Alcon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

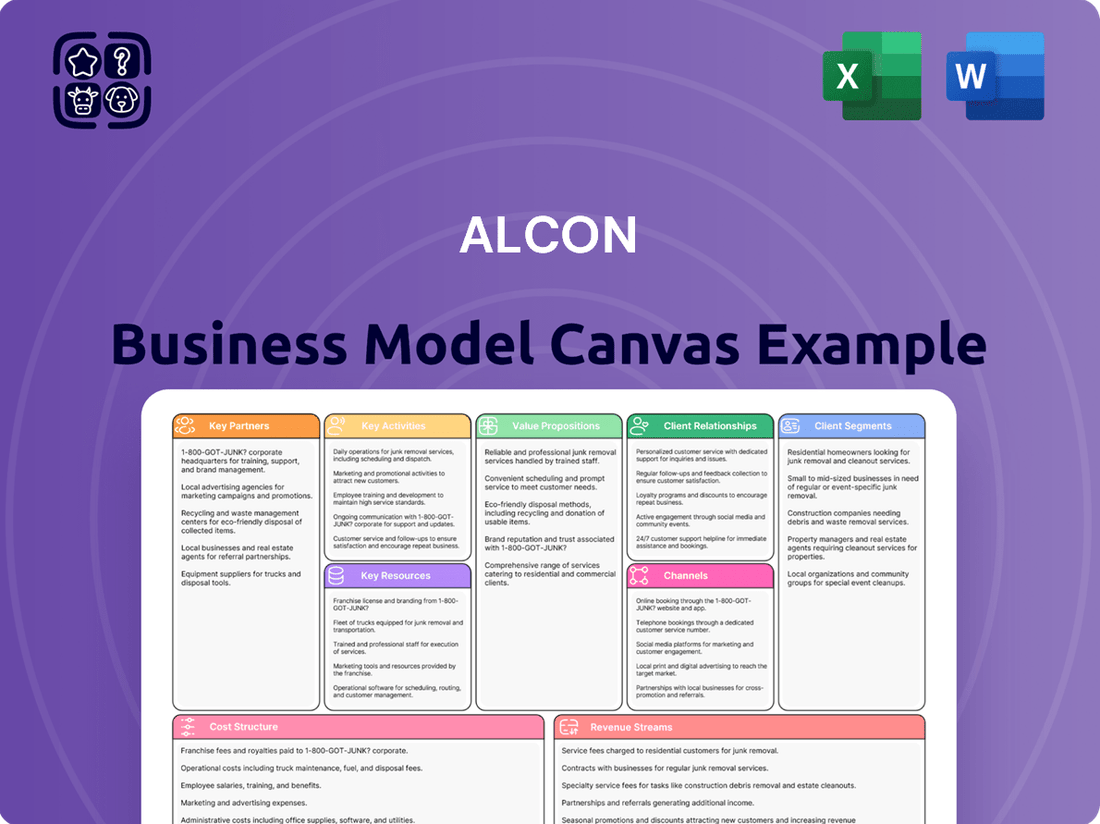

Unlock the strategic blueprint behind Alcon's success with our comprehensive Business Model Canvas. Discover how they create value, reach customers, and generate revenue in the competitive eye care market. This detailed analysis is perfect for anyone looking to understand industry leaders.

Want to dissect Alcon's winning formula? Our full Business Model Canvas provides a clear, actionable breakdown of their customer relationships, revenue streams, and key resources. Download it now to gain a competitive edge.

Partnerships

Alcon actively cultivates strategic partnerships with eye care professionals worldwide, encompassing surgeons and clinics. These alliances are crucial for bolstering global eye health infrastructure and enhancing surgical capacity. In 2024, Alcon continued its commitment to these collaborations, focusing on surgeon education and resource provision.

Key initiatives include extensive surgeon training programs, the donation of essential surgical equipment, and direct financial support, with a particular emphasis on regions facing significant healthcare challenges. For instance, Alcon's Phaco Development surgeon training program saw expansion into Zambia and Kenya, aiming to elevate surgical skills in these areas. Furthermore, the Aravind Alcon Surgical Centre of Excellence represents a significant step in establishing high-standard training facilities.

Alcon actively cultivates partnerships with philanthropic and non-profit organizations to broaden the reach of essential eye care services. These collaborations are crucial for improving access to treatment, particularly in underserved regions.

A prime example is the Alcon Cares program, which in 2024 alone delivered $37.3 million in product and equipment donations. Furthermore, the Alcon Foundation contributed $5.4 million to its non-profit allies, underscoring a significant commitment to global vision health.

These alliances are strategically designed to address the significant burden of untreated eye conditions, such as cataracts, in low- and middle-income countries, ultimately aiming to restore sight for millions worldwide.

Alcon actively pursues research and development partnerships to drive innovation in eye care. These collaborations are crucial for building a strong pipeline of new products in both surgical and vision care segments.

For instance, Alcon has partnered with companies like Visible Patient to integrate advanced 3D visualization technology into surgical workflows, enhancing precision and patient outcomes. Such strategic alliances allow Alcon to leverage external expertise and accelerate the development of cutting-edge solutions.

Supply Chain and Manufacturing Partners

Alcon relies on a robust network of supply chain and manufacturing partners to bring its extensive portfolio of eye care solutions to market. While Alcon boasts significant in-house manufacturing capabilities, producing approximately 90% of its products internally, external collaborations are vital for securing specialized components, essential raw materials, and efficient logistics services. These partnerships are critical for maintaining Alcon's commitment to high-quality standards and optimizing overall operational efficiency.

Key collaborations in this area ensure Alcon can access specialized materials and manufacturing processes not covered by its internal operations. This strategic outsourcing allows for greater flexibility and scalability, particularly for niche product lines or when demand fluctuates. For instance, in 2023, Alcon continued to strengthen its relationships with key suppliers to ensure a consistent flow of high-purity chemicals and advanced polymers necessary for its contact lens and surgical equipment manufacturing.

- Strategic Sourcing: Alcon partners with suppliers for specialized raw materials, ensuring consistent quality and availability for its diverse product lines.

- Manufacturing Augmentation: External manufacturers are engaged for specific components or to supplement internal production capacity, enhancing flexibility.

- Logistics and Distribution: Collaborations with logistics providers are essential for the efficient and timely delivery of Alcon's products to global markets.

- Quality Assurance: Partnerships are managed under strict quality control agreements to uphold Alcon's rigorous product standards.

Environmental Sustainability Initiatives

Alcon actively seeks key partnerships to bolster its environmental sustainability initiatives, aiming to reduce its overall ecological impact.

A notable collaboration is with Plastic Bank, a venture designed to counteract the plastic content in certain Alcon products. Through this partnership, Alcon commits to collecting an equivalent amount of plastic waste that would otherwise enter the ocean, directly addressing plastic pollution.

- Plastic Bank Partnership: Alcon is working with Plastic Bank to offset plastic usage in select products by recovering ocean-bound plastic.

- Environmental Commitment: These collaborations underscore Alcon's dedication to responsible resource management and minimizing waste generation.

- Impact Focus: The goal is to foster a circular economy approach within its operations and supply chain.

Alcon's key partnerships are vital for extending its reach and impact in eye care. Collaborations with eye care professionals, including surgeons and clinics, are fundamental for advancing global eye health and surgical capabilities. In 2024, these partnerships focused on enhancing surgeon education and providing necessary resources, demonstrating a continued commitment to improving surgical skills worldwide.

What is included in the product

A detailed Alcon Business Model Canvas that outlines key customer segments, value propositions, and channels, reflecting the company's strategic focus on eye care solutions.

Alcon's Business Model Canvas streamlines complex strategies, offering a clear, visual representation that simplifies understanding and communication.

It serves as a powerful tool for identifying and addressing potential inefficiencies, thereby alleviating pain points in strategic planning and execution.

Activities

Alcon's commitment to Research and Development is a cornerstone of its strategy, fueling the creation of advanced eye care solutions. The company's significant investment in innovation, exceeding $6 billion since 2019, underscores its dedication to staying at the forefront of the industry.

In 2024 alone, Alcon allocated over $876 million to R&D, a clear indicator of its focus on building a strong product pipeline. This substantial investment supports the development of next-generation surgical equipment, intraocular lenses, and contact lenses, ensuring a continuous flow of new and improved offerings to the market.

Alcon's manufacturing and production are central to its operations, with roughly 90% of its diverse eye care products made in-house. This internal production covers everything from sophisticated surgical equipment for cataract procedures to everyday contact lenses and lens care solutions.

In 2023, Alcon's manufacturing network spanned 17 global sites, a testament to their commitment to quality control and supply chain reliability. These facilities are crucial for producing their extensive portfolio, ensuring that patients and eye care professionals worldwide have access to Alcon's innovative solutions.

Alcon's marketing and sales efforts are crucial for driving adoption of its innovative eye care solutions. In 2024, the company continued to emphasize its surgical and vision care product portfolios through targeted campaigns aimed at ophthalmologists, optometrists, and consumers. This includes showcasing robust clinical data and engaging directly with the ophthalmic community through participation in major industry conferences and events globally.

Distribution and Logistics

Alcon operates a sophisticated global distribution network, reaching healthcare professionals and patients in more than 140 countries. This extensive reach necessitates robust logistics to ensure timely delivery of surgical equipment, consumables, and vision care products across diverse geographical markets.

The company's key activities in distribution and logistics are centered on managing intricate supply chains, maintaining strategically located warehousing facilities, and coordinating efficient transportation. These operations are vital for supporting Alcon's widespread global presence and ensuring product availability.

In 2023, Alcon reported net sales of $8.7 billion, underscoring the scale of its operations and the importance of its distribution capabilities. The efficient movement of these products is a core activity enabling Alcon to serve its customer base effectively.

- Global Reach: Serves customers in over 140 countries.

- Product Diversity: Distributes surgical equipment, consumables, and vision care products.

- Supply Chain Management: Focuses on efficient warehousing and transportation.

- Market Support: Ensures product availability to healthcare providers and patients worldwide.

Professional Training and Education

Alcon invests heavily in professional training and education, ensuring eye care professionals are proficient with its advanced products and technologies. This commitment is demonstrated through programs like Phaco Development, designed to enhance global eye health infrastructure and surgical capacity. In 2024, Alcon continued to offer comprehensive training, supporting thousands of surgeons in mastering new techniques and technologies.

Their training initiatives are central to customer engagement, providing best-in-class support for healthcare providers. This focus on education not only reinforces the benefits of Alcon's offerings but also fosters deeper relationships within the medical community.

- Surgeon Training Programs: Alcon offers specialized training, such as the Phaco Development program, to build expertise in cataract surgery.

- Product Proficiency: Education ensures eye care professionals can effectively utilize Alcon's advanced products and technologies.

- Customer Support: Providing top-tier training is a cornerstone of Alcon's customer engagement strategy.

- Capacity Building: These efforts contribute to strengthening the overall capacity and infrastructure of eye health services globally.

Alcon's key activities encompass robust research and development, efficient manufacturing, targeted marketing and sales, extensive global distribution, and comprehensive professional training. These pillars collectively support the company's mission to enhance eye care worldwide.

The company's commitment to innovation is evident in its significant R&D spending, exceeding $6 billion since 2019, with over $876 million allocated in 2024 alone. Alcon's manufacturing prowess is highlighted by its in-house production of approximately 90% of its diverse product portfolio across 17 global sites in 2023.

Marketing and sales efforts in 2024 focused on surgical and vision care products, engaging ophthalmologists, optometrists, and consumers through industry events and clinical data showcases. The distribution network reaches over 140 countries, ensuring product availability through efficient supply chain management.

Furthermore, Alcon's investment in professional training, including programs like Phaco Development, aims to enhance surgeon proficiency and global eye health infrastructure, supporting thousands of surgeons in 2024.

| Key Activity | Focus Area | 2024/2023 Data Points | Impact |

|---|---|---|---|

| Research & Development | New Product Innovation | >$876M R&D spend (2024); >$6B since 2019 | Drives pipeline of advanced surgical equipment, IOLs, and contact lenses. |

| Manufacturing & Production | In-house Quality Control | ~90% of products made in-house; 17 global sites (2023) | Ensures supply chain reliability and product quality. |

| Marketing & Sales | Targeted Customer Engagement | Focus on surgical and vision care portfolios | Drives adoption of innovative solutions among eye care professionals and consumers. |

| Distribution & Logistics | Global Market Access | Serves >140 countries; $8.7B net sales (2023) | Ensures timely delivery of products worldwide. |

| Professional Training & Education | Skill Development & Support | Supports thousands of surgeons (2024); Phaco Development program | Enhances proficiency with advanced products and strengthens eye health infrastructure. |

Full Document Unlocks After Purchase

Business Model Canvas

The Alcon Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally formatted Business Model Canvas in its entirety, ready for immediate use. There are no hidden sections or altered content; what you see is precisely what you will get, ensuring full transparency and immediate value.

Resources

Alcon's business model heavily relies on its robust intellectual property portfolio, featuring numerous patents for groundbreaking medical technologies and eye care innovations. This IP is fundamental to their competitive advantage.

A significant portion of Alcon's patent strategy involves artificial intelligence. For instance, they hold patents related to AI applications designed to assess contact lens compatibility and improve visualization techniques in ophthalmology, showcasing their commitment to cutting-edge solutions.

Protecting this valuable intellectual property is paramount for Alcon. It safeguards their market leadership and allows them to continue investing in research and development, ensuring a steady stream of innovative products for the eye care industry.

Alcon's research and development capabilities are a cornerstone of its business model, featuring dedicated teams and cutting-edge facilities. The company's commitment to innovation is evident in its significant and consistent R&D investments, which are crucial for developing next-generation products.

This focus on R&D has cultivated a strong product pipeline across both its Surgical and Vision Care segments. For instance, Alcon reported research and development expenses of $787 million in 2023, underscoring its dedication to advancing ophthalmic technologies.

Alcon's global manufacturing infrastructure is a critical asset, encompassing numerous facilities worldwide dedicated to producing its extensive portfolio of eye care solutions. This expansive network allows Alcon to maintain rigorous control over product quality and ensure efficient supply chain operations, reaching customers across the globe.

The company's commitment to operational excellence is underscored by tangible achievements. In 2022, a significant milestone was reached when three of Alcon's manufacturing sites achieved GreenCircle Zero Waste to Landfill Certification. This recognition highlights Alcon's dedication to sustainable practices within its manufacturing processes, demonstrating a focus on environmental responsibility alongside production capacity.

Skilled Workforce and Expertise

Alcon's strength lies in its more than 25,000 associates worldwide. This diverse team includes highly skilled scientists, engineers, medical professionals, and dedicated sales representatives, forming the backbone of the company's operations.

Their collective expertise in ophthalmology, cutting-edge medical device development, and effective market engagement is absolutely crucial. This deep knowledge allows Alcon to consistently drive innovation in vision care and cultivate strong, lasting relationships with its customers and healthcare providers.

Alcon actively invests in its people through various development and engagement programs. These initiatives often include opportunities for employees to gain vision screening certifications and participate in volunteer programs, reinforcing the company's commitment to both professional growth and community impact.

- Global Workforce: Over 25,000 associates worldwide.

- Key Expertise: Ophthalmology, medical device innovation, market engagement.

- Investment in People: Employee development programs and community volunteerism.

- Impact: Drives innovation and strengthens customer relationships.

Advanced Technology Platforms and Equipment

Alcon’s advanced technology platforms and equipment are crucial resources, forming the backbone of its surgical offerings. These include sophisticated systems like the UNITY Vitreoretinal Cataract System (VCS) and the UNITY Cataract System (CS), which are central to their ophthalmic surgical solutions.

These cutting-edge platforms are not just equipment; they represent Alcon's commitment to innovation in eye care. For instance, the SMARTCataract DX digital solution is integrated to optimize the entire surgical workflow.

The strategic deployment of these technologies directly impacts Alcon’s value proposition by enhancing surgical efficiency and improving patient outcomes. In 2023, Alcon reported strong growth in its Surgical segment, driven in part by the adoption of these advanced platforms.

- UNITY Vitreoretinal Cataract System (VCS): A comprehensive platform for complex retinal and cataract surgeries.

- UNITY Cataract System (CS): Designed to streamline cataract procedures with enhanced precision.

- SMARTCataract DX: A digital solution aimed at improving surgical planning and execution.

- Impact on Efficiency: These systems aim to reduce procedure times and improve surgeon comfort.

Alcon's key resources extend to its extensive intellectual property portfolio, including patents for AI applications in contact lens fitting and ophthalmic visualization, underpinning its innovative edge. The company's substantial investment in research and development, totaling $787 million in 2023, fuels a robust product pipeline. Furthermore, Alcon's global manufacturing network, with facilities achieving zero waste certifications in 2022, ensures quality and efficient delivery.

Value Propositions

Alcon provides a complete range of eye care products, encompassing both surgical and vision care needs. This includes treatments for common conditions like cataracts and glaucoma, alongside contact lenses and general ocular health products.

Their extensive product line supports patients across their entire eye health journey, from early-stage concerns to advanced treatments. This broad offering ensures Alcon can cater to diverse patient needs throughout their lives.

By addressing a wide array of eye conditions, Alcon delivers integrated solutions that benefit eye care professionals and patients alike. For instance, their surgical portfolio, a significant revenue driver, saw robust growth in 2023, contributing to their overall market position.

Alcon is deeply committed to pioneering innovations that redefine eye care, aiming to enhance vision and establish new benchmarks for treatment. This dedication is evident in their consistent introduction of advanced technologies designed to elevate patient results and streamline clinical workflows.

Recent product introductions, such as the UNITY VCS, PanOptix Pro, Voyager, and PRECISION7, underscore Alcon's focus on cutting-edge solutions. These advancements are strategically developed to meet existing gaps in the eye care sector and ultimately improve the lives of patients.

Alcon's surgical products, such as the UNITY 4D Phaco and HYPERVIT 30K, are engineered to enhance surgeon control and procedural speed. These advanced platforms are built to offer greater stability and precision, directly contributing to improved patient outcomes.

By facilitating faster nucleus removal and optimizing the overall surgical workflow, Alcon's technologies aim to increase efficiency within ophthalmic practices. This focus on streamlined performance not only benefits the surgical team but also leads to a better experience and recovery for patients.

Enhanced Patient Comfort and Vision Quality

Alcon's vision care portfolio, encompassing contact lenses and ocular health solutions, is meticulously crafted to deliver superior patient comfort and exceptional vision quality. This commitment translates into products designed to significantly improve the everyday experiences of individuals relying on vision correction.

For instance, their PRECISION7 contact lenses are engineered for extended wear, providing sustained comfort throughout the day. Furthermore, Alcon is continuously innovating in ocular health, introducing products that offer advanced hydration to combat dryness and irritation. These advancements aim to directly enhance patients' daily lives by offering clearer sight and a more comfortable visual experience.

- Superior Comfort: PRECISION7 contact lenses are a prime example, designed for prolonged wear and reduced discomfort.

- Advanced Hydration: New ocular health products focus on delivering enhanced moisture to the eye, addressing common issues like dryness.

- Improved Vision Quality: The overall goal is to provide patients with sharper, clearer vision, reducing reliance on glasses and improving daily activities.

- Enhanced Daily Life: By prioritizing comfort and vision, Alcon's products contribute to a better quality of life for individuals with vision impairments.

Commitment to Global Eye Health Access

Alcon actively works to broaden access to essential eye care, especially in areas that need it most. This goes beyond just selling products; it’s about making sure people can actually receive the care they need.

Through initiatives like Alcon Cares and dedicated surgeon training partnerships, the company strives to enhance vision for millions suffering from conditions that can be treated. For instance, in 2024, Alcon continued its commitment to training healthcare professionals globally, aiming to improve surgical outcomes and patient access.

This dedication to improving eye health access underscores Alcon's broader strategy for social impact and long-term sustainability. Their efforts contribute to a world where more individuals can see clearly, impacting their quality of life and economic potential.

- Global Reach: Alcon's programs target underserved regions, aiming to bridge the gap in eye care access.

- Training Initiatives: Partnerships focus on educating surgeons and healthcare providers to enhance treatment capabilities.

- Social Impact: The commitment reflects a broader ESG (Environmental, Social, and Governance) strategy, prioritizing patient well-being.

- Measurable Outcomes: Efforts are directed towards improving vision for millions affected by treatable eye conditions.

Alcon's value proposition centers on delivering comprehensive eye care solutions that enhance vision and improve patient quality of life. They offer a complete spectrum of products, from surgical interventions for conditions like cataracts to everyday vision care essentials like contact lenses.

Their commitment to innovation is a core value, consistently introducing advanced technologies such as the UNITY VCS and PRECISION7 contact lenses to address unmet needs and elevate treatment standards.

Alcon also focuses on expanding access to eye care globally through initiatives like surgeon training and dedicated programs, aiming to improve outcomes for millions worldwide.

The company's surgical products, like the UNITY 4D Phaco, are designed for enhanced surgeon control and procedural efficiency, ultimately leading to better patient results.

Alcon's vision care portfolio prioritizes superior comfort and exceptional vision quality, exemplified by extended-wear contact lenses and advanced ocular health solutions that improve daily life.

Customer Relationships

Alcon fosters direct relationships with eye care professionals via its dedicated sales force, offering crucial product information, training, and continuous technical support. This direct interaction ensures customers are up-to-date on Alcon's innovations and can maximize product utility.

In 2023, Alcon continued to invest in its sales force, a key component of its customer relationship strategy, aiming to enhance engagement and support for eye care professionals.

Alcon cultivates deep customer loyalty through robust training and education initiatives. These programs, designed for surgeons and eye care professionals, go beyond product instruction to build lasting partnerships.

A prime example is Alcon's Phaco Development surgeon training, which empowers practitioners with advanced surgical techniques. This commitment to enhancing professional skills ensures that users are not only proficient but also confident in utilizing Alcon's innovative solutions.

By investing in the continuous learning and development of the eye care community, Alcon fosters a strong sense of partnership and expertise. This approach directly contributes to increased product adoption and a more skilled user base, reinforcing Alcon's position as a leader in eye care innovation.

Alcon places a strong emphasis on responsive customer service, aiming to quickly address inquiries and resolve product-related issues. This dedication to support is key in fostering trust and building lasting relationships with their broad customer base, which includes healthcare professionals and patients.

In 2023, Alcon reported a significant increase in customer satisfaction scores, with over 90% of surveyed customers indicating they received timely assistance for their queries. This focus on responsiveness is crucial for maintaining product uptime and ensuring continued support for their ophthalmic solutions.

Partnerships for Market Development

Alcon actively cultivates partnerships with key opinion leaders (KOLs) and professional organizations within ophthalmology. These collaborations are crucial for gaining deep insights into unmet market needs and co-developing innovative, tailored solutions that address specific challenges in eye care.

These strategic alliances enable Alcon to remain at the cutting edge of ophthalmic trends and ensure their product development pipeline directly reflects the dynamic and evolving demands of the healthcare industry. For instance, in 2023, Alcon reported significant engagement with over 50 major ophthalmology congresses globally, fostering direct feedback loops with thousands of clinicians.

- KOL Engagement: Alcon partners with leading ophthalmologists to validate new technologies and gather real-world clinical feedback.

- Professional Organization Alliances: Collaborations with groups like the American Academy of Ophthalmology help shape industry standards and identify emerging patient needs.

- Market Insight Gathering: These partnerships provide invaluable data on market trends, informing Alcon's R&D investments.

- Strengthened Market Position: The collaborative approach solidifies Alcon's leadership by ensuring its offerings are aligned with clinical practice and patient outcomes.

Patient-Centric Approach through Professionals

Alcon's customer relationships are built on a foundation of empowering eye care professionals (ECPs) to deliver superior patient outcomes. While Alcon's direct sales are to these professionals, the company's core mission is patient well-being. This indirect, yet powerful, patient-centric approach is fostered through continuous support and advanced product offerings.

By investing heavily in professional education and training, Alcon ensures that ECPs are equipped with the latest knowledge and skills to utilize their innovative solutions effectively. For instance, Alcon's commitment to training saw significant engagement in their 2024 digital education platforms, reaching over 15,000 ECPs globally, directly impacting patient care quality.

- Professional Empowerment: Alcon provides ECPs with cutting-edge surgical equipment and advanced contact lens technologies, enabling them to offer the best possible care.

- Indirect Patient Focus: Through product innovation and comprehensive training programs, Alcon ensures patients benefit from the most up-to-date and effective treatments available.

- Quality of Care Enhancement: By equipping professionals with superior tools and knowledge, Alcon indirectly cultivates a relationship of trust and improved health outcomes for patients.

- Global Reach in Education: Alcon’s 2024 initiatives included expanding their virtual reality surgical simulation training, which was adopted by over 200 ophthalmology residency programs worldwide, underscoring their dedication to professional development and patient safety.

Alcon's customer relationships are multi-faceted, focusing on empowering eye care professionals (ECPs) through direct engagement, robust training, and responsive support. Their strategy emphasizes building loyalty by equipping ECPs with the latest knowledge and skills, ultimately benefiting patients.

In 2023, Alcon reported high customer satisfaction, with over 90% of surveyed customers receiving timely assistance. Furthermore, their 2024 digital education platforms engaged over 15,000 ECPs globally, and their VR surgical simulations were adopted by more than 200 ophthalmology residency programs worldwide.

| Customer Relationship Aspect | Key Initiatives | 2023/2024 Impact |

|---|---|---|

| Direct Engagement | Dedicated sales force, technical support | Enhanced product utility and awareness |

| Professional Development | Training programs (e.g., Phaco Development), digital education | 15,000+ ECPs engaged in 2024 digital platforms; improved surgical skills |

| Customer Support | Responsive inquiry handling | Over 90% customer satisfaction with timely assistance (2023) |

| Strategic Alliances | KOL partnerships, professional organization collaborations | Market insight gathering, industry standard shaping; 50+ congress engagements (2023) |

| Patient-Centric Approach | Advanced product offerings, professional empowerment | 200+ VR surgical simulation adoptions by residency programs (2024) |

Channels

Alcon's direct sales force is a cornerstone of its customer engagement strategy, reaching out to hospitals, surgical centers, and individual eye care practices worldwide. This direct interaction enables personalized product demonstrations and the delivery of solutions specifically designed for professional clients.

The company's commitment to its sales force is evident in its significant investments, aimed at boosting market penetration and effectively supporting new product introductions. For instance, Alcon's focus on its sales team is crucial for the successful rollout of innovations like the AcrySof IQ Vivity IOL, which saw strong adoption following targeted sales efforts.

Alcon leverages a network of authorized distributors and optical retailers to ensure its vision care products, including contact lenses and solutions, reach a broad customer base. This strategy is crucial for maintaining product availability across various geographic markets and retail environments.

In 2024, Alcon's extensive distribution network was a key factor in its performance, contributing to its significant market presence in the ophthalmic device sector. The company reported net sales of $10.7 billion for the full year 2024, underscoring the effectiveness of its channel partnerships.

Alcon is actively enhancing its online presence to engage with customers and stakeholders. Their investor relations website serves as a key hub, providing access to crucial financial reports and live webcast events, ensuring transparency and accessibility for investors.

The company is also investing in digital planning solutions specifically for surgeons. These tools are designed to simplify and improve the surgical planning process, demonstrating Alcon's commitment to leveraging technology for clinical advancement.

A significant digital initiative is the Alcon Vision Suite, a cloud-connected platform. This suite is engineered to streamline surgical workflows and foster greater connectivity across Alcon's diverse product ecosystem, aiming for enhanced operational efficiency and a more integrated customer experience.

Medical Conferences and Trade Shows

Alcon leverages key industry events like the American Society of Cataract and Refractive Surgery Conference (ASCRS) and the American Academy of Ophthalmology (AAO) annual meeting. These gatherings are vital for introducing new products and demonstrating technological advancements directly to eye care professionals.

These conferences provide invaluable platforms for direct engagement, offering hands-on product demonstrations and educational sessions that foster deeper understanding and adoption of Alcon's solutions. In 2024, ASCRS reported over 5,000 attendees, highlighting the significant reach of these events.

- Product Launches: Major events for unveiling new surgical technologies and ophthalmic pharmaceuticals.

- Professional Engagement: Direct interaction with ophthalmologists and optometrists to gather feedback and build relationships.

- Educational Hub: Offering workshops and symposia to educate professionals on best practices and new treatment modalities.

- Market Visibility: Enhancing brand presence and competitive positioning within the eye care industry.

Direct-to-Consumer Marketing (for Vision Care)

Alcon leverages direct-to-consumer (DTC) marketing, a strategic move to complement its core business-to-business approach, especially for its popular contact lens and ocular health lines. This strategy is crucial for building strong brand recognition and fostering patient demand, ultimately guiding consumers to request Alcon products from their eye care professionals. In 2024, Alcon continued to invest in digital platforms and educational content to reach consumers directly, aiming to enhance product visibility and patient engagement.

- Brand Awareness: DTC campaigns, particularly digital ones, significantly boost consumer awareness of Alcon's contact lens and ocular health brands.

- Consumer Demand: By educating patients on product benefits, Alcon stimulates demand, encouraging them to specifically ask for Alcon products during eye exams.

- Digital Engagement: Alcon's investment in digital marketing and educational content in 2024 aimed to create a direct channel for consumer interaction and information sharing.

- Professional Recommendation: The ultimate goal of DTC efforts is to empower patients with knowledge, leading them to seek recommendations for Alcon products from their eye care providers.

Alcon utilizes a multi-faceted channel strategy, combining direct sales with a robust distributor network and expanding digital engagement. This approach ensures broad market reach for its surgical and vision care products.

The company's direct sales force is critical for engaging with hospitals and eye care practices, facilitating personalized support and product introductions. In 2024, Alcon's net sales reached $10.7 billion, reflecting the effectiveness of these established channels.

Alcon also invests in digital platforms and industry events like ASCRS and AAO to connect with professionals, showcase innovation, and gather feedback, further solidifying its market presence.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales Force | Engages hospitals, surgical centers, and eye care practices globally. | Crucial for product demonstrations and tailored solutions. |

| Distributors & Retailers | Ensures broad availability of contact lenses and ocular health products. | Supported $10.7 billion in net sales for 2024. |

| Digital Platforms | Investor relations website, surgeon planning tools, Alcon Vision Suite. | Enhances customer engagement and streamlines surgical workflows. |

| Industry Events | ASCRS, AAO annual meetings. | Key for new product launches and professional education; ASCRS had over 5,000 attendees in 2024. |

| Direct-to-Consumer (DTC) | Digital marketing for contact lenses and ocular health. | Builds brand awareness and patient demand for specific products. |

Customer Segments

Ophthalmic surgeons and the surgical centers or hospitals where they operate are a core customer segment for Alcon's Surgical franchise. These professionals rely on Alcon for cutting-edge surgical equipment, vital implantable lenses, and essential consumables to perform procedures like cataract, glaucoma, and vitreoretinal surgeries.

In 2024, the global ophthalmic surgery market continued its robust growth, driven by an aging population and increasing demand for vision correction. Alcon's commitment to innovation in this space is evident in its product portfolio, designed to enhance surgical precision and patient outcomes.

Optometrists and ophthalmologists are crucial customers for Alcon, acting as the primary channels through which its contact lenses, lens care solutions, and dry eye treatments reach patients. These eye care professionals are the decision-makers who prescribe and fit lenses, making Alcon's extensive product range, including their popular DAILIES TOTAL1 and PRECISION1 contact lenses, highly relevant to their practice.

These professionals are not just prescribers but also trusted advisors for ocular health. Alcon's commitment to innovation, evident in their 2024 product development pipeline, directly supports these practitioners in offering advanced solutions for vision correction and eye health management, reinforcing their role as key gatekeepers in the vision care market.

Patients with eye conditions are the core beneficiaries of Alcon's innovations. These individuals suffer from a range of issues such as cataracts, glaucoma, retinal diseases, and refractive errors, all of which can significantly impact their quality of life.

Alcon's extensive portfolio aims to address these needs by protecting, restoring, or enhancing vision across all stages of eye health. This commitment extends from early intervention to managing chronic conditions and improving visual outcomes after surgery.

Globally, an estimated 2.5 billion people experience vision-related needs, highlighting the vast market Alcon serves. For instance, in 2023, over 50 million cataract surgeries were performed worldwide, a procedure where Alcon is a leading supplier of intraocular lenses and surgical equipment.

Hospitals and Clinics

Hospitals and clinics, from sprawling healthcare networks to individual practices, form a core customer base for Alcon. These institutions procure Alcon's advanced surgical equipment and essential consumables for their ophthalmology and surgical departments. For instance, in 2024, many hospital systems are investing in next-generation cataract surgery platforms to improve patient outcomes and operational efficiency.

Alcon actively partners with these healthcare providers, offering integrated solutions that extend beyond product sales. This includes training, technical support, and inventory management services designed to streamline operations within surgical centers and vision clinics. The company's commitment to providing comprehensive support helps institutions maximize the utility of their Alcon investments.

- Key Purchasers: Large hospital systems and independent clinics.

- Product Focus: Surgical equipment and consumables for vision care.

- Value Proposition: Comprehensive solutions, training, and ongoing support.

- Market Trend (2024): Increased investment in advanced surgical platforms.

Governmental and Non-Governmental Organizations

Alcon collaborates with governmental and non-governmental organizations focused on public health and eye care, particularly in areas with limited access. These partnerships are crucial for distributing Alcon's products through charitable missions and educational programs designed to enhance global eye health. In 2024, Alcon continued its commitment to these initiatives, supporting programs that reached millions of individuals worldwide.

These organizations often act as key procurement channels for Alcon, enabling the company to extend its reach into underserved communities. For example, partnerships with organizations like the World Health Organization (WHO) and various national health ministries facilitate the implementation of large-scale eye care strategies. The demand for ophthalmic solutions from these sectors underscores Alcon's role in addressing global health disparities.

- Public Health Initiatives: Alcon supports programs aimed at preventing blindness and treating common eye conditions, aligning with global health agendas.

- Underserved Regions: Partnerships facilitate product access in low-income countries and remote areas where eye care is scarce.

- Charitable Missions & Training: Organizations procure Alcon products for humanitarian efforts and to train local healthcare professionals, building sustainable eye care capacity.

- Social Impact Alignment: These collaborations directly support Alcon's corporate social responsibility goals by improving access to vision care.

Alcon's customer base is diverse, encompassing eye care professionals, healthcare institutions, and ultimately, patients. These segments are interconnected, with professionals influencing patient choices and institutions facilitating access to treatments. Alcon strategically targets each group with tailored value propositions.

In 2024, the emphasis remained on innovation and accessibility, reflecting the growing global demand for vision care solutions. Alcon's product development and market strategies are designed to meet the evolving needs of these distinct customer groups.

The company's success hinges on its ability to serve both the providers of eye care and the recipients of that care, ensuring a comprehensive approach to improving vision worldwide.

| Customer Segment | Key Needs/Interests | Alcon's Offering | 2024 Market Context |

|---|---|---|---|

| Ophthalmic Surgeons & Surgical Centers | Advanced surgical equipment, implantable lenses, consumables for procedures. | Cutting-edge technology, high-quality implants, comprehensive surgical solutions. | Aging population driving demand for cataract and refractive surgeries. |

| Optometrists & Ophthalmologists | Contact lenses, lens care solutions, dry eye treatments, diagnostic tools. | Broad product portfolio (e.g., DAILIES TOTAL1, PRECISION1), innovative treatments, practice support. | Increasing prevalence of dry eye and demand for multifocal contact lenses. |

| Patients with Eye Conditions | Restoration or enhancement of vision, management of chronic conditions. | Wide range of products for cataracts, glaucoma, refractive errors, and dry eye. | Global vision impairment affecting billions, with significant unmet needs. |

| Hospitals & Clinics | Surgical equipment, consumables, efficient operations, patient care quality. | Integrated solutions, training, technical support, next-generation platforms. | Investment in advanced surgical technologies for improved outcomes and efficiency. |

Cost Structure

A substantial part of Alcon's expenses is dedicated to Research and Development, underscoring its focus on pioneering new solutions in eye care. The company has demonstrated this commitment by investing more than $6 billion in innovation since 2019, with R&D expenditures exceeding $876 million in 2024 alone.

These significant investments fuel crucial activities such as conducting extensive clinical trials, advancing the development of new products, and driving technological progress. This ensures Alcon remains at the forefront of the eye care industry, maintaining its competitive advantage through continuous innovation.

Alcon's manufacturing and production costs are a significant component of its business model, largely due to its internal production of about 90% of its product portfolio. These costs encompass raw materials, labor, and overhead across its 17 global manufacturing facilities.

In 2023, Alcon reported Cost of Sales of $4.5 billion, reflecting the substantial investment in its internal manufacturing operations. The company actively pursues efficiency and optimization strategies to control these expenditures.

Key initiatives aimed at cost reduction include improving energy efficiency and minimizing waste throughout the production process. These efforts directly contribute to managing the overall cost structure and enhancing profitability.

Sales, General, and Administrative (SG&A) expenses are a significant component of Alcon's cost structure, covering essential functions like marketing, sales force management, and distribution. These costs are crucial for driving product adoption and expanding the company's presence in global markets.

In 2024, Alcon's commitment to innovation and market penetration is reflected in its SG&A investments. For instance, the company's strategic focus on launching new ophthalmic surgical devices and expanding its contact lens portfolio necessitates substantial marketing and sales support. These efforts directly contribute to the operational costs within SG&A.

Furthermore, Alcon's growth strategy involves increasing its sales force, which naturally adds to these operational expenses. This investment in human capital is designed to enhance customer engagement and drive revenue growth, underscoring the direct link between sales force expansion and SG&A expenditure.

Regulatory and Compliance Costs

Alcon navigates a complex regulatory landscape, incurring significant costs for product approvals and ongoing compliance. This includes expenses related to the U.S. Food and Drug Administration (FDA) submissions and European Medicines Agency (EMA) clearances, essential for market access in key regions. For instance, obtaining FDA approval for a new medical device can cost hundreds of thousands to millions of dollars, depending on the device's complexity and the required clinical trials.

These expenditures are critical for ensuring the safety and efficacy of Alcon's ophthalmic products, from contact lenses to surgical equipment. Quality assurance systems and post-market surveillance also contribute to these costs, maintaining adherence to global standards like ISO 13485.

Key cost drivers within regulatory and compliance include:

- Research and Development for regulatory submissions: Costs associated with generating data for clinical trials and regulatory dossiers.

- Regulatory Affairs Personnel: Salaries and training for experts managing global compliance.

- Quality Management Systems: Investment in software, audits, and maintenance of quality processes.

- Post-Market Surveillance: Expenses for monitoring product performance and reporting adverse events.

Supply Chain and Logistics Costs, including Tariffs

Managing Alcon's extensive global supply chain involves significant expenses. These include costs for transporting goods, storing them in warehouses, and maintaining optimal inventory levels. These operational necessities are a core component of their cost structure.

Tariffs present a notable financial challenge for Alcon. The company anticipates an $80 million impact in 2025, largely due to tariffs affecting shipments between China and the U.S. This is a direct consequence of evolving trade policies.

Alcon is actively implementing strategies to mitigate these tariff-related cost increases. Their plan involves taking specific operational actions to offset the financial pressures arising from these trade barriers.

- Global Supply Chain Expenses: Transportation, warehousing, and inventory management represent substantial costs.

- Tariff Impact Projection: An estimated $80 million cost in 2025, primarily affecting China-related trade.

- Mitigation Strategies: Alcon is pursuing operational adjustments to counter these financial pressures.

Alcon's cost structure is heavily influenced by its significant investments in research and development, aiming to maintain its innovative edge in the eye care market. The company's commitment to R&D is evident in its substantial spending, with over $876 million allocated in 2024 alone to fuel new product development and clinical trials.

Manufacturing and production represent another major cost center, with Alcon producing approximately 90% of its product line internally. This necessitates considerable expenditure on raw materials, labor, and overhead across its global manufacturing sites, as reflected in its $4.5 billion Cost of Sales in 2023. Sales, General, and Administrative (SG&A) expenses are also substantial, supporting global marketing, sales force expansion, and distribution efforts essential for market penetration.

Navigating a complex regulatory environment adds further costs, including expenses for product approvals and ongoing compliance with bodies like the FDA and EMA. Additionally, the company faces significant supply chain costs, encompassing transportation, warehousing, and inventory management, with an anticipated $80 million impact from tariffs in 2025.

| Cost Category | 2023/2024 Data | Key Drivers |

| Research & Development | $876M+ (2024) | New product development, clinical trials, innovation |

| Cost of Sales (Manufacturing) | $4.5B (2023) | Raw materials, labor, overhead for internal production |

| SG&A | Ongoing investment | Marketing, sales force, distribution, market expansion |

| Regulatory & Compliance | Significant expenditure | Product approvals (FDA, EMA), quality systems |

| Supply Chain & Tariffs | $80M tariff impact (2025 projection) | Logistics, warehousing, inventory, trade policies |

Revenue Streams

Alcon's surgical product sales are a significant revenue engine, encompassing implantable devices like intraocular lenses (IOLs), essential surgical consumables, and advanced ophthalmic equipment. This segment is fundamental to the company's financial performance.

In the first quarter of 2025, Alcon reported surgical net sales of $1.3 billion. This performance was bolstered by robust growth in its advanced technology IOLs, particularly within international markets, underscoring the global demand for their innovative surgical solutions.

Alcon generates significant revenue from its Vision Care segment, which includes the sale of contact lenses and a variety of ocular health products. This segment's offerings cater to a broad range of consumer needs, from vision correction to managing conditions like dry eye and maintaining contact lens hygiene.

In the first quarter of 2025, Alcon's Vision Care net sales reached $1.1 billion. This performance was bolstered by a combination of innovative product introductions and effective pricing strategies. For instance, the launch of PRECISION7 has been a key driver of growth within this vital business area.

Alcon generates recurring revenue through the continuous sale of consumables essential for its surgical equipment, like phacoemulsification and vitreoretinal products. This ongoing demand for disposable items used in procedures creates a predictable income flow.

Beyond consumables, Alcon also earns revenue from providing crucial services. These include regular maintenance for its surgical devices and offering technical support to healthcare professionals, ensuring equipment longevity and operational efficiency.

For instance, in 2023, Alcon's Surgical segment, heavily reliant on these aftermarket sales, reported net sales of $4.4 billion, highlighting the significant contribution of consumables and services to its overall business performance.

Geographic Market Expansion

Alcon's revenue growth is significantly boosted by its strategic expansion into high-growth market segments and emerging economies. For instance, India represents a key focus area, experiencing increasing demand for sophisticated eye care solutions. The company is actively launching a diverse range of products in India, anticipating that heightened consumer awareness and improving economic conditions will translate into robust sales figures. This deliberate global market penetration is a substantial contributor to Alcon's overall revenue generation.

This geographic expansion strategy is supported by tangible market data. In 2023, Alcon reported that its Surgical segment, which benefits greatly from emerging market penetration, saw strong performance. The company's commitment to these regions is evident in its product rollout plans, aiming to capture market share as disposable incomes rise and access to advanced healthcare increases. This approach diversifies revenue streams and taps into previously underserved populations.

- Expansion into India: Alcon is strategically rolling out multiple products in India, capitalizing on rising demand for advanced eye care.

- Driving Factors: Increased consumer awareness and rising income levels in emerging markets are key drivers for Alcon's sales growth.

- Global Footprint Contribution: The company's expanding global presence, particularly in high-growth regions, plays a significant role in its overall revenue.

- 2023 Performance Indicators: The Surgical segment, a beneficiary of emerging market expansion, demonstrated strong performance in 2023, underscoring the success of this strategy.

Innovation and New Product Launches

Alcon's revenue growth is significantly propelled by its commitment to innovation and the introduction of new products. These launches are strategically designed to capture new market segments and accelerate sales. For instance, the introduction of products like UNITY VCS, PanOptix Pro, Voyager, and SYSTANE Pro Preservative-Free are key drivers for the company's performance, particularly expected to boost sales in the latter half of 2025 and into the future.

These new product introductions are not just about expanding the product portfolio; they represent Alcon's strategy to gain a competitive edge and drive top-line growth. By consistently bringing advanced solutions to market, Alcon aims to meet evolving customer needs and solidify its position as an industry leader. This focus on groundbreaking innovations is a core element of their revenue stream generation.

- New Product Introductions: Alcon actively launches innovative products to drive revenue.

- Key Innovations: Examples include UNITY VCS, PanOptix Pro, Voyager, and SYSTANE Pro Preservative-Free.

- Market Share Capture: These new offerings are designed to attract new customers and increase market penetration.

- Sales Acceleration: Product launches are a critical strategy for boosting sales performance, with significant impact anticipated from mid-2025 onwards.

Alcon's revenue streams are primarily driven by its two core segments: Surgical and Vision Care. The Surgical segment generates income from implantable lenses, surgical equipment, and consumables, while Vision Care focuses on contact lenses and ocular health products. The company also benefits from recurring revenue through service agreements and maintenance for its surgical devices.

In the first quarter of 2025, Alcon reported strong net sales, with the Surgical segment reaching $1.3 billion and Vision Care contributing $1.1 billion. This performance reflects the broad appeal and consistent demand for Alcon's diverse product offerings across both segments.

Alcon's strategy of expanding into emerging markets, such as India, is a key revenue driver. The company is actively introducing a range of products in these regions, anticipating growth fueled by increasing consumer awareness and rising disposable incomes. This geographic diversification is crucial for sustained revenue generation.

Innovation is another significant pillar of Alcon's revenue strategy. The launch of new products like UNITY VCS and PanOptix Pro is expected to further boost sales, particularly from mid-2025 onwards, as these advanced solutions capture new market segments and enhance competitive positioning.

| Segment | Q1 2025 Net Sales (USD billions) | Key Product Examples | Revenue Drivers |

|---|---|---|---|

| Surgical | 1.3 | Intraocular Lenses (IOLs), Surgical Consumables, Ophthalmic Equipment | New product launches, emerging market expansion, consumables and services |

| Vision Care | 1.1 | Contact Lenses, Ocular Health Products | Product innovation, pricing strategies, consumer demand |

Business Model Canvas Data Sources

The Alcon Business Model Canvas is informed by a blend of internal financial reports, market research on ophthalmic trends, and competitive analysis of industry players. These diverse data sources ensure a comprehensive and accurate representation of Alcon's strategic approach.