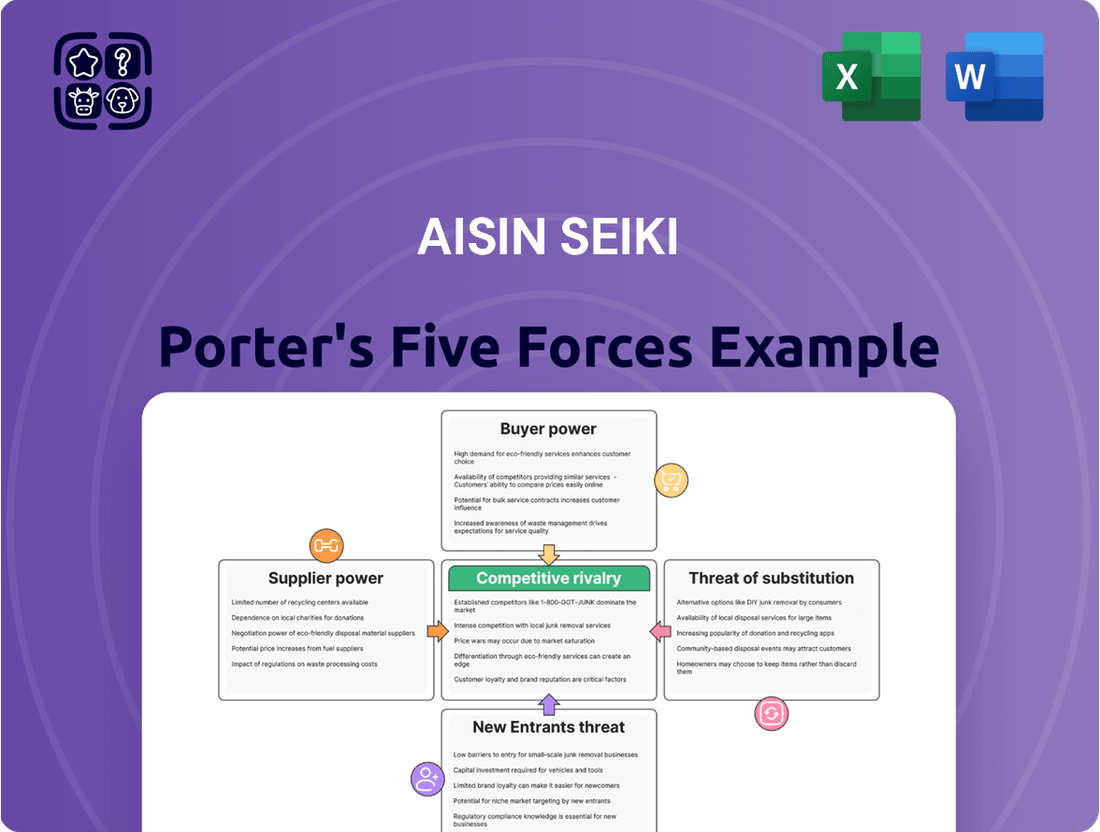

Aisin Seiki Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Aisin Seiki faces moderate threats from new entrants due to high capital requirements and established brand loyalty in the automotive parts sector. The bargaining power of buyers, primarily major automakers, is significant, influencing pricing and product specifications. Intense rivalry among existing players like Denso and Bosch shapes the competitive landscape.

The threat of substitutes, such as alternative powertrain technologies, presents a growing challenge for Aisin Seiki's traditional offerings. Supplier power is relatively strong, especially for specialized components, but Aisin's scale can mitigate some of this influence. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Aisin Seiki’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aisin Seiki, a significant player in the automotive component sector, sources materials and parts from a wide array of suppliers. The degree to which these suppliers are concentrated, particularly for essential or unique components, directly impacts their leverage. For instance, in 2023, the semiconductor shortage highlighted how a concentrated supplier base for critical electronic components could grant significant pricing power to those few providers.

The bargaining power of suppliers, specifically focusing on Aisin's switching costs, is a significant factor. Aisin Seiki faces substantial expenses when considering a change in suppliers. These costs can include significant investments in new tooling, rigorous re-certification processes for new parts, and the complex task of re-establishing efficient supply chain logistics.

These high switching costs effectively bolster the negotiating position of Aisin's current suppliers. For Aisin, the financial outlay and potential for disruption during a supplier transition can be considerable, making it less likely to switch for marginal gains.

This dynamic is especially pronounced for suppliers providing highly integrated or specialized components. For instance, if a supplier provides a unique electronic control unit deeply embedded within Aisin's product architecture, the cost and complexity of finding and onboarding an alternative supplier would be exceptionally high, granting that original supplier significant leverage.

Suppliers providing highly specialized or patented components, like advanced battery management systems for electric vehicles, wield significant influence. Aisin Seiki's reliance on such unique offerings, which are critical for enhancing product performance, directly translates into increased supplier bargaining power. For instance, a supplier holding a key patent for a next-generation ADAS sensor could command higher prices.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into automotive component manufacturing, thereby becoming direct competitors to Aisin Seiki, significantly bolsters their bargaining power. While less likely for basic raw material providers, this risk is more pronounced for suppliers of highly specialized technologies. Such a move would require substantial capital investment and technical expertise, creating a considerable barrier to entry. For instance, a key semiconductor supplier could potentially develop its own integrated automotive control units.

However, the sheer scale and complexity involved in producing a wide array of automotive components act as a deterrent for most suppliers. This capital intensity often makes forward integration a financially prohibitive strategy. Consequently, while the threat exists, its practical realization for many suppliers remains limited, moderating its impact on Aisin's bargaining position.

Consider the automotive electronics sector, where specialized firms might possess the intellectual property for advanced driver-assistance systems (ADAS). Should such a firm perceive significant value capture through direct manufacturing, it could pose a threat. However, the established manufacturing capabilities and extensive supply chain relationships of companies like Aisin present formidable competition. In 2024, the global automotive electronics market was valued at approximately $250 billion, highlighting the significant investment required to compete effectively.

- Supplier Forward Integration: A credible threat of suppliers entering Aisin's direct manufacturing space increases their leverage.

- Specialized Technology Providers: This threat is more relevant for suppliers of unique, high-value components rather than raw materials.

- Capital Intensity Barrier: The significant investment needed for auto parts manufacturing limits the feasibility of forward integration for many suppliers.

- Market Dynamics: Established players like Aisin have scale and expertise that create high entry barriers for potential integrating suppliers.

Importance of Aisin to Suppliers

The significance of Aisin's business to its suppliers directly influences their bargaining power. When a supplier relies heavily on Aisin for a substantial portion of its revenue, that supplier’s leverage tends to diminish, making them more amenable to Aisin's terms. Conversely, if Aisin is a smaller client for a supplier that also serves numerous other major automotive manufacturers, the supplier can often dictate pricing and contract conditions more assertively.

The automotive supply chain experienced notable volatility through 2024 and into 2025. This period was characterized by persistent supply chain disruptions and a significant increase in the cost of raw materials. These conditions have collectively amplified the bargaining power of many suppliers within the sector, enabling them to negotiate more favorable terms and prices.

- Supplier Dependence: If Aisin constitutes a large percentage of a supplier's annual sales, the supplier has less power to dictate terms.

- Market Diversification: Suppliers serving many large clients, with Aisin being a smaller account, gain more bargaining leverage.

- 2024-2025 Trends: Ongoing supply chain issues and rising material costs have generally strengthened supplier positions.

- Impact on Aisin: This dynamic can lead to increased input costs for Aisin, impacting its profitability and pricing strategies.

For Aisin Seiki, the bargaining power of suppliers is a critical consideration. When a supplier is highly concentrated, particularly for essential or unique components, their leverage increases significantly. For example, the 2024 semiconductor crunch demonstrated how a limited number of suppliers for vital electronic parts gave them substantial pricing power.

High switching costs for Aisin, involving tooling, re-certification, and logistics, strengthen suppliers' negotiating positions. Suppliers of specialized or patented items, such as advanced battery management systems, also hold considerable influence due to Aisin's reliance on these unique offerings. The global automotive electronics market, valued at roughly $250 billion in 2024, underscores the investment needed for specialized component production.

The threat of suppliers integrating forward into manufacturing, though often deterred by the capital intensity of auto parts production, remains a factor for specialized technology providers. In 2024, persistent supply chain disruptions and rising material costs generally amplified supplier leverage across the sector, impacting Aisin's input costs.

| Factor | Impact on Supplier Bargaining Power | Aisin Seiki Relevance |

|---|---|---|

| Supplier Concentration | High for essential/unique parts | Significant for critical electronic components |

| Switching Costs | High for Aisin (tooling, certification) | Bolsters current suppliers' leverage |

| Product Uniqueness/Patents | High for specialized tech (ADAS, BMS) | Increases reliance and supplier influence |

| Forward Integration Threat | Credible for specialized tech providers | Limited by capital intensity, but a concern |

| Supplier Dependence on Aisin | Low when Aisin is a small client | Increases supplier leverage |

| 2024-2025 Market Trends | Amplified by disruptions/cost increases | Led to higher input costs for Aisin |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Aisin Seiki, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Aisin Seiki Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive pressures, perfect for quick strategic decision-making and identifying potential pain points.

Customers Bargaining Power

Aisin Seiki's customer base is dominated by a few major Original Equipment Manufacturers (OEMs), such as Toyota and BMW Group. This concentration means these large customers purchase components in significant quantities, granting them substantial bargaining power. For instance, Toyota, Aisin's largest customer, accounted for approximately 35% of Aisin's net sales in fiscal year 2023, highlighting the impact of a single client.

This customer concentration allows OEMs to exert considerable pressure on Aisin to negotiate for lower prices, superior quality standards, and precise delivery timelines. Their sheer volume of purchases empowers them to dictate terms that Aisin must often accommodate to maintain these crucial relationships.

A prime example of this dynamic is Aisin's collaboration with BMW Group on e-axle production, a strategic partnership that underscores the critical importance of catering to the specific needs and demands of these key automotive giants. Such collaborations are vital for Aisin's continued growth and market position.

Customer switching costs for Aisin Seiki are relatively low for many original equipment manufacturers (OEMs). While OEMs do incur some expenses in re-engineering and testing new components when changing suppliers, these are often outweighed by the potential for cost savings or better performance. In 2023, the automotive industry saw continued pressure on manufacturing costs, with many OEMs actively seeking to optimize their supply chains, making supplier loyalty less of a guarantee.

Aisin's ability to offer highly differentiated products significantly curtails the bargaining power of its customers. By investing heavily in advanced technologies and ensuring superior quality, Aisin creates unique value propositions that make it harder for buyers to switch to competitors based solely on price. This differentiation is evident in their push towards innovative mobility solutions. For instance, Aisin's developments in Advanced Driver-Assistance Systems (ADAS) and Electric Vehicle (EV) technologies are designed to offer distinct advantages, thereby reducing customer price sensitivity.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large Original Equipment Manufacturers (OEMs) like Toyota, presents a considerable challenge to Aisin Seiki. These OEMs possess the substantial financial resources and technical expertise to bring certain component manufacturing in-house. This capability grants them significant leverage in negotiations, as they can credibly threaten to produce components themselves if supplier terms are unfavorable.

While OEMs traditionally concentrate on vehicle assembly, the strategic option of insourcing critical parts is a powerful tool. For instance, major automakers have been investing heavily in battery technology and electric vehicle (EV) component production, areas where Aisin also operates. This strategic shift by customers can directly impact Aisin's market share and pricing power.

- OEMs often possess the financial muscle to invest in new manufacturing capabilities.

- The potential for backward integration increases customer bargaining power by creating an alternative supply source.

- Automakers' growing interest in EV components and battery technology highlights their capacity for insourcing.

- This threat compels suppliers like Aisin to maintain competitive pricing and technological innovation.

Price Sensitivity of Customers

The automotive sector is intensely competitive, forcing original equipment manufacturers (OEMs) to vigilantly control their expenses. This pressure directly impacts component suppliers like Aisin, as OEMs exert significant influence over pricing for parts. Consequently, Aisin faces substantial price sensitivity from its automotive customers.

Aisin's financial disclosures for the fiscal year ending March 2025 highlight this dynamic. Revenue from its powertrain segment saw a notable decrease, which can be attributed, in part, to increased pricing demands and reduced order volumes from major automotive clients. This trend underscores the direct correlation between market demand, OEM cost management strategies, and pricing power wielded by customers.

- High Competition: The automotive industry's competitive nature intensifies OEMs' focus on cost reduction, directly affecting component pricing.

- OEM Pressure: Automakers frequently leverage their purchasing volume to negotiate lower prices for parts, impacting supplier margins.

- Aisin's FY2025 Performance: A decrease in revenue from Aisin's powertrain division suggests a tangible effect of customer pricing pressures and market demand shifts.

- Demand Sensitivity: Fluctuations in vehicle sales and production volumes directly translate into altered demand for automotive components, further empowering customer negotiation.

Aisin Seiki faces significant bargaining power from its customers, primarily large automotive Original Equipment Manufacturers (OEMs). These customers' substantial purchasing volumes, coupled with relatively low switching costs for many components, allow them to exert considerable pressure on pricing and terms. The automotive industry's intense competition further amplifies this pressure, as OEMs are driven to control costs. Aisin's FY2025 powertrain segment revenue decline illustrates this dynamic, reflecting customer pricing demands and shifts in order volumes.

| Customer Factor | Impact on Aisin Seiki | Supporting Data/Example |

|---|---|---|

| Customer Concentration | High bargaining power due to volume purchases. | Toyota accounted for ~35% of Aisin's net sales in FY2023. |

| Switching Costs | Low for many components, increasing customer leverage. | OEMs can re-engineer for cost savings despite some initial investment. |

| Threat of Backward Integration | Customers can insource production, creating leverage. | Automakers' investment in EV components and battery tech. |

| Price Sensitivity | High due to intense competition in the automotive sector. | Aisin's FY2025 powertrain revenue decline linked to OEM pricing pressures. |

What You See Is What You Get

Aisin Seiki Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis for Aisin Seiki meticulously details the competitive landscape. It thoroughly examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive components industry. This professional analysis is formatted and ready for your immediate use.

Rivalry Among Competitors

The automotive components sector is fiercely competitive, populated by a multitude of global giants such as Denso, Magna International, ZF Friedrichshafen, and Robert Bosch GmbH. Aisin Seiki navigates this landscape, confronting significant rivalry across its broad range of products, which includes crucial areas like drivetrain, braking, and chassis systems.

In 2024, the sheer volume of players means Aisin constantly contends with established manufacturers and emerging specialists. For instance, the global automotive sensor market, a key area for Aisin, is projected to reach over $40 billion by 2025, highlighting the intense battle for market share among many suppliers.

This diversity extends to specialized niches within Aisin's portfolio. Companies focusing solely on advanced driver-assistance systems (ADAS) or electric vehicle (EV) components present unique competitive pressures, often innovating at a rapid pace that demands constant adaptation from larger, more diversified players like Aisin.

While the electric vehicle (EV) parts sector is booming, the broader automotive parts manufacturing market is set for more subdued growth. Some analysts anticipate a potential dip in global auto and auto parts production around 2025-2026, partly influenced by ongoing trade disputes and tariffs. This environment of slower overall expansion naturally heats up the competition as established companies vie more aggressively for market share.

Competitive rivalry in the automotive parts sector is fierce, largely fueled by relentless innovation. Companies are constantly pushing boundaries in areas such as electrification, advanced driver-assistance systems (ADAS), and connected vehicle software. This drive for new features and improved performance means that staying ahead requires substantial and ongoing investment in research and development.

Aisin Seiki, for instance, has been strategically investing heavily in R&D, particularly focusing on electric vehicle (EV) components and ADAS technologies. These investments are vital to keep pace with rivals who are also aggressively innovating. Aisin’s collaborations, such as its partnerships for e-axle production, underscore the industry's trend towards specialized alliances to accelerate development and market entry.

In 2024, the automotive industry's R&D spending saw a significant increase, with major players dedicating billions to electrification and software. For example, Toyota, a key Aisin partner, announced plans to invest over $30 billion in battery electric vehicles and related technologies through 2030, signaling the critical importance of these innovations for all stakeholders in the supply chain, including component suppliers like Aisin.

Exit Barriers

The automotive components sector, where Aisin Seiki operates, is characterized by substantial exit barriers. High capital investments required for advanced manufacturing facilities and specialized machinery, coupled with the need for large, skilled labor forces, make it incredibly difficult and costly for companies to leave the market. For instance, setting up a modern automotive parts plant can easily run into hundreds of millions of dollars.

These significant exit barriers mean that even businesses struggling with profitability may persist in the industry. This can lead to a more intense competitive rivalry as these firms fight for market share, often resorting to aggressive pricing strategies. The presence of these entrenched, albeit less successful, players can depress overall industry profitability.

Consider the implications of these barriers:

- High Fixed Costs: The substantial upfront investment in plant and equipment creates a large fixed cost base, making it financially unviable for many firms to cease operations.

- Specialized Assets: Automotive component manufacturing often requires highly specialized machinery and tooling that have limited alternative uses, further increasing the cost of exiting.

- Labor Commitments: Significant investment in training and maintaining a skilled workforce creates another layer of commitment that discourages abrupt departures.

- Contractual Obligations: Long-term supply agreements with major automakers can also bind companies to the market, even during downturns.

Strategic Commitments and Acquisitions

Competitive rivalry is intensifying as players like Denso and Hyundai Mobis make significant strategic commitments. For instance, Denso announced plans to invest ¥1 trillion (approximately $7 billion USD as of late 2024) in areas like electrification and software over the next five years, aiming to bolster its competitive standing. Hyundai Mobis, too, is actively pursuing acquisitions and partnerships, notably its collaboration with Stellantis on EV components, to capture market share in high-growth segments.

Aisin itself is not standing still. The company is undertaking a substantial overhaul of its global aftermarket strategy, which includes streamlining operations and expanding its service network in regions like Southeast Asia and India. This strategic pivot, coupled with its ongoing investments in advanced technologies for electric vehicles, highlights the aggressive nature of competition within the automotive supply sector.

- Strategic Commitments: Competitors are actively engaging in mergers, acquisitions, and partnerships to gain an edge, particularly in the burgeoning electric vehicle (EV) component market.

- Market Expansion: Aisin's proactive approach to revamping its global aftermarket strategy and entering emerging markets underscores the dynamic and competitive landscape.

- Investment in Growth Areas: Significant capital is being deployed by major players, such as Denso's ¥1 trillion investment, to fortify positions in critical future growth sectors like EV technology.

- Partnership Strategies: Collaborations, like Hyundai Mobis's alliance with Stellantis, are becoming a key tactic to accelerate development and market penetration in EV solutions.

Competitive rivalry within the automotive components sector is intense, with Aisin Seiki facing established global players like Denso, Magna, ZF, and Bosch. This rivalry is amplified by rapid innovation in crucial areas such as electrification and advanced driver-assistance systems (ADAS). In 2024, companies are making substantial R&D investments, with Denso, for example, planning to invest approximately $7 billion USD in electrification and software over five years, underscoring the aggressive pursuit of market share.

The high exit barriers in automotive parts manufacturing, driven by massive capital investments and specialized assets, mean that even struggling firms remain, intensifying competition and often leading to price wars. Aisin's strategic investments in EV components and ADAS, alongside partnerships for e-axle production, demonstrate its commitment to staying competitive in a market where rivals like Hyundai Mobis are also actively pursuing growth through collaborations, such as its EV component venture with Stellantis.

| Competitor | Key Investment/Strategy (2024/Near Term) | Focus Area |

|---|---|---|

| Denso | ¥1 trillion ($7 billion USD) investment | Electrification, Software |

| Hyundai Mobis | Partnership with Stellantis | EV Components |

| Aisin Seiki | Global aftermarket strategy overhaul, EV component investment | Electrification, Market Expansion |

SSubstitutes Threaten

The accelerating pace of automotive innovation, especially in electric and autonomous vehicle technologies, poses a serious threat from substitute products. For example, the increasing demand for electric powertrains, including e-axles and battery frames, directly challenges Aisin Seiki's established offerings in traditional internal combustion engine components.

This technological shift means that companies not heavily invested in EV components might see their market share eroded. In 2024, global EV sales continued their upward trajectory, with projections indicating further significant growth, making the transition to EV-compatible products a critical factor for Aisin's continued success.

As new technologies mature, their price-performance ratio improves, making them more attractive alternatives. For instance, advancements in battery technology and electric motors are making electric vehicles (EVs) more competitive with traditional internal combustion engine (ICE) vehicles. This trend indirectly substitutes the demand for many of Aisin's conventional automotive parts, as EV powertrains often require fewer traditional components.

The propensity for Original Equipment Manufacturers (OEMs) to substitute components, like those supplied by Aisin Seiki, is increasingly influenced by external pressures. Regulatory mandates, such as stricter emission standards globally, are a significant driver. For instance, by 2024, many regions have tightened emissions targets, pushing OEMs towards cleaner technologies.

Consumer demand for electric vehicles (EVs) is another powerful factor accelerating this substitution trend. In 2024, EV sales continue to grow robustly, with some markets reporting EV market penetration exceeding 20% of new vehicle sales. This shift directly impacts the demand for traditional powertrain components, encouraging OEMs to seek out suppliers for EV-specific systems.

Furthermore, the pursuit of cost efficiencies through new technologies is compelling OEMs to re-evaluate their component sourcing. Advances in battery technology and electric motor efficiency are making EVs more cost-competitive, reducing the price premium over internal combustion engine vehicles. This economic advantage makes it more attractive for OEMs to adopt these new componentries, potentially substituting traditional suppliers.

Government incentives, such as subsidies for EV purchases and manufacturing, further fuel this transition. In 2024, many governments continue to offer substantial financial support, making EVs more accessible to consumers and reducing the financial risk for OEMs investing in EV production. This, combined with growing consumer environmental awareness, creates a strong impetus for OEMs to embrace new component technologies and potentially move away from legacy suppliers.

Technological Disruption and Innovation Pace

The automotive sector is undergoing rapid technological shifts, impacting the threat of substitutes for companies like Aisin Seiki. Innovations in electric vehicle (EV) powertrains and autonomous driving systems are creating entirely new product categories that can replace traditional internal combustion engine components. For instance, the increasing demand for advanced driver-assistance systems (ADAS) means that suppliers not offering sophisticated sensor and computing solutions face growing obsolescence risks. The pace of these advancements means Aisin must consistently invest in R&D to keep its offerings competitive.

This ongoing disruption presents a significant threat. Consider the rapid advancements in battery technology; while not a direct substitute for Aisin's current product lines, the shift to EVs fundamentally alters the components needed in vehicles. Furthermore, the rise of software-defined vehicles means that core functionalities can be updated or even replaced via over-the-air (OTA) updates, potentially reducing the need for certain hardware components that Aisin currently produces. The industry is seeing substantial investment in these new areas, with global R&D spending in the automotive sector projected to reach hundreds of billions of dollars annually by 2024.

- Software-Defined Vehicles: Increasing reliance on software for core vehicle functions can bypass traditional hardware components.

- Advanced Sensor Technology: Breakthroughs in LiDAR, radar, and camera systems offer new ways to achieve vehicle control and safety.

- AI Integration: Artificial intelligence is enabling new functionalities and potentially replacing mechanical systems with intelligent software.

- EV Powertrain Evolution: The shift away from internal combustion engines necessitates entirely different component sets.

Emergence of New Mobility Solutions

The threat of substitutes for Aisin Seiki, particularly concerning traditional automotive components, is amplified by the burgeoning mobility-as-a-service (MaaS) sector. As consumers increasingly opt for ride-sharing, car-sharing, and other flexible transport options, the fundamental need for personal vehicle ownership may diminish. This evolving landscape directly impacts the volume of new vehicle production, a key driver for Aisin Seiki's component sales.

Consider the projected growth: the global MaaS market was valued at approximately USD 30 billion in 2023 and is anticipated to expand significantly, with some forecasts suggesting it could reach over USD 100 billion by 2030. This trend represents a substantial substitution threat, as a shift away from individual car ownership means less demand for the very parts Aisin Seiki specializes in producing, such as transmissions, powertrains, and braking systems. The entire automotive supply chain faces this long-term challenge.

Key aspects of this substitution threat include:

- Reduced vehicle sales: Increased adoption of MaaS could lead to fewer new car purchases, directly impacting demand for OEM parts.

- Shift in component needs: MaaS vehicles might require different types of components optimized for high utilization and durability rather than traditional consumer preferences.

- New service providers: Companies focused solely on mobility services, rather than vehicle manufacturing, could become major customers, altering supplier relationships.

- Changing aftermarket: The aftermarket for traditional vehicle parts could shrink as the overall number of privately owned vehicles plateaus or declines.

The rise of electric vehicles (EVs) and advancements in autonomous driving technologies present a significant threat of substitutes for Aisin Seiki's traditional internal combustion engine (ICE) components. For example, e-axles and battery frames are becoming increasingly vital, directly challenging Aisin's established product lines. Global EV sales continued their strong growth in 2024, underscoring the urgency for Aisin to adapt.

As new technologies mature, their improved price-performance ratio makes them more compelling alternatives. Advancements in battery and electric motor technology are making EVs more competitive with ICE vehicles, indirectly reducing demand for many of Aisin's conventional parts, as EV powertrains often require fewer traditional components. This shift is driven by both regulatory pressures, like stricter emissions standards implemented by 2024, and growing consumer preference for EVs, with some markets seeing over 20% EV market penetration in new vehicle sales by 2024.

The evolving automotive landscape, including the growth of mobility-as-a-service (MaaS), also contributes to this threat. As MaaS adoption increases, the demand for new vehicle production, a key market for Aisin, could decline. The global MaaS market, valued around USD 30 billion in 2023, is projected for substantial expansion, potentially impacting the need for traditional powertrain and braking system components.

Key substitute threats impacting Aisin Seiki:

| Technology Shift | Impact on Aisin | 2024 Market Context |

| Electric Vehicle (EV) Powertrains | Reduced demand for ICE components (transmissions, engines) | Continued robust EV sales growth globally; increasing OEM investment in EV platforms. |

| Autonomous Driving Systems | Potential for fewer mechanical control components; increased demand for sensors and computing. | Significant R&D spending in automotive sector projected to exceed hundreds of billions annually by 2024. |

| Mobility-as-a-Service (MaaS) | Lower overall new vehicle sales, impacting component volume. | Global MaaS market projected to grow significantly from approx. USD 30 billion in 2023. |

Entrants Threaten

For a company like Aisin, operating at the forefront of automotive component manufacturing, the capital required to even consider entering the market is staggering. Think about building state-of-the-art research and development centers, constructing advanced manufacturing plants with specialized machinery, and establishing robust global supply chains and distribution networks. These aren't small investments; they often run into billions of dollars.

In 2024, the automotive industry continued to see significant capital expenditure across major players, with companies investing heavily in electrification and autonomous driving technologies. For instance, major automotive suppliers reported R&D spending in the hundreds of millions to billions of dollars annually to stay competitive. This massive upfront financial commitment acts as a formidable barrier, effectively deterring many potential new competitors from even attempting to enter Aisin's space.

Incumbents like Aisin Seiki benefit immensely from significant economies of scale across production, procurement, and research and development. This allows them to achieve lower per-unit costs for automotive components, a substantial advantage.

New entrants would find it exceptionally difficult to replicate these cost efficiencies without achieving comparable production volumes, posing a formidable barrier to entry. For instance, in 2024, the global automotive component market was valued at over $1.5 trillion, with major players like Aisin leveraging vast operational footprints.

Furthermore, Aisin's long-standing presence has allowed it to develop an invaluable experience curve, leading to optimized manufacturing processes and greater efficiency. This accumulated knowledge further entrenches their cost advantage, making it challenging for newcomers to compete on price and quality.

Newcomers face significant hurdles in accessing established distribution channels and supply chains, particularly in the automotive sector. Aisin Seiki, for instance, has cultivated deep, long-standing relationships with major original equipment manufacturers (OEMs) globally. These partnerships are not easily replicated, requiring new entrants to invest heavily in building trust and demonstrating reliability over extended periods. For example, Aisin's integration into the supply chains of major Japanese automakers, who often demand stringent quality control and just-in-time delivery, represents a substantial barrier.

Brand Loyalty and Switching Costs for Customers

Original Equipment Manufacturers (OEMs) frequently foster deep, long-standing partnerships with established suppliers such as Aisin. These relationships are built on a foundation of demonstrated quality, unwavering reliability, and seamless integration into existing vehicle architectures. This deep entanglement significantly raises the barrier for new competitors.

The financial and operational implications for OEMs when switching suppliers are substantial. Re-engineering, rigorous testing, and extensive validation processes are all required, representing considerable investments of time and capital. For instance, a major automotive platform redesign can easily cost hundreds of millions of dollars. These high switching costs effectively deter new entrants from aggressively challenging Aisin's established market position.

- High OEM Switching Costs: Ranging from hundreds of millions to over a billion dollars for a complete vehicle platform transition.

- Supplier Integration: Aisin's components are often deeply embedded in vehicle designs, making component-level changes complex.

- Proven Track Record: OEMs prioritize suppliers with a history of delivering defect-free parts, reducing their own warranty and recall risks.

- Supplier Qualification Time: The process for qualifying a new automotive supplier can take 18-36 months, further delaying market entry.

Regulatory Barriers and Intellectual Property

The automotive sector faces rigorous safety, environmental, and quality standards. New players must contend with these complex regulations and establish substantial intellectual property (IP) to be competitive.

This is especially true for advanced and safety-critical automotive components, where significant investment in research and development is necessary. For instance, as of 2024, the average cost for automakers to comply with emissions standards globally continues to rise, necessitating advanced technological solutions that are often protected by patents.

- Regulatory Compliance Costs: Automakers face substantial expenses in meeting evolving safety and environmental regulations, like Euro 7 standards, which require significant R&D and manufacturing process adjustments.

- Intellectual Property Protection: Companies like Aisin Seiki heavily invest in and protect IP related to powertrain technology, chassis systems, and electronic components, creating a high barrier for new entrants lacking similar proprietary assets.

- Capital Intensity: Developing and patenting new automotive technologies demands immense capital investment, making it difficult for newcomers to match the established technological capabilities and IP portfolios of incumbents.

The threat of new entrants for Aisin Seiki remains relatively low, primarily due to the substantial capital investment required and the deep integration within existing automotive supply chains. New companies would face immense financial hurdles in establishing the necessary R&D, manufacturing capabilities, and distribution networks. Furthermore, the established relationships Aisin has with original equipment manufacturers (OEMs), built on years of proven quality and reliability, create significant barriers.

In 2024, the automotive component market, valued at over $1.5 trillion globally, continued to demand massive upfront investments, particularly in advanced technologies like electrification. Newcomers would struggle to match the economies of scale and experience curve advantages held by incumbents like Aisin. The lengthy supplier qualification processes, often 18-36 months, coupled with high OEM switching costs, further solidify the position of established players.

The stringent regulatory environment and the need for substantial intellectual property also deter new entrants. Companies must navigate complex safety and environmental standards, which require significant R&D and patent protection. For instance, evolving emissions standards in 2024 necessitate advanced technological solutions often guarded by patents, making it difficult for newcomers to compete on technological parity.

| Factor | Barrier Strength | Impact on Aisin |

| Capital Requirements | Very High | Deters new entrants due to billions needed for R&D and manufacturing. |

| Economies of Scale | High | Aisin's large production volumes lead to lower per-unit costs, a significant advantage. |

| OEM Switching Costs | High | Hundreds of millions to over a billion dollars for platform transitions, locking in current suppliers. |

| Brand Loyalty and Reputation | Moderate | Aisin benefits from a strong, established reputation for quality. |

| Access to Distribution Channels | High | Aisin's deep, long-standing relationships with global OEMs are difficult to replicate. |

| Intellectual Property & Technology | High | Patented technologies in areas like powertrain and chassis create a technological moat. |

| Regulatory Landscape | High | Meeting stringent safety and environmental standards is costly and complex for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aisin Seiki is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and publications from reputable automotive industry analysts to capture current market dynamics and competitive landscapes.