Alcon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Alcon's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to anticipate market shifts and identify strategic opportunities. Don't be left in the dark; download the full version now to gain a decisive advantage.

Political factors

Government healthcare policies significantly shape Alcon's operational environment. For instance, the US Medicare reimbursement rate for cataract surgery, a core procedure for Alcon's intraocular lenses, is a critical determinant of market pricing and surgeon adoption. In 2024, Medicare's Outpatient Prospective Payment System (OPPS) typically adjusts these rates annually, impacting the revenue Alcon can expect from its surgical equipment and consumables.

Furthermore, regulatory approvals for new medical devices and pharmaceuticals, such as Alcon's latest innovations in refractive surgery or contact lens technology, are directly tied to governmental bodies like the FDA in the United States or the EMA in Europe. The timeline and stringency of these approval processes can delay market entry and affect Alcon's ability to capitalize on its research and development investments. For example, a new lens technology might face a multi-year review period, influencing its launch strategy.

Shifts in healthcare spending priorities by governments, particularly in major markets like the EU or Japan, can also influence demand. If a government decides to increase funding for elective procedures or vision correction, it can boost sales for Alcon's product portfolio. Conversely, austerity measures or a focus on other health areas might dampen market growth for Alcon's offerings.

Alcon's global footprint means it's highly sensitive to changes in international trade policies and tariffs. For instance, ongoing trade tensions between major economic blocs could lead to increased import duties on crucial medical device components, directly impacting Alcon's cost of goods sold and potentially forcing price adjustments for its products in affected markets.

The stability of global trade relations is paramount for Alcon's intricate supply chains and extensive distribution networks. Disruptions, such as unexpected tariffs imposed in 2024 on ophthalmic surgical equipment, can significantly hinder the efficient movement of goods and impact Alcon's ability to serve its customer base across different regions, affecting its competitive edge.

Political instability in key markets presents a significant risk to Alcon's operations. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022, continue to impact global supply chains and create uncertainty in emerging markets where Alcon may seek to expand. This instability can directly affect Alcon's ability to source materials and distribute products, potentially leading to disruptions in its manufacturing and sales processes.

Furthermore, social unrest or conflicts in major operating regions can deter patient access to essential healthcare services, including those provided by Alcon's products. This reduced access, coupled with potential declines in consumer spending power due to economic instability linked to political factors, directly threatens Alcon's revenue streams. The unpredictable business environment fostered by such conditions necessitates vigilant monitoring of geopolitical risks to ensure business resilience.

Regulatory Environment for Medical Devices

The regulatory landscape for medical devices, a critical political factor for Alcon, is intricate and country-specific, demanding constant vigilance. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards that can significantly impact product development timelines and costs.

Stricter regulations, such as those implemented by the FDA's Quality System Regulation (21 CFR Part 820) and the EU's Medical Device Regulation (MDR), necessitate robust safety, efficacy, and manufacturing compliance. These requirements can extend approval processes, potentially adding months or even years to market entry for new Alcon products, and increasing R&D and compliance expenditures. In 2024, the ongoing implementation and refinement of the EU MDR, for example, continued to present challenges for manufacturers in terms of re-certification and market access.

- Increased Compliance Costs: Alcon faces substantial costs associated with meeting evolving regulatory standards, including quality management systems and post-market surveillance.

- Delayed Market Access: Stringent approval processes in key markets like the US and EU can delay the launch of innovative Alcon products, impacting revenue generation.

- Global Regulatory Harmonization Efforts: While efforts towards global harmonization exist, significant differences in national regulations continue to pose a challenge for a global player like Alcon.

Public Health Initiatives and Prevention Programs

Government-led public health initiatives significantly shape the demand for Alcon's products. For instance, campaigns promoting regular eye check-ups and early detection of conditions like glaucoma or diabetic retinopathy could boost the need for diagnostic equipment and treatments. In 2024, many countries continued to invest in preventative healthcare, with a particular focus on chronic disease management, which often includes eye health components.

These initiatives can have a dual effect. While increased awareness and prevention might lower the incidence of severe eye diseases requiring complex surgical solutions, they can simultaneously drive demand for Alcon's vision correction products and diagnostic tools. For example, a government-backed program to screen schoolchildren for refractive errors could increase sales of Alcon's ophthalmic lenses and instruments.

- Increased demand for diagnostic tools: Public health drives for early detection of conditions like macular degeneration or diabetic retinopathy directly benefit Alcon's diagnostic imaging and testing equipment.

- Shifting demand for treatments: While preventative measures may reduce the need for advanced surgical interventions, they can increase the market for less invasive treatments and vision correction solutions.

- Impact on vaccination programs: Initiatives targeting infections that can cause vision loss, such as measles or rubella, indirectly support Alcon by maintaining a healthier patient population less susceptible to certain vision impairments.

Government policies on healthcare spending and reimbursement directly influence Alcon's revenue streams, particularly for surgical procedures. For example, changes to Medicare's Outpatient Prospective Payment System (OPPS) in 2024 can impact the profitability of cataract surgeries, a key area for Alcon's intraocular lenses and surgical equipment.

Regulatory approvals from bodies like the FDA and EMA are crucial for Alcon's new product launches. The stringent and often lengthy review processes for medical devices, such as advanced refractive surgery technologies, can delay market entry and affect Alcon's ability to capitalize on innovation. The EU's Medical Device Regulation (MDR) continues to require significant compliance efforts in 2024, impacting timelines and costs.

International trade policies and tariffs pose risks to Alcon's global supply chains. Tariffs on medical device components, as seen in various trade disputes in 2023-2024, can increase Alcon's cost of goods sold and necessitate price adjustments in affected markets.

Government public health initiatives, such as those promoting regular eye check-ups in 2024, can boost demand for Alcon's diagnostic tools and vision correction products, even as preventative care may reduce the need for some advanced surgical interventions.

What is included in the product

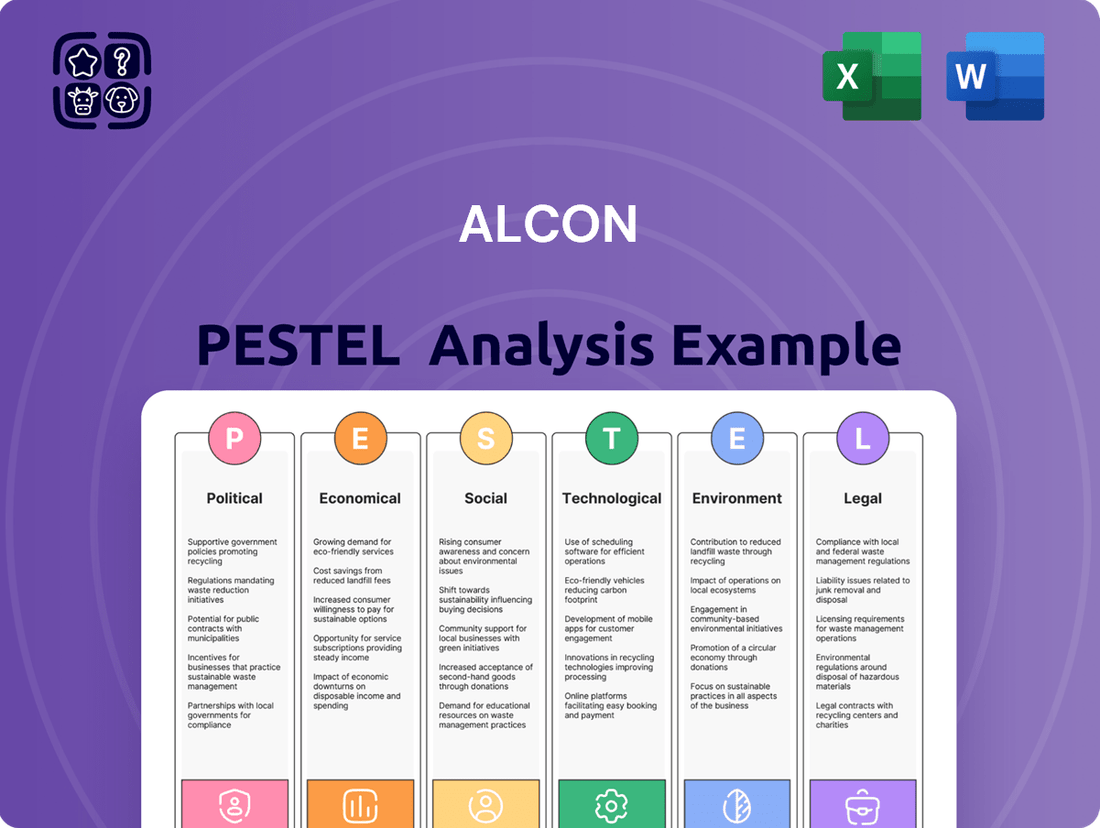

This PESTLE analysis provides a comprehensive examination of the external forces impacting Alcon, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors create strategic opportunities and potential threats.

The Alcon PESTLE analysis provides a structured framework to proactively identify and address external factors, thereby alleviating the pain of unexpected market shifts and regulatory changes.

Economic factors

Global economic growth significantly impacts Alcon's performance. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a figure expected to remain steady into 2025. This growth directly influences consumer disposable income, which in turn affects demand for Alcon's premium vision care products like advanced intraocular lenses and specialized contact lenses.

Economic slowdowns can negatively affect Alcon by reducing consumer spending on non-essential or elective vision correction procedures. During such periods, consumers might opt for more basic or lower-cost alternatives, potentially impacting Alcon's revenue streams. For instance, if disposable income falls, fewer patients may choose premium lens implants that offer enhanced visual outcomes.

Conversely, periods of economic prosperity generally boost demand for Alcon's innovative and high-value offerings. As disposable incomes rise, consumers are more likely to invest in advanced vision correction technologies that improve quality of life. This trend supports Alcon's strategy of focusing on premium products and procedures, driving sales and market share.

National healthcare spending is a critical driver for Alcon. In 2023, global healthcare spending was projected to reach over $10 trillion, with significant portions allocated to medical devices and pharmaceuticals. Changes in government budgets, insurance reimbursement policies, and private patient expenditures directly impact the market accessibility and demand for Alcon's surgical and vision care solutions.

Increased government and private investment in ophthalmology, a trend observed in many developed economies through 2024 and anticipated into 2025, presents substantial growth opportunities for Alcon. Conversely, any contraction in healthcare budgets or a redirection of funds away from eye care could pose challenges, potentially limiting market expansion for Alcon's product portfolio. Strategic alignment with these healthcare investment trends is paramount for sustained success.

Rising inflation in 2024 and projected into 2025 directly impacts Alcon's operational costs. For instance, the US Consumer Price Index (CPI) saw a notable increase, with core inflation remaining a concern, directly affecting the price of raw materials and manufacturing components essential for Alcon's products. This inflationary pressure can squeeze profit margins if Alcon cannot fully pass these increased expenses onto customers, particularly in the healthcare sector where pricing can be more rigid.

The cost of logistics and transportation also escalates with inflation, adding another layer of expense to Alcon's supply chain. For example, global shipping rates experienced volatility throughout 2024, influenced by fuel prices and geopolitical factors, directly impacting Alcon's ability to deliver products efficiently and affordably. Effectively managing these rising supply chain costs and improving operational efficiencies are paramount for Alcon to maintain competitive pricing and profitability, while also safeguarding its capacity for crucial research and development investments.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Alcon, a global healthcare company. For instance, in Q1 2024, Alcon reported that unfavorable currency movements had a negative impact on its reported net sales, although the exact percentage is often detailed in their financial reports. A stronger Swiss Franc (Alcon's reporting currency) can make its products pricier in other markets, potentially dampening sales volume.

Conversely, a weaker local currency in regions where Alcon sources raw materials or manufactures can increase its operational costs. For example, if Alcon sources components from a country whose currency strengthens against the Swiss Franc, the cost of those components rises. This can squeeze profit margins if not effectively managed.

To navigate these risks, Alcon employs currency hedging strategies. These financial instruments aim to lock in exchange rates for future transactions, thereby reducing the volatility of earnings. For example, in 2023, Alcon likely engaged in forward contracts or options to protect against adverse currency movements on its anticipated revenues and expenses.

- Global Exposure: Alcon operates in numerous countries, exposing it to a wide array of currency pairs and their inherent volatility.

- Revenue Impact: A strong local currency in key markets can make Alcon's products more expensive for international buyers, potentially reducing demand.

- Cost Impact: A weaker currency can increase the cost of imported raw materials and components, affecting Alcon's cost of goods sold.

- Mitigation Strategies: Effective currency hedging is crucial for Alcon to manage financial risks and ensure more predictable earnings.

Competition and Pricing Pressures

The eye care sector is intensely competitive, with many companies offering comparable products. This intense rivalry naturally leads to ongoing pressure on pricing. For instance, in 2023, the global ophthalmic devices market, where Alcon operates, was valued at approximately $47.8 billion, with significant growth driven by innovation but also by competitive dynamics.

Alcon contends with both long-standing industry giants and emerging companies. This dual threat can compel Alcon to lower prices to remain competitive, potentially affecting its profit margins and its standing in the market. The increasing prevalence of generic alternatives in certain segments further amplifies these pricing challenges.

To counter these pressures, consistent investment in research and development is crucial. Alcon must continually innovate and find ways to differentiate its offerings, from contact lenses to surgical equipment, to command premium pricing and sustain its competitive advantage across its diverse product lines.

- Market Value: The global ophthalmic devices market reached an estimated $47.8 billion in 2023.

- Competitive Landscape: Alcon faces rivalry from established players and new market entrants.

- Pricing Strategy: Innovation is key to justifying premium pricing and maintaining market share.

Economic factors significantly shape Alcon's market. Global economic growth, projected by the IMF to remain at 3.2% in 2024 and 2025, directly influences consumer spending on Alcon's premium vision care products. Conversely, economic downturns can lead consumers to opt for less expensive alternatives, impacting Alcon's revenue.

Inflationary pressures, evident in rising consumer prices in 2024, increase Alcon's operational costs for raw materials and logistics. For instance, volatile shipping rates in 2024 due to fuel prices and geopolitical events add to supply chain expenses. Managing these costs is vital for Alcon's profitability and R&D investments.

Currency fluctuations also present a challenge, as seen with Alcon's Q1 2024 report noting unfavorable currency movements impacting net sales. A stronger Swiss Franc can make products more expensive internationally, while weaker local currencies increase the cost of sourced materials, squeezing profit margins.

| Economic Factor | 2024/2025 Projection/Trend | Impact on Alcon |

| Global Economic Growth | IMF projects 3.2% for 2024 and 2025 | Influences disposable income and demand for premium products |

| Inflation | Rising consumer prices in 2024 | Increases operational costs (raw materials, logistics) |

| Currency Exchange Rates | Volatility observed in 2024 | Affects reported sales and cost of goods sold |

Preview Before You Purchase

Alcon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alcon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

The world's population is getting older, and this trend is a significant tailwind for Alcon. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion, more than double the 2019 figure. This demographic shift directly fuels demand for Alcon's products, as age is a key factor in developing conditions like cataracts and glaucoma, which Alcon specializes in treating.

This growing elderly demographic translates into a larger addressable market for Alcon's surgical equipment, intraocular lenses (IOLs), and other vision correction solutions. In 2023, Alcon reported net sales of $20.8 billion, with a significant portion driven by its surgical segment, which caters directly to age-related eye conditions.

A growing global emphasis on eye health and preventative measures is prompting more people to get regular eye check-ups and address vision issues early. This shift directly fuels demand for Alcon's diagnostic equipment, contact lenses, and lens care solutions, as well as treatments for eye conditions.

This heightened health consciousness translates into significant market opportunities; for instance, the global ophthalmic devices market was projected to reach over $50 billion by 2024. Alcon can capitalize on this by investing in public awareness initiatives about the importance of routine eye exams and developing user-friendly products that support preventative eye care.

Modern lifestyles are increasingly dominated by digital screens, leading to a rise in conditions like digital eye strain and dry eye syndrome. This trend directly impacts the demand for vision care solutions, creating a significant market opportunity for companies like Alcon. For instance, a 2024 survey indicated that over 70% of adults report experiencing symptoms of digital eye strain, a figure expected to grow as screen time continues to increase.

Alcon can capitalize on these evolving lifestyle changes by developing and marketing specialized products. This includes contact lenses engineered to reduce strain from prolonged screen use or advanced dry eye treatments. The company's focus on innovation in these areas is vital, as consumers actively seek solutions for digitally induced eye discomfort.

Consumer Preferences for Aesthetics and Convenience

Consumer preferences are increasingly shifting towards products that offer both aesthetic appeal and convenience in the vision care sector. Beyond simply correcting vision, consumers are drawn to options like cosmetic contact lenses that enhance appearance, reflecting a growing demand for personalized style. Alcon's strategy must acknowledge this trend, ensuring product development caters to these evolving consumer desires.

The drive for convenience is also paramount, with daily disposable contact lenses and extended wear options gaining significant traction. These products simplify routines and offer greater flexibility, aligning with busy modern lifestyles. For instance, the global contact lens market, valued at approximately $10.7 billion in 2023, saw a notable segment driven by daily disposables, indicating strong consumer adoption of convenience-focused solutions.

Alcon's innovation pipeline must therefore prioritize not only visual acuity but also user experience, comfort, and aesthetic integration. Meeting these demands requires a deep understanding of consumer behavior and a commitment to developing products that seamlessly fit into daily life.

- Aesthetic Appeal: Growing demand for cosmetic contact lenses and colored lenses, allowing for personal style expression.

- Convenience: Increased preference for daily disposable lenses and extended wear options, simplifying user routines.

- Lifestyle Alignment: Products must cater to active and diverse lifestyles, offering comfort and ease of use throughout the day.

- Market Growth: The global contact lens market, projected to reach over $14.6 billion by 2028, highlights the significant impact of these evolving consumer preferences.

Cultural Acceptance of Surgical Interventions

Cultural attitudes towards surgical procedures, especially elective ones like vision correction, significantly impact Alcon's market penetration. For instance, while Western markets generally show high acceptance of procedures like LASIK and cataract surgery, some Asian or African regions might exhibit a stronger preference for traditional or non-invasive remedies, potentially delaying adoption. Understanding these deeply ingrained beliefs is crucial for Alcon to develop targeted marketing campaigns that build confidence and address specific cultural hesitations.

The global acceptance of surgical interventions is evolving, with a growing trend towards preventative and quality-of-life enhancing procedures. For example, by the end of 2024, it's projected that over 50 million cataract surgeries will have been performed globally, indicating a strong underlying acceptance in many markets. However, Alcon must remain attuned to regional differences. A 2025 market survey might reveal that in certain developing economies, patient education about the safety and efficacy of modern surgical techniques is still a primary barrier, necessitating a focus on trust-building initiatives.

- Regional Disparities: Acceptance of refractive surgery varies; while North America and Europe show high adoption rates, certain Middle Eastern and African countries are still building patient confidence.

- Preference for Non-Surgical Options: In some demographics, there's a cultural inclination to exhaust all non-surgical treatment avenues before considering elective surgery, impacting the uptake of Alcon's advanced surgical solutions.

- Impact on Marketing: Alcon's marketing strategies must be culturally sensitive, emphasizing patient testimonials and educational content tailored to address specific regional concerns and beliefs about surgical interventions.

Societal trends significantly influence Alcon's market. The aging global population, with projections indicating 1.6 billion individuals aged 65+ by 2050, directly boosts demand for Alcon's solutions targeting age-related eye conditions like cataracts and glaucoma. Alcon's 2023 net sales of $20.8 billion reflect this demand, with its surgical segment playing a crucial role.

Increased health consciousness and a focus on preventative eye care are driving more frequent eye check-ups and early treatment of vision issues. This trend is supported by the ophthalmic devices market, which was expected to exceed $50 billion by 2024, presenting opportunities for Alcon in diagnostics and preventative solutions.

Modern lifestyles, characterized by extensive screen time, contribute to a rise in digital eye strain and dry eye syndrome. A 2024 survey found over 70% of adults experiencing digital eye strain symptoms, a figure expected to climb, creating a market for Alcon's specialized contact lenses and dry eye treatments.

Consumer preferences are also evolving towards products offering both aesthetic appeal and convenience. The global contact lens market, valued at approximately $10.7 billion in 2023, shows a strong demand for convenient options like daily disposables, with projections suggesting a market value exceeding $14.6 billion by 2028.

| Sociological Factor | Description | Impact on Alcon | Data Point/Projection |

| Aging Population | Increasing proportion of elderly individuals globally. | Higher demand for age-related eye condition treatments. | 1.6 billion people aged 65+ by 2050. |

| Health Consciousness | Growing emphasis on preventative healthcare and regular check-ups. | Increased demand for diagnostic tools and early intervention solutions. | Ophthalmic devices market projected over $50 billion by 2024. |

| Digital Lifestyle | Increased screen time leading to eye strain and dry eye. | Demand for specialized contact lenses and dry eye treatments. | Over 70% of adults report digital eye strain symptoms (2024). |

| Consumer Preferences | Demand for convenience and aesthetic appeal in vision care. | Growth in daily disposable lenses and cosmetic lens offerings. | Global contact lens market valued at $10.7 billion (2023). |

Technological factors

Continuous innovation in surgical techniques, like minimally invasive procedures and advanced imaging, fuels demand for sophisticated surgical equipment and implants. Alcon's growth hinges on integrating cutting-edge technologies into its cataract, glaucoma, and retinal surgery offerings, providing surgeons with more precise tools.

For instance, the global surgical equipment market was valued at approximately $17.6 billion in 2023 and is projected to reach $26.7 billion by 2030, growing at a CAGR of 6.1%. Alcon's investment in R&D, including its $3.3 billion total R&D spending in 2023, directly addresses this trend, ensuring its product pipeline remains competitive.

Staying at the forefront of these technological advancements is crucial for Alcon to maintain its leadership in the ophthalmic surgical market, allowing it to offer enhanced patient outcomes and surgeon satisfaction.

Alcon's commitment to research and development in new materials and lens technologies is a significant technological driver. For instance, advancements in silicone hydrogel materials for contact lenses have dramatically improved oxygen permeability, a key factor in wearer comfort and eye health. This ongoing innovation directly impacts the performance and marketability of their product lines.

The company's investment in next-generation intraocular lenses (IOLs), such as multifocal and toric designs, addresses a growing demand for solutions that reduce reliance on glasses. These sophisticated lenses offer patients improved vision at multiple distances and correction for astigmatism, representing a substantial technological leap in ophthalmology.

In 2023, Alcon reported significant R&D spending, with a focus on surgical and vision care innovations, including advanced lens technologies. This strategic allocation of resources underscores the importance of technological differentiation in maintaining a competitive edge within the global eye care market.

The eye care sector is rapidly embracing digital health and artificial intelligence, transforming how services are delivered. Telemedicine platforms are expanding patient reach, and AI is proving invaluable in diagnostics and personalized treatment. For instance, AI algorithms are showing promise in detecting diabetic retinopathy with accuracy comparable to human experts, a significant step for early intervention.

Alcon can capitalize on these technological advancements by integrating AI into its diagnostic tools and patient management systems. This integration could lead to more precise diagnoses, tailored treatment strategies for conditions like glaucoma, and the ability to monitor patients remotely, thereby improving outcomes and operational efficiency. By embedding these digital solutions, Alcon can solidify its market position.

Automation and Robotics in Manufacturing

Alcon's manufacturing operations are increasingly leveraging automation and robotics to enhance efficiency and product quality. This technological adoption directly translates to lower production costs and more consistent output, crucial for maintaining high standards in the medical device industry. For instance, by 2024, the global industrial robotics market was projected to reach over $60 billion, indicating a significant industry-wide trend towards automation that Alcon actively participates in.

Investing in these advanced manufacturing technologies is key for Alcon to scale production effectively and speed up the introduction of innovative ophthalmic products to the market. This agility is vital for staying ahead in a competitive global landscape. The company's focus on operational resilience is further bolstered by these investments, ensuring reliable supply chains even amidst market fluctuations.

- Increased Efficiency: Automation streamlines production lines, reducing cycle times and labor dependency.

- Cost Reduction: Robotics can lower manufacturing expenses through optimized resource utilization and reduced error rates.

- Quality Improvement: Automated systems ensure greater precision and consistency, leading to higher product quality and fewer defects.

- Scalability and Agility: Advanced manufacturing allows Alcon to adapt production volumes and accelerate new product launches.

Research and Development Investment and Patent Protection

Alcon's commitment to innovation is evident in its substantial research and development (R&D) investments, which are critical for maintaining its leadership in the eye care sector. For instance, in 2023, Alcon reported R&D expenses of approximately $931 million, underscoring its dedication to developing novel solutions and improving existing offerings in areas like surgical equipment and vision care products. This consistent investment fuels the discovery of new treatments and the creation of advanced medical devices, directly impacting its product pipeline and market competitiveness.

The company's ability to safeguard its innovations through robust patent protection is equally vital. Strong patent portfolios allow Alcon to secure exclusive rights to its groundbreaking technologies, preventing competitors from easily replicating its advancements. This exclusivity is essential for recouping significant R&D expenditures and maintaining a competitive edge. As of early 2024, Alcon holds thousands of active patents globally, covering a wide range of its product categories, from intraocular lenses to ophthalmic surgical instruments.

- R&D Investment: Alcon's R&D spending reached $931 million in 2023, a key driver for its innovation pipeline.

- Patent Portfolio: The company possesses thousands of global patents, protecting its technological advancements in surgical and vision care.

- Competitive Advantage: Patents enable Alcon to maintain exclusivity, supporting its market position and return on innovation investments.

- Future Growth: Continued R&D and patent protection are fundamental to Alcon's strategy for sustained growth and market leadership.

Technological advancements in surgical equipment, such as minimally invasive tools and enhanced imaging, are driving demand for sophisticated ophthalmic devices. Alcon's focus on integrating these cutting-edge technologies into its surgical and vision care products is paramount for its continued growth and market leadership.

The company's significant investment in research and development, with $931 million allocated in 2023, directly supports its innovation pipeline for new materials and lens technologies. This commitment ensures Alcon remains at the forefront of advancements like next-generation intraocular lenses, which improve patient vision and reduce reliance on glasses.

Furthermore, Alcon is embracing digital health and AI, integrating these technologies into diagnostics and patient management for more precise treatments and remote monitoring. This strategic adoption of automation and robotics in manufacturing, with the global industrial robotics market projected to exceed $60 billion by 2024, enhances production efficiency and product quality, vital for scaling operations and accelerating new product introductions.

| Area of Technological Focus | 2023 Data/Projections | Impact on Alcon |

|---|---|---|

| R&D Investment | $931 million (2023) | Drives innovation in surgical equipment and vision care products. |

| Surgical Equipment Market Growth | Projected CAGR of 6.1% (2023-2030) | Fuels demand for Alcon's advanced surgical tools and implants. |

| Industrial Robotics Market | Projected >$60 billion (2024) | Enhances manufacturing efficiency and product quality. |

| Patent Portfolio | Thousands of active global patents | Protects technological advancements, ensuring competitive advantage. |

Legal factors

Alcon navigates a complex web of medical device regulations. In 2024, the U.S. Food and Drug Administration (FDA) continued its rigorous review process for new devices, emphasizing safety and efficacy. Similarly, the European Medicines Agency (EMA) and other global bodies maintain strict approval pathways, impacting Alcon's market entry and product lifecycle management.

Compliance is not just a formality; it's a critical business imperative. For instance, a recall due to a regulatory lapse could significantly impact Alcon's revenue and brand trust. The company's 2023 annual report highlights ongoing investments in quality systems and regulatory affairs to ensure adherence to evolving global standards.

Alcon's eye care products are subject to stringent product liability laws, meaning any harm caused by a faulty device could lead to significant legal repercussions. For instance, in 2023, the U.S. Food and Drug Administration (FDA) reported a notable increase in medical device complaints, underscoring the critical need for rigorous safety protocols.

Maintaining the highest safety standards from initial design through ongoing post-market surveillance is paramount for Alcon to mitigate these legal risks. This includes adhering to global regulatory requirements, such as those set by the European Medicines Agency (EMA) and the FDA, which often involve extensive testing and clinical trials before product approval.

Implementing robust quality control systems throughout manufacturing and ensuring clear, comprehensive product labeling are essential. These measures not only help prevent adverse events but also build consumer trust, which is vital in the healthcare sector. Failure to comply can result in substantial fines and reputational damage, as seen in past cases involving medical device manufacturers.

Alcon's competitive edge is deeply rooted in its intellectual property, especially patents covering its groundbreaking technologies and products. Safeguarding these rights across the globe is paramount to deterring rivals from replicating its innovations.

For instance, Alcon's commitment to R&D is reflected in its substantial patent portfolio. In 2023, the company continued to invest heavily in innovation, with a significant portion of its operating expenses allocated to research and development, aiming to secure and expand its IP in areas like advanced intraocular lenses and surgical equipment.

Furthermore, Alcon must diligently ensure its own offerings do not infringe upon existing patents held by other entities. This necessitates rigorous patent landscape analysis and comprehensive legal review to mitigate risks of litigation and maintain market freedom.

Data Privacy and Cybersecurity Laws

Alcon must navigate a complex web of data privacy and cybersecurity laws, especially with the increasing digitization of healthcare. Regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandate strict handling of patient data. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial implications of non-compliance.

Protecting sensitive patient information, whether from traditional medical records or data generated by Alcon's smart devices and digital health platforms, is paramount. A significant data breach could lead to substantial legal penalties, reputational damage, and erosion of customer trust. The healthcare sector experienced a notable increase in data breaches in recent years, with ransomware attacks becoming a significant threat, making robust cybersecurity an ongoing operational necessity.

- GDPR fines can be up to 4% of global annual turnover or €20 million.

- HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual caps.

- The healthcare industry continues to be a prime target for cyberattacks, with ransomware being a prevalent threat.

Anti-Trust and Competition Laws

Alcon, as a significant entity in the global eye care sector, operates under stringent anti-trust and competition laws. These regulations are in place to foster a competitive marketplace and prevent any single company from dominating the industry. For instance, in 2023, regulatory bodies worldwide continued to scrutinize major mergers and acquisitions across various industries, with healthcare not being an exception. Alcon's strategic moves, including potential partnerships or acquisitions, must navigate these complex legal frameworks to avoid penalties.

Compliance with these laws is paramount to prevent investigations, substantial fines, or even mandated divestitures of business units. The European Commission, a key enforcer of competition law, has historically taken action against companies found to be engaging in anti-competitive practices. Ensuring fair competition is not just a legal obligation but a cornerstone for Alcon's long-term, sustainable expansion and market presence.

- Regulatory Scrutiny: Alcon must ensure all mergers, acquisitions, and collaborations comply with global anti-trust regulations.

- Market Dominance Prevention: Laws aim to prevent monopolies and promote a level playing field for all market participants.

- Potential Penalties: Non-compliance can lead to significant fines, legal challenges, and forced business divestitures.

- Sustainable Growth: Adherence to fair competition practices is crucial for Alcon's ongoing market viability and growth.

Alcon's operations are heavily influenced by evolving medical device regulations, with bodies like the FDA and EMA maintaining strict approval processes. In 2024, ongoing scrutiny of new devices emphasizes safety and efficacy, directly impacting Alcon's product lifecycle and market entry strategies.

Product liability laws pose significant risks, as demonstrated by the FDA's increased reporting of medical device complaints in 2023. Alcon's investments in quality systems, highlighted in its 2023 annual report, are crucial for mitigating these legal repercussions and maintaining brand trust.

Intellectual property protection is vital, with Alcon's substantial patent portfolio, bolstered by continued R&D investment in 2023, safeguarding its innovations in areas like intraocular lenses and surgical equipment.

Navigating data privacy laws like GDPR and HIPAA is critical, especially as healthcare digitizes. GDPR fines can reach 4% of global annual turnover, and the healthcare sector's vulnerability to cyberattacks, particularly ransomware, underscores the need for robust data protection measures.

Environmental factors

Alcon's manufacturing processes, crucial for producing its ophthalmic devices and pharmaceuticals, inherently consume significant resources and generate waste. In 2023, Alcon reported a 10% reduction in water consumption across its manufacturing sites compared to 2022, demonstrating a commitment to optimizing resource use. This focus on sustainable manufacturing is vital for minimizing its environmental footprint.

The company is actively working to reduce greenhouse gas emissions, targeting a 25% reduction by 2025 from a 2019 baseline. Initiatives include enhancing energy efficiency in its facilities and exploring renewable energy sources. By implementing greener manufacturing techniques, Alcon not only addresses environmental concerns but also anticipates potential cost savings and a strengthened brand image among increasingly eco-conscious consumers and investors.

Alcon's reliance on plastic packaging for high-volume products like contact lenses and surgical supplies presents a significant environmental challenge, directly contributing to global plastic waste. For instance, the sheer volume of daily disposable contact lenses manufactured and distributed necessitates substantial packaging materials.

Growing pressure from consumers, regulators, and investors is pushing Alcon, like many in the healthcare industry, to explore and implement more sustainable packaging alternatives. This includes a focus on materials that are recyclable, biodegradable, or designed to minimize overall material usage.

Effective waste management strategies and the adoption of circular economy principles are becoming increasingly vital for Alcon. Companies are being evaluated on their ability to reduce waste, increase recyclability, and responsibly manage the end-of-life of their product packaging.

Alcon's vast global supply chain, spanning raw material acquisition to final product delivery, inherently carries an environmental burden. This impact stems from transportation-related emissions and the resource intensity of sourcing materials. For instance, in 2023, the logistics sector accounted for approximately 25% of global CO2 emissions, a significant factor for companies with extensive distribution networks like Alcon.

Mitigating these environmental effects is paramount. Alcon can focus on initiatives such as partnering with suppliers committed to sustainability, refining logistics to reduce mileage and fuel consumption, and actively promoting the use of responsibly sourced materials. These strategies are vital for shrinking the company's overall ecological footprint.

Furthermore, there is a growing demand for supply chain transparency. Stakeholders increasingly expect companies to openly disclose their environmental practices and performance, making robust reporting and clear communication about sustainability efforts essential for Alcon's reputation and long-term viability.

Climate Change and Resource Scarcity

Climate change poses a significant threat to Alcon's global operations. Extreme weather events, such as the increasing frequency of hurricanes and floods, could disrupt manufacturing facilities and impact supply chain logistics. For instance, the \$1.2 trillion in economic losses attributed to weather and climate disasters in 2023 alone highlights the growing financial risks associated with environmental instability.

Water scarcity in key manufacturing regions presents another challenge. Alcon's production processes, like many in the healthcare sector, can be water-intensive. Regions facing increasing water stress, as predicted by many climate models, could necessitate costly investments in water management and alternative sourcing strategies to maintain operational continuity.

Adapting to these environmental risks and ensuring resilience against resource scarcities, particularly for specialized materials used in ophthalmic devices, is crucial for Alcon's long-term strategic planning. Companies are increasingly being assessed on their environmental, social, and governance (ESG) performance, with investors in 2024 showing a strong preference for sustainable business practices.

- Disruption Risk: Extreme weather events in 2024, like severe droughts and intensified storms, could impact Alcon's manufacturing sites and distribution networks.

- Resource Management: Alcon must proactively address potential water scarcity in key production areas, a growing concern as global water stress is projected to affect over 5 billion people by 2050.

- Supply Chain Vulnerability: Reliance on specific raw materials could be jeopardized by climate-induced disruptions, requiring robust supply chain diversification and resilience planning.

- Investor Scrutiny: ESG factors, including climate risk management, are becoming paramount for investors, with a significant portion of assets under management in 2024 being influenced by sustainability criteria.

Environmental Regulations and Reporting

Alcon navigates a complex web of environmental regulations, from managing emissions and hazardous waste to controlling chemical use across its global manufacturing sites. These rules vary significantly by country, demanding constant vigilance and adaptation to ensure compliance. For instance, in 2024, the European Union continued to strengthen its environmental directives, impacting chemical management and waste handling for companies operating within its borders.

The pressure for transparency in environmental performance is mounting. Investors and stakeholders increasingly demand detailed reporting on Alcon's carbon footprint and overall sustainability achievements. This trend is underscored by the growing adoption of ESG (Environmental, Social, and Governance) reporting frameworks, with many financial institutions prioritizing companies demonstrating robust environmental stewardship. For example, a significant portion of institutional investors now explicitly consider climate-related risks and opportunities in their investment decisions, as highlighted by various financial sector reports in late 2024 and early 2025.

- Compliance Costs: Adhering to evolving environmental regulations can lead to increased operational costs for Alcon, including investments in cleaner technologies and waste management systems.

- Reputational Risk: Failure to meet environmental standards or provide transparent reporting can damage Alcon's corporate reputation, potentially affecting brand loyalty and investor confidence.

- Sustainability Reporting: Alcon faces the challenge of accurately measuring and reporting its environmental impact, such as greenhouse gas emissions, water usage, and waste generation, in line with emerging global standards.

- Innovation Driver: Conversely, stringent environmental regulations can also spur innovation within Alcon, encouraging the development of more sustainable products and manufacturing processes.

Alcon's environmental strategy focuses on reducing its operational footprint, including greenhouse gas emissions and water consumption, with a target of 25% GHG reduction by 2025 from a 2019 baseline. The company is actively addressing plastic waste from product packaging, a significant challenge given the volume of products like daily disposable contact lenses. Furthermore, Alcon must navigate evolving environmental regulations globally, which can impact compliance costs and drive innovation in sustainable practices.

| Environmental Focus Area | Target/Initiative | 2023 Data/Context |

|---|---|---|

| Greenhouse Gas Emissions | 25% reduction by 2025 (vs. 2019 baseline) | Ongoing initiatives in energy efficiency and renewables. |

| Water Consumption | 10% reduction in manufacturing sites (vs. 2022) | Demonstrated progress in optimizing resource use. |

| Plastic Waste | Exploring sustainable packaging alternatives | High volume packaging for contact lenses and surgical supplies. |

| Regulatory Compliance | Adherence to global environmental standards | Increasingly stringent regulations in regions like the EU. |

PESTLE Analysis Data Sources

Our Alcon PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and international economic reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the ophthalmic industry.