Alcon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

Alcon's leadership in ophthalmic innovation is a significant strength, but the competitive landscape presents a clear threat. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities in the eye care market.

Want the full story behind Alcon's market position, potential challenges, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Alcon stands as a dominant force in the global eye care market, boasting an exceptionally comprehensive product portfolio. This extensive range covers critical areas like surgical solutions for cataracts and glaucoma, treatments for retinal diseases, and a wide array of contact lenses and lens care products. This breadth ensures Alcon addresses patient needs across the entire spectrum of eye health, from intricate surgical interventions to everyday vision correction.

This integrated approach provides Alcon with a substantial competitive edge. By offering solutions that cater to patients throughout their lives, Alcon solidifies its market position and fosters deep customer loyalty. For instance, in 2023, Alcon reported net sales of $9.4 billion, underscoring the market's demand for its diverse offerings.

Alcon showcased impressive financial strength throughout 2024, achieving $9.8 billion in full-year sales, marking a solid 5% growth compared to the previous year. This performance was underpinned by robust expansion in both revenue and earnings, alongside a notable $2.1 billion in cash generated from operations and $1.6 billion in free cash flow, indicating efficient capital management and strong operational execution.

Alcon's dedication to innovation is a significant strength, evidenced by its substantial investment in research and development. In 2024 alone, the company allocated over $876 million to R&D initiatives.

This consistent financial commitment underpins a strong pipeline of new products and cutting-edge technologies for both its surgical and vision care divisions. Alcon’s focus on advanced solutions keeps it a leader in the eye care industry.

Recent product introductions such as Unity VCS, PanOptix Pro, Voyager, Precision7, and Systane Pro PF exemplify this strategic emphasis on developing and bringing to market next-generation eye care solutions.

Strategic Acquisitions and Partnerships

Alcon's strategy of pursuing strategic acquisitions and partnerships is a significant strength, allowing it to rapidly expand its product offerings and solidify its market standing. This proactive approach ensures the company remains at the forefront of innovation in the eye care sector.

Notable examples highlight this commitment. The acquisition of a major stake in Aurion Biotech in early 2024 is a prime example, aiming to bolster Alcon's capabilities in cell therapy for corneal diseases. Furthermore, the announced intent to acquire LENSAR, a leader in laser technologies for cataract surgery, underscores Alcon's dedication to strengthening its surgical solutions portfolio.

These strategic moves are designed to broaden Alcon's technological base and market appeal, attracting investors who recognize the potential for transformative growth. By integrating cutting-edge technologies and therapeutic approaches, Alcon is positioning itself for sustained success.

- Acquisition of Aurion Biotech stake: Enhances cell therapy for corneal diseases, a key area for future growth.

- Intent to acquire LENSAR: Strengthens Alcon's position in the lucrative cataract surgery market with advanced laser technology.

- Portfolio Expansion: These actions directly contribute to a more comprehensive and competitive product suite.

Global Presence and Social Impact Initiatives

Alcon boasts an extensive global reach, operating in over 140 countries. This broad geographic presence allows the company to access diverse markets and cater to a wide range of customer needs worldwide.

Beyond its commercial operations, Alcon actively engages in social impact initiatives focused on improving vision and eye care access. Programs like the Phaco Development surgeon training aim to enhance surgical skills, while Alcon Cares facilitates product and equipment donations to underserved communities.

- Global Footprint: Operations in over 140 countries.

- Vision Improvement: Programs like Phaco Development surgeon training.

- Product Donations: Alcon Cares provides essential products and equipment.

- Access to Care: Initiatives focused on enhancing global eye care accessibility.

Alcon's extensive and diversified product portfolio is a cornerstone strength, covering surgical solutions and vision care products. This comprehensive offering, demonstrated by $9.8 billion in full-year sales for 2024, allows Alcon to serve a broad customer base across the eye health spectrum. The company's commitment to innovation, backed by over $876 million invested in R&D in 2024, fuels a pipeline of advanced solutions and reinforces its leadership position.

Strategic acquisitions and partnerships, such as the stake in Aurion Biotech and the intent to acquire LENSAR, bolster Alcon's technological capabilities and market reach. This proactive approach to portfolio expansion, coupled with a global presence in over 140 countries, solidifies Alcon's competitive advantage and its ability to drive growth in diverse markets.

| Strength | Description | Supporting Data (2023/2024) |

|---|---|---|

| Comprehensive Product Portfolio | Covers surgical solutions (cataracts, glaucoma) and vision care (contact lenses, lens care). | Net sales of $9.4 billion (2023), $9.8 billion (2024) |

| Commitment to Innovation | Significant investment in R&D for new products and technologies. | Over $876 million invested in R&D (2024) |

| Strategic Acquisitions & Partnerships | Expands product offerings and market standing. | Acquisition of Aurion Biotech stake (early 2024), Intent to acquire LENSAR |

| Global Reach | Operations in over 140 countries. | Presence in over 140 countries |

What is included in the product

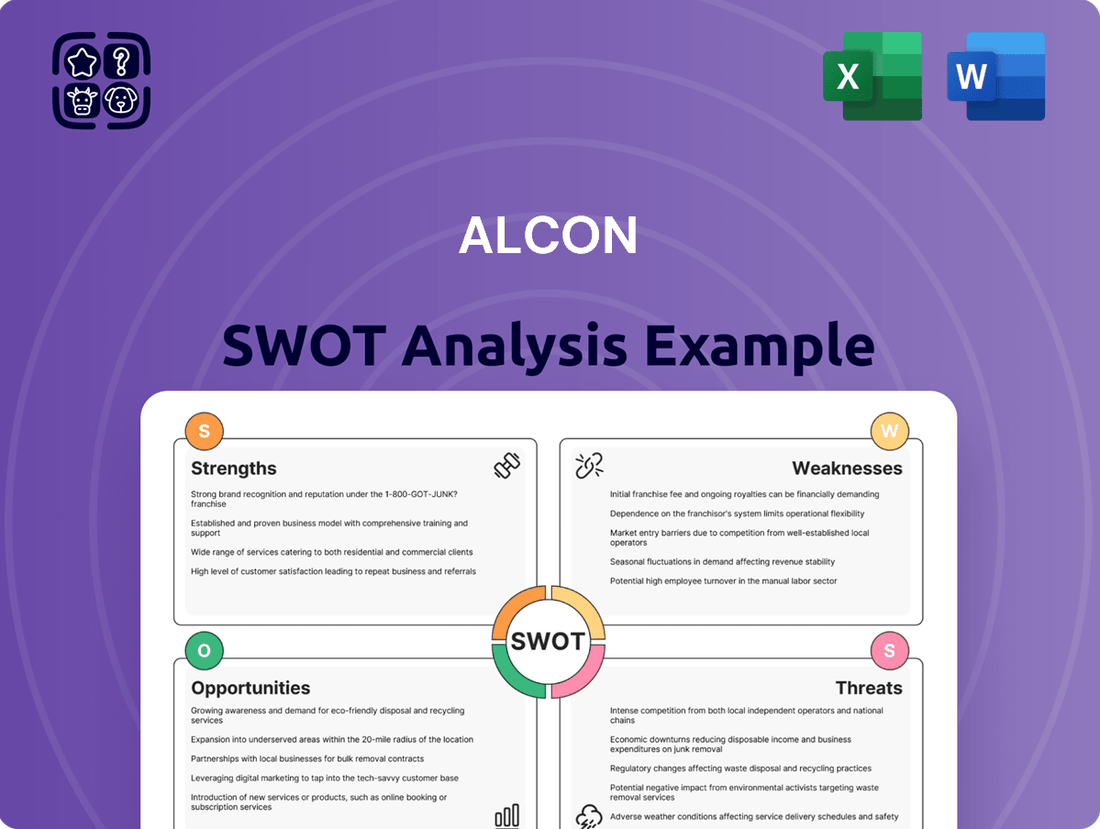

Delivers a strategic overview of Alcon’s internal and external business factors, highlighting its strengths in innovation and market leadership alongside potential weaknesses in product diversification and market threats from competitors.

Offers a clear, actionable framework to identify and address Alcon's strategic challenges and opportunities.

Weaknesses

Alcon grapples with substantial competitive pressures in its core markets. The contact lens segment, a significant part of its Vision Care business, is seeing an influx of new products, especially from Asian manufacturers, intensifying rivalry.

Furthermore, the U.S. surgical market has been experiencing a period of softness, which naturally translates into heightened competitive dynamics for Alcon's offerings in this crucial sector.

The contact lens market is experiencing a shift, with older, reusable product lines seeing a decline in sales volumes. This trend is impacting companies across the sector, and Alcon is not immune. While Alcon has seen robust growth in its newer daily disposable and advanced material lenses, the ongoing decrease in demand for its legacy products can put a drag on its overall sales figures.

Alcon faces headwinds from currency fluctuations, which can negatively impact its reported sales and profitability. For instance, a stronger US dollar versus other major currencies can make Alcon's products more expensive in those markets, potentially dampening demand and reducing the value of foreign earnings when translated back into dollars.

The company also anticipates considerable pressure on its cost of sales due to existing tariffs. These trade barriers, particularly those affecting commerce between China and the United States, directly increase the cost of raw materials and finished goods, squeezing Alcon's gross margins.

Increased Investment in R&D Impacting Operating Margin

Alcon's commitment to innovation, while crucial for future growth, has presented a short-term challenge to its operating margin. For instance, in the first half of 2024, the company reported a slight dip in its core operating margin, attributed in part to increased R&D expenditures aimed at developing next-generation surgical and vision care products. This strategic investment, though essential for maintaining a competitive edge, temporarily dampens immediate profitability metrics.

While this increased R&D spending is a necessary investment for long-term product pipeline strength, it does mean that profitability metrics like the operating margin can be temporarily impacted. For example, Alcon's 2024 guidance indicated that R&D investments would be a key driver of SG&A expenses, potentially creating headwinds for margin expansion in the near term.

- R&D Investment Impact: Increased spending on research and development is a strategic necessity for Alcon's long-term product innovation and market competitiveness.

- Short-Term Margin Pressure: This investment directly contributes to higher operating expenses, leading to a temporary reduction in the core operating margin.

- 2024 Financial Context: Alcon's financial reports for the first half of 2024 highlighted R&D as a significant contributor to increased operating costs, impacting near-term profitability.

Supply Chain Challenges

Alcon has faced significant supply chain hurdles, particularly with essential components like microchips, specialized resins and plastics, and various metals and filters. These shortages directly impede manufacturing processes, leading to potential delays in product availability and impacting Alcon's ability to meet market demand. For instance, the global semiconductor shortage, which persisted through 2023 and into early 2024, affected numerous industries, including medical device manufacturers like Alcon, by limiting the availability of critical electronic components used in their advanced surgical equipment.

These disruptions can ripple through operations, affecting not only production output but also overall sales performance and operational efficiency. The unpredictability of component sourcing necessitates careful inventory management and may require exploring alternative suppliers or redesigning products to accommodate available materials. In 2024, many companies reported increased lead times for critical raw materials, with some extending by 20-30% compared to pre-pandemic levels, a trend that likely impacted Alcon’s supply chain reliability.

The ongoing volatility in global logistics and raw material pricing, exacerbated by geopolitical events in 2023 and continuing into 2024, presents a persistent weakness. Alcon's reliance on a complex global network for sourcing and distribution means it is susceptible to these external shocks. For example, disruptions in shipping routes or increased freight costs can directly inflate the cost of goods sold and reduce profit margins.

- Component Shortages: Alcon experiences difficulties securing microchips, resins, plastics, metals, and filters.

- Manufacturing Impact: These shortages disrupt production schedules and product availability.

- Operational Efficiency: Supply chain issues can reduce overall operational efficiency and impact sales.

- Global Volatility: Reliance on global supply chains makes Alcon vulnerable to shipping disruptions and rising logistics costs, as seen with increased freight rates in 2023-2024.

Alcon's product portfolio faces obsolescence risk as newer technologies emerge, particularly in the contact lens market where daily disposables are gaining traction over older reusable options. This necessitates continuous investment in innovation to avoid market share erosion.

The company's reliance on a complex global supply chain exposes it to significant risks from geopolitical instability, trade disputes, and logistical disruptions, which can inflate costs and hinder product availability. For instance, continued global shipping cost increases in 2024 impacted many manufacturers.

Alcon also contends with intense competition, especially from Asian manufacturers entering the contact lens space, and a softening U.S. surgical market, both of which pressure pricing and sales volumes.

What You See Is What You Get

Alcon SWOT Analysis

This is the actual Alcon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights into Alcon's strategic positioning.

The preview below is taken directly from the full Alcon SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete understanding of their Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual Alcon SWOT analysis file. The complete version, offering detailed strategic analysis, becomes available after checkout.

Opportunities

The global population is aging rapidly, with the World Health Organization projecting that by 2030, one in six people worldwide will be 60 years or older. This demographic trend directly fuels demand for Alcon's products, as age-related eye conditions like cataracts and glaucoma become more prevalent. For instance, cataract surgery, a core Alcon offering, is increasingly sought after by this growing demographic.

Technological leaps like femtosecond laser-assisted cataract surgery and robotic systems are revolutionizing eye procedures, making them more precise and efficient than ever. Alcon is well-positioned to leverage these innovations, developing advanced intraocular lenses and new surgical approaches. This focus on cutting-edge products promises to enhance patient outcomes and solidify Alcon's market leadership.

The global contact lens market is projected to reach approximately $15.9 billion by 2025, with daily disposable lenses leading the charge due to their convenience and hygiene benefits. Alcon’s robust offerings in daily disposables, such as Dailies Total1, position it favorably to capture this expanding segment.

Furthermore, the demand for specialty lenses, including multifocal and toric designs for astigmatism and presbyopia correction, is on the rise, with these segments showing strong year-over-year growth. Alcon’s investment in innovation and its comprehensive range of DAILIES TOTAL1 Multifocal and PRECISION1 for Astigmatism lenses directly addresses this increasing consumer need.

Expansion into Emerging Markets and Increased Healthcare Access

Emerging markets offer substantial avenues for Alcon's growth, particularly as healthcare access expands. By 2024, the Asia-Pacific region alone represented a significant portion of global healthcare spending, with continued projected growth driven by improving infrastructure and rising incomes. This trend directly translates to increased demand for Alcon's advanced eye care solutions and surgical technologies.

Alcon can capitalize on this by tailoring its product offerings and distribution strategies to meet the specific needs of these evolving markets. For instance, the increasing prevalence of age-related eye conditions in these regions, coupled with greater affordability of treatments, creates a fertile ground for expanding Alcon's customer base and diversifying its revenue streams beyond developed economies.

Key opportunities include:

- Expanding presence in high-growth Asian markets: Alcon's focus on countries like India and China, where the middle class is growing and eye care awareness is rising, is crucial.

- Introducing cost-effective solutions: Developing and marketing products that are accessible to a wider demographic within these emerging economies will drive adoption.

- Partnering with local healthcare providers: Collaborations can enhance Alcon's reach and build trust within new healthcare ecosystems.

Integration of AI and Telemedicine in Eye Care

The convergence of AI and telemedicine is poised to significantly transform eye care. This technological shift promises earlier detection of eye conditions, enhanced precision in diagnoses, and the convenience of remote patient consultations. For instance, AI algorithms are demonstrating remarkable accuracy in identifying diabetic retinopathy from retinal images, a condition affecting millions globally. In 2024, the digital health market, which includes telemedicine, is projected to reach over $370 billion, highlighting substantial growth potential.

Alcon has a prime opportunity to capitalize on these advancements. By developing AI-driven diagnostic tools, Alcon can offer solutions that assist ophthalmologists in identifying diseases more efficiently. Furthermore, the company could explore smart eyewear that integrates AI for real-time visual assistance or monitoring. Expanding its digital health platforms will also allow Alcon to reach a broader patient base, particularly in underserved areas, and strengthen its market position in the evolving healthcare landscape.

- AI-powered diagnostics: Development of AI tools for early detection of conditions like glaucoma and macular degeneration.

- Smart eyewear innovation: Creation of connected eyewear offering enhanced vision, monitoring, and diagnostic capabilities.

- Telemedicine expansion: Leveraging digital platforms to provide remote eye care consultations and follow-ups.

- Market growth: Capitalizing on the projected expansion of the digital health market, which saw a significant increase in telemedicine adoption in 2023 and is expected to continue its upward trajectory through 2025.

Alcon is strategically positioned to benefit from the increasing demand for advanced eye care solutions driven by an aging global population and technological advancements in surgical procedures.

The company can further expand its market share by focusing on high-growth emerging markets, particularly in Asia, and by developing more affordable product options to increase accessibility.

Leveraging the convergence of AI and telemedicine presents a significant opportunity for Alcon to innovate in diagnostics, smart eyewear, and remote patient care, aligning with the substantial growth projected for the digital health sector.

| Opportunity Area | Key Drivers | Alcon's Strategic Advantage |

|---|---|---|

| Aging Global Population | Increased prevalence of age-related eye conditions (cataracts, glaucoma) | Strong portfolio of cataract surgery solutions and intraocular lenses |

| Technological Innovation | Advancements in surgical precision (e.g., femtosecond lasers) | Development of cutting-edge lenses and surgical technologies |

| Contact Lens Market Growth | Rising demand for daily disposable and specialty lenses | Leading position in daily disposables (Dailies Total1) and toric lenses |

| Emerging Markets | Expanding healthcare access and rising incomes in Asia-Pacific | Potential for tailored product offerings and distribution strategies |

| AI & Telemedicine Integration | Digital health market expansion, early disease detection | Opportunity for AI-powered diagnostics and remote care platforms |

Threats

The ophthalmology market is a crowded space, with giants like Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss Meditec vying for dominance. This fierce rivalry often translates into significant pricing pressures, making it a constant challenge for companies like Alcon to maintain their market share, particularly when new innovations emerge from multiple sources.

Global economic uncertainties, particularly persistent inflation observed throughout 2023 and into early 2024, present a significant threat to Alcon. Rising inflation directly impacts Alcon's cost of goods sold and operating expenses, potentially squeezing profit margins if these increases cannot be fully passed on to consumers.

Geopolitical events, such as ongoing conflicts and the potential for new trade restrictions, disrupt global supply chains, which are critical for Alcon's manufacturing and distribution of medical devices and pharmaceuticals. For instance, increased tariffs or export bans could elevate Alcon's procurement costs and delay product availability in key markets, impacting sales and revenue growth.

While the broader eye care market shows resilience, certain segments like traditional contact lenses and eyewear frames are facing headwinds. Projections for 2024 indicate a slight contraction in these mature categories, with some analysts estimating a decline of up to 1% year-over-year. This trend underscores the imperative for Alcon to pivot its focus and resources towards more dynamic and innovative areas within eye care to sustain overall growth.

Regulatory Changes and Compliance Risks

The eye care sector operates under a rigorous regulatory framework. Shifts in policies concerning product approvals, manufacturing processes, or reimbursement structures pose a significant threat, potentially hindering Alcon's market entry for new innovations or impacting the financial viability of its current offerings.

For instance, in 2024, the FDA continued to emphasize post-market surveillance for medical devices, meaning Alcon faces ongoing scrutiny and potential compliance costs for its existing product lines. Furthermore, evolving data privacy regulations, such as updates to HIPAA or GDPR, could necessitate substantial investments in compliance infrastructure to safeguard patient information, impacting operational efficiency and potentially leading to fines for non-adherence.

- Increased scrutiny on device manufacturing standards: Alcon must continually adapt to evolving Good Manufacturing Practices (GMP) guidelines to ensure product safety and efficacy.

- Potential impact of reimbursement policy changes: Alterations in how eye care procedures and devices are covered by insurance providers can directly affect sales volumes and profitability.

- Data privacy compliance: Adhering to stringent data protection laws is critical, with potential penalties for breaches impacting financial performance and brand reputation.

Development of Alternative Medical Therapies

Alcon's business model, heavily reliant on surgical procedures and devices, faces a significant threat from the rise of alternative medical therapies. Pharmaceutical companies are increasingly developing non-surgical treatments for conditions like glaucoma and age-related macular degeneration, potentially reducing the demand for Alcon's intraocular lenses and surgical equipment.

For instance, advancements in gene therapy and intravitreal injections are offering new avenues for managing eye diseases, bypassing traditional surgical interventions. This shift could impact Alcon's market share in areas where these therapies gain traction. The global ophthalmology market, valued at approximately $50 billion in 2023, is expected to see growth, but the nature of that growth could be reshaped by these emerging treatments.

- Pharmaceutical Innovation: Competitors are investing heavily in R&D for non-invasive treatments, directly challenging Alcon's surgical solutions.

- Market Disruption: Alternative therapies could erode Alcon's market share in key segments like cataract surgery and retinal disease management.

- Shifting Patient Preferences: As non-surgical options become more effective and accessible, patient demand may shift away from surgical procedures.

Alcon faces intense competition from established players and emerging innovators, leading to pricing pressures and challenges in maintaining market share, especially as new technologies emerge. Economic uncertainties, including persistent inflation into early 2024, directly impact Alcon's costs and profit margins. Geopolitical instability and potential trade restrictions disrupt critical global supply chains, affecting product availability and increasing procurement expenses.

The eye care market is highly regulated, and changes in product approval, manufacturing, or reimbursement policies pose significant threats, potentially hindering market entry or impacting the financial viability of current products. For example, increased post-market surveillance by regulatory bodies like the FDA in 2024 adds ongoing compliance costs. Furthermore, evolving data privacy laws require substantial investment in infrastructure to protect patient information, risking penalties for non-compliance.

The rise of alternative, non-surgical medical therapies for conditions like glaucoma and macular degeneration presents a substantial threat to Alcon's surgical device and procedure-centric business model. Innovations in gene therapy and intravitreal injections could reduce demand for Alcon's intraocular lenses and surgical equipment, potentially impacting market share in key segments.

| Threat Category | Specific Risk | Potential Impact | 2023/2024 Data Point |

|---|---|---|---|

| Competition | Intense rivalry and pricing pressure | Reduced market share and profit margins | Ophthalmology market valued at ~$50 billion in 2023 |

| Economic Factors | Global inflation and economic uncertainty | Increased cost of goods sold and operating expenses | Inflation remained a key concern through early 2024 |

| Supply Chain/Geopolitics | Disruptions from conflicts and trade restrictions | Higher procurement costs and delayed product availability | Supply chain vulnerabilities remain a global concern |

| Regulatory Environment | Policy shifts in approvals, manufacturing, reimbursement | Hindered market entry, impacted product viability | FDA emphasized post-market surveillance in 2024 |

| Therapeutic Alternatives | Emergence of non-surgical treatments | Erosion of market share in surgical segments | Growth in advanced pharmaceutical treatments observed |

SWOT Analysis Data Sources

This Alcon SWOT analysis is built upon a robust foundation of data, including Alcon's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's internal capabilities and the external market landscape.