Alcon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

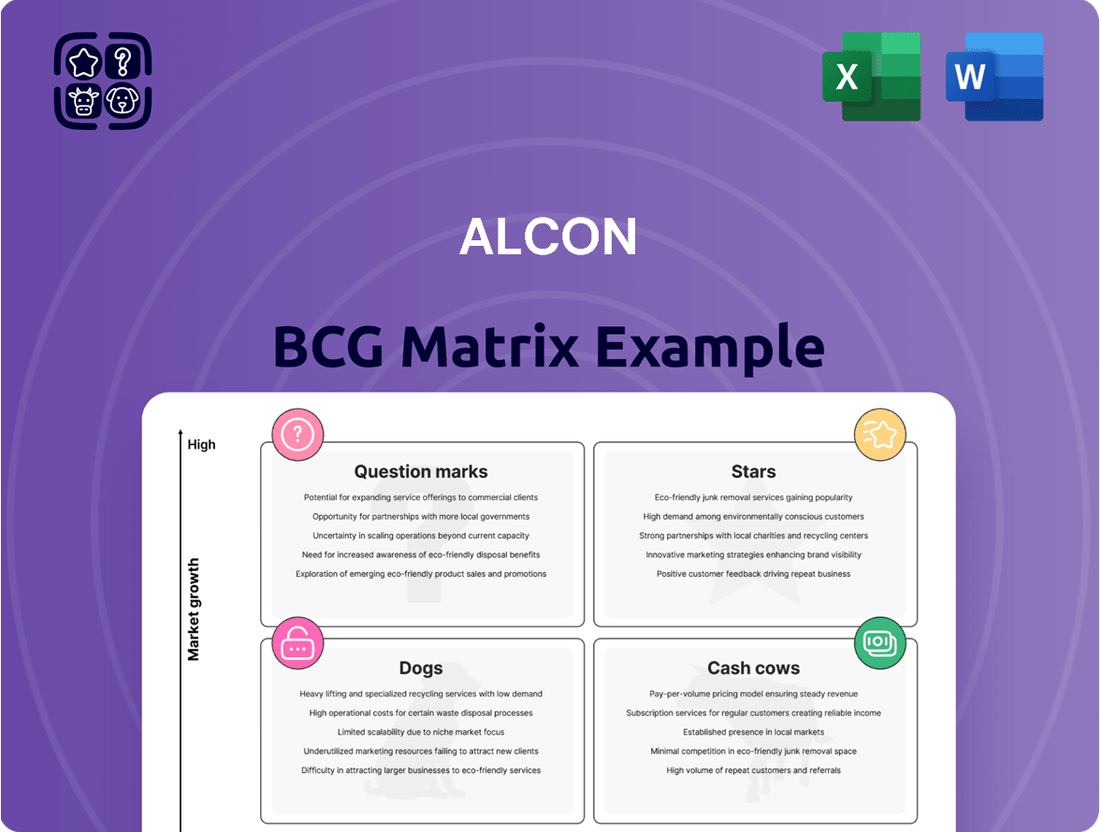

Curious about Alcon's product portfolio performance? Our BCG Matrix analysis reveals where their innovations sit – are they market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks? Gain a strategic advantage by understanding these dynamics.

Unlock the full potential of this insight by purchasing the complete Alcon BCG Matrix. It provides a comprehensive, quadrant-by-quadrant breakdown, empowering you with actionable strategies to optimize your investments and product development decisions.

Don't miss out on the critical intelligence needed to navigate the competitive landscape. Get the full BCG Matrix now for a clear roadmap to Alcon's strategic positioning and future growth opportunities.

Stars

The Unity VCS Surgical Platform, launched with U.S. FDA 510(k) clearance in June 2024 and commercially available since May 2025, is a significant new offering from Alcon. This innovative system is positioned to bolster Alcon's strong presence in the expanding ophthalmic surgery market, a sector where the company already holds a leading market share.

The PanOptix Pro, launched by Alcon in May 2025, represents a significant advancement in the premium intraocular lens (IOL) market. Building on the established success of the PanOptix trifocal IOL, the world's most implanted of its kind, the Pro version is engineered for superior performance.

This innovative lens is strategically positioned to dominate the expanding premium IOL segment. Its design focuses on optimizing light utilization and minimizing light scatter, key factors for enhanced visual outcomes in cataract surgery patients. Alcon projects the PanOptix Pro will capture a substantial market share, reflecting the growing demand for advanced vision correction solutions.

PRECISION7 sphere and toric contact lenses, slated for full commercial launch in Q1 2025, are Alcon's cutting-edge entry into the one-week replacement contact lens market. These lenses are positioned to capture substantial market share due to their advanced comfort features and a convenient replacement cycle, addressing a growing segment of the contact lens industry.

TRYPTYR (acoltremon ophthalmic solution) 0.003%

TRYPTYR (acoltremon ophthalmic solution) 0.003%, approved by the FDA in May 2025, positions Alcon in the burgeoning dry eye disease market.

With a projected compound annual growth rate of 7.1% from 2024 to 2033, this segment represents a significant opportunity for Alcon.

The strategic focus on promoting and placing TRYPTYR could elevate it to a leading position within this expanding therapeutic area.

- Market Entry: Alcon entered the dry eye market in May 2025 with the FDA approval of TRYPTYR.

- Market Growth: The dry eye treatment market is expected to grow at a 7.1% CAGR between 2024 and 2033.

- Strategic Potential: Significant promotional investment could establish TRYPTYR as a market leader.

Voyager Laser Trabeculoplasty Device

The Voyager Laser Trabeculoplasty Device represents a significant 2025 innovation for Alcon, bolstering its offerings in surgical glaucoma treatment.

This device targets the rapidly expanding ophthalmic surgery market, specifically addressing unmet needs in glaucoma management and aiming for substantial market share capture.

- Market Segment: Ophthalmic Surgery, specifically Glaucoma Treatment

- Key Innovation Year: 2025

- Strategic Goal: Capture significant market share in a high-growth segment

- Competitive Advantage: Addresses unmet needs in glaucoma management

Stars in the BCG Matrix represent products or business units with high market share in a high-growth industry. Alcon's recent launches, such as the Unity VCS Surgical Platform and the PanOptix Pro IOL, are positioned to become Stars. These innovations are entering rapidly expanding ophthalmic markets, where Alcon already has a strong foothold.

The PRECISION7 contact lenses and TRYPTYR for dry eye disease also exhibit Star potential. The contact lens market and the dry eye segment are experiencing significant growth, with the latter projected at a 7.1% CAGR from 2024 to 2033. Alcon's strategic investments in these areas aim to secure dominant market positions.

The Voyager Laser Trabeculoplasty Device, targeting glaucoma treatment within the ophthalmic surgery market, is another key contender for Star status. By addressing unmet needs in this expanding area, Alcon aims to capture substantial market share, solidifying its leadership in advanced ophthalmic solutions.

| Product/Segment | Market Growth | Alcon's Market Position | BCG Category Potential |

|---|---|---|---|

| Unity VCS Surgical Platform | Expanding Ophthalmic Surgery | Leading Market Share | Star |

| PanOptix Pro IOL | Expanding Premium IOL Market | Strong, Building on Success | Star |

| PRECISION7 Contact Lenses | Growing One-Week Replacement Market | New Entry, High Potential | Star |

| TRYPTYR (Dry Eye) | 7.1% CAGR (2024-2033) | New Entry, Strategic Focus | Star |

| Voyager Laser Trabeculoplasty | Expanding Ophthalmic Surgery (Glaucoma) | New Entry, Addressing Unmet Needs | Star |

What is included in the product

The Alcon BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

Alleviate strategic planning headaches by visualizing Alcon's portfolio for clear decision-making.

Cash Cows

The AcrySof IQ intraocular lenses represent a significant Cash Cow for Alcon. Their status as the most implanted IOL worldwide, as of 2024, underscores a robust market dominance and consistent demand in the cataract surgery sector.

This widespread adoption translates directly into substantial, reliable cash flow generation. The high volume of cataract procedures globally ensures that AcrySof IQ lenses continue to be a primary revenue driver for Alcon, solidifying their Cash Cow position.

Alcon's established surgical consumables, a key component of its surgical business, generated $712 million in net sales during the first quarter of 2025. This segment represents a strong cash cow within the Alcon BCG Matrix, benefiting from consistent demand in routine ophthalmic surgeries.

These essential products, required for nearly every surgical procedure, offer a dependable and recurring revenue stream. Their necessity in the market translates to relatively low marketing and promotional expenses, further solidifying their cash cow status.

The SYSTANE family of artificial tears continues to be a powerhouse, marking its fourth year of impressive double-digit growth. This sustained performance firmly establishes it as a dominant force in the ocular health market, especially for those seeking relief from dry eye conditions.

While the broader artificial tears market experiences more measured expansion, SYSTANE's robust brand equity and loyal customer following translate into substantial profit margins and a consistent, reliable stream of cash flow, characteristic of a mature cash cow.

TOTAL1 and PRECISION1 Contact Lenses

Alcon's TOTAL1 and PRECISION1 contact lenses are strong performers within the company's portfolio, fitting the description of cash cows. These brands dominate the daily disposable and multifocal segments, capturing a substantial portion of the U.S. market. In 2024, Alcon reported that its Vision Care segment, which includes these lenses, saw continued growth, driven by these flagship products.

These lenses benefit from established brand recognition and high customer retention, leading to predictable and consistent revenue streams. Their position in a mature but stable market segment ensures ongoing demand. This allows Alcon to leverage their market share for significant cash generation without requiring substantial reinvestment for growth.

- Market Dominance: TOTAL1 and PRECISION1 hold approximately 25% of the U.S. contact lens market.

- Customer Loyalty: High repeat purchase rates contribute to stable revenue.

- Cash Generation: These established brands consistently generate significant cash flow for Alcon.

- Segment Stability: They operate in a mature, predictable segment of the vision care industry.

Legacy Ophthalmic Surgical Equipment (e.g., CENTURION, CONSTELLATION)

Alcon's legacy ophthalmic surgical equipment, such as the CENTURION Vision System and CONSTELLATION Vision System, represent significant cash cows. These established products benefit from a large installed base, ensuring ongoing revenue streams.

The consistent cash generation from these systems is primarily driven by recurring sales of consumables, service contracts, and maintenance agreements. For example, Alcon reported total revenue of $10.7 billion in 2023, with their Surgical segment contributing $5.7 billion, underscoring the importance of their established equipment lines.

- Dominant Installed Base: Alcon commands a substantial installed base for its CENTURION and CONSTELLATION surgical platforms.

- Recurring Revenue Streams: These cash cows generate consistent income through consumables, servicing, and maintenance contracts.

- Stable Cash Flow: Despite potentially moderating new unit sales, the installed base ensures a predictable and robust cash flow for Alcon.

Alcon's AcrySof IQ intraocular lenses are a prime example of a Cash Cow. As the most implanted IOL globally in 2024, their widespread use generates consistent, high-volume revenue. This sustained demand in the cataract surgery market translates into substantial and reliable cash flow for Alcon.

The SYSTANE family of artificial tears also firmly fits the Cash Cow profile, demonstrating four consecutive years of double-digit growth. Despite a more moderate expansion in the overall artificial tears market, SYSTANE's strong brand loyalty and equity ensure healthy profit margins and a dependable cash stream.

Alcon's TOTAL1 and PRECISION1 contact lenses are recognized as significant Cash Cows. These brands hold a substantial share of the U.S. market, particularly in the daily disposable and multifocal segments. Their established brand recognition and high customer retention contribute to predictable, consistent revenue, allowing Alcon to generate considerable cash without extensive reinvestment.

Established ophthalmic surgical equipment, including the CENTURION and CONSTELLATION Vision Systems, are key Cash Cows for Alcon. Their large installed base ensures ongoing revenue from consumables, service contracts, and maintenance. In 2023, Alcon's Surgical segment contributed $5.7 billion to its total revenue of $10.7 billion, highlighting the crucial role of these established equipment lines.

| Product/Segment | BCG Category | Key Financial Indicator (2024/2025 Data) | Rationale |

| AcrySof IQ IOLs | Cash Cow | Most implanted IOL worldwide (2024) | High volume, consistent demand, reliable cash flow. |

| SYSTANE Artificial Tears | Cash Cow | Fourth year of double-digit growth (2024) | Strong brand equity, loyal customer base, healthy profit margins. |

| TOTAL1 & PRECISION1 Contact Lenses | Cash Cow | ~25% U.S. market share in their segments (2024) | Established brands, high customer retention, predictable revenue. |

| Ophthalmic Surgical Equipment (e.g., CENTURION) | Cash Cow | Surgical segment revenue: $5.7 billion (2023) | Large installed base, recurring revenue from consumables and services. |

| Surgical Consumables | Cash Cow | Net sales: $712 million (Q1 2025) | Essential for most surgeries, dependable recurring revenue. |

What You’re Viewing Is Included

Alcon BCG Matrix

The Alcon BCG Matrix preview you see is the exact, fully rendered document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently proceed with your purchase, knowing the file you've reviewed is precisely the one that will be delivered to you, enabling swift integration into your business planning and decision-making processes.

Dogs

Alcon's older surgical equipment, including legacy cataract and vitreoretinal devices, saw a 9% dip in net sales during the first quarter of 2025. This decline is attributed to softening demand for these established products.

These older surgical equipment lines likely represent Alcon's 'Dogs' within the BCG matrix. They probably hold a low market share and face limited growth potential, especially as newer, more advanced technologies emerge from both Alcon and its competitors.

Given these market dynamics, Alcon may consider divesting these older surgical equipment assets or significantly reducing further investment to reallocate resources towards higher-growth areas.

In Q4 2024, Alcon reported a net gain from divesting product rights in China. This move aligns with a strategy to shed assets with low market share and limited growth prospects in that specific region, freeing up capital for more promising ventures.

Within Alcon's ocular health segment, certain products are showing signs of underperformance. Despite the segment's overall strength, net sales saw a 1% dip in Q1 2025. This indicates that some older or less innovative offerings within this category are facing challenges in the market.

These underperforming products likely possess a small market share in mature sub-segments of the ocular health market. Their contribution to Alcon's overall growth is minimal, prompting a need for strategic review, potential divestment, or focused revitalization efforts.

Commoditized Contact Lens Solutions

Commoditized contact lens solutions, such as basic saline solutions and general multipurpose solutions, often find themselves in the Dogs quadrant of the BCG Matrix. These products are characterized by low differentiation and face significant price competition from numerous generic brands. For instance, in 2024, the global contact lens solution market, while growing, sees intense pressure on margins for these basic offerings.

Companies like Alcon, which have a broad portfolio, might categorize these highly commoditized segments as Dogs because they typically exhibit low market share growth and potentially low profitability. Despite their presence in the market, these solutions offer limited opportunities for significant expansion or premium pricing, making them less attractive investments compared to other business units.

- Low Market Growth: The growth rate for basic saline and multipurpose solutions is often modest, mirroring the overall contact lens market growth but without the innovation premium.

- Intense Price Competition: Numerous brands compete on price, squeezing profit margins for manufacturers.

- Low Differentiation: Products offer minimal unique features, making it difficult to command higher prices.

- Limited Investment Potential: Resources may be better allocated to higher-growth, higher-share segments.

Niche or Outdated Vision Care Accessories

Niche or Outdated Vision Care Accessories would fall into the Dogs category of the Alcon BCG Matrix. These are products with low market share and little to no growth potential. Think of older styles of eyeglasses frames or specialized contact lens solutions that have been superseded by newer, more effective alternatives.

These products often tie up valuable company resources, such as manufacturing capacity or marketing efforts, without generating significant returns. For instance, a line of non-prescription reading glasses with limited design variety might struggle to compete against the vast array of fashionable and technologically advanced options available today.

- Low Market Share: Products in this segment typically hold a very small percentage of the overall vision care market.

- Minimal Growth Potential: Demand for these items is either stagnant or declining, making significant sales increases unlikely.

- Resource Drain: Continued investment in production or promotion of these items can detract from resources that could be better allocated to growth areas.

- Technological Obsolescence: Many "dog" products in vision care are likely outdated due to advancements in lens technology, frame materials, or contact lens innovation.

Alcon's "Dogs" represent product lines with low market share and minimal growth prospects, often requiring careful management. These include older surgical equipment lines, such as legacy cataract devices, which saw a 9% sales dip in Q1 2025 due to softening demand.

Similarly, certain commoditized contact lens solutions, like basic saline, are categorized as Dogs due to intense price competition and low differentiation, despite the overall market's growth. Niche or outdated vision care accessories also fall into this quadrant, consuming resources without substantial returns.

Alcon's strategy often involves divesting or reducing investment in these "Dog" segments to reallocate capital towards more promising, higher-growth areas, as seen with the Q4 2024 divestment of product rights in China.

These underperforming assets, while present, contribute minimally to overall growth and may represent a strategic challenge for resource allocation.

| Product Category | BCG Quadrant | Market Share | Growth Potential | Strategic Consideration |

| Legacy Surgical Equipment | Dog | Low | Low | Divestment or reduced investment |

| Commoditized Contact Lens Solutions | Dog | Low | Low | Focus on efficiency, potential divestment |

| Niche Vision Care Accessories | Dog | Low | Low | Resource reallocation, divestment |

Question Marks

Unity VCS and Unity CS are positioned as potential Stars within Alcon's portfolio, but their broad commercialization is slated for 2025. This means they are currently question marks, demanding substantial investment.

Significant capital will be channeled into marketing, sales force expansion, and comprehensive surgeon training programs. These efforts are crucial for converting their high technological potential into substantial market penetration in the highly competitive surgical equipment sector.

PanOptix Pro IOL, launched in May 2025, is positioned within the high-growth advanced intraocular lens (IOL) segment. Its market penetration hinges on attracting users beyond the established PanOptix base, a crucial step for a new iteration of a successful product. The initial adoption rate will be a key indicator of its ability to carve out significant market share against established and emerging competitors in this dynamic field.

PRECISION7 contact lenses aim to carve out a new niche in the one-week replacement market. Launched in Q1 2025, they currently hold a minimal market share, reflecting their recent introduction.

To prevent PRECISION7 from becoming a 'Dog' in the BCG matrix, significant investment in consumer awareness and professional endorsements is paramount. This strategic push is crucial for accelerating market penetration and establishing a strong foothold.

TRYPTYR (acoltremon ophthalmic solution) 0.003% Adoption

TRYPTYR (acoltremon ophthalmic solution) 0.003% is positioned as a Question Mark on Alcon's BCG Matrix. Its recent FDA approval in May 2025 places it in a high-growth dry eye market, but as a new entrant, it faces intense competition.

Significant investment will be crucial for TRYPTYR's success. This includes substantial outlays for clinical education to inform healthcare providers about its efficacy and safety profile. Furthermore, securing favorable market access and reimbursement will be paramount to gaining traction against established competitors in the dry eye segment, which is projected for continued expansion.

- Market Entry: Newly FDA-approved in May 2025, TRYPTYR enters the growing dry eye market.

- Market Potential: The dry eye market exhibits high growth potential, indicating a favorable environment for new pharmaceuticals.

- Investment Needs: Significant investment in clinical education and market access is required to build market share.

- Competitive Landscape: TRYPTYR faces competition from existing products and other pipeline candidates in the dry eye space.

Voyager Laser Trabeculoplasty Device Adoption

The Voyager laser trabeculoplasty device, poised for a 2025 launch in glaucoma treatment, currently falls into the Question Mark category within Alcon's BCG Matrix. Its potential is significant, addressing a growing global burden of glaucoma, which affected an estimated 76 million people worldwide in 2020.

The device's future success is intrinsically linked to its ability to gain rapid acceptance among ophthalmologists and navigate the complex landscape of healthcare reimbursement. This necessitates substantial strategic investment to build market awareness and secure a strong foothold.

- Market Penetration Challenges: Alcon must overcome initial physician skepticism and demonstrate clear clinical superiority over existing treatments like Selective Laser Trabeculoplasty (SLT).

- Reimbursement Landscape: Securing favorable reimbursement codes and rates from payers will be critical for widespread adoption, especially given the device's novel nature.

- Competitive Environment: The glaucoma treatment market is competitive, with established laser therapies and emerging pharmaceutical options, requiring Alcon to clearly articulate Voyager's unique value proposition.

- Investment Needs: Significant capital will be required for clinical trials, marketing, sales force training, and post-market surveillance to drive adoption and achieve market leadership.

Question Marks represent products with low market share in high-growth industries, requiring significant investment to determine their future potential. Alcon's Unity VCS and Unity CS, slated for broad commercialization in 2025, exemplify this, demanding substantial capital for market penetration and surgeon training. Similarly, TRYPTYR, a new entrant in the expanding dry eye market, needs significant investment in clinical education and market access to compete effectively. The Voyager laser trabeculoplasty device for glaucoma also falls into this category, requiring investment in awareness and reimbursement to overcome initial hurdles in a competitive market.

| Product | Market Share (as of mid-2025 projection) | Market Growth Rate | Investment Required | Strategic Focus |

|---|---|---|---|---|

| Unity VCS/CS | Low (pre-commercialization) | High (Surgical Equipment) | High (Marketing, Sales, Training) | Market Penetration |

| PanOptix Pro IOL | Moderate (early adoption) | High (Advanced IOLs) | Moderate (Marketing, Sales) | Market Share Expansion |

| PRECISION7 Contact Lenses | Low (newly launched) | Moderate (One-Week Replacement) | High (Consumer Awareness, Endorsements) | Prevent 'Dog' Status |

| TRYPTYR | Low (newly approved) | High (Dry Eye Market) | High (Clinical Education, Market Access) | Gain Traction |

| Voyager Laser Trabeculoplasty | Low (pre-launch) | High (Glaucoma Treatment) | High (Awareness, Reimbursement) | Physician Acceptance, Reimbursement |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to accurately position products.