Algoma Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

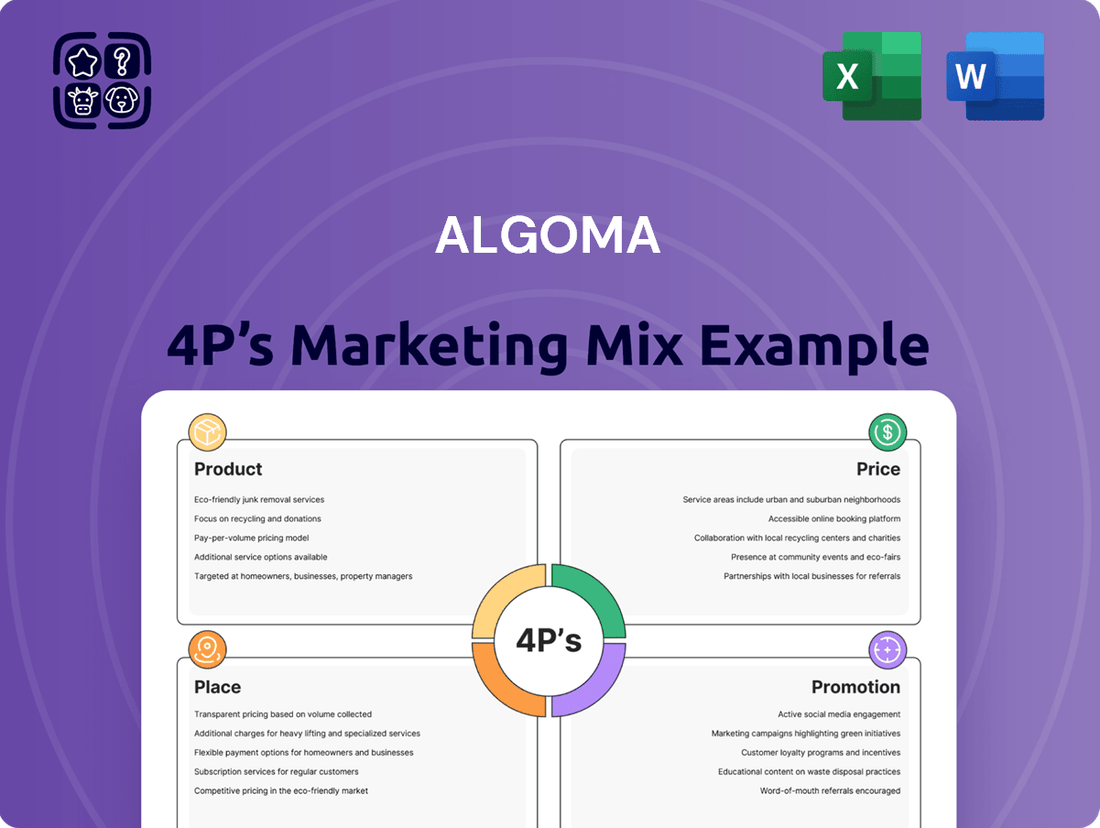

Discover how Algoma masterfully blends its product offerings, pricing strategies, distribution channels, and promotional campaigns to capture market share. This analysis goes beyond the surface to reveal the strategic brilliance behind their success.

Unlock the full potential of your own marketing efforts by learning from Algoma's proven playbook. Gain access to an in-depth, ready-made 4Ps Marketing Mix Analysis that provides actionable insights and a clear roadmap for competitive advantage.

Product

Algoma Central Corporation's diverse marine transportation services are central to its product offering, focusing on the efficient movement of dry and liquid bulk commodities. This includes vital materials like iron ore, grain, coal, and salt, underscoring their role in supporting key industries. For 2024, Algoma reported moving approximately 14.1 million metric tons of cargo across its fleet.

Algoma's product portfolio is anchored by a modern, growing fleet specifically engineered for efficiency and distinct operational needs. These vessels are expertly designed for navigating the Great Lakes and St. Lawrence Seaway, with several featuring ice-class capabilities to tackle demanding winter voyages.

A significant aspect of their product strategy is the integration of advanced, environmentally conscious technologies. For instance, recent fleet expansions include dual-fuel and methanol-ready tankers, showcasing Algoma's forward-thinking approach to sustainable shipping solutions in the 2024-2025 period.

Algoma's commitment to fleet modernization and expansion is a cornerstone of its product strategy. By 2025, the company will have welcomed several new vessels, including the final Equinox Class, the Algoma East Coast and Algoma Acadian product tankers, and new ocean self-unloaders.

These strategic additions, with deliveries spanning 2024 through early 2026, significantly boost Algoma's cargo capacity and operational efficiency. The new builds are designed with advanced fuel efficiency, directly impacting operational costs and environmental performance.

International Short-Sea Shipping

Algoma's international short-sea shipping ventures, such as NovaAlgoma Cement Carriers and NovaAlgoma Bulk Holdings, are crucial for its global presence. These operations, focusing on specialized cargo like cement and general bulk commodities, extend Algoma's reach beyond its domestic Canadian routes. This international segment leverages handy-size bulk carriers, enabling participation in diverse global trade lanes and enhancing the company's overall service portfolio.

This strategic expansion into international waters diversifies Algoma's revenue streams and mitigates risks associated with reliance on any single market. For instance, the global dry bulk shipping market, which includes handy-size vessels, experienced significant fluctuations in 2024. Freight rates for handy-size bulk carriers, a key segment for Algoma's international operations, saw periods of volatility, influenced by global economic activity and commodity demand. As of late 2024, average daily rates for handy-size bulk carriers were reported in the range of $10,000-$15,000, depending on specific routes and vessel specifications, highlighting the dynamic nature of this market.

- Expanded Market Access: Participation in global trade routes for commodities like cement and bulk goods.

- Risk Mitigation: Diversification away from solely domestic Canadian operations reduces regional economic dependency.

- Specialized Services: Operation of handy-size bulk carriers caters to specific international shipping needs.

- Joint Venture Strength: Partnerships like NovaAlgoma enhance operational capabilities and market penetration.

Ancillary Services and Real Estate Interests

Algoma Central Corporation, beyond its primary role in marine transportation, strategically diversifies its portfolio by holding interests in commercial real estate. This dual focus not only generates an additional revenue stream but also broadens the company's asset base, offering a stable complement to its core shipping operations. For instance, as of late 2024, Algoma's real estate segment contributes a notable portion to its overall financial health, providing a buffer against the cyclical nature of the shipping industry.

The company's commitment to its ancillary services is deeply intertwined with its logistics and cargo delivery excellence. Algoma prioritizes ensuring efficient and dependable cargo movement, which inherently involves meticulous management of supply chains and guaranteeing that products reach industrial clients precisely when needed. This operational efficiency in shipping directly supports the value proposition of its real estate interests, often located in strategic logistical hubs.

Algoma's ancillary services and real estate interests are key components of its broader marketing mix, enhancing its competitive advantage. These elements contribute to:

- Revenue Diversification: Reducing reliance solely on marine transportation by leveraging commercial real estate assets.

- Asset Base Expansion: Broadening the company's overall financial stability and valuation.

- Logistical Synergy: Supporting core shipping operations through strategically located real estate holdings.

- Client Value Enhancement: Ensuring reliable product availability for industrial partners through integrated logistics.

Algoma's product is its comprehensive marine transportation service, moving essential bulk commodities like iron ore, grain, and coal. This core offering is bolstered by a modern, efficient fleet designed for the Great Lakes and St. Lawrence Seaway, with new, environmentally conscious vessels joining the fleet through 2025. Beyond domestic operations, Algoma expands its product reach through international short-sea shipping ventures, diversifying its cargo types and market access.

| Product Aspect | Description | Key Data/Facts (2024-2025) |

|---|---|---|

| Core Service | Marine transportation of dry and liquid bulk commodities | Moved ~14.1 million metric tons of cargo in 2024 |

| Fleet | Modern, efficient vessels, including ice-class capabilities | New builds include dual-fuel and methanol-ready tankers; Equinox Class expansion through early 2026 |

| International Operations | Specialized services via joint ventures (e.g., NovaAlgoma) | Focus on cement and general bulk; handy-size bulk carriers active in global trade lanes |

| Ancillary | Commercial real estate holdings | Contributes to overall financial health and stability; located in strategic logistical hubs |

What is included in the product

This analysis provides a comprehensive examination of Algoma's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Place

Algoma Central Corporation's primary operational 'place' is the extensive Great Lakes and St. Lawrence Seaway network. This vital waterway is the backbone for moving bulk commodities across North America, linking major industrial centers and resource extraction sites.

The company's fleet is purpose-built to efficiently traverse this complex system, facilitating the movement of goods between Canadian and U.S. ports. For instance, in 2024, Algoma's vessels are expected to handle millions of tons of cargo, including iron ore, grain, and aggregates, underscoring the Seaway's economic significance.

Algoma’s international reach is a significant component of its marketing strategy, extending beyond its core Great Lakes operations. The company actively engages in short-sea shipping, connecting with markets in Northern Europe and along the Canadian and U.S. East Coasts. This diversified geographical presence allows Algoma to cater to a broader customer base and mitigate risks associated with reliance on a single region.

Specifically, Algoma's fleet of product tankers plays a crucial role in this international outreach. These vessels facilitate the movement of goods across international waters, demonstrating the company's capability to provide essential transportation services in diverse maritime environments. This global footprint is vital for tapping into varied market demands and offering comprehensive logistics solutions.

Algoma's distribution strategy centers on building direct relationships with its industrial clientele, ensuring a highly personalized and efficient approach to cargo delivery. This direct engagement allows for a deep understanding of client needs, facilitating tailored logistics solutions.

The company actively manages its fleet deployment to maximize customer convenience and streamline its overall logistics operations. For instance, in 2024, Algoma reported a significant increase in on-time deliveries, a testament to its optimized supply chain management, ensuring products reach their destinations precisely when and where required by its industrial partners.

Strategic Port Access and Connectivity

Algoma Central Corporation's strategic port access is a cornerstone of its marketing mix, ensuring efficient movement of bulk commodities. The company leverages a robust network of ports and terminals throughout North America, crucial for its dry-bulk and product tanker operations. This extensive infrastructure supports the reliable transport of key materials such as iron ore, grain, and coal, vital for numerous industries.

The placement of Algoma's services is designed to optimize the supply chain for its diverse clientele. By providing access to critical loading and unloading points, the company minimizes transit times and facilitates seamless cargo transfers. This connectivity is particularly important for clients in the Great Lakes region and along the St. Lawrence Seaway, where Algoma is a dominant player.

- Extensive Network: Algoma operates a significant number of ports and terminals, facilitating efficient logistics for bulk cargo.

- Key Commodities: The company's port access is essential for the movement of iron ore, grain, coal, and salt, among other vital resources.

- Transit Time Reduction: Strategic port locations and terminal operations contribute to faster and more reliable cargo delivery, enhancing client supply chains.

- Regional Dominance: Algoma's strong presence in the Great Lakes and St. Lawrence Seaway regions underscores the importance of its port connectivity strategy.

Fleet Deployment and Capacity Management

Algoma's 'place' strategy hinges on the strategic deployment of its varied fleet to align with shifting market needs. This ensures optimal vessel utilization and capacity management.

For the 2025 season, Algoma's domestic dry bulk fleet is projected to be fully booked, indicating strong demand. Similarly, Canadian product tankers are anticipated to operate at full deployment, reflecting robust utilization rates.

- Domestic Dry Bulk Fleet: Expected to be fully booked for the 2025 season.

- Canadian Product Tankers: Anticipated to be in full deployment.

- Fleet Utilization: Proactive management aims to consistently meet customer needs.

- Operational Capacity: Optimized through strategic vessel deployment.

Algoma's 'place' is fundamentally its extensive network of waterways, primarily the Great Lakes and St. Lawrence Seaway, which serve as the arteries for bulk commodity transport. This strategic positioning allows for efficient movement of goods between key industrial and resource-rich areas in North America.

The company's distribution channels are direct, fostering strong relationships with industrial clients and ensuring tailored logistics solutions. This direct approach minimizes intermediaries, leading to greater efficiency and responsiveness in cargo delivery.

Algoma's fleet deployment is meticulously managed to align with market demand, ensuring optimal utilization and capacity. This strategic placement of vessels is crucial for meeting the seasonal and ongoing needs of its diverse customer base.

For the 2025 season, Algoma's domestic dry bulk fleet is projected to be fully booked, with Canadian product tankers anticipated to operate at full deployment, highlighting strong demand and efficient fleet utilization.

| Fleet Segment | 2024 Outlook | 2025 Projection |

|---|---|---|

| Domestic Dry Bulk | High Utilization | Fully Booked |

| Canadian Product Tankers | Strong Deployment | Full Deployment |

| International Short-Sea | Expanding Reach | Continued Growth |

What You Preview Is What You Download

Algoma 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Algoma 4P's Marketing Mix is fully complete and ready for your immediate use. You can buy with full confidence, knowing you're getting the exact content you see.

Promotion

Algoma Central Corporation's promotional strategy heavily emphasizes its dedication to providing dependable marine transportation. This focus on reliability is key to fostering trust and long-term partnerships with its industrial clientele, assuring them of consistent service delivery.

The company backs this promise through continuous investment in its fleet, aiming to ensure operational efficiency and minimize disruptions. For instance, Algoma's investment in new environmentally friendly vessels, like the Equinox class, directly translates to enhanced reliability and service quality for its customers.

Algoma's strategic fleet modernization is a powerful promotional tool, highlighting significant capital investments in new, fuel-efficient, and technologically advanced vessels. The company's commitment to sustainability is evident with the delivery of multiple new ships in 2024 and 2025, including Equinox Class vessels and methanol-ready tankers.

Algoma Central Corporation actively showcases its commitment to environmental stewardship, a key element in its marketing strategy. The company is working towards ambitious goals, aiming for a 40% reduction in greenhouse gas (GHG) emissions by 2030 and achieving net-zero emissions by 2050. This dedication is tangible, as seen in their investment in new vessels designed for fuel efficiency and readiness for alternative fuels.

This proactive approach to sustainability directly appeals to a growing segment of clients and stakeholders who prioritize environmentally responsible partners. By highlighting these efforts, Algoma positions itself not just as a reliable marine carrier, but as a forward-thinking company that aligns with global environmental objectives, enhancing its brand reputation in the competitive market.

Transparent Investor Communications

Algoma prioritizes clear and consistent communication with its investors. They leverage their official website, timely press releases, and mandatory regulatory filings to share crucial financial results, outline strategic direction, and detail governance practices. This multi-channel approach ensures stakeholders are well-informed.

The company's commitment to transparency is evident in its regular updates. For instance, Algoma reported strong fiscal 2024 results, demonstrating solid operational performance. Looking ahead, the company has provided an optimistic outlook for 2025, further building confidence among current and prospective shareholders.

This open dialogue serves as a vital promotional element for Algoma within the financial community. It helps to build trust and attract investment by clearly articulating the company's value proposition and future potential.

- Website: Algoma's investor relations section provides comprehensive financial reports and company updates.

- Press Releases: Regular releases communicate key milestones and financial performance.

- Regulatory Filings: Adherence to filing requirements ensures transparency in financial reporting.

- Fiscal 2024 Performance: The company highlighted strong financial results, reinforcing its market position.

Branding and Industry Recognition

Algoma actively cultivates its brand identity with the tagline 'Your Marine Carrier of Choice™,' underscoring its dedication to superior service and industry leadership. This brand promise is consistently validated by strong operational results and significant industry acknowledgments.

The company's commitment to excellence has been recognized through prestigious awards, including being named one of Hamilton-Niagara's Top Employers for 2025. Such recognition not only boosts Algoma's public image but also strengthens its attractiveness to potential employees and clients alike.

These industry accolades serve as tangible proof of Algoma's market position and operational integrity. For instance, in the first quarter of 2024, Algoma reported a significant increase in revenue, demonstrating its ability to translate brand strength into financial performance.

- Brand Positioning: Algoma promotes itself as 'Your Marine Carrier of Choice™' to signify industry leadership and commitment to quality.

- Industry Recognition: The company was recognized as one of Hamilton-Niagara's Top Employers for 2025, enhancing its reputation.

- Performance Reinforcement: Positive performance reports, such as increased revenue in Q1 2024, validate the brand's strength.

- Talent Attraction: Accolades improve Algoma's appeal to both customers and skilled professionals in the marine sector.

Algoma Central Corporation's promotional efforts highlight its reliability and commitment to sustainability, reinforced by fleet modernization. The delivery of new Equinox Class vessels and methanol-ready tankers in 2024 and 2025 underscores this dedication to advanced, eco-friendly marine transport.

The company actively communicates its environmental goals, including a 40% GHG reduction by 2030 and net-zero by 2050, resonating with environmentally conscious clients. This focus on sustainability, coupled with strong financial performance, such as reported robust fiscal 2024 results and an optimistic 2025 outlook, builds investor confidence.

Algoma's brand promise, 'Your Marine Carrier of Choice™,' is supported by industry recognition, including being named one of Hamilton-Niagara's Top Employers for 2025. This reinforces its market leadership and appeal to both customers and talent.

| Key Promotional Aspect | Supporting Fact/Data (2024/2025) | Impact |

|---|---|---|

| Reliability & Fleet Modernization | Delivery of new Equinox Class vessels and methanol-ready tankers (2024-2025) | Enhances service quality and customer trust |

| Sustainability Commitment | Target: 40% GHG reduction by 2030; Net-zero by 2050 | Appeals to environmentally conscious stakeholders |

| Financial Transparency & Performance | Strong fiscal 2024 results; Optimistic 2025 outlook | Builds investor confidence and attracts capital |

| Brand Positioning & Recognition | Tagline: Your Marine Carrier of Choice™; Named Top Employer 2025 | Strengthens market leadership and talent attraction |

Price

Algoma's approach to pricing for its industrial clients is fundamentally value-based. This means their prices reflect the tangible benefits and reliability they offer, rather than just the cost of production. For instance, in 2024, Algoma's consistent performance in delivering essential bulk commodities like iron ore and grain, crucial for manufacturing and food production, underpins this value.

The company's ongoing investment in fleet modernization, with a significant portion of its fleet built or retrofitted in recent years, directly contributes to operational efficiency and cost-effectiveness for clients. This translates into predictable shipping costs and reduced transit times, which are highly valued by industrial customers who rely on timely material flow.

The perceived value of Algoma's secure and timely cargo transport is a key determinant in their pricing structure. In 2023, Algoma reported a strong operational performance, with vessel utilization rates remaining high, demonstrating their capacity to meet demand reliably. This dependable service minimizes supply chain disruptions for their clients, a critical factor that justifies their value-based pricing.

Algoma Central Corporation navigates competitive marine transportation sectors, necessitating pricing strategies that are both appealing to customers and sufficient to cover operational expenses while generating profit. For instance, in 2023, Algoma reported revenue growth in its Product Tankers segment, suggesting their pricing remained competitive within that market.

The company projects a stable rate environment for its product tankers, reflecting an adaptive approach to prevailing market dynamics. This steady outlook suggests that Algoma's pricing is aligned with industry expectations and the anticipated demand for the commodities it transports.

Key economic indicators and the demand for specific goods, such as grain or refined petroleum products, significantly shape Algoma's pricing decisions. For example, fluctuations in global energy prices directly impact the freight rates for product tankers, a factor Algoma closely monitors.

Algoma's commitment to operational efficiency, particularly through investments in new, fuel-efficient vessels, directly impacts its cost structure. For instance, the delivery of their new Equinox-class vessels, designed for improved fuel economy, can significantly reduce per-voyage operating expenses compared to older tonnage.

These cost savings enable Algoma to offer competitive pricing in the market while still achieving healthy profit margins. The enhanced productivity and reduced long-term operating expenses stemming from fleet modernization are key factors that can be translated into more attractive service pricing for their customers.

Demand-Driven Pricing Adjustments

Algoma's pricing strategy is clearly influenced by the ebb and flow of demand across various commodities and shipping lanes. For example, periods of high demand for grain exports, particularly during harvest seasons, can lead to increased freight rates. Similarly, the resurgence of domestic steel production in 2024 has created new opportunities and likely influenced pricing on relevant routes.

The company's proactive approach to securing new spot business, such as in the iron ore market, further demonstrates this dynamic pricing. This ability to adapt pricing based on immediate market opportunities, rather than relying solely on long-term contracts, allows Algoma to capitalize on favorable market conditions. In 2024, Algoma reported a significant increase in its dry-bulk cargo volumes, partly driven by new contracts and spot market activity, indicating successful demand-responsive pricing.

- Seasonal Demand Impact: Freight rates for Algoma's vessels can see upward pressure during peak seasons for commodities like grain, which often experience strong demand in the latter half of the year.

- New Industry Business: The revival of domestic steel production in 2024 has opened up new shipping demand for raw materials like iron ore and coal, allowing Algoma to adjust pricing for these specific routes.

- Spot Market Agility: Algoma's success in securing new spot business in iron ore highlights its capacity to leverage short-term market opportunities by offering competitive yet profitable pricing.

- Volume Growth: Algoma's dry-bulk segment saw a notable increase in cargo carried in early 2024, reflecting the positive impact of demand-driven pricing adjustments on overall business volume.

Long-Term Contracts and Joint Venture Structures

Algoma's strategy heavily relies on long-term time charter contracts, particularly for its cement carrier segment. These agreements, often spanning several years, offer a predictable revenue base and shield against short-term market volatility. For instance, in early 2024, Algoma secured a multi-year contract for a newbuild cement carrier, ensuring consistent earnings upon its delivery.

Joint ventures play a significant role in shaping Algoma's pricing power and market reach. By collaborating with partners, Algoma can leverage shared resources and expertise to offer more competitive pricing. This approach allows them to achieve economies of scale and provide specialized services that might be cost-prohibitive alone. An example is their participation in joint ventures for specialized bulk cargo transport, which has enabled them to secure larger contracts at favorable rates.

- Long-Term Contracts: Provide revenue stability and predictable pricing for specific services, such as cement carriage.

- Joint Ventures: Enhance competitiveness through resource pooling, economies of scale, and specialized service offerings, influencing overall pricing strategies.

- Market Impact: These structures allow Algoma to secure larger contracts and maintain a more stable financial footing in fluctuating market conditions.

Algoma's pricing is a dynamic blend of value-based and market-driven strategies, reflecting the essential nature of its services and the fluctuating demand for bulk commodities. The company leverages its operational efficiencies, such as fuel-saving Equinox-class vessels, to offer competitive rates while ensuring profitability. For instance, in early 2024, Algoma reported increased cargo volumes in its dry-bulk segment, a testament to its ability to adjust pricing effectively based on market opportunities and demand, including new business from the revived domestic steel sector.

Long-term contracts, particularly in the cement carrier segment, provide a stable pricing foundation, as seen with a multi-year agreement secured in early 2024. Joint ventures further bolster Algoma's pricing power by enabling economies of scale and specialized service offerings, allowing them to secure larger contracts at favorable rates. This strategic approach ensures Algoma remains competitive and financially resilient amidst market shifts.

| Metric | 2023 Data | Early 2024 Data | Key Pricing Impact |

|---|---|---|---|

| Dry-Bulk Cargo Volumes | Strong performance | Notable increase | Demand-driven pricing adjustments |

| Product Tankers Revenue | Reported growth | Projected stable rates | Alignment with market expectations |

| New Contracts (Cement Carrier) | N/A | Multi-year secured | Revenue stability and predictable pricing |

| Fleet Modernization Investment | Ongoing | Continued focus | Improved operational efficiency, potential for competitive pricing |

4P's Marketing Mix Analysis Data Sources

Our Algoma 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, market research, and competitor intelligence. We leverage insights from product catalogs, pricing strategies, distribution networks, and promotional activities to provide a holistic view.