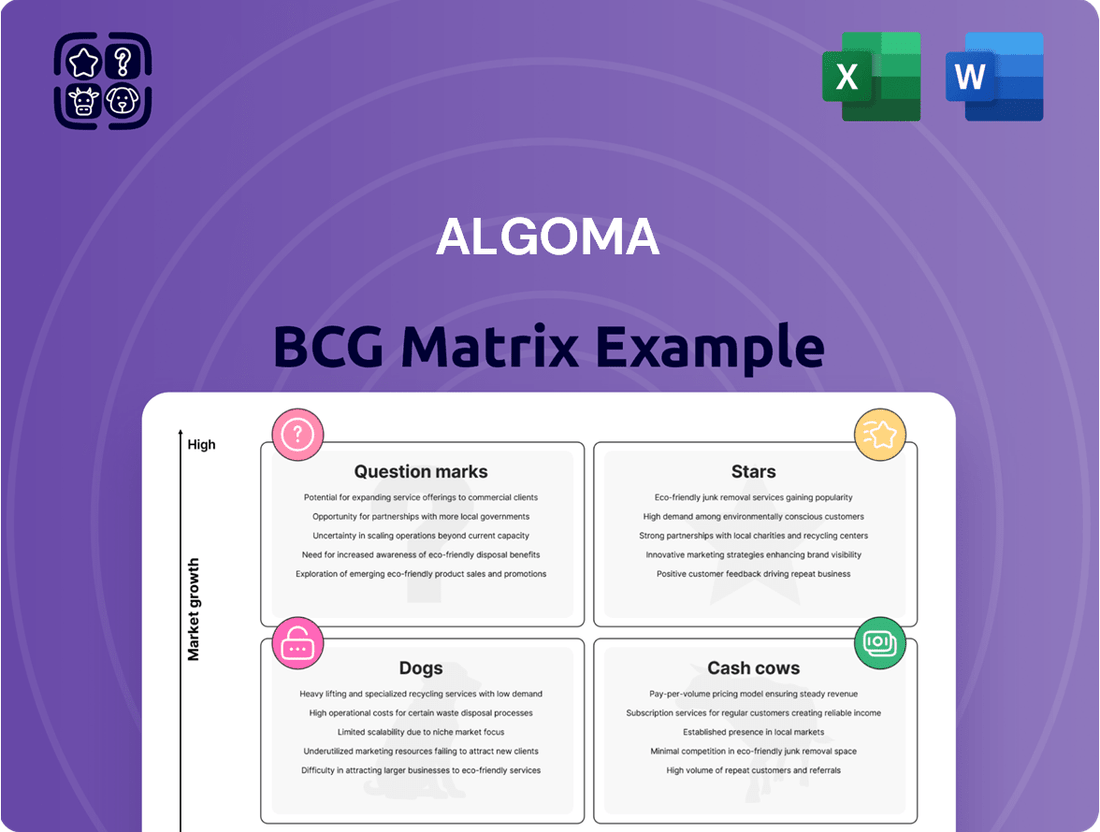

Algoma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Unlock the strategic potential of the Algoma BCG Matrix, revealing how its diverse product portfolio navigates market growth and share. Understand which products are poised for future success and which require careful management. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment strategy.

Stars

Algoma's strategic investment in the FureBear joint venture places it squarely in the burgeoning international product tanker market. With five advanced, climate-friendly dual-fuel tankers delivered by early 2025 and an additional five slated for early 2026, the company is poised to capitalize on this expansion.

These vessels, specifically engineered for the demanding Northern European trade routes, are designed to benefit from a projected steady rate environment. This focus on specialized, environmentally conscious shipping suggests significant growth potential within this niche segment of the maritime industry.

The Algoma East Coast and Algoma Acadian tankers represent significant investments in Algoma's fleet, designed for specialized service. These 37,000 DWT vessels are ice-class product tankers, built to navigate challenging northern waters. Their delivery in early 2025 positions them as modern assets in the company's portfolio.

These tankers are immediately deployed on long-term time charters with Irving Oil, a key strategic partner. This arrangement focuses on servicing the Canadian and U.S. East Coast markets, highlighting a strong demand for these specific capabilities. The immediate and long-term deployment suggests a robust market position for these new vessels.

Algoma's commitment to modernizing its fleet is highlighted by the Equinox Class, with the Algoma Endeavour, the twelfth and last of this series, set for delivery in early 2025. This strategic move significantly upgrades their domestic dry-bulk carrying capacity.

These new vessels are engineered for enhanced fuel efficiency, contributing to lower operational costs and a reduced environmental footprint. This focus on sustainability aligns with increasingly stringent environmental regulations, positioning Algoma favorably within the Great Lakes dry-bulk market.

Domestic Dry-Bulk (New Steel Industry Business)

The domestic dry-bulk segment is a star performer, fully booked for the 2025 season. This strong demand is fueled by significant new business from the domestic steel industry, signaling a robust market position.

This growth is further bolstered by strong agricultural shipments. The combination of these factors suggests Algoma holds a high market share in a segment experiencing a resurgence.

- 2025 Season Bookings: Fully booked, indicating strong demand and capacity utilization.

- Key Demand Drivers: New domestic steel industry business and robust agricultural shipments.

- Market Position: High market share in a segment exhibiting renewed growth.

Ocean Self-Unloaders (Newbuild Orders)

Algoma's strategic move to order three new methanol-ready Kamsarmax-based ocean self-unloaders signals a significant investment in modernizing its fleet. The first of these advanced vessels is slated for delivery in 2025, marking a pivotal step in replacing older tonnage and setting a new standard for future builds.

This initiative is designed to capitalize on the robust demand within the ocean self-unloader sector, serving key commodities like aggregates, gypsum, iron ore, coal, and salt. Algoma's commitment to these efficient, next-generation vessels positions them for substantial growth and leadership in this specialized segment of the maritime industry.

- Fleet Modernization: Three new methanol-ready Kamsarmax-based ocean self-unloaders ordered, with the first delivery in 2025.

- Market Focus: Targeting high growth in the ocean self-unloader market, serving key bulk commodities.

- Strategic Replacement: Vessels designed to replace older units and establish a new benchmark for Algoma's fleet.

- Environmental Preparedness: Methanol-readiness aligns with evolving environmental regulations and sustainability goals.

Algoma's domestic dry-bulk segment is a clear star in its portfolio. This segment is fully booked for the 2025 season, a testament to its strong market demand. Key drivers include new business from the domestic steel industry and robust agricultural shipments, indicating a high market share and a segment experiencing a resurgence.

| Segment | 2025 Outlook | Key Demand Drivers | Market Position |

|---|---|---|---|

| Domestic Dry-Bulk | Fully Booked | Domestic Steel Industry, Agricultural Shipments | High Market Share, Resurgent Growth |

What is included in the product

The Algoma BCG Matrix analyzes business units based on market growth and share, offering strategic guidance.

The Algoma BCG Matrix offers a clear, visual snapshot of your portfolio, easing the pain of strategic decision-making by highlighting areas needing attention.

Cash Cows

Algoma's established Great Lakes dry-bulk operations are a classic cash cow. Their significant market share, operating the largest fleet on the Great Lakes and St. Lawrence Seaway, means they are a dominant player in a mature industry. This segment reliably generates strong cash flow by moving essential commodities like iron ore, grain, coal, and salt, crucial for industrial supply chains.

Algoma's existing Canadian-flagged product tanker fleet operates as a strong Cash Cow. This segment consistently delivers essential liquid petroleum product transportation across the Great Lakes – St. Lawrence Seaway and Atlantic Canada, demonstrating reliable service.

Customer demand remains steady, ensuring high and consistent utilization rates for these vessels. This reliable performance translates directly into significant and predictable cash flow generation for the company, reinforcing its Cash Cow status.

Algoma's cement fleet operates as a classic cash cow within its Global Short Sea Shipping segment. These vessels are largely tied up in long-term time charter contracts, ensuring a steady and predictable revenue stream.

This stability is a hallmark of a mature, niche market where Algoma holds a significant share. For example, in 2024, the company's dedicated cement carriers consistently generated strong, reliable cash flows, underscoring their cash cow status.

Real Estate Properties

Algoma's commercial real estate properties are classic Cash Cows. They are mature assets, meaning they're in a stable, low-growth phase, much like a well-established business that consistently churns out profits. This stability is key to their Cash Cow status.

These properties are likely generating reliable rental income for Algoma. This consistent cash flow is a hallmark of Cash Cows, as they typically require minimal new investment to maintain their earnings. Think of it as a reliable income stream that doesn't demand much attention or capital infusion.

For instance, in 2024, many commercial real estate markets experienced steady rental demand, particularly for well-located, quality assets. While overall growth might be modest, the income generated is predictable and contributes significantly to overall profitability. This steady performance is what makes them valuable Cash Cows within the BCG matrix.

- Stable Rental Income: Commercial properties provide a predictable revenue stream.

- Low Growth, High Profitability: Mature assets require minimal investment for consistent returns.

- Cash Generation: These assets are primary contributors to cash flow.

- Market Resilience: In 2024, demand for quality commercial spaces remained robust in many sectors.

Long-Term Contracts and Customer Relationships

Algoma's focus on long-term contracts with industrial clients is a key driver of its stable revenue. These agreements, often spanning multiple years, provide a predictable demand for its cargo delivery services. This stability is crucial for maintaining high profit margins, as it allows for efficient operational planning and resource allocation.

The company's commitment to these enduring customer relationships, particularly in mature markets, translates directly into consistent cash generation. For instance, in 2024, Algoma reported that a significant portion of its revenue was secured through these long-term agreements, underscoring their importance to its financial health.

- Stable Revenue Streams: Long-term contracts provide predictable income, reducing reliance on volatile spot market rates.

- High Profit Margins: Predictable demand in mature markets allows for optimized operations and cost control, leading to higher margins.

- Consistent Cash Generation: The reliability of these contracts ensures a steady flow of cash, supporting ongoing investments and shareholder returns.

- Customer Retention: Algoma's success in maintaining these relationships highlights its commitment to service quality and customer satisfaction.

Algoma's established Great Lakes dry-bulk operations are a classic cash cow. Their significant market share, operating the largest fleet on the Great Lakes and St. Lawrence Seaway, means they are a dominant player in a mature industry. This segment reliably generates strong cash flow by moving essential commodities like iron ore, grain, coal, and salt, crucial for industrial supply chains.

The company's cement fleet also operates as a cash cow, largely tied up in long-term time charter contracts, ensuring a steady and predictable revenue stream. In 2024, Algoma's dedicated cement carriers consistently generated strong, reliable cash flows, underscoring their cash cow status within its Global Short Sea Shipping segment.

Algoma's commercial real estate properties are also considered cash cows. These mature assets are in a stable, low-growth phase, generating reliable rental income with minimal new investment required. In 2024, demand for quality commercial spaces remained robust, contributing significantly to overall profitability.

Long-term contracts with industrial clients further bolster Algoma's cash cow status, providing predictable demand and high profit margins. In 2024, a significant portion of Algoma's revenue was secured through these long-term agreements, highlighting their importance to the company's financial health.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Notes |

|---|---|---|---|

| Great Lakes Dry-Bulk Operations | Cash Cow | Dominant market share, mature industry, essential commodities | Largest fleet on Great Lakes/St. Lawrence Seaway, strong cash flow generation |

| Canadian-Flagged Product Tanker Fleet | Cash Cow | Essential liquid petroleum product transportation, steady demand | Consistent high utilization, reliable service across key routes |

| Cement Fleet | Cash Cow | Long-term time charter contracts, niche market | Steady, predictable revenue stream, strong cash flow |

| Commercial Real Estate | Cash Cow | Mature assets, stable low-growth phase, rental income | Minimal investment needed, robust demand for quality assets in 2024 |

| Long-Term Industrial Contracts | Cash Cow driver | Predictable demand, high profit margins, stable revenue | Significant portion of 2024 revenue secured by these agreements |

Delivered as Shown

Algoma BCG Matrix

The preview you see is the complete Algoma BCG Matrix report you will receive upon purchase, offering a clear and actionable framework for your business strategy. This document is fully formatted and ready for immediate use, providing a professional analysis without any watermarks or demo content. You'll be able to directly apply the insights from this matrix to your strategic planning and decision-making processes. Rest assured, what you see is precisely what you'll get—a comprehensive tool designed for strategic clarity and immediate application.

Dogs

As Algoma Central Corporation progresses with its fleet modernization, older, less fuel-efficient vessels are naturally moving towards the 'Dogs' category in the BCG matrix. These ships, while still operational, face increasing challenges in competing with newer, more economical tonnage. For instance, the average fuel consumption of a modern bulk carrier can be significantly lower than that of vessels built in earlier decades, impacting their operating costs and profitability.

These older vessels may also incur higher maintenance expenses due to their age and design. Their potentially lower market share, stemming from these inefficiencies, makes them less attractive for long-term investment. Consequently, Algoma might consider divesting these assets or engaging in responsible recycling programs to streamline its fleet and focus on its more competitive, modern assets.

While the broader dry bulk market shows resilience, certain commodity segments are facing headwinds. For instance, coal shipments, a significant component of dry bulk, are anticipated to experience a marginal decline in 2025. According to industry forecasts, global coal demand for power generation is expected to plateau or slightly decrease in key importing regions due to a push towards renewable energy sources.

Vessels heavily reliant on these declining commodity trades, particularly if they possess low market share and limited growth potential in these specific sectors, could be categorized as 'Dogs' within the Algoma BCG Matrix. This classification suggests these assets may generate low returns and require careful strategic consideration for potential divestment or repositioning.

Within Algoma's real estate portfolio, properties consistently underperforming, demanding substantial capital without proportional returns, or misaligned with long-term strategic goals fall into the category of Dogs. These assets typically exhibit low market growth and a low relative market share, representing a drag on overall portfolio performance.

Mini-bulker Fleet in Global Short Sea Shipping

The mini-bulker fleet in global short sea shipping faced significant headwinds in Q1 2025. Increased dry-docking days and adverse weather conditions led to operational disruptions, impacting overall fleet utilization.

These challenges, coupled with exposure to volatile market conditions, put pressure on profitability within this segment. For instance, the Baltic Dry Index, a benchmark for dry bulk shipping rates, saw fluctuations throughout early 2025, directly influencing the revenue potential for mini-bulkers.

If these operational inefficiencies and market volatility persist, leading to sustained low profitability and a declining market share, the mini-bulker fleet could be categorized as a 'Dog' within the Algoma BCG Matrix. This classification would indicate a need for strategic review, potentially involving divestment or significant operational restructuring to improve performance.

- Operational Challenges: Q1 2025 saw a notable increase in dry-docking days for the mini-bulker fleet, impacting vessel availability.

- Market Volatility: Exposure to fluctuating freight rates, as indicated by the Baltic Dry Index, created an unpredictable revenue environment.

- Profitability Concerns: The combination of operational issues and market pressures led to concerns about the segment's ability to generate consistent profits.

- Strategic Implications: Persistent underperformance could necessitate a re-evaluation of the mini-bulker fleet's role within Algoma's broader business strategy.

Product Tankers with Increased Dry-dockings

The Product Tankers segment faced headwinds in Q1 2025, reporting a revenue decline and an operating loss. This downturn was primarily attributed to a significant increase in scheduled dry-dockings, which removed vessels from revenue-generating service.

While essential for maintaining fleet health, the elevated number of off-hire days directly impacted profitability. If this trend of increased dry-docking costs and reduced revenue generation persists without a swift market rebound, certain product tanker vessels or specific operational sub-segments could be classified as Dogs within the BCG matrix.

- Revenue Impact: Increased dry-dockings directly reduce the number of vessels available for charter, leading to lower potential revenue.

- Cost Increase: Dry-docking itself incurs significant costs for maintenance, repairs, and shipyard fees.

- Market Sensitivity: The product tanker market is cyclical, and prolonged periods of low charter rates can exacerbate the negative impact of increased off-hire days.

- BCG Classification: A sustained period of low revenue and high costs could relegate specific assets to the 'Dog' quadrant, requiring strategic evaluation.

Assets in the 'Dogs' category, such as older, less fuel-efficient vessels or underperforming real estate, represent a challenge for Algoma. These assets typically have low market share and low growth potential, often requiring significant investment without commensurate returns.

For instance, the mini-bulker fleet experienced operational disruptions in Q1 2025 due to increased dry-docking days. Similarly, the Product Tankers segment reported a revenue decline and operating loss in the same period, largely due to elevated off-hire days for maintenance.

These situations highlight the need for strategic review, potentially leading to divestment or restructuring to align with Algoma's modernization goals and focus on more profitable segments.

The following table illustrates potential 'Dog' assets within Algoma's portfolio, considering their performance and market position.

| Asset Category | BCG Classification | Key Challenges | Market Context (2025) |

|---|---|---|---|

| Older Bulk Carriers | Dog | Higher fuel consumption, increased maintenance costs | Facing competition from modern, efficient tonnage |

| Underperforming Real Estate | Dog | Low returns, high capital requirements, strategic misalignment | Varies by property, but generally low growth and market share |

| Mini-Bulker Fleet | Potential Dog | Operational disruptions, market volatility | Q1 2025 saw increased dry-docking and fluctuating Baltic Dry Index |

| Product Tankers | Potential Dog | Revenue decline, operating losses due to dry-dockings | Elevated off-hire days impacting profitability |

Question Marks

Algoma is actively exploring new technologies for decarbonization, such as trialing biofuels. These innovative solutions represent high-growth potential areas, aligning with the 'Question Mark' category in the BCG Matrix due to their nascent stage and the need for significant investment to achieve widespread adoption and market leadership.

The company's advocacy for short-sea shipping also falls into this category. While offering substantial future environmental and economic benefits, these solutions currently have a low market share. Their success hinges on further development, infrastructure investment, and regulatory support, positioning them as future 'Stars' if current investments yield positive market traction.

Algoma's exploration into international short-sea shipping beyond its established cement operations presents a classic 'Question Mark' scenario in the BCG matrix. While the cement fleet offers stability, venturing into new international segments requires careful consideration of market dynamics and potential returns.

The global short-sea shipping market is anticipated to expand, with projections indicating significant growth in the coming years. For instance, the European short-sea shipping market alone was valued at approximately €100 billion in 2023 and is expected to see a compound annual growth rate of around 4% through 2030. This presents an opportunity for Algoma.

However, Algoma's market share in these nascent international sub-segments would likely start low. Significant strategic investment would be necessary to build capacity, establish routes, and gain competitive footing, making these ventures a capital-intensive proposition with uncertain immediate outcomes.

Algoma's installation of Buffalo Automation's 'AutoMate' system on its Equinox series vessels positions autonomous navigation as a prime candidate for a Question Mark in the BCG Matrix. This venture into cutting-edge technology signifies a high-growth potential market, though current adoption rates are likely nascent.

The strategic move reflects Algoma's exploration of a technology that, while potentially revolutionary for maritime operations, requires significant investment and development to overcome technical hurdles and establish market acceptance. Success hinges on proving its reliability and cost-effectiveness.

Expansion into New Niche Cargo Markets

Algoma's strategic growth may involve venturing into new niche cargo markets, such as specialized project cargo or renewable energy components. These markets, while experiencing growth, represent areas where Algoma currently holds a minimal market share. Significant investment in marketing and specialized operational capabilities will be necessary to build a strong presence and achieve profitability.

The company's approach to these new niche markets aligns with the concept of question marks in the Boston Consulting Group (BCG) matrix. These are businesses with low relative market share in high-growth industries. For instance, if Algoma were to target the burgeoning offshore wind turbine component transport market, it would likely face established players but benefit from the sector's projected 10% compound annual growth rate through 2028.

- Niche Market Exploration: Algoma is considering expanding into specialized cargo segments like oversized industrial equipment or critical raw materials for emerging technologies.

- Growth Potential vs. Market Share: These new markets exhibit strong growth trajectories, but Algoma's current market share is negligible, necessitating substantial investment.

- Investment Requirements: Establishing a foothold will demand significant capital for specialized vessels, port infrastructure upgrades, and targeted marketing campaigns.

- Strategic Objective: The goal is to transition these question mark ventures into stars by capturing market share and achieving economies of scale within these high-growth niches.

Strategic Partnerships for Future Growth

Algoma's 2022 FureBear joint venture, aimed at constructing eco-friendly product tankers, exemplifies a strategic move from a 'Question Mark' to a potential 'Star' within the BCG framework. This venture required significant investment to navigate the nascent market for climate-friendly shipping solutions.

Looking ahead, Algoma's pursuit of partnerships in emerging marine transportation sectors, such as autonomous shipping or advanced alternative fuel technologies, would position these initiatives as new 'Question Marks'. These areas, while holding substantial future growth potential, currently demand considerable capital and technological development to prove their viability and market acceptance.

- FureBear JV: Established in 2022, this venture focuses on building climate-friendly product tankers, representing a significant investment in a developing market segment.

- Emerging Marine Tech: Future partnerships in areas like autonomous vessels or alternative fuels will likely start as 'Question Marks', requiring substantial investment to assess and cultivate their growth potential.

- Strategic Importance: Identifying and nurturing these 'Question Mark' opportunities is crucial for Algoma's long-term competitive positioning and market leadership in evolving shipping landscapes.

Question Marks in Algoma's portfolio represent ventures with high growth potential but currently low market share. These are areas where significant investment is needed to establish a competitive position and drive future success. For example, Algoma's exploration into international short-sea shipping beyond its core cement operations fits this profile, requiring capital for capacity building and route development.

The company's adoption of autonomous navigation technology, like the 'AutoMate' system, also falls under Question Marks. While this technology promises to revolutionize maritime operations, it necessitates substantial investment and development to overcome technical challenges and gain market acceptance. Success in these areas is crucial for Algoma's long-term growth and market leadership.

Algoma's strategic foray into niche cargo markets, such as components for renewable energy projects, exemplifies another Question Mark. These markets are experiencing robust growth, but Algoma's current share is minimal, demanding considerable investment in specialized assets and marketing to build a significant presence.

The company's 2022 FureBear joint venture, focused on eco-friendly product tankers, is a prime example of a Question Mark that required substantial investment to penetrate a developing market. Future ventures into emerging marine technologies, like advanced alternative fuels, will likely also begin as Question Marks, needing significant capital and technological maturation to prove their viability.

| Venture Area | BCG Category | Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| International Short-Sea Shipping | Question Mark | High | Low | Significant |

| Autonomous Navigation | Question Mark | High | Nascent | Substantial |

| Niche Cargo Markets (e.g., Renewables) | Question Mark | High | Negligible | Considerable |

| Emerging Marine Technologies | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial performance data, market share analysis, and industry growth rate projections to provide a comprehensive strategic overview.