Alexander & Baldwin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

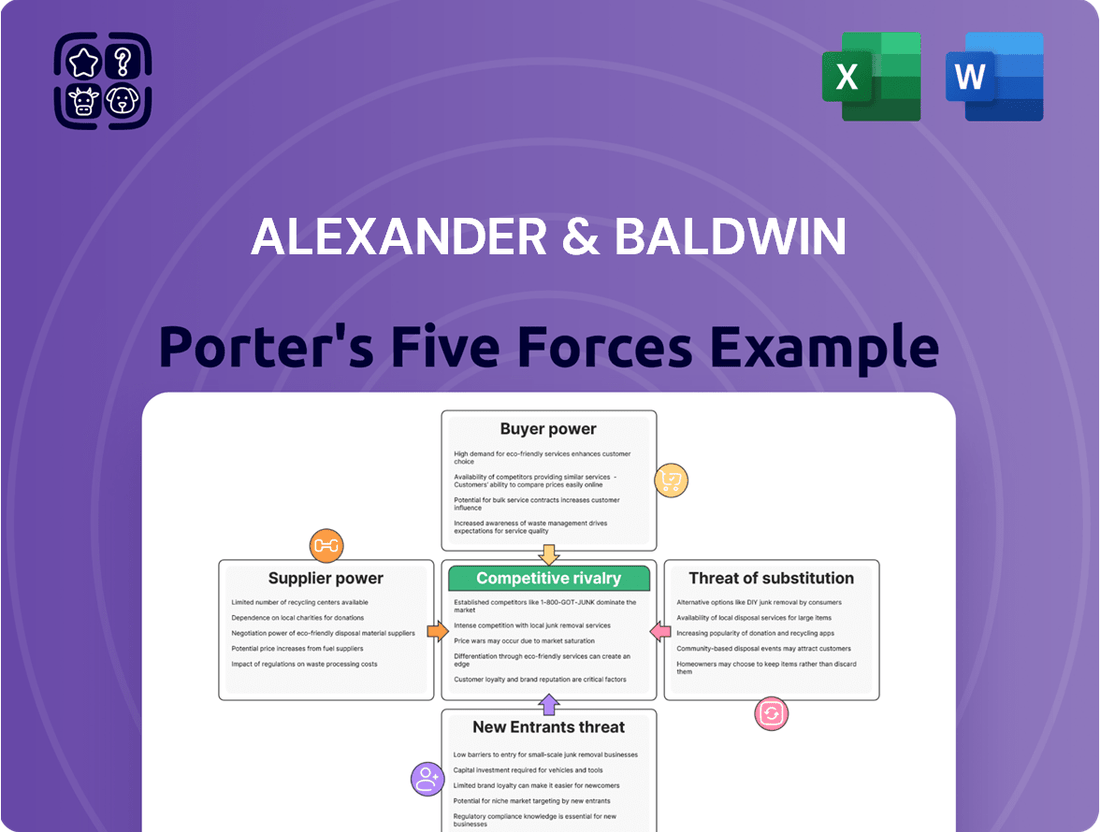

Alexander & Baldwin's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of their buyers to the ever-present threat of new entrants in their diverse markets. Understanding these dynamics is crucial for navigating their strategic path forward.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alexander & Baldwin’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hawaii's limited land availability significantly bolsters the bargaining power of suppliers, especially landowners. Developable land is exceptionally scarce across the Hawaiian Islands, with O'ahu facing particular constraints. This scarcity directly impacts Alexander & Baldwin's ability to secure new properties for development or expansion at advantageous terms.

The intense competition for these finite parcels inevitably drives up acquisition costs for companies like Alexander & Baldwin. In 2024, the median home price on O'ahu, a key indicator of land value, remained exceptionally high, reflecting this ongoing scarcity and its influence on development costs.

Suppliers in the construction sector, encompassing general contractors and specialized trades, wield significant influence over Alexander & Baldwin. This power is amplified by Hawaii's persistently high construction costs, which saw the median cost of a new single-family home reach approximately $1.1 million in early 2024, according to the Honolulu Board of Realtors. Furthermore, ongoing labor shortages in skilled trades contribute to this leverage, potentially driving up project expenses and lengthening development schedules for A&B's ventures.

These conditions directly impact Alexander & Baldwin’s ability to manage project budgets and timelines for new developments or redevelopments. For instance, local restaurant owners, a segment of Hawaii's economy that A&B serves, are already grappling with the dual pressures of a tight labor market and escalating wage demands, which are direct consequences of these broader supply-side dynamics.

Financial institutions, acting as suppliers of capital, wield significant power by setting interest rates and dictating lending terms. This power directly influences a company's cost of financing, a crucial input for growth and operations.

The period of 2022-2024 saw a notable increase in global interest rates, impacting sectors like real estate. For Alexander & Baldwin, this translated to higher borrowing costs and a potential slowdown in financing new projects or acquisitions, as evidenced by a cooling of real estate transaction volumes during this time.

While future forecasts suggest a potential easing of interest rates, the cost of debt remains a fundamental supplier cost for any business reliant on external financing. Alexander & Baldwin's ability to secure favorable financing terms is therefore a key determinant of its competitive positioning.

Building Material Supply Chain

Alexander & Baldwin's reliance on imported building materials for its Hawaii-based projects grants significant bargaining power to its suppliers. The inherent logistical complexities and substantial costs of transporting materials to the islands mean that any supply chain disruptions or rising freight charges directly translate into higher construction expenses for Alexander & Baldwin. This vulnerability exposes the company to the volatility of global raw material markets, impacting project timelines and financial outcomes.

For instance, during 2023, shipping costs saw fluctuations, with the cost of shipping a 40-foot container from Asia to the US West Coast averaging around $1,500-$2,000, but with significant spikes and volatility throughout the year due to various global events. While direct Hawaii-specific data is often proprietary, these broader trends illustrate the cost pressures Alexander & Baldwin likely faces. Any increase in these freight rates, coupled with potential tariffs or shortages of key materials like lumber or steel, can dramatically affect the company's development costs.

- Logistical Hurdles: Importing materials to Hawaii involves significant shipping costs and lead times, increasing supplier leverage.

- Supply Chain Sensitivity: Global disruptions or increased freight rates directly inflate Alexander & Baldwin's construction expenses.

- Price Volatility: Fluctuations in raw material prices and shipping costs create uncertainty in project budgeting and profitability.

- Limited Local Sourcing: The geographic isolation of Hawaii often restricts Alexander & Baldwin's ability to source materials locally, reinforcing supplier power.

Utility and Infrastructure Providers

Utility and infrastructure providers, such as electricity, water, and telecommunications companies, generally wield significant bargaining power. This stems from their often monopolistic or oligopolistic market structures, meaning there are few or no alternatives for Alexander & Baldwin (A&B) to switch to. For instance, in many regions where A&B operates, there is only one provider for electricity or essential water services. This reliance means A&B has limited ability to negotiate lower rates or better service terms.

The impact of this supplier power on A&B is substantial. Any price increases by utility companies directly translate to higher operating costs for A&B, affecting its profitability. Furthermore, the cost and availability of infrastructure development, like new power lines or broadband expansion to new properties, are dictated by these providers. In 2024, average commercial electricity prices in Hawaii, where A&B has significant holdings, remained notably higher than the national average, underscoring the cost pressures A&B faces from utility suppliers.

- High Dependence: Alexander & Baldwin's extensive property portfolio necessitates reliable access to essential utilities, making it highly dependent on these providers.

- Monopolistic Tendencies: The limited number of utility providers in many of A&B's operating regions grants these suppliers considerable pricing power.

- Cost Pass-Through: Increases in utility rates or infrastructure development charges are often passed directly to A&B, impacting its bottom line and property development feasibility.

- Strategic Implications: A&B must factor in the bargaining power of utility providers when planning new developments or managing existing properties, potentially influencing site selection and long-term operational costs.

Suppliers of essential development inputs, particularly landowners and construction material providers, hold considerable sway over Alexander & Baldwin (A&B). This leverage is amplified by Hawaii's unique geographic and economic landscape, characterized by limited land and significant logistical costs for imported goods. In 2024, the persistent scarcity of developable land on Oahu, evidenced by its high median home prices, directly translated to increased acquisition costs for A&B. Furthermore, the reliance on imported building materials, coupled with fluctuating global shipping costs, means that A&B's construction expenses are highly susceptible to external price pressures.

| Supplier Type | Source of Power | Impact on A&B | 2024 Data/Trend |

|---|---|---|---|

| Landowners | Scarcity of developable land in Hawaii | Increased acquisition costs, limited expansion opportunities | Median home prices on Oahu remained exceptionally high, reflecting ongoing scarcity. |

| Construction Materials Suppliers | Logistical costs of imports, global raw material prices | Higher construction expenses, project timeline uncertainty | Fluctuating shipping costs; increased demand for lumber and steel impacting prices. |

| Skilled Labor Providers | Labor shortages in construction trades | Increased labor costs, potential project delays | Persistent shortages in skilled trades across Hawaii, driving up wages. |

| Financial Institutions | Interest rate environment, lending terms | Higher cost of capital, potential slowdown in project financing | Global interest rates remained elevated, increasing borrowing costs for real estate developers. |

What is included in the product

This analysis breaks down the competitive landscape for Alexander & Baldwin, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its operating industries.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

For Alexander & Baldwin's grocery-anchored retail centers, the bargaining power of their customers, the tenants, is relatively low. This is primarily because these tenants provide essential services that residents consistently need, making them less inclined to relocate. For example, in 2023, Alexander & Baldwin's Hawaii segment, which includes its retail operations, reported rental revenue of $120.3 million, demonstrating the stability of demand for their anchored centers.

Customers looking for industrial properties in Hawaii are facing a very limited market. Vacancy rates are exceptionally low, especially on O'ahu. In the fourth quarter of 2024, O'ahu's industrial space availability was a mere 0.93%.

This scarcity means that tenants have less leverage. New industrial spaces are quickly snapped up, and larger businesses often struggle to find suitable locations for immediate use, weakening their bargaining power.

The bargaining power of customers in Hawaii's office market is currently moderate. While remote work has presented challenges, the sector is showing signs of stabilization, with positive net absorption reported in recent periods. This indicates a healthier demand for office space, which naturally shifts power away from tenants.

Office-to-residential conversions are also playing a role in reducing the overall availability of office inventory. For instance, in Honolulu, several projects have been initiated or completed, repurposing older office buildings. This tightening of supply means tenants have fewer readily available alternatives, thereby tempering their bargaining leverage.

Tenants still possess some ability to negotiate, especially those seeking larger or more specialized spaces. However, compared to markets with significant oversupply, the recovering Hawaiian office landscape, with its diminishing vacancy rates, grants landlords a stronger position, resulting in a balanced, moderate power dynamic for tenants.

Long-Term Ground Lease Commitments

Customers involved in long-term ground leases with Alexander & Baldwin (A&B) generally have diminished bargaining power after the lease is finalized. These lengthy commitments, often spanning decades, create a barrier to switching for lessees, thereby strengthening A&B's position.

While initial negotiations allow customers some leverage, the inherent nature of these long-term contracts—which A&B relies on for predictable revenue streams—significantly curtails their ability to renegotiate terms or exit the agreement prematurely. For instance, A&B's Hawaiian Commercial & Sugar Company (HC&S) segment, which leases agricultural land, operates under agreements that provide long-term stability.

- Long-Term Lease Structure: Ground leases typically lock in customers for extended periods, reducing their flexibility and bargaining power post-agreement.

- Reduced Switching Costs: The significant investment and commitment involved in ground leases make it costly and impractical for customers to switch to alternative land providers.

- Revenue Stability for A&B: These long-term commitments provide Alexander & Baldwin with a stable and predictable revenue base, enhancing its financial forecasting and operational planning.

- Limited Customer Leverage: Once the lease is signed, customers have minimal ongoing ability to influence lease terms or demand concessions, especially compared to short-term rental agreements.

Buyers of Developed Properties

For Alexander & Baldwin's real estate development segment, the bargaining power of direct property buyers is significantly shaped by the prevailing housing market conditions. While Hawaii's real estate market has historically seen robust demand and high prices, shifts in inventory levels and sales velocity can impact buyer leverage.

In 2024, Hawaii's housing market, particularly for residential properties, has experienced an increase in inventory and a lengthening of the time properties spend on the market. This trend suggests that buyers are encountering more choices and potentially have a greater capacity to negotiate terms. For instance, data from the first half of 2024 indicated a rise in the number of available homes compared to previous years, coupled with an average increase in days on market across several Hawaiian islands.

- Increased Inventory: More available properties give buyers more options and reduce their urgency.

- Longer Days on Market: Properties taking longer to sell can signal a cooling demand, empowering buyers to negotiate.

- Price Sensitivity: Buyers may become more sensitive to pricing as the market shifts, seeking better value.

- Developer Response: Developers might adjust pricing or offer incentives to maintain sales velocity in a changing market.

Alexander & Baldwin's (A&B) customers, particularly those in retail and industrial sectors, generally exhibit low bargaining power. This is due to the essential nature of their services and the extremely limited availability of industrial space in Hawaii, as evidenced by O'ahu's 0.93% industrial vacancy rate in Q4 2024. Tenants in the office market face moderate bargaining power, influenced by stabilizing demand and office-to-residential conversions that tighten supply.

Customers in long-term ground leases have diminished bargaining power post-agreement due to the significant commitment and reduced switching costs, providing A&B with revenue stability. Conversely, direct property buyers in A&B's development segment gained some leverage in 2024 due to increased housing inventory and longer days on market across Hawaii.

| Segment | Customer Type | Bargaining Power | Key Factors |

|---|---|---|---|

| Retail Centers | Tenants (Grocery Stores, etc.) | Low | Essential services, high tenant retention |

| Industrial Properties | Tenants (Businesses) | Very Low | Extreme scarcity (0.93% O'ahu vacancy Q4 2024) |

| Office Market | Tenants (Businesses) | Moderate | Stabilizing demand, office conversions reducing supply |

| Ground Leases | Lessees (Long-term Land Users) | Diminished (Post-Agreement) | Long-term commitment, high switching costs |

| Real Estate Development | Direct Property Buyers | Moderate to Increased (2024) | Increased inventory, longer days on market |

Full Version Awaits

Alexander & Baldwin Porter's Five Forces Analysis

This preview shows the exact Alexander & Baldwin Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details the competitive landscape for Alexander & Baldwin, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use, providing actionable insights into the strategic positioning of Alexander & Baldwin.

Rivalry Among Competitors

The Hawaii commercial real estate market, though featuring significant entities like Alexander & Baldwin, is characterized by a blend of major national players and strong local competitors. Firms such as CBRE, Colliers International, and JLL maintain a presence, alongside numerous established local developers and property management companies. This diverse landscape intensifies competition for leasing, sales, and management services across various property types.

Alexander & Baldwin's (ALEX) deliberate strategy of concentrating its Real Estate Investment Trust (REIT) portfolio solely on Hawaii's commercial real estate market sets it apart. However, this specialization doesn't insulate it from intense competition. ALEX directly contends with other REITs and private equity firms that also recognize the unique value and potential of the Hawaiian property landscape.

This focused approach funnels competitive pressures specifically within the Hawaiian islands, making the rivalry for prime commercial assets particularly acute. For instance, as of the first quarter of 2024, the Hawaiian commercial real estate market, while robust, sees significant interest from multiple players vying for limited prime locations and development opportunities, directly impacting ALEX's acquisition and leasing strategies.

While competition among existing real estate developers and landowners in Hawaii is present, the significant barriers to entry substantially curb the emergence of new large-scale players. These barriers include the extreme scarcity of available land, particularly in desirable locations, and the substantial capital investment required for large-scale development projects, often running into hundreds of millions of dollars.

For instance, in 2024, the median home price in Hawaii remained exceptionally high, reflecting this land scarcity and development cost reality. This situation naturally limits the pool of potential new entrants capable of undertaking projects comparable to those of established companies like Alexander & Baldwin, thereby moderating the intensity of direct rivalry.

Strong Fundamentals in Key Sectors

Sectors where Alexander & Baldwin (ALX) has a significant footprint, such as industrial and grocery-anchored retail, are currently experiencing strong market fundamentals. This strength, characterized by robust demand and notably low vacancy rates, can actually fuel more intense competition among players. When attractive segments are performing well, it draws more attention and capital, leading to a fiercer battle for prime assets and desirable tenants.

For instance, in the industrial sector, vacancy rates in many key markets remained exceptionally low throughout 2024, often dipping below 3%. Similarly, grocery-anchored retail centers demonstrated resilience, with vacancy rates for well-located properties staying under 5%. These favorable conditions create a scenario where established companies and new entrants alike are actively seeking opportunities, thereby heightening the competitive rivalry for limited, high-quality real estate.

- Low Vacancy Rates: Industrial sector vacancies averaged 2.8% nationally in Q3 2024, while grocery-anchored retail saw average vacancies of 4.2% in similar periods.

- High Tenant Demand: Increased e-commerce activity continued to drive demand for industrial logistics space, while essential retail services kept grocery-anchored centers consistently occupied.

- Intensified Competition: The attractiveness of these sectors leads to more bidders for acquisitions and a greater number of developers seeking prime locations, increasing rivalry.

Development Activity and Conversions

The competitive rivalry within Hawaii's real estate sector is intensifying, fueled by significant development activity and a notable trend of office-to-residential conversions. This surge in construction and repurposing signals a robust market where multiple entities are vying for prime locations and essential resources.

Companies are actively pursuing growth by transforming underutilized office spaces into much-needed housing. This dynamic is particularly evident in 2024, with several high-profile conversion projects underway across Oahu. For instance, the conversion of the former First Hawaiian Center into residential units highlights this trend, creating a competitive environment for development sites and skilled labor.

- Increased Competition for Land: The demand for development sites is escalating, driving up acquisition costs and intensifying competition among developers.

- Resource Scarcity: A growing number of construction projects, including conversions, strains the availability of skilled labor and construction materials, leading to higher project costs and longer timelines.

- Market Saturation Potential: While demand is high, a rapid increase in residential units from conversions could lead to localized market saturation, impacting rental yields and property values.

- Innovation in Development: The pressure of competition encourages developers to innovate, finding creative solutions for urban infill and adaptive reuse projects.

Alexander & Baldwin (ALEX) faces vigorous competition within Hawaii's commercial real estate market, battling both national firms like CBRE and local developers. This rivalry is particularly sharp for prime assets and leasing opportunities, intensified by ALEX's strategic focus on the Hawaiian islands.

The company's concentration on Hawaii means it directly competes with other REITs and private equity players also targeting the state's unique property market. This focused competition drives up acquisition costs and intensifies the fight for desirable tenants and locations.

Sectors like industrial and grocery-anchored retail, where ALEX has a strong presence, are experiencing robust demand with low vacancy rates, such as industrial vacancies averaging 2.8% nationally in Q3 2024. This strength attracts multiple bidders, further escalating competitive rivalry for high-quality properties.

| Property Type | 2024 Vacancy Rate (Approx.) | Competitive Intensity Factor |

|---|---|---|

| Industrial | 2.8% | High demand, low supply fuels competition for assets. |

| Grocery-Anchored Retail | 4.2% | Resilient sector attracts multiple players seeking stable income. |

| Office (for conversion) | Varies significantly by submarket | Increased competition for suitable sites due to conversion trend. |

SSubstitutes Threaten

The burgeoning growth of e-commerce presents a potent substitute for traditional brick-and-mortar retail. While Alexander & Baldwin strategically focuses on resilient segments like grocery-anchored and needs-based retail, which inherently possess lower susceptibility to online substitution, a persistent evolution in consumer purchasing habits could still exert pressure on demand for specific retail property types.

The rise of remote and hybrid work models presents a significant threat of substitutes for Alexander & Baldwin's (ALEX) office portfolio. These flexible work arrangements directly replace the need for traditional, long-term office leases, potentially dampening demand for physical space.

This shift could translate into increased vacancy rates or slower rental growth for ALEX's office properties, even as the broader Hawaiian office market shows signs of stabilization. For instance, a significant portion of companies, even in sectors requiring some in-person collaboration, are adopting hybrid models, reducing their overall office footprint.

The growing trend of adaptive reuse, where old commercial buildings are transformed into housing, acts as a significant substitute for new commercial development. This is particularly relevant in Hawaii, where a severe housing shortage exists. For instance, in 2024, Honolulu continued to see initiatives focused on converting office spaces to residential units, aiming to alleviate housing pressures.

This conversion diverts potential investment and development capital that might otherwise flow into new commercial projects. By addressing housing needs, adaptive reuse can reduce the demand for new commercial spaces, impacting the market for traditional commercial property development.

Direct Property Ownership by Businesses

The threat of substitutes for commercial real estate leasing is amplified when businesses choose direct property ownership. This trend is particularly pronounced in sectors like industrial real estate, where major players are increasingly investing in their own facilities rather than leasing. For instance, companies like Amazon and UPS have significantly expanded their owned logistics networks, demonstrating a clear preference for vertical integration and control over their physical infrastructure.

This direct ownership strategy allows businesses to customize spaces precisely to their operational needs and avoid the long-term costs and inflexibility associated with leases. In 2024, the industrial real estate market continued to see robust demand for owned assets, driven by e-commerce growth and supply chain resilience efforts. Companies are willing to make substantial capital expenditures to secure strategically located, purpose-built facilities.

- Amazon's ongoing investment in owned fulfillment centers and delivery stations directly reduces its reliance on leased industrial spaces.

- UPS has also been active in acquiring and developing its own logistics hubs, enhancing its operational efficiency and control.

- Matson, a shipping and logistics company, has invested in port facilities and intermodal assets, showcasing a broader trend of companies owning critical infrastructure.

Flexible Workspace Solutions

The proliferation of co-working spaces and flexible office solutions presents a significant threat of substitutes for Alexander & Baldwin's traditional office properties. These alternatives offer businesses agility and reduced capital outlay compared to long-term leases.

For instance, by mid-2024, the flexible office market continued its expansion, with major providers reporting high occupancy rates. This trend directly impacts the demand for conventional office spaces, as companies increasingly opt for adaptable arrangements that can scale with their needs.

Consider these key aspects of the threat:

- Cost-Effectiveness: Flexible spaces often bundle services like utilities and internet, providing a predictable monthly cost that can be more attractive than the variable expenses of traditional leases.

- Agility and Scalability: Businesses can quickly adjust their space requirements, avoiding the commitment and potential vacancy issues associated with fixed-term leases.

- Market Growth: The global flexible workspace market was projected to reach over $60 billion by 2024, indicating a substantial and growing alternative to traditional office rentals.

- Reduced Commitment: Shorter commitment periods in flexible spaces appeal to startups and companies seeking to minimize long-term financial obligations.

The threat of substitutes for Alexander & Baldwin's real estate portfolio is multifaceted, impacting both its retail and office segments. E-commerce and flexible work arrangements represent significant alternatives that can reduce demand for traditional physical spaces. Furthermore, the trend of businesses owning their facilities rather than leasing, especially in industrial sectors, directly substitutes for leasing opportunities.

Entrants Threaten

The Hawaii commercial real estate market demands a significant upfront financial commitment. Acquiring prime land parcels alone can run into tens of millions of dollars, with development and construction costs easily adding hundreds of millions more. For instance, large-scale projects in Honolulu, such as new office buildings or retail centers, often require budgets exceeding $100 million, presenting a substantial hurdle for any new competitor.

Hawaii's extreme land scarcity presents a formidable barrier to new entrants in the real estate and agricultural sectors. The island state's limited developable land, coupled with stringent environmental regulations and high acquisition costs, makes it incredibly difficult for new companies to gain a foothold. For instance, in 2024, the average price per acre for agricultural land in Hawaii continued its upward trend, often exceeding figures seen in mainland states, further escalating the capital required for market entry.

The complex and often lengthy regulatory and entitlement processes in Hawaii for real estate development present a significant barrier to entry for new companies. Navigating intricate zoning laws, stringent environmental regulations, and a multi-layered permitting system requires substantial time, expertise, and financial investment. For instance, obtaining necessary approvals for a new residential project in Hawaii can easily extend over several years, significantly increasing upfront costs and project timelines, thereby deterring potential new competitors.

Established Market Relationships and Local Expertise

Alexander & Baldwin's nearly 150-year legacy in Hawaii has cultivated deep-rooted relationships with local communities, government bodies, and crucial tenants. This extensive network and ingrained local expertise create a formidable barrier for new entrants. These newcomers would struggle to replicate the nuanced understanding of Hawaii's unique market dynamics and cultural considerations that A&B possesses. For instance, in 2024, A&B continued to leverage its long-standing partnerships, which are vital for navigating regulatory landscapes and securing prime development opportunities, areas where new players would face significant hurdles.

New entrants simply do not have the advantage of this established network. Building trust and securing the necessary local buy-in, especially within Hawaii's distinct cultural context, takes considerable time and effort. This is a significant hurdle that can deter potential competitors from entering the market, protecting A&B's existing market share.

- Established Relationships: A&B's 150-year history fosters strong ties with local stakeholders.

- Local Expertise: Deep understanding of Hawaii's unique market and cultural nuances.

- Barriers to Entry: Newcomers face challenges replicating A&B's established network and local knowledge.

- Competitive Advantage: These factors provide a significant deterrent to potential new market participants.

Limited Access to Prime Locations and Tenant Base

New companies entering the Hawaii commercial real estate market would face significant hurdles in acquiring prime locations. Established players like Alexander & Baldwin have already secured many of the most desirable retail and industrial properties, especially those anchored by strong grocery tenants. This scarcity of prime real estate limits the ability of new entrants to establish a competitive foothold.

Furthermore, building a robust and stable tenant base is a considerable challenge for newcomers. Alexander & Baldwin, with its long-standing relationships and reputation, can attract and retain quality tenants more readily. New entrants would need to invest heavily in marketing and tenant incentives to compete for desirable businesses in a market where established landlords already hold significant sway.

- Limited prime locations: Alexander & Baldwin holds significant market share in desirable Hawaiian commercial real estate.

- Tenant acquisition difficulty: New entrants must overcome established relationships to attract quality tenants.

- High barrier to entry: Securing prime locations and a stable tenant base requires substantial capital and time.

The threat of new entrants into Hawaii's real estate and agricultural sectors is significantly mitigated by the immense capital requirements. Acquiring land and developing projects demands tens to hundreds of millions of dollars, a substantial barrier. For instance, in 2024, large-scale developments in Honolulu frequently surpassed $100 million in initial budgets.

Land scarcity in Hawaii, exacerbated by environmental regulations and high acquisition costs, makes market entry exceptionally difficult. Agricultural land prices in 2024 continued their ascent, often exceeding mainland averages, further inflating the necessary investment for new competitors.

The complex and protracted regulatory and entitlement processes in Hawaii for real estate development represent a major deterrent. Navigating zoning, environmental laws, and permitting can take years and substantial investment, increasing upfront costs and project timelines for any new player.

Alexander & Baldwin's deep-rooted relationships and local expertise, cultivated over 150 years, create a formidable barrier. New entrants struggle to replicate A&B's understanding of Hawaii's unique market dynamics and cultural considerations. In 2024, A&B continued to leverage these partnerships for regulatory navigation and securing prime opportunities, areas where newcomers face significant challenges.

New companies face considerable hurdles in securing prime locations in Hawaii's commercial real estate market. Established entities like Alexander & Baldwin have already secured many of the most desirable retail and industrial properties, limiting opportunities for new entrants to establish a competitive foothold.

Building a stable tenant base is also a significant challenge for newcomers. Alexander & Baldwin's established reputation and relationships allow them to attract and retain quality tenants more easily. New entrants would need substantial investment in marketing and incentives to compete for desirable businesses in a market where established landlords hold considerable influence.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for land acquisition and development. | Significant deterrent due to the scale of financial commitment. | Large Honolulu projects often exceed $100 million. |

| Land Scarcity & Regulations | Limited developable land, stringent environmental rules. | Makes acquiring suitable sites extremely difficult and costly. | Agricultural land prices continue to rise, exceeding mainland averages. |

| Regulatory Processes | Complex, lengthy entitlement and permitting procedures. | Increases project timelines, costs, and uncertainty. | Residential project approvals can take several years. |

| Established Relationships & Expertise | A&B's 150-year legacy and local network. | New entrants cannot easily replicate deep market understanding and stakeholder buy-in. | A&B leverages long-standing partnerships for regulatory navigation. |

| Prime Location & Tenant Acquisition | Limited availability of prime real estate and difficulty securing quality tenants. | New entrants struggle to compete for desirable properties and businesses. | A&B holds significant share in prime retail and industrial spaces. |

Porter's Five Forces Analysis Data Sources

Our Alexander & Baldwin Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, investor relations materials, and reputable industry research reports.

We also incorporate data from real estate market analyses and agricultural sector reports to provide a comprehensive understanding of Alexander & Baldwin's competitive landscape.