Alexander & Baldwin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

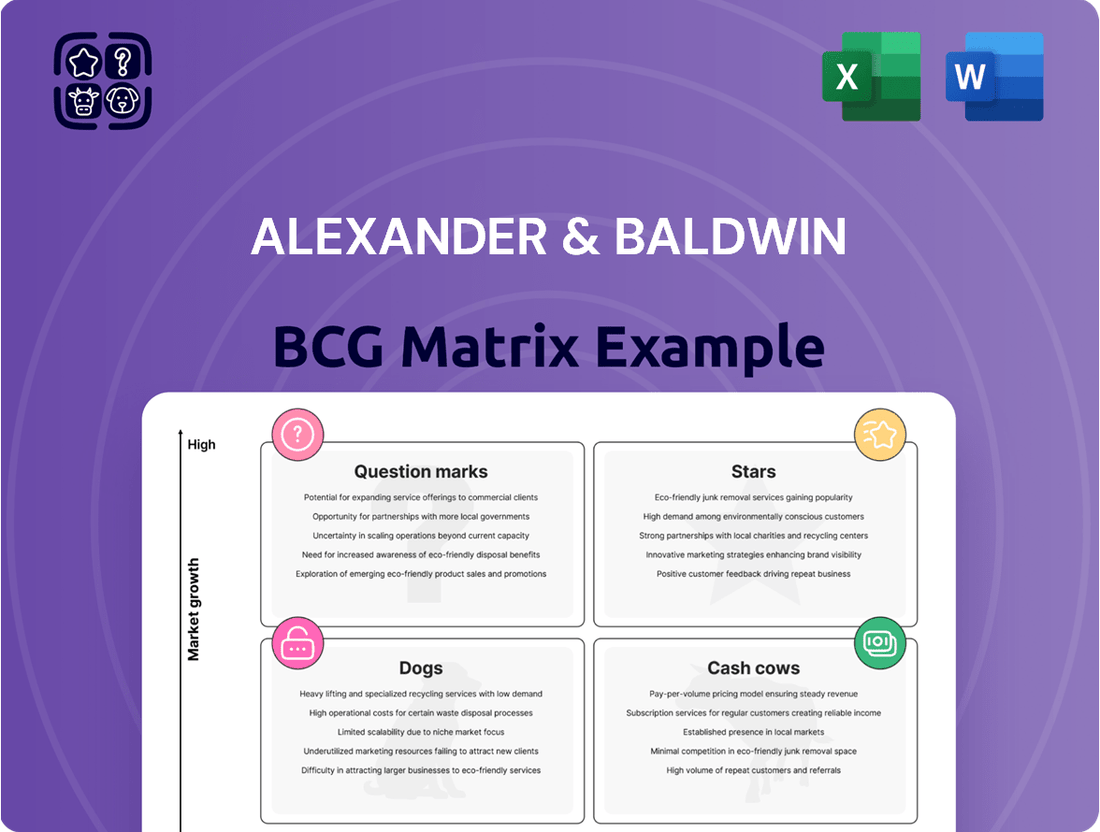

Curious about Alexander & Baldwin's strategic positioning? Understanding their product portfolio through the BCG Matrix is key to unlocking their growth potential. Discover which segments are fueling their success and which require careful consideration.

This glimpse into Alexander & Baldwin's BCG Matrix is just the beginning. Purchase the full report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment decisions.

Don't miss out on the full picture of Alexander & Baldwin's market performance. Get the complete BCG Matrix to gain a strategic advantage and confidently navigate their diverse business units.

Stars

Alexander & Baldwin's industrial development pipeline showcases a strong focus on build-to-suit projects, a key indicator of their strategic growth. For instance, the 91,000-square-foot facility for Lowe's at Komohana Industrial Park and the 29,550-square-foot warehouse at Maui Business Park are prime examples of these high-growth initiatives.

These developments are strategically placed to leverage Hawaii's exceptionally tight industrial market. With vacancy rates hovering at very low levels and demand significantly exceeding supply, these projects are well-positioned for success.

The fact that a substantial portion of these new industrial spaces have already been pre-leased underscores robust market demand and signals strong future revenue streams for Alexander & Baldwin. This preemptive leasing validates their development strategy in a supply-constrained environment.

Alexander & Baldwin's existing industrial assets are a prime example of a high-demand portfolio. As of June 30, 2025, these properties boast an impressive 98.2% occupancy rate, underscoring their desirability. This strong performance is rooted in their operation within Hawaii's high-growth, supply-constrained industrial market.

The company's significant market share in this rapidly appreciating sector places them in a favorable position. The robust demand for industrial space, fueled by the ongoing expansion of e-commerce and logistics operations, directly translates into advantageous leasing spreads and consistent revenue expansion for Alexander & Baldwin.

Alexander & Baldwin's strategic ground lease conversions represent a significant move into the Stars quadrant of the BCG Matrix. By transforming underutilized land into long-term, income-producing assets, the company is actively cultivating future growth. A prime example is the 75-year ground lease at Maui Business Park, which exemplifies this high-growth strategy.

This conversion tactic effectively monetizes Alexander & Baldwin's substantial land portfolio, establishing stable, recurring revenue streams. This is particularly valuable in expanding commercial markets. Such long-term leasing agreements are designed to bolster future Funds From Operations (FFO) and systematically increase the overall value of their real estate holdings.

Maui Business Park Expansion

The expansion of the Maui Business Park represents a significant strategic initiative. The completion of a build-to-suit warehouse in Q1 2026 is projected to boost Net Operating Income (NOI) by $1.0 million.

This development is strategically positioned to capitalize on its proximity to Kahului Harbor and Airport. This prime location supports its status as a key neighborhood retail and industrial submarket, drawing in both national and regional enterprises.

- Strategic Location: Proximity to Kahului Harbor and Airport enhances its appeal.

- Growth Driver: The build-to-suit warehouse completion in Q1 2026 is a key factor.

- Financial Impact: Anticipated $1.0 million uplift in Net Operating Income (NOI).

- Market Attractiveness: Attracts national and regional businesses due to its submarket strength.

Oahu Industrial Redevelopment

The redevelopment of Komohana Industrial Park on O'ahu is a key growth driver for Alexander & Baldwin. This project will boost the gross leasable area by 44% once finished in Q4 2026.

The initiative is projected to add around $2.8 million to the Net Operating Income (NOI). It directly tackles the high demand for contemporary industrial facilities in a market known for its scarcity.

- Projected completion: Q4 2026

- Gross leasable area increase: 44%

- Estimated NOI contribution: $2.8 million

- Market context: Addresses critical need for modern industrial space in a tight U.S. market

Alexander & Baldwin's strategic ground lease conversions, such as the 75-year lease at Maui Business Park, firmly place them in the Stars quadrant of the BCG Matrix. These initiatives actively cultivate future growth by transforming underutilized land into stable, income-producing assets. This approach effectively monetizes their extensive land portfolio, establishing recurring revenue streams designed to boost future Funds From Operations (FFO) and increase the overall value of their real estate holdings.

| Project | Type | Projected NOI Impact | Completion | Lease Term |

|---|---|---|---|---|

| Maui Business Park Warehouse | Build-to-Suit | $1.0 million | Q1 2026 | 75 years |

| Komohana Industrial Park Redevelopment | Industrial Development | $2.8 million | Q4 2026 | N/A (Ground Lease) |

What is included in the product

This analysis categorizes Alexander & Baldwin's business units based on market growth and share.

It offers strategic recommendations for investment, divestment, or maintenance of each unit.

Quickly identify underperforming Hawaiian sugar operations by visualizing them as "Dogs" on the Alexander & Baldwin BCG Matrix.

Cash Cows

Grocery-anchored retail centers are Alexander & Baldwin's cash cows, recognized for their unwavering stability and resilience in Hawaii's market. These centers consistently attract shoppers, leading to dependable rental income and robust occupancy rates, even when the economy faces challenges.

As of the second quarter of 2025, Alexander & Baldwin reported an impressive retail occupancy rate of 95.4% for these centers. This high occupancy underscores their mature and reliable nature, solidifying their position as a consistent revenue generator for the company.

Alexander & Baldwin's established urban ground leases are a prime example of a Cash Cow within their portfolio. With 142 acres dedicated to these assets, they command a significant share of a mature Hawaiian real estate market, generating consistent, long-term income with very little ongoing effort.

The predictable nature of ground lease payments, which are fixed over extended periods, directly translates into stable and reliable cash flow for the company. This stability is crucial, making these urban ground leases a foundational element of Alexander & Baldwin's financial strength.

Alexander & Baldwin's mature industrial assets are a prime example of a Cash Cow. As of June 30, 2025, these properties boast an impressive 98.2% occupancy rate, showcasing their stability and consistent demand.

This high occupancy translates directly into robust and reliable cash flow for the company. The industrial sector in which these assets operate is mature, and A&B's strong market position allows them to command consistent rental income and maintain efficient operational management.

The financial performance of these assets is further underscored by healthy leasing spreads and a stable Net Operating Income, solidifying their status as a significant contributor to A&B's overall financial health.

Overall Commercial Real Estate Portfolio Stability

Alexander & Baldwin's Commercial Real Estate (CRE) portfolio exhibits remarkable stability, a key indicator of its cash cow status. As of Q2 2025, the portfolio boasts a leased occupancy rate of 95.8%, underscoring its consistent demand and tenant retention.

This high occupancy directly translates into robust cash generation. The CRE Same-Store Net Operating Income (NOI) experienced a healthy 5.3% growth in Q2 2025. Such consistent growth from core assets signals a mature and efficiently managed portfolio, capable of producing substantial Funds From Operations (FFO).

- 95.8% leased occupancy in Q2 2025

- 5.3% CRE Same-Store NOI growth in Q2 2025

- Demonstrates strong cash-generating capability

- Provides substantial FFO for reinvestment or dividends

Consistent Dividend Payouts

Alexander & Baldwin's consistent quarterly dividend of $0.225 per share, confirmed for both Q2 and Q3 2025, highlights its robust and dependable cash flow. This stability in payouts, bolstered by a strong balance sheet and minimal debt, signals that the company's primary businesses are highly profitable and generate surplus cash.

This consistent dividend payout is a key indicator of a Cash Cow. The company's financial health, demonstrated by its ability to maintain these payments, suggests its mature business segments are generating substantial profits with limited need for reinvestment. For instance, in 2024, the company reported strong operating income, enabling these shareholder returns.

- Consistent Dividend: $0.225 per share quarterly payout for Q2 and Q3 2025.

- Financial Stability: Supported by a healthy balance sheet and low leverage.

- Profitability: Core operations generate more cash than required for reinvestment.

- Cash Generation: Demonstrates strong and reliable cash flow from mature segments.

Alexander & Baldwin's grocery-anchored retail centers and urban ground leases are prime examples of Cash Cows. These mature assets consistently generate dependable rental income with high occupancy rates, such as 95.4% for retail centers in Q2 2025. Their stability is further evidenced by Alexander & Baldwin's consistent quarterly dividend of $0.225 per share in 2025, a direct result of strong cash flow from these core businesses.

| Asset Type | Key Metric | Value (Q2 2025 unless noted) | Significance |

|---|---|---|---|

| Grocery-Anchored Retail Centers | Leased Occupancy | 95.4% | Consistent rental income, resilient demand |

| Urban Ground Leases | Total Acreage | 142 acres | Long-term, stable income generation |

| Mature Industrial Assets | Occupancy Rate | 98.2% (as of June 30, 2025) | Robust and reliable cash flow |

| Commercial Real Estate (CRE) Portfolio | CRE Same-Store NOI Growth | 5.3% | Strong cash generation, substantial FFO |

Preview = Final Product

Alexander & Baldwin BCG Matrix

The preview you see is the actual, fully formatted Alexander & Baldwin BCG Matrix document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just a professionally designed, analysis-ready report ready for your strategic planning. You are viewing the exact same comprehensive document that will be available for download, enabling you to gain immediate insights into Alexander & Baldwin's business units. This preview assures you of the quality and completeness of the BCG Matrix you are acquiring, allowing for direct application in your business analysis or presentations.

Dogs

Alexander & Baldwin's legacy agricultural landholdings, those not slated for commercial development, represent a segment characterized by low growth and a relatively small market share within the company's broader portfolio. These parcels often come with ongoing carrying costs and may not contribute substantially to income generation, positioning them as potential candidates for divestiture as the company streamlines its operations.

The company has demonstrated a clear strategy of simplifying its business by actively monetizing these non-core agricultural assets. For instance, in 2023, Alexander & Baldwin completed the sale of approximately 1,400 acres of former sugar plantation land in Maui for $26 million, a move that aligns with their stated goal of focusing on higher-return development projects.

Underperforming non-strategic land parcels within Alexander & Baldwin's portfolio can be categorized as Dogs. These are typically unimproved properties that present challenges in the entitlement process, are not situated in key growth areas, or experience subdued market interest.

These land parcels represent a drain on capital, as they are not aligned with the company's primary commercial real estate objectives. For instance, as of the first quarter of 2024, Alexander & Baldwin reported that its Hawaiian portfolio, which includes various land holdings, generated rental revenue of $70.1 million. While this figure encompasses all assets, a portion of this revenue may be offset by the carrying costs of these underperforming parcels.

Divesting these assets, even at a reduced profit margin, is a prudent strategy. It allows Alexander & Baldwin to minimize ongoing expenses associated with holding these properties and frees up capital for more strategic investments. This move is crucial for optimizing the overall performance of their real estate holdings.

Alexander & Baldwin's office properties, representing a modest 3.6% of their gross leasable area, may fall into the Dogs category within a BCG matrix. While the company boasts high overall occupancy, specific office assets could experience reduced demand and increased vacancy, especially when contrasted with their stronger retail and industrial segments.

If these office properties hold a low market share within a potentially stagnant office market, they would align with the characteristics of a Dog. Alexander & Baldwin has indeed acknowledged some vacancy within its office portfolio, further supporting this classification.

Divested Assets

Divested Assets represent business units or properties that Alexander & Baldwin (ALEX) is selling off, often because they no longer align with the company's strategic direction. This move is typical for companies looking to streamline operations and focus on core competencies.

For instance, ALEX's strategy includes shedding assets that are not central to its commercial real estate ambitions. A prime example is the sale of 90 acres of land, mainly zoned for agriculture, in the first quarter of 2025. This action underscores the company's commitment to divesting underperforming or non-strategic holdings.

- Divestment Strategy: Alexander & Baldwin actively seeks to sell assets not contributing to its core commercial real estate focus.

- Agricultural Land Sale: In Q1 2025, the company sold 90 acres of land, primarily agriculture-zoned.

- Focus on Core Business: This divestment aligns with ALEX's strategy to shed underperforming or non-strategic assets.

High-Cost, Low-Return Legacy Joint Ventures

High-Cost, Low-Return Legacy Joint Ventures represent a category within Alexander & Baldwin's strategic considerations that might be classified as Dogs. These are ventures that are complex, yield minimal returns, or demand substantial ongoing management effort disproportionate to their profitability. The company has publicly stated its initiatives to simplify its operations and resolve liabilities associated with these legacy joint ventures, which implies these entities were not performing to their full potential.

For example, in 2024, Alexander & Baldwin continued its focus on portfolio optimization. While specific details on individual legacy joint ventures are often proprietary, the company's overall strategic direction in 2024 has been to divest or restructure underperforming assets to enhance shareholder value. This aligns with the principle of identifying and addressing business units that consume resources without generating commensurate returns.

- Legacy Joint Ventures: Complex, low-return, high-management-cost entities.

- Strategic Streamlining: Company actively works to simplify business and settle liabilities.

- Suboptimal Contribution: These ventures are identified as not contributing optimally to overall performance.

- 2024 Focus: Alexander & Baldwin's ongoing efforts in portfolio optimization underscore this strategic approach.

Within Alexander & Baldwin's portfolio, certain agricultural land parcels and underperforming office properties can be classified as Dogs. These assets typically exhibit low market share and operate in slow-growth sectors, demanding resources without generating significant returns.

The company's strategy involves divesting these non-core assets to streamline operations and reallocate capital. For example, Alexander & Baldwin sold approximately 1,400 acres of Maui land in 2023 for $26 million, a move to focus on more profitable ventures.

These "Dog" assets, such as legacy joint ventures with high costs and low returns, represent a drag on overall performance. Alexander & Baldwin's 2024 focus on portfolio optimization highlights their effort to identify and address such underperforming segments.

The sale of 90 acres of primarily agricultural land in the first quarter of 2025 further exemplifies this divestment strategy, aiming to shed non-strategic holdings and improve financial efficiency.

| Asset Category | BCG Classification | Key Characteristics | Example Transaction/Data Point |

|---|---|---|---|

| Legacy Agricultural Land | Dog | Low growth, small market share, ongoing carrying costs | Sale of ~1,400 acres in Maui for $26M (2023) |

| Underperforming Office Properties | Dog | Reduced demand, potential vacancy, low market share in stagnant sector | Acknowledged vacancy within office portfolio |

| High-Cost, Low-Return Legacy Joint Ventures | Dog | Complex, minimal returns, high management effort | Ongoing focus on portfolio optimization and resolving liabilities (2024) |

| Divested Non-Core Land | Dog (prior to sale) | Not aligned with core commercial real estate focus, underperforming | Sale of 90 acres in Q1 2025 |

Question Marks

The 30,000-square-foot speculative industrial build at Komohana Industrial Park, with no existing tenants, clearly falls into the Question Mark category of the BCG Matrix for Alexander & Baldwin. This project is situated in a market experiencing robust growth, a positive indicator for potential future success.

However, its current market share is effectively zero, as it lacks any pre-leased space. This means Alexander & Baldwin must invest heavily to bring this facility to completion, with the hope of attracting tenants swiftly.

The critical factor for this speculative build is its ability to quickly secure tenants at competitive rental rates. If successful, it could transition from a Question Mark to a Star, a highly desirable position in the BCG Matrix, signifying high growth and high market share.

Future phases of development within existing business parks, such as Maui Business Park Phase II, are crucial for Alexander & Baldwin's growth. These areas offer build-to-suit, ground lease, and fee purchase options, catering to diverse tenant needs. In 2024, the company continued to see demand for industrial and commercial spaces across its portfolio, with occupancy rates remaining strong in key locations.

New, unannounced acquisitions or redevelopments for Alexander & Baldwin would fall into the Question Marks category. These are ventures in high-growth Hawaiian submarkets that are still in their nascent stages, lacking firm pre-commitments or widespread market validation.

These potential projects represent opportunities for significant future growth, but they also come with inherent risks. For instance, a new residential development in a rapidly appreciating but unproven neighborhood might offer substantial returns if successful, but carries the uncertainty of market absorption and construction cost overruns.

As of early 2024, Alexander & Baldwin has been actively exploring opportunities to diversify its portfolio beyond traditional retail and office spaces, particularly in sectors like industrial and residential development. Specific unannounced projects, if any, would be in this early, high-risk, high-reward phase.

Exploration of New Commercial Segments

Exploring new commercial segments for Alexander & Baldwin (A&B) would place them in the Question Mark quadrant of the BCG Matrix. These are ventures with low market share in high-growth industries. For A&B, this could mean entering emerging sectors within Hawaii's real estate market, such as specialized logistics facilities or innovative co-working spaces, areas where their current presence is minimal.

Such strategic moves necessitate significant capital outlay and robust marketing campaigns to build brand recognition and capture market share. For instance, if A&B were to invest in developing advanced agricultural technology hubs, a segment experiencing global growth but with limited existing infrastructure in Hawaii, it would fit this category. The potential for high returns exists, but so does the risk of failure if market penetration is not achieved.

- High Growth Potential: New segments offer opportunities to tap into evolving market demands.

- Substantial Investment Required: Entry into unfamiliar territories demands significant financial commitment.

- Strategic Marketing is Crucial: Building a presence and customer base in new areas requires targeted promotional efforts.

- Risk of Low Market Share: Initial ventures may struggle to gain traction against established players or market inertia.

Undeveloped Core Landholdings

Undeveloped core landholdings for Alexander & Baldwin, comprising about 51 acres of strategically positioned land, can be viewed as potential Stars or Question Marks within a BCG Matrix framework. These parcels are situated in markets with strong demand, yet their ultimate value hinges on future development strategies and prevailing economic conditions.

The realization of value from these undeveloped core landholdings is contingent upon successful future development projects. For instance, if Alexander & Baldwin were to initiate a high-density residential or commercial project on a portion of this land, and it achieved rapid market penetration and profitability, that specific land parcel could transition into a Star. Conversely, if development plans are uncertain or face significant market headwinds, the land might be classified as a Question Mark, requiring further investment and strategic evaluation to determine its future potential.

- Strategic Location: Approximately 51 acres of core landholdings are strategically positioned for future development.

- High Demand Market: These undeveloped lands are situated in areas experiencing robust market demand.

- Value Realization: Their current value is not fully realized and depends on future development decisions and market conditions.

- BCG Matrix Classification: These holdings could be categorized as Stars or Question Marks depending on development success and market reception.

Question Marks represent ventures with low market share in high-growth industries, demanding significant investment to capture potential. For Alexander & Baldwin, this includes speculative projects like the Komohana Industrial Park build, where securing tenants quickly is paramount for a potential transition to a Star. New, unannounced acquisitions or ventures into emerging commercial segments also fall into this category, carrying inherent risks alongside substantial growth opportunities.

The company's 51 acres of undeveloped core landholdings also represent potential Question Marks, their future value contingent on successful development strategies and market reception. As of early 2024, A&B's exploration into new sectors like industrial and residential development, including specific but unannounced projects, highlights their active pursuit of these high-risk, high-reward opportunities.

Alexander & Baldwin's strategic focus on diversifying beyond traditional retail and office spaces, particularly into industrial and residential development, positions many of its nascent projects as Question Marks. For example, the 30,000-square-foot speculative industrial build at Komohana Industrial Park, with no existing tenants in a growing market, exemplifies this. Similarly, exploring new commercial segments like specialized logistics facilities or innovative co-working spaces, where A&B has minimal current presence, places them squarely in this quadrant.

These ventures require substantial capital and targeted marketing to build brand recognition and market share. The success of these Question Marks, such as the Komohana build or undeveloped land parcels, hinges on their ability to achieve rapid market penetration and profitability, potentially transitioning them into Stars. In 2024, A&B continued to see strong demand for industrial and commercial spaces, a positive backdrop for these growth-oriented, but still uncertain, initiatives.

| Project/Venture Type | Market Growth | Current Market Share | BCG Category | Key Considerations |

| Speculative Industrial Build (Komohana) | High | Low (Zero) | Question Mark | Tenant acquisition, rental rates, rapid market absorption |

| New Commercial Segment Entry (e.g., Logistics Hubs) | High | Low | Question Mark | Capital investment, marketing, brand building, market penetration |

| Undeveloped Core Landholdings (51 acres) | High (in strategic locations) | Low (until developed) | Potential Question Mark / Star | Future development strategy, economic conditions, market reception |

| Unannounced Acquisitions/Redevelopments | High (in submarkets) | Low / Undetermined | Question Mark | Nascent stage, lack of pre-commitments, market validation |

BCG Matrix Data Sources

Our Alexander & Baldwin BCG Matrix is built on comprehensive market data, including financial disclosures, industry growth rates, and competitor analysis to accurately position each business unit.