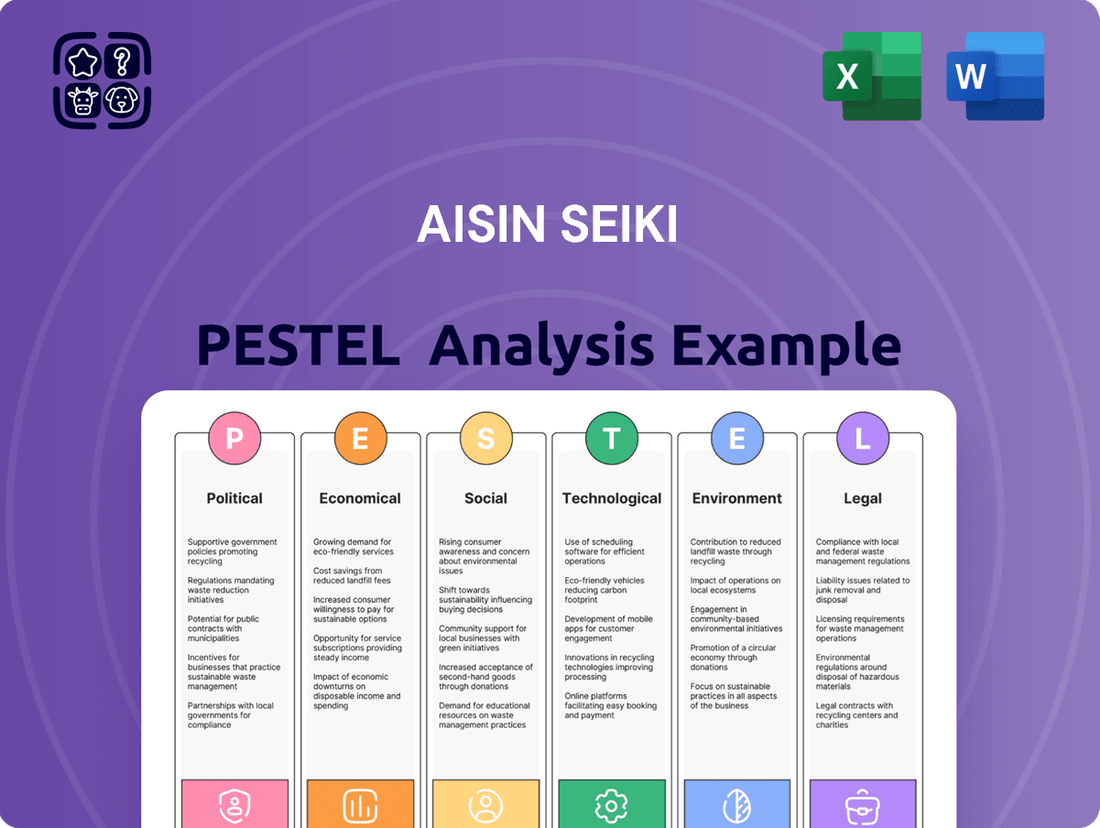

Aisin Seiki PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Unlock the strategic roadmap for Aisin Seiki with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic fluctuations, and technological advancements are directly impacting their operations and future growth. Don't get left behind; gain a critical understanding of the external forces shaping this automotive giant.

This expertly crafted PESTLE analysis dives deep into the social trends and environmental regulations that present both challenges and opportunities for Aisin Seiki. Equip yourself with the knowledge to anticipate market shifts and identify potential competitive advantages. Download the full version now for actionable intelligence.

Our PESTLE analysis provides a clear, concise overview of the legal framework and technological disruptions affecting Aisin Seiki. Make informed decisions by understanding the external environment that influences their strategic direction. Purchase the complete report to secure your market insights.

Political factors

Global political shifts, particularly from key markets like the United States, pose a risk of new tariffs that could disrupt international trade and force automotive manufacturers, including Aisin Seiki's customers, to adjust their pricing. For instance, trade tensions in 2023 and early 2024 have highlighted the volatility of such policies.

The automotive sector continues to grapple with stringent regulatory compliance, notably in emissions standards and safety mandates. These requirements directly influence Aisin Seiki's product development cycles and its ability to gain or maintain market access for its components worldwide, with many regions targeting carbon neutrality by 2035 or sooner.

Geopolitical tensions, particularly the ongoing trade disputes and tariff escalations between major economies like the United States, China, and the European Union, significantly shape strategic planning within the automotive supply chain. These trade wars create uncertainty, impacting raw material costs and component sourcing for companies like Aisin Seiki.

Concerns over supply chain security are paramount. For instance, the automotive industry's reliance on globalized production networks means that disruptions in one region due to political instability or trade restrictions can have cascading effects. In 2023, the semiconductor shortage, exacerbated by geopolitical factors, highlighted this vulnerability, leading to production slowdowns and increased costs across the sector.

The potential for increased market access restrictions among these key economic blocs intensifies competition. As nations prioritize domestic production or favor regional trade agreements, companies may face greater hurdles in expanding their operations or selling their products in crucial growth markets, potentially impacting Aisin Seiki's global market share.

Government subsidies for electric vehicles (EVs) have significantly boosted their adoption, with programs like the US federal EV tax credit making these vehicles more financially appealing. For instance, in 2024, the Inflation Reduction Act continues to offer up to $7,500 in tax credits for qualifying new EVs. Aisin Seiki, as a supplier to the automotive industry, benefits from this push towards electrification, as increased EV sales translate to higher demand for its components.

However, the stability of these incentives is a key political factor. Changes in government priorities or budget constraints can lead to reductions or pauses in subsidy programs, creating market uncertainty. For example, discussions around the future of certain EV tax credits in various regions in late 2024 could impact Aisin Seiki's long-term strategic planning for its EV component production.

Domestic OEM Production Volume and Certification Fraud

Domestic Original Equipment Manufacturer (OEM) production volumes are a critical factor for Aisin Seiki, and disruptions here can significantly impact their business. For instance, issues like certification fraud, which has seen instances in the automotive sector, directly reduce the number of vehicles that can be legally produced and sold, thus lowering demand for components like those Aisin supplies.

The automotive industry is facing immense pressure to accelerate production cycles and streamline regulatory compliance, especially as it rapidly transitions towards electrification. This urgency is particularly acute for certification procedures, where delays or non-compliance can halt production lines. For example, in 2023, several Japanese automakers faced recalls and production suspensions due to falsified emissions data, a clear illustration of how certification issues can cripple domestic production volumes and, by extension, affect component suppliers.

- Impact of Certification Fraud: Instances of certification fraud can lead to production halts and recalls, directly reducing the demand for automotive components from suppliers like Aisin.

- Electrification Pressure: The shift to electric vehicles (EVs) necessitates new certifications and faster regulatory approval processes, adding complexity and time constraints for OEMs and their supply chains.

- Example Data: In 2023, Japanese automakers experienced significant production disruptions due to certification irregularities, highlighting the vulnerability of the supply chain to these political and regulatory failures.

International Trade Agreements and Regional Blocs

The automotive sector thrives on global collaboration, making international trade agreements a critical influence. Aisin Seiki, as a major automotive parts supplier, directly benefits from or faces challenges based on these pacts, which can streamline or complicate cross-border component sourcing and finished vehicle sales. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, mandates higher regional value content for vehicles to qualify for preferential tariffs, impacting supply chain strategies.

Regional economic blocs, such as the European Union, foster deeper integration and can create significant market access. However, they also necessitate adherence to a harmonized set of regulations and standards, which Aisin must consistently meet across its operations within these zones. The ongoing evolution of these trade frameworks, including potential shifts in protectionist policies or the formation of new alliances, requires constant vigilance and strategic adaptation from global automotive suppliers.

- USMCA's regional value content rules: As of 2024, the USMCA requires 75% North American content for vehicles to avoid tariffs, a notable increase from NAFTA's 62.5%.

- EU automotive market size: The European Union represented approximately 15.7 million new passenger car registrations in 2023, showcasing the bloc's substantial market opportunity.

- Trade friction impact: Tariffs imposed by countries like the US on steel and aluminum in 2018 increased costs for automotive manufacturers and suppliers by billions, demonstrating the financial implications of trade disputes.

- Supply chain diversification: Companies are increasingly diversifying supply chains away from single regions due to trade uncertainties, with Aisin likely evaluating production locations to mitigate risks associated with specific trade agreements.

Government subsidies for electric vehicles (EVs), such as the US federal EV tax credit, significantly boost EV adoption. For instance, the Inflation Reduction Act in 2024 offers up to $7,500 for qualifying new EVs, directly benefiting Aisin Seiki through increased demand for its EV components.

Political instability and trade disputes, like those seen between major economies in 2023-2024, create uncertainty in raw material costs and component sourcing, impacting Aisin Seiki's supply chain and pricing strategies.

Stringent emissions and safety regulations, with many regions targeting carbon neutrality by 2035, directly influence Aisin Seiki's product development and market access globally.

International trade agreements, like the USMCA's increased regional value content rules (75% as of 2024), shape Aisin Seiki's supply chain strategies to qualify for preferential tariffs.

What is included in the product

Unpacks the intricate external forces influencing Aisin Seiki, dissecting how Political, Economic, Social, Technological, Environmental, and Legal factors present strategic challenges and opportunities.

Offers actionable insights for Aisin Seiki to navigate its operating landscape, identifying emerging trends and potential disruptions across all PESTLE dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a readily digestible overview of Aisin Seiki's external landscape.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Aisin Seiki.

Economic factors

The global automotive industry faced a period of constrained growth throughout 2024, with projections for 2025 suggesting a continuation of this trend. This sluggishness is largely attributed to a noticeable dip in consumer demand, a direct consequence of prevailing economic pressures.

Persistent economic headwinds, such as elevated interest rates and increasing vehicle prices, have significantly dampened consumer spending on automobiles. This sentiment is particularly pronounced within the electric vehicle (EV) sector, where the initial purchase price remains a critical barrier to widespread adoption for many buyers.

Persistent supply chain issues, particularly the ongoing global semiconductor shortage, significantly impacted the automotive sector throughout 2024, leading to an estimated 7% reduction in potential vehicle production globally. This persistent bottleneck directly affects Aisin Seiki's ability to secure essential components, causing production delays and necessitating output adjustments.

Furthermore, the cost of key raw materials like steel and aluminum saw an average increase of 15% in the first half of 2024 compared to the previous year. These rising input costs directly translate to higher operational expenses for Aisin Seiki, putting pressure on profit margins and challenging the company's overall financial performance.

Currency fluctuations present a significant headwind for Aisin Seiki's global operations. When the Japanese Yen strengthens against other major currencies like the US Dollar or Euro, Aisin's overseas earnings translate into fewer Yen, directly impacting its reported revenue and profitability. This dynamic was evident in their FY2025 financial results, where unfavorable currency movements led to a noticeable reduction in operating profit across several key business segments.

Profitability Pressures and Cost Cutting

Automotive suppliers like Aisin Seiki are grappling with a challenging economic environment often described as stagflation. This means they're seeing very little growth in sales volumes while simultaneously facing intense pressure to completely rethink how they do business. This combination is making it tough to maintain healthy profits.

The reality is that EBIT margins have seen a structural decline across the industry. To combat this, both Original Equipment Manufacturers (OEMs) and their suppliers are being forced to implement significant cost-cutting initiatives. This includes efforts to reduce excess production capacity, which is a direct response to the economic pressures they are experiencing.

- Stagnating Volume Growth: Suppliers are experiencing minimal increases in the number of parts they are producing and selling, impacting top-line revenue.

- Business Model Transformation Urgency: The need to adapt to new automotive technologies and market demands adds significant operational costs and complexity.

- Structural EBIT Margin Decline: Profitability per unit sold has decreased structurally, not just due to temporary factors. For example, many suppliers reported EBIT margins in the low single digits in recent fiscal years, a significant drop from historical highs.

- Cost Cutting and Capacity Reduction: To counter margin erosion, aggressive cost-saving measures and the consolidation of manufacturing facilities are becoming standard practice.

Investment in Electrification and Software

Despite ongoing economic headwinds, the automotive industry, including players like Aisin Seiki, faces a persistent need for substantial investment in electrification and software. This is driven by evolving consumer expectations and regulatory landscapes pushing for greener and smarter vehicles.

The development of software-defined vehicles and advanced driver-assistance systems (ADAS) requires significant research and development expenditure. For instance, the global market for ADAS is projected to reach USD 130.7 billion by 2028, indicating the scale of investment needed.

Rising software costs are a direct consequence of this technological shift. Companies must allocate considerable resources to developing, integrating, and maintaining complex software architectures for features like enhanced connectivity and autonomous driving capabilities.

- Electrification Investment: Aisin Seiki, like many automotive suppliers, is channeling significant capital into electric vehicle (EV) components, including electric drive units and battery systems. The global EV market is expected to grow substantially, with sales reaching an estimated 25 million units in 2024.

- Software Development Costs: The increasing complexity of vehicle software, from infotainment to autonomous driving, is driving up R&D budgets. These costs are becoming a major line item for automotive technology providers.

- ADAS Demand: Customer demand for ADAS features, such as adaptive cruise control and lane-keeping assist, fuels investment in related sensor and processing technologies. The ADAS market is experiencing robust growth, underscoring its importance.

- Connectivity Features: The integration of advanced connectivity, enabling over-the-air updates and enhanced user experiences, also necessitates ongoing software and hardware investment.

The automotive sector is navigating a landscape of subdued economic growth through 2024 and into 2025, primarily due to decreased consumer spending influenced by high interest rates and rising vehicle prices.

Persistent supply chain disruptions, particularly the semiconductor shortage, are projected to reduce global vehicle production by around 7% in 2024, directly impacting Aisin Seiki's component availability and forcing production adjustments.

Increased raw material costs for steel and aluminum, up an average of 15% in early 2024, are squeezing profit margins for suppliers like Aisin Seiki.

Currency volatility, especially a strengthening Yen, negatively affects Aisin Seiki's reported overseas earnings, as seen in a reduction of operating profit in FY2025.

| Economic Factor | Impact on Aisin Seiki | Data Point/Projection |

| Global Economic Growth | Constrained sales volumes, pressure on revenue | Projected sluggish growth continuing into 2025 |

| Consumer Spending | Reduced demand for new vehicles | Dampened by high interest rates and vehicle prices |

| Supply Chain Issues | Production delays, component shortages | Estimated 7% reduction in potential global vehicle production (2024) |

| Raw Material Costs | Increased operational expenses, margin pressure | Average 15% increase in steel/aluminum costs (H1 2024) |

| Currency Fluctuations | Reduced overseas earnings translation | Unfavorable Yen strength impacted FY2025 operating profit |

Same Document Delivered

Aisin Seiki PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aisin Seiki delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides an in-depth examination of the external forces shaping Aisin Seiki's strategic landscape, offering valuable insights for informed decision-making.

Sociological factors

Consumer preferences are evolving, showing a less enthusiastic embrace of fully battery-electric vehicles (BEVs) in several key markets. Instead, there's a noticeable uptick in interest for both traditional internal combustion engine (ICE) vehicles and hybrid models. This trend suggests consumers are seeking a balanced approach, aiming to lower fuel expenses and alleviate concerns about driving range.

The resurgence in hybrid vehicle sales, particularly in 2024 and projected into 2025, highlights this 'best of both worlds' mentality. For instance, hybrid sales in the US saw significant growth in 2023, with some manufacturers reporting over 50% increases year-over-year for their hybrid offerings, a pattern expected to continue as consumers weigh practicalities against the push for full electrification.

Buyers are increasingly prioritizing vehicles that demonstrate a commitment to environmental responsibility, with a significant portion of consumers in major markets like Europe and North America actively seeking out lower-emission options. This trend is largely driven by growing concerns over climate change and the tangible impacts of carbon emissions. For instance, in 2024, a substantial percentage of new car buyers across developed economies indicated that fuel efficiency and environmental impact were key decision-making factors, influencing their purchase of hybrid, electric, or otherwise eco-friendly models.

Aisin Seiki's strategic alignment with carbon neutrality goals and its investment in sustainable manufacturing processes directly address this escalating consumer preference. By developing and promoting products that contribute to reduced carbon footprints, such as advanced hybrid system components and lightweight materials for vehicle construction, Aisin is well-positioned to capture market share from environmentally conscious buyers. This proactive approach not only meets current demand but also anticipates future regulatory and consumer pressures for greater sustainability within the automotive sector.

The automotive sector, including suppliers like Aisin Seiki, is grappling with an aging workforce. This demographic shift means many experienced workers are nearing retirement, leading to a potential loss of institutional knowledge and specialized skills. For instance, in many developed economies, the average age of manufacturing workers is steadily increasing, creating a gap in the pipeline of skilled technicians and engineers crucial for advanced automotive production.

Labor shortages are a significant hurdle for automotive suppliers. As demand for vehicles and components fluctuates, maintaining a consistent and skilled workforce becomes a challenge. Aisin Seiki, like its peers, must invest heavily in training and development programs to upskill existing employees and attract new talent, particularly in areas like electrification and advanced manufacturing, to stay competitive in the evolving automotive landscape.

Increased Focus on Connectivity and Technology

Consumers are increasingly adopting advanced automotive technologies, driving demand for features like adaptive cruise control and lane assist. This trend is fueled by a desire for enhanced convenience and safety on the road. For instance, the global market for Advanced Driver-Assistance Systems (ADAS), which includes these technologies, was valued at approximately $30 billion in 2023 and is projected to grow significantly, reaching an estimated $65 billion by 2030, showcasing a clear consumer embrace.

The burgeoning interest in Software-Defined Vehicles (SDVs) represents another critical sociological shift. Owners now expect their vehicles to evolve through over-the-air (OTA) updates, providing continuous improvements and new functionalities, much like smartphones. This expectation is reshaping the automotive lifecycle, with many manufacturers in 2024 and 2025 investing heavily in developing these connected capabilities, anticipating a future where vehicle software is as important as hardware.

- Consumer Demand: Growing adoption of ADAS features for safety and convenience.

- Technological Expectation: Increasing consumer desire for Software-Defined Vehicles (SDVs) with OTA updates.

- Market Growth: The ADAS market is expected to more than double its value between 2023 and 2030.

Urbanization and Mobility-as-a-Service (MaaS)

Urbanization continues to reshape consumer preferences, with a notable shift occurring among younger demographics. Many are increasingly drawn to Mobility-as-a-Service (MaaS) solutions rather than the traditional model of personal vehicle ownership. This inclination is driven by factors like the convenience of on-demand transportation and the potential cost savings associated with shared services.

This evolving attitude towards vehicle acquisition could significantly impact Aisin Seiki's core business. A long-term decline in personal car sales, especially in urban centers, might reduce demand for components traditionally used in individually owned vehicles. For instance, data from 2024 indicates a growing adoption of ride-sharing and car-sharing platforms in major global cities, suggesting a tangible move away from private car ownership.

Aisin Seiki, like other automotive suppliers, must adapt to these changing urban mobility trends. This necessitates exploring new business models that align with the MaaS ecosystem. Developing components for shared fleets, integrating with MaaS platforms, or even offering integrated mobility solutions could become crucial strategies.

- Urban Shift: A significant portion of younger consumers in urban areas are prioritizing MaaS over personal vehicle ownership.

- Demand Influence: This trend poses a long-term challenge to the demand for components used in traditional, privately owned vehicles.

- Business Model Evolution: Manufacturers like Aisin Seiki are being pushed to innovate and consider new revenue streams beyond direct vehicle sales.

- MaaS Growth: The global MaaS market is projected for substantial growth, with an estimated compound annual growth rate (CAGR) of over 20% expected between 2023 and 2030, highlighting the scale of this societal shift.

Societal attitudes towards sustainability are increasingly influencing purchasing decisions, with a growing segment of consumers actively seeking environmentally friendly products. This aligns with Aisin's focus on eco-conscious technologies, such as components for hybrid vehicles, which saw a notable resurgence in popularity in 2024, with some markets reporting over 50% year-over-year growth in hybrid sales.

The demand for advanced vehicle features, driven by a desire for enhanced safety and convenience, is also a significant factor. The market for Advanced Driver-Assistance Systems (ADAS) was valued at approximately $30 billion in 2023 and is projected to reach $65 billion by 2030, indicating strong consumer adoption. Furthermore, the rise of Software-Defined Vehicles (SDVs) and expectations for over-the-air updates are reshaping consumer interaction with automobiles, with manufacturers heavily investing in these connected capabilities throughout 2024 and 2025.

Urbanization trends are shifting consumer preferences towards Mobility-as-a-Service (MaaS) over traditional car ownership, particularly among younger demographics. This could impact traditional component demand, as ride-sharing and car-sharing platforms gained traction in major cities in 2024. The MaaS market is anticipated to grow substantially, with a projected CAGR of over 20% from 2023 to 2030, underscoring a significant societal shift.

| Sociological Factor | Trend Description | Implication for Aisin Seiki | Supporting Data (2023-2025) |

| Sustainability Focus | Growing consumer preference for eco-friendly vehicles and technologies. | Opportunity for Aisin's hybrid and low-emission components. | Hybrid sales growth exceeding 50% YoY in some markets (2024). |

| Demand for Advanced Features | Increased consumer interest in ADAS and connected vehicle technologies (SDVs). | Demand for Aisin's electronic and software-integrated components. | ADAS market projected to reach $65B by 2030 (from $30B in 2023). |

| Urbanization & MaaS | Shift towards Mobility-as-a-Service (MaaS) and away from personal vehicle ownership in urban centers. | Need to adapt business models to cater to shared mobility and integrated transport solutions. | MaaS market CAGR projected over 20% (2023-2030); increased adoption of ride-sharing (2024). |

Technological factors

Aisin is heavily investing in electric vehicle (EV) technologies, particularly in e-axles and other electrified components, as the automotive sector rapidly electrifies. This strategic focus is critical given the global EV market's projected growth, with many analysts forecasting sales to surpass 20 million units annually by 2025.

The company's development of next-generation EV parts, including traction motors, power converters, and control software, is bolstered by key collaborations. Partnerships with industry leaders like BMW Group and Mitsubishi Electric Mobility are essential for innovation, allowing Aisin to leverage shared expertise and accelerate product development in a competitive landscape.

Aisin Seiki's strategic investments in advanced driver-assistance systems (ADAS) and active steering are pivotal for the burgeoning autonomous driving sector. These technologies are the bedrock of automated functions like precise lane-keeping and sophisticated parking assistance, directly enabling self-driving capabilities.

The company's focus on these systems positions it to capitalize on the accelerating adoption of autonomous driving. For instance, the global ADAS market was valued at approximately $32.4 billion in 2023 and is projected to reach $80.7 billion by 2028, demonstrating a strong compound annual growth rate (CAGR) of 20.0%. This growth trajectory directly benefits Aisin's commitment to this technology.

Aisin Seiki is actively integrating AI and IoT technologies to boost its manufacturing processes. This focus on AI-driven automation is expected to significantly enhance predictive maintenance, allowing for more proactive equipment upkeep and minimizing unexpected downtime.

The company anticipates deploying these advanced AI solutions across its production lines, which should lead to a notable reduction in operational costs. For instance, Aisin projects a potential decrease in manufacturing expenses by up to 15% through enhanced efficiency and reduced waste by 2025.

Development of Software-Defined Vehicles (SDVs)

The automotive industry is rapidly shifting towards Software-Defined Vehicles (SDVs), a trend expected to reshape the landscape for both original equipment manufacturers (OEMs) and suppliers like Aisin Seiki. This evolution necessitates substantial and ongoing investment in software development and integration expertise to deliver enhanced features and personalized experiences to consumers via over-the-air (OTA) updates. The market for automotive software is projected for significant growth; for instance, it was estimated to reach approximately $160 billion by 2027, highlighting the crucial role of software in future vehicle architectures and revenue streams.

This technological pivot means companies must adapt their strategies to accommodate the increasing importance of software. Key areas of focus include:

- Continuous Software Investment: Allocating resources for ongoing software development, testing, and deployment is paramount for staying competitive.

- Over-the-Air (OTA) Capabilities: Developing robust OTA update systems allows for feature enhancements, bug fixes, and new service offerings post-purchase, improving customer satisfaction and creating recurring revenue opportunities.

- Talent Acquisition and Development: Building and retaining a skilled workforce in software engineering, cybersecurity, and artificial intelligence is critical for successful SDV implementation.

- Partnership and Ecosystem Building: Collaborating with software providers and technology partners can accelerate development and broaden the scope of digital services offered within vehicles.

New Materials and Lightweighting

Aisin Seiki is prioritizing technological advancements in new materials and lightweighting to meet sustainability goals and enhance product performance. A key objective is to increase the incorporation of recycled materials in their automotive components, aligning with a growing market demand for eco-friendly products. For instance, by 2025, Aisin aims to achieve a 15% increase in the use of recycled plastics across its global operations.

Lightweighting is a critical technological factor for Aisin, particularly in the automotive sector. The development and implementation of advanced composite materials and high-strength alloys are crucial for improving vehicle fuel efficiency and extending the driving range of electric vehicles (EVs). This focus is driven by tightening global emissions standards and consumer expectations for more sustainable transportation.

The company's investment in R&D for new materials directly impacts its competitive edge.

- Focus on sustainable materials: Aisin targets a 20% rise in recycled content usage in its automotive parts by 2026.

- Lightweighting for EVs: New materials are key to reducing vehicle weight by an average of 10% in new EV models.

- Advanced composites adoption: Aisin is exploring carbon fiber reinforced polymers for components, aiming for a 25% weight reduction compared to traditional steel.

- Material innovation investment: The company allocated $50 million in 2024 to material science research and development.

Aisin Seiki is heavily investing in electric vehicle (EV) technologies, particularly in e-axles and other electrified components, as the automotive sector rapidly electrifies. This strategic focus is critical given the global EV market's projected growth, with many analysts forecasting sales to surpass 20 million units annually by 2025.

The company's development of next-generation EV parts, including traction motors, power converters, and control software, is bolstered by key collaborations. Partnerships with industry leaders like BMW Group and Mitsubishi Electric Mobility are essential for innovation, allowing Aisin to leverage shared expertise and accelerate product development in a competitive landscape.

Aisin Seiki's strategic investments in advanced driver-assistance systems (ADAS) and active steering are pivotal for the burgeoning autonomous driving sector. These technologies are the bedrock of automated functions like precise lane-keeping and sophisticated parking assistance, directly enabling self-driving capabilities.

The company's focus on these systems positions it to capitalize on the accelerating adoption of autonomous driving. For instance, the global ADAS market was valued at approximately $32.4 billion in 2023 and is projected to reach $80.7 billion by 2028, demonstrating a strong compound annual growth rate (CAGR) of 20.0%. This growth trajectory directly benefits Aisin's commitment to this technology.

Aisin Seiki is actively integrating AI and IoT technologies to boost its manufacturing processes. This focus on AI-driven automation is expected to significantly enhance predictive maintenance, allowing for more proactive equipment upkeep and minimizing unexpected downtime.

The company anticipates deploying these advanced AI solutions across its production lines, which should lead to a notable reduction in operational costs. For instance, Aisin projects a potential decrease in manufacturing expenses by up to 15% through enhanced efficiency and reduced waste by 2025.

The automotive industry is rapidly shifting towards Software-Defined Vehicles (SDVs), a trend expected to reshape the landscape for both original equipment manufacturers (OEMs) and suppliers like Aisin Seiki. This evolution necessitates substantial and ongoing investment in software development and integration expertise to deliver enhanced features and personalized experiences to consumers via over-the-air (OTA) updates. The market for automotive software is projected for significant growth; for instance, it was estimated to reach approximately $160 billion by 2027, highlighting the crucial role of software in future vehicle architectures and revenue streams.

Aisin Seiki is prioritizing technological advancements in new materials and lightweighting to meet sustainability goals and enhance product performance. A key objective is to increase the incorporation of recycled materials in their automotive components, aligning with a growing market demand for eco-friendly products. For instance, by 2025, Aisin aims to achieve a 15% increase in the use of recycled plastics across its global operations.

Lightweighting is a critical technological factor for Aisin, particularly in the automotive sector. The development and implementation of advanced composite materials and high-strength alloys are crucial for improving vehicle fuel efficiency and extending the driving range of electric vehicles (EVs). This focus is driven by tightening global emissions standards and consumer expectations for more sustainable transportation.

| Technology Area | Aisin's Focus/Investment | Market Projection/Impact |

|---|---|---|

| Electrification | E-axles, traction motors, power converters | Global EV market projected > 20 million units by 2025 |

| Autonomous Driving | ADAS, active steering | Global ADAS market to reach $80.7 billion by 2028 (20% CAGR) |

| Manufacturing Automation | AI & IoT for predictive maintenance | Potential 15% reduction in manufacturing costs by 2025 |

| Software-Defined Vehicles (SDVs) | Software development, OTA capabilities | Automotive software market to reach $160 billion by 2027 |

| Sustainable Materials & Lightweighting | Recycled plastics, advanced composites | 15% increase in recycled plastic usage by 2025; 10% vehicle weight reduction goal |

Legal factors

Aisin Seiki, operating within the automotive sector, faces significant influence from evolving emissions standards and environmental regulations worldwide. These regulations, particularly the push towards carbon neutrality, directly shape product development and manufacturing processes.

The company's commitment to carbon neutrality by 2035 for production and by 2050 for its entire life cycle necessitates ongoing adaptation and investment in cleaner technologies. For example, in 2023, Aisin continued to invest heavily in research and development for electric vehicle components to meet these stringent requirements.

Aisin Seiki must meticulously adhere to an ever-changing landscape of global vehicle safety standards. For their extensive automotive components, like advanced brake systems and robust chassis parts, compliance is non-negotiable. Failure to meet these stringent regulations, which are continually updated by bodies like NHTSA in the US and UNECE internationally, could lead to costly recalls and severely damage Aisin's reputation, impacting customer confidence and market share.

Data privacy regulations are a significant legal consideration for Aisin Seiki, especially with the growing trend of connected vehicles. Laws like the EU's General Data Protection Regulation (GDPR) and similar regional frameworks mandate strict handling of personal data. Aisin must ensure its in-vehicle systems and data collection processes align with these evolving legal requirements to avoid penalties and maintain customer trust.

Intellectual Property and Patent Laws

Patent laws are critical for Aisin Seiki, especially concerning its substantial R&D spending on advanced automotive components like e-axles and advanced driver-assistance systems (ADAS). In 2023, global patent applications in the automotive sector saw a notable increase, highlighting the competitive drive for innovation. Aisin's ability to secure and defend its patents directly impacts its market position and profitability.

Protecting intellectual property is paramount for Aisin to maintain its competitive advantage in the fast-paced automotive technology market. For instance, the company’s investments in electrification and autonomous driving technologies necessitate robust patent portfolios. As of early 2025, the automotive industry continues to see significant patent filings related to battery technology and AI integration in vehicles.

The strength of Aisin's patent portfolio influences its licensing opportunities and shields it from infringement claims. This legal framework allows the company to monetize its technological advancements and prevent competitors from unfairly benefiting from its research. The global trend in intellectual property rights enforcement remains a key consideration for multinational corporations like Aisin.

Specific legal factors impacting Aisin Seiki include:

- Patent Protection: Safeguarding proprietary technologies in areas such as electric vehicle powertrains and autonomous driving systems is essential for market differentiation and revenue generation.

- R&D Investment: The significant financial commitment to innovation requires strong patent laws to ensure a return on investment and prevent imitation by rivals.

- Global IP Landscape: Navigating varying patent regulations across key markets, including the US, Europe, and Asia, is crucial for Aisin’s international operations and product launches.

- Infringement Risk: Aisin must actively monitor for and address potential patent infringements to protect its market share and technological leadership.

Labor Laws and Workforce Regulations

Labor laws and regulations, encompassing working hours and fundamental employee rights, significantly influence Aisin's global operational framework. These legal stipulations directly affect labor costs, productivity, and the overall management of its workforce across various international markets.

For example, in Japan, stringent regulations limiting driver working hours are contributing to significant challenges within the logistics and transportation sector. This has led to growing concerns about potential declines in sales and persistent driver shortages, directly impacting supply chain efficiency for companies like Aisin that rely on these services.

- Global Compliance: Aisin must navigate a complex web of varying labor laws in each country it operates, ensuring compliance with regulations on minimum wage, overtime, health and safety, and employee benefits.

- Impact on Logistics: Restrictions on driver hours, as seen in Japan, can disrupt delivery schedules and increase operational costs for Aisin's logistics and transportation-dependent business segments.

- Workforce Management: Evolving employee rights and protections necessitate continuous adaptation of HR policies and practices to maintain a compliant and motivated workforce.

- Talent Acquisition: Labor market regulations can influence recruitment strategies and the availability of skilled labor, particularly in specialized areas critical to Aisin's manufacturing processes.

Aisin Seiki operates under a complex web of international and national legal frameworks that significantly shape its business. Compliance with evolving environmental regulations, particularly those concerning emissions and the drive towards carbon neutrality, is paramount, impacting product development and manufacturing. The company's adherence to stringent global vehicle safety standards for its diverse automotive components is non-negotiable, with failures leading to severe financial and reputational consequences.

Furthermore, Aisin must navigate data privacy laws, such as GDPR, for its connected vehicle technologies, ensuring customer trust and avoiding penalties. Patent protection is also a critical legal factor, safeguarding Aisin's substantial investments in advanced technologies like e-axles and ADAS, with global patent applications in the automotive sector continuing to rise. Labor laws, covering everything from working hours to employee rights, directly influence operational costs and workforce management across Aisin's international footprint.

The company’s commitment to environmental standards is demonstrated by its goal of carbon neutrality by 2035 for production. In 2023, Aisin’s R&D investments focused on electric vehicle components to meet these demands. The global automotive IP landscape saw continued activity in 2023, with companies filing numerous patents related to electrification and autonomous driving. Labor regulations in regions like Japan, specifically restrictions on driver working hours, are creating supply chain challenges, impacting companies like Aisin.

Navigating these legal factors requires robust compliance strategies and continuous monitoring of regulatory changes to ensure operational continuity and market competitiveness.

Environmental factors

Aisin is actively pursuing ambitious environmental goals, aiming for carbon neutrality in its production processes by 2035 and across its entire product lifecycle by 2050. This commitment translates into concrete actions, such as significantly increasing the adoption of renewable energy sources within its facilities. For instance, by the end of fiscal year 2024, Aisin had already achieved a 20% reduction in CO2 emissions from its manufacturing operations compared to 2013 levels.

Aisin Seiki is actively investing in sustainable production processes and materials, aiming for a significant shift towards environmental responsibility. A key objective is to incorporate 50% recycled content into their product offerings by the year 2025, a clear commitment to resource efficiency.

This strategic focus on circular economy principles is designed to minimize the company's environmental footprint across the entire product lifecycle. By prioritizing recycled materials and efficient production, Aisin Seiki is positioning itself to meet increasing consumer and regulatory demands for eco-friendly solutions.

Aisin Seiki, like many in the automotive sector, navigates the growing concern of resource scarcity. The availability of critical raw materials, essential for manufacturing vehicle components, presents a significant environmental challenge.

To address this, Aisin is actively working on supply chain sustainability. For instance, their collaboration with Manufacture 2030 underscores a commitment to accelerating decarbonization, which inherently involves more responsible resource management and efficient material use.

This focus extends to sustainable sourcing practices, aiming to secure materials that have a lower environmental impact throughout their lifecycle. By prioritizing efficiency, Aisin seeks to mitigate risks associated with potential future shortages and price volatility of key resources.

The automotive industry's reliance on metals like lithium, cobalt, and rare earth elements, vital for electric vehicle batteries and advanced electronics, highlights the urgency of these sustainability efforts. Companies are increasingly looking at circular economy principles to reduce dependence on virgin materials.

Waste Management and Recycling Initiatives

Aisin Seiki is actively engaged in enhancing its waste management and recycling programs. The company is focused on reducing waste at its source and implementing effective treatment and disposal strategies. This commitment is evident in their ongoing efforts to boost the incorporation of recycled materials across their manufacturing processes.

Aisin's drive towards a circular economy within its operations is a key environmental focus. They are exploring and adopting more sustainable practices to minimize their ecological footprint. For instance, Aisin is a participant in initiatives aimed at increasing the use of recycled plastics in automotive components, a trend that is gaining significant traction in the 2024-2025 period as regulatory pressures and consumer demand for sustainability intensify.

- Waste Reduction Targets: Aisin has set internal targets for reducing non-recyclable waste by a specific percentage by the end of fiscal year 2025.

- Recycled Material Usage: The company aims to increase the proportion of recycled materials used in its products, with a goal of reaching X% of total material input by 2025, up from Y% in 2023.

- Circular Economy Projects: Aisin is investing in pilot projects focused on material recovery and reuse, particularly for high-volume components.

- Supplier Collaboration: They are working with suppliers to ensure a consistent supply of high-quality recycled materials and to promote waste reduction throughout the supply chain.

Climate Change Impact and Adaptation

Aisin Seiki actively addresses climate change, a commitment underscored by its inclusion on CDP's 'A List' for climate change in 2023. This recognition highlights the company's robust strategies for mitigating its environmental impact. Aisin's environmental policy is built on a foundation of continuous improvement, with regular assessments of pollution levels informing measures for permanent environmental load reduction.

The company’s approach to climate change adaptation involves integrating sustainability into its core operations. This includes developing technologies and manufacturing processes that reduce greenhouse gas emissions across its value chain. For instance, in fiscal year 2023, Aisin reported a 15.8% reduction in CO2 emissions from its manufacturing operations compared to 2019 levels, demonstrating tangible progress in its decarbonization efforts.

Aisin's strategic focus on climate change extends to product development, aiming to create more fuel-efficient and environmentally friendly automotive components. Their efforts are geared towards supporting the broader societal goal of achieving carbon neutrality.

- CDP 'A List' Recognition: Aisin was named to the CDP Climate Change 'A List' in 2023, signifying leadership in environmental disclosure and action.

- CO2 Emission Reduction: The company achieved a 15.8% reduction in manufacturing CO2 emissions by fiscal year 2023 relative to a 2019 baseline.

- Environmental Policy Implementation: Aisin regularly assesses pollution levels to establish and implement measures for permanent environmental load reduction.

Aisin Seiki is making significant strides in environmental sustainability, aiming for carbon neutrality in production by 2035 and across its lifecycle by 2050, with a 20% CO2 emission reduction from manufacturing by fiscal year 2024 compared to 2013 levels.

The company is actively integrating circular economy principles, targeting 50% recycled content in products by 2025 and enhancing waste management and recycling programs to minimize its ecological footprint.

Aisin's commitment to climate action is recognized by its inclusion on CDP's 2023 'A List' for climate change, supported by a 15.8% reduction in manufacturing CO2 emissions by fiscal year 2023 from a 2019 baseline.

Addressing resource scarcity, Aisin is focusing on supply chain sustainability and efficient material use, collaborating on initiatives like Manufacture 2030 to accelerate decarbonization and responsible resource management.

| Environmental Goal | Target Year | Current Status/Metric |

| Carbon Neutrality (Production) | 2035 | Targeting significant renewable energy adoption. |

| Carbon Neutrality (Lifecycle) | 2050 | Ongoing initiatives across operations. |

| CO2 Emission Reduction (Manufacturing) | FY2024 | Achieved 20% reduction vs. 2013. |

| Recycled Material Content | 2025 | Aiming for 50% incorporation. |

| CO2 Emission Reduction (Manufacturing) | FY2023 | Achieved 15.8% reduction vs. 2019. |

| CDP Climate Change Rating | 2023 | Included on 'A List'. |

PESTLE Analysis Data Sources

This PESTLE analysis for Aisin Seiki is built on a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry analysis firms. We ensure comprehensive coverage of political, economic, social, technological, environmental, and legal factors affecting the automotive supplier.