Alexander & Baldwin Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

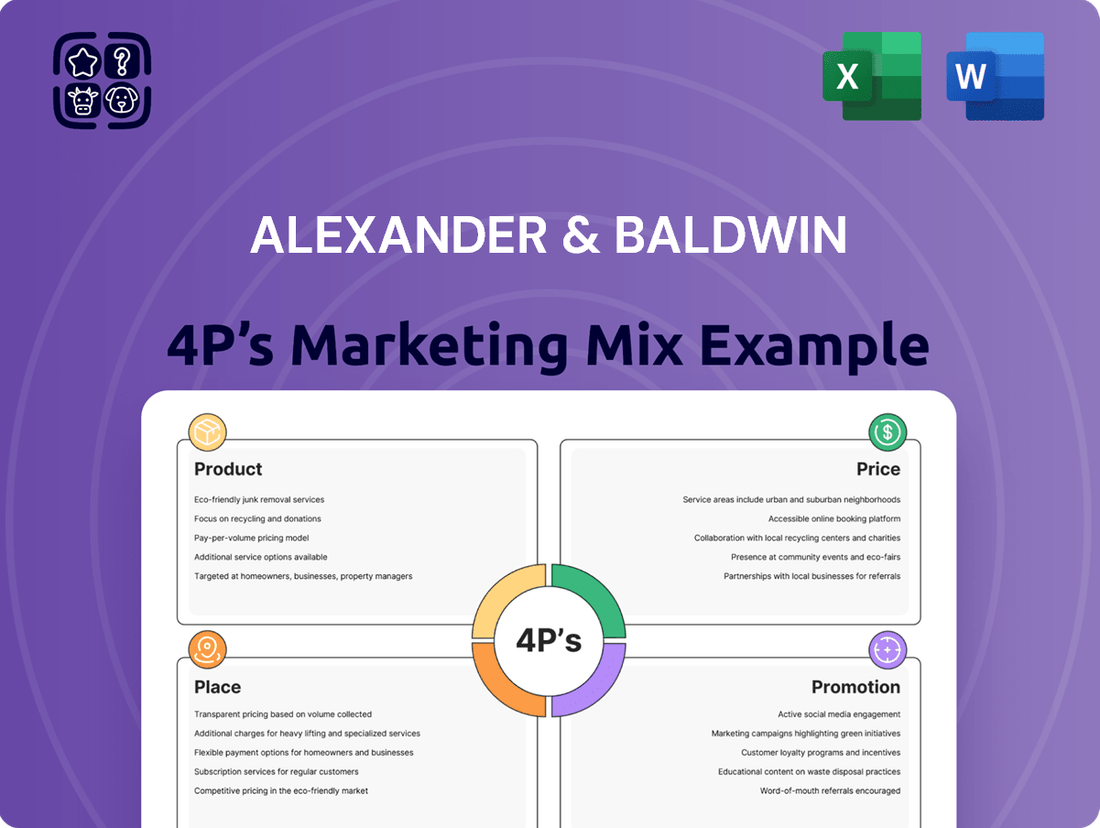

Discover how Alexander & Baldwin leverages its unique product portfolio, strategic pricing, extensive distribution, and impactful promotions to maintain its market leadership. This analysis goes beyond the surface, offering actionable insights into their winning marketing mix.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Alexander & Baldwin. Perfect for students, professionals, and consultants, this editable report provides a deep dive into their strategies for competitive advantage.

Product

Alexander & Baldwin's commercial real estate portfolio is a cornerstone of its business, primarily focused on Hawai'i. This portfolio is strategically built around resilient assets like grocery-anchored retail centers, which saw continued demand in 2024. The company also holds industrial and office properties, aiming for stable, long-term value appreciation.

In 2024, Alexander & Baldwin reported that its Hawai'i portfolio, which includes these commercial assets, generated significant rental income. The company's commitment to owning and operating these properties reflects a strategy of sustained growth and stability within the unique Hawai'i market.

Alexander & Baldwin's (ALEX) ground lease assets are a cornerstone of their Hawai'i real estate strategy, offering predictable, long-term revenue. These aren't just properties; they are income-generating agreements that underpin the company's financial stability. The company actively manages and expands this vital segment of its portfolio.

In 2024, ALEX's commitment to these assets is evident in their ongoing management and strategic growth initiatives. These ground leases provide a reliable income stream, contributing significantly to the company's overall financial health and its ability to invest in future opportunities within the Hawai'i market.

Alexander & Baldwin (ALEX) actively drives value through its real estate development arm, focusing on entitlement and construction of new projects. This strategic approach expands their Gross Leasable Area (GLA) and addresses evolving market needs. For instance, their recent redevelopment of Komohana Industrial Park features new Class A industrial buildings, including a significant build-to-suit distribution center pre-leased to Lowe's, demonstrating their commitment to securing high-quality tenants and creating modern industrial spaces.

Further illustrating this commitment, a new warehouse and distribution center at Maui Business Park is also part of their development pipeline. These projects are crucial for increasing ALEX's rental income streams and solidifying their position in key markets. As of their Q1 2024 earnings, ALEX reported continued progress in their development portfolio, with several projects on track to deliver increased GLA in the coming years, contributing to their long-term growth strategy.

Property Management and Leasing Services

Alexander & Baldwin's Property Management and Leasing Services are a core component of their owner-operator model. This in-house capability allows for direct oversight of their diverse real estate portfolio, ensuring high operational standards and optimal asset performance. By managing these functions internally, they can more effectively control costs and enhance revenue streams across their retail and industrial properties.

This vertical integration is crucial for maximizing rental income and occupancy rates. For instance, in 2023, Alexander & Baldwin reported strong leasing activity, with 17 new leases and 41 renewals across their portfolio, demonstrating their commitment to proactive tenant management and asset optimization. Their strategy centers on securing timely lease renewals and attracting new tenants to bolster financial results.

The company's focus on efficient leasing translates into tangible financial benefits. In the first quarter of 2024, their portfolio occupancy stood at a robust 96.3%, highlighting the effectiveness of their property management strategies in maintaining high tenant retention and attracting new business. This sustained high occupancy is a direct result of their hands-on approach to leasing and property upkeep.

- Owner-Operator Advantage: Direct control over asset quality and performance.

- Revenue Maximization: Focus on timely renewals and new leases for retail assets.

- Occupancy Enhancement: Strategic leasing to boost tenant numbers in industrial properties.

- Performance Metrics: Achieved 96.3% portfolio occupancy in Q1 2024.

Legacy Land Holdings Monetization

Alexander & Baldwin's (ALEX) Land Operations segment, while secondary to its commercial real estate focus, plays a crucial role in monetizing legacy land holdings. This strategic initiative is designed to unlock capital from these non-core assets, enabling reinvestment into more profitable commercial real estate ventures and simplifying the company's overall business structure. For instance, in 2023, ALEX completed the sale of approximately 1,000 acres of agricultural land in Hawaii for $26 million, a move aligned with their divestiture strategy.

The monetization of these legacy assets is a key component of ALEX's broader strategy to enhance shareholder value. By strategically divesting land that doesn't align with its core commercial real estate operations, the company can reallocate resources towards development projects with higher potential returns. This approach is reflected in their ongoing efforts to streamline their portfolio and focus on growth areas within the commercial sector.

- Divestiture of Non-Core Assets: ALEX actively seeks opportunities to sell off land holdings that are not central to its commercial real estate strategy.

- Capital Reinvestment: Proceeds from land sales are earmarked for investment in higher-yielding commercial properties, such as retail and office spaces.

- Portfolio Streamlining: This process aims to simplify the company's asset base, improving operational efficiency and focus.

- Strategic Simplification: The overall goal is to create a more focused and financially robust business model centered on core commercial real estate strengths.

Alexander & Baldwin's product strategy centers on its diversified Hawai'i commercial real estate portfolio, emphasizing grocery-anchored retail, industrial, and office properties. This focus on resilient assets aims for long-term value appreciation and stable rental income. The company actively develops new projects, like modern industrial buildings and distribution centers, to expand its Gross Leasable Area and meet evolving market demands.

Their owner-operator model, supported by in-house property management and leasing services, is key to maximizing revenue and occupancy. This hands-on approach ensures high operational standards and tenant retention, as evidenced by their robust 96.3% portfolio occupancy in Q1 2024. Furthermore, ALEX strategically monetizes legacy land holdings to reinvest capital into higher-yielding commercial ventures, streamlining its portfolio and enhancing shareholder value.

| Asset Type | Key Strategy | 2024/2025 Focus | Impact |

|---|---|---|---|

| Commercial Real Estate | Owner-Operator Model | Grocery-anchored retail, industrial, office | Stable, long-term rental income |

| Development Pipeline | Expansion of GLA | New industrial buildings, distribution centers | Increased rental income streams |

| Land Operations | Monetization of Legacy Assets | Divestiture of non-core land | Capital for reinvestment in commercial properties |

What is included in the product

This analysis provides a comprehensive overview of Alexander & Baldwin's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of A&B's market positioning, offering a solid foundation for case studies or competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for Alexander & Baldwin's leadership.

Provides a clear, concise overview of Alexander & Baldwin's 4Ps, easing the burden of understanding and communicating their marketing approach to diverse teams.

Place

Alexander & Baldwin's (ALEX) product strategy is deeply rooted in its Hawai'i-centric portfolio, encompassing land development, residential and commercial real estate, and agricultural operations. This exclusive focus allows them to deeply understand and cater to the unique needs and regulatory landscape of the Hawaiian Islands. Their commitment to this singular geographic market is a core element of their business model, leveraging decades of experience and strong local ties.

Alexander & Baldwin's retail strategy heavily leans on 21 grocery-anchored centers, a cornerstone of their property portfolio. These locations are not just retail spaces; they are vital community hubs, drawing consistent foot traffic because groceries are everyday necessities. This focus ensures a steady stream of customers, enhancing the centers' resilience and appeal to local Hawaiian residents by offering convenient access to essential goods.

Alexander & Baldwin's portfolio includes 14 industrial assets situated in prime locations such as Kapolei and Pearl City on O'ahu. These sites offer significant advantages due to their proximity to critical infrastructure, including Daniel K. Inouye International Airport and Honolulu Harbor.

This strategic placement is paramount for businesses reliant on efficient logistics and distribution networks. The company's industrial properties are designed to support the operational needs of a diverse range of industries requiring seamless supply chain management.

Office Properties and Ground Leases

Alexander & Baldwin's (ALX) portfolio extends beyond retail and industrial sectors to include four key office properties and a substantial 146 acres dedicated to ground leases across Hawai'i. This strategic diversification within the commercial real estate landscape ensures ALX caters to a broad spectrum of business requirements, from office space needs to long-term land utilization opportunities.

These office assets, alongside the extensive ground lease holdings, form a crucial component of ALX's 'Place' strategy in Hawai'i's dynamic market. The company's commitment to these property types reflects a long-term vision for supporting business growth and development throughout the islands.

- Office Properties: Four distinct office buildings contribute to ALX's commercial real estate footprint.

- Ground Lease Acreage: ALX manages 146 acres of land under ground lease agreements, fostering long-term development.

- Market Diversification: These holdings solidify ALX's presence across various segments of Hawai'i's commercial property market.

- Business Support: The diverse offerings aim to meet a wide range of corporate and business operational needs.

Development in Land-Constrained Market

Alexander & Baldwin's development efforts are strategically focused on Hawai'i's unique land-constrained environment. This scarcity of available urban land provides a significant advantage, enabling the company to secure prime locations for its projects. For instance, their developments at Komohana Industrial Park and Maui Business Park are designed to address the strong demand for premium commercial properties in these sought-after areas.

This focus on limited developable land in Hawai'i allows Alexander & Baldwin to command premium pricing and ensure robust occupancy rates for its commercial spaces. The company's ongoing projects are meticulously planned to align with market needs, capitalizing on the inherent value created by geographical limitations.

- Hawai'i's land scarcity drives demand for A&B's commercial projects.

- Komohana Industrial Park and Maui Business Park exemplify this strategy.

- Limited supply supports strong leasing and rental income potential.

Alexander & Baldwin's 'Place' strategy is intrinsically tied to its Hawai'i-centric real estate portfolio, comprising 21 grocery-anchored retail centers, 14 industrial assets, four office properties, and 146 acres of ground leases. This concentrated geographic focus allows for deep market penetration and understanding, crucial in Hawai'i's unique, land-constrained environment. Their strategic placement of industrial assets near key infrastructure like Honolulu Harbor enhances logistics for businesses, while retail centers serve as community anchors, ensuring consistent demand.

| Asset Type | Number of Properties/Acreage | Key Locations/Features |

|---|---|---|

| Retail Centers | 21 | Grocery-anchored, community hubs |

| Industrial Assets | 14 | Kapolei, Pearl City; near airport & harbor |

| Office Properties | 4 | Diverse business needs |

| Ground Leases | 146 acres | Long-term development opportunities |

What You Preview Is What You Download

Alexander & Baldwin 4P's Marketing Mix Analysis

The preview shown here is the actual Alexander & Baldwin 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Product, Price, Place, and Promotion strategies. You can be confident that the detailed insights and actionable recommendations you see are precisely what you'll get.

Promotion

Alexander & Baldwin (ALEX) prioritizes investor relations through consistent engagement, including quarterly earnings calls and comprehensive SEC filings like their 10-K reports. These channels offer transparent updates on financial performance and operational strategies, crucial for individual investors, financial analysts, and business strategists alike.

For example, in their Q1 2024 earnings, ALEX reported total revenues of $75.7 million, demonstrating their commitment to providing timely financial data. This proactive communication strategy aims to build trust and inform a wide range of stakeholders, from novice investors to seasoned portfolio managers.

Alexander & Baldwin actively engages in prominent industry conferences, such as Nareit's REITweek Investor Conference. This participation allows their management to directly communicate the company's strategic direction, operational performance, and future growth prospects to a wide audience of investors and industry professionals.

These events serve as crucial touchpoints for Alexander & Baldwin to enhance its corporate visibility and attract potential investment by showcasing its business model and financial health. For instance, during the 2024 REITweek, the company likely highlighted its diversified portfolio, which includes a significant presence in Hawaiian real estate and agribusiness, aiming to demonstrate resilience and potential returns.

Alexander & Baldwin strategically employs news releases and corporate announcements to keep stakeholders informed about their progress. These communications detail new developments, such as their ongoing residential development projects in Kapolei, Hawaii, and significant acquisitions, ensuring transparency and timely updates.

These official channels are crucial for reaching a broad audience, including financial news outlets and industry publications. For instance, their Q1 2024 earnings report, released via these channels, highlighted a net income of $32.8 million, demonstrating their commitment to accurate financial reporting.

Company Website and Digital Presence

Alexander & Baldwin's (ALEX) company website acts as a critical digital storefront, offering a comprehensive overview of its diverse real estate portfolio, including residential, commercial, and industrial properties. It provides detailed financial reports, investor relations materials, and updates on their strategic growth initiatives. This platform is key for stakeholders to access information on their commitment to sustainability and corporate responsibility.

The digital presence facilitates direct engagement with investors and the public, ensuring transparency and accessibility to crucial business data. For instance, in their Q1 2024 earnings report, ALEX highlighted continued progress in their Hawaii Community Development segment, with detailed project updates available on their website. This direct channel allows for efficient dissemination of information regarding their operational performance and future outlook.

- Website as Information Hub: Provides detailed portfolio information, financial reports, and sustainability initiatives.

- Direct Stakeholder Communication: Enables direct engagement with investors and the public.

- Transparency and Accessibility: Offers comprehensive data on business model and strategic direction.

- Q1 2024 Data Integration: Showcases progress in segments like Hawaii Community Development.

Focus on Hawai'i Community Engagement

Alexander & Baldwin (A&B) deeply roots its marketing strategy in community engagement, a critical aspect of its Place (4Ps) in Hawai'i. As a company with a significant historical presence in the islands, A&B actively showcases its dedication to local well-being and environmental stewardship. This commitment is not just stated but demonstrated through tangible actions and transparent reporting.

Their corporate responsibility reports, often highlighting initiatives from 2023 and projections for 2024, detail A&B's involvement in crucial local projects. For instance, their participation in watershed partnerships, aimed at preserving Hawai'i's vital water resources, directly appeals to environmentally conscious consumers and potential business partners. In 2023, A&B reported investing over $1.5 million in community programs and environmental conservation efforts across Hawai'i.

- Community Investment: A&B's 2023 corporate social responsibility report detailed over $1.5 million allocated to community programs and environmental conservation.

- Watershed Partnerships: Active participation in initiatives like the Waiʻaleʻale Watershed Partnership demonstrates a commitment to sustainable land management.

- Brand Enhancement: These engagements bolster A&B's reputation, fostering goodwill and a positive brand image among Hawai'i residents and businesses.

- Stakeholder Appeal: The focus on local impact resonates strongly with stakeholders, including potential tenants seeking to align with socially responsible companies.

Alexander & Baldwin (ALEX) utilizes a multi-faceted promotional strategy to communicate its value proposition. This includes robust investor relations efforts, active participation in industry events, and strategic use of corporate announcements and news releases.

Their digital presence, particularly their company website, serves as a central hub for detailed information on their diversified real estate portfolio and financial performance. This ensures transparency and accessibility for a wide range of stakeholders, from individual investors to financial professionals.

ALEX's commitment to community engagement, especially in Hawai'i, is a key promotional element, reinforcing their brand image and local ties. This is supported by tangible actions and transparent reporting on their social responsibility initiatives.

For instance, ALEX reported total revenues of $75.7 million in Q1 2024, with a net income of $32.8 million, demonstrating their consistent financial reporting and operational progress through these promotional channels.

| Promotional Channel | Key Activities | Data/Example |

|---|---|---|

| Investor Relations | Earnings calls, SEC filings (10-K) | Q1 2024 Revenue: $75.7 million; Net Income: $32.8 million |

| Industry Conferences | Presentations at events like Nareit's REITweek | Highlighting diversified portfolio (real estate, agribusiness) |

| Corporate Communications | News releases, website updates | Announcements on residential development projects (e.g., Kapolei) |

| Digital Presence | Company website | Detailed portfolio, financial reports, sustainability initiatives |

| Community Engagement | CSR reports, local partnerships | Over $1.5 million invested in community/environmental efforts in 2023 |

Price

Alexander & Baldwin's approach to rental rates and leasing spreads demonstrates a strategic pricing model for its diverse commercial real estate portfolio. In the first quarter of 2024, the company reported a notable increase in rental rates across its retail and industrial properties, driven by robust demand within Hawai'i's unique market. This upward trend is a direct reflection of their ability to command premium pricing based on property quality and prime locations.

The leasing spreads, which represent the difference between new lease rates and expiring lease rates, also showed positive momentum. For the first quarter of 2024, Alexander & Baldwin achieved average leasing spreads of approximately 11.6% for retail and 14.7% for industrial properties. These figures underscore the company's success in leveraging market conditions and tenant demand to enhance revenue and property value.

Alexander & Baldwin's (ALEX) valuation as a REIT hinges on Net Operating Income (NOI) and Funds From Operations (FFO). These are crucial for understanding the company's ability to generate profit from its properties and its overall cash flow. Investors closely monitor these figures to gauge the health of its real estate assets and make informed decisions.

For the first quarter of 2024, Alexander & Baldwin reported FFO per diluted share of $0.44, showing a steady performance in its operational cash flow. This metric is vital for REIT investors as it provides a clearer picture of a company's earnings power than traditional GAAP earnings, stripping out non-cash items like depreciation.

While specific NOI figures for Q1 2024 are embedded within broader financial reporting, the growth and stability of NOI are directly reflected in FFO. A strong NOI indicates efficient property management and rental income generation, which are fundamental to ALEX's value proposition as a real estate investment trust.

Alexander & Baldwin (ALX) strategically manages its asset portfolio through disposals of legacy land holdings, a key component of its pricing and value enhancement strategy. For instance, in the first quarter of 2024, the company completed the sale of approximately 3,300 acres of agricultural land in Hawaii for $261.7 million, a move designed to unlock capital.

The proceeds from these asset sales are then channeled into higher-yielding commercial real estate investments, such as the development of new retail and industrial properties. This reinvestment strategy is crucial for boosting overall portfolio value and generating sustainable, long-term returns for shareholders, reflecting a disciplined approach to capital allocation.

Dividend Policy and Shareholder Value

Alexander & Baldwin (ALEX) provides a compelling dividend yield, a key component of its marketing mix for income-seeking investors. This yield is underpinned by a robust balance sheet and consistent cash flow generated from its diversified operations, particularly in agriculture and real estate. The company's commitment to its dividend policy signals strong financial health and a positive outlook on its earnings capacity.

For the fiscal year ending December 31, 2023, Alexander & Baldwin reported a dividend per share of $0.90, translating to a dividend yield of approximately 3.5% based on its share price in early 2024. This policy directly appeals to investors prioritizing regular income streams, enhancing the overall shareholder value proposition.

- Attractive Dividend Yield: ALEX offers a competitive yield, making it appealing to income-focused investors.

- Financial Stability: The dividend is supported by a healthy balance sheet and predictable cash flow.

- Shareholder Value: The dividend policy is a direct contributor to shareholder returns and reflects management's confidence.

- Operational Support: Stable operations in agriculture and real estate provide the cash flow necessary to sustain dividend payments.

Market Positioning and Economic Conditions

Alexander & Baldwin's (ALEX) pricing strategy is deeply intertwined with its identity as a Hawai'i-centric commercial real estate entity. This positioning leverages the unique characteristics of the Hawaiian market, particularly its inherent land scarcity, which naturally supports higher property valuations. The company's overall valuation reflects this premium, driven by the desirability and limited supply of real estate in the state.

External economic forces significantly shape ALEX's pricing and financial prospects. For instance, fluctuations in interest rates directly impact borrowing costs and investment yields, influencing property demand and pricing. Similarly, the health of Hawai'i's tourism sector is a critical driver, as it underpins retail and hospitality property values.

Broader economic conditions within Hawai'i, such as employment rates and consumer spending, also play a crucial role. As of early 2024, Hawai'i's economy showed resilience, with a low unemployment rate of around 2.7% in January 2024, supporting demand for commercial spaces. However, ongoing inflation and potential shifts in consumer behavior continue to be monitored factors influencing ALEX's pricing adjustments and overall financial performance.

- Market Positioning: Hawai'i-focused commercial real estate company.

- Key Market Driver: Land-constrained environment in Hawai'i.

- Influencing Factors: Interest rates, tourism performance, and overall Hawai'i economic health.

- Economic Context (Early 2024): Hawai'i unemployment around 2.7%, indicating a stable labor market supporting real estate demand.

Alexander & Baldwin's pricing strategy is intrinsically linked to the value derived from its premium Hawaiian real estate portfolio. The company leverages its prime locations and the inherent scarcity of land in Hawaii to command strong rental rates, as evidenced by the positive leasing spreads achieved in early 2024. This strategic pricing reflects a deep understanding of market dynamics and a focus on maximizing asset value.

The company's pricing is also influenced by its capital allocation decisions, such as the sale of agricultural land to fund higher-yielding commercial developments. This approach ensures that capital is deployed to assets that can generate superior returns, thereby supporting its pricing power and overall valuation. Alexander & Baldwin's ability to generate consistent FFO, with $0.44 per diluted share in Q1 2024, further validates its effective pricing and operational management.

The pricing of Alexander & Baldwin's shares as a REIT is directly tied to its ability to generate stable income through its real estate assets and its commitment to returning value to shareholders via dividends. The dividend per share of $0.90 for fiscal year 2023, yielding approximately 3.5% in early 2024, appeals to income-seeking investors and reflects the underlying strength of its operations.

| Metric | Q1 2024 Data | Significance |

|---|---|---|

| Average Retail Leasing Spread | 11.6% | Indicates strong rental rate growth on new leases. |

| Average Industrial Leasing Spread | 14.7% | Demonstrates significant value appreciation on industrial leases. |

| FFO per Diluted Share | $0.44 | Key indicator of operational cash flow and profitability for REITs. |

| FY 2023 Dividend per Share | $0.90 | Reflects commitment to shareholder returns and company stability. |

4P's Marketing Mix Analysis Data Sources

Our Alexander & Baldwin 4P's Marketing Mix Analysis is built using a comprehensive review of company disclosures, including annual reports and investor presentations, alongside an examination of their property development projects and rental income streams. We also incorporate market research on Hawaii's real estate and agricultural sectors to understand competitive landscapes and consumer behavior.