Aisin Seiki Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

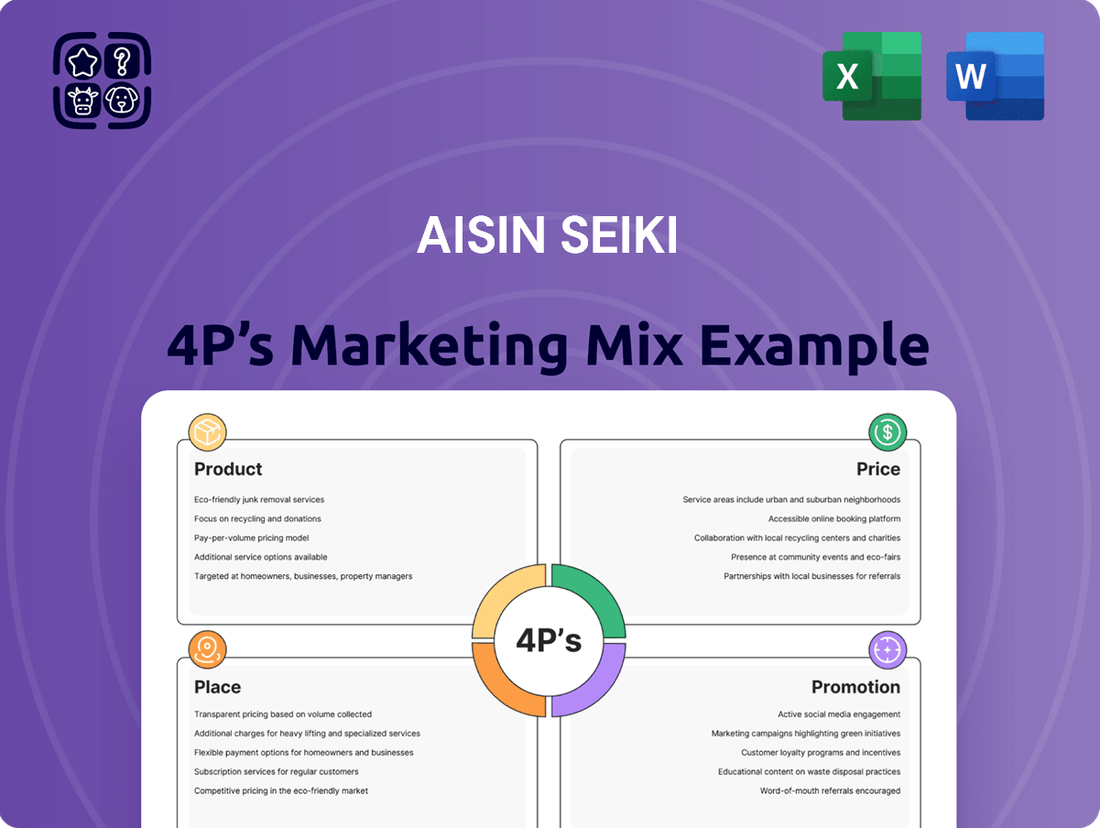

Aisin Seiki's marketing prowess is built on a foundation of strategic alignment across its 4Ps. This analysis delves into how their robust product development, competitive pricing, extensive distribution networks, and targeted promotional activities create a compelling market presence. Understand the intricate interplay of these elements that drives their global success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Aisin Seiki's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this industry leader.

Product

Aisin Seiki's product portfolio is a cornerstone of the automotive industry, encompassing a vast array of essential components and integrated systems. Their offerings span critical areas such as drivetrain, braking, chassis, body, and engine technologies, serving a wide spectrum of vehicle manufacturers globally. This broad product line underscores their position as a vital partner in automotive manufacturing.

As a premier Tier One supplier, Aisin Seiki is deeply committed to delivering exceptional quality and driving innovation. This dedication is particularly evident in their focus on future mobility solutions, including advanced driver-assistance systems (ADAS) and key components for electrified vehicles, such as sophisticated e-axles. Their product development actively supports the automotive sector's transition towards electrification and enhanced safety features.

In 2024, Aisin Seiki reported significant revenue, with a substantial portion derived from its diverse automotive component sales, reflecting strong demand across both internal combustion engine and hybrid/electric vehicle segments. The company's investment in R&D for electrified powertrains and ADAS technologies is a key driver of its product strategy, aiming to capture market share in these rapidly growing areas.

Aisin Seiki is aggressively expanding its electrified vehicle component offerings, encompassing a broad range from hybrid electric vehicles (HEVs) to plug-in hybrid electric vehicles (PHEVs). This strategic push includes key developments like e-axles and battery frames, engineered to enhance energy efficiency, driving dynamics, and overall safety in EVs.

The company's commitment is underscored by ambitious plans to establish a global production capacity for 4.5 million electric units. Furthermore, Aisin is set to introduce its third-generation e-axle products by 2027, signaling a significant leap in technological advancement within the EV powertrain sector.

Aisin is evolving its aftermarket division into a comprehensive parts and service hub, moving beyond its established brands to encompass a broader spectrum of vehicle maintenance essentials. This expansion includes critical components like cooling systems, drivetrain parts, steering and suspension elements, alongside a wide array of chemicals, fluids, wiper blades, lubricants, and batteries. The company is also incorporating tools and paints, aiming to establish a true one-stop solution for the automotive aftermarket. This strategic pivot supports Aisin's goal of providing a complete ecosystem for vehicle upkeep.

Non-Automotive s and Solutions

Aisin Seiki actively extends its technological expertise beyond the automotive sector, demonstrating a robust strategy in non-automotive products and solutions. This diversification is crucial for Aisin's sustained growth and market resilience, allowing it to tap into new revenue streams and leverage its core competencies across various industries. The company’s commitment to innovation is evident in its expansion into areas such as energy systems, housing and lifestyle products, and industrial equipment.

A prime example of this strategic diversification is the development of the AI-powered 'YYSystem'. This innovative technology is designed for real-time speech transcription, significantly enhancing communication accessibility. Its practical applications are already being realized in diverse environments, including government offices and retail settings, where it promotes inclusive communication by breaking down language barriers and improving understanding. This system highlights Aisin's ability to translate advanced technological capabilities into tangible, real-world solutions that address societal needs.

Aisin's non-automotive segment contributes significantly to its overall business, with specific figures often integrated within broader financial reports. For instance, while automotive sales typically dominate, the company's strategic investments in these other sectors are designed to create stable, long-term value. The YYSystem, as a representative product, showcases Aisin's forward-thinking approach to leveraging artificial intelligence and digital transformation to create market-leading solutions.

- Diversified Product Portfolio: Aisin's non-automotive offerings span energy systems, housing, lifestyle products, and industrial equipment.

- Innovation in AI: The AI-powered 'YYSystem' provides real-time speech transcription, enhancing communication.

- Market Applications: The 'YYSystem' is deployed in government offices and retail settings to promote inclusive communication.

- Strategic Growth: Diversification beyond automotive aims to build resilience and tap into new revenue streams.

Continuous Innovation and Technology Integration

Aisin Seiki prioritizes innovation, channeling substantial resources into research and development to embed cutting-edge technologies such as artificial intelligence (AI) and the Internet of Things (IoT) across its product lines and manufacturing operations. This commitment is evident in their R&D spending, which has consistently been a significant portion of their revenue, enabling them to stay ahead in a rapidly evolving automotive sector.

The company's technological integration aims to boost operational efficiency and introduce predictive maintenance solutions, reducing downtime and optimizing performance. For instance, Aisin's smart factory initiatives are designed to leverage data analytics for real-time monitoring and adjustments, contributing to a more streamlined production flow.

Furthermore, Aisin is actively developing technologies geared towards carbon neutrality and sustainable manufacturing. Their work on perovskite solar cells, a promising next-generation solar technology, exemplifies this dedication to environmental responsibility and future energy solutions. This focus aligns with global trends and regulatory pressures for greener industrial practices.

- R&D Investment: Aisin consistently allocates a significant percentage of its annual revenue towards research and development, ensuring a pipeline of innovative solutions.

- AI & IoT Integration: The company is actively implementing AI and IoT technologies to enhance product functionality and optimize manufacturing processes.

- Sustainability Focus: Development of carbon-neutral technologies, including advancements in perovskite solar cells, underscores Aisin's commitment to environmental stewardship.

- Predictive Maintenance: Technology integration is driving the adoption of predictive maintenance strategies to improve efficiency and reliability across operations.

Aisin Seiki's product strategy centers on a comprehensive portfolio covering essential automotive components, from drivetrain and braking systems to advanced solutions for electrified vehicles like e-axles. Their commitment to innovation is reflected in substantial R&D investments and a strategic expansion into the aftermarket, aiming for a one-stop solution for vehicle maintenance. Beyond automotive, Aisin is diversifying into non-automotive sectors, including energy systems and AI-driven communication tools like the 'YYSystem', to foster growth and resilience.

| Product Category | Key Offerings | Focus Areas |

| Automotive Components | Drivetrain, Braking, Chassis, Engine Parts, e-axles | Electrification, ADAS, Powertrain Efficiency |

| Aftermarket | Cooling Systems, Drivetrain Parts, Fluids, Batteries, Tools | Comprehensive Vehicle Maintenance, One-Stop Solutions |

| Non-Automotive | Energy Systems, Housing Products, Industrial Equipment, AI Systems | Diversification, Communication Accessibility, Sustainability |

What is included in the product

This analysis provides a comprehensive examination of Aisin Seiki's marketing mix, detailing their product innovation, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

Aisin Seiki's 4Ps marketing mix analysis provides a clear roadmap to address market challenges, offering a structured approach to product, price, place, and promotion strategies that alleviate competitive pressures.

This analysis serves as a vital tool for pinpointing and resolving key marketing pain points, enabling Aisin Seiki to optimize its offerings and market presence.

Place

Aisin Seiki's global manufacturing and supply network is a cornerstone of its Place strategy, featuring facilities strategically located in North America, Europe, ASEAN, and India. This widespread operational base is crucial for effectively serving diverse automotive markets and supporting the needs of multinational original equipment manufacturers (OEMs) worldwide.

The company's broad geographic footprint ensures timely product availability, a critical factor for maintaining smooth global vehicle production schedules. As of early 2024, Aisin continues to invest in expanding this network, with particular emphasis on establishing new manufacturing plants in key emerging markets to capitalize on future growth opportunities.

Aisin Seiki's Place strategy heavily relies on direct sales to Original Equipment Manufacturers (OEMs). This B2B approach means they don't typically sell to individual consumers but rather supply parts directly to car companies. For instance, Aisin maintains strong, long-term partnerships with automotive giants like BMW Group, ensuring their components are integrated into new vehicle production lines.

These direct relationships are vital for Aisin's business, allowing them to supply critical parts such as transmissions, braking systems, and advanced e-axles. These are not just off-the-shelf items; they are engineered and supplied for specific vehicle models, requiring close collaboration. In 2023, Aisin's automotive segment revenue reached ¥2.7 trillion, underscoring the significance of these OEM relationships in their overall financial performance.

Aisin Seiki's aftermarket distribution strategy focuses on streamlining operations and expanding its reach. The formation of Aisin Aftermarket & Service of America, Inc. is a key move, creating a dedicated entity to boost efficiency and broaden its product selection. This consolidated approach aims to leverage Aisin's extensive global footprint.

This new American entity will operate independently, allowing for greater agility and a more focused approach to the aftermarket sector. By consolidating, Aisin can better coordinate its diverse product lines, from engine components to braking systems, across various markets. This strategic alignment is crucial for competing effectively in the dynamic automotive aftermarket.

Aisin's global network, comprising 36 locations in 17 countries, is instrumental in tailoring its aftermarket offerings. This extensive presence enables the company to understand and respond to specific regional demands and customer preferences, ensuring that product lines are relevant and competitive worldwide. For example, in 2024, Aisin reported a significant increase in its aftermarket sales in North America, driven by this localized strategy.

Strategic Regional Management

Aisin Seiki is increasingly adopting a strategic regional management approach to better address diverse market demands and evolving customer behaviors across different geographies. This shift is crucial for tailoring product offerings and service strategies to specific regional nuances, thereby strengthening customer loyalty and operational effectiveness.

By decentralizing some decision-making and focusing on local market insights, Aisin aims to enhance its responsiveness to customer needs and optimize its supply chain. This regional empowerment is key to improving problem-solving capabilities and streamlining logistics, ultimately boosting customer satisfaction and operational efficiency.

- Regional Focus: Aisin's strategy emphasizes understanding and catering to specific market needs and customer trends in each region.

- Customer Relationship Enhancement: This approach aims to foster stronger, more personalized relationships with customers on a regional basis.

- Operational Optimization: Regional management facilitates more efficient problem-solving and improved logistics, leading to greater convenience for customers.

- Market Responsiveness: By tailoring strategies to local conditions, Aisin can more effectively adapt to changing market dynamics and competitive landscapes.

Online Presence and Digital Platforms

Aisin's online presence is primarily geared towards its business-to-business (B2B) clientele, serving as a crucial hub for corporate information, investor relations, and detailed product catalogs. This digital infrastructure is vital for effective communication with all stakeholders, offering easy access to product specifications and technical data, which complements their established direct sales channels and aftermarket distribution networks.

In 2024, Aisin continued to leverage digital platforms to enhance engagement. Their corporate website, a.isin.com, provides comprehensive sections dedicated to investors, including financial reports and stock information, alongside detailed product listings across their diverse business segments like driveline, chassis, and engine components.

The company utilizes its digital platforms to showcase innovation and technical capabilities. For instance, information on their advanced hybrid systems and electric vehicle components is readily available, targeting automotive manufacturers and tier-one suppliers. This strategic online approach ensures that potential partners and existing clients can easily find the information they need to foster collaborations and streamline procurement processes.

Key aspects of Aisin's digital platform strategy include:

- Corporate Information Hub: Providing access to company history, sustainability reports, and news releases for transparency and stakeholder trust.

- Investor Relations Portal: Offering financial statements, annual reports, and investor meeting schedules to support investment decisions.

- Extensive Product Catalogs: Detailed specifications and application information for their wide range of automotive and industrial components.

- Technical Support and Documentation: Resources for engineers and partners to facilitate product integration and troubleshooting.

Aisin Seiki's place strategy centers on its extensive global manufacturing and distribution network, designed to serve automotive OEMs and the aftermarket efficiently. This network, with facilities across North America, Europe, and Asia, ensures timely delivery of critical components like transmissions and braking systems. For instance, in early 2024, Aisin continued to expand its presence in emerging markets, aiming to capture future growth.

The company's approach is primarily B2B, focusing on direct sales to major automakers such as BMW Group, underscoring strong OEM partnerships. Aisin's aftermarket strategy is bolstered by dedicated entities like Aisin Aftermarket & Service of America, Inc., streamlining operations and product availability. This strategic regional management allows for tailored offerings and improved customer service, as evidenced by increased aftermarket sales in North America during 2024.

Aisin's digital presence acts as a vital B2B information hub, offering detailed product catalogs and technical data to partners. Their corporate website, a.isin.com, provides essential investor relations information and showcases innovations in hybrid and EV components. This digital infrastructure complements their physical distribution, facilitating strong stakeholder communication and procurement processes.

| Key Place Strategy Elements | Description | Example/Data Point |

|---|---|---|

| Global Manufacturing & Supply Network | Widespread facilities to serve diverse automotive markets and OEMs. | 36 locations in 17 countries as of 2024. |

| Direct OEM Sales | Supplying parts directly to car manufacturers for integration into new vehicles. | Long-term partnerships with automotive giants like BMW Group. |

| Aftermarket Distribution | Streamlining operations and expanding reach in the aftermarket sector. | Formation of Aisin Aftermarket & Service of America, Inc. |

| Regional Management Approach | Tailoring strategies to specific market demands and customer behaviors. | Increased aftermarket sales in North America in 2024 driven by localized strategy. |

| Digital Presence (B2B Focused) | Online hub for corporate information, investor relations, and product catalogs. | a.isin.com provides investor reports and detailed product specifications. |

Same Document Delivered

Aisin Seiki 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Aisin Seiki 4P's Marketing Mix analysis you’ll own. You'll gain immediate access to a comprehensive breakdown covering Product, Price, Place, and Promotion strategies. Understand Aisin Seiki's market positioning and tactical execution. This document provides actionable insights for competitive advantage.

Promotion

Aisin Seiki actively cultivates industry partnerships, engaging with over 20 global automotive manufacturers and technology leaders. These collaborations are vital for their marketing strategy, enabling the development and widespread adoption of advanced mobility solutions.

A prime example of this is their e-axle production agreement with BMW Group, a significant move in the electric vehicle sector. Furthermore, Aisin's ongoing collaborations with Toyota Group companies on AI and software development highlight their commitment to innovation and future-proofing their product offerings.

Aisin Seiki actively participates in key automotive industry gatherings, such as AAPEX (Automotive Aftermarket Products Expo) and the Automotive Engineering Exposition. These events are vital for showcasing Aisin's cutting-edge technologies and diverse product offerings to a global audience.

These trade shows are instrumental for Aisin's B2B marketing efforts, providing a platform to launch new products and clearly communicate its overarching global strategy, particularly its aftermarket initiatives. For instance, at the 2023 AAPEX show, Aisin highlighted its expanded range of drivetrain components and advanced driver-assistance systems (ADAS) solutions, underscoring its commitment to innovation in the evolving automotive landscape.

Aisin Seiki actively showcases its dedication to environmental responsibility and building a sustainable future. A prime example of this commitment is their recognition on the CDP 'A List' for climate change initiatives, underscoring their proactive approach to environmental challenges.

This strategic focus on achieving carbon neutrality goals, significantly reducing CO2 emissions, and pioneering sustainable manufacturing methods directly bolsters Aisin's corporate standing and brand appeal. For instance, Aisin's consolidated net sales for the fiscal year ending March 31, 2024, reached ¥4,505.7 billion, with ongoing investments in sustainability expected to drive long-term value and stakeholder confidence.

Technical Publications and Investor Relations

Aisin, as a B2B entity, leverages technical publications and investor relations to communicate its progress. These channels are crucial for informing stakeholders about its technological advancements and financial health. For instance, Aisin's integrated reports and sustainability data books offer a comprehensive view of its operations and strategic direction.

These publications are vital for financial professionals, business strategists, and academic researchers who rely on transparent data. They highlight critical areas such as research and development investments, which are foundational to Aisin's innovation. In fiscal year 2024, Aisin reported R&D expenses of ¥210 billion, underscoring its commitment to future technologies.

- Integrated Reports: Detailed financial and operational summaries for stakeholders.

- Sustainability Data Books: Transparency on environmental, social, and governance (ESG) performance.

- Investor Relations News Releases: Timely updates on financial results and strategic initiatives.

- R&D Investment Disclosure: Specific figures and insights into future technological development.

Digital Communication and Accessibility Solutions

Aisin Seiki actively utilizes digital communication channels to disseminate corporate news and detailed product information, ensuring broad accessibility for stakeholders. This digital presence is a key component of their strategy to reach a wider audience and provide transparent updates.

The company has pioneered innovative accessibility solutions, such as the AI-powered 'YYSystem'. This technology, designed for real-time speech transcription, showcases Aisin's commitment to leveraging advanced tech for practical applications. For instance, the YYSystem can convert spoken words into text with remarkable accuracy, aiding individuals with hearing impairments or in noisy environments.

This public-facing innovation serves a dual purpose: it highlights Aisin's forward-thinking approach and commitment to inclusivity. By developing and promoting technologies that enhance communication accessibility, Aisin is not only addressing societal needs but also potentially strengthening its brand perception as a socially responsible and technologically advanced entity, extending its appeal beyond the core automotive industry.

While specific financial figures directly tied to the impact of the YYSystem on Aisin's overall revenue were not publicly detailed as of early 2025, the company's consistent investment in R&D, which includes such accessibility solutions, underscores a strategic focus on diversification and future growth markets.

Aisin Seiki's promotion strategy emphasizes strategic partnerships and active participation in industry events to showcase technological advancements. Their collaborations with major automotive manufacturers, like the e-axle agreement with BMW, and presence at expos such as AAPEX, are key to communicating their global strategy and product innovations to a broad audience.

The company also leverages its commitment to sustainability, highlighted by its CDP 'A List' recognition, to enhance brand appeal and stakeholder confidence. Financial professionals and strategists rely on detailed disclosures, like R&D investments of ¥210 billion in fiscal year 2024, to gauge future growth potential.

Furthermore, Aisin utilizes digital channels and innovative public-facing technologies, such as the AI-powered YYSystem for speech transcription, to demonstrate its commitment to inclusivity and forward-thinking solutions, thereby broadening its market perception.

| Promotional Activity | Key Channels/Examples | Target Audience | Fiscal Year 2024 Data/Insights |

|---|---|---|---|

| Industry Partnerships & Collaborations | BMW Group (e-axle), Toyota Group (AI/Software) | Automotive Manufacturers, Technology Leaders | Active engagement with over 20 global automotive manufacturers. |

| Trade Shows & Expos | AAPEX, Automotive Engineering Exposition | B2B Customers, Industry Professionals | Showcased drivetrain components and ADAS solutions at 2023 AAPEX. |

| Sustainability Communication | CDP 'A List' recognition, Integrated Reports | Investors, Stakeholders, ESG Analysts | Consolidated net sales ¥4,505.7 billion (FYE March 31, 2024). |

| Digital & Technical Disclosures | Investor Relations News, R&D Disclosures, YYSystem | Financial Professionals, Researchers, General Public | R&D expenses ¥210 billion (FY2024); YYSystem highlights accessibility innovation. |

Price

Aisin Seiki's pricing for advanced automotive components, such as e-axles and ADAS systems, is firmly rooted in value-based strategies. This approach recognizes the substantial benefits these technologies offer to automakers, including enhanced vehicle efficiency, improved safety, and the enabling of autonomous driving features. The company’s significant investment in research and development, which reached ¥296.8 billion in fiscal year 2023, directly supports the creation of these high-value, cutting-edge products, justifying their premium pricing.

Aisin Seiki's pricing strategy for Original Equipment Manufacturer (OEM) components is deeply intertwined with competitive bidding and enduring supply contracts with major automotive manufacturers. These agreements are not simply about unit cost; they encompass intricate negotiations that often factor in volume commitments, advanced quality assurances, and robust performance metrics demanded by the auto industry.

For instance, in 2023, the global automotive market saw significant fluctuations, impacting the negotiation leverage for suppliers like Aisin. The average contract length for Tier One suppliers often spans three to five years, during which pricing is typically fixed or subject to pre-defined escalation clauses, reflecting the long-term nature of automotive product cycles.

These long-term OEM contracts frequently incorporate volume discounts, where larger purchase orders lead to lower per-unit costs for the automaker. This structure encourages stable demand for Aisin's components, providing a predictable revenue stream, albeit with pricing pressures inherent in securing these substantial, multi-year commitments.

Aisin Seiki is actively pursuing cost optimization and structural reforms to bolster its financial foundation. This includes a strategic focus on reducing inventory levels, which directly impacts working capital and operational efficiency. For instance, in fiscal year ending March 2024, Aisin reported a decrease in its days of inventory outstanding, a key indicator of their reform success.

Monetizing non-core assets is another pillar of their strategy, freeing up capital and streamlining operations. These initiatives are designed to enhance overall cost efficiency, providing Aisin with greater flexibility in its pricing strategies. Improved cost structures can lead to more competitive pricing, ultimately influencing market share and profitability.

These structural changes are crucial for Aisin's long-term financial health and competitive positioning. By strengthening its earnings structure, Aisin aims to achieve sustainable profitability and better navigate market fluctuations.

Regional Market Pricing Adjustments

Aisin Seiki's adoption of region-based management facilitates dynamic pricing strategies tailored to local market realities, encompassing demand levels and competitive pressures. This localized approach is crucial for navigating diverse economic environments and consumer behaviors across different geographies.

Evidence of this strategy's effectiveness can be seen in Aisin's financial performance. For instance, in fiscal year 2024, while overall group revenue saw adjustments, regions like North America and ASEAN demonstrated resilience, signaling successful pricing or sales strategy adaptations to their specific market dynamics. This suggests Aisin is adept at leveraging regional insights to optimize revenue generation.

The company's ability to navigate these regional nuances is supported by:

- Targeted Product Offerings: Adjusting product portfolios to meet regional demand, potentially influencing pricing flexibility.

- Competitive Benchmarking: Continuously monitoring competitor pricing in key markets to maintain market share.

- Economic Sensitivity: Reflecting local inflation rates, currency fluctuations, and purchasing power in pricing decisions.

- Distribution Channel Optimization: Adapting pricing based on the cost structure and margin expectations of different sales channels within each region.

Strategic Investments and Shareholder Value

Aisin's strategic financial decisions, including its recent stock split and ongoing share repurchase programs, underscore a commitment to boosting shareholder value. These actions are intrinsically tied to the company's robust financial standing and its capacity to influence market pricing.

The company is actively generating substantial capital, earmarked for deployment into key growth sectors. For instance, Aisin reported a net sales of ¥4,304.7 billion for the fiscal year ended March 2024, demonstrating strong revenue generation capabilities that support these investment strategies.

- Focus on Shareholder Returns: Aisin’s financial tactics, such as stock splits and buybacks, are designed to directly benefit shareholders by increasing per-share value and signaling financial strength.

- Capital Generation for Growth: The company is successfully generating significant funds, which are strategically allocated to promising areas of future growth, ensuring long-term expansion.

- Financial Health Indicator: These maneuvers reflect a healthy financial position, which in turn bolsters Aisin's pricing power in the competitive automotive parts market.

- Investment in Future Markets: Aisin is prioritizing investments in areas like electrification and autonomous driving technologies, crucial for future market relevance and profitability.

Aisin Seiki employs a multi-faceted pricing strategy, blending value-based pricing for advanced components like e-axles with competitive contract pricing for OEM parts. This dual approach ensures they capture premium value for innovation while maintaining strong relationships with major automakers through long-term agreements. Their pricing is also influenced by ongoing cost optimization efforts, such as inventory reduction, and a dynamic regional pricing structure that adapts to local market conditions.

| Pricing Strategy Aspect | Key Drivers | Supporting Data/Context |

| Value-Based Pricing | Technological innovation, enhanced vehicle performance (efficiency, safety), R&D investment | R&D expenditure ¥296.8 billion (FY2023) for advanced components. |

| Competitive Contract Pricing (OEM) | Volume commitments, quality assurance, performance metrics, long-term supply agreements | Average contract length 3-5 years; pricing often fixed or with pre-defined escalation. |

| Cost Optimization Impact | Reduced inventory, operational efficiency, cost structure improvements | Decrease in days of inventory outstanding (FY ending March 2024). |

| Regional Pricing | Local demand, competition, economic factors (inflation, currency) | Resilience in North America and ASEAN markets (FY2024) suggests effective regional adaptation. |

4P's Marketing Mix Analysis Data Sources

Our Aisin Seiki 4P's Marketing Mix Analysis is meticulously constructed using official company disclosures, including annual reports and investor presentations, alongside robust industry research and competitive intelligence.