Alcon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

Alcon's competitive landscape is shaped by five key forces, from the intense rivalry among existing players to the looming threat of new entrants. Understanding these dynamics is crucial for navigating the ophthalmic industry.

The complete report reveals the real forces shaping Alcon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alcon's reliance on suppliers for highly specialized raw materials, components, and advanced technologies, crucial for its surgical devices, implantables, and contact lenses, highlights a significant aspect of supplier bargaining power. The proprietary nature of these inputs, coupled with potentially limited alternative sources or intricate manufacturing processes, can tip the scales in favor of suppliers. For instance, a key supplier of advanced polymers for intraocular lenses might command higher prices if Alcon faces difficulties in sourcing comparable materials elsewhere, impacting Alcon's cost of goods sold.

Suppliers of cutting-edge technology and innovation in eye care can hold significant sway over Alcon. Companies that develop novel therapies or patented devices, especially those with unique intellectual property, are in a strong position to negotiate terms. Alcon's strategic acquisitions, like BELKIN Vision in 2023 for its augmented reality contact lens technology, highlight the company's effort to bring these innovative capabilities in-house, thereby reducing reliance on external technology providers over the long term.

Alcon faces significant supplier power due to high switching costs. Changing suppliers for specialized ophthalmic lenses or intricate surgical equipment involves lengthy and expensive qualification processes, often requiring revalidation under strict regulatory frameworks like those from the FDA. This complexity means Alcon incurs substantial expenses and potential production delays when considering a change, reinforcing their reliance on existing suppliers.

Supplier Concentration and Scale

In specific, specialized areas of the eye care supply chain, Alcon might encounter a restricted number of suppliers who can consistently meet its stringent quality and volume requirements. This scarcity can significantly amplify the bargaining power of these suppliers, enabling them to exert greater control over pricing, contract terms, and delivery timelines.

A concentrated supplier base means fewer alternatives for Alcon, potentially leading to higher input costs or less favorable supply agreements. For instance, if a critical component for a new intraocular lens technology is sourced from only two or three global manufacturers, those entities hold considerable sway.

However, Alcon's substantial global footprint and its immense purchasing volume act as a crucial counterbalancing force. By leveraging its scale, Alcon can negotiate more advantageous terms, secure bulk discounts, and potentially foster long-term partnerships that mitigate supplier leverage.

- Supplier Concentration: In niche segments, Alcon may face a limited pool of qualified suppliers for specialized materials or components.

- Supplier Leverage: A concentrated supplier base can dictate terms, prices, and delivery schedules due to fewer viable alternatives for Alcon.

- Alcon's Counter-Leverage: Alcon's global scale and significant purchasing volume provide it with considerable bargaining power to negotiate favorable terms.

Risk of Forward Integration by Suppliers

Suppliers possessing unique expertise or patented technologies could potentially move into Alcon's market, effectively becoming direct rivals. This risk is typically low, considering the significant capital and intricate processes involved in manufacturing and distributing eye care devices. However, for specialized technology providers, this remains a potential concern.

Alcon actively mitigates this threat through strategic acquisitions, thereby preempting potential forward integration by its suppliers.

- Supplier Integration Risk: Suppliers with proprietary technology could enter Alcon's market, becoming competitors.

- Mitigation Strategy: Alcon uses acquisitions to counter potential forward integration by suppliers.

- Industry Barriers: The high capital and technical demands of eye care device manufacturing limit supplier integration.

The bargaining power of Alcon's suppliers is a key factor in its operational costs and strategic flexibility. For highly specialized inputs, like advanced polymers for intraocular lenses or critical components for surgical equipment, Alcon may face suppliers with considerable leverage due to limited alternatives and high switching costs. For instance, the intricate regulatory approval processes for new medical device components can extend for months or even years, making it costly and time-consuming for Alcon to change suppliers.

In 2024, the ophthalmic industry continued to see consolidation among key component manufacturers, potentially increasing supplier concentration in certain niche areas. Suppliers who hold patents for innovative materials or manufacturing techniques can command premium pricing, directly impacting Alcon's cost of goods sold. Alcon's global purchasing volume, however, provides a significant counter-leveraging force, enabling negotiations for better terms and discounts.

| Factor | Impact on Alcon | Example |

|---|---|---|

| Supplier Concentration | Potentially higher input costs and less favorable terms. | A single supplier for a proprietary lens coating material. |

| Switching Costs | Reinforces reliance on existing suppliers due to regulatory and qualification hurdles. | Revalidating a new supplier for surgical instrument components can take over 12 months. |

| Supplier Differentiation | Suppliers with unique technology can dictate pricing. | Providers of advanced micro-optics for surgical microscopes. |

| Alcon's Purchasing Power | Mitigates supplier leverage through scale and negotiation. | Bulk purchasing of contact lens materials to secure volume discounts. |

What is included in the product

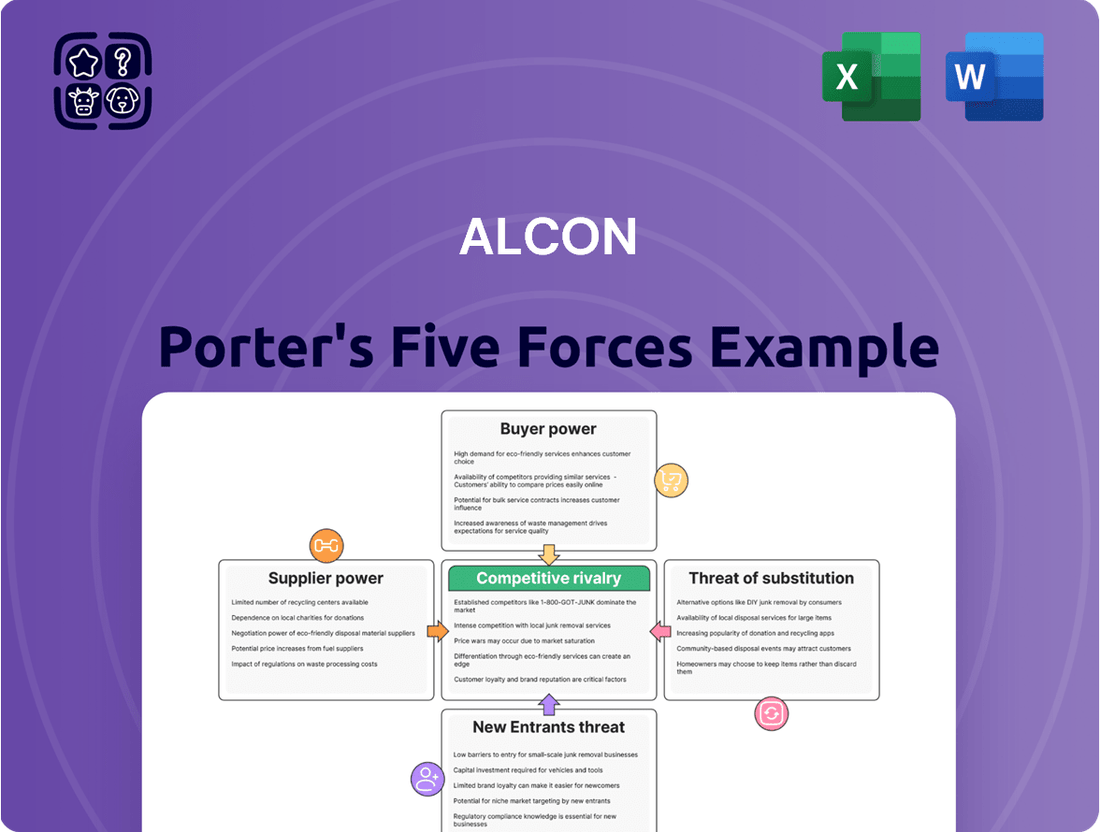

This analysis dissects Alcon's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the ophthalmic device industry.

Effortlessly identify and quantify competitive threats with a visual breakdown of each Porter's Five Forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Alcon's diverse customer base, spanning ophthalmologists, optometrists, hospitals, clinics, and even direct consumers, presents a complex bargaining power dynamic. Each segment has unique needs and priorities, influencing their negotiation leverage.

While individual consumers purchasing contact lenses may have limited individual power, larger entities like major hospital networks or purchasing consortia can wield considerable influence. This is due to their substantial collective purchasing volume, allowing them to negotiate more favorable terms.

For instance, in 2024, the global ophthalmic devices market, which Alcon operates within, reached an estimated value of over $45 billion, with significant portions driven by institutional purchasing. This scale underscores the potential for large buyers to impact pricing and product specifications.

Customer price sensitivity in the ophthalmic industry is heavily shaped by healthcare reimbursement policies and managed vision care plans. These frameworks often establish allowable costs for medical devices and procedures, directly impacting what patients and providers are willing to pay. For instance, Medicare reimbursement rates for cataract surgery, a key procedure involving Alcon's intraocular lenses, can set a benchmark for pricing across the market.

This pressure is especially pronounced for prescribed ophthalmic products and surgical equipment where third-party payers, including insurance companies and government programs, bear a significant portion of the cost. In 2024, the average annual premium for employer-sponsored health insurance in the US continued to rise, pushing more cost onto patients through deductibles and co-pays, which in turn heightens their awareness of product pricing.

For Alcon's surgical equipment and implantables, customers, primarily ophthalmologists and hospitals, face significant hurdles when switching to a competitor. This includes the cost of new equipment, retraining staff on different systems, and integrating new product lines. For example, a hospital investing millions in Alcon's latest cataract surgery platform, like the Centurion® Vision System, will likely stick with Alcon for subsequent purchases and consumables to maximize their initial investment and leverage existing staff expertise. This deep integration and training investment effectively locks in customers, substantially diminishing their bargaining power.

However, the dynamic shifts for Alcon's consumables, such as intraocular lenses (IOLs) or ophthalmic viscoelastic devices. Here, switching costs are considerably lower. A surgeon can readily switch between different brands of IOLs based on price or specific product features without needing to overhaul their entire surgical setup or retrain their team. This makes Alcon’s consumables segment more susceptible to price competition, as customers can more easily compare and negotiate terms with various suppliers, thereby increasing their bargaining power in this area.

Availability of Alternatives in Vision Care

The vision care market, especially for contact lenses, offers consumers numerous options. Major players such as Johnson & Johnson Vision, Bausch + Lomb, and CooperVision provide significant competition to Alcon. This competitive landscape empowers customers, as they can readily switch between brands if they find better pricing, improved comfort, or specific product attributes elsewhere.

This abundance of alternatives directly influences Alcon's pricing power and its ability to retain market share without concessions. For instance, in 2024, the global contact lens market was valued at approximately $12.5 billion, with a projected compound annual growth rate (CAGR) of around 5.5% through 2030. This growth indicates a dynamic market where customer choice plays a crucial role.

- Increased Customer Choice: Competitors offer a wide array of contact lens brands and types, from daily disposables to specialized toric and multifocal lenses.

- Price Sensitivity: The availability of similar products from different manufacturers means customers are more likely to shop around for the best prices.

- Feature Comparison: Customers can easily compare lens materials, wearing schedules, and comfort technologies across brands, leading to more informed purchasing decisions.

Information Access and Market Transparency

Customers today have unprecedented access to information, significantly boosting their bargaining power. This heightened awareness comes from readily available product details, detailed comparative reviews, and the ease of online purchasing, particularly evident in sectors like contact lenses. For instance, in 2024, online sales channels for eyewear and related products continued to grow, giving consumers more leverage to compare prices and features across multiple vendors.

This easy access to information empowers consumers to make more informed purchasing decisions. They can thoroughly research product specifications, read user experiences, and understand the value proposition of different offerings. This often translates into higher expectations for both product quality and overall value, forcing companies like Alcon to be more competitive.

- Enhanced Consumer Awareness: Increased availability of product information and reviews allows customers to make more educated choices.

- Price and Feature Comparison: Online platforms enable easy comparison of prices, features, and customer satisfaction across various brands.

- Informed Decision-Making: Thorough research empowers consumers to demand better value and performance from suppliers.

- Digital Marketplaces: The growth of e-commerce, especially for items like contact lenses, directly amplifies customer bargaining power by providing more alternatives.

Alcon's customers, ranging from individual patients to large hospital networks, possess varying degrees of bargaining power. While switching costs for advanced surgical equipment can be high, locking in customers, the market for consumables like contact lenses offers greater flexibility for buyers due to lower switching costs and intense competition. In 2024, the global ophthalmic devices market exceeded $45 billion, highlighting the significant purchasing volume that can be leveraged by large institutions.

The bargaining power of Alcon's customers is significantly influenced by the availability of substitutes and the ease with which they can switch suppliers. For products like contact lenses, where numerous competitors offer similar items, customers can readily compare prices and features, leading to increased price sensitivity. This dynamic is further amplified by the growing trend of online purchasing, which provides consumers with more options and information in 2024.

Customer price sensitivity is also shaped by healthcare reimbursement policies and managed vision care plans, which can dictate allowable costs for procedures and devices. For instance, Medicare reimbursement rates for cataract surgery influence pricing benchmarks across the industry. The rising cost of health insurance premiums in 2024 also makes consumers more aware of product pricing, thus enhancing their bargaining power.

| Customer Segment | Switching Costs | Bargaining Power Influence |

|---|---|---|

| Hospital Networks/Consortia | High (for integrated systems) | High (due to volume) |

| Individual Ophthalmologists/Optometrists | Moderate (for equipment) | Moderate (influences consumables) |

| Individual Consumers (Contact Lenses) | Low | High (due to alternatives and information access) |

Full Version Awaits

Alcon Porter's Five Forces Analysis

This preview showcases the comprehensive Alcon Porter's Five Forces analysis you will receive immediately after purchase, offering a detailed examination of competitive forces within the ophthalmic industry. You're looking at the actual document, ensuring transparency and no hidden elements, so you can be confident in the quality and completeness of the strategic insights provided. Once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate application in your business strategy.

Rivalry Among Competitors

Alcon faces intense competition from major global players like Johnson & Johnson Vision, Bausch + Lomb, and CooperVision. These rivals boast extensive product lines, robust research and development investment, and established worldwide distribution, creating a fierce battle for market dominance in the eye care sector.

The eye care market is booming, with a projected compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, reaching an estimated $107.2 billion by 2030. This expansion is primarily driven by an aging global population, as individuals over 60 are more susceptible to age-related eye conditions. For instance, cataracts affect over 50% of people over 80.

This demographic shift, coupled with a rising incidence of diseases like glaucoma and myopia, particularly in younger populations, creates significant opportunities for companies like Alcon. In 2023, Alcon reported net sales of $9.4 billion, underscoring the substantial market demand.

However, this strong growth also intensifies competitive rivalry. The race for innovation in areas like advanced intraocular lenses and new myopia management solutions is fierce. Companies are heavily investing in research and development to capture market share, leading to aggressive marketing and sales strategies among major players in the sector.

The ophthalmic industry thrives on relentless innovation, compelling companies like Alcon to pour significant resources into research and development. This focus on R&D is essential for launching cutting-edge products that differentiate them from competitors and capture market share. For instance, Alcon's commitment is evident in its substantial R&D spending, which fuels a pipeline of advanced solutions.

Alcon's strategic investments in its product pipeline, featuring innovations such as the UNITY VCS and PanOptix Pro intraocular lenses, are vital for staying ahead. These advanced offerings not only meet evolving patient needs but also solidify Alcon's position in a highly competitive landscape. By consistently introducing superior products, Alcon aims to drive sales growth and maintain its leadership.

Market Share Dynamics and Strategic Acquisitions

Competitive rivalry within the ophthalmic industry is intense, with established players and emerging innovators vying for market share. While market share in segments like contact lenses tends to shift slowly due to high switching costs and established brand loyalty, companies actively engage in strategic acquisitions to expand their portfolios and consolidate their positions. This inorganic growth strategy is crucial for staying competitive and gaining access to new technologies and customer bases.

Alcon's recent strategic acquisitions underscore this dynamic. In 2023, Alcon acquired BELKIN Vision, a company known for its innovative contact lens technology, aiming to bolster its contact lens offerings. Earlier in 2023, Alcon also completed the acquisition of Aurion Biotech, which focuses on regenerative medicine for eye conditions, signaling a move into advanced therapeutic areas. Furthermore, the acquisition of LENSAR in 2022, a leader in femtosecond laser technology for cataract surgery, demonstrates Alcon's commitment to enhancing its surgical equipment portfolio and capturing a larger share of the surgical market.

- Market Share Shifts: While contact lens market share changes slowly, strategic acquisitions are key to rapid expansion.

- Portfolio Expansion: Alcon's acquisitions of BELKIN Vision and Aurion Biotech in 2023 show a focus on both contact lenses and advanced eye treatments.

- Surgical Technology Enhancement: The 2022 acquisition of LENSAR highlights Alcon's strategy to strengthen its position in ophthalmic surgical equipment.

- Competitive Landscape: These moves reflect a broader industry trend where companies consolidate to gain a competitive edge and broaden their technological capabilities.

Marketing and Distribution Strength

Alcon's marketing and distribution strength significantly influences competitive rivalry. The company leverages effective marketing campaigns and a strong brand reputation built over years of innovation in eye care. This allows Alcon to capture and retain market share, making it harder for new entrants or smaller competitors to gain traction.

The company's extensive distribution channels are crucial. Alcon's established relationships with eye care professionals worldwide ensure its products reach a broad customer base. For instance, in 2023, Alcon reported net sales of $9.4 billion, with a significant portion driven by its strong distribution network reaching over 140 countries.

- Brand Recognition: Alcon is a globally recognized name in ophthalmology and vision care, fostering trust among patients and practitioners.

- Distribution Network: An established global network ensures broad product availability and efficient delivery to eye care providers.

- Customer Engagement: Direct relationships with ophthalmologists and optometrists facilitate product adoption and loyalty.

- Market Reach: Alcon's presence in over 140 countries provides a substantial advantage in reaching diverse patient populations.

Competitive rivalry in the eye care sector is characterized by intense innovation and strategic consolidation. Alcon's substantial net sales of $9.4 billion in 2023 highlight the significant market it operates within, but also the fierce competition it faces from global giants. These competitors, including Johnson & Johnson Vision and Bausch + Lomb, are also investing heavily in research and development to introduce advanced products like new intraocular lenses and myopia management solutions.

The market's projected growth, with a CAGR of 5.8% from 2023 to 2030, fuels this rivalry, as companies aim to capture a larger share of the expanding $107.2 billion market by 2030. Alcon's strategic acquisitions, such as BELKIN Vision and Aurion Biotech in 2023, and LENSAR in 2022, demonstrate a clear industry trend towards consolidating capabilities and expanding product portfolios to gain a competitive edge.

Alcon's robust marketing and extensive distribution network, reaching over 140 countries, further intensifies rivalry by enabling strong brand recognition and customer engagement. This established presence makes it challenging for smaller players to compete effectively, as Alcon leverages its global reach and trusted brand to maintain market share.

| Key Competitors | 2023 Net Sales (Approximate, if publicly available) | Key Product Areas | Strategic Focus |

| Johnson & Johnson Vision | Not publicly disclosed separately | Contact Lenses, IOLs, Vision Care Products | Innovation in multifocal IOLs, myopia management |

| Bausch + Lomb | Not publicly disclosed separately | Contact Lenses, Ophthalmic Pharmaceuticals, Surgical Equipment | Expansion in surgical portfolio, digital health solutions |

| CooperVision | Not publicly disclosed separately | Contact Lenses | Focus on specialty lenses, sustainability initiatives |

SSubstitutes Threaten

Traditional eyeglasses continue to serve as a significant substitute for Alcon's contact lens offerings. Despite the growing popularity and convenience of contact lenses, eyeglasses often present a more budget-friendly and less demanding option for a substantial portion of the population. In 2023, the global eyeglasses market was valued at approximately $140 billion, indicating a robust and persistent demand for this alternative vision correction method.

For specific eye conditions Alcon addresses with its surgical products, alternative medical or less invasive surgical options from competitors, or even non-medical approaches like lifestyle changes, can act as substitutes. For example, emerging pharmaceutical treatments for conditions like dry eye or glaucoma might lessen the demand for certain Alcon surgical devices.

Emerging technologies like smart glasses and AI-driven diagnostics present a significant threat of substitution for Alcon. These innovations could offer alternative methods for vision correction and eye health monitoring, potentially drawing customers away from traditional contact lenses and surgical procedures. For instance, advancements in augmented reality contact lenses, which are actively being researched and developed, could eventually provide vision enhancement and information display capabilities that currently rely on external devices.

Preventive Eye Care and Lifestyle Changes

The increasing emphasis on preventive eye care, incorporating dietary adjustments, vitamin supplements, and environmental protection, poses a threat of substitutes. This proactive approach aims to mitigate the occurrence or severity of various eye conditions.

Consequently, this trend could diminish the long-term demand for Alcon's corrective and therapeutic ophthalmic products. For instance, the global dietary supplements market, which includes eye-health specific formulations, was valued at approximately $156.5 billion in 2023 and is projected to grow significantly.

- Preventive Measures: Growing adoption of healthier lifestyles and dietary changes.

- Reduced Incidence: Potential decrease in the need for corrective lenses or surgical interventions for certain conditions.

- Market Impact: Could lead to a gradual erosion of demand for Alcon's core product segments over time.

Patient Propensity to Adopt New Solutions

The willingness of patients and eye care professionals to embrace novel, perhaps less invasive or more user-friendly, treatments directly influences the threat posed by substitutes. For instance, if emerging therapies demonstrate clear superiority in effectiveness, safety profiles, or affordability, patient inclination to move away from Alcon's current product lines could rise.

This propensity to adopt new solutions is a critical factor in Alcon's competitive landscape. In 2024, the ophthalmology market saw continued innovation, with a growing emphasis on patient-centric care. Studies indicate that patient satisfaction with treatment outcomes and ease of use are significant drivers for switching, even if initial costs are higher.

- Patient Preference for Minimally Invasive Procedures: A growing number of patients are seeking treatments that reduce recovery time and discomfort, directly impacting the appeal of alternative solutions.

- Efficacy and Safety Data: Robust clinical trial results showcasing improved patient outcomes and reduced side effects for new treatments can rapidly shift adoption patterns.

- Cost-Effectiveness and Insurance Coverage: The economic viability and accessibility of substitute solutions, often influenced by insurance reimbursement policies, play a crucial role in patient decision-making.

- Physician Endorsement and Training: The readiness of eye care professionals to adopt and recommend new technologies, supported by adequate training and evidence, is paramount.

Traditional eyeglasses remain a strong substitute for Alcon's contact lenses, offering a more affordable and less maintenance-intensive option for many consumers. The global eyeglasses market's substantial valuation, around $140 billion in 2023, underscores its enduring appeal. Furthermore, advancements in technology, such as smart glasses and AI-driven diagnostics, present emerging threats by offering alternative vision correction and monitoring methods that could divert demand from Alcon's established product lines.

| Substitute Category | Description | Market Data (2023/2024 Estimates) | Impact on Alcon |

|---|---|---|---|

| Eyeglasses | Traditional vision correction | Global market valued at ~$140 billion (2023) | Persistent demand, cost-effective alternative |

| Alternative Treatments | Pharmaceuticals, lifestyle changes for specific conditions | Growing dietary supplements market (~$156.5 billion in 2023) | Potential reduction in demand for surgical products |

| Emerging Technologies | Smart glasses, AR contact lenses | Active research and development | Future threat to traditional lenses and procedures |

Entrants Threaten

The eye care industry, particularly in areas like surgical devices and sophisticated vision care, demands significant upfront capital. Companies need to invest heavily in research and development, conduct extensive clinical trials, and build specialized manufacturing plants. For instance, developing a new intraocular lens can cost tens of millions of dollars, encompassing R&D, regulatory approvals, and production setup.

New entrants in the ophthalmic device and pharmaceutical sector confront substantial barriers due to rigorous regulatory pathways. Obtaining approvals, such as FDA clearance in the United States, for new medical devices and drug products is a complex and time-consuming endeavor. For instance, the average time for FDA approval of a new drug can stretch for years, involving extensive clinical trials and data submission, which requires substantial capital investment and specialized knowledge.

Established brand loyalty and extensive distribution networks pose a significant barrier to new entrants in the ophthalmic device market. Companies like Alcon have cultivated deep trust with eye care professionals over decades, making it difficult for newcomers to gain market access. For instance, Alcon's global sales force and established relationships with optometrists and ophthalmologists ensure their products reach a wide customer base efficiently.

Intellectual Property and Patent Protection

The eye care sector is heavily guarded by robust intellectual property and patent portfolios, a significant barrier for potential newcomers. Companies like Alcon invest heavily in R&D, securing patents for their innovative products and manufacturing processes, making it difficult for new entrants to compete without substantial innovation or licensing agreements. For example, in 2023, the global ophthalmic surgical devices market, a key segment for Alcon, was valued at approximately $10.6 billion, with a significant portion driven by patented technologies.

Developing truly novel solutions or navigating the complex landscape of licensing existing intellectual property can be prohibitively expensive and time-consuming for new market entrants. This high cost of entry, coupled with the need for specialized knowledge and advanced research capabilities, effectively deters many potential competitors.

- High R&D Investment: Companies like Alcon allocate significant resources to research and development, leading to extensive patent filings that protect their innovations.

- Patent Portfolio Strength: Existing players possess strong patent portfolios covering everything from contact lens materials to surgical equipment, creating a high hurdle for new entrants.

- Licensing Costs: Acquiring licenses for essential technologies can be a substantial financial burden, further discouraging new companies from entering the market.

- Innovation Requirements: New entrants must either develop groundbreaking, patentable technologies or find ways to circumvent existing patents, both of which are challenging and resource-intensive endeavors.

Economies of Scale and Experience Curve Effects

Alcon, as a major player in the ophthalmic medical device industry, benefits significantly from economies of scale. This allows them to spread fixed costs like R&D and manufacturing across a larger production volume, leading to lower per-unit costs. For instance, in 2023, Alcon reported substantial R&D investments, a luxury not easily matched by a new entrant. This cost advantage makes it challenging for new companies to compete on price.

Experience curve effects also create a barrier. As Alcon has produced and sold its products over many years, it has refined its processes, improved efficiency, and reduced costs. A new entrant would start at the beginning of this curve, facing higher initial production costs and a steeper learning curve. This accumulated knowledge and operational efficiency are difficult and time-consuming to replicate.

- Economies of Scale: Alcon leverages its size for lower manufacturing and procurement costs, making it hard for new entrants to match pricing.

- R&D Investment: Significant R&D spending by incumbents like Alcon creates a technological barrier that new companies struggle to overcome.

- Experience Curve: Years of operational refinement allow Alcon to produce more efficiently and at a lower cost than a nascent competitor.

The threat of new entrants in the eye care industry, particularly for companies like Alcon, is generally considered low due to several significant barriers. These include the substantial capital required for research and development, the intricate and lengthy regulatory approval processes, and the strong brand loyalty and established distribution networks that incumbents have built over time.

Furthermore, the industry is protected by robust intellectual property rights and patent portfolios, making it difficult for newcomers to enter without substantial innovation or costly licensing agreements. Economies of scale and experience curve effects also provide established players with cost advantages that new entrants struggle to match.

For example, the global ophthalmic surgical devices market, a key area for Alcon, was valued at approximately $10.6 billion in 2023, with innovation and patents being crucial drivers of market share. The cost to bring a new ophthalmic drug to market can easily exceed hundreds of millions of dollars, encompassing extensive clinical trials and regulatory submissions, further deterring new entrants.

The need for specialized knowledge and advanced manufacturing capabilities also contributes to the high barrier to entry, ensuring that only well-funded and technologically adept companies can realistically consider competing.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023) |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and clinical trial costs | Deters new entrants due to significant upfront investment | New drug development cost: $100M - $2B+ |

| Regulatory Hurdles | Complex FDA/EMA approval processes | Time-consuming and costly, requiring specialized expertise | Average drug approval time: 8-15 years |

| Brand Loyalty & Distribution | Established trust with eye care professionals | Difficult for newcomers to gain market access and customer trust | Alcon's global sales force & relationships |

| Intellectual Property | Strong patent portfolios on products and processes | Requires significant innovation or expensive licensing | Ophthalmic surgical devices market value: ~$10.6B |

| Economies of Scale & Experience | Lower per-unit costs for incumbents | New entrants face higher initial production costs | Alcon's substantial R&D and production volume |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and expert interviews to capture the nuances of competitive intensity.