Aisin Seiki Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Curious about Aisin Seiki's product portfolio performance? This BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications is crucial for informed strategic decisions.

Don't let this limited view hold you back from unlocking actionable insights. Purchase the full BCG Matrix report for a comprehensive breakdown of Aisin Seiki's market position, complete with data-backed recommendations and a clear roadmap for optimizing resource allocation and future investments.

Stars

Aisin's integrated electric drive units, or eAxles, represent a substantial growth opportunity, fueled by the worldwide transition to electric vehicles. The company is actively building a robust global production capacity, aiming for 4.5 million electric units, underscoring its commitment to this high-demand sector.

As a vital supplier for both hybrid and battery-electric vehicles, Aisin is capitalizing on its deep-seated expertise in powertrain technology. This strategic focus positions Aisin as a frontrunner in the dynamic and rapidly expanding electric vehicle market.

Advanced Driver-Assistance Systems (ADAS) represent a star in Aisin Seiki's BCG Matrix. The company actively participates in this rapidly expanding market, offering innovative solutions such as automated parking and emergency braking systems. This strategic focus aligns with the significant global demand for improved vehicle safety and the development of autonomous driving capabilities.

Aisin's commitment to the ADAS sector is underscored by its substantial investment of approximately $300 million in research and development, specifically targeting ADAS and electric vehicle technologies. This investment demonstrates confidence in the market's robust growth trajectory and Aisin's ambition to maintain a leading position within it.

The ADAS market is expected to experience substantial expansion in the coming years. Projections indicate a continued surge in demand for these advanced safety and convenience features, positioning Aisin favorably within a high-growth industry. This makes ADAS a critical component of Aisin's current and future business portfolio.

Aisin's thermal management systems for EVs are a shining example of their growth potential. As the electric vehicle market continues its rapid expansion, the demand for sophisticated solutions to manage battery temperature and ensure passenger comfort is paramount. Aisin is well-positioned to capitalize on this trend, offering advanced products that enhance EV efficiency and performance.

In 2024, the global EV market is projected to reach over 15 million units sold, a significant increase from previous years. Aisin's commitment to developing cutting-edge thermal management technologies, including battery cooling systems and advanced heat pumps, directly addresses the critical needs of this burgeoning sector. Their investment in these areas solidifies their status as a star in the automotive industry's electrification drive.

Hydrogen and Fuel Cell Technologies (ENE-FARM)

Aisin Seiki's investment in hydrogen and fuel cell technologies, particularly its ENE-FARM residential fuel cell cogeneration systems, positions it as a star in the BCG matrix. These systems offer high efficiency in generating electricity from gas, bolstering energy resilience for households. The market for solid oxide fuel cells (SOFCs) and solid oxide electrolyzer cells (SOECs) is experiencing substantial growth, with projections indicating a significant expansion in the coming years. Aisin's established presence and strong market share within this high-growth clean energy segment underscore its star status.

- ENE-FARM Efficiency: Aisin's ENE-FARM systems achieve exceptional electrical efficiency, often exceeding 40%, significantly reducing energy consumption and costs for end-users.

- Market Growth Projections: The global SOFC market alone was valued at approximately USD 2.1 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 8-10% through 2030, driven by demand for cleaner energy solutions.

- SOEC Advancements: Aisin's concurrent development in SOEC technology, crucial for green hydrogen production, aligns with the global push towards decarbonization and renewable energy integration.

- Aisin's Market Position: Aisin holds a significant share in the residential fuel cell market, particularly in Japan, demonstrating a proven ability to capture and maintain leadership in emerging clean energy sectors.

Automotive Aftermarket & Service of America, Inc. (AASA)

Automotive Aftermarket & Service of America, Inc. (AASA), by integrating transmission remanufacturing and aftermarket sales, marks a pivotal step towards becoming a broad-spectrum parts and service provider. This strategic move is designed to broaden its reach beyond its existing brands, encompassing a wider range of maintenance essentials and services.

The company's objective is to capture a larger share of the burgeoning aftermarket segment, which saw the global automotive aftermarket size valued at USD 475.8 billion in 2023 and is projected to grow significantly. AASA's expanded model is anticipated to drive substantial growth and market penetration.

- Strategic Integration: Merging transmission remanufacturing with aftermarket sales creates a synergistic approach to parts and service.

- Market Expansion: The aim is to offer a comprehensive suite of maintenance items beyond in-house brands, tapping into a wider customer base.

- Growth Potential: This initiative positions AASA for significant expansion in the dynamic automotive aftermarket industry.

- Market Share Increase: The new structure is expected to bolster AASA's market share by offering more integrated solutions.

Aisin's integrated electric drive units, or eAxles, represent a substantial growth opportunity, fueled by the worldwide transition to electric vehicles. The company is actively building a robust global production capacity, aiming for 4.5 million electric units, underscoring its commitment to this high-demand sector. As a vital supplier for both hybrid and battery-electric vehicles, Aisin is capitalizing on its deep-seated expertise in powertrain technology. This strategic focus positions Aisin as a frontrunner in the dynamic and rapidly expanding electric vehicle market.

Advanced Driver-Assistance Systems (ADAS) represent a star in Aisin Seiki's BCG Matrix. The company actively participates in this rapidly expanding market, offering innovative solutions such as automated parking and emergency braking systems. This strategic focus aligns with the significant global demand for improved vehicle safety and the development of autonomous driving capabilities. Aisin's commitment to the ADAS sector is underscored by its substantial investment of approximately $300 million in research and development, specifically targeting ADAS and electric vehicle technologies. This investment demonstrates confidence in the market's robust growth trajectory and Aisin's ambition to maintain a leading position within it.

Aisin's thermal management systems for EVs are a shining example of their growth potential. As the electric vehicle market continues its rapid expansion, the demand for sophisticated solutions to manage battery temperature and ensure passenger comfort is paramount. Aisin is well-positioned to capitalize on this trend, offering advanced products that enhance EV efficiency and performance. In 2024, the global EV market is projected to reach over 15 million units sold, a significant increase from previous years. Aisin's commitment to developing cutting-edge thermal management technologies, including battery cooling systems and advanced heat pumps, directly addresses the critical needs of this burgeoning sector. Their investment in these areas solidifies their status as a star in the automotive industry's electrification drive.

Aisin Seiki's investment in hydrogen and fuel cell technologies, particularly its ENE-FARM residential fuel cell cogeneration systems, positions it as a star in the BCG matrix. These systems offer high efficiency in generating electricity from gas, bolstering energy resilience for households. The market for solid oxide fuel cells (SOFCs) and solid oxide electrolyzer cells (SOECs) is experiencing substantial growth, with projections indicating a significant expansion in the coming years. Aisin's established presence and strong market share within this high-growth clean energy segment underscore its star status.

| Category | Description | Key Growth Drivers | Aisin's Position | Market Data (2024/Projected) |

|---|---|---|---|---|

| Electric Drive Units (eAxles) | Integrated electric powertrain components for EVs | Global EV adoption, government regulations | Building significant global production capacity (4.5 million units target) | EV market projected to exceed 15 million units sold globally in 2024 |

| Advanced Driver-Assistance Systems (ADAS) | Automated parking, emergency braking, safety features | Demand for vehicle safety, autonomous driving development | Substantial R&D investment ($300 million) in ADAS and EV tech | ADAS market experiencing significant global expansion |

| EV Thermal Management Systems | Battery cooling, heat pumps for EVs | EV efficiency and performance enhancement needs | Developing advanced solutions for critical EV needs | Global EV market growth necessitates sophisticated thermal management |

| Hydrogen & Fuel Cell Technologies (ENE-FARM) | Residential fuel cell cogeneration, SOFC/SOEC development | Clean energy demand, energy resilience, green hydrogen production | Strong market share in residential fuel cells, SOEC advancements | SOFC market valued at approx. USD 2.1 billion in 2023, projected 8-10% CAGR |

What is included in the product

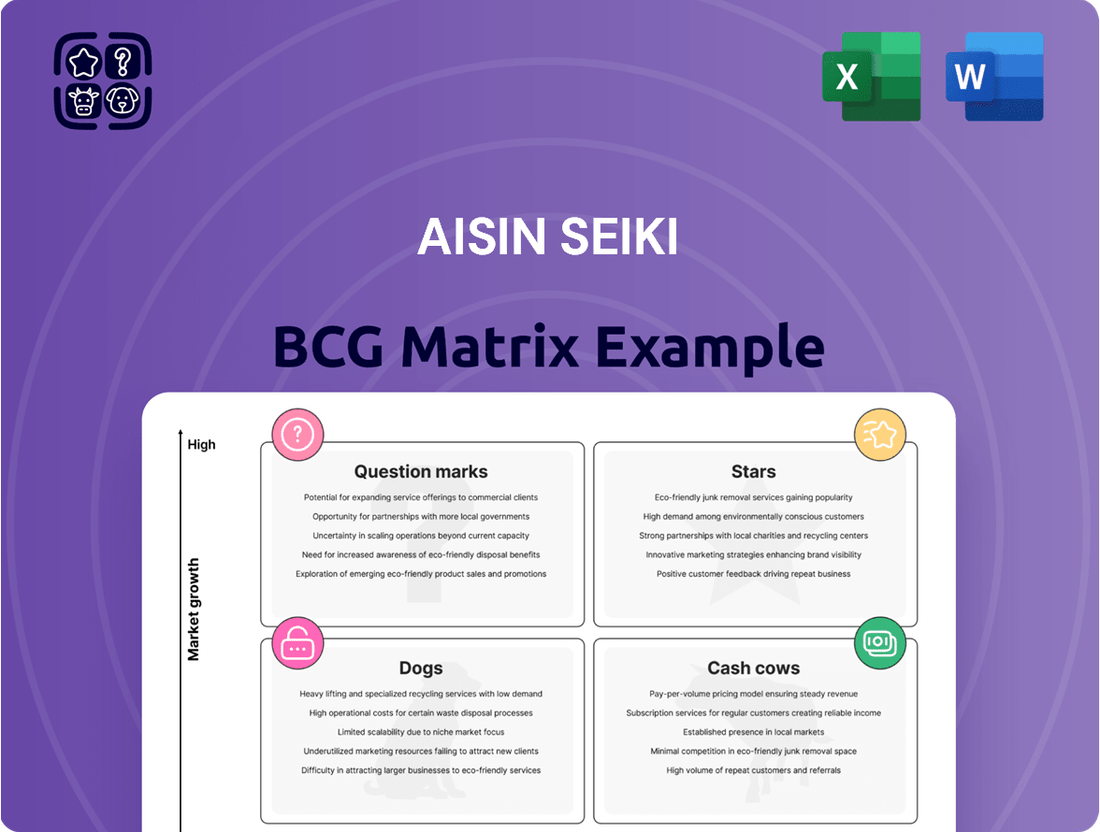

Aisin Seiki's BCG Matrix offers a strategic overview, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions, identifying units for growth, maintenance, or divestment within the company's portfolio.

A clear, visual Aisin Seiki BCG Matrix identifies underperforming units, simplifying strategic resource allocation.

Cash Cows

Aisin Seiki stands as the undisputed leader in global transmission manufacturing, particularly for automatic transmissions. Their substantial market share in this segment is a testament to their enduring strength.

While the market for traditional automatic transmissions in Internal Combustion Engine (ICE) vehicles is considered mature with limited growth prospects, Aisin's dominant position allows them to generate significant and reliable cash flow. This consistent revenue stream is crucial for funding future innovation.

For instance, in 2023, Aisin's automotive segment, heavily reliant on transmission sales, reported robust revenue, demonstrating the continued demand for their established products. This steady income serves as a vital financial bedrock.

These established transmission products act as the company's cash cows, providing a stable financial base that Aisin strategically utilizes to invest in and develop next-generation technologies, such as those for electric vehicles.

Aisin's braking systems, including master cylinders and disc brakes, represent a strong cash cow. This mature automotive segment benefits from Aisin's high market share, built on decades of partnerships with leading car manufacturers. In 2023, the automotive sector, a key market for Aisin, saw global vehicle production reach approximately 77.7 million units, underscoring the demand for essential components like braking systems.

These established product lines are reliable profit generators, requiring minimal additional investment in research and development or marketing. Aisin's consistent performance in this area provides stable cash flow, crucial for funding other strategic initiatives within the company. For fiscal year 2024, Aisin is expected to continue leveraging its strong position in this segment to maintain robust profitability.

Aisin's traditional drivetrain components for internal combustion engine vehicles remain a significant revenue generator, underpinning their financial stability. Despite the automotive industry's shift towards electrification, these established products command a high market share due to Aisin's long-standing relationships and manufacturing expertise.

While the growth trajectory for non-EV drivetrain components may be moderate compared to newer technologies, their consistent profitability is a key strength. For example, in the fiscal year ending March 2024, Aisin reported total revenue of ¥4.5 trillion, with a substantial portion still derived from these core components, acting as dependable cash cows for the company.

Chassis and Body Parts

Aisin Seiki's Chassis and Body Parts segment, a key Cash Cow, benefits from its extensive product offerings, including power sliding door systems and sunroofs, supplied to major global automakers. These are mature product lines with predictable, stable demand within the automotive industry.

The segment's success is underpinned by Aisin's strong brand equity, built on a reputation for exceptional quality and reliability. This translates into a significant market share and consistent, robust cash generation.

- Product Breadth: Aisin is a leading supplier of diverse chassis and body components to a global automotive client base.

- Market Stability: Demand for these established product categories, like power sliding doors, remains consistently high.

- Brand Strength: Aisin's commitment to quality solidifies its market position and ensures steady cash flow generation.

Engine-related Products (for ICE Vehicles)

Aisin's engine-related products, particularly cast-iron parts for internal combustion engine (ICE) vehicles, represent a significant Cash Cow in their business portfolio. Even as the automotive industry pivots towards electrification, ICE vehicles still dominate the global fleet, ensuring sustained demand for these essential components.

This continued reliance on ICE technology translates into predictable revenue streams for Aisin. Their long-standing expertise and established relationships with original equipment manufacturers (OEMs) in this mature market allow for consistent cash generation, even with the industry's gradual transition.

- Mature Market Dominance: ICE vehicles represented approximately 85% of global new car sales in 2023, highlighting the ongoing demand for related components.

- Consistent Revenue: Aisin's cast-iron engine parts benefit from the large installed base of ICE vehicles, providing a stable cash flow.

- OEM Relationships: Decades of supplying major automakers have solidified Aisin's position, guaranteeing continued orders for these established products.

Aisin's expertise in traditional drivetrain components for internal combustion engine (ICE) vehicles forms a significant cash cow. Despite the industry's move towards EVs, these mature product lines continue to generate substantial and reliable revenue due to high market share and long-standing OEM partnerships.

These components, including established transmission parts, benefit from the sheer volume of ICE vehicles still on the road. In fiscal year 2024, Aisin's financial performance is expected to continue benefiting from the stable profitability of these core offerings, providing a dependable income stream.

The company's ability to consistently generate strong cash flow from these mature segments is critical for its strategic investments in emerging technologies, ensuring Aisin remains competitive in the evolving automotive landscape.

| Aisin Seiki Cash Cow Segments (FY 2024 Projections/2023 Data) | Market Position | Revenue Contribution (Est.) | Growth Outlook | Cash Flow Generation |

|---|---|---|---|---|

| Automatic Transmissions (ICE) | Global Leader | High | Mature/Stable | Very Strong |

| Braking Systems | Strong Market Share | Significant | Stable | Strong |

| Chassis & Body Parts (e.g., Power Sliding Doors) | Leading Supplier | Substantial | Consistent Demand | Robust |

| Engine Parts (ICE - Cast Iron) | Key Supplier | High | Sustained Demand | Consistent |

What You See Is What You Get

Aisin Seiki BCG Matrix

The Aisin Seiki BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, is fully editable and ready for your immediate use in business planning or presentations.

Dogs

Older generation car navigation systems, lacking modern connectivity and advanced mapping capabilities, are positioned as Dogs within Aisin Seiki's BCG Matrix. These units, often found in vehicles predating widespread smartphone integration, are experiencing a noticeable decline in market relevance. For instance, while the global automotive navigation market continues to grow, driven by advanced features, the segment for standalone, less sophisticated systems is shrinking. By the end of 2023, the penetration of embedded, connected navigation systems in new vehicles had surpassed 70% in major markets, significantly overshadowing demand for older, non-connected units.

Aisin Seiki's diverse offerings include standalone industrial equipment, and within this segment, niche products with low market traction or intense competition could be classified as dogs. These low-volume items might consume substantial resources for meager returns. For instance, if a specific piece of specialized manufacturing machinery, with only a handful of units sold annually and facing established global competitors, fails to innovate or expand its market reach, it's likely to struggle to achieve profitability.

Historically, Aisin Seiki, now Aisin Corporation, operated in sewing machine and bed manufacturing. These segments were eventually handed over to partner companies. This strategic move strongly suggests these businesses occupied a low market share in industries with limited growth potential for Aisin.

Entrusting these ventures to others indicates they were not considered core to Aisin's future growth trajectory. It's highly probable these were viewed as underperforming assets that no longer aligned with the company's primary automotive focus and innovation efforts.

Certain Less Competitive Aftermarket Products

Certain less competitive aftermarket products within Aisin Seiki's portfolio, prior to their recent strategic adjustments, likely fell into the 'dog' category of the BCG matrix. These were products, often under Aisin's own brands, that struggled to gain significant market share. They may have faced intense competition from a broader range of aftermarket suppliers, making it difficult to stand out.

These 'dog' products were characterized by their inability to adapt to changing consumer preferences or technological advancements in the automotive aftermarket. Low brand recognition in certain niches also contributed to their poor performance. For instance, a specific line of older-generation vehicle filters might have seen declining demand as newer models gained prominence.

Aisin's updated aftermarket strategy is designed to revitalize these underperforming areas by broadening their product offerings and enhancing service capabilities. This initiative aims to address the core issues that led to these products being classified as dogs.

- Limited Product Diversification: Historically, Aisin's aftermarket presence was heavily reliant on its core in-house brands, potentially limiting choices for consumers seeking specialized or niche components.

- Market Lag: Products failing to integrate newer technologies or meet evolving performance standards for a significant segment of the aftermarket could be categorized as dogs.

- Brand Perception Gaps: In specific aftermarket segments, Aisin's brand might not have carried the same weight or recognition as established specialists, hindering sales.

- Strategic Overhaul Focus: The recent aftermarket strategy aims to inject new life into these segments through expanded product lines and improved service delivery.

Traditional Manual Transmissions (MT)

Traditional manual transmissions (MTs) are categorized as a ‘Dog’ within Aisin Seiki's product portfolio. While Aisin does manufacture manual transmissions, the global automotive industry is experiencing a significant and ongoing shift away from this technology. This transition is particularly pronounced in developed markets, where consumers are increasingly opting for automatic transmissions and electrified powertrains.

The declining demand for manual transmissions places them in a shrinking market segment. Data from 2024 indicates a continued downward trend in manual transmission production globally, with many manufacturers phasing them out. For instance, in North America, the penetration of manual transmissions in new vehicle sales has fallen to very low single digits, often below 1% for many brands.

- Declining Market Share: The global market for manual transmissions is contracting due to the rise of automatic and electrified vehicles.

- Reduced Production: Many automakers are ceasing or significantly reducing manual transmission production, impacting Aisin's potential volume.

- Limited Growth Potential: The inherent nature of this technological shift offers little prospect for future growth or market expansion for MTs.

- Focus on Future Technologies: Aisin's strategic focus is likely shifting towards higher-growth areas like advanced automatic transmissions and electrification components.

Older car navigation systems, lacking modern connectivity, are now considered Dogs. These units, once prevalent, are rapidly losing relevance as newer, integrated systems dominate the market. By late 2023, over 70% of new vehicles in key markets featured connected navigation, dramatically reducing demand for older, standalone units.

Niche industrial equipment with low market traction or facing intense competition also falls into the Dog category. These products may consume resources without generating significant returns. For example, a specialized manufacturing machine with minimal annual sales and strong competition, if not innovated, would likely struggle.

Historically, Aisin's ventures into sewing machines and bed manufacturing were divested to partners. This strongly suggests these businesses held low market share in slow-growth industries for Aisin, indicating they were viewed as underperforming assets not aligned with the company's core automotive and innovation focus.

Manual transmissions (MTs) are a prime example of a Dog product for Aisin. The global automotive industry is rapidly shifting away from MTs, especially in developed markets, towards automatic and electrified powertrains. Data from 2024 confirms a continued decline in MT production, with many manufacturers phasing them out; North American sales penetration has fallen below 1% for many brands.

| Product Category | BCG Classification | Market Trend | Aisin's Position | Strategic Implication |

| Older Car Navigation Systems | Dog | Shrinking demand | Low market share | Divestment or minimal support |

| Niche Industrial Equipment | Dog | Varies, but low traction for specific items | Low volume, high competition | Review for profitability, potential exit |

| Manual Transmissions (MTs) | Dog | Significant decline | Declining production volumes | Phasing out, resource reallocation |

Question Marks

Aisin Seiki is positioning its perovskite solar cells for market entry, evidenced by ongoing in-house demonstrations aimed at social implementation. This places them in the burgeoning clean energy sector, a market projected to reach $1.5 trillion globally by 2030, according to recent projections.

However, Aisin's current market share in this advanced solar technology is likely minimal, reflecting its early-stage development and commercialization efforts. The company faces the challenge of significant capital investment necessary to build substantial market presence and manufacturing capacity.

The future success of Aisin's perovskite solar cells remains contingent on overcoming technological hurdles and outcompeting established players. The inherent uncertainty in pioneering new technologies means substantial R&D and market penetration strategies are critical for Aisin to establish a strong foothold.

Aisin Seiki's ventures into bio-briquette charcoal, utilizing palm kernel shells, and CO2 fixation technology position them within the burgeoning environmental and sustainability market. These innovative areas hold significant future potential but are currently in their nascent stages for Aisin.

Given their likely low current market share and profitability in these segments, both bio-briquette charcoal and CO2 fixation technology would be classified as Question Marks in the BCG Matrix. This classification signifies that they require substantial investment to grow and capture market share, with the potential to become Stars if successful.

ILY-Ai, Aisin's multi-functional personal mobility solution, fits within the emerging personal mobility and lifestyle solutions market. This sector shows considerable growth potential, particularly in densely populated urban areas and for targeted consumer groups.

While the market is expanding, ILY-Ai's presence is likely nascent, meaning Aisin probably holds a small market share. This necessitates substantial investment in marketing and consumer education to drive adoption.

The personal mobility market, including autonomous and assisted devices, is projected to see significant expansion. For instance, the global personal mobility market was valued at approximately $13.5 billion in 2023 and is anticipated to reach over $25 billion by 2028, indicating a robust CAGR of around 13-15% in the coming years.

Given its innovative nature and the early stage of market development, ILY-Ai is best positioned as a 'Question Mark' in the BCG matrix. Its success hinges on Aisin's ability to capture market share and convert potential into sustained demand.

Voice Recognition System 'YYSystem' and 'YYProbe'

Aisin Seiki's development of voice recognition systems like YYSystem and YYProbe positions them in the rapidly expanding AI-driven voice interface market, which is projected to reach substantial growth figures. These systems, designed for universal access and real-time speech processing, tap into a sector experiencing significant investment and innovation. For instance, the global market for conversational AI, which voice recognition underpins, was valued at approximately $8.2 billion in 2023 and is anticipated to grow at a compound annual growth rate of over 23% through 2030, reaching an estimated $32.2 billion by that year.

However, within the broader context of Aisin Seiki's established automotive and industrial component businesses, their presence in the software-centric voice recognition market likely represents a question mark. While the potential for these technologies is immense across diverse sectors, Aisin's current market share and competitive positioning in this specific software domain are probably nascent. This suggests a high-growth opportunity that requires significant scaling and market penetration to become a strong contender.

- Market Opportunity: The AI-driven voice interface market is experiencing exponential growth, driven by increased adoption in smart devices, automotive, and customer service applications.

- Aisin's Technology: YYSystem and YYProbe are Aisin's proprietary voice recognition technologies, aiming for applications in universal design and real-time speech recognition.

- Potential for Growth: While Aisin's current market penetration in software-focused voice recognition is likely low, the high-growth nature of the sector presents a significant question mark with substantial upside if successfully scaled.

- Competitive Landscape: The market is competitive, with established tech giants and specialized AI firms, meaning Aisin needs to carve out a distinct niche for its voice recognition solutions.

New Regional Market Expansions (e.g., Southeast Asia Plants)

Aisin's strategic move into Southeast Asia, specifically with new plants planned for Vietnam and Indonesia by 2024, positions these ventures as question marks within its BCG matrix. This expansion targets regions with significant automotive component growth potential.

These emerging markets represent an investment opportunity where Aisin aims to build substantial market share. The success of these new plants hinges on significant capital infusion to overcome initial market entry challenges and establish a strong foothold.

- Vietnam and Indonesia: Target Markets for 2024 Expansion

- High Growth Potential in Automotive Components Sector

- Investment Required to Capture Market Share in New Regions

- Strategic Focus on Emerging Market Penetration

Aisin Seiki's ventures into bio-briquette charcoal and CO2 fixation technology are currently in their early stages, characterized by low market share and profitability. These initiatives are positioned as Question Marks because they require significant investment to grow and capture market share, with the potential to become Stars if successful.

ILY-Ai, Aisin's personal mobility solution, also falls into the Question Mark category. While the personal mobility market is expanding, with a projected global value of over $25 billion by 2028, Aisin's market share is likely nascent, necessitating substantial investment in marketing and consumer education.

Similarly, Aisin's voice recognition systems, YYSystem and YYProbe, are considered Question Marks. The conversational AI market, which these systems serve, is growing rapidly, projected to reach $32.2 billion by 2030. However, Aisin's current penetration in this software-focused area is probably low, requiring significant scaling efforts.

The company's expansion into Vietnam and Indonesia by 2024 for automotive components also represents a Question Mark. These regions offer high growth potential, but Aisin will need substantial capital infusion to establish a strong foothold and capture market share against existing players.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.