Alexander & Baldwin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

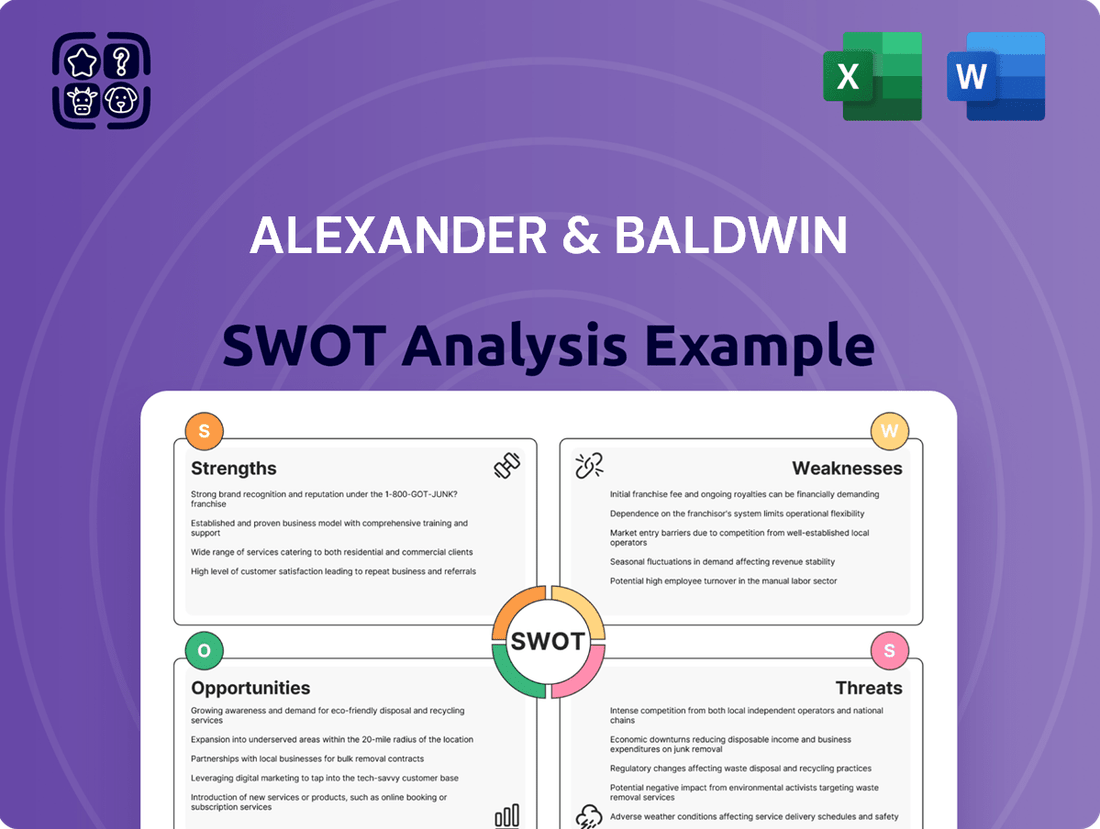

Alexander & Baldwin's strategic position is shaped by its diversified portfolio, but understanding the nuances of its strengths, weaknesses, opportunities, and threats is crucial for informed decision-making. Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights for investors and strategic planners.

Want the full story behind Alexander & Baldwin's market advantages, potential challenges, and future growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Alexander & Baldwin's (ALEX) exclusive focus on Hawai'i grants them deep, specialized knowledge of the local real estate market, a significant advantage. This intimate understanding allows them to effectively navigate the unique regulatory environment and cultural nuances of the islands, fostering strong community relationships and a competitive edge in acquiring and managing properties. For instance, in their 2024 first quarter report, Hawai'i portfolio income was a key driver, demonstrating the strength of their localized strategy.

Alexander & Baldwin's diverse real estate portfolio, encompassing grocery-anchored retail centers, industrial assets, and ground leases, is a significant strength. This variety across different property types naturally diversifies income streams, lessening the company's dependence on any one sector of the real estate market. For instance, as of the first quarter of 2024, their retail segment, largely composed of neighborhood centers, demonstrated resilience.

Alexander & Baldwin's (A&B) commitment to a long-term ownership strategy is a significant strength, capitalizing on Hawai'i's inherently valuable and supply-constrained real estate market. This patient approach allows the company to maximize returns through consistent property enhancements and strategic lease escalations, rather than chasing short-term market fluctuations.

Proven Real Estate Development Capabilities

Alexander & Baldwin's proven real estate development capabilities are a significant strength, allowing them to add value through entitlement and construction of new projects. This internal expertise enables the creation of new inventory and the enhancement of existing assets, unlocking hidden value within their portfolio. For instance, in the first quarter of 2024, the company reported progress on several key development projects, contributing to their ongoing organic growth strategy and ability to meet specific market demands.

- Development Expertise: Demonstrated ability to manage entitlement and construction processes for new projects.

- Value Creation: Capacity to enhance existing assets and unlock latent value within the company's real estate holdings.

- Organic Growth Driver: Development activities directly contribute to expanding the company's revenue-generating inventory.

Strong Established Market Presence

Alexander & Baldwin benefits from a deeply entrenched market presence in Hawai'i, built over a century of operations. This long-standing history translates into significant brand recognition and substantial landholdings across the islands, a key advantage in a geographically unique and regulated market.

Their established position allows them to more effectively secure prime development opportunities and attract premium tenants, contributing to a stable revenue stream. For instance, in the first quarter of 2024, Alexander & Baldwin reported total revenues of $64.6 million, with their Commercial Real Estate segment, heavily reliant on this market presence, performing robustly.

- Established Brand Reputation: Decades of operation have cultivated strong trust and recognition within Hawai'i's communities.

- Significant Landholdings: Ownership of extensive land parcels provides a pipeline for future development and strategic flexibility.

- Navigational Expertise: Deep understanding of local regulations and permitting processes streamlines project execution.

- Tenant Attraction: Strong market presence makes A&B a preferred partner for high-quality commercial tenants.

Alexander & Baldwin's (ALEX) concentrated focus on Hawai'i allows for specialized market knowledge and effective navigation of local regulations, a distinct advantage. This deep understanding fosters strong community ties and a competitive edge in property acquisition and management, as evidenced by the strong performance of their Hawai'i portfolio in Q1 2024.

The company's diverse real estate portfolio, including retail, industrial, and ground leases, provides income diversification and reduces reliance on any single sector, as seen in the resilience of their neighborhood retail centers in early 2024. Their long-term ownership strategy in Hawai'i's valuable, supply-constrained market maximizes returns through consistent property enhancements and strategic lease escalations.

ALEX's development expertise enables value creation through entitlements and construction, expanding revenue-generating inventory and enhancing existing assets. This internal capability supports organic growth and the ability to meet specific market demands, with Q1 2024 progress reported on several key development projects.

| Strength | Description | Supporting Data (Q1 2024) |

|---|---|---|

| Hawai'i Market Focus | Deep, specialized knowledge of the local real estate market and regulatory environment. | Hawai'i portfolio income a key driver of total revenue. |

| Portfolio Diversification | Variety across retail, industrial, and ground leases diversifies income streams. | Resilience demonstrated in grocery-anchored retail centers. |

| Long-Term Ownership Strategy | Maximizes returns through property enhancements and strategic lease escalations. | Capitalizes on Hawai'i's inherently valuable and supply-constrained market. |

| Development Capabilities | Adds value through entitlements and construction of new projects. | Progress reported on key development projects contributing to organic growth. |

What is included in the product

Analyzes Alexander & Baldwin’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Alexander & Baldwin's strategic challenges and opportunities.

Weaknesses

Alexander & Baldwin's (ALEX) singular focus on the Hawaiian market presents a significant geographic concentration risk. This means that any economic slowdown, natural disaster like volcanic activity or hurricanes, or adverse regulatory shifts specifically within Hawaii could severely impact the company's entire business operations and financial results, as there are no other geographic segments to offset these localized challenges.

Operating in Hawai'i presents significant challenges due to inherently higher costs for labor, materials, and transportation compared to the U.S. mainland. For Alexander & Baldwin, this translates to compressed development margins and increased property management expenses, directly impacting overall profitability. For instance, in 2023, the Honolulu Consumer Price Index was approximately 20% higher than the national average, reflecting these elevated operational costs.

Alexander & Baldwin's significant exposure to Hawaii's tourism-dependent economy presents a notable weakness. Fluctuations in tourist arrivals directly impact consumer spending, which in turn affects the performance of their retail and commercial properties. For instance, a downturn in tourism, as seen during periods of global travel disruption, can lead to decreased foot traffic and sales for tenants, potentially increasing vacancy rates and pressuring rental income.

Limited Land Availability and High Barriers to Entry

Hawai'i's extremely limited land availability, coupled with some of the nation's most stringent land use regulations, presents a significant hurdle for Alexander & Baldwin. This scarcity directly impacts the company's ability to pursue large-scale new development projects, as acquiring suitable land is both challenging and costly. For instance, in 2024, land prices in prime Hawaiian locations continued their upward trend, making greenfield development a capital-intensive endeavor.

These high barriers to entry restrict Alexander & Baldwin's organic growth potential through new construction. The cost of land acquisition alone can significantly inflate project budgets, potentially slowing down the pace at which the company can expand its real estate portfolio. This scarcity also limits diversification opportunities, forcing a greater reliance on existing assets and their optimization.

- Finite Land Supply: Hawai'i's island geography inherently limits developable land.

- Stringent Regulations: Strict zoning, environmental reviews, and community input processes extend development timelines and increase costs.

- Elevated Land Costs: In 2024, prime commercial land in Honolulu continued to command premium prices, impacting acquisition feasibility.

- Restricted Expansion: The scarcity and regulatory environment hinder rapid portfolio growth through new development.

Complex Regulatory Environment

Alexander & Baldwin (ALEX) faces significant challenges due to Hawai'i's intricate regulatory landscape for real estate development. This complexity, characterized by extensive permitting processes, thorough environmental impact assessments, and mandatory community consultations, directly impacts project feasibility and execution.

Navigating these regulatory hurdles often results in prolonged development timelines and escalating costs. For instance, projects can face delays of several years due to the sheer volume of approvals required, as seen in many large-scale developments across the islands. This protracted process introduces considerable uncertainty, potentially hindering the initiation or completion of new housing and commercial projects, which are critical for economic growth.

- Extended Project Timelines: Regulatory reviews can add 1-3 years to project schedules.

- Increased Development Costs: Compliance and permitting fees can add 5-15% to overall project expenses.

- Development Uncertainty: Stringent environmental and community review processes can lead to project modifications or cancellations.

Alexander & Baldwin's (ALEX) heavy reliance on the Hawaiian market creates significant vulnerability. Economic downturns or natural disasters unique to the islands can disproportionately impact the company, as there are no other geographic segments to buffer these localized risks. This concentration means that challenges like increased operating costs, which were evident with the Honolulu Consumer Price Index being approximately 20% higher than the national average in 2023, directly affect the entirety of ALEX's business.

The company also faces limitations due to Hawai'i's constrained land availability and rigorous land use regulations. These factors make large-scale new development projects difficult and expensive to undertake, as evidenced by continued upward trends in prime Hawaiian land prices throughout 2024. This scarcity restricts organic growth potential and limits diversification, forcing a greater dependence on optimizing existing assets.

| Weakness | Description | Impact on ALEX | Supporting Data (2023-2024) |

|---|---|---|---|

| Geographic Concentration | Sole focus on Hawaii market. | Vulnerability to localized economic or environmental events. | Honolulu CPI ~20% above national average (2023). |

| High Operating Costs | Elevated costs for labor, materials, transport in Hawaii. | Compressed development margins, increased property management expenses. | Continued upward trend in prime Hawaiian land prices (2024). |

| Regulatory Environment | Complex and stringent real estate development regulations in Hawaii. | Extended project timelines, increased development costs, project uncertainty. | Project delays of several years common; permitting/compliance fees add 5-15% to costs. |

Same Document Delivered

Alexander & Baldwin SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Alexander & Baldwin's Strengths, Weaknesses, Opportunities, and Threats. You'll gain access to the complete, professionally structured analysis to inform your strategic decisions.

Opportunities

Hawai'i's continued reliance on imports, coupled with a surge in e-commerce, fuels a strong demand for industrial and logistics spaces. This trend presents a prime opportunity for Alexander & Baldwin to leverage its industrial asset portfolio.

The company can capitalize by expanding and modernizing its existing industrial properties, or by developing new facilities to meet this escalating need. Such strategic moves are poised to generate stable, appreciating rental income, reinforcing the value of their industrial holdings.

Alexander & Baldwin (ALEX) has a significant opportunity to boost the value of its current property portfolio through strategic redevelopment and repositioning. This involves updating existing assets to better align with current market needs and tenant preferences.

For instance, ALEX could focus on converting underused areas within its retail or office spaces, or undertaking comprehensive renovations to attract premium tenants. In 2023, the company reported that its Hawaii portfolio continued to perform well, with occupancy rates in its commercial properties remaining strong, indicating a receptive market for enhanced offerings.

By proactively re-tenanting properties with businesses that offer higher rental income, ALEX can directly increase its net operating income and, consequently, the overall valuation of its assets. This approach is crucial for maximizing returns from its existing real estate holdings.

Alexander & Baldwin's substantial ground lease portfolio is a significant asset, generating consistent, long-term income with low operational demands. This segment provides a predictable revenue base, as seen in their continued focus on managing and expanding these agreements.

Opportunities exist to further capitalize on this portfolio by exploring new ground lease arrangements or strategically divesting certain leasehold interests. This approach can unlock value and enhance the company's financial flexibility, reinforcing its stable income foundation.

Sustainable Development and Green Initiatives

Alexander & Baldwin (ALEX) can leverage Hawai'i's growing emphasis on sustainability by integrating green building practices into its real estate projects. This strategy aligns with the state's renewable energy goals and increasing demand for eco-friendly spaces, potentially attracting environmentally conscious tenants and improving the company's public image.

The company can capitalize on this trend by:

- Developing properties with LEED certification or similar green building standards.

- Implementing energy-efficient technologies to reduce operational expenses and environmental impact.

- Exploring renewable energy sources for its developments, such as solar power.

- Marketing its sustainable features to appeal to a growing segment of eco-conscious consumers and businesses.

For instance, in 2024, Hawai'i continued its push towards renewable energy, with a target of 100% clean electricity by 2045. This regulatory environment creates a favorable landscape for companies like ALEX that invest in green initiatives, potentially leading to tax incentives and enhanced marketability for their properties.

Population Growth and Local Demand

Hawai'i's population continues to grow, with an estimated 1.43 million residents in 2024, creating a consistent local demand for goods and services. This demographic trend provides Alexander & Baldwin with a stable revenue stream beyond tourism. The company is well-positioned to leverage this by focusing on community-centric real estate developments.

Alexander & Baldwin can enhance its portfolio by developing and managing grocery-anchored retail centers and other properties that cater to the everyday needs of Hawai'i's residents. This strategy ensures resilient demand for its assets, as these services are essential regardless of economic fluctuations or shifts in the tourism sector. For instance, in 2023, retail sales in Hawai'i reached approximately $21.2 billion, underscoring the significant local consumer market.

- Steady Local Demand: Hawai'i's population growth fuels consistent demand for essential retail and services.

- Resilient Asset Class: Grocery-anchored centers and community-serving properties offer stable income.

- Market Size: Hawai'i's retail market demonstrates significant local spending power.

Alexander & Baldwin can capitalize on Hawai'i's robust e-commerce growth and reliance on imports by expanding its industrial and logistics portfolio. This strategic focus on modernizing and developing industrial spaces is projected to generate consistent rental income, as evidenced by strong occupancy rates in their commercial properties in 2023.

The company has an opportunity to enhance its existing real estate assets through redevelopment and repositioning, aiming to attract higher-paying tenants and boost net operating income. Furthermore, leveraging Hawai'i's commitment to sustainability by integrating green building practices into new developments can appeal to eco-conscious tenants and potentially unlock tax incentives, aligning with the state's clean energy goals.

Alexander & Baldwin can also tap into the steady demand from Hawai'i's growing population by developing community-centric retail centers, particularly those anchored by grocery stores. This strategy ensures a resilient revenue stream, supported by the state's significant retail sales, which reached approximately $21.2 billion in 2023.

Threats

A significant economic downturn or recession, particularly one affecting Hawai'i, presents a substantial threat to Alexander & Baldwin. Such a scenario could trigger a decline in consumer spending, leading to higher unemployment rates and increased vacancy across the company's commercial properties. This would inevitably put downward pressure on rental income, directly impacting Alexander & Baldwin's financial results. For instance, the U.S. economy experienced a contraction in GDP during the first half of 2022, and while forecasts for 2024 and 2025 generally anticipate moderate growth, the risk of a recession remains a persistent concern for businesses heavily reliant on consumer and commercial activity.

Rising interest rates present a significant threat to Alexander & Baldwin. For instance, the Federal Reserve's continued monetary tightening throughout 2024 and into early 2025 means higher borrowing costs for A&B's development projects and potential acquisitions. This increase in financing expenses directly impacts profitability and can make previously viable projects less attractive.

Furthermore, elevated interest rates can lead to a decrease in property valuations as the cost of capital rises, potentially affecting A&B's asset base and making it harder to sell properties at desired prices. This was a concern noted in market analyses during late 2023 and early 2024, with many real estate investment trusts (REITs) experiencing valuation pressures due to the shifting rate environment.

Alexander & Baldwin faces significant threats from natural disasters common to Hawai'i, including hurricanes, tsunamis, and volcanic activity. These events can directly damage or destroy the company's physical assets, such as agricultural lands, real estate holdings, and infrastructure.

The escalating impacts of climate change present a more insidious, long-term threat. Projections indicate a rise in sea levels, which could inundate or erode coastal properties owned by Alexander & Baldwin, potentially requiring substantial investments in protective measures or leading to the divestment of vulnerable assets.

Intensified Competition for Prime Assets

Hawai'i's enduring appeal continues to draw significant investor interest, leading to a more crowded landscape for Alexander & Baldwin. This heightened competition, particularly from mainland entities with potentially deeper pockets, means securing prime commercial real estate assets is becoming an increasingly challenging endeavor. For instance, in 2024, transaction volumes for high-quality retail and office spaces in Honolulu saw an uptick, pushing cap rates lower and increasing the cost of entry for new acquisitions.

This competitive pressure directly impacts Alexander & Baldwin's ability to expand its portfolio on favorable terms. As more players vie for the same limited supply of desirable properties, acquisition costs are inevitably driven higher. This escalation in purchase prices can compress expected investment yields, making it more difficult for the company to achieve its targeted returns on new developments and acquisitions, potentially impacting future profitability.

- Increased Acquisition Costs: Competition drives up prices for prime Hawai'i real estate.

- Compressed Investment Yields: Higher purchase prices reduce the potential return on investment.

- Reduced Property Availability: Fewer attractive assets are available at valuations that meet A&B's criteria.

Community Opposition and Regulatory Hurdles

Alexander & Baldwin, like many developers in Hawai'i, faces significant headwinds from community opposition. Concerns often center on environmental impacts, increased traffic congestion, and the preservation of local cultural heritage, which can stall or even halt new projects. For example, in late 2023, a proposed residential development on O'ahu faced strong pushback from residents citing these very issues.

These community concerns translate into substantial regulatory hurdles. Navigating Hawai'i's intricate permitting processes, often exacerbated by local activism, can lead to prolonged timelines and escalating project costs. In 2024, several major development initiatives across the islands experienced delays exceeding 12 months due to these combined factors, directly impacting projected revenue streams and capital deployment strategies.

- Community Opposition: Projects frequently challenged on environmental and cultural grounds, impacting project timelines and public perception.

- Regulatory Complexity: Hawai'i's stringent and often lengthy permitting processes add significant risk and cost to development.

- Impact on Growth: Delays and potential cancellations due to these factors directly hinder Alexander & Baldwin's ability to execute its growth strategies and realize new revenue opportunities.

Alexander & Baldwin faces a significant threat from increased competition in Hawai'i's real estate market, driving up acquisition costs for prime properties. This heightened competition, particularly from well-capitalized mainland investors, compresses investment yields as purchase prices rise. Consequently, the availability of attractive assets at valuations aligning with A&B's investment criteria diminishes, directly impacting portfolio expansion opportunities.

| Threat Category | Specific Threat | Impact on A&B | Relevant Data/Observation |

|---|---|---|---|

| Market Competition | Increased Acquisition Costs | Higher prices for prime Hawai'i real estate | Transaction volumes for quality retail and office spaces in Honolulu increased in 2024, pushing cap rates lower. |

| Market Competition | Compressed Investment Yields | Reduced potential return on investment due to higher purchase prices | Escalating purchase prices can make it difficult for the company to achieve targeted returns on new developments. |

| Market Competition | Reduced Property Availability | Fewer attractive assets available at desired valuations | More players vying for limited supply drives up costs and reduces options for A&B. |

SWOT Analysis Data Sources

This SWOT analysis for Alexander & Baldwin is built upon a foundation of comprehensive data, including their official financial filings, detailed market research reports, and expert industry commentary to ensure a robust and insightful assessment.