Agilent Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

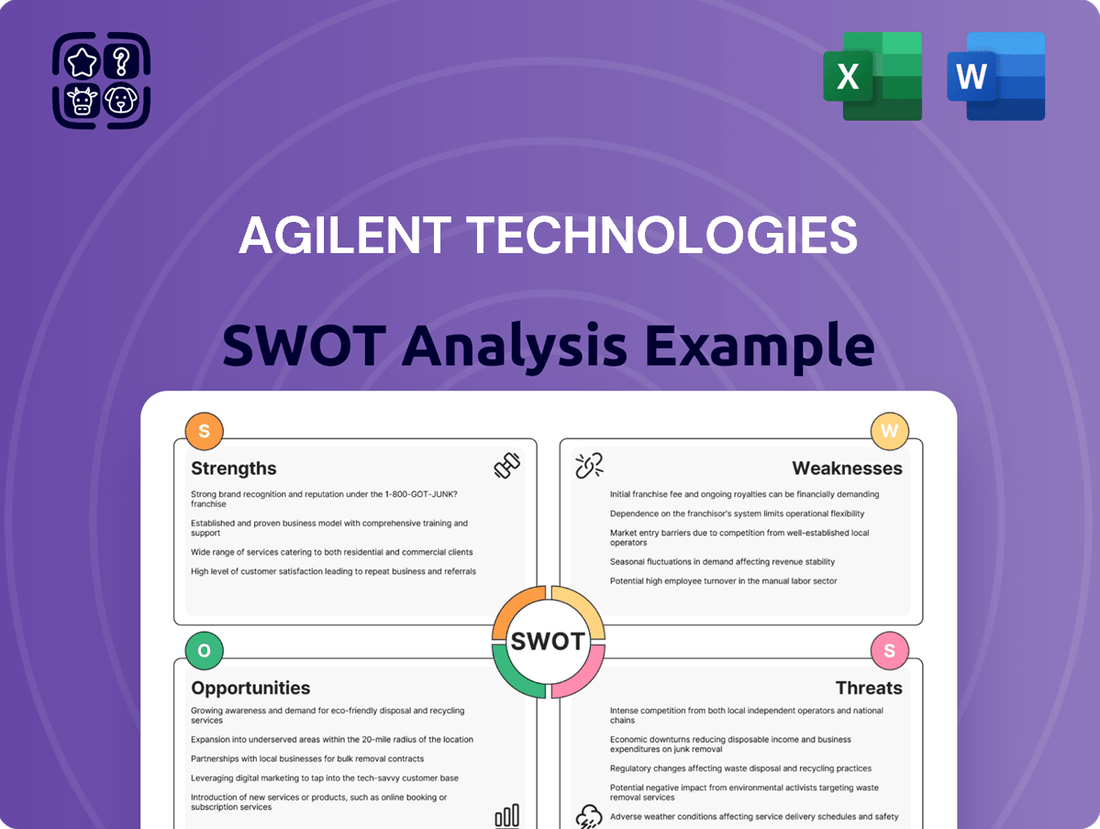

Agilent Technologies leverages its strong brand reputation and innovative product portfolio as key strengths, yet faces threats from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any stakeholder looking to navigate the life sciences and diagnostics market.

Want the full story behind Agilent's market position, including detailed breakdowns of its opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Agilent Technologies offers a robust and diverse product lineup, encompassing instruments, software, services, and consumables. This broad spectrum of offerings serves the life sciences, diagnostics, and applied chemical markets, making Agilent a comprehensive solution provider for laboratories worldwide.

The company's extensive product range attracts a wide array of customers across critical sectors such as biopharmaceuticals, chemicals, and advanced materials. Agilent's leadership is particularly evident in key areas like chromatography and mass spectrometry, where it holds significant market share.

Agilent Technologies boasts a substantial global presence, with key operations spanning the Americas, Europe, and Asia, providing a solid foundation for its business. This widespread footprint allows the company to serve a diverse customer base and navigate different market dynamics effectively.

The company is strategically focused on expanding into emerging markets, notably India, which is projected to experience high-teen growth. This targeted investment in high-potential regions like India underscores Agilent's commitment to capturing future growth opportunities and diversifying its revenue streams beyond established markets.

Agilent Technologies consistently demonstrates a strong commitment to innovation, channeling significant resources into research and development. This dedication fuels the creation of cutting-edge analytical instruments that are vital for scientific advancement across various industries.

The company's robust patent portfolio, holding thousands of patents, underscores its proprietary technological advancements and provides a distinct competitive edge. This intellectual property allows Agilent to develop highly precise and reliable solutions that meet the evolving needs of its customers.

In 2023, Agilent reported R&D expenses of $694 million, representing a notable increase from previous years, highlighting its ongoing investment in future growth. Recent launches, such as the Agilent Intuvo 9000 RTD GC system, exemplify this focus, offering enhanced performance and user experience.

Robust Financial Performance and Operational Efficiency

Agilent Technologies demonstrates robust financial performance, a key strength. For fiscal year 2024, the company reported revenues of $6.51 billion. This financial strength is further evidenced by a 6.0% reported revenue growth in the second quarter of fiscal year 2025 when compared to the same period in fiscal year 2024.

The company's strategic 'Ignite Transformation' initiative is a significant driver of this financial success. By focusing on operational excellence, Agilent is achieving notable cost savings and improving its profit margins.

- Strong Revenue Growth: Reported 6.0% revenue growth in Q2 FY2025 year-over-year.

- Fiscal Year 2024 Performance: Achieved $6.51 billion in revenues.

- Operational Efficiency: The 'Ignite Transformation' program enhances margins through cost savings.

- Financial Resilience: Solid financial health supports future investments and market stability.

Comprehensive Service and Support Offerings

Agilent's CrossLab Group (ACG) is a powerhouse, offering a broad spectrum of services, software, automation, and consumables. This comprehensive support is crucial for customers across all their served markets, ensuring their laboratories run smoothly and efficiently.

ACG is a substantial revenue driver for Agilent, contributing significantly to the company's top line. Its deep engagement with customers strengthens relationships and directly impacts the sustained performance and productivity of Agilent's instrument portfolio.

- Significant Revenue Contribution: In fiscal year 2023, Agilent's Services segment, which includes ACG, generated $1.72 billion in revenue, representing approximately 28% of total company revenue.

- Customer Retention: The extensive service offerings foster strong customer loyalty, as clients rely on Agilent for ongoing support, maintenance, and optimization of their laboratory operations.

- Recurring Revenue: This service-oriented approach builds predictable, recurring revenue streams, providing a stable financial foundation for the company.

- Enhanced Instrument Value: By ensuring optimal instrument performance, ACG effectively increases the long-term value proposition of Agilent's products.

Agilent's diverse product portfolio, spanning instruments, software, services, and consumables, caters to vital life sciences, diagnostics, and applied chemical markets. This comprehensive offering, particularly strong in chromatography and mass spectrometry, solidifies its position as a leading solutions provider. The company's commitment to innovation is evident in its substantial R&D investments, with $694 million allocated in 2023, bolstering its robust patent portfolio and driving the development of cutting-edge analytical instruments.

Financially, Agilent demonstrates considerable strength. The company reported revenues of $6.51 billion for fiscal year 2024 and achieved 6.0% revenue growth in the second quarter of fiscal year 2025 compared to the prior year. Its 'Ignite Transformation' initiative further enhances profitability through operational efficiencies and cost savings, contributing to solid financial health and market stability.

The CrossLab Group (ACG) is a significant contributor to Agilent's success, generating $1.72 billion in revenue in fiscal year 2023, which represented approximately 28% of total company revenue. ACG's extensive services, software, and consumables offerings foster strong customer loyalty and create predictable, recurring revenue streams, thereby enhancing the overall value of Agilent's instrument portfolio.

| Metric | FY2024 | Q2 FY2025 (YoY Growth) | FY2023 Services Revenue |

|---|---|---|---|

| Total Revenue | $6.51 billion | ||

| Revenue Growth | 6.0% | ||

| Services Revenue Contribution | $1.72 billion (28% of total) |

What is included in the product

Delivers a strategic overview of Agilent Technologies’s internal and external business factors, highlighting its strong market position and innovation capabilities alongside potential threats and areas for improvement.

Offers a structured framework to identify and address Agilent's strategic challenges and opportunities, transforming complex data into actionable insights.

Weaknesses

Agilent has faced operational hurdles, with recent financial reports showing revenue dips in specific product segments, underscoring internal execution challenges.

The company has grappled with parts shortages and broader supply chain disruptions, impacting its capacity to fulfill customer orders and potentially causing inventory imbalances.

These vulnerabilities necessitate a stronger focus on supply chain robustness and improved inventory control to mitigate further financial strain and revenue shortfalls.

Agilent's innovation engine and market position hinge significantly on its highly skilled employees, especially in critical areas like research, development, and executive leadership. The company's ability to maintain its competitive edge is directly tied to the expertise and contributions of these individuals.

The global market for specialized technical talent is intensely competitive, creating a persistent challenge for Agilent in attracting and retaining top-tier professionals. This is particularly true in specialized fields and in regions with a high concentration of technology companies, impacting the company's capacity for growth and innovation.

The uncertain macroeconomic environment poses a significant hurdle for Agilent's growth. A slowdown in global economic activity can directly curb spending on critical research and development, thereby dampening demand for Agilent's advanced analytical instruments and essential services.

For instance, if major economies experience a contraction, as some analysts predicted for parts of 2024 due to persistent inflation and interest rate hikes, industries that rely heavily on Agilent's offerings, such as pharmaceuticals and biotech, might scale back their investments. This could translate into slower revenue growth and potentially impact Agilent's ability to meet its financial projections for the fiscal year 2025.

Sensitivity to Specific Market Segment Performance

Agilent's significant revenue concentration, with its Agilent CrossLab Group (ACG) contributing over 40%, exposes it to risks if this key segment underperforms. A downturn in lab instrumentation demand or shifts in customer purchasing behavior within ACG could negatively impact profitability. This reliance means that a slowdown in these core areas can disproportionately affect overall financial results.

Further illustrating this, the Applied Markets Group experienced a revenue decline in the second quarter of fiscal year 2025. This indicates that even within its diversified portfolio, specific market segments can face headwinds, highlighting Agilent's sensitivity to the performance of these individual areas.

- Revenue Concentration: ACG accounts for over 40% of Agilent's total revenue.

- Segmental Vulnerability: Slowdowns in lab instrumentation orders or demand shifts in core segments pose a risk.

- Applied Markets Performance: The Applied Markets Group saw a revenue decline in Q2 FY25.

- Profit Margin Impact: Underperformance in key segments can destabilize profit margins.

Fluctuations in GAAP Net Income

Agilent Technologies experienced a notable dip in its reported net income under Generally Accepted Accounting Principles (GAAP) during the second quarter of fiscal year 2025. Specifically, GAAP net income fell by 29% compared to the second quarter of fiscal year 2024. This decline, even amidst overall revenue expansion, suggests that certain accounting adjustments or cost factors are impacting the company's bottom line as per GAAP reporting standards.

While the company's non-GAAP net income presented a more positive picture with growth, the decrease in GAAP net income warrants attention. This divergence can sometimes indicate the impact of non-recurring items, such as restructuring charges or acquisition-related expenses, which are treated differently under GAAP versus non-GAAP calculations.

- GAAP Net Income Decline: Agilent's GAAP net income decreased by 29% in Q2 FY2025 compared to Q2 FY2024.

- Revenue Growth Contrast: This decline occurred despite the company reporting overall revenue growth during the same period.

- Potential Underlying Factors: The GAAP net income reduction may point to underlying cost pressures or specific financial adjustments affecting reported profitability.

Agilent's reliance on key segments like the Agilent CrossLab Group (ACG), which represents over 40% of its revenue, creates a significant vulnerability. A downturn in lab instrumentation demand or shifts in customer purchasing behavior within ACG could disproportionately impact overall financial results. This was evidenced by the Applied Markets Group's revenue decline in Q2 FY2025, highlighting the sensitivity to specific market segment performance.

Furthermore, Agilent experienced a notable 29% decrease in GAAP net income in Q2 FY2025 compared to the prior year, even while reporting overall revenue growth. This divergence suggests potential impacts from accounting adjustments or cost factors affecting reported profitability.

| Weakness | Description | Impact |

|---|---|---|

| Revenue Concentration | Agilent CrossLab Group (ACG) accounts for over 40% of total revenue. | Underperformance in ACG can significantly affect overall financial performance. |

| Segmental Vulnerability | Slowdowns in lab instrumentation orders or demand shifts in core segments pose a risk. | Impacts revenue stability and profitability if key segments falter. |

| GAAP Net Income Decline | GAAP net income fell 29% in Q2 FY2025 vs. Q2 FY2024. | Indicates potential underlying cost pressures or accounting adjustments impacting reported profitability. |

Full Version Awaits

Agilent Technologies SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Agilent Technologies SWOT analysis, complete with detailed insights into its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version, allowing you to leverage this comprehensive strategic tool.

Opportunities

Emerging markets, especially in Asia, present substantial growth avenues for Agilent Technologies. The company is actively pursuing these opportunities, with plans to double its investment in India and establish new capability centers to bolster the burgeoning life sciences sector there.

This strategic push into rapidly developing economies allows Agilent to tap into escalating demand for advanced laboratory solutions, positioning it to benefit from significant economic expansion in these regions.

Agilent is well-positioned to capitalize on ongoing technological advancements and its commitment to digital transformation. This focus is already yielding tangible results, with the company reporting high-single-digit growth in digital orders, demonstrating the effectiveness of its enhanced digital ecosystem.

Further investment in cutting-edge technologies like artificial intelligence, advanced data analytics, and automation presents significant opportunities. These innovations can drive the development of new, high-value products and streamline Agilent's internal operations, boosting overall efficiency.

The intensifying focus on environmental protection, driven by heightened public awareness and stricter governmental regulations worldwide, creates a substantial growth avenue. This is particularly evident in the increasing demand for testing related to persistent contaminants like PFAS.

Agilent is well-positioned to capitalize on this trend, evidenced by its impressive revenue growth. The company reported over a 70% year-over-year increase in revenue specifically from PFAS analysis, demonstrating strong market traction. This segment is anticipated to evolve into a $1 billion market by 2030, offering Agilent a significant opportunity to expand its market share.

Strategic Acquisitions and Growth in CDMO Market

Agilent's strategic acquisitions, notably the $1 billion acquisition of BioVectra, significantly bolster its Contract Development and Manufacturing Organization (CDMO) segment. This move specifically enhances its capacity in high-demand areas like GLP-1 therapies and complex chemical manufacturing.

This expansion positions Agilent to aggressively pursue opportunities within the burgeoning global CDMO market. Projections indicate this market will reach an estimated $50 billion, presenting substantial revenue potential for Agilent's expanded service offerings.

These strategic investments not only broaden Agilent's CDMO service portfolio but also extend its market penetration and client base, solidifying its competitive standing.

- Expanded CDMO Capabilities: Acquisition of BioVectra for $1 billion enhances expertise in GLP-1 and complex chemistries.

- Market Growth Capture: Agilent is well-positioned to capitalize on the estimated $50 billion global CDMO market.

- Enhanced Market Reach: Acquisitions broaden service offerings and increase Agilent's presence in key therapeutic areas.

Increased Investment in Biopharma and Advanced Therapies

The biopharmaceutical sector is experiencing robust growth, particularly in areas like weight-loss drugs, such as GLP-1 agonists, and cutting-edge cell and gene therapies. This surge is directly translating into increased demand for the sophisticated instruments and services Agilent Technologies provides. For instance, the global GLP-1 market was projected to reach tens of billions of dollars by 2024, highlighting the immense commercial potential.

Agilent is strategically positioning itself to capitalize on these trends by offering comprehensive solutions that support the entire lifecycle of drug development within these rapidly expanding biopharma segments. This includes providing essential tools for research, development, and manufacturing, thereby fostering innovation and enabling crucial collaborations within the industry.

- GLP-1 Market Growth: The market for GLP-1 based drugs is expanding rapidly, with projections indicating significant revenue increases through 2025, driving demand for analytical instruments.

- Cell and Gene Therapy Acceleration: The increasing number of approved cell and gene therapies and those in clinical trials necessitates advanced diagnostic and manufacturing tools.

- Agilent's Strategic Alignment: The company's portfolio is being tailored to support the complex workflows associated with these advanced therapies, from discovery to production.

- Industry Collaboration: Agilent's focus on providing integrated solutions encourages partnerships and streamlines the development process for biopharma companies.

Agilent is strategically expanding its Contract Development and Manufacturing Organization (CDMO) capabilities, notably through its $1 billion acquisition of BioVectra, to address the booming demand in areas like GLP-1 therapies and complex chemical manufacturing. This move positions Agilent to capture a significant share of the estimated $50 billion global CDMO market, broadening its service offerings and client base. The company's investments are designed to enhance its market penetration and competitive standing in these high-growth sectors.

| Opportunity Area | Key Driver | Agilent's Action/Positioning | Market Size/Growth |

| CDMO Expansion | High demand for GLP-1 therapies, complex chemistries | Acquisition of BioVectra ($1B), enhanced capacity | Global CDMO market estimated at $50 billion |

| Biopharmaceutical Growth | Advancements in GLP-1 drugs, cell and gene therapies | Comprehensive solutions for drug lifecycle support | GLP-1 market projected for tens of billions by 2024 |

| Emerging Markets | Growing life sciences sector in Asia | Doubling investment in India, new capability centers | Tapping into escalating demand for advanced lab solutions |

| Digital Transformation | Technological advancements, AI, automation | Enhanced digital ecosystem, high-single-digit digital order growth | Driving new product development and operational efficiency |

Threats

Agilent Technologies operates in a fiercely competitive landscape, contending with major players like Thermo Fisher Scientific, Waters Corporation, PerkinElmer, and Shimadzu Corporation. These rivals are constantly innovating, putting pressure on Agilent to maintain its market position through continuous technological advancement and compelling customer offerings.

The life sciences and diagnostics sectors are ripe for further consolidation. Should key competitors merge, Agilent could face even larger, more formidable entities with increased market power and resources, potentially impacting Agilent's market share and profitability.

Public health crises, much like the COVID-19 pandemic, can significantly disrupt Agilent's operations, its supply chain, and the demand from its customers. These events are inherently unpredictable, posing a substantial threat to the company's financial stability.

To mitigate these risks, Agilent must maintain robust contingency plans and agile response strategies. For instance, during the COVID-19 pandemic, many companies in the life sciences sector experienced supply chain disruptions, impacting their ability to deliver essential products.

Escalating geopolitical tensions and the imposition of trade tariffs, like the hypothetical April 2025 'Liberation Day' tariffs, pose a significant threat to Agilent's cost structure and global supply chain. These trade barriers can directly inflate the cost of goods and disrupt the flow of essential components, impacting profitability.

Given that Agilent derives a substantial portion of its revenue from the Chinese market, any trade friction between major economic blocs presents a considerable risk. Such disruptions could impede growth, necessitate costly operational adjustments, and challenge Agilent's ability to maintain consistent market access and competitive pricing.

Regulatory Shifts and Funding Uncertainties

Changes in regulatory landscapes, especially in crucial markets like China, pose a significant threat by potentially disrupting demand for Agilent's diverse product portfolio. For instance, evolving regulations in China regarding chemical testing or medical devices could necessitate costly product modifications or limit market access.

Uncertainties in U.S. federal funding for scientific research and environmental initiatives present another challenge. Reductions in grants for academic research or environmental monitoring programs could directly impact government agencies and universities, key customers for Agilent's analytical instruments and laboratory services. In 2023, U.S. federal spending on research and development saw fluctuations, with agencies like the National Institutes of Health (NIH) and the Environmental Protection Agency (EPA) subject to budget considerations that could trickle down to instrument procurement.

- Regulatory Impact: Stricter import regulations in China, for example, could increase compliance costs and slow product adoption.

- Funding Dependence: A significant portion of Agilent's revenue is tied to government and academic research budgets, making it vulnerable to funding cuts.

- Geopolitical Factors: Trade tensions or shifts in international scientific collaboration policies can also affect Agilent's global sales and operational strategies.

Economic Downturns and Inflationary Pressures

A challenging macroeconomic environment, such as economic downturns or extended periods of slow growth, can significantly impact Agilent Technologies. These conditions often lead to reduced spending on research and development across key industries that rely on Agilent's products and services, potentially dampening demand.

Furthermore, persistent inflationary pressures present a direct threat by increasing Agilent's operational costs. This could squeeze profit margins if the company finds it difficult to pass these higher expenses onto its customers, especially in competitive markets.

For instance, in the first quarter of fiscal year 2024, Agilent reported a net revenue of $1.58 billion, a slight decrease from $1.61 billion in the prior year's quarter. While this reflects broader market trends, it highlights the sensitivity to economic fluctuations. The company has also navigated supply chain challenges, which can be exacerbated by inflationary pressures, impacting inventory costs and production efficiency.

- Reduced R&D Spending: Economic slowdowns can cause clients in sectors like pharmaceuticals and biotech to scale back their investment in new research, directly affecting Agilent's instrument and consumables sales.

- Increased Operational Costs: Inflation can drive up the cost of raw materials, energy, and labor, potentially eroding Agilent's profitability if cost increases cannot be fully offset by price adjustments.

- Pricing Power Limitations: In a competitive landscape, Agilent may face challenges in fully passing on increased costs to customers, impacting its gross margins.

- Supply Chain Volatility: Inflationary environments can amplify supply chain disruptions, leading to higher input costs and potential production delays.

Agilent faces intense competition from established players and emerging innovators, requiring continuous investment in R&D to maintain its edge. The threat of market consolidation among rivals could create larger, more dominant competitors, potentially impacting Agilent's market share and pricing power.

Geopolitical instability and trade disputes, such as potential tariffs in 2025, can disrupt Agilent's global supply chains and increase operational costs. Its significant reliance on the Chinese market makes it particularly vulnerable to trade friction between major economic blocs.

Changes in government funding for scientific research, as seen with fluctuations in U.S. federal R&D spending in 2023, directly affect demand for Agilent's analytical instruments from academic and government institutions. Economic downturns and persistent inflation also pose threats by reducing client R&D budgets and increasing Agilent's operational expenses, potentially squeezing profit margins.

| Threat Category | Specific Risk | Potential Impact | Example Data/Context |

|---|---|---|---|

| Competition | Market Consolidation | Reduced market share, pricing pressure | Ongoing M&A activity in life sciences sector |

| Geopolitical | Trade Tariffs/Restrictions | Increased costs, supply chain disruption | Hypothetical April 2025 tariffs, China market reliance |

| Economic | Reduced R&D Spending | Lower instrument and consumables sales | Q1 FY24 revenue decline to $1.58B |

| Economic | Inflationary Pressures | Higher operational costs, margin erosion | Impact on raw materials, energy, labor costs |

SWOT Analysis Data Sources

This Agilent Technologies SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.