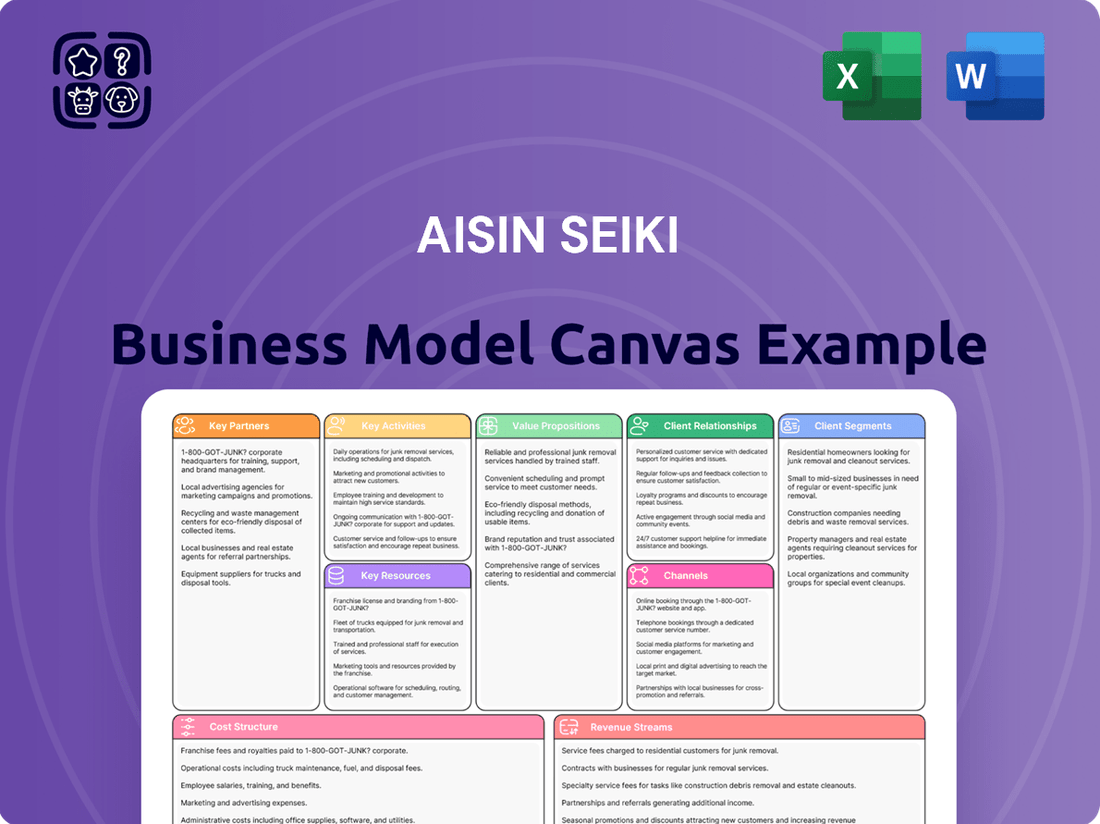

Aisin Seiki Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Uncover the strategic architecture of Aisin Seiki's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they build value, engage customers, and manage resources effectively. See their core activities, key partners, and revenue streams in one clear, actionable document. Ideal for anyone seeking to understand industry-leading automotive component manufacturing.

Dive deeper into Aisin Seiki’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Aisin Seiki's key partnerships are vital for its electrification strategy, with alliances forged with over 20 major global automotive manufacturers. These collaborations are essential for co-developing competitive products for the evolving electric vehicle (xEV) market. This extensive network ensures Aisin can meet the diverse and rapidly changing demands of its automotive clients worldwide.

A prime example of this partnership strategy is Aisin's recent agreement with the BMW Group. This deal specifically focuses on build-to-print e-axle production, highlighting Aisin's role as a critical supplier in BMW's electrification efforts. Manufacturing is slated for China and Europe, targeting vehicles expected in the late 2020s, demonstrating a forward-looking commitment to innovation and market needs.

Aisin actively partners with technology development and research institutions to push the boundaries of manufacturing. These collaborations focus on advanced areas like Artificial Intelligence (AI) and the Internet of Things (IoT). For instance, by integrating AI and IoT, Aisin aims to significantly enhance predictive maintenance, reducing downtime and boosting overall efficiency on the factory floor. This strategic approach allows them to leverage cutting-edge research for tangible operational improvements.

Their commitment to sustainability is further demonstrated through partnerships expanding the demonstration of perovskite solar cells with external organizations. This initiative underscores Aisin's dedication to developing and implementing environmentally friendly technologies. Furthermore, these collaborations extend to the joint development of novel materials and advanced production processes, all geared towards achieving crucial carbon neutrality goals by 2050.

Aisin Seiki is actively partnering with Manufacture 2030 to drive decarbonization throughout its extensive supply chain. This strategic alliance is crucial for achieving Aisin's ambitious target of carbon neutrality by 2050, showcasing a deep commitment to environmental responsibility across its entire value chain.

This collaboration is designed to foster a more sustainable and resilient supply network, ensuring long-term viability and reduced environmental impact. By working with Manufacture 2030, Aisin leverages specialized expertise and technology to identify and implement effective decarbonization strategies across its diverse supplier base.

Aftermarket Service Network Partners

Aisin is significantly reshaping its global aftermarket approach by integrating AWTEC and Aisin World Corporation of America's (AWA) aftermarket divisions into a unified entity, Aisin Aftermarket & Service of America Inc., effective April 2025. This strategic consolidation is designed to create a more robust and all-encompassing parts and service provider within the North American market.

The core of this overhaul involves deepening collaborations with established distributors and an extensive network of service centers. These partnerships are crucial for Aisin to effectively broaden its product offerings and streamline its service delivery, ensuring greater accessibility and efficiency for end-users.

The success of this new entity hinges on its ability to leverage the existing infrastructure and expertise of its channel partners. For instance, by April 2025, Aisin Aftermarket & Service of America Inc. will be fully operational, aiming to capture a larger share of the aftermarket sector, which in 2024, saw significant growth in demand for specialized automotive components and reliable repair services.

- Unified Operations: Aisin Aftermarket & Service of America Inc. merges AWTEC and AWA aftermarket units, operational from April 2025.

- Expanded Product Range: Collaboration with existing distributors will broaden the available parts and service portfolio.

- Streamlined Processes: The integration aims to enhance efficiency in parts distribution and service delivery.

- Market Focus: The initiative targets a more comprehensive aftermarket presence in North America.

Regional Sales and Distribution Alliances

Aisin Seiki cultivates robust regional sales and distribution alliances to enhance its global reach and customer engagement. These collaborations are fundamental to its market penetration strategy, allowing for tailored approaches in diverse geographical areas. For instance, Aisin actively collaborates with entities like Aisin Sales Latin America (ASLA).

These regional alliances facilitate a deeper understanding of local market dynamics and customer needs. Aisin’s strategic acquisitions, such as the business assets of Leon Import, S.A., underscore this commitment. This move in 2024 specifically aimed to bolster Aisin's presence in South America, shortening product delivery timelines and improving service responsiveness.

- Aisin Sales Latin America (ASLA): Acts as a key partner for localized market penetration and customer service enhancement in the Latin American region.

- Acquisition of Leon Import, S.A. business assets (2024): A strategic move to fortify Aisin's standing and reduce product delivery lead times in South America.

- Strengthened Market Presence: These alliances are critical for Aisin to effectively compete and serve customers in specific regional markets.

- Improved Responsiveness: Partnerships enable quicker adaptation to local demands and a more efficient supply chain.

Aisin Seiki's key partnerships are crucial for its growth and innovation, especially in the rapidly evolving automotive sector. These alliances extend beyond mere supplier relationships to encompass co-development and strategic market access. The company actively collaborates with over 20 major global automakers for electric vehicle (xEV) components.

In 2024, Aisin deepened its ties with key partners, exemplified by its agreement with the BMW Group for build-to-print e-axle production, targeting vehicles in the late 2020s. This focus on co-creation ensures Aisin's products align with the future needs of its automotive clients. Furthermore, partnerships with research institutions are vital for integrating advanced technologies like AI and IoT into manufacturing processes.

Aisin's sustainability efforts are bolstered by collaborations focused on green technologies, including perovskite solar cells, aiming for carbon neutrality by 2050. The company also partners with Manufacture 2030 to decarbonize its supply chain. Domestically, the consolidation of its aftermarket divisions into Aisin Aftermarket & Service of America Inc. from April 2025 aims to strengthen relationships with distributors and service centers, enhancing market reach in North America.

| Key Partnership Area | Example Partner | Strategic Objective | 2024/2025 Impact |

| Electrification (xEV) | BMW Group | Co-development of e-axles | Agreement for late 2020s vehicle production |

| Technology & Innovation | Research Institutions | AI & IoT integration in manufacturing | Enhanced predictive maintenance |

| Sustainability | Manufacture 2030 | Supply chain decarbonization | Progress towards 2050 carbon neutrality goal |

| Aftermarket Services | Distributors & Service Centers (North America) | Unified parts & service delivery | Formation of Aisin Aftermarket & Service of America Inc. (April 2025) |

| Regional Market Access | Aisin Sales Latin America (ASLA) / Leon Import, S.A. (acquired 2024) | Strengthened presence and reduced lead times in South America | Improved market responsiveness and delivery efficiency |

What is included in the product

Aisin Seiki's business model focuses on leveraging its deep expertise in automotive components to serve a wide range of global automakers, emphasizing high-quality manufacturing and technological innovation across diverse product lines.

Aisin Seiki's Business Model Canvas acts as a pain point reliver by providing a clear, concise overview of their value proposition, allowing stakeholders to quickly identify how their automotive components solve customer needs.

This one-page snapshot of Aisin Seiki's operations effectively alleviates the pain of complex strategic understanding, enabling rapid comprehension of their core business drivers.

Activities

Aisin Seiki places a significant emphasis on Research and Development, dedicating 4.7% of its total revenue to fostering innovation in advanced automotive technologies. This substantial investment fuels the creation of cutting-edge products designed to shape the future of mobility.

Key areas of focus for Aisin's R&D include advanced driver-assistance systems (ADAS) and the rapidly evolving field of electric vehicle technologies. The company reportedly channels approximately $300 million into these critical segments, underscoring their commitment to staying at the forefront of automotive advancements.

This dedication to innovation is a cornerstone of Aisin's growth strategy, consistently leading to the introduction of new products. These developments are geared towards enhancing fuel efficiency and elevating overall vehicle performance, ensuring their offerings remain competitive and desirable in the market.

Aisin's primary function revolves around the sophisticated design and manufacturing of a comprehensive range of automotive components. This includes critical systems such as drivetrains, braking mechanisms, chassis structures, body parts, and engine-related technologies, showcasing their deep expertise across the automotive spectrum.

The company is strategically enhancing its global manufacturing footprint, with a specific focus on electric vehicle components. Aisin is targeting the production of 4.5 million electric units and is actively augmenting plant capacities for electrified products, including advanced e-axles, in crucial markets like China and Europe to meet growing demand.

Aisin is actively growing its aftermarket business, aiming to be a comprehensive provider of both parts and services. A key part of this strategy involves strengthening its remanufacturing operations to enhance efficiency and ensure continuous service availability for customers.

The company is broadening its product offerings to include a wide range of maintenance essentials, not limited to its own brands. This expansion includes items like wiper blades, lubricants, and batteries, specifically curated to meet the diverse demands of local markets.

Aisin’s global aftermarket reach extends across 17 countries, supported by 36 operational locations. This extensive network allows for the localized supply of these diverse maintenance products, ensuring availability and relevance in each market.

Sustainable Operations and Environmental Initiatives

Aisin is actively pursuing sustainability, with a clear goal to reduce its environmental impact. A significant step in this direction is their commitment to increasing renewable energy sources, targeting 50% of their total energy consumption by 2024. This ambitious target underscores their dedication to cleaner energy alternatives.

Furthermore, Aisin has set a long-term objective of achieving carbon neutrality by 2050. To support these environmental aims, the company is making strategic investments in developing and implementing more sustainable production processes. These investments are crucial for operationalizing their environmental commitments.

The company is also focusing on the circular economy by increasing the use of recycled materials in its product offerings. This initiative not only helps reduce waste but also conserves natural resources. Aisin’s approach integrates environmental responsibility directly into its product development and manufacturing.

- Renewable Energy Target: Aims for 50% of total energy consumption from renewable sources by 2024.

- Carbon Neutrality Goal: Committed to achieving carbon neutrality by 2050.

- Investment in Sustainability: Allocating resources to improve sustainable production processes.

- Recycled Material Usage: Increasing the incorporation of recycled materials into products.

Integrated Vehicle Control and Sensing Solutions Development

Aisin is actively developing sophisticated integrated vehicle control systems. These systems leverage intelligent electric units, advanced braking and chassis technologies, and even aerodynamic devices, all informed by precise location data. The primary goals are to significantly enhance electricity consumption efficiency, elevate driving performance, and bolster overall vehicle safety.

This development also encompasses a strong emphasis on integrated sensing, both within and outside the vehicle. By combining these sensing capabilities, Aisin aims to create a mobile environment that is not only exceptionally comfortable but also highly secure for all occupants.

- Enhanced Efficiency: Integrating control systems allows for optimized energy management, crucial as the automotive industry moves towards electrification.

- Improved Driving Dynamics: Coordinated control of braking, chassis, and propulsion systems leads to a more responsive and enjoyable driving experience.

- Advanced Safety Features: Real-time data from sensors and control units enables proactive safety interventions, reducing accident risks.

- Comfort and Security: Sensing technologies contribute to features like advanced driver-assistance systems (ADAS) and personalized cabin environments.

Aisin Seiki's key activities center on the sophisticated design and manufacturing of a wide array of automotive components, including crucial systems like drivetrains, braking, and chassis. The company is strategically expanding its global production capabilities, with a significant focus on meeting the growing demand for electric vehicle components. Furthermore, Aisin is actively developing advanced integrated vehicle control systems that enhance efficiency, driving performance, and safety through intelligent electrification and sensing technologies.

| Key Activity | Description | Focus Area | 2024 Impact/Data |

|---|---|---|---|

| Component Design & Manufacturing | Producing essential automotive parts. | Drivetrains, Braking, Chassis, Body Parts, Engine Tech | Core business driving revenue and market share. |

| EV Component Production | Increasing capacity for electrified product manufacturing. | e-Axles, Electrified Powertrains | Targeting 4.5 million electric units production; capacity expansion in China and Europe. |

| Integrated Vehicle Control Systems | Developing advanced systems for vehicle operation. | Intelligent Electric Units, ADAS, Chassis Control | Enhancing electricity efficiency, driving performance, and safety. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them now, ensuring no surprises. You can be confident that the insights and strategic framework presented here will be yours to utilize immediately. This preview offers a genuine glimpse into the comprehensive analysis of Aisin Seiki's business model, ready for your review and application.

Resources

Aisin Seiki operates a vast global production network, with manufacturing facilities strategically located across Japan, North America, Europe, China, ASEAN, and India. This extensive footprint allows for efficient, high-volume manufacturing of a wide array of automotive components.

These advanced facilities are not only geared for traditional automotive parts but are also expanding capabilities for electrified products. For instance, Aisin is increasing production capacity for e-axles, a critical component for electric vehicles, reflecting its commitment to future mobility trends.

In 2024, Aisin continued to invest in its manufacturing infrastructure. While specific financial figures for plant expansions are proprietary, the company's capital expenditure in recent years has consistently supported the modernization and scaling of these global operations to meet evolving automotive demands.

Aisin Seiki's intellectual property is a cornerstone of its business model, particularly in its automotive component offerings. The company boasts a vast portfolio of patents covering critical areas like drivetrain systems, braking technology, chassis components, and engine-related parts. This deep well of IP underpins their competitive advantage in the automotive supply chain.

Their commitment to research and development is evident in their continuously expanding patent portfolio. Aisin has strategically focused on emerging automotive technologies, with significant advancements in Advanced Driver-Assistance Systems (ADAS) and electric vehicle (EV) components. For instance, their development of the eAxle, a crucial component for EVs, is protected by numerous proprietary technologies.

In 2023, Aisin reported R&D expenses of approximately 270 billion Japanese Yen, a clear indication of their dedication to innovation and the creation of new intellectual property. This investment fuels their ability to offer cutting-edge solutions and maintain a technological edge in the rapidly evolving automotive landscape.

Aisin Seiki's competitive edge is significantly bolstered by its vast pool of skilled talent, boasting a global workforce of engineers, researchers, and technicians. This deep reservoir of expertise is fundamental to their ability to innovate and maintain the high quality synonymous with their products.

The company actively cultivates a positive work environment, prioritizing employee job satisfaction and opportunities for continuous professional development. This strategic focus on human capital development is a direct driver of their ongoing innovation and the consistent quality that defines their automotive and industrial components.

In 2024, Aisin Seiki continued to invest heavily in training and development programs. For instance, their global workforce, exceeding 100,000 employees, participated in over 1 million hours of specialized technical training, underscoring their commitment to engineering excellence and a highly skilled workforce.

Strong Financial Capital and Investment Capacity

Aisin Seiki's robust financial standing is a cornerstone of its business model, enabling substantial investments in innovation and growth. The company's financial strength is evident in its impressive revenue figures, demonstrating a consistent ability to generate income and maintain profitability.

This financial capacity directly fuels Aisin's commitment to research and development, a critical component for staying competitive in the automotive industry. Significant capital is allocated to exploring new technologies and enhancing existing product lines.

- Record Revenue: Aisin achieved a record ¥1,800 billion in revenue for the fiscal year ending March 2024.

- Investment Policy: The company adheres to a policy of controlling capital investments to align with depreciation costs.

- R&D Focus: Strong financial capital supports significant investments in research and development initiatives.

- Strategic Agility: Financial stability provides the flexibility to pursue strategic partnerships and acquisitions.

Established Relationships with Global Automakers

Aisin's established relationships with global automakers form a cornerstone of its business model. These enduring partnerships, particularly with giants like the Toyota Group and BMW Group, ensure a consistent and substantial demand for Aisin's diverse product portfolio. In 2023, Aisin reported significant revenue contributions from these key automotive clients, highlighting the stability and strength these relationships provide. This deep integration allows for early involvement in vehicle development cycles, fostering co-creation and ensuring Aisin's components meet evolving automotive needs.

These collaborations aren't just about supply; they foster innovation. Aisin works closely with automakers on next-generation technologies, from advanced powertrains to sophisticated chassis systems. This collaborative approach not only solidifies Aisin's position as a preferred supplier but also provides invaluable insights into future market trends and technological advancements. The company's commitment to quality and reliability has cultivated a trust that translates into long-term contracts and joint development projects, securing its competitive edge.

- Toyota Group Partnership: Aisin is a core supplier to the Toyota Group, a relationship that has historically driven a significant portion of its revenue.

- BMW Group Collaboration: Aisin supplies key components to BMW, underscoring its ability to meet the stringent quality and performance demands of premium automotive manufacturers.

- New Model Integration: These relationships enable Aisin to be integrated into new vehicle platforms from the initial design stages, securing future business.

- Global Reach: The partnerships extend across the global operations of these automakers, providing Aisin with a broad international customer base.

Aisin Seiki's key resources are its extensive global manufacturing facilities, a deep portfolio of intellectual property, a highly skilled workforce, strong financial capital, and robust relationships with major automakers.

The company's manufacturing footprint, particularly its investments in e-axle production capacity, positions it well for the EV transition. Its patent portfolio, with a strong focus on ADAS and EV components, underscores its commitment to innovation, as evidenced by its significant R&D spending. Aisin's substantial investment in employee training, with over 1 million hours dedicated in 2024, ensures its workforce remains at the forefront of automotive technology.

Financially, Aisin reported a record ¥1,800 billion in revenue for the fiscal year ending March 2024, demonstrating its capacity to fund ongoing development and strategic initiatives. These resources enable Aisin to maintain its role as a crucial, collaborative partner for leading automotive manufacturers like the Toyota and BMW Groups, securing its future in the evolving automotive landscape.

Value Propositions

Aisin delivers a comprehensive range of automotive components, spanning critical areas like drivetrain, braking, chassis, body, and engine systems. Their dedication to superior quality is underscored by a robust quality management system that adheres to ISO/TS 16949 standards. This unwavering focus on excellence translates into tangible results, with Aisin reporting an impressive 95% customer satisfaction rate directly tied to product quality.

Aisin Seiki is a key player in shaping the future of transportation by driving innovation in electrified and advanced mobility. They are deeply invested in developing cutting-edge technologies like advanced driver-assistance systems (ADAS) and crucial electric vehicle (EV) components, such as their integrated eAxle systems.

Their commitment extends to providing a comprehensive suite of electrified components specifically designed for hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs). This strategic focus positions Aisin to meet the growing demand for cleaner and more efficient automotive solutions, aiming to significantly enhance both vehicle safety and overall operational efficiency.

For instance, Aisin's eAxle, a critical component for EVs, integrates the motor, gearbox, and inverter into a single, compact unit, streamlining vehicle design and boosting performance. This innovation is vital as the global EV market continues its rapid expansion, with projections indicating continued strong growth through 2025 and beyond.

Aisin positions itself as a comprehensive provider of aftermarket parts and services, striving to be the ultimate destination for automotive needs. Their extensive and growing product catalog covers everything from their own manufactured components to essential maintenance items like wiper blades, lubricants, and batteries, simplifying the procurement process for customers worldwide.

This one-stop-shop approach is backed by Aisin's significant global presence, serving millions of vehicles. For instance, in 2023, Aisin's aftermarket sales reached approximately ¥789.1 billion (around $5.3 billion USD), demonstrating substantial market penetration and customer reliance on their broad product offering.

Contribution to Environmental Sustainability

Aisin Seiki actively contributes to environmental sustainability by prioritizing the development of technologies and processes that support a carbon-neutral future. This commitment is a fundamental aspect of their business strategy, aiming to align operations with global environmental goals.

Their initiatives directly address climate change through tangible actions.

- Greenhouse Gas Emission Reduction: Aisin is focused on decreasing its operational carbon footprint. For instance, in fiscal year 2023, they reported a reduction in Scope 1 and Scope 2 greenhouse gas emissions by 3.5% compared to the previous year, a step towards their 2030 targets.

- Renewable Energy Adoption: The company is increasing its reliance on renewable energy sources across its manufacturing facilities. By the end of 2023, approximately 15% of their total energy consumption was derived from renewable sources, with plans to reach 30% by 2028.

- Sustainable Production and Materials: Aisin is investing in R&D for sustainable production methods and the use of eco-friendly materials. This includes developing components made from recycled plastics and bio-based materials, which resonates with environmentally conscious partners and consumers seeking greener supply chains.

Integrated Systems for Enhanced Safety and Comfort

Aisin Seiki integrates advanced vehicle control and sensing solutions to elevate driving performance, safety, and passenger comfort. These systems create a more intuitive and secure mobility experience for users.

Their innovations, such as the Intelligent Pillar Unit, are designed for smoother and more comfortable boarding and alighting from vehicles. This focus on user convenience is a key aspect of their value proposition.

Furthermore, the inclusion of features like the Forgotten Item Detection System highlights Aisin's dedication to a truly seamless and secure automotive environment. This addresses common passenger concerns and enhances overall trust in the vehicle's capabilities.

Aisin's commitment to integrated systems directly addresses the growing consumer demand for enhanced safety and convenience in modern vehicles. For instance, by 2024, the global automotive safety systems market is projected to reach over $60 billion, underscoring the significance of these technologies.

- Intelligent Pillar Unit: Enhances ease of entry and exit.

- Forgotten Item Detection System: Prevents accidental leaving of objects.

- Integrated Control: Optimizes driving dynamics and safety.

- Sensing Solutions: Provide real-time environmental awareness.

Aisin delivers high-quality automotive components across various systems, achieving a 95% customer satisfaction rate for product excellence. They are at the forefront of automotive innovation, developing crucial components for electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Their aftermarket segment is substantial, with sales reaching approximately ¥789.1 billion in 2023, demonstrating a strong customer reliance on their broad product range.

Customer Relationships

Aisin Seiki's strategy centers on forging enduring alliances with Original Equipment Manufacturers (OEMs), fostering a foundation of unwavering trust and reliable product delivery. These collaborations are not merely transactional; they often blossom into joint ventures for pioneering future automotive innovations, underscoring a shared commitment to progress and dependable performance. For instance, Aisin's long-standing relationship with Toyota, its parent company and largest customer, exemplifies this approach, with Aisin components being integral to Toyota's global vehicle production for decades.

Aisin Seiki actively cultivates strong customer relationships through its dedicated feedback programs. In 2023 alone, over 10,000 customers participated, offering valuable insights that directly inform product development and service enhancements. This direct line to customer sentiment is crucial for Aisin's continuous improvement efforts.

This emphasis on listening and adapting has demonstrably boosted customer satisfaction levels. By integrating feedback, Aisin ensures its offerings remain aligned with evolving market demands and user expectations. This proactive approach fosters loyalty and strengthens Aisin's market position.

Aisin is actively strengthening its customer relationships in the global aftermarket by evolving into a complete parts and service provider. The company's strategy focuses on delivering uninterrupted service, a critical factor for customer retention and satisfaction in the automotive sector.

This commitment is demonstrated through the tailoring of product lines to meet specific local market requirements across Aisin's extensive global network. For instance, Aisin's Genuine Parts are designed to meet or exceed OEM specifications, ensuring reliability and performance for a wide range of vehicles.

By ensuring agility in responding to diverse market demands, Aisin aims to foster deeper loyalty. This adaptability is crucial, especially given that the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to grow steadily.

Technical Support and Collaborative Development

Aisin Seiki offers robust technical support, crucial for customers integrating intricate automotive systems or adopting new technologies. This support ensures seamless implementation and optimal performance of their components.

Their commitment extends to collaborative development, actively engaging with partners to co-create solutions for future mobility. A prime example is their work with BMW on next-generation xEV powertrains, demonstrating a forward-thinking strategy to anticipate and satisfy market demands.

- Extensive Technical Support: Aisin provides in-depth technical assistance for complex automotive systems and new technology integration, ensuring customer success.

- Collaborative Development Focus: Proactive partnerships, like the one with BMW for next-generation xEVs, underscore Aisin's dedication to evolving with customer needs and industry trends.

- Meeting Evolving Requirements: These collaborations allow Aisin to directly address and shape the development of future automotive technologies, ensuring their offerings remain cutting-edge and relevant.

Regionalized Customer Engagement and Management

Aisin Seiki is increasingly focusing on regionalized customer engagement to foster deeper relationships. This strategic shift involves tailoring their approach based on specific market demands and emerging customer trends within each geographic area. By understanding these localized nuances, Aisin can offer more relevant products and services, directly boosting regional customer satisfaction.

This localized strategy is crucial for adapting to diverse market dynamics. For instance, in 2024, Aisin's European operations saw a notable uptick in demand for electrified powertrain components, a trend less pronounced in other regions. This regional insight allowed for a more targeted product development and marketing push in Europe.

- Regional Market Analysis: Aisin actively analyzes distinct market needs and customer behaviors region by region.

- Tailored Product Development: This localized understanding informs the creation of product offerings that resonate with specific regional preferences.

- Enhanced Service Delivery: Customer service and support are customized to meet the expectations and operational environments of each geographic market.

- Strengthened Partnerships: The focus on regional engagement aims to build more robust and enduring relationships with key customers across diverse territories.

Aisin Seiki builds deep customer relationships through collaborative development, extensive technical support, and a focus on regional engagement. Their commitment to understanding and adapting to specific market needs, as seen with the 2024 European demand for electrified components, ensures tailored product offerings and enhanced service delivery, fostering stronger, more loyal partnerships.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Collaborative Development | Partnering with customers to co-create future solutions. | Work with BMW on next-generation xEV powertrains. |

| Technical Support | Providing in-depth assistance for complex systems. | Ensures seamless integration and optimal performance of components. |

| Regional Engagement | Tailoring approaches to specific market demands and trends. | Noted uptick in demand for electrified components in Europe in 2024. |

| Feedback Integration | Utilizing customer input for product and service improvements. | Over 10,000 customers participated in feedback programs in 2023. |

Channels

Aisin's core distribution strategy centers on direct sales to Original Equipment Manufacturers (OEMs), acting as a crucial Tier 1 supplier. This channel is fundamental, with established, long-term supply agreements ensuring Aisin's components are integrated directly into the manufacturing process of new vehicles worldwide. For instance, Aisin's transmission systems are a key component in many Toyota models, reflecting the deep integration within their established partnerships.

This direct relationship fosters intense collaboration, with Aisin working closely alongside automotive manufacturers from the initial stages of vehicle design and development through to mass production. This ensures seamless integration and adherence to stringent quality and performance standards demanded by the automotive industry. Aisin's commitment to R&D, often in direct consultation with OEMs, allows for the co-creation of advanced technologies that meet future automotive needs.

The financial implications of this direct OEM channel are significant, representing the bulk of Aisin's revenue. In the fiscal year ending March 2024, Aisin reported consolidated net sales of approximately ¥4.1 trillion (roughly $26 billion USD at current exchange rates), with a substantial portion directly attributed to OEM supply contracts. This highlights the critical importance of maintaining strong, reliable relationships with major global automakers.

Aisin Seiki's global aftermarket distribution network is a cornerstone of its business, spanning 17 countries and encompassing 36 operational locations. This extensive reach ensures timely availability of parts and services to a wide customer base.

The company is actively enhancing this network, exemplified by the establishment of Aisin Aftermarket & Service of America Inc. This strategic move is designed to optimize the delivery of a broad spectrum of automotive parts and specialized services, bolstering customer support and market penetration.

In 2024, Aisin continued to invest in its distribution infrastructure, focusing on efficiency and responsiveness. This commitment is critical for maintaining customer satisfaction and competitive advantage in the dynamic automotive aftermarket sector.

Aisin strategically utilizes specialized regional sales subsidiaries, exemplified by Aisin Sales Latin America (ASLA), to cultivate and expand its market presence in distinct geographic territories. These entities are instrumental in achieving deep localized market penetration and tailoring strategies to meet specific regional customer needs.

These subsidiaries play a vital role in adapting Aisin’s product offerings and sales approaches to the unique demands of each region, ensuring greater market relevance and customer satisfaction. This localized focus allows for a more agile response to evolving market trends and competitive landscapes.

By establishing these regional outposts, Aisin significantly improves its product delivery lead times, a critical factor in customer retention and satisfaction within the automotive supply chain. For instance, ASLA’s presence in Latin America facilitates quicker access to Aisin components for regional manufacturers.

The operational efficiency gained through these subsidiaries directly impacts Aisin's ability to compete effectively, as evidenced by their continuous efforts to strengthen their global distribution networks. This decentralized approach allows for more targeted sales efforts and better support for local clients.

Automotive Expos and Industry Trade Shows

Aisin Seiki actively participates in key automotive engineering expositions and industry trade shows, such as AAPEX. These events are crucial for demonstrating Aisin's cutting-edge technologies and new product offerings to a global audience. For example, in 2024, AAPEX reported record attendance with over 150,000 attendees, providing Aisin with unparalleled access to potential customers and partners.

These trade shows are vital for Aisin to foster direct engagement with prospective clients, thereby strengthening relationships and identifying new business opportunities. They also serve as a significant platform for enhancing market visibility and brand recognition within the highly competitive automotive sector. Aisin uses these gatherings to unveil strategic initiatives and gather valuable market intelligence.

Aisin's presence at these shows allows for direct feedback on its innovations, helping to shape future product development. It also provides a venue to network with industry leaders and competitors, staying abreast of market trends and technological advancements. The company leverages these opportunities to solidify its position as a leading automotive supplier.

Key benefits of Aisin's participation include:

- Showcasing new technologies and products: Demonstrating advancements in areas like electrification and autonomous driving systems.

- Customer engagement: Direct interaction with automakers, Tier 1 suppliers, and aftermarket distributors.

- Market visibility and brand building: Enhancing Aisin's profile within the global automotive industry.

- Strategic announcements: Unveiling new partnerships, investments, or product roadmaps.

Digital Platforms and Online Catalogs

Aisin Seiki strategically utilizes digital platforms and detailed online part catalogs to serve its global customer base, especially in the aftermarket. These resources are crucial for providing comprehensive product information and simplifying the selection process for mechanics and consumers alike.

While Aisin's primary business involves supplying original equipment manufacturer (OEM) parts directly to automakers, its digital presence plays a vital role in its broader service ecosystem. The online catalogs are not just repositories of part numbers but also serve as a testament to Aisin's commitment to supporting its products throughout their lifecycle.

- Enhanced Customer Support: Digital platforms offer customers easy access to technical specifications, compatibility guides, and installation resources, reducing reliance on traditional, slower support channels.

- Market Reach and Efficiency: Online catalogs expand Aisin's reach beyond direct OEM relationships, allowing the aftermarket segment to efficiently identify and procure necessary components.

- Data-Driven Insights: Digital interactions provide valuable data on customer search patterns and product demand, informing inventory management and product development strategies.

- Brand Visibility: A strong digital footprint reinforces Aisin's brand as a reliable provider of high-quality automotive components, building trust and loyalty among end-users.

Aisin leverages digital platforms, including detailed online part catalogs, to support its global aftermarket customers. These resources provide essential product information, streamlining part selection for mechanics and consumers. This digital presence complements its direct OEM supply chain by ensuring aftermarket support throughout the product lifecycle.

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Aisin's foundational customer base. These are the major car companies worldwide, such as Toyota, General Motors, and Volkswagen Group, that incorporate Aisin's extensive product portfolio into their vehicle assembly lines. Their demand drives a significant portion of Aisin's revenue, with Aisin supplying critical components for millions of vehicles annually.

This segment is increasingly diverse, with OEMs actively developing and producing both traditional internal combustion engine vehicles and a substantial number of electric and hybrid vehicles. Aisin's ability to adapt its offerings, including transmissions, braking systems, and powertrain components, to these evolving vehicle architectures is crucial for maintaining its strong relationships with these key partners.

In 2024, the automotive industry continued its transition, with electric vehicle sales projected to reach over 15 million units globally. Aisin’s strategic focus on supplying components for these growing EV and hybrid markets directly aligns with the needs of its OEM customers, who are themselves investing heavily in electrification technologies.

Automotive aftermarket businesses, including distributors and independent repair shops, represent a critical customer segment for Aisin Seiki. These entities rely on a consistent supply of high-quality replacement parts and maintenance products to service vehicles. Aisin is strategically enhancing its product portfolio to serve as a comprehensive, one-stop solution for their diverse needs.

In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the significant market opportunity. Independent repair shops, in particular, are a growing force, often competing on service and price. Aisin's commitment to providing a wide array of parts, from engine components to braking systems, directly addresses their operational requirements and supports their ability to maintain and repair a broad range of vehicles.

The electric vehicle (EV) and hybrid electric vehicle (HEV/PHEV) manufacturer segment represents a critical and rapidly expanding customer base for Aisin Seiki. These companies are actively seeking Aisin's sophisticated electrified powertrain components, including advanced eAxles, highly efficient hybrid transmissions, and integrated electric drive units. Aisin's strategic focus on developing and supplying these cutting-edge technologies directly addresses the urgent need for electrification solutions in the automotive industry.

Global EV sales are projected to continue their upward trajectory, with forecasts indicating significant year-over-year growth. For instance, in 2024, the market is expected to see millions of new EV registrations worldwide, a trend that directly fuels the demand for specialized components like those offered by Aisin. This surge in demand underscores Aisin's pivotal role in enabling the transition to cleaner mobility solutions.

Industrial Equipment Manufacturers

Aisin Seiki's industrial equipment segment caters to a broad range of manufacturers beyond the automotive sector, providing critical components and specialized solutions for their machinery. This diversification showcases Aisin's adaptability and its ability to apply its renowned precision manufacturing prowess to varied industrial needs.

The company's offerings in this space are vital for industries requiring robust and reliable equipment. For instance, Aisin's transmissions and driveline components find applications in construction vehicles, agricultural machinery, and material handling systems, underscoring the versatility of their engineering.

- Diverse Applications: Components are crucial for construction, agriculture, and logistics equipment.

- Precision Engineering: Leverages advanced manufacturing for high-performance industrial machinery.

- Quality and Reliability: Focus on durable parts that withstand demanding operational environments.

- Global Reach: Serves manufacturers worldwide, supporting diverse industrial operations.

Housing and Lifestyle Product Companies

Aisin Seiki extends its manufacturing prowess into the housing and lifestyle sectors, serving companies that produce essential home goods. This diverse customer base includes manufacturers of sewing machines, beds, and advanced heat pump systems.

These partnerships underscore Aisin's commitment to diversification, showcasing its ability to apply its precision engineering and production expertise to markets outside its primary automotive focus. For instance, in 2023, the global market for smart home devices, which often incorporate components similar to those Aisin produces, was valued at approximately $80 billion and is projected to grow significantly.

- Diverse Product Offerings: Aisin supplies components and finished goods like sewing machines, beds, and heat pumps to lifestyle product companies.

- Market Reach: This segment demonstrates Aisin's capability to serve non-automotive industries with high-quality manufactured products.

- Technological Application: Aisin's expertise in areas like thermal management and automation is leveraged for creating efficient and reliable lifestyle products.

Aisin Seiki's customer base is notably diverse, extending beyond its core automotive original equipment manufacturers (OEMs). This includes a significant segment of automotive aftermarket businesses, such as distributors and independent repair shops, who require a steady supply of quality replacement parts. Furthermore, the company actively serves manufacturers specializing in electric and hybrid vehicles, providing them with critical electrified powertrain components.

Beyond automotive applications, Aisin also caters to industrial equipment manufacturers, supplying essential components for machinery used in construction, agriculture, and logistics. The company's reach further expands into the housing and lifestyle sectors, supporting producers of home goods like sewing machines, beds, and heat pump systems, demonstrating a broad application of its manufacturing expertise.

| Customer Segment | Key Needs/Focus | 2024 Market Context/Data |

| Global Automotive OEMs | Vehicle components (powertrain, chassis, electronics) for ICE, EV, and hybrid vehicles. | Global EV sales projected to exceed 15 million units in 2024. |

| Automotive Aftermarket | High-quality replacement parts and maintenance products for vehicle servicing. | Global aftermarket projected over $500 billion in 2024; growth in independent repair shops. |

| EV/HEV Manufacturers | Advanced electrified powertrain components (eAxles, hybrid transmissions). | Significant growth in EV registrations expected globally in 2024. |

| Industrial Equipment Manufacturers | Robust and reliable components for construction, agriculture, and material handling. | Diverse applications requiring precision-engineered, durable parts. |

| Housing & Lifestyle Product Manufacturers | Components and finished goods (sewing machines, beds, heat pumps) leveraging precision engineering. | Smart home device market valued around $80 billion in 2023, with strong growth anticipated. |

Cost Structure

Aisin Seiki dedicates a significant portion of its financial resources to Research and Development, a critical element for staying ahead in the automotive sector. In 2024, the company continued to prioritize investments in areas like advanced driver-assistance systems (ADAS) and the burgeoning field of electric vehicle (EV) technologies. This commitment to innovation isn't just about future products; it's a fundamental strategy to ensure Aisin maintains its competitive standing in an industry undergoing rapid transformation.

Manufacturing and production costs are a significant component for Aisin Seiki. These costs encompass the procurement of raw materials essential for their diverse product lines, from automotive components to information equipment. In fiscal year 2024, Aisin continued its focus on efficiency, aiming to control these expenditures through ongoing structural reforms.

Labor costs for the production workforce, spread across their global manufacturing footprint, are carefully managed. The company also incurs substantial overheads associated with maintaining and operating these international facilities. Efforts to optimize these overheads are particularly concentrated in key manufacturing regions, such as China, to enhance cost competitiveness.

Aisin Seiki's extensive global operations, spanning 17 countries and 36 locations, necessitate significant expenditures in managing its supply chain and logistics. These costs are driven by the complexity of sourcing diverse components worldwide and ensuring their timely delivery. For instance, in 2024, a substantial portion of Aisin's operational budget was allocated to warehousing, transportation, and inventory holding, reflecting the challenges of a decentralized manufacturing footprint.

Furthermore, Aisin's strategic commitment to decarbonizing its supply chain, a key initiative in 2024, involves upfront investments in greener logistics solutions and sustainable sourcing practices. While these investments may increase short-term costs, they are projected to yield long-term efficiencies through reduced fuel consumption and improved resource management, aligning with evolving environmental regulations and consumer preferences.

Sales, Marketing, and Distribution Expenses

Aisin Seiki's sales, marketing, and distribution expenses are crucial for reaching both original equipment manufacturers (OEMs) and the aftermarket. These costs cover maintaining a global sales force that engages with automotive clients worldwide. For instance, in fiscal year 2024, Aisin reported consolidated sales of ¥4.5 trillion, with a significant portion allocated to these customer-facing activities.

The company invests in industry presence through participation in major automotive trade shows, which are essential for showcasing new technologies and fostering relationships. Additionally, a substantial part of these costs involves developing and managing sophisticated digital platforms that support sales and customer service. These digital initiatives are key to efficient engagement in today's market.

- Marketing to OEMs: Costs include direct sales team salaries, travel, and relationship management with major car manufacturers.

- Aftermarket Engagement: Expenses cover advertising, promotions, and support for distributors and service centers globally.

- Distribution Channel Operations: This involves the logistics and overhead of warehouses, shipping, and managing a network of partners.

- Digital Platform Development: Investments in e-commerce solutions, CRM systems, and online marketing campaigns to enhance customer reach and efficiency.

Administrative and General Expenses

Administrative and General Expenses at Aisin Seiki represent the essential corporate overheads that keep the company running smoothly. These costs cover everything from the salaries of their dedicated administrative teams and the vital expenses associated with legal and compliance matters, to the ongoing investment in IT infrastructure and other general business operations. These are the foundational costs that support the entire organization.

Aisin Seiki is actively engaged in internal structural realignments aimed at streamlining these administrative functions. The goal is to enhance overall operational efficiency and bolster the company's competitive standing in the global automotive parts market. This focus on internal optimization is crucial for adapting to evolving industry demands.

- Salaries for administrative staff: Covering the human resources dedicated to corporate functions.

- Legal and compliance costs: Ensuring adherence to regulatory frameworks and managing legal affairs.

- IT infrastructure: Maintaining and upgrading the technology systems that underpin business operations.

- General business operations: Including office supplies, utilities, and other day-to-day running costs.

Aisin Seiki's cost structure is heavily influenced by its substantial investments in research and development, particularly in areas like ADAS and EV technologies, reflecting a 2024 focus on innovation. Manufacturing and production costs, including raw material procurement and global labor expenses, are managed through ongoing structural reforms to maintain competitiveness.

Supply chain and logistics represent significant expenditures due to Aisin's extensive global operations, with a notable portion of the 2024 budget allocated to warehousing and transportation. Sales, marketing, and distribution expenses are also considerable, supporting a global sales force and digital platform development, evidenced by fiscal year 2024 consolidated sales of ¥4.5 trillion.

Administrative and general expenses cover essential corporate overheads, including IT infrastructure and compliance, with ongoing efforts to streamline these functions for improved efficiency. These costs are foundational to supporting the company's broad operational scope and strategic initiatives.

| Cost Category | Key Components | 2024 Focus/Impact |

| Research & Development | ADAS, EV Technologies | Prioritized investment for innovation and competitiveness |

| Manufacturing & Production | Raw Materials, Labor, Overheads | Efficiency improvements through structural reforms |

| Supply Chain & Logistics | Warehousing, Transportation, Inventory | Managed for global operations; impact of decarbonization initiatives |

| Sales, Marketing & Distribution | Sales Force, Trade Shows, Digital Platforms | Supporting ¥4.5 trillion in consolidated sales |

| Administrative & General | Salaries, IT, Legal, Compliance | Streamlining for operational efficiency |

Revenue Streams

Aisin Seiki's sales of drivetrain components represent a core revenue stream, with automatic transmissions being a particularly strong product. This segment is a significant contributor to the company's overall financial performance.

In the fiscal year concluding March 2024, Aisin reported ¥600 billion in revenue specifically from drivetrain components. This indicates a substantial market presence and demand for these essential automotive parts.

Furthermore, this critical revenue stream experienced a robust 15% growth rate during the same period. This impressive expansion highlights Aisin's success in this competitive market and its ability to adapt to evolving automotive needs.

Sales of electric vehicle (EV) and hybrid components represent a significant and rapidly expanding revenue stream for Aisin Seiki. In the fiscal year concluding in March 2024, these electrified powertrain solutions, including crucial eAxles, contributed over 25% to the company's overall sales revenue. This highlights the increasing demand for hybrid and plug-in hybrid electric vehicles (HEVs and PHEVs) and Aisin's strong position in supplying their essential parts.

Aisin Seiki generates significant revenue from its braking and chassis systems segment. This crucial business area involves the manufacturing and sale of essential components that ensure vehicle safety and performance across a wide range of automotive applications.

In the fiscal year concluding in March 2024, Aisin Seiki's braking systems alone were a substantial revenue driver, bringing in ¥350 billion. This highlights the strong market demand and Aisin's competitive position in this critical automotive component sector.

Aftermarket Parts and Service Sales

Aisin Seiki's aftermarket parts and service sales represent a crucial revenue stream, focusing on providing replacement components, maintenance supplies, and refurbished products to a wide customer base. This strategy extends beyond original equipment, encompassing a broader spectrum of automotive and industrial needs.

In 2024, Aisin continued to invest in its aftermarket capabilities, recognizing the growing demand for reliable and accessible replacement parts. This segment offers a consistent revenue stream, leveraging the longevity and performance of Aisin's manufactured components across various vehicle lifecycles.

- Aftermarket Parts: Sales of genuine and compatible replacement parts for automotive and industrial applications.

- Service and Maintenance: Revenue generated from maintenance services, repairs, and the sale of related consumables.

- Remanufactured Units: Offering refurbished components that provide a cost-effective and sustainable alternative to new parts.

- Global Distribution Network: Expanding reach through established channels to ensure availability of aftermarket products worldwide.

Sales of Other Automotive and Non-Automotive Products

Aisin Seiki diversifies its revenue through the sale of a wide array of automotive and non-automotive products. This segment captures income from climate control systems, which are crucial for passenger comfort and vehicle efficiency.

Beyond climate control, Aisin also generates revenue from body exterior components, contributing to the aesthetics and structural integrity of vehicles. The company’s reach extends into non-automotive sectors with offerings such as car navigation systems, enhancing the driving experience.

Further diversification comes from lifestyle products, including sewing machines and beds, demonstrating Aisin's ability to leverage its manufacturing expertise across different markets. The company also produces heat pumps, a product line aligned with growing demand for energy-efficient solutions.

In fiscal year 2024, Aisin Seiki's climate control systems alone contributed approximately ¥300 billion to its revenue, underscoring the significance of these diverse product streams.

- Climate Control Systems: A significant revenue generator, crucial for vehicle comfort.

- Body Exterior Components: Contributing to both vehicle design and function.

- Car Navigation Systems: Enhancing the automotive user experience.

- Lifestyle Products: Including sewing machines and beds, showcasing market breadth.

- Heat Pumps: Tapping into the energy-efficient product market.

Aisin Seiki's revenue streams are diverse, anchored by its strong presence in drivetrain components, where automatic transmissions are a key driver. The company also sees significant income from braking and chassis systems, vital for vehicle safety and performance.

Sales of components for electrified vehicles, including eAxles, are rapidly growing, reflecting the shift in the automotive industry. Additionally, aftermarket parts and services provide a consistent revenue stream, extending the lifecycle of Aisin's products.

The company's diversified product portfolio also includes climate control systems, body exterior parts, car navigation systems, and even lifestyle products like sewing machines. This broad range of offerings, including the sale of heat pumps, demonstrates Aisin's adaptability and broad manufacturing capabilities.

| Revenue Stream | Fiscal Year Ending March 2024 (Billions JPY) | Growth Rate (YoY) |

|---|---|---|

| Drivetrain Components | 600 | 15% |

| Braking Systems | 350 | N/A |

| EV/Hybrid Components | Over 25% of total sales | N/A |

| Climate Control Systems | 300 | N/A |

Business Model Canvas Data Sources

The Aisin Seiki Business Model Canvas is informed by a blend of internal financial reports, detailed market research on the automotive and industrial sectors, and strategic insights derived from competitor analysis. These data sources ensure each component of the canvas accurately reflects the company's current operations and future potential.