Alexander & Baldwin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Navigate the complex external forces impacting Alexander & Baldwin with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping their industry. Download the full version to gain actionable intelligence and refine your own strategic approach.

Political factors

Hawaii's political climate, particularly its robust land use and zoning policies, presents a significant factor for Alexander & Baldwin (A&B). These regulations directly shape the company's ability to develop and repurpose land across the islands. For instance, the Honolulu City Council's recent comprehensive review and potential overhaul of land use rules in 2024 are critical for A&B, as they could redefine permissible development types and densities, impacting project feasibility and A&B's strategic land allocation.

These policies are not merely bureaucratic hurdles; they are fundamental determinants of where and what A&B can build. Whether it's residential communities, commercial centers, or agricultural ventures, zoning dictates the scope and scale of A&B's operations. Understanding these evolving regulations is paramount for A&B's long-term development strategies and its capacity for portfolio growth in a market with unique environmental and social considerations.

The Hawaiian government is prioritizing affordable housing, a significant political factor for developers like Alexander & Baldwin. This focus translates into potential policy shifts that could affect commercial real estate.

Legislation is being considered to boost housing supply, which might involve rezoning commercial spaces for residential purposes or mandating affordable housing quotas in new developments. For instance, proposals in 2024 aimed to streamline permitting for affordable housing projects, potentially impacting land use decisions.

Alexander & Baldwin must adapt to these initiatives, which could open avenues for new residential developments but also introduce complexities or limitations for their existing commercial property portfolio. Navigating these evolving regulations will be key to their strategic planning.

Political decisions, especially concerning tourism and short-term rentals, significantly impact commercial property demand and value. Maui County's recent vote to restrict short-term rentals in apartment zones exemplifies a political shift favoring long-term housing for residents. This regulatory change directly affects retail centers and other commercial properties reliant on visitor spending, prompting Alexander & Baldwin (A&B) to re-evaluate its tenant mix and property management strategies to align with evolving local priorities.

Infrastructure Spending and Development Plans

Government investment in infrastructure and long-term development plans significantly shape opportunities and challenges for real estate firms like Alexander & Baldwin (A&B). Policies focused on sustainable infrastructure, enhanced public safety, and funding for affordable housing directly impact A&B's development sites and the valuation of existing properties through improved accessibility and services.

These initiatives often involve public-private partnerships, which A&B can strategically leverage for growth. For instance, in 2024, the U.S. Department of Transportation announced billions in grants for infrastructure projects, with a significant portion allocated to improving transportation networks and public transit, directly benefiting areas where A&B has holdings. Hawaii, A&B's primary market, has also seen substantial state and county investments in infrastructure upgrades, including road improvements and renewable energy projects, enhancing the desirability and utility of its land assets.

- Infrastructure Investment: The U.S. Bipartisan Infrastructure Law, enacted in 2021 and continuing its impact through 2024-2025, allocates over $1 trillion to infrastructure, including significant funds for transportation and broadband expansion, directly benefiting A&B's development potential.

- Sustainable Development Focus: Government incentives for green building and renewable energy infrastructure projects in Hawaii could reduce development costs and increase the appeal of A&B's properties.

- Public-Private Partnerships: A&B's engagement in public-private partnerships for projects like the Honolulu Rail Transit expansion highlights the direct impact of government development plans on its business strategy.

Political Stability and Business Environment

Political stability in Hawaii is a cornerstone for Alexander & Baldwin's real estate ventures. The state's generally stable political climate, coupled with a supportive approach to business and investment, provides a predictable framework for long-term planning. This stability is vital for mitigating risks associated with development and fostering investor confidence in the commercial real estate market.

However, potential shifts in political priorities or unexpected legislative actions can introduce uncertainty. For instance, changes in land use regulations or environmental policies, which are common areas of political focus, could affect development timelines and increase project costs. In 2024, Hawaii continued to navigate evolving environmental regulations, impacting construction and development sectors.

- 2024 Economic Outlook: Hawaii's economy, while recovering, faced challenges that could influence political decisions impacting business.

- Legislative Focus: Ongoing discussions around affordable housing and sustainable development in 2024 highlighted potential areas for policy shifts affecting real estate.

- Investment Climate: A consistent and predictable regulatory environment remains a key factor for attracting and retaining real estate investment in the state.

Government policies on affordable housing and land use significantly shape Alexander & Baldwin's development opportunities and constraints in Hawaii. In 2024, continued legislative efforts to address housing shortages, such as streamlining permits for affordable projects, directly influence A&B's land allocation and project feasibility. This focus can create new avenues for residential development but may also impose requirements on commercial properties.

Political decisions concerning tourism and short-term rentals, like Maui County's 2024 restrictions, impact commercial real estate by altering demand drivers tied to visitor spending. These shifts necessitate strategic re-evaluation of tenant mixes and property management to align with local priorities for long-term housing.

Government investment in infrastructure, supported by initiatives like the Bipartisan Infrastructure Law continuing through 2024-2025, enhances the value and utility of A&B's land assets. Public-private partnerships for projects like transit expansion also offer strategic growth opportunities, directly integrating A&B into state and county development plans.

What is included in the product

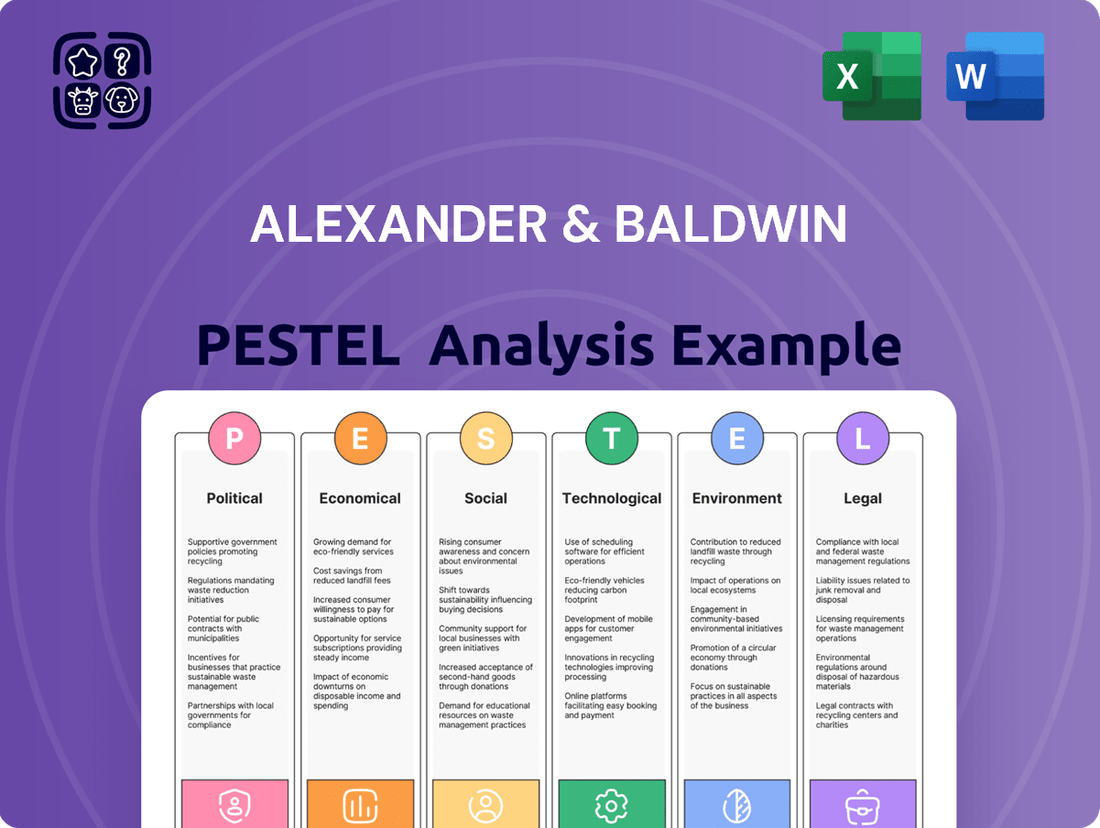

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Alexander & Baldwin across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape strategic decisions and market positioning for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Alexander & Baldwin’s strategic decisions.

Economic factors

Hawaii's economic growth is a crucial driver for Alexander & Baldwin, directly impacting demand for its commercial real estate holdings. Projections for 2025 suggest a modest expansion, with construction and real estate sectors leading the way, supported by a recovering tourism industry. This anticipated growth is favorable for the retail, industrial, and office spaces that form the backbone of A&B's business, though any lag in tourism's rebound could moderate demand in certain areas.

Interest rate fluctuations are a major factor for Alexander & Baldwin (A&B), directly influencing real estate investment and development expenses. While rates are showing signs of stabilization, potentially encouraging more market participants, elevated borrowing costs can still pose challenges for A&B's project financing and acquisitions.

Access to capital at competitive rates is paramount for A&B's expansion plans, which heavily rely on real estate development and sustained ownership of properties. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, remained at 5.25%-5.50% as of mid-2024, a level that still reflects a tighter monetary policy compared to recent years.

Tourism is a critical engine for Hawaii's economy, directly influencing commercial real estate, especially in the retail and hospitality sectors. Alexander & Baldwin (A&B) is particularly exposed to these dynamics.

Visitor arrivals are anticipated to see a boost in 2025, driven by the anticipated rebound of the Japanese travel market. However, if the broader tourism sector's recovery lags behind pre-pandemic benchmarks, it could negatively impact A&B's rental income streams and the overall valuation of its retail properties.

Housing Market Dynamics and Affordability

The Hawaii housing market, a significant factor for Alexander & Baldwin (A&B), continues to grapple with high demand and persistently low inventory. This imbalance fuels rising home prices, with median home prices in Honolulu County reaching approximately $985,000 in early 2024, a slight increase from the previous year. This affordability challenge directly impacts A&B by potentially squeezing the disposable income of the local workforce, thereby influencing consumer spending patterns at their retail centers.

The scarcity and cost of housing can also create labor shortages for businesses like A&B, potentially increasing operational costs. Furthermore, the strain on housing affordability may inadvertently boost demand for more accessible retail and service options within A&B's portfolio, as residents seek cost-effective solutions for their daily needs. Understanding this dynamic is crucial for A&B's strategic planning, particularly for their grocery-anchored retail centers and ongoing development projects.

- High Demand, Limited Supply: Hawaii's housing market, particularly on Oahu, consistently experiences a demand-supply gap, pushing median home prices upwards.

- Workforce Impact: Elevated housing costs can strain household budgets, potentially reducing consumer spending on non-essential goods and services.

- Labor Availability: Persistent housing affordability issues can exacerbate labor recruitment and retention challenges for businesses operating in Hawaii.

- Retail Demand Shift: A&B may see increased demand for value-oriented retail and service offerings as consumers adapt to higher living expenses.

Inflation and Operating Costs

Persistent consumer inflation, particularly noticeable in areas like Honolulu, directly impacts Alexander & Baldwin's (A&B) operating costs. Expenses such as property maintenance, utility rates, and labor wages are likely to rise, putting pressure on the company's bottom line.

While A&B has demonstrated an ability to manage its operational expenses, sustained inflationary trends could diminish profit margins. This necessitates proactive strategies like strategic rental rate adjustments or enhanced operational efficiencies to offset these rising costs.

Inflation also plays a significant role in shaping consumer spending habits. Changes in consumer purchasing power can directly affect the performance of A&B's retail tenants, potentially influencing occupancy rates and rental income.

- Consumer Price Index (CPI) in Honolulu: As of early 2024, Honolulu's CPI has shown elevated levels, impacting everyday costs. For example, the CPI for all urban consumers in the Honolulu metropolitan area saw an increase, with specific categories like shelter and transportation experiencing notable rises.

- Wage Growth vs. Inflation: While wages may see some growth, they often lag behind the pace of inflation, impacting both consumer spending power and labor costs for A&B.

- Rental Market Dynamics: A&B's ability to pass on increased operating costs through rental adjustments depends on the elasticity of demand in its specific markets and the prevailing economic conditions for its tenants.

Hawaii's economic outlook for 2025 indicates a modest growth trajectory, primarily driven by a recovering tourism sector and continued strength in construction. This positive environment bodes well for Alexander & Baldwin's (A&B) real estate holdings, particularly its retail and industrial properties, though a slower-than-expected tourism rebound could temper demand.

Interest rates, a critical factor for A&B's development and acquisition strategies, are expected to remain relatively stable but elevated in 2025. The Federal Reserve's benchmark rate, hovering around 5.25%-5.50% in mid-2024, continues to influence borrowing costs, potentially impacting the feasibility of new projects and the cost of capital for A&B.

Persistent inflation, especially in housing and transportation, continues to affect Hawaii's cost of living and A&B's operational expenses. While A&B may implement rental adjustments, the impact of inflation on consumer spending power for its retail tenants remains a key consideration for the company's revenue streams.

| Economic Factor | 2024/2025 Outlook | Impact on A&B |

|---|---|---|

| GDP Growth (Hawaii) | Modest expansion projected for 2025 | Increased demand for commercial real estate |

| Interest Rates (Federal Funds Rate) | Stabilizing around 5.25%-5.50% (mid-2024) | Influences project financing costs and investment |

| Consumer Price Index (Honolulu) | Elevated, with specific increases in shelter and transportation | Higher operating costs and potential impact on consumer spending |

| Visitor Arrivals | Anticipated boost, particularly from Japan | Supports retail and hospitality sectors within A&B's portfolio |

Same Document Delivered

Alexander & Baldwin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alexander & Baldwin provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape affecting their operations and future growth.

Sociological factors

Hawaii's population is experiencing notable shifts. Between 2020 and 2023, Hawaii saw a net out-migration of over 17,000 people, a trend driven by the state's high cost of living. However, the rise of remote work is also drawing new residents, particularly to desirable areas, potentially offsetting some of this outflow and influencing demand for different property types across Alexander & Baldwin's portfolio.

Consumer preferences are shifting, with e-commerce continuing its strong growth trajectory. In 2024, online retail sales in the U.S. are projected to reach over $2.1 trillion, a significant portion of total retail spending. This trend demands that Alexander & Baldwin's (A&B) grocery-anchored centers evolve beyond traditional shopping by incorporating experiential elements and a diverse mix of dining and services to stay relevant.

The desire for unique, in-person experiences is also on the rise, influencing how consumers interact with retail spaces. This means A&B's centers need to offer more than just goods; they must provide community hubs that foster engagement. By focusing on a blend of essential services, diverse dining options, and community-centric events, A&B can enhance the appeal of its properties to both shoppers and potential tenants.

Furthermore, retailers are actively seeking locations that align with demographic shifts, particularly in areas experiencing housing growth. A&B's suburban retail assets are well-positioned to capitalize on this trend. For instance, in 2023, Hawaii saw a modest increase in new housing starts, indicating continued demand for retail services in developing residential areas, which A&B can leverage.

Public sentiment plays a critical role in Alexander & Baldwin's (A&B) development pipeline. For instance, in 2024, community feedback on a proposed residential project in Kapolei, Oahu, led to a revised design incorporating more green space, demonstrating how local concerns can directly influence project scope and timelines. A&B's ongoing efforts to engage with community stakeholders, including public forums and partnerships with local organizations, are vital for navigating potential opposition and securing necessary approvals, especially as they aim to develop approximately 1,000 residential units by 2027.

Concerns regarding overdevelopment and the preservation of Hawaii's unique character are frequently voiced. In 2024, environmental impact assessments for a new commercial center in Maui highlighted community apprehension about increased traffic and strain on local resources, prompting A&B to invest in upgraded infrastructure as part of the project's mitigation strategy. This underscores the need for A&B to consistently demonstrate its commitment to responsible development practices, balancing growth with the desire to maintain the islands' distinct cultural and environmental integrity.

Lifestyle Changes and Demand for Specific Property Types

The enduring desire for larger homes, often with increased access to natural environments, continues to shape housing preferences, a trend amplified by recent lifestyle shifts. This impacts not only residential real estate but also indirectly influences the demand for commercial properties as people re-evaluate their living and working spaces. For instance, a 2024 survey indicated that 65% of potential homebuyers prioritize outdoor space and proximity to parks.

Furthermore, a significant and growing segment of the population is actively seeking eco-friendly living solutions and sustainable practices. This translates into a tangible demand for properties equipped with green features, such as solar panels, energy-efficient appliances, and sustainable building materials. A&B's strategic commitment to long-term ownership and the integration of sustainable elements across its portfolio positions it favorably to capitalize on these evolving consumer preferences.

- Increased Demand for Larger Homes: Post-pandemic surveys consistently show a preference for more spacious living environments.

- Growing Interest in Sustainability: Consumer reports from 2024 highlight a 20% year-over-year increase in searches for eco-friendly homes.

- Impact on Commercial Real Estate: Shifting residential needs can lead to changes in demand for retail, office, and mixed-use spaces.

- A&B's Alignment: The company's focus on sustainable development directly addresses these emerging lifestyle trends.

Remote Work and Office Space Utilization

The enduring shift towards remote and hybrid work models continues to reshape demand for traditional office spaces. While many mainland U.S. cities have seen office vacancy rates climb, Oahu's market has shown more resilience. For example, as of Q1 2024, Honolulu's office vacancy rate stood at approximately 12.5%, a figure notably lower than the national average which hovered around 18% in early 2024.

This trend is further influenced by adaptive strategies within cities like Honolulu, where office-to-residential conversions are actively absorbing available commercial inventory. Alexander & Baldwin (A&B), holding significant office property assets, must navigate these evolving tenant preferences. This includes a growing interest in flexible workspaces and potentially smaller, more efficient office footprints to accommodate a workforce that spends less time in the physical office.

A&B's strategic response could involve:

- Adapting existing office spaces: Incorporating more co-working areas, meeting rooms, and shared amenities to cater to hybrid work needs.

- Portfolio diversification: Exploring mixed-use developments that blend office with residential or retail components to create more dynamic environments.

- Tenant engagement: Proactively understanding and responding to tenant demands for updated technology, wellness features, and flexible lease terms.

- Market monitoring: Continuously tracking vacancy rates, rental price trends, and conversion activity across key Hawaiian markets to inform investment decisions.

Hawaii's population dynamics are a key sociological factor for Alexander & Baldwin (A&B). Between 2020 and 2023, the state experienced a net out-migration of over 17,000 people, largely due to the high cost of living. However, the increasing prevalence of remote work is attracting new residents, potentially balancing this outflow and influencing demand for A&B's diverse property types.

Consumer preferences are also evolving, with a notable shift towards e-commerce. In 2024, U.S. online retail sales are projected to exceed $2.1 trillion. This trend necessitates that A&B's grocery-anchored centers offer more than just traditional retail, incorporating experiential elements and a varied mix of dining and services to remain competitive and appealing.

The growing desire for unique, in-person experiences is reshaping how consumers interact with retail spaces. A&B's centers must function as community hubs that foster engagement. By offering essential services, diverse dining, and community events, A&B can enhance the appeal of its properties to both shoppers and tenants, aligning with evolving consumer behaviors.

Retailers are increasingly seeking locations that align with demographic shifts, particularly in areas with housing growth. A&B's suburban retail assets are well-positioned for this. Hawaii saw a modest increase in new housing starts in 2023, signaling continued demand for retail services in developing residential areas, a trend A&B can leverage.

Technological factors

Alexander & Baldwin is positioned to benefit significantly from the increasing adoption of advanced property management software. These cloud-based solutions, which streamline everything from tenant screening and rent collection to maintenance requests, are fundamentally changing real estate operations. For instance, a 2024 report indicated that 75% of property management firms are investing in or have recently upgraded their technology stack to improve efficiency and tenant satisfaction.

By leveraging these technologies, Alexander & Baldwin can achieve greater operational efficiency and reduce costs across its retail, industrial, and ground lease properties. The ability to automate routine tasks and utilize data analytics for informed decision-making is crucial. In 2025, the property technology market is projected to reach $30 billion globally, highlighting the widespread investment and expected returns from such digital transformations.

Alexander & Baldwin's commercial properties can significantly benefit from smart building technology and IoT integration. For instance, in 2024, the global smart building market was valued at over $80 billion, with projections indicating substantial growth driven by energy efficiency demands. This integration enables remote monitoring and control of systems like HVAC and lighting, leading to optimized energy consumption and reduced operational costs for A&B.

The implementation of IoT solutions, such as smart meters and predictive maintenance sensors, allows for proactive management of building infrastructure. This not only enhances operational efficiency but also contributes to A&B's sustainability objectives by minimizing waste and resource usage. By 2025, it's estimated that smart building technologies will reduce energy consumption in commercial buildings by up to 30%, directly impacting A&B's bottom line and property valuations.

Alexander & Baldwin can leverage big data analytics and AI to gain granular market insights, crucial for making smarter investment and development choices. For instance, by analyzing vast datasets on consumer behavior and economic indicators, A&B can better predict demand for specific property types in Hawaii. This data-driven approach is particularly valuable as the company focuses on the long-term growth and ownership of its Hawaii-centric real estate portfolio.

AI tools offer sophisticated capabilities, such as forecasting property value appreciation with greater accuracy and optimizing rental income through dynamic pricing models. In 2024, the real estate technology market saw significant investment in AI solutions for property management and market analysis, indicating a strong trend towards data-informed decision-making. This allows A&B to proactively identify emerging trends and capitalize on new development opportunities within its core markets.

Digitalization of Real Estate Transactions

The increasing digitalization of real estate transactions, featuring online leasing platforms and virtual tours, offers Alexander & Baldwin (A&B) significant opportunities to boost efficiency in its leasing and sales operations. This digital shift can streamline processes, making them faster and more user-friendly.

Implementing streamlined online applications and robust digital document management systems can markedly improve the experience for both prospective tenants and buyers. This not only accelerates transaction cycles but also substantially reduces the administrative burdens associated with traditional paper-based workflows. For instance, in 2024, many commercial real estate firms reported a 20-30% reduction in leasing turnaround times by adopting fully digital platforms.

- Enhanced Efficiency: Digital platforms can automate many steps in the leasing and sales process, from initial inquiries to contract signing.

- Improved Customer Experience: Online portals and virtual tours cater to modern consumer expectations for convenience and accessibility.

- Accelerated Transactions: Digital document management and e-signatures significantly shorten the time from application to closing.

- Portfolio Management: These digital tools are especially valuable for A&B in managing its diverse property portfolio across different locations and types.

Construction Technology and Building Information Modeling (BIM)

Advances in construction technology, like Building Information Modeling (BIM) and modular construction, are significantly boosting efficiency and cost-effectiveness in development. For Alexander & Baldwin's (A&B) real estate projects, embracing these innovations means quicker builds, less waste, and more streamlined project oversight. For instance, a 2024 report indicated that BIM adoption can reduce construction costs by up to 10% and shorten project timelines by 7-15%.

A&B's strategic adoption of these technologies directly enhances the value derived from entitlement and construction phases. This technological integration allows for more precise planning and execution, minimizing errors and rework. The company's focus on sustainable development further aligns with the environmental benefits offered by modular construction, which can reduce construction waste by as much as 90% compared to traditional methods.

- BIM adoption can lead to a 10% reduction in construction costs.

- Modular construction can shorten project timelines by up to 15%.

- Reduced waste from modular building can reach 90%.

- Enhanced project management through digital twins and advanced analytics.

Alexander & Baldwin's technological advantage is amplified by the increasing integration of AI and big data analytics. These tools enable a deeper understanding of market trends and consumer behavior, crucial for strategic investment decisions in Hawaii's unique real estate landscape. For example, in 2024, AI-powered analytics were increasingly used to forecast property value appreciation, with some platforms showing accuracy improvements of up to 25% over traditional methods.

The company can leverage AI for dynamic pricing strategies in its rental properties and for more precise demand forecasting, optimizing revenue streams. The global PropTech market, heavily influenced by AI and data solutions, was projected to exceed $30 billion in 2025, underscoring the significant financial opportunities in this sector. This data-driven approach allows A&B to proactively identify and capitalize on emerging development opportunities.

The company's adoption of advanced property management software, including cloud-based solutions and IoT integration in smart buildings, is a key technological factor. These innovations streamline operations, enhance tenant experiences, and improve energy efficiency. By 2025, smart building technologies were expected to reduce energy consumption in commercial buildings by as much as 30%, directly impacting operational costs and property valuations for A&B.

Furthermore, the digitalization of real estate transactions, such as online leasing platforms and virtual tours, significantly boosts efficiency. In 2024, many firms adopting these digital platforms reported a 20-30% reduction in leasing turnaround times. This digital transformation, coupled with advancements in construction technology like BIM, positions A&B for enhanced project delivery and cost savings, with BIM adoption potentially reducing construction costs by up to 10%.

Legal factors

Hawaii's intricate land use framework, managed by state-designated districts like urban, rural, agricultural, and conservation, alongside county zoning, directly shapes Alexander & Baldwin's (A&B) development potential. These regulations dictate what can be built where, influencing A&B's project planning and execution across its portfolio.

Recent legislative actions, such as Honolulu City Council's Bill 64, enacted in 2024, have introduced stricter parameters for permitted uses, building heights, and minimum lot sizes within urban areas. A&B must meticulously adhere to these updated rules, ensuring all existing properties and upcoming developments meet the new compliance standards, which could impact project timelines and costs.

Alexander & Baldwin (A&B) operates under Hawaii's stringent environmental protection laws, particularly concerning coastal zone management and natural resource preservation. These regulations are critical for A&B's real estate development projects, demanding thorough environmental impact assessments and specific permits to ensure compliance with ecological and cultural heritage standards. For instance, the Hawaii Coastal Zone Management Program requires careful consideration of development impacts on sensitive coastal ecosystems and public access.

Alexander & Baldwin (A&B) operates within a framework heavily influenced by building codes and safety standards, crucial legal elements for both construction and property management. These regulations are non-negotiable, ensuring that all A&B's new projects and existing properties meet stringent requirements for structural soundness, fire prevention, and public accessibility.

The dynamic nature of these legal requirements, particularly with evolving climate change considerations, necessitates continuous adaptation. For instance, updated codes mandating enhanced flood mitigation and building resilience against extreme weather events, which are increasingly relevant in Hawaii, require significant and ongoing capital investment from A&B to ensure compliance and maintain property value.

Affordable Housing Mandates and Inclusionary Zoning

Government mandates, such as inclusionary zoning, can legally require developers like Alexander & Baldwin (A&B) to allocate a portion of new housing units to lower-income residents. This legal obligation directly impacts A&B's development pipeline and financial projections by necessitating the inclusion of affordable housing components or financial contributions to affordable housing funds. For example, in Hawaii, where A&B is a major landowner, counties often have affordable housing requirements for new developments. The Honolulu City Council, for instance, has explored and implemented inclusionary zoning policies that could affect future projects, potentially requiring a percentage of units to be affordable.

These mandates can influence project feasibility and profitability by increasing development costs or reducing the market-rate unit mix. A&B's strategic planning must account for these legal requirements, which can vary significantly by jurisdiction within Hawaii. For instance, if a project is subject to a 10% inclusionary zoning requirement, the developer must ensure that 10% of the units are affordable, impacting the overall revenue potential of the development. This necessitates careful financial modeling to ensure project viability under such regulations.

- Inclusionary Zoning: Legal requirement for developers to include a percentage of affordable housing units in market-rate projects.

- Impact on Profitability: Can reduce profit margins due to lower sale prices for affordable units or increased development costs.

- Jurisdictional Variation: Requirements differ across counties in Hawaii, necessitating localized analysis for A&B's projects.

- Regulatory Compliance: A&B must navigate evolving affordable housing laws to ensure legal and financial success of its developments.

Tenant and Landlord Laws

Tenant and landlord laws are critical for Alexander & Baldwin (A&B) as a significant commercial real estate owner. These regulations, covering everything from lease terms and eviction procedures to essential property maintenance, directly impact A&B's operational efficiency and profitability. For instance, in Hawaii, where A&B has substantial holdings, landlords must adhere to strict notice periods for lease terminations and maintain properties to specific habitability standards, influencing A&B's capital expenditure planning and tenant retention strategies.

Compliance is not just a legal necessity but a strategic imperative for A&B. Navigating these laws effectively helps prevent costly legal disputes and fosters positive, long-term relationships with its diverse commercial tenant base, which includes retail outlets, industrial facilities, and office spaces. Failure to comply can lead to significant fines and reputational damage, impacting A&B's ability to attract and retain high-value tenants in a competitive market.

Key legal factors impacting A&B's real estate portfolio include:

- Lease Agreement Compliance: Ensuring all commercial leases meet or exceed state and local legal requirements regarding rent, duration, renewal options, and tenant responsibilities.

- Eviction Process Adherence: Strictly following legal protocols for lease violations and non-payment of rent, which can be lengthy and complex, impacting vacancy rates and cash flow.

- Property Maintenance Standards: Meeting legal obligations for property upkeep, including structural integrity, safety features, and common area maintenance, to avoid tenant disputes and potential lawsuits.

- Regulatory Changes: Monitoring and adapting to evolving landlord-tenant legislation, such as potential changes in rent control ordinances or energy efficiency mandates for commercial buildings, which could affect operating costs and investment strategies.

Alexander & Baldwin (A&B) faces significant legal considerations, including adherence to Hawaii's comprehensive land use and zoning laws, which dictate development potential and project planning. Recent legislation, like Honolulu's Bill 64 enacted in 2024, imposes stricter rules on building heights and lot sizes, requiring A&B to ensure ongoing compliance for all its properties and future developments.

Environmental factors

Hawaii is particularly vulnerable to climate change, with projections indicating rising sea levels and more frequent extreme weather events like flash floods. These environmental shifts directly threaten coastal assets, a significant concern for Alexander & Baldwin's real estate holdings. The company must proactively evaluate and manage the risks associated with its properties, especially those situated in low-lying coastal zones, to safeguard its portfolio.

The increasing focus on climate resilience means that government policies and incentives aimed at adaptation are gaining prominence. For Alexander & Baldwin, this translates into a need to align its strategies with these evolving regulatory landscapes, potentially investing in infrastructure upgrades or exploring new development approaches that account for future environmental conditions. For instance, the state of Hawaii has set ambitious renewable energy goals, impacting land use and development opportunities.

Alexander & Baldwin (A&B) operates in Hawaii, a region particularly vulnerable to natural disasters like hurricanes, wildfires, and volcanic activity. This inherent risk necessitates robust preparedness and resilience strategies for its extensive property portfolio. In 2023, Hawaii experienced several significant weather events, including heavy rainfall and flooding, highlighting the ongoing need for infrastructure hardening.

A&B's commitment to resilience involves significant investment in property design and maintenance to withstand these environmental challenges. For instance, the company may need to allocate capital for retrofitting existing structures or securing specialized insurance coverage, which can represent a substantial operational cost. The company's 2024 capital expenditure plans will likely reflect these ongoing resilience investments.

Furthermore, government and community-led initiatives aimed at disaster recovery and structural fortification directly impact A&B's operational environment. These efforts, often supported by state and federal funding, can influence building codes and mitigation requirements, indirectly shaping A&B's approach to environmental risk management and long-term sustainability.

Hawaii's environment faces significant water challenges, with scarcity and the necessity of conservation directly impacting development feasibility and operational expenses for companies like Alexander & Baldwin. This situation necessitates a proactive approach to water resource management.

Strict regulations governing water usage and wastewater treatment in Hawaii directly influence A&B's development projects and the day-to-day running of its commercial properties. For instance, the Hawaii Department of Health sets stringent standards for wastewater discharge, requiring substantial investment in advanced treatment systems. In 2023, the Honolulu Board of Water Supply continued to emphasize tiered water rates and conservation incentives, aiming to reduce overall demand by 10% by 2030.

Energy Consumption and Renewable Energy Adoption

Hawaii is pushing hard to use less energy and more clean energy, and Alexander & Baldwin (A&B) is on board. They're installing solar panels, upgrading to LED lights, and using more efficient air conditioning systems. These efforts not only help A&B save money on their energy bills but also boost their image as a sustainable company, fitting with Hawaii's clean energy targets.

A&B's commitment to energy efficiency is evident in their ongoing projects. For example, in 2023, they completed solar installations across several of their properties, contributing to a significant reduction in their reliance on traditional energy sources. This focus on renewable energy adoption is crucial for meeting Hawaii's ambitious goal of 100% renewable energy by 2045.

- Energy Efficiency Initiatives: A&B has invested in upgrading HVAC systems and lighting, aiming to cut energy usage across its portfolio.

- Renewable Energy Growth: The company continues to expand its photovoltaic (PV) system capacity, contributing to its own clean energy generation.

- Cost Savings and Sustainability: These environmental actions directly reduce operational expenses and enhance A&B's environmental, social, and governance (ESG) performance.

Waste Management and Pollution Control

Alexander & Baldwin (A&B) faces significant environmental considerations, particularly concerning waste management and pollution control, which are critical for its real estate and agricultural operations. Compliance with stringent environmental regulations is paramount, covering everything from construction site runoff to agricultural waste disposal. For instance, in 2023, Hawaii’s Department of Health reported increased enforcement actions related to improper waste disposal from commercial sites, underscoring the need for robust internal protocols.

A&B's commitment to sustainability means actively managing the environmental footprint of its developments and ongoing operations. This includes adhering to guidelines for recycling construction debris and preventing soil and water contamination. The company’s strategy often involves integrating green building practices and utilizing eco-friendly materials, which not only aids in regulatory compliance but also enhances the long-term value and appeal of its properties. For example, projects incorporating recycled content can reduce landfill burdens and often qualify for environmental certifications.

Key aspects of A&B’s waste management and pollution control efforts include:

- Regulatory Compliance: Adherence to local and federal environmental laws governing waste disposal, emissions, and water quality.

- Sustainable Development Practices: Prioritizing the use of recycled and low-impact materials in new construction and renovation projects.

- Pollution Prevention: Implementing measures to prevent soil erosion, chemical runoff, and air pollution from agricultural and construction activities.

- Waste Reduction and Recycling Programs: Establishing comprehensive programs to minimize waste generation and maximize recycling rates across all operational sites.

Hawaii's environment is a critical factor for Alexander & Baldwin (A&B). The islands are highly susceptible to climate change impacts, including rising sea levels and more frequent extreme weather events, posing a direct threat to A&B's coastal real estate holdings. The company must integrate resilience into its development and property management strategies to mitigate these risks.

Water scarcity and conservation are significant concerns in Hawaii, directly affecting development feasibility and operational costs for A&B. Strict water usage and wastewater treatment regulations, such as those from the Honolulu Board of Water Supply, necessitate substantial investments in water management infrastructure and conservation practices.

A&B is actively pursuing energy efficiency and renewable energy adoption, aligning with Hawaii's clean energy goals. Investments in solar panel installations and upgrades to more efficient systems, like LED lighting, not only reduce operational expenses but also enhance the company's sustainability profile, contributing to Hawaii's target of 100% renewable energy by 2045.

Waste management and pollution control are paramount for A&B's operations, requiring strict adherence to environmental regulations. The company prioritizes sustainable development practices, including recycling construction debris and preventing soil and water contamination, to minimize its environmental footprint and ensure regulatory compliance.

| Environmental Factor | Impact on A&B | Key Considerations/Actions | Relevant Data/Examples (2023-2025) |

| Climate Change & Extreme Weather | Threatens coastal real estate, requires resilience investments. | Property risk assessment, infrastructure hardening, climate-resilient design. | Hawaii's vulnerability to sea-level rise and flash floods; A&B's 2024 capital expenditure likely includes resilience upgrades. |

| Water Scarcity & Management | Affects development feasibility, increases operational costs. | Water conservation, efficient irrigation, compliance with usage regulations. | Honolulu Board of Water Supply's tiered rates and 2030 demand reduction goals; A&B's investment in water-efficient systems. |

| Energy Efficiency & Renewables | Reduces operational expenses, enhances sustainability image. | Solar PV installations, HVAC and lighting upgrades, clean energy adoption. | A&B's completed solar projects in 2023; Hawaii's 2045 renewable energy target. |

| Waste Management & Pollution Control | Requires regulatory compliance, impacts operational costs. | Recycling programs, pollution prevention measures, sustainable building practices. | Hawaii Department of Health's enforcement on waste disposal in 2023; A&B's use of recycled materials in projects. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alexander & Baldwin draws from official Hawaiian government publications, financial reports from the company itself, and reputable real estate and economic data providers specific to the Hawaiian market. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in local realities and company performance.