Alcon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alcon Bundle

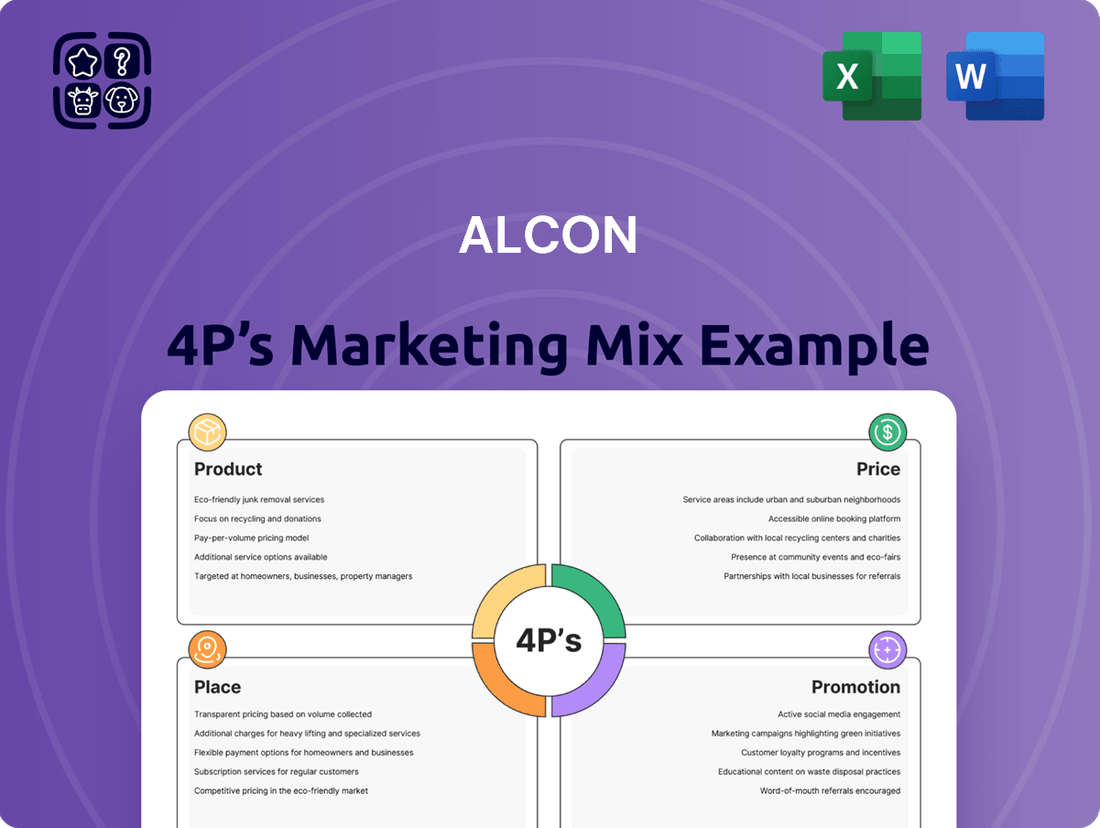

Discover how Alcon masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the eye care market. This analysis reveals the intricate connections between their innovative product portfolio, competitive pricing, strategic distribution, and impactful promotional campaigns.

Go beyond this glimpse and unlock the full, actionable insights within our comprehensive Alcon 4Ps Marketing Mix Analysis. It’s your shortcut to understanding market leadership and applying proven strategies to your own business endeavors.

Product

Alcon's surgical portfolio is robust, featuring advanced intraocular lenses (IOLs) like Clareon PanOptix Pro and Vivity for cataract procedures. These IOLs are designed to offer improved visual acuity and range of vision for patients.

The company also supplies essential equipment and consumables for vitreoretinal surgeries. A key development is the UNITY Vitreoretinal Cataract System (VCS), which gained FDA clearance in 2024 and is slated for a wider commercial rollout in 2025, signaling Alcon's commitment to innovation in surgical technology.

Alcon's contact lens product strategy centers on a broad and innovative portfolio designed to meet diverse vision needs. This includes daily and monthly disposables, alongside specialized lenses addressing astigmatism and presbyopia, catering to a wide patient base.

A key recent development is the U.S. market introduction of PRECISION7, a one-week replacement lens, with widespread commercial availability commencing in early 2025. This launch signifies Alcon's commitment to filling market gaps with advanced solutions.

PRECISION7, featuring ACTIV-FLO technology, is strategically positioned to capture a substantial market segment. The lens aims to deliver enhanced comfort and consistently clear vision, leveraging technological advancements to improve patient outcomes and satisfaction.

Alcon's vision care portfolio for ocular health is robust, featuring the highly successful SYSTANE line of artificial tears. This family of products, including the recently launched SYSTANE PRO Preservative-Free in 2025, demonstrates Alcon's commitment to advanced hydration solutions and continued market growth in the dry eye segment.

Further strengthening its prescription offerings, Alcon introduced TRYPTYR (acoltremon ophthalmic solution) 0.003% in the U.S. in July 2025. This innovative treatment targets dry eye disease by actively stimulating the body's natural tear production, offering a novel therapeutic approach for patients.

Pipeline and Innovation

Alcon is heavily invested in its future, dedicating 8%-10% of its annual sales to research and development to fuel a strong pipeline. This commitment is set to translate into a significant wave of new product launches starting in 2025.

Key innovations on the horizon include next-generation intraocular lenses (IOLs) and advanced therapeutic solutions. Digital platforms like Unity VCS and Unity CS are also a major focus, aiming to enhance efficiency within clinics and operating rooms.

The company is strategically bolstering its therapeutic portfolio through acquisitions. The recent additions of LumiThera and Aurion Biotech are particularly noteworthy, expanding Alcon's reach into critical areas such as dry age-related macular degeneration (AMD) and corneal endothelial disease.

- R&D Investment: 8%-10% of annual sales.

- Upcoming Launches: Focus on 2025 and beyond.

- Digital Health Focus: Unity VCS and Unity CS for clinic/OR efficiency.

- Strategic Acquisitions: LumiThera (dry AMD) and Aurion Biotech (corneal disease).

Design and Technology

Alcon's product design and technology are deeply rooted in innovation, aiming to address critical patient needs with advanced solutions. For instance, their contact lenses feature ACTIV-FLO technology, which significantly boosts comfort during wear. This focus on user experience is a hallmark of their development process.

The company actively integrates cutting-edge technology to enhance product performance and patient outcomes. A prime example is the Clareon PanOptix Pro IOL, engineered for superior light utilization and minimal light scatter, leading to improved visual quality for cataract patients. Alcon reported strong growth in its Surgical segment in 2023, reaching $4.5 billion in sales, underscoring the market's reception of these advanced products.

- Enhanced Comfort: ACTIV-FLO technology in contact lenses.

- Superior Visuals: Clareon PanOptix Pro IOL with best-in-class light utilization.

- Integrated Solutions: Unity platform for seamless surgical capabilities.

- Digital Innovation: Adi platform within Alcon Vision Suite for efficiency and connected care.

Alcon's product strategy emphasizes innovation across its surgical and vision care segments, aiming to provide advanced solutions for a wide range of ocular conditions. The company's commitment to R&D, representing 8%-10% of annual sales, fuels a pipeline of next-generation products, including advanced IOLs and therapeutic treatments. Recent launches and upcoming innovations, such as PRECISION7 contact lenses and TRYPTYR for dry eye, underscore this focus on addressing unmet patient needs and expanding market reach.

| Product Category | Key Products/Technologies | Recent/Upcoming Developments | Segment Performance (2023) |

|---|---|---|---|

| Surgical (IOLs) | Clareon PanOptix Pro, Vivity | UNITY Vitreoretinal Cataract System (VCS) FDA clearance (2024), wider rollout 2025 | Surgical segment sales: $4.5 billion |

| Surgical (Equipment) | UNITY Vitreoretinal Cataract System (VCS) | Focus on clinic/OR efficiency with Unity VCS and Unity CS digital platforms | |

| Vision Care (Contact Lenses) | PRECISION7, ACTIV-FLO technology | U.S. market introduction of PRECISION7 (one-week replacement), widespread availability early 2025 | |

| Vision Care (Ocular Health) | SYSTANE line (artificial tears), TRYPTYR (acoltremon ophthalmic solution) | SYSTANE PRO Preservative-Free launch (2025), TRYPTYR U.S. launch July 2025 | |

| Therapeutic Portfolio | Acquisitions of LumiThera and Aurion Biotech | Expansion into dry AMD and corneal endothelial disease |

What is included in the product

This analysis provides a comprehensive deep dive into Alcon's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers.

It offers a complete breakdown of Alcon’s marketing positioning, grounded in actual brand practices and competitive context.

Simplifies the complex Alcon 4Ps analysis into actionable insights, alleviating the pain of information overload for strategic decision-making.

Provides a clear, concise framework for understanding Alcon's marketing strategy, easing the burden of detailed market research for busy executives.

Place

Alcon's global distribution network is a cornerstone of its market presence, reaching over 140 countries. This expansive reach ensures their surgical and vision care products are available to a diverse patient population across the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Alcon heavily relies on its direct sales force to build strong relationships with ophthalmologists and optometrists. This direct channel allows for in-depth product education and training, crucial for the adoption of new treatments like TRYPTYR for dry eye. In 2024, Alcon's sales force engagement was a significant driver in introducing innovative solutions to approximately 90% of target ECPs.

Alcon is significantly expanding its digital footprint to improve how eye care professionals (ECPs) interact with their products and services. This digital push enhances accessibility and operational efficiency across the board.

The MARLO platform exemplifies this strategy, acting as a central hub for ECPs to manage their inventory and orders. Through MARLO, Alcon streamlines the procurement of contact lenses, care products, and other over-the-counter items, making it easier for practices to stock what they need.

MARLO also provides ECPs with access to a suite of expanded digital tools and resources, further integrating Alcon’s offerings into daily practice workflows. This digital ecosystem aims to foster stronger relationships and provide greater value beyond traditional product sales.

Supply Chain and Logistics

Alcon prioritizes an efficient supply chain to ensure its surgical and vision care products reach customers precisely when and where they are needed. This focus on operational excellence is crucial for maintaining market presence and customer satisfaction.

The company actively manages inventory levels and optimizes logistics networks to support its diverse product portfolio. This strategic approach helps to minimize stockouts and ensure timely delivery, a critical factor in the healthcare sector.

Alcon's robust supply chain and commitment to operational efficiency directly translate into enhanced customer convenience and maximized sales potential across its global operations. For instance, in 2023, Alcon reported a 3% increase in its Surgical segment revenue, partly driven by strong product availability and efficient distribution.

- Inventory Management: Alcon employs advanced forecasting and inventory control systems to balance product availability with holding costs.

- Logistics Optimization: The company leverages partnerships and technology to streamline transportation and warehousing, ensuring efficient product flow.

- Global Reach: Alcon's supply chain infrastructure supports its presence in over 140 countries, adapting to regional demands and regulatory landscapes.

- Customer Service: Efficient logistics directly impact customer satisfaction by ensuring reliable access to essential medical devices and solutions.

Strategic Market Presence

Alcon strategically builds its market presence by targeting high-potential segments and adapting to local market needs. A prime example is their impressive market share growth in China's Advanced Technology Intraocular Lens (ATIOL) sector, demonstrating effective penetration into key emerging markets. This focused approach ensures resources are directed towards areas with the greatest opportunity for expansion and impact.

Looking ahead, Alcon is poised for significant market engagement with the upcoming broad commercial rollouts of innovative surgical platforms. The Unity VCS surgical system, slated for various market introductions in 2025, is a key initiative designed to bolster their position in the surgical equipment landscape. This proactive launch strategy underscores their commitment to delivering cutting-edge solutions and capturing market leadership.

- Targeted Growth: Alcon's focus on key growth areas like the ATIOL market in China has yielded substantial market share gains.

- Regional Responsiveness: The company actively tailors its market entry and expansion strategies to meet diverse regional demands.

- 2025 Product Launches: Preparations are underway for the widespread commercial launch of new surgical systems, including Unity VCS, in multiple global markets during 2025.

- Innovation-Driven Presence: Alcon leverages technological advancements and new product introductions to solidify and expand its strategic market footprint.

Alcon's place strategy focuses on broad accessibility and targeted market penetration. Their extensive global distribution network spans over 140 countries, ensuring their surgical and vision care products reach diverse patient populations. This expansive reach is supported by a robust supply chain, prioritizing efficient logistics and inventory management to guarantee timely product delivery, as evidenced by a 3% revenue increase in their Surgical segment in 2023, partly attributed to strong product availability.

The company also enhances its place through a growing digital footprint, exemplified by the MARLO platform, which streamlines inventory and order management for eye care professionals. This digital integration aims to improve accessibility and operational efficiency, fostering stronger relationships with customers by providing value beyond traditional sales.

| Metric | Value | Year | Impact |

|---|---|---|---|

| Global Reach | 140+ Countries | Ongoing | Broad market access |

| Surgical Segment Revenue Growth | 3% | 2023 | Driven by product availability |

| Digital Platform Usage (MARLO) | Increasing | 2024 | Enhanced ECP interaction |

| Targeted Market Penetration (China ATIOL) | Significant Growth | Ongoing | Strategic expansion |

What You Preview Is What You Download

Alcon 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Alcon 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You'll gain immediate access to this ready-to-use document, empowering your marketing decisions.

Promotion

Alcon's commitment to professional education is a cornerstone of its marketing strategy, particularly within the Professional Education and Training aspect of its 4Ps. They actively engage eye care professionals (ECPs) by offering comprehensive training on their advanced products and surgical methods. This investment ensures ECPs are proficient with Alcon's latest innovations, fostering adoption and optimal patient outcomes.

At major industry gatherings like ASCRS 2025, Alcon hosts educational symposiums and hands-on demonstrations, showcasing cutting-edge technologies such as the UNITY VCS|CS surgical systems. These events facilitate peer-to-peer learning and direct engagement with Alcon's experts, reinforcing the value proposition of their offerings.

Furthermore, Alcon deploys specialized sales teams to support ECPs, as seen with the launch of TRYPTYR for dry eye treatment. These teams provide crucial resources and ongoing support, building strong relationships and ensuring ECPs can effectively integrate new treatments into their practices, driving sales and market penetration.

Alcon actively engages its audience through digital platforms, offering interactive websites and patient support tools. Their MARLO digital solution streamlines online ordering and provides valuable resources, enhancing customer experience.

New product introductions, such as TRYPTYR, are supported by comprehensive ECP campaigns. These campaigns include engaging videos and dedicated websites, ensuring broad reach and detailed product information for healthcare professionals and patients.

Social media plays a crucial role in Alcon's digital strategy, utilizing platforms like Facebook and LinkedIn. These channels facilitate direct connections with both healthcare professionals and patients, fostering community and disseminating important updates.

Alcon executes robust promotional campaigns for new product introductions, aiming to build strong market awareness and encourage uptake. The successful rollout of PRECISION7 contact lenses in the United States, for example, was backed by substantial marketing initiatives emphasizing its advanced comfort and distinctive weekly replacement cycle.

Furthermore, the market introduction of TRYPTYR was accompanied by a focused awareness drive specifically targeting both eye care professionals (ECPs) and consumers, ensuring broad reach and understanding of the product's benefits.

Industry Conferences and Events

Alcon's promotional efforts heavily leverage participation in significant industry gatherings. For instance, their presence at the J.P. Morgan Healthcare Conference and SECO International serves as a vital channel to showcase new product developments and share critical clinical trial findings. These events are crucial for direct engagement with influential groups including financial analysts, healthcare professionals, and potential business partners.

These conferences offer Alcon a prime opportunity to:

- Unveil cutting-edge innovations and technologies

- Present robust clinical data supporting product efficacy

- Foster direct dialogue with key opinion leaders and decision-makers

- Strengthen brand visibility within the global eye care community

In 2024, Alcon continued its active participation in such forums, aiming to reinforce its market position and communicate its strategic direction to a broad audience of investors and medical professionals. The company's investment in these promotional activities underscores their importance in driving market awareness and building relationships within the ophthalmology and optometry sectors.

Public Relations and Corporate Communications

Alcon leverages public relations to effectively communicate its financial performance and strategic initiatives, such as significant product approvals and acquisitions. This proactive approach aims to bolster its corporate reputation and foster trust with stakeholders.

Key communications often highlight achievements like the reported 2024 sales growth, which saw Alcon's revenue reach $9.4 billion, and the anticipated launch of innovative products slated for 2025. These announcements underscore Alcon's commitment to advancing eye care solutions and solidifying its market leadership.

- Financial Transparency: Alcon regularly issues press releases detailing quarterly and annual financial results, providing investors with clear insights into the company's performance.

- Strategic Milestones: Communications emphasize significant events such as regulatory approvals for new ophthalmic devices and pharmaceuticals, reinforcing innovation.

- Investor Relations: Dedicated investor relations efforts ensure consistent dialogue with shareholders, addressing performance, strategy, and future outlook.

- Corporate Image: Public relations activities are designed to cultivate a positive corporate image, highlighting Alcon's contributions to vision health and its ethical business practices.

Alcon's promotional strategy focuses on educating eye care professionals (ECPs) and building brand awareness through diverse channels. They emphasize professional training, industry event participation, and digital engagement to showcase their innovative products and surgical techniques. This multi-faceted approach aims to drive adoption and foster strong relationships within the eye care community.

Price

Alcon utilizes value-based pricing for its innovative surgical products, like advanced technology intraocular lenses (ATIOLs) and the Unity VCS surgical system. This strategy aligns pricing with the demonstrable benefits, including superior patient outcomes and increased efficiency for eye care professionals.

Alcon navigates the competitive contact lens landscape by strategically pricing its innovative products. For instance, while the launch of PRECISION7 highlights technological advancements, Alcon also recognizes the importance of cost-effectiveness for consumers, particularly influencing the choice between reusable and daily disposable lenses. This dual approach aims to capture both premium and value-conscious segments of the market.

Alcon's pricing policies are designed to cater to diverse market segments and distribution channels, reflecting the varied needs of healthcare providers and patients. While specific discount structures remain proprietary, typical industry practices suggest Alcon likely employs volume-based discounts for significant institutional purchasers and group purchasing organizations to incentivize larger orders and foster long-term partnerships.

The company's pricing strategy for its ophthalmic surgical equipment and vision care products would also consider factors like product innovation, competitive landscape, and the perceived value delivered to both clinicians and end-users. For instance, the advanced features of their latest surgical platforms, such as the NGENUITY 3D Visualization System, would command a premium, offset by potential bundled service agreements or educational support.

In 2023, Alcon reported net sales of $9.4 billion, with their Surgical segment contributing $4.4 billion. This performance indicates a robust market presence, suggesting their pricing and discount strategies are effective in driving sales across their extensive product portfolio, from intraocular lenses to advanced diagnostic equipment.

Reimbursement and Market Access Considerations

For Alcon's prescription products and surgical devices, securing favorable reimbursement and market access is paramount to pricing strategies. The company actively generates robust clinical and economic data to underscore product value, aiming to influence third-party payor decisions and facilitate broader adoption. This focus is critical, as coverage and reimbursement methodologies directly impact sales volumes and market penetration.

Alcon's approach involves demonstrating a clear return on investment for healthcare systems and patients. For instance, by showcasing how a new surgical device can reduce hospital stays or improve patient outcomes, they build a case for favorable reimbursement. This data-driven strategy is essential in navigating the complex landscape of healthcare economics.

- Value Demonstration: Alcon emphasizes clinical efficacy and economic benefits to payers.

- Market Access Strategy: Proactive engagement with payors to secure favorable reimbursement terms.

- Data-Driven Approach: Utilizing real-world evidence and health economic outcomes research (HEOR) to support pricing and access.

- Impact on Sales: Reimbursement directly influences product adoption rates and overall revenue generation for Alcon's portfolio.

Financial Performance and Shareholder Value

Alcon's pricing strategies are directly linked to its financial health, influencing both top-line revenue and bottom-line earnings per share. The company demonstrated significant sales momentum in 2024, achieving $9.8 billion in full-year sales, and projects continued growth with 2025 revenues anticipated to be between $10.2 billion and $10.4 billion. This performance suggests that Alcon's pricing is competitive and resonating with the market.

The company's commitment to enhancing shareholder value is evident in its strategic use of share repurchase programs, which are underpinned by strong cash flow generation. This approach not only signals financial strength but also aims to boost earnings per share by reducing the number of outstanding shares.

- 2024 Full-Year Sales: $9.8 billion

- Projected 2025 Revenue: $10.2 billion to $10.4 billion

- Impact of Pricing: Drives revenue growth and affects earnings per share.

- Shareholder Value Focus: Supported by share repurchases and robust cash generation.

Alcon's pricing strategy is deeply intertwined with its product innovation and market positioning. For their advanced surgical offerings, like the NGENUITY 3D Visualization System, a premium pricing model is employed, reflecting the enhanced capabilities and value delivered to surgeons. This is further supported by robust clinical data and economic outcome research, which are crucial for securing favorable reimbursement from payors, directly impacting market access and sales volumes.

| Product Category | Pricing Strategy | Key Considerations |

|---|---|---|

| Surgical Innovations (e.g., ATIOLs, NGENUITY) | Value-Based Pricing | Clinical efficacy, patient outcomes, surgeon efficiency, reimbursement landscape |

| Contact Lenses (e.g., PRECISION7) | Competitive & Value-Conscious | Technological advancement, cost-effectiveness, consumer choice |

| Overall Portfolio | Segmented & Channel-Specific | Volume discounts for institutions, proprietary discount structures |

4P's Marketing Mix Analysis Data Sources

Our Alcon 4P's Marketing Mix Analysis is grounded in comprehensive data, including Alcon's official investor relations materials, product launch announcements, and detailed pricing structures. We also incorporate insights from reputable industry reports and competitive landscape analyses.