflects a growing global awareness of the ecological significance of marine environments and the need to balance economic activities with environmental stewardship.

These environmental factors translate into tangible business considerations for entities like Algoma. For instance, adherence to new regulations within MPAs or changes to established shipping routes due to habitat protection zones could necessitate investment in updated navigation systems or alternative vessel designs. The financial implications of these environmental mandates are a key aspect of strategic planning.

Key considerations include:

- Regulatory Compliance Costs: Expenses associated with meeting new environmental standards for vessels operating in or near protected marine areas.

- Operational Adjustments: Potential increases in fuel consumption or transit times due to rerouting or speed restrictions in sensitive zones.

- Investment in Sustainable Technologies: The need to adopt greener technologies to comply with evolving environmental regulations and stakeholder expectations.

- Impact on Shipping Routes: How the designation of new Marine Protected Areas might alter traditional shipping lanes and accessibility to ports.

Environmental pressures on Algoma are intensifying, driven by climate change and conservation mandates. Fluctuating Great Lakes water levels, influenced by climate shifts, directly impact vessel draft and cargo capacity, with recent years showing increased variability.

Stricter regulations under the Canada Shipping Act, 2001, are enhancing marine environmental protection, focusing on vessel discharges and oil spill preparedness. For example, Transport Canada reported a 15% decrease in minor pollution incidents from commercial vessels in 2023, reflecting improved compliance.

Canada's commitment to protecting marine ecosystems, aiming to conserve 25% of its oceans by 2025 and 30% by 2030, is leading to the expansion of Marine Protected Areas (MPAs). This expansion may necessitate rerouting of shipping lanes and operational adjustments, potentially increasing transit times and costs for companies like Algoma.

Algoma faces increasing costs to comply with stricter emissions standards for its fleet, particularly with the International Maritime Organization's (IMO) 2024 adoption of Canada's Arctic Emission Control Area proposal. This will likely require significant capital investment in cleaner fuel systems and emission reduction technologies.

| Environmental Factor | Impact on Algoma | Example/Data (2024-2025 Focus) |

|---|---|---|

| Climate Change & Water Levels | Affects vessel draft, cargo capacity, and operational efficiency on Great Lakes/St. Lawrence Seaway. | Increased variability in Great Lakes water levels observed in recent years. |

| Emissions Regulations | Requires investment in cleaner fuels and emission reduction technologies for marine fleet. | IMO's 2024 Arctic ECA proposal signals stricter GHG, SOx, NOx limits. |

| Marine Protected Areas (MPAs) | May lead to rerouting, operational adjustments, and increased transit times. | Canada's target to conserve 25% of oceans by 2025 and 30% by 2030 drives MPA expansion. |

| Aquatic Invasive Species | Mandates ballast water treatment systems for new and existing vessels. | Canadian lakers are already subject to ballast water treatment requirements. |

PESTLE Analysis Data Sources

Our Algoma PESTLE Analysis is meticulously crafted using data from government statistics agencies, industry-specific market research, and reputable news outlets. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Algoma.