Agilent Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

Agilent Technologies masterfully crafts its product portfolio, from advanced analytical instruments to software solutions, ensuring they meet the evolving needs of life sciences, diagnostics, and applied chemical markets. Their pricing strategy reflects the high-value, innovative nature of their offerings, while their distribution channels ensure global reach and accessibility for researchers and professionals.

Discover the intricate details of Agilent's promotional strategies and how each element of the 4Ps synergizes to drive their market leadership. This comprehensive analysis goes beyond the surface, providing actionable insights for your own strategic planning.

Unlock a complete, editable 4Ps Marketing Mix Analysis for Agilent Technologies, perfect for business professionals, students, and consultants seeking a competitive edge. Save valuable research time and gain a deep understanding of their market success.

Product

Agilent Technologies provides a robust suite of laboratory instruments, including advanced liquid chromatography (LC) and mass spectrometry (MS) systems, alongside gas chromatography (GC) and MS solutions. These are critical tools for scientific analysis across various industries.

Complementing its hardware, Agilent offers sophisticated software like InfinityLab Assist Technology and OpenLab CDS. These platforms are designed to streamline laboratory operations, improve data integrity, and boost overall productivity for users.

Innovation is a cornerstone, with Agilent launching the next-generation InfinityLab LC Series and the 8850 GC System in 2024. These releases highlight Agilent's commitment to delivering enhanced performance and sustainable solutions to meet dynamic market needs.

Beyond its core instruments and software, Agilent Technologies offers a robust suite of specialized services and high-quality consumables. These are vital for supporting the entire laboratory workflow, from sample preparation to data analysis. For instance, their analytical lab services and informatics solutions streamline operations, while automation enhances efficiency.

The Agilent CrossLab Group (ACG) is central to these offerings, focusing on maximizing the value of Agilent's installed base. ACG provides targeted workflows and application support, ensuring customers achieve accurate and reproducible results. This dedication to comprehensive customer support is a key differentiator in the market.

In 2023, Agilent reported that services revenue grew by 9% year-over-year, reaching $1.5 billion, highlighting the increasing importance of these specialized offerings. Consumables, a critical component of their product mix, also saw consistent demand, underpinning laboratory productivity and research advancements.

Agilent's product strategy centers on application-focused solutions for vital markets like life sciences, diagnostics, and applied chemical analysis. This means they're building tools specifically for challenges in areas such as drug discovery, food safety, and environmental monitoring. For instance, their work in PFAS testing is crucial given the increasing regulatory focus and public concern around these persistent chemicals.

Their commitment to these specific applications is evident in offerings like the Agilent SureSelect Cancer Pan Heme Assay and Agilent Avida DNA Cancer Panels. These products showcase Agilent's dedication to providing targeted solutions for complex scientific and medical needs, reflecting a deep understanding of their customers' workflows and objectives in 2024 and beyond.

Strategic Acquisitions for Portfolio Expansion

Agilent Technologies actively pursues strategic acquisitions to broaden its product offerings and bolster its market presence. These acquisitions are designed to integrate new technologies and expertise, thereby enhancing its value proposition to customers across various life science and diagnostic sectors.

The company's acquisition strategy is evident in key deals from 2024. For example, the September 2024 acquisition of BIOVECTRA significantly boosted Agilent's contract development and manufacturing organization (CDMO) services. This move not only deepened its relationships with pharmaceutical clients but also infused expertise in high-growth areas such as GLP-1 therapeutics, a segment experiencing substantial investment and demand.

Further demonstrating this commitment, Agilent acquired Sigsense Technologies in July 2024. This acquisition was strategically aimed at augmenting Agilent's software capabilities, specifically incorporating advanced AI and power monitoring solutions crucial for optimizing laboratory operations and workflow efficiency.

- September 2024: Acquisition of BIOVECTRA to enhance CDMO capabilities and tap into GLP-1 market.

- July 2024: Acquisition of Sigsense Technologies to expand AI and lab operational software.

- Strategic Rationale: Portfolio expansion through targeted technology and market access integration.

- Impact: Deepened customer engagement and strengthened position in growth segments.

Innovation Driving New Development

Agilent Technologies places a strong emphasis on continuous innovation as a core driver of its product development strategy, consistently introducing new solutions to the market. This commitment is evident in recent product launches and ongoing research initiatives.

Examples of this innovation include the introduction of the Mito-rOCR Assay Kit, a tool designed to enhance the analysis of mitochondrial function, and new LC Single Quadrupole Mass Spectrometers engineered to significantly improve laboratory efficiency. These products reflect Agilent's dedication to advancing scientific capabilities.

Furthermore, Agilent is actively integrating artificial intelligence into its laboratory efficiency solutions and pushing the boundaries of technologies critical for fields such as cancer research. This forward-thinking approach ensures Agilent remains at the forefront of scientific advancement.

- Mito-rOCR Assay Kit: Enhances mitochondrial function analysis.

- New LC Single Quadrupole Mass Spectrometers: Designed for increased laboratory efficiency.

- AI Integration: Focus on embedding AI into lab efficiency tools.

- Cancer Research Advancements: Continued development of technologies for critical research areas.

Agilent's product strategy is centered on delivering application-focused solutions for critical markets like life sciences, diagnostics, and applied chemical analysis. This includes advanced LC, GC, and MS systems, complemented by sophisticated software for streamlined operations. Recent innovations like the next-generation InfinityLab LC Series and the 8850 GC System, launched in 2024, underscore their commitment to enhanced performance and sustainability.

The company also focuses on specialized services and consumables, crucial for supporting the entire laboratory workflow. Agilent's CrossLab Group specifically aims to maximize the value of their installed base through targeted workflows and application support. In 2023, Agilent's services revenue grew by 9% to $1.5 billion, demonstrating the increasing importance of these offerings.

Agilent actively expands its product portfolio through strategic acquisitions. In 2024, they acquired BIOVECTRA to enhance CDMO services and Sigsense Technologies to bolster AI and lab operational software. These moves integrate new technologies and expertise, strengthening their position in high-growth segments like GLP-1 therapeutics.

| Product Category | Key Examples | 2024/2025 Focus/Impact |

| Laboratory Instruments | LC, GC, MS Systems | Next-gen InfinityLab LC Series, 8850 GC System (2024) |

| Software Solutions | InfinityLab Assist, OpenLab CDS | AI integration via Sigsense acquisition (July 2024) |

| Services & Consumables | CrossLab Group, Assay Kits | 9% revenue growth in services (2023), Mito-rOCR Assay Kit |

| Strategic Acquisitions | BIOVECTRA, Sigsense Technologies | CDMO expansion, AI/software enhancement (2024) |

What is included in the product

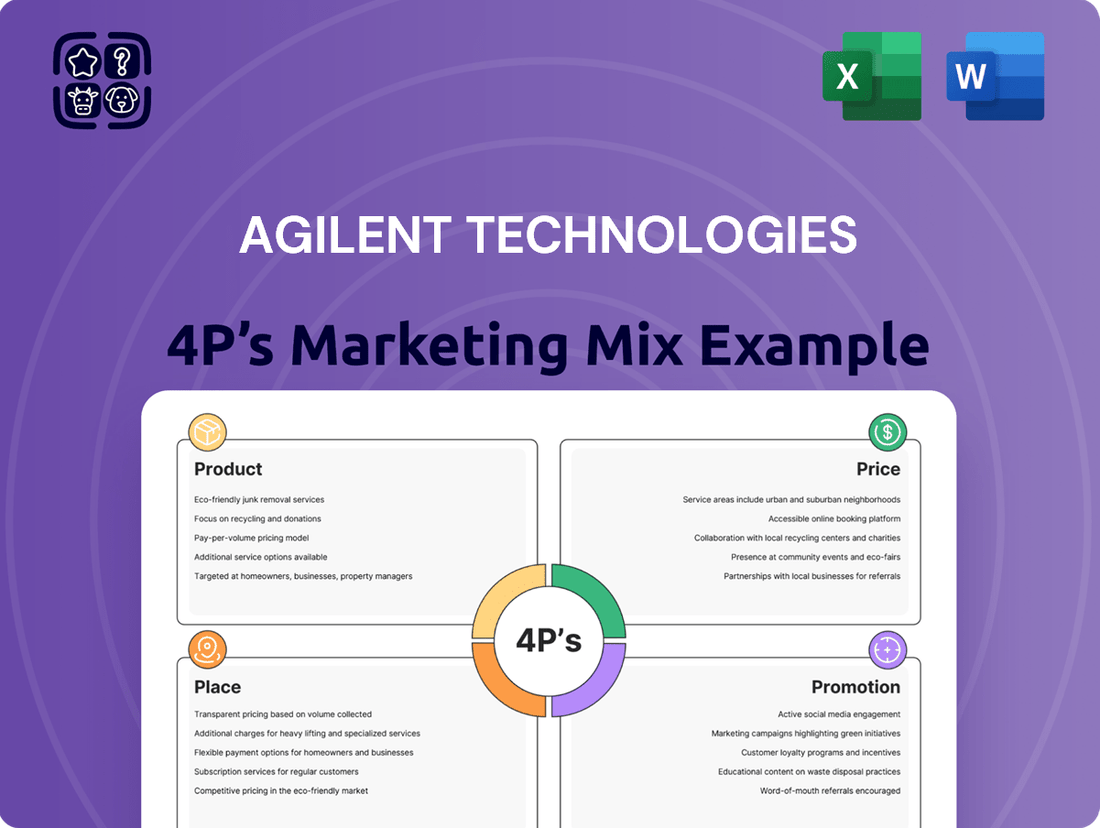

This analysis provides a comprehensive overview of Agilent Technologies' marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning and competitive advantage.

Simplifies complex marketing strategies by clearly outlining Agilent's Product, Price, Place, and Promotion, alleviating the pain of understanding their market approach.

Provides a clear, actionable framework for identifying and addressing potential gaps in Agilent's marketing efforts, easing the burden of strategic planning.

Place

Agilent Technologies employs a direct sales strategy in numerous key markets, capitalizing on its extensive global network to serve customers in life sciences, diagnostics, and applied chemical sectors. This approach ensures proximity to its diverse customer base.

With a workforce of around 18,000 employees globally, Agilent's significant worldwide revenue underscores its ability to make its innovative products and services readily available to laboratories across various continents. This expansive reach is crucial for market penetration.

The direct sales model fosters deeper connections with clients, enabling Agilent to provide more personalized support and understand specific laboratory needs, enhancing customer loyalty and product adoption.

Agilent Technologies employs a multi-pronged approach to distribution, leveraging direct sales, its own online platforms, and crucial strategic partnerships. This ensures broad market penetration and caters to diverse customer preferences.

The company's investment in its digital infrastructure is paying off, with digital orders experiencing high-single-digit growth. This trend underscores Agilent's successful adaptation to the increasing importance of e-commerce in the scientific instrument sector, meeting customers where they are.

Strategic collaborations, like the one with Sangon Biotech in China for a Digital Demonstration Laboratory, and partnerships with academic institutions such as the National University of Singapore (NUS) and Nanyang Technological University, are key. These alliances not only expand Agilent's geographical reach but also provide specialized, hands-on access to its technologies for researchers and students.

Agilent Technologies is strategically investing in regional hubs and experience centers to deepen customer relationships, offer advanced training, and foster collaborative innovation. These facilities are crucial for demonstrating Agilent's comprehensive solutions and providing hands-on learning opportunities.

A prime example of this commitment is the inauguration of the Biopharma Capability Center in Hyderabad, India, and the India Solution Center in Manesar. These centers are equipped with state-of-the-art analytical and regulatory capabilities, underscoring Agilent's dedication to supporting the growing biopharmaceutical sector in the region.

These centers act as vibrant innovation hubs, enabling customers to replicate real-world laboratory conditions, meticulously test for quality and compliance, and benefit from specialized expert training. This hands-on approach ensures customers can effectively leverage Agilent's technology for their specific needs.

Market-Centric Organizational Structure

Agilent Technologies is implementing a new market-centric organizational structure starting in fiscal year 2025. This strategic shift is designed to foster better collaboration and execution, placing customer needs at the forefront of their operations. The company believes this will accelerate their operational transformation and unlock higher growth potential.

The business is now organized into three distinct segments, each tailored to specific market demands:

- Life Sciences and Diagnostics Markets Group (LDG): Focusing on the needs of the life sciences and diagnostics sectors.

- Applied Markets Group (AMG): Catering to the requirements of applied markets.

- Agilent CrossLab Group (ACG): Providing integrated services and solutions across various market segments.

This reorganization directly supports Agilent's commitment to a customer-first approach. By aligning business groups more closely with end markets, they aim to respond more effectively to evolving customer needs and market dynamics. This structure is expected to drive innovation and improve overall business performance, building on their strong financial footing, which saw revenues grow by 3% year-over-year to $6.9 billion in fiscal year 2023.

Supply Chain and Inventory Management

Agilent Technologies places significant emphasis on its supply chain and inventory management to ensure its diverse product portfolio, including instruments, software, services, and consumables, reaches customers worldwide efficiently. While precise inventory figures are proprietary, the company's sustained ability to meet global demand, evidenced by its consistent revenue growth, points to sophisticated logistics operations. For instance, Agilent reported total net revenue of $6.85 billion for the fiscal year ending October 31, 2023, indicating substantial operational throughput.

The company's strategic approach integrates optimized transportation and distribution networks to minimize lead times and enhance customer experience. This focus is crucial given the global nature of its customer base in life sciences, diagnostics, and applied chemical markets. Agilent's commitment to supply chain excellence supports its market position by ensuring product availability and reliable delivery.

- Global Reach: Agilent serves customers across numerous countries, requiring a resilient and adaptable supply chain.

- Product Diversity: Managing inventory for a wide range of complex instruments, software, and consumables presents unique challenges.

- Revenue Impact: Efficient supply chain operations directly contribute to Agilent's ability to generate significant revenue, such as the $6.85 billion in FY2023.

- Customer Satisfaction: Timely delivery and product availability are key drivers of customer loyalty in its target markets.

Agilent Technologies utilizes a direct sales force and a robust online platform to ensure its products are accessible globally. This strategy is reinforced by strategically located regional hubs and experience centers, such as the Biopharma Capability Center in Hyderabad, India, and the India Solution Center in Manesar, which facilitate hands-on customer engagement and training.

The company's market-centric organizational structure, implemented in fiscal year 2025, with segments like LDG, AMG, and ACG, enhances its ability to deliver solutions tailored to specific customer needs across diverse geographic regions.

Agilent's commitment to customer proximity is further demonstrated through strategic partnerships, like the one with Sangon Biotech in China, expanding its reach and providing specialized access to its technologies.

Agilent's place in the market is defined by its extensive global distribution network, direct sales approach, and digital infrastructure, ensuring products and services are readily available to its diverse customer base. This is supported by significant investments in regional centers and a market-aligned organizational structure, which saw revenues grow by 3% year-over-year to $6.9 billion in fiscal year 2023.

| Key Distribution Aspects | Description | Impact |

| Direct Sales Force | Extensive global team serving key markets. | Proximity to diverse customer base, personalized support. |

| Online Platforms | Company's e-commerce presence. | High-single-digit growth in digital orders, meeting customer convenience. |

| Regional Hubs/Experience Centers | Facilities in locations like Hyderabad and Manesar, India. | Deepen customer relationships, offer training, foster innovation. |

| Strategic Partnerships | Collaborations with entities like Sangon Biotech. | Expand geographical reach, provide specialized access to technologies. |

| Market-Centric Structure (FY25) | Organization into LDG, AMG, ACG segments. | Improved response to customer needs, accelerated transformation. |

Same Document Delivered

Agilent Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual Agilent Technologies 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use. This isn’t a teaser or a sample; it’s the actual content you’ll receive when you complete your order.

Promotion

Agilent Technologies leverages industry conferences and exhibitions, like the anticipated HPLC 2025 and AACR 2025, as a crucial promotional tool. These events allow Agilent to directly showcase its cutting-edge products and solutions to a highly relevant audience of scientists and researchers. For instance, in 2023, Agilent reported significant lead generation from its participation in key scientific gatherings, contributing to its robust sales pipeline.

Agilent Technologies actively cultivates a robust digital marketing and online presence. This includes a dynamic website, engagement across platforms like LinkedIn and Facebook, and dedicated investor relations portals. These efforts are designed to foster communication and build relationships with stakeholders.

The company's strategic investment in its digital infrastructure is yielding tangible results, with digital orders experiencing high-single-digit growth. This demonstrates the effectiveness of their online marketing initiatives in driving business. Agilent also utilizes webcasts for earnings calls and investor presentations, ensuring widespread accessibility to crucial financial and strategic updates.

Agilent Technologies actively utilizes public relations and news releases to communicate significant company milestones. These announcements cover new product launches, crucial strategic alliances, quarterly and annual financial performance, and their commitment to corporate social responsibility. This consistent flow of information is vital for cultivating brand recognition and ensuring all stakeholders are kept informed about Agilent's progress and values.

In 2024, Agilent continued its proactive communication strategy. For instance, news releases highlighted the opening of new capability centers, such as their advanced facility in Suzhou, China, aimed at enhancing customer support and innovation in the Asia-Pacific region. Furthermore, the company received notable recognition for its sustainability initiatives, including being named to the Dow Jones Sustainability Index for its environmental, social, and governance (ESG) performance, underscoring their dedication to responsible business practices.

Thought Leadership and Scientific Collaboration

Agilent Technologies actively cultivates thought leadership by sharing its scientific expertise and showcasing innovative solutions. This is evident in their engagement with academic institutions and research organizations, fostering a collaborative environment that benefits both Agilent and the scientific community.

A key aspect of this strategy involves scientific collaboration. Agilent partners on research projects, offering access to advanced instrumentation and expert training. For instance, their collaborations with institutions like the National University of Singapore and Nanyang Technological University in 2024 exemplify this commitment. These partnerships not only advance scientific discovery but also solidify Agilent's standing as a trusted partner in research.

- Thought Leadership: Agilent positions itself as an expert resource through publications, webinars, and participation in scientific conferences.

- Scientific Collaboration: Partnerships with universities like NUS and NTU facilitate joint research and development efforts.

- Access to Technology: Agilent provides researchers with access to state-of-the-art analytical instruments and technologies.

- Expert Training: The company offers training programs to enhance the skills of scientists using their solutions, fostering deeper adoption and understanding.

Investor Relations and Shareholder Communications

Agilent Technologies prioritizes investor relations, offering detailed financial data, annual reports, and SEC filings to a broad spectrum of investors and financial professionals. This commitment to transparency is crucial for fostering trust and enabling informed investment decisions.

The company actively engages the financial community through regular earnings calls and investor events. For instance, during their Q2 2024 earnings call in May 2024, Agilent reported net revenue of $1.65 billion, a slight increase from the previous year. These events provide updates on performance, strategic direction, and future outlook.

- Financial Transparency: Agilent provides comprehensive financial reports, including quarterly earnings releases and annual reports, ensuring investors have access to critical performance data.

- Investor Engagement: Regular earnings calls and investor conferences facilitate direct communication, allowing for questions and detailed discussions about company strategy and financial health.

- Shareholder Value Focus: This open communication aims to build confidence and support the long-term valuation of Agilent's stock, reflecting a dedication to shareholder interests.

Agilent Technologies' promotional efforts are multi-faceted, focusing on thought leadership, scientific engagement, and robust investor relations. By actively participating in industry events and fostering collaborations, they showcase their expertise and cutting-edge solutions to a targeted audience.

Digital marketing and public relations are key components, with online presence and timely news releases highlighting milestones and ESG commitments. This consistent communication builds brand recognition and stakeholder trust.

The company's commitment to financial transparency, evident in detailed reports and active investor engagement, aims to bolster confidence and support long-term shareholder value.

Price

Agilent Technologies employs a value-based pricing strategy, reflecting the significant worth of its advanced scientific instruments, software, and services. This approach acknowledges that their solutions are integral to critical applications, such as pharmaceutical development and ensuring food safety, where precision and reliability are paramount.

The pricing is set to align with the substantial benefits and actionable insights customers gain, rather than solely on the cost of production. For instance, Agilent's LC/MS systems, vital for drug discovery, are priced considering the accelerated research timelines and improved diagnostic accuracy they enable, contributing to higher customer ROI.

Agilent Technologies strategically prices its offerings within its niche markets, such as life sciences and diagnostics, to reflect the high value proposition of its advanced solutions. This approach ensures competitiveness by balancing the perceived worth of its products against those of rivals. For instance, in the highly specialized field of genomics sequencing, where Agilent offers advanced platforms, pricing is carefully calibrated to align with the sophisticated capabilities and research outcomes these instruments enable, while remaining a viable option for leading institutions.

Agilent Technologies actively pursues strategic pricing initiatives, often integrated within broader transformation programs like 'Ignite Transformation,' to enhance profitability and foster growth. These efforts are geared towards refining pricing policies for greater organizational agility and operational efficiency.

The company's commitment to regularly reviewing and adjusting its pricing strategies ensures alignment with evolving market dynamics and internal financial objectives, which has demonstrably contributed to improved operating margins, with the company reporting a notable increase in its gross profit margin in the fiscal year 2023.

Impact of External Factors on Pricing

Agilent Technologies' pricing is significantly shaped by external forces. For instance, currency fluctuations can directly impact the cost of goods sold and the revenue recognized from international sales. The company has noted these currency headwinds, which can affect its reported financial results.

Tariffs also play a role, potentially increasing the cost of imported components or finished goods. Agilent has indicated efforts to absorb these incremental tariff costs, suggesting that pricing adjustments may be considered to offset such impacts.

Broader economic conditions, including inflation and interest rates, influence overall demand and the competitive landscape, further necessitating flexible pricing strategies.

- Currency Impact: Agilent has previously reported that unfavorable currency movements can reduce its net revenue. For example, in Q1 2024, the company reported a 1% negative impact on revenue due to currency.

- Tariff Absorption: The company aims to mitigate the financial effects of tariffs by integrating these costs into its operational planning and pricing models where feasible.

- Economic Sensitivity: Pricing must remain competitive and reflective of market demand, which is directly influenced by macroeconomic trends affecting customer spending and investment in scientific instrumentation and services.

Differentiated Pricing for Products and Services

Agilent Technologies likely utilizes differentiated pricing strategies across its extensive product and service offerings. This approach allows them to capture maximum value from different customer segments and product types. For instance, high-value analytical instruments might command premium pricing, reflecting their technological sophistication and significant impact on research and development.

Recurring revenue streams from software and services, particularly through their Agilent CrossLab Group, are strategically priced to encourage long-term customer engagement. This focus on services and software, which represented approximately 30% of Agilent's revenue in fiscal year 2023, highlights a commitment to providing comprehensive solutions and fostering sustained customer relationships. For example, their service contracts often include preventative maintenance and software updates, ensuring optimal instrument performance and adding ongoing value.

This tiered pricing model allows Agilent to cater to a broad market, from academic institutions requiring cost-effective solutions to large pharmaceutical companies needing advanced capabilities and comprehensive support. Their strategy balances upfront investment for capital equipment with ongoing, predictable revenue from essential services and consumables.

- Instrument Pricing: Premium pricing for advanced, high-throughput analytical instruments.

- Software & Services: Subscription-based or contract pricing for software licenses and support, emphasizing recurring revenue.

- Consumables: Competitive pricing for reagents, columns, and other disposable items, driving consistent sales.

- Bundled Solutions: Offering packages that combine instruments, software, and services at a potentially discounted rate to increase overall deal value.

Agilent's pricing strategy is deeply rooted in the value its advanced scientific solutions deliver, particularly in critical sectors like life sciences and diagnostics. This value-based approach means prices reflect the substantial benefits, such as accelerated research and improved accuracy, rather than just production costs. For fiscal year 2023, Agilent reported a gross profit margin of 59.7%, underscoring the effectiveness of this strategy in capturing value.

The company employs differentiated pricing, with premium pricing for sophisticated analytical instruments and recurring revenue models for software and services, which constituted about 30% of their 2023 revenue. This segmentation allows Agilent to cater to diverse customer needs, from academic labs to large pharmaceutical firms.

External factors like currency fluctuations and tariffs also influence pricing; for instance, unfavorable currency movements resulted in a 1% negative impact on Q1 2024 revenue. Agilent aims to absorb tariff costs where feasible, while economic conditions necessitate flexible pricing to maintain competitiveness and demand.

| Pricing Aspect | Description | Fiscal Year 2023 Data/Impact |

|---|---|---|

| Value-Based Pricing | Pricing reflects the significant benefits and ROI customers receive from advanced solutions. | Gross Profit Margin: 59.7% |

| Differentiated Pricing | Premium pricing for high-end instruments; recurring revenue for software/services. | Software & Services Revenue: ~30% of total revenue |

| External Influences | Currency fluctuations, tariffs, and economic conditions impact pricing and revenue. | Q1 2024 Currency Impact: -1% on revenue |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Agilent Technologies leverages a robust set of data, including official SEC filings, investor relations materials, and detailed product specifications from their corporate website. We also incorporate insights from industry analyst reports and competitor benchmarking to ensure a comprehensive understanding of their market strategy.