Alexander & Baldwin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Explore the strategic framework that powers Alexander & Baldwin's diversified operations. This comprehensive Business Model Canvas unpacks their approach to land development, agriculture, and investment, revealing key partnerships and revenue streams. Gain a competitive edge by understanding their unique value proposition and cost structure.

Partnerships

Alexander & Baldwin cultivates strategic alliances with local Hawaiian businesses, particularly anchor tenants like grocery stores and drugstores. These collaborations are vital for their retail centers, creating a symbiotic relationship that boosts customer visits and secures consistent tenancy. For instance, in 2024, their retail segment continued to benefit from strong local grocer presence, contributing to a stable occupancy rate across their Hawaiian properties.

Alexander & Baldwin (ALEX) heavily relies on experienced construction and development contractors to bring its ambitious projects to life. These partnerships are crucial for the successful execution of new commercial real estate developments, like the ongoing Komohana Industrial Park and the planned Maui Business Park.

These collaborations are not just about building; they directly influence the speed and quality of new asset creation, which in turn fuels future revenue growth for the company. For instance, the efficient completion of industrial parks can lead to quicker occupancy and rental income generation.

Alexander & Baldwin (A&B) cultivates robust relationships with financial institutions and lenders, crucial for securing debt financing, revolving credit facilities, and accessing broader capital markets. These partnerships are foundational to maintaining operational liquidity and fueling strategic growth initiatives, including acquisitions and development projects.

A prime example of this vital partnership is A&B's amended revolving credit facility, which was extended through October 2028, demonstrating a continued commitment and trust from its banking partners. This facility provides essential financial flexibility, allowing the company to efficiently manage its capital needs and pursue opportunities in its diverse real estate and agribusiness segments.

Governmental and Regulatory Bodies

Alexander & Baldwin's engagement with governmental and regulatory bodies is crucial for its real estate development operations in Hawaii. These partnerships are vital for navigating the intricate entitlement and permitting processes, ensuring compliance with local and state regulations. For instance, in 2024, the company continued to work with entities like the Hawaii Department of Land and Natural Resources and county planning departments to advance its residential and commercial projects.

These collaborations are not just about compliance; they actively facilitate the smooth progression of new developments, which is especially important in Hawaii's unique, land-constrained market. By fostering strong relationships, Alexander & Baldwin can streamline approvals and mitigate potential delays. This proactive approach is key to unlocking the value of its extensive land holdings and bringing much-needed housing and commercial spaces to the islands.

- Navigating Entitlements: Collaborating with county planning departments and state agencies to secure necessary permits for projects like the Hoopili development.

- Regulatory Compliance: Adhering to environmental regulations and land use policies set forth by various Hawaiian governmental bodies.

- Facilitating Development: Working with infrastructure providers, often state- or county-managed, to ensure project viability.

- Community Engagement: Partnering with government representatives to address community concerns and incorporate feedback into development plans.

Property Management and Service Providers

Alexander & Baldwin (ALX) likely relies on a network of key partners, including property management firms and specialized service providers, to ensure the smooth operation and upkeep of its diverse real estate portfolio. These partnerships are crucial for delivering high-quality tenant experiences and maintaining property value.

These collaborations often cover essential services such as routine maintenance, advanced security systems, landscaping, and the implementation of sophisticated property management software. For instance, in 2023, ALX reported that its Hawaii segment, which comprises a significant portion of its real estate holdings, continued to focus on enhancing the tenant experience through property improvements and operational efficiencies.

- Maintenance and Repairs: Partnerships with local contractors for timely and efficient upkeep of residential and commercial spaces.

- Security Services: Collaborations with security firms to ensure the safety and security of tenants and assets across their properties.

- Property Technology: Engaging with providers of property management software and smart building technologies to optimize operations and tenant services.

- Leasing and Brokerage: Working with real estate brokers and leasing agents to fill vacancies and manage tenant relationships effectively.

Alexander & Baldwin (ALEX) leverages partnerships with financial institutions to secure capital for development and operations. In 2024, the company highlighted its access to a significant revolving credit facility, demonstrating ongoing lender confidence. These relationships are fundamental for liquidity and funding strategic growth.

ALEX also depends on local businesses, particularly anchor tenants like grocery stores, for its retail segment's success. These collaborations drive foot traffic and ensure stable occupancy rates, a trend that continued to benefit their Hawaiian retail centers in 2024. This symbiotic relationship is key to their retail strategy.

Furthermore, ALEX collaborates with construction and development contractors to execute its real estate projects. These partnerships are critical for timely and quality delivery of new assets, directly impacting future revenue streams. The efficient development of projects like the Komohana Industrial Park is a testament to these vital collaborations.

Engagement with governmental and regulatory bodies is essential for navigating Hawaii's complex entitlement and permitting landscape. In 2024, ALEX continued its work with state and county agencies to advance its development pipeline, ensuring compliance and facilitating project progression in a land-constrained market.

| Partnership Type | Key Activities | 2024 Impact/Example |

|---|---|---|

| Financial Institutions | Securing debt financing, credit facilities | Extended revolving credit facility through October 2028 |

| Anchor Tenants (Retail) | Driving foot traffic, ensuring occupancy | Continued stability in retail segment occupancy due to strong grocer presence |

| Construction & Development Contractors | Project execution, quality delivery | Facilitating progress on industrial park developments |

| Governmental & Regulatory Bodies | Entitlement, permitting, compliance | Advancing residential and commercial projects through regulatory engagement |

What is included in the product

A detailed Alexander & Baldwin Business Model Canvas outlining their diversified operations across Hawaii's real estate, materials, and agribusiness sectors, emphasizing their integrated approach to land management and community development.

Alexander & Baldwin's Business Model Canvas provides a clear, actionable framework that simplifies complex strategic planning, alleviating the pain of unstructured and time-consuming business development.

Activities

Alexander & Baldwin's key activities heavily revolve around the ownership and active management of its substantial real estate portfolio. This includes overseeing a variety of commercial properties such as retail centers, industrial spaces, and office buildings primarily located throughout Hawaii.

The company's operational focus is on the day-to-day running of these assets, which involves cultivating strong tenant relationships and diligently working to maintain high occupancy levels across its properties. For instance, as of the first quarter of 2024, Alexander & Baldwin reported a strong occupancy rate of 94.2% for its retail portfolio, demonstrating effective management.

Alexander & Baldwin's key activity in real estate development involves identifying and executing new projects, enhancing value through entitlement and construction. This includes developing commercial spaces like the Komohana Industrial Park and Maui Business Park.

In 2024, the company continued to focus on these development efforts, aiming to create modern commercial and industrial properties. Their strategy centers on transforming land assets into revenue-generating opportunities.

Alexander & Baldwin actively manages its commercial property portfolio through securing and overseeing leases. This core activity involves negotiating terms for new leases and renewals, aiming to maintain robust tenant relationships. The company focuses on achieving high occupancy rates and favorable leasing spreads to maximize property income.

In 2024, Alexander & Baldwin continued its focus on leasing and tenant management across its Hawaiian portfolio. The company reported a strong occupancy rate of 94.7% for its commercial properties as of the first quarter of 2024, demonstrating effective tenant retention and acquisition strategies. This high occupancy contributes significantly to stable revenue streams and supports their goal of achieving favorable leasing spreads on renewed and new agreements.

Strategic Acquisitions and Dispositions

Alexander & Baldwin actively pursues strategic acquisitions that bolster its Hawaii-focused real estate portfolio, seeking properties that offer strong growth potential and align with its core market strengths. This proactive approach ensures the company remains invested in high-value, strategically located assets within its primary operating region.

Concurrently, the company engages in the disposition of non-core or legacy land holdings. This divestment strategy allows Alexander & Baldwin to unlock capital and reallocate resources towards more profitable commercial real estate ventures, thereby enhancing overall portfolio yield and operational efficiency.

In 2024, Alexander & Baldwin continued to refine its portfolio through targeted transactions. For instance, the company completed the sale of certain agricultural lands, generating proceeds that were earmarked for reinvestment in its commercial and community development segments. This focus on monetizing non-strategic assets is a key component of its capital allocation strategy.

- Strategic Acquisitions: Focus on acquiring properties that enhance the Hawaii-centric real estate portfolio, prioritizing high-yield potential.

- Asset Dispositions: Monetize legacy land holdings and non-core assets to free up capital for strategic reinvestment.

- Portfolio Optimization: Continuously evaluate and adjust the asset mix to concentrate on higher-yielding commercial real estate.

- Capital Reallocation: Utilize proceeds from dispositions to fund accretive acquisitions and development projects.

Capital Management and Financial Reporting

Alexander & Baldwin actively manages its capital structure, balancing debt and equity to support its operational and investment strategies. This includes optimizing its debt-to-equity ratio to ensure financial flexibility and cost-effectiveness.

Transparent financial reporting is a cornerstone activity, ensuring all stakeholders have a clear understanding of the company's performance. This involves meticulous record-keeping and adherence to accounting standards.

Key activities also include rigorous monitoring of financial performance against established metrics and ensuring compliance with Real Estate Investment Trust (REIT) regulations. This is crucial for maintaining its tax-advantaged status and investor confidence.

Communicating financial results and strategic updates to investors is paramount. For example, in the first quarter of 2024, Alexander & Baldwin reported total revenues of $67.2 million, demonstrating ongoing operational activity and the need for clear financial disclosure.

- Capital Structure Optimization: Actively managing debt and equity to maintain a healthy balance.

- Financial Performance Monitoring: Continuously tracking key financial indicators.

- REIT Compliance: Adhering to all regulatory requirements for REIT status.

- Investor Communication: Providing timely and transparent financial reporting to shareholders.

Alexander & Baldwin's key activities center on managing its significant real estate portfolio, focusing on leasing, development, and strategic transactions. They actively work to maintain high occupancy rates, as evidenced by their 94.7% commercial property occupancy in Q1 2024, and pursue new development projects like the Komohana Industrial Park.

The company also actively refines its portfolio through strategic acquisitions and dispositions. In 2024, they continued to sell non-core agricultural lands to fund growth in commercial and community development sectors, demonstrating a clear capital reallocation strategy to enhance portfolio yield.

Furthermore, robust financial management is a critical activity, involving capital structure optimization and strict adherence to REIT regulations. This includes transparent reporting, with Q1 2024 revenues reaching $67.2 million, underscoring their commitment to investor communication and financial oversight.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Real Estate Portfolio Management | Owning and managing commercial properties (retail, industrial, office) in Hawaii. | High occupancy rates (94.7% commercial Q1 2024). |

| Real Estate Development | Identifying and executing new development projects. | Focus on modern commercial/industrial properties like Komohana Industrial Park. |

| Strategic Transactions | Acquiring growth-oriented properties and disposing of non-core assets. | Sale of agricultural lands in 2024 to fund reinvestment. |

| Financial Management | Optimizing capital structure and ensuring REIT compliance. | Q1 2024 revenues of $67.2 million; transparent investor reporting. |

Delivered as Displayed

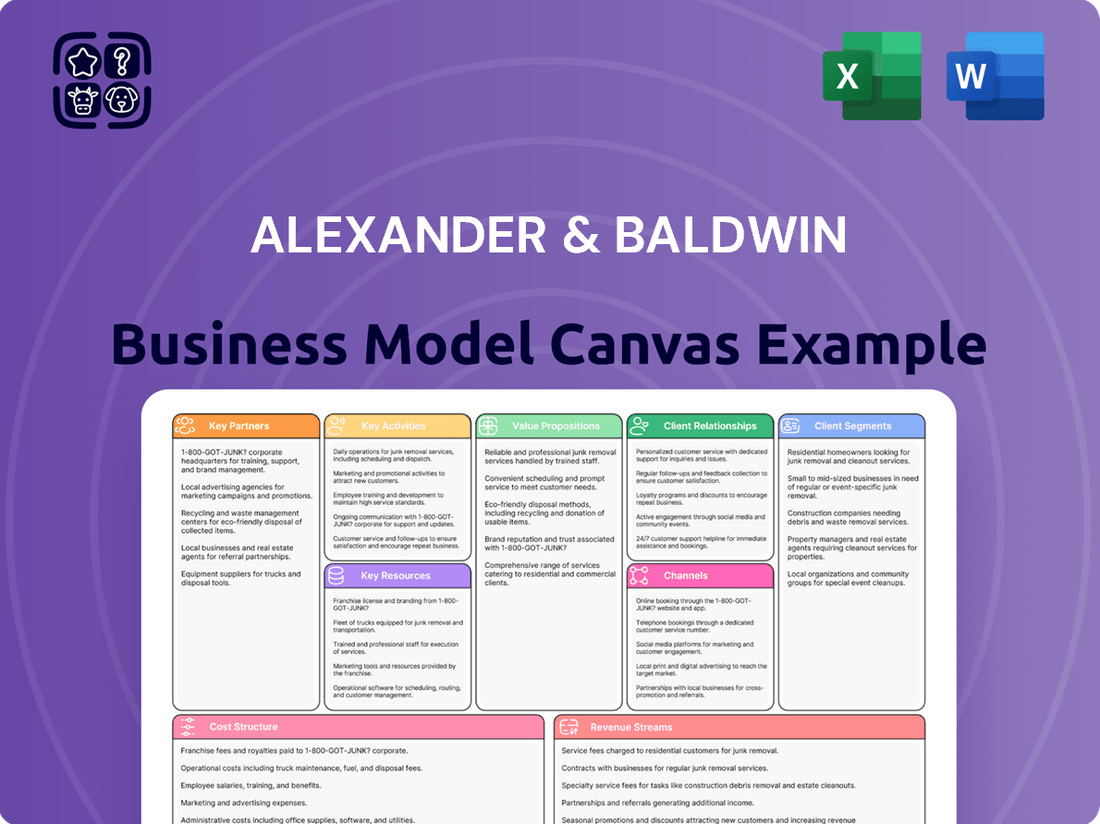

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a comprehensive overview of Alexander & Baldwin's strategic framework. This is not a mockup; it's a direct representation of the complete, ready-to-use analysis that will be delivered to you, ensuring full transparency and immediate value.

Resources

Alexander & Baldwin's core asset is its substantial Hawai'i-centric commercial real estate portfolio. This includes a variety of property types, such as grocery-anchored retail centers, industrial facilities, and office buildings. As of the first quarter of 2024, this portfolio represented approximately 3.7 million square feet of leasable space, generating consistent rental income.

The strategic importance of this portfolio is amplified by Hawaii's unique market dynamics, particularly its limited land availability. This scarcity creates a natural barrier to entry and supports stable property values and rental rates. In 2023, the company reported over $160 million in rental revenue from its real estate operations, highlighting the portfolio's significant contribution to its financial performance.

Alexander & Baldwin's substantial entitled land holdings across Hawaii represent a cornerstone of its business model, offering a robust pipeline for future commercial real estate development. These prime locations, with high barriers to entry, are critical for sustained long-term growth.

As of the first quarter of 2024, Alexander & Baldwin reported approximately 3,500 acres of land designated for development, underscoring the significant asset base supporting its strategic expansion plans in a market characterized by limited availability.

Alexander & Baldwin's financial capital is a cornerstone, encompassing substantial cash reserves, readily accessible credit lines, and a proven capacity to secure equity financing. This robust financial foundation is critical for their strategic initiatives, including acquisitions, property development, and the day-to-day management of their diverse portfolio. As of the first quarter of 2024, the company reported cash and cash equivalents of $188.5 million, underscoring their liquidity.

Their strong balance sheet, characterized by moderate leverage ratios, empowers Alexander & Baldwin to pursue significant strategic investments. This financial discipline ensures they can capitalize on opportunities for growth and expansion without undue risk. The company's debt-to-equity ratio stood at approximately 0.55 in early 2024, indicating a healthy and manageable level of financial leverage.

Local Market Expertise and Relationships

Alexander & Baldwin's (ALEX) over 150 years of operation in Hawaii has cultivated unparalleled local market expertise. This deep-rooted presence translates into strong community relationships and an intimate understanding of the islands' unique real estate dynamics. This extensive history provides a significant competitive advantage, allowing them to navigate the Hawaiian market with a level of insight few others possess.

Their long-standing commitment to Hawaii means they've witnessed and adapted to its evolving economic and social landscapes. This historical perspective is invaluable for identifying opportunities and mitigating risks in a market with distinct characteristics. For instance, understanding local land use regulations and community preferences, honed over decades, is crucial for successful development projects.

- Deeply entrenched local knowledge

- Strong community and stakeholder relationships

- Understanding of Hawaii's unique real estate and regulatory environment

- Over 150 years of operational history in the Hawaiian market

Experienced Management and Real Estate Professionals

Alexander & Baldwin's business model relies heavily on its experienced management and real estate professionals. This team comprises seasoned property managers, adept development specialists, and forward-thinking executive leadership. Their collective knowledge is particularly crucial in navigating the unique Hawaiian real estate market, ensuring strategic decisions are well-informed and operations run smoothly.

The depth of expertise within the management ranks is a cornerstone for Alexander & Baldwin. For instance, their property management division is staffed by individuals with proven track records in optimizing asset performance and tenant satisfaction. Similarly, development specialists bring a wealth of experience in site selection, planning, and execution of complex real estate projects, often contributing significantly to the company's growth and profitability.

- Deep Market Knowledge: The team possesses extensive familiarity with the Hawaiian real estate landscape, including regulatory environments and local economic drivers.

- Operational Excellence: Expertise in property management ensures efficient operations, leading to higher occupancy rates and stronger rental income.

- Strategic Development: Skilled professionals drive the successful planning and execution of new development projects, creating long-term value.

- Leadership Acumen: Executive leadership provides strategic direction, guiding the company through market fluctuations and identifying growth opportunities.

Alexander & Baldwin's key resources include its significant Hawai'i-based commercial real estate portfolio, comprising approximately 3.7 million square feet of leasable space as of Q1 2024, generating consistent rental income. This is complemented by substantial entitled land holdings, totaling around 3,500 acres for future development as of Q1 2024, a critical asset in a market with limited land availability. Furthermore, the company possesses robust financial capital, including $188.5 million in cash and cash equivalents as of Q1 2024, and a manageable debt-to-equity ratio of approximately 0.55 in early 2024, enabling strategic investments and operations.

| Key Resource | Description | Q1 2024 Data/2023 Data |

|---|---|---|

| Commercial Real Estate Portfolio | Leasable space across Hawai'i | ~3.7 million sq ft |

| Rental Revenue | Income generated from real estate operations | Over $160 million (2023) |

| Entitled Land Holdings | Land designated for future development | ~3,500 acres |

| Cash and Cash Equivalents | Liquidity for operations and investments | $188.5 million |

| Debt-to-Equity Ratio | Financial leverage indicator | ~0.55 (Early 2024) |

Value Propositions

Alexander & Baldwin's premier commercial real estate in Hawaii offers businesses access to highly sought-after locations, enhancing their visibility and operational efficiency. These prime assets, including vital grocery-anchored retail centers, are crucial for community access to essential goods and services.

Alexander & Baldwin's strategy emphasizes long-term ownership, which translates into stability and reliability for its tenants and investors. This approach cultivates enduring relationships and ensures consistent property management across its diverse portfolio.

This commitment to holding assets for the long haul is a key differentiator in the Hawaiian market. For instance, in 2024, the company continued to focus on its core real estate and agribusiness segments, demonstrating a sustained investment philosophy rather than a quick-turnaround model.

This long-term vision fosters a stable operating environment, allowing for predictable revenue streams and a consistent return on investment. It underpins the company's reputation for dependability within the communities it serves.

Alexander & Baldwin (A&B) drives value by actively developing new commercial properties and revitalizing existing ones. This approach ensures their portfolio remains high-quality and functional, adapting to changing market needs. For instance, in 2023, A&B reported leasing activity that included new development projects, demonstrating their commitment to portfolio enhancement.

This strategic development and redevelopment strategy is crucial for modernizing Hawaii's commercial landscape. By investing in new projects and upgrading current assets, A&B contributes to economic growth and provides improved commercial spaces. This focus on enhancing their real estate assets underpins their long-term value proposition.

Diversified Portfolio for Tenant Needs

Alexander & Baldwin's diverse property portfolio, including retail, industrial, and ground leases, is designed to meet a wide array of tenant requirements. This broad offering ensures that businesses of all types can find suitable space within their Hawaii-based holdings.

This strategic diversification is key to Alexander & Baldwin's ability to serve a varied customer base. By offering different property types, they reduce reliance on any single market segment, thereby mitigating overall business risk.

For example, in 2024, Alexander & Baldwin's Hawaii portfolio continued to demonstrate resilience. Their retail segment, comprising shopping centers, caters to consumer-facing businesses, while their industrial properties support logistics and manufacturing. Ground leases provide long-term development opportunities for a variety of uses.

The company's approach provides significant advantages:

- Broad Tenant Appeal: Caters to diverse business needs from retail to industrial operations.

- Risk Mitigation: Diversification across property types reduces exposure to single-market downturns.

- Market Adaptability: Ability to serve various economic sectors within Hawaii.

- Long-Term Value: Ground leases offer stable, long-term revenue streams and development potential.

Hawaii-Focused Investment Opportunity

Alexander & Baldwin presents a compelling investment proposition for those seeking exposure to Hawaii's unique commercial real estate landscape. This focus offers investors a chance to tap into a market with significant barriers to entry, such as limited land availability and complex regulatory environments, which can foster stability and potentially higher returns.

For investors, Alexander & Baldwin offers a unique opportunity to invest in Hawaii's commercial real estate market, characterized by high barriers to entry and limited land supply. This focus provides geographic diversification and exposure to a resilient local economy.

- Geographic Diversification: Investing in Alexander & Baldwin provides a distinct geographical diversification away from mainland U.S. markets, offering a unique risk-return profile.

- Resilient Local Economy: Hawaii's economy, while tourism-dependent, also benefits from strong government sector and military presence, contributing to its resilience.

- High Barriers to Entry: The scarcity of developable land and stringent environmental regulations in Hawaii create a protective moat around existing commercial properties.

Alexander & Baldwin's value proposition centers on providing prime commercial real estate in Hawaii, offering businesses exceptional locations that boost visibility and operational efficiency. Their portfolio, featuring essential grocery-anchored centers, ensures community access to necessary goods and services.

The company's commitment to long-term asset ownership provides tenants and investors with stability and reliable property management. This sustained investment philosophy, evident in their continued focus on real estate and agribusiness in 2024, cultivates lasting relationships and predictable returns.

A&B actively enhances its portfolio through new development and revitalization, ensuring properties meet evolving market demands. Their 2023 leasing activity, which included new development projects, underscores this dedication to portfolio improvement and economic contribution.

By offering a diverse range of property types—retail, industrial, and ground leases—Alexander & Baldwin caters to a wide spectrum of tenant needs, mitigating risk and adapting to various economic sectors. Their resilient Hawaii portfolio in 2024, encompassing shopping centers and industrial properties, highlights this strategic diversification.

| Value Proposition Element | Description | Key Benefit |

|---|---|---|

| Prime Hawaiian Locations | Access to highly sought-after commercial spaces. | Enhanced visibility and operational efficiency for businesses. |

| Long-Term Ownership Strategy | Commitment to holding assets for extended periods. | Stability, reliability, and consistent property management for tenants and investors. |

| Active Development & Redevelopment | Investing in new properties and revitalizing existing ones. | High-quality, functional spaces that adapt to market needs, supporting economic growth. |

| Diverse Property Portfolio | Offering retail, industrial, and ground leases. | Meeting a wide array of tenant requirements and mitigating business risk through diversification. |

| Unique Investment Opportunity | Exposure to Hawaii's real estate market with high barriers to entry. | Geographic diversification and access to a resilient local economy. |

Customer Relationships

Alexander & Baldwin prioritizes direct and personalized engagement with its tenants, offering dedicated property management and swift service to meet their specific requirements. This focus on individual tenant needs is key to cultivating enduring partnerships and ensuring high levels of satisfaction and loyalty, which in turn drives consistent occupancy rates.

Alexander & Baldwin (ALEX) prioritizes investor relations through transparent and proactive communication. This includes detailed financial performance reporting during quarterly earnings calls and in their annual reports, often highlighting key operational metrics and strategic advancements. For instance, in their 2024 reporting, the company emphasized its commitment to providing clear insights into its diversified portfolio, aiming to foster investor confidence.

Alexander & Baldwin, with its deep roots in Hawaii, actively cultivates community engagement as a cornerstone of its operations. They position themselves as a 'Partner for Hawaii,' demonstrating a commitment that extends beyond business interests.

This partnership translates into tangible support for local initiatives and a dedication to ensuring their development projects enhance, rather than detract from, Hawaii's unique environment and economy. For instance, in 2024, the company continued its long-standing tradition of investing in community well-being through various programs and sponsorships.

Broker and Real Estate Agent Network

Alexander & Baldwin (A&B) relies heavily on its network of commercial real estate brokers and agents. These professionals are instrumental in marketing A&B's available retail and commercial spaces across Hawaii, acting as a vital extension of the company's sales and leasing efforts. Their market knowledge and established relationships are key to attracting and securing new tenants, ensuring high occupancy rates for A&B's properties.

This external network is particularly critical in Hawaii's unique and competitive real estate landscape. Brokers and agents provide A&B with crucial market intelligence and access to a broader pool of potential lessees than A&B could reach alone. Their expertise facilitates smoother and more efficient leasing transactions, directly impacting A&B's revenue generation from its real estate holdings.

- Key Role: Commercial real estate brokers and agents are essential for marketing A&B's properties and securing new tenants, driving leasing activity.

- Market Reach: These partners extend A&B's presence and access within the competitive Hawaiian real estate market.

- Transaction Facilitation: Their expertise is vital for efficiently managing and closing leasing deals, directly supporting A&B's rental income.

- Data Insight: Brokers provide valuable market data that helps A&B understand demand and pricing for its commercial spaces.

Strategic Client Partnerships (Build-to-Suit)

For significant development projects, particularly those involving build-to-suit arrangements, Alexander & Baldwin cultivates deep, collaborative relationships with their primary clients. This approach is crucial for ensuring that the properties developed align perfectly with the unique needs of anchor tenants. For instance, their relationship with Lowe's for a build-to-suit project exemplifies this strategy, guaranteeing the final structure meets all operational and spatial requirements.

These strategic partnerships are characterized by ongoing dialogue and feedback loops throughout the development lifecycle. This allows for adjustments and refinements, ensuring the end product is not just a building, but a tailored solution. In 2024, Alexander & Baldwin continued to leverage these close ties to secure and deliver on complex commercial real estate projects, demonstrating the value of client-centric development.

- Collaborative Development: Building properties tailored to specific anchor tenant needs.

- Client Alignment: Ensuring project specifications precisely match tenant requirements.

- Long-Term Value: Fostering partnerships that drive successful, customized real estate solutions.

Alexander & Baldwin (A&B) nurtures its relationships with commercial real estate brokers and agents, recognizing their pivotal role in marketing properties and securing tenants. These partnerships are vital for A&B's leasing success in Hawaii's dynamic market, with brokers providing crucial market intelligence and access to potential lessees, thereby facilitating efficient transactions and bolstering rental income.

The company also fosters deep, collaborative relationships with key clients for build-to-suit projects, ensuring developments precisely match anchor tenant needs. This client-centric approach, exemplified by projects like the Lowe's build-to-suit, involves continuous dialogue to deliver tailored real estate solutions, a strategy that remained central to A&B's project delivery in 2024.

| Relationship Type | Key Function | 2024 Focus/Impact |

| Commercial Real Estate Brokers/Agents | Property Marketing, Tenant Acquisition, Market Intelligence | Extended market reach, facilitated leasing, provided demand data |

| Anchor Tenants (Build-to-Suit) | Collaborative Development, Project Specification Alignment | Ensured tailored property solutions, secured complex projects |

| Community Stakeholders | Local Engagement, Partnership for Hawaii | Supported community initiatives, enhanced local environment and economy |

Channels

Alexander & Baldwin's direct leasing and property management teams are crucial for its commercial real estate operations. These in-house experts handle the marketing, leasing, and day-to-day management of the company's diverse property portfolio, ensuring a hands-on approach and tailored tenant experiences.

This direct engagement allows Alexander & Baldwin to maintain strong relationships with its tenants and respond efficiently to market demands. For instance, in 2024, the company continued to focus on optimizing its retail and office spaces, leveraging its teams' local market knowledge to drive occupancy and rental income.

Alexander & Baldwin's official website, alexandbaldwinc.com, acts as a central hub for potential investors and stakeholders. It prominently features their diverse real estate portfolio, offering detailed property listings and crucial investor relations information, including financial reports and corporate governance. This digital presence is key for transparency and accessibility.

Beyond investor relations, the website and associated online portals streamline communication with current tenants. This includes facilitating service requests, rent payments, and disseminating important building updates, enhancing the tenant experience and operational efficiency. For instance, in their 2023 annual report, the company highlighted digital initiatives aimed at improving customer engagement.

Alexander & Baldwin actively utilizes established commercial real estate brokerage networks to connect with a broad spectrum of potential tenants. This strategy is crucial for efficiently filling their diverse portfolio of retail, industrial, and office spaces. These partnerships are key to expanding their market reach and ensuring successful leasing outcomes.

Investor Relations Platforms and Publications

Alexander & Baldwin (ALEX) leverages its investor relations website as a primary hub for investor outreach, offering direct access to earnings reports, investor presentations, and other crucial financial disclosures. This digital channel ensures transparency and broad accessibility for a wide range of stakeholders.

Beyond its own website, ALEX also utilizes established financial news outlets to disseminate important company updates and financial performance data. This strategy broadens the reach of their investor communications, tapping into established media channels that investors routinely follow.

Furthermore, mandatory SEC filings, such as 10-K and 10-Q reports, serve as a cornerstone for providing detailed financial information. In 2024, for instance, these filings continue to be a critical resource for investors seeking in-depth insights into the company's financial health and operational activities.

- Website Investor Relations: Direct access to earnings reports, presentations, and financial disclosures.

- Financial News Outlets: Dissemination of company updates and performance data to a wider audience.

- SEC Filings: Mandatory, detailed financial reporting (e.g., 10-K, 10-Q) for regulatory compliance and investor information.

Public Relations and Media Outlets

Alexander & Baldwin (ALX) actively engages with public relations and media outlets to broadcast its strategic direction and development progress. These efforts are crucial for informing stakeholders and the general public about the company's ongoing projects and its positive impact on the Hawaiian community.

In 2024, ALX continued to leverage media relations to highlight its community involvement, which is a key aspect of its brand building. For instance, the company's commitment to sustainability initiatives and local partnerships are frequently featured, reinforcing its image as a responsible corporate citizen.

- Enhanced Brand Visibility: Media coverage in 2024 helped increase ALX's visibility across Hawaii and national markets.

- Reputation Management: Proactive communication through media channels bolstered ALX's reputation, particularly concerning its development projects.

- Stakeholder Communication: Public relations activities facilitated the dissemination of information about ALX's financial performance and strategic goals to investors and the broader public.

Alexander & Baldwin (ALX) utilizes a multi-channel approach to reach its diverse stakeholders. Their direct leasing and property management teams are key for commercial real estate, fostering strong tenant relationships and responding to market shifts. In 2024, ALX focused on optimizing retail and office spaces, using local expertise to boost occupancy and rental income.

The company's official website, alexandbaldwinc.com, serves as a central hub for investors and stakeholders, detailing their property portfolio and providing investor relations information like financial reports. This digital presence ensures transparency and accessibility for all parties involved.

ALX also leverages established commercial real estate brokerage networks to connect with a wide array of potential tenants, essential for filling their varied property types. These partnerships are vital for expanding market reach and ensuring successful leasing.

Furthermore, ALX actively engages with public relations and media outlets to communicate its strategic direction and development progress, enhancing brand visibility and reputation, especially concerning its community impact and sustainability initiatives in 2024.

| Channel | Purpose | Key Activities/Focus (2024) | Impact |

|---|---|---|---|

| Direct Leasing & Property Management | Tenant acquisition and retention, property optimization | Optimizing retail/office spaces, leveraging local market knowledge | Increased occupancy and rental income |

| Company Website (alexandbaldwinc.com) | Investor relations, property information, tenant communication | Detailed property listings, financial reports, service requests | Transparency, accessibility, enhanced tenant experience |

| Real Estate Brokerage Networks | Broad tenant outreach, market expansion | Connecting with potential tenants across diverse property types | Successful leasing outcomes |

| Public Relations & Media Outlets | Brand building, strategic communication, reputation management | Highlighting community involvement, sustainability, development progress | Enhanced brand visibility, strengthened reputation |

Customer Segments

Alexander & Baldwin's retail segment primarily serves grocery-anchored and neighborhood shopping centers. These locations are crucial for daily consumer needs, attracting consistent foot traffic. This focus ensures a stable customer base for a diverse range of retail tenants.

Industrial and logistics companies are a key customer segment for Alexander & Baldwin. These businesses, which include distribution centers and warehousing operations, rely on strategically located facilities to manage their supply chains effectively. The demand for such spaces is particularly high in Hawaii's tight industrial market.

Alexander & Baldwin offers commercial office spaces tailored for businesses. This segment caters to a diverse range of professional services and corporate tenants who value prime locations and high-quality property management. In 2024, companies continue to seek flexible and well-equipped office environments to support their operations and employee needs.

Developers and Long-Term Ground Lease Tenants

Alexander & Baldwin caters to developers and businesses that require long-term ground leases, particularly for build-to-suit projects. These clients often seek strategically located land parcels to accommodate their specialized operational requirements, ensuring a secure foundation for their business growth.

For instance, in 2024, Alexander & Baldwin's Hawaiian Commercial & Sugar (HCS) division continued to engage with various developers for its extensive land portfolio. These partnerships are crucial for unlocking the value of their agricultural lands through diversified development, such as industrial parks and commercial centers.

- Targeting Developers: Alexander & Baldwin actively seeks partnerships with developers for its diverse land holdings across Hawaii.

- Build-to-Suit Opportunities: The company provides ground lease options for businesses needing custom-built facilities tailored to specific operational needs.

- Long-Term Partnerships: Emphasis is placed on establishing enduring relationships with tenants who contribute to the long-term economic vitality of the land.

- Strategic Land Use: These segments are key to Alexander & Baldwin's strategy of converting traditional agricultural land into higher-value commercial and industrial uses.

Real Estate Investors (Institutional and Individual)

Alexander & Baldwin, as a publicly traded Real Estate Investment Trust (REIT), actively courts both institutional and individual investors. These investors are specifically looking for opportunities to gain exposure to Hawaii's dynamic commercial real estate sector, often prioritizing stable, dividend-paying investments. For instance, in 2024, the company's focus on its Hawaii portfolio, which includes retail, industrial, and office properties, aims to deliver consistent returns. The segment's key drivers include strong financial performance metrics, demonstrable growth prospects, and a reliable dividend yield.

Key investor considerations for Alexander & Baldwin include:

- Financial Performance: Investors scrutinize metrics like Funds From Operations (FFO) and Net Asset Value (NAV) to gauge the company's profitability and asset value.

- Growth Prospects: The potential for rental income growth, property appreciation, and strategic acquisitions within Hawaii's market is a significant draw.

- Dividend Yield: A consistent and attractive dividend payout is a primary attraction for income-seeking investors, reflecting the REIT's ability to generate distributable cash flow.

- Market Exposure: The unique appeal of investing in Hawaii's real estate market, often characterized by limited supply and strong tourism-driven demand, attracts a specialized investor base.

Alexander & Baldwin's customer segments are diverse, encompassing retail tenants in grocery-anchored centers, industrial and logistics firms needing efficient supply chain spaces, and businesses seeking quality office environments. They also cater to developers and businesses requiring long-term ground leases for specialized facilities, particularly leveraging their extensive Hawaiian land portfolio. Furthermore, the company attracts both institutional and individual investors drawn to Hawaii's real estate market and the REIT's potential for stable returns and dividends.

| Customer Segment | Needs/Focus | 2024 Relevance |

|---|---|---|

| Retail Tenants | Daily consumer needs, consistent foot traffic | Stable demand in neighborhood centers |

| Industrial/Logistics | Strategic locations for supply chains | High demand in Hawaii's limited industrial market |

| Office Tenants | Professional services, corporate operations | Continued need for flexible, quality spaces |

| Developers/Ground Lease Clients | Build-to-suit projects, specialized facilities | Key for unlocking value in agricultural land |

| Investors | Exposure to Hawaii real estate, stable dividends | Focus on FFO, growth prospects, and yield |

Cost Structure

Alexander & Baldwin's property operating and maintenance costs are substantial, encompassing utilities, routine repairs, property taxes, and insurance for its extensive commercial real estate holdings. These are fundamental to preserving asset value and ensuring tenant contentment.

In 2024, the company reported significant expenditures in this category. For instance, their Hawaii segment alone, which forms a core part of their real estate operations, often sees these costs fluctuate based on energy prices and maintenance cycles. While specific 2024 figures for this line item are still being finalized, historical trends show these costs represent a considerable portion of operating expenses, directly impacting net operating income.

Alexander & Baldwin's cost structure heavily features real estate development and construction expenses. These significant outlays encompass the entire lifecycle of new and redeveloped properties, from initial planning to physical completion.

Key cost drivers include the acquisition of land, which forms the foundational investment for any project. Beyond land, substantial funds are allocated to construction materials, reflecting market prices for lumber, concrete, steel, and other essential components. Labor costs, covering skilled trades and general construction workers, also represent a major expenditure, influenced by regional wage rates and demand for construction professionals.

Furthermore, project management fees, architectural and engineering services, permitting, and entitlement processes contribute to the overall development cost. For instance, in 2024, the company continued to invest in its portfolio, with ongoing projects like the development of residential communities and commercial spaces in Hawaii, underscoring the continuous nature of these substantial expenses.

Alexander & Baldwin's general and administrative expenses encompass essential corporate functions like executive and staff salaries, office rent, utilities, and legal or accounting fees. For instance, in 2023, their selling, general, and administrative expenses were reported at $146.4 million, reflecting the ongoing costs of managing their diverse real estate and agricultural operations.

The company actively seeks to optimize these overheads. Their strategic initiatives aim to improve operational efficiency, which can lead to a reduction in the proportion of G&A costs relative to revenue. This focus on streamlining is crucial for maintaining profitability across their various business segments.

Financing and Interest Expenses

Financing and interest expenses are a key component of Alexander & Baldwin's cost structure. These costs primarily stem from interest payments on their various debt obligations, including mortgages for their real estate holdings and interest on corporate credit facilities. Managing this leverage effectively is crucial for maintaining a stable debt profile and ensuring financial health.

In 2024, Alexander & Baldwin's financial strategy focused on prudent management of its debt. While specific interest expense figures fluctuate with market conditions and debt levels, the company consistently works to optimize its capital structure. This involves balancing the benefits of debt financing with the associated interest costs.

- Debt Financing Costs: Interest paid on mortgages and credit lines forms a significant expense.

- Leverage Management: Alexander & Baldwin actively manages its debt levels to maintain financial stability.

- Debt Profile Stability: The company aims for a consistent and manageable debt profile over time.

- Interest Expense Impact: These financing costs directly affect the company's profitability.

Acquisition and Disposition Costs

Acquisition and disposition costs are significant components of Alexander & Baldwin's (ALEX) cost structure, directly impacting profitability from real estate transactions. These costs are inherently transactional, arising whenever the company buys or sells properties.

These expenses include a range of fees essential for navigating property deals. For example, due diligence fees cover investigations into a property's condition and legal standing, while brokerage commissions are paid to agents facilitating the sale or purchase. Legal costs are also a substantial part of these expenses, covering contract reviews and closing procedures.

In 2024, the real estate industry saw varying transaction volumes. For a company like Alexander & Baldwin, which manages a diverse portfolio, these costs are directly tied to the pace of their strategic portfolio adjustments. For instance, if ALEX engaged in significant property sales or acquisitions during the year, these costs would naturally be higher.

- Due Diligence Fees: Costs associated with property inspections, environmental assessments, and title searches.

- Brokerage Commissions: Fees paid to real estate agents or brokers for their services in facilitating transactions.

- Legal and Closing Costs: Expenses related to legal counsel, title insurance, recording fees, and other administrative charges to finalize property transfers.

- Transaction Taxes: Any applicable taxes imposed by local or state governments on property sales or purchases.

Alexander & Baldwin's cost structure is heavily influenced by property operating and maintenance expenses, which are essential for preserving their extensive real estate portfolio. These costs, including utilities, taxes, and upkeep, directly impact net operating income and are subject to market fluctuations like energy prices. In 2024, these expenditures remained a significant operational outlay, particularly within their core Hawaii segment.

Revenue Streams

Alexander & Baldwin's core revenue engine is the rental income derived from its extensive real estate holdings. This income stream is multifaceted, encompassing base rent, which is the fixed amount paid by tenants, and percentage rent, a portion of a tenant's sales that exceeds a predetermined threshold.

Furthermore, the company benefits from recoveries, where tenants reimburse Alexander & Baldwin for operating expenses such as property taxes, insurance, and maintenance. In 2023, Alexander & Baldwin reported that its Hawaii portfolio, a significant portion of its rental operations, continued to show resilience, with occupancy rates remaining strong across its retail and industrial segments.

Alexander & Baldwin's revenue is significantly bolstered by income from long-term ground leases. In these arrangements, the company leases its land to various tenants who are responsible for constructing and managing their own buildings. This model generates a predictable and consistent revenue stream, as the company incurs very little operational cost associated with the tenant's development.

Alexander & Baldwin's revenue streams heavily rely on the profits generated from developing and selling new real estate projects. This includes capturing margins on the construction and sale of residential, commercial, and industrial properties. In 2023, the company's Hawai'i Community Development segment, which encompasses land sales and development, reported revenues of $177.9 million, showcasing the significance of these sale margins.

Beyond new developments, the company also monetizes its substantial legacy land holdings. This involves selling off undeveloped or underutilized land, often in strategic locations, which contributes to their overall revenue through land sale margins. For instance, in the first nine months of 2024, Alexander & Baldwin reported $115.7 million in land sales revenue, highlighting the ongoing importance of this revenue stream.

Property Management Fees (Potentially)

Alexander & Baldwin (ALEX) primarily operates as an owner-operator of its real estate portfolio. However, there's a potential avenue for revenue through third-party property management services if the company decides to leverage its expertise beyond its own holdings. This would involve managing properties for external clients.

While not a primary focus, exploring third-party property management could diversify ALEX's revenue streams. For instance, if they were to offer these services, they might charge a percentage of gross rents collected or a flat monthly fee per unit. As of the first quarter of 2024, ALEX reported total revenues of $69.5 million, with their portfolio management being a significant contributor.

- Owner-Operator Model: ALEX's core business involves managing its own diverse real estate assets, including retail, industrial, and office spaces.

- Potential for Third-Party Services: The company could generate additional income by offering property management expertise to external property owners.

- Revenue Diversification: Expanding into third-party management would offer a new revenue stream, potentially complementing existing income from their owned properties.

Strategic Partnership Income/Joint Ventures

Alexander & Baldwin can generate revenue through its equity stakes in earnings from unconsolidated joint ventures and other strategic partnerships focused on real estate development. This approach effectively shares project risks and opens up diverse income streams beyond wholly-owned assets. For instance, in 2024, the company's participation in various development projects through these partnerships contributed to its overall financial performance.

These strategic alliances allow Alexander & Baldwin to tap into specialized expertise and capital for large-scale real estate ventures. This not only diversifies their revenue but also provides access to opportunities they might not pursue independently. Such collaborations are crucial for expanding their portfolio and mitigating the financial impact of individual project outcomes.

- Equity in Earnings: Revenue recognized from profits generated by joint venture projects where Alexander & Baldwin holds an equity stake, but does not fully consolidate the venture's financials.

- Shared Risk and Reward: Partnerships allow for the distribution of development costs and potential returns, making larger or more complex projects feasible.

- Diversified Income Sources: This revenue stream complements income from wholly-owned properties, offering a broader base for financial stability.

- Strategic Real Estate Ventures: Focus on partnerships specifically for developing or managing real estate assets, leveraging combined strengths.

Alexander & Baldwin's revenue streams are robust and diversified, primarily stemming from its extensive real estate operations. The company benefits from rental income, long-term ground leases, and the development and sale of new properties. Additionally, they monetize legacy land holdings and can generate income from equity stakes in joint ventures.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Rental Income | Base rent and percentage rent from tenants, plus expense recoveries. | Hawaii portfolio occupancy remained strong in 2023. |

| Long-Term Ground Leases | Income from leasing land for tenant development. | Provides predictable and consistent revenue with low operational costs. |

| Property Development & Sales | Profits from developing and selling residential, commercial, and industrial properties. | $177.9 million in revenue from Hawai'i Community Development in 2023. |

| Land Sales | Monetizing undeveloped or underutilized land holdings. | $115.7 million in land sales revenue in the first nine months of 2024. |

| Joint Venture Equity | Earnings from unconsolidated joint ventures and strategic partnerships. | Contributed to overall financial performance in 2024 through various development projects. |

Business Model Canvas Data Sources

The Alexander & Baldwin Business Model Canvas is informed by a robust blend of financial disclosures, including annual reports and SEC filings, alongside comprehensive market research and analysis of the real estate and agriculture sectors. This data ensures each component of the canvas accurately reflects the company's operational realities and strategic positioning.