Aisin Seiki SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Aisin Seiki, a global leader in automotive components, boasts significant strengths in its technological innovation and diverse product portfolio. However, the company faces potential threats from evolving industry trends and intense competition, demanding a proactive strategic approach. Understanding these dynamics is crucial for any stakeholder looking to navigate the automotive landscape.

Want the full story behind Aisin Seiki's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aisin Corporation showcases an extensive array of automotive components, covering critical areas like drivetrain, braking, chassis, body, and engine systems. This comprehensive portfolio solidifies its standing as a significant global supplier, capable of serving diverse vehicle segments and adapting to shifts towards electrified powertrains. Aisin's ability to supply major original equipment manufacturers (OEMs) worldwide highlights its market leadership and commitment to high-quality standards.

Aisin Seiki's deep integration within the Toyota Group is a cornerstone strength. As a long-standing subsidiary, it benefits from a secured and substantial customer base, guaranteeing consistent demand for its diverse automotive components.

This close relationship fosters collaborative innovation, particularly in emerging areas like eAxles and electrification. For instance, in fiscal year 2023, Aisin's revenue from its automotive segment, heavily influenced by Toyota's production volumes, reached ¥2,918.3 billion, underscoring the financial stability derived from this affiliation.

The affiliation also grants Aisin significant leverage and preferential access within the global automotive supply chain. This strategic advantage allows for more efficient resource allocation and a stronger negotiating position, contributing to its overall competitive edge.

Aisin's unwavering dedication to innovation and research and development is a cornerstone of its strength. The company consistently channels a substantial portion of its revenue, often exceeding 5% in recent years, into R&D initiatives. This significant investment fuels the creation of groundbreaking technologies, particularly in rapidly evolving sectors like automotive electronics and powertrain systems.

This commitment is clearly demonstrated by Aisin's pioneering work in advanced driver-assistance systems (ADAS) and electric vehicle (EV) components. Their development of highly integrated eAxle systems, such as the innovative 'Xin1' eAxle, showcases a proactive strategy to address the future demands of mobility. Furthermore, Aisin is actively integrating artificial intelligence (AI) and the Internet of Things (IoT) to enhance the efficiency and intelligence of its manufacturing processes, solidifying its position as a technology leader.

Global Presence and Strategic Expansion

Aisin Seiki boasts an impressive global footprint, operating across 17 countries with 36 distinct locations. This extensive network underpins its robust manufacturing and sales capabilities worldwide.

The company is strategically focused on expanding its presence in key emerging markets, notably in Southeast Asia. These expansion efforts include the development of new manufacturing facilities, signaling a commitment to growth in these dynamic regions. For instance, Aisin's investment in new plants in Thailand and Indonesia highlights this strategic push as of early 2024.

This expansive global presence allows Aisin to effectively tailor its product offerings to meet the specific demands of diverse local markets. It also significantly strengthens the company's competitive standing by enabling it to navigate and capitalize on opportunities in various international landscapes.

Aisin's commitment to global reach is further evidenced by its consistent investment in existing facilities and exploration of new market entries, ensuring its competitive edge in the automotive supply chain.

Strong Focus on Sustainability and Carbon Neutrality

Aisin Seiki demonstrates a robust commitment to sustainability, setting ambitious targets for carbon neutrality. They aim to achieve carbon neutrality in their production processes by 2035 and across their entire value chain by 2050, showcasing a long-term vision for environmental responsibility.

Their strategic initiatives focus on tangible actions such as reducing greenhouse gas emissions, significantly increasing the utilization of renewable energy sources, and pioneering sustainable manufacturing methods and materials. These efforts are central to their operational strategy and product development.

This dedication has not gone unnoticed, as evidenced by their inclusion on CDP's prestigious 'A List' for climate change performance. This recognition underscores the effectiveness and leadership of their environmental initiatives in the industry.

- Carbon Neutrality Targets: Production by 2035, full lifecycle by 2050.

- Key Initiatives: Greenhouse gas emission reduction, renewable energy adoption, sustainable process development.

- Recognition: Named to CDP's 'A List' for climate change.

Aisin's strengths lie in its comprehensive product portfolio, covering essential automotive systems like drivetrain, braking, and chassis. This breadth allows it to serve diverse OEM needs and adapt to evolving market demands, particularly in electrification. Its deep integration within the Toyota Group provides a stable customer base and fosters collaborative innovation, as seen in the ¥2,918.3 billion automotive segment revenue in FY2023.

Aisin is a clear leader in R&D, consistently investing over 5% of revenue into developing advanced technologies such as eAxles and ADAS. This commitment is further evidenced by its global operational network spanning 17 countries and strategic expansion into emerging markets like Southeast Asia, including new facilities in Thailand and Indonesia as of early 2024.

The company also demonstrates a strong commitment to sustainability, targeting carbon neutrality by 2035 for production and 2050 for its value chain. Recognized on CDP's 'A List' for climate change performance, Aisin actively pursues greenhouse gas emission reductions and increased renewable energy use.

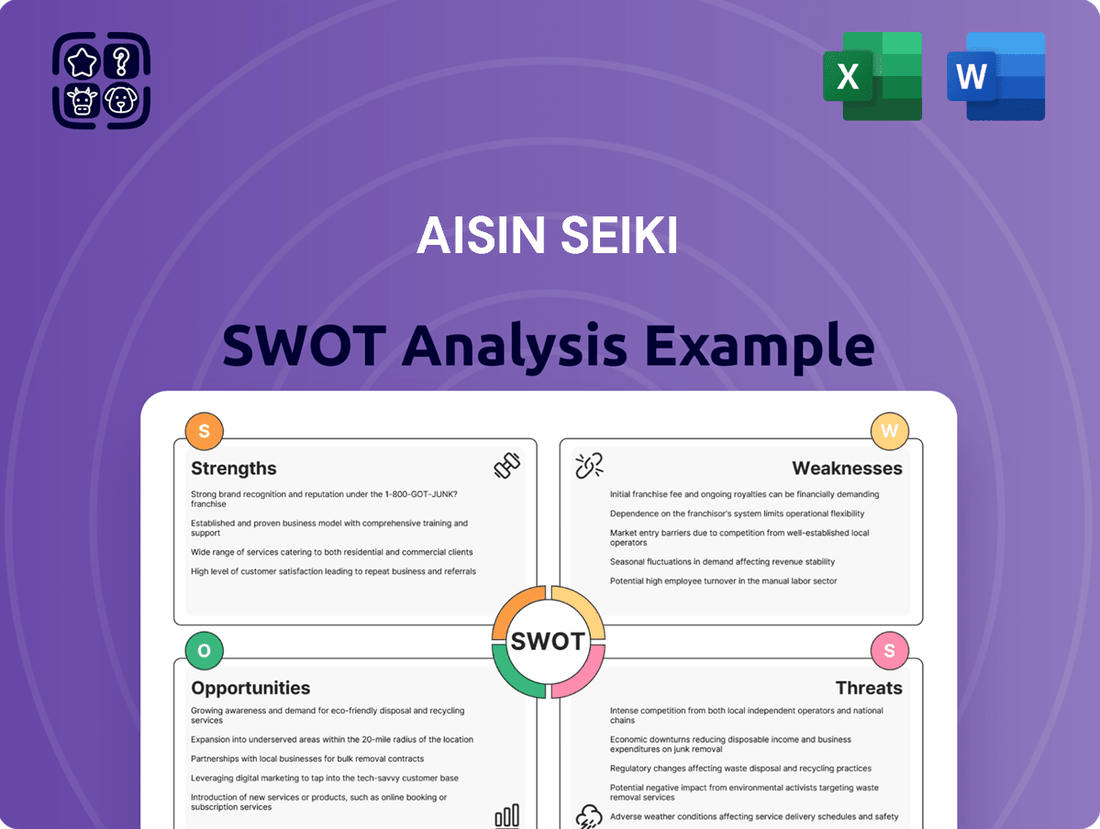

What is included in the product

Analyzes Aisin Seiki’s competitive position through key internal and external factors, detailing its robust product portfolio and technological innovation against industry shifts and competitive pressures.

Aisin Seiki's SWOT analysis identifies key competitive advantages and areas for improvement, enabling targeted strategies to mitigate risks and capitalize on opportunities.

Weaknesses

Aisin Seiki's significant reliance on the automotive industry, while a historical strength, is also a notable weakness. This dependence makes the company vulnerable to the sector's inherent cyclicality and the rapid pace of technological change, particularly the ongoing transition to electric vehicles (EVs). For instance, a global economic downturn leading to reduced vehicle sales, as seen in periods like early 2020 due to the pandemic, directly impacts Aisin's order volumes and financial performance.

The automotive supply chain is also susceptible to disruptions, whether from geopolitical events, natural disasters, or component shortages. Aisin's business model is deeply intertwined with the production schedules of major automakers, meaning any hiccup in that chain can have immediate and substantial consequences on its revenue. For example, semiconductor shortages experienced throughout 2021 and 2022 significantly hampered global vehicle production, directly affecting suppliers like Aisin.

Furthermore, the accelerating shift towards EVs presents a dual challenge for Aisin. While it's an opportunity to develop new powertrain components, it also necessitates significant investment in retooling and adapting existing manufacturing capabilities. Companies that fail to pivot quickly to EV-specific technologies risk becoming obsolete, and Aisin must ensure its product portfolio remains relevant in this evolving landscape. Its 2023 financial reports, while showing resilience, still highlight the need for strategic adaptation in this area.

Aisin Seiki faces intense competition in the automotive components sector, a market characterized by many established global suppliers and agile new entrants. Major rivals such as Robert Bosch, Continental AG, Denso Corporation, and Magna International consistently challenge Aisin's market position through aggressive R&D and pricing strategies. For instance, in 2024, the automotive supplier industry saw significant investment in electrification and autonomous driving technologies, areas where competitors are also heavily focused, demanding substantial capital expenditure from Aisin. This competitive landscape necessitates continuous innovation and stringent cost control measures to prevent erosion of market share and maintain healthy profit margins.

Aisin Seiki's reliance on essential materials like aluminum and steel makes it susceptible to price swings. For instance, aluminum prices saw significant volatility in early 2024, with LME prices fluctuating between $2,100 and $2,400 per metric ton. This directly increases Aisin's production expenses.

The company faces a hurdle in fully transferring these higher input costs to original equipment manufacturers (OEMs). In the intensely competitive automotive supply chain, OEMs often resist price increases, squeezing Aisin's profit margins and impacting its financial performance. This dynamic was evident throughout 2024 as the automotive industry navigated supply chain challenges and inflationary pressures.

Complexity of Shifting Business Models for Electrification

Aisin's shift from traditional internal combustion engine (ICE) components to electric vehicle (EV) specific parts, such as eAxles, necessitates significant capital outlay. This transition demands substantial investment in research and development, alongside the costly retooling of existing manufacturing plants and the retraining of its extensive workforce. For instance, the automotive industry globally is projected to invest over $1.2 trillion in EVs and batteries through 2030, highlighting the scale of Aisin's undertaking.

This complete overhaul, often termed a 'full model change,' is inherently complex. It requires a thorough review and potential restructuring of Aisin's entire business portfolio to align with the evolving automotive landscape. Such a strategic re-evaluation is a challenging and capital-intensive endeavor for any established manufacturer.

- R&D Investment: Significant funds are needed to develop new EV technologies.

- Manufacturing Retooling: Converting production lines for EV components is a major expense.

- Workforce Retraining: Upskilling employees for new manufacturing processes is critical.

- Portfolio Review: Assessing and adapting the product mix to focus on electrification is complex.

Geopolitical and Trade Policy Risks

Global geopolitical tensions and evolving trade policies, like tariffs and sanctions, pose a significant threat to Aisin's intricate international supply chains. For instance, the ongoing trade disputes between major economies could lead to increased costs for imported components and restricted access to key markets. This requires Aisin to be agile in its sourcing and sales strategies to mitigate potential disruptions.

Aisin must strategically adapt to these complexities to maintain its competitive edge. The company’s reliance on global manufacturing hubs and extensive distribution networks means that changes in trade agreements or the imposition of new tariffs can directly impact operational efficiency and profitability. For example, a sudden tariff on automotive parts in a major export market could necessitate costly adjustments to production locations or supplier bases.

- Supply Chain Vulnerability: Aisin's globalized operations are susceptible to disruptions from trade wars and political instability, potentially increasing logistics costs.

- Market Access Restrictions: Evolving trade policies can limit Aisin's ability to sell products in certain regions, impacting revenue streams.

- Increased Operational Costs: Tariffs on raw materials or finished goods can directly raise production expenses, squeezing profit margins.

- Strategic Realignment Needs: The company may need to invest in diversifying its manufacturing footprint or developing alternative sourcing strategies to counter geopolitical risks.

Aisin Seiki's deep entanglement with the automotive sector leaves it exposed to the industry's cyclical nature and rapid technological shifts, especially the move to electric vehicles (EVs). For example, a global economic slowdown, which reduced vehicle sales in early 2020 due to the pandemic, directly affected Aisin's order volumes. The company also faces significant competition from global rivals like Bosch and Denso, who are heavily investing in electrification, requiring Aisin to allocate substantial capital to R&D and manufacturing upgrades to remain competitive.

The company's profitability is further pressured by its inability to fully pass on rising material costs, such as fluctuating aluminum prices observed in early 2024, to automakers. This squeeze on margins necessitates stringent cost control and continuous innovation. Moreover, Aisin's global supply chains are vulnerable to geopolitical tensions and trade policies, which can escalate costs and restrict market access, demanding agile sourcing and strategic diversification of its manufacturing base.

Same Document Delivered

Aisin Seiki SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Aisin Seiki's key Strengths like its strong market position and technological innovation, its Weaknesses such as reliance on automotive sector demand, Opportunities in emerging markets and new technologies, and Threats from increased competition and economic downturns.

Opportunities

The accelerating global shift towards electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) offers a substantial growth avenue for Aisin. As the automotive industry pivots to electrification, demand for specialized components is surging. For instance, the global EV market was valued at approximately $380 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 18% through 2030, according to various market analyses.

Aisin's strategic focus on developing advanced eAxles, integrated electric units, and other EV-specific powertrain components places it advantageously to meet this escalating demand. The company's investment in these areas directly aligns with market trends, ensuring its product portfolio is relevant for next-generation vehicles.

Further strengthening this opportunity are Aisin's strategic collaborations. The joint venture with Mitsubishi Electric for EV components and the development of eAxles with Subaru are prime examples. These partnerships not only expand Aisin's technological capabilities but also secure its position as a key supplier in the rapidly evolving electric mobility landscape.

Aisin Seiki is actively growing its global aftermarket presence, aiming to be a complete provider of parts and services, not just for its own brands. This means offering a broader range of maintenance items like wiper blades, lubricants, and batteries, and even venturing into workshop equipment.

This strategic move into the aftermarket is poised to create new avenues for revenue. For instance, the global automotive aftermarket was projected to reach over $500 billion in 2024, indicating a substantial market to tap into.

By diversifying its product and service offerings, Aisin can also foster stronger customer loyalty. Customers appreciate having a single, reliable source for all their vehicle maintenance needs, from essential parts to specialized tools.

This expansion beyond original equipment manufacturing (OEM) allows Aisin to capture value throughout a vehicle's lifecycle, potentially increasing its overall market share and profitability in the automotive service sector.

Aisin can capitalize on the growing demand for advanced safety features by investing in ADAS and autonomous driving. This allows them to create intelligent, safety-boosting systems for the next generation of vehicles. For example, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $70 billion by 2028, presenting a significant growth avenue.

By utilizing their existing strengths in vehicle control and sensor technology, Aisin is well-positioned to offer solutions that improve both safety and efficiency. This directly addresses the increasing consumer and regulatory push towards smarter, more connected mobility. The increasing complexity of vehicle electronics, with ADAS components often representing a substantial portion of a vehicle's value, provides a clear opportunity for Aisin’s specialized offerings.

Leveraging Digital Transformation (DX) and AI/IoT Integration

Aisin's commitment to digital transformation, specifically integrating AI and IoT, offers a clear path to enhanced operational efficiency. This includes predictive maintenance, reducing downtime and costs, and speeding up new product development cycles. For instance, by leveraging AI in manufacturing, Aisin can pinpoint potential equipment failures before they occur, a significant improvement over reactive maintenance strategies. This proactive approach not only saves money but also ensures smoother production flow.

The company's focus on AI deployment across its manufacturing processes presents a substantial opportunity for cost reduction. By optimizing workflows and resource allocation through intelligent automation, Aisin can achieve leaner operations. This digital shift also accelerates its expansion into high-growth market segments, where data-driven insights are paramount for competitive advantage and the creation of new value propositions.

- Increased Efficiency: AI-driven predictive maintenance can reduce unplanned downtime by an estimated 20-30% in manufacturing environments.

- Cost Savings: Optimizing energy consumption and material usage through AI can lead to direct cost reductions in production.

- Accelerated Innovation: AI in product development can shorten design and testing phases, bringing new technologies to market faster.

- Data Monetization: Insights derived from IoT-enabled products and processes can unlock new revenue streams.

Diversification Beyond Automotive into Energy and Lifestyle Products

Aisin Seiki's deep-rooted expertise isn't confined solely to the automotive sector. The company has a significant presence and ongoing development in energy systems, housing solutions, and various lifestyle products, demonstrating a broad technological base. This existing diversification is a substantial opportunity to build resilience against the inherent cyclicality of the automotive market.

By strategically expanding its footprint in these non-automotive areas, Aisin can create more stable revenue streams and unlock new growth avenues. For instance, continued investment in sustainable energy, such as their work with perovskite solar cells, positions them well within the rapidly expanding clean energy market. This strategic shift strengthens their overall business portfolio.

- Diversified Revenue Streams: Aisin's non-automotive segments, including energy and lifestyle products, offer a buffer against automotive industry downturns.

- Growth in Sustainable Energy: Investments in areas like perovskite solar cells tap into the burgeoning global demand for renewable energy solutions.

- Leveraging Existing Expertise: Aisin can apply its core engineering and manufacturing capabilities to innovate and expand within these complementary sectors.

- Market Resilience: A broader business base reduces reliance on a single industry, enhancing overall financial stability and long-term viability.

The automotive industry's rapid shift towards electrification presents a significant opportunity for Aisin. As the global EV market, projected to exceed $1 trillion by 2030, continues its ascent, Aisin's focus on eAxles and integrated electric units positions it to capture substantial growth. Strategic partnerships, like the one with Mitsubishi Electric for EV components, further solidify its market standing and technological advancement in this critical sector.

Threats

Aisin Seiki, like many in the automotive sector, faces ongoing risks from supply chain disruptions and global geopolitical instability. For instance, the semiconductor shortage that began in late 2020 continued to impact automotive production throughout 2021 and 2022, with some analysts predicting lingering effects into 2024. These disruptions can directly translate into higher component costs and delayed deliveries for Aisin, affecting their production schedules and overall revenue.

The escalation of trade disputes and regional conflicts, such as those witnessed in Eastern Europe and other global hotspots, can further complicate logistics and increase operational expenses. Aisin's reliance on a complex, international network of suppliers means that even localized instability can have far-reaching consequences, potentially leading to significant production slowdowns and impacting their ability to meet demand.

The automotive industry's rapid evolution, especially the move towards electric vehicles (EVs), presents a significant threat to Aisin's established product lines. As demand for internal combustion engine (ICE) components wanes, Aisin risks its traditional offerings becoming obsolete if it cannot pivot its manufacturing and R&D quickly enough. For example, the global EV market share is projected to reach 30% by 2028, a substantial increase from its 15% share in 2023, indicating a shrinking market for ICE-dependent parts.

The automotive components industry is incredibly competitive, and this pressure is amplified when Original Equipment Manufacturers (OEMs) face their own economic challenges. This often translates into tougher price negotiations for suppliers like Aisin Seiki. In 2024, continued inflation and supply chain uncertainties are likely to exacerbate this trend, forcing Aisin to balance cost-effectiveness demands with maintaining healthy profit margins.

Aisin must contend with global competitors who are also vying for market share, often by offering lower prices. For instance, in 2023, several emerging market suppliers increased their penetration in certain component segments, intensifying the competitive landscape. This necessitates a constant focus on operational efficiency and innovation to offer value beyond just price.

Regulatory Changes and Environmental Compliance Costs

Increasingly stringent global environmental regulations, particularly concerning carbon emissions, present a significant threat to Aisin Seiki. These evolving standards can lead to higher compliance costs for manufacturing processes and the development of new products. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030, a target that will ripple through supply chains. Failure to adapt swiftly to these tightening rules could result in substantial penalties and erode Aisin's competitive edge in key markets.

Aisin's commitment to sustainability is a strategic advantage, but keeping pace with regulatory shifts is crucial. The company must invest in cleaner technologies and potentially redesign components to meet stricter environmental benchmarks. The automotive industry, a core market for Aisin, is already facing significant pressure to decarbonize, with many regions mandating the phase-out of internal combustion engines in the coming years. This necessitates proactive adaptation to avoid being left behind.

Key considerations for Aisin regarding regulatory changes include:

- Rising compliance costs: Increased spending on emissions control technology and sustainable material sourcing.

- Market access risks: Potential exclusion from markets with non-compliance, impacting sales volumes.

- Reputational damage: Failure to meet environmental standards could negatively affect brand perception and customer loyalty.

- Investment in R&D: The need for continuous innovation to develop eco-friendly products and processes.

Economic Slowdown and Decreased Vehicle Production

An economic downturn presents a significant threat to Aisin Seiki. A slowdown in major economies, like the US and Europe, often translates to reduced consumer spending on big-ticket items, including new cars. This directly impacts the automotive industry, leading to lower production targets for manufacturers.

For Aisin, this means a potential drop in orders for its diverse range of components. For instance, if global vehicle production, which stood at around 78.5 million units in 2023, were to contract by, say, 5% in 2024, Aisin would see a corresponding decrease in demand for its transmissions, braking systems, and other parts. This reliance on automotive output makes the company vulnerable to these macroeconomic cycles.

- Reduced Consumer Demand: Economic slowdowns typically curb discretionary spending, impacting new vehicle sales.

- Lower Production Volumes: Automakers respond to reduced demand by cutting vehicle production, directly affecting component suppliers like Aisin.

- Financial Performance Impact: Decreased sales volumes translate to lower revenue and profitability for Aisin, highlighting its sensitivity to economic fluctuations.

- Supply Chain Disruptions: Broader economic instability can also lead to disruptions in Aisin's own supply chain, further exacerbating production challenges.

Aisin Seiki faces significant threats from the rapid shift to electric vehicles (EVs), as demand for traditional internal combustion engine (ICE) components declines. With the global EV market share projected to grow substantially, Aisin risks obsolescence if it cannot adapt its product lines and manufacturing capabilities quickly. This transition necessitates substantial investment in new technologies and research to remain competitive in a rapidly evolving automotive landscape.

SWOT Analysis Data Sources

This analysis leverages a comprehensive blend of Aisin Seiki's official financial statements, detailed industry market research reports, and expert opinions from automotive sector analysts to ensure a robust and informed strategic assessment.