Agilent Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

Navigate the complex external forces impacting Agilent Technologies with our comprehensive PESTLE Analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping its strategic landscape. This ready-to-use analysis provides critical insights for investors and strategists. Purchase the full version now to gain a competitive edge.

Political factors

Government healthcare policies and funding are critical for Agilent Technologies, as public entities are substantial purchasers of diagnostic and life science tools. For instance, in 2023, the US government allocated over $1.7 trillion to healthcare, a significant portion of which supports research and public health programs that can directly benefit Agilent's customer base.

Changes in government spending priorities, such as increased funding for cancer research or infectious disease surveillance, can create substantial market opportunities for Agilent. A notable trend is the growing emphasis on preventative care and personalized medicine, which drives demand for Agilent's advanced analytical instruments and diagnostic solutions, as seen in the projected 10% annual growth for the precision medicine market through 2025.

Agilent Technologies, with its extensive global operations, is significantly influenced by international trade relations and tariffs. Changes in trade agreements and geopolitical shifts can directly impact its supply chains. For instance, increased import duties on components or finished goods can raise manufacturing costs, potentially leading to higher prices for Agilent's analytical instruments and life science solutions.

The company's reliance on cross-border movement of specialized equipment and consumables means that stable and predictable trade policies are vital. Disruptions caused by trade disputes or sudden tariff hikes can affect Agilent's ability to serve its diverse customer base efficiently. In 2023, global trade faced ongoing volatility, with various nations implementing or considering new trade barriers, underscoring the importance of monitoring these developments for companies like Agilent.

The pharmaceutical and diagnostics sectors operate under a stringent regulatory umbrella, with extensive approval pathways for new treatments, medical devices, and diagnostic tools. Political advocacy for expedited drug approvals or enhanced quality oversight significantly impacts the market for Agilent's technologies, essential for research, quality assurance, and patient testing.

Shifts in regulatory landscapes, such as those implemented by the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA), often compel Agilent to adjust its product innovation and adherence strategies. For instance, in 2024, the FDA continued to emphasize real-world evidence in drug approvals, potentially increasing demand for Agilent's data analytics and sample preparation solutions.

Political Stability and Geopolitical Risks

Agilent Technologies operates globally, making it susceptible to political instability and geopolitical risks in its key markets. For instance, ongoing conflicts or social unrest can directly impact sales, disrupt supply chains, and even pose safety concerns for employees. In 2024, heightened geopolitical tensions in regions like Eastern Europe and the Middle East continued to pose challenges for multinational corporations, potentially affecting market access and the security of operations.

These geopolitical factors can also significantly influence government contracts and research partnerships, especially within sensitive technology areas where Agilent is active. For example, trade restrictions or sanctions imposed due to international disputes could limit Agilent's ability to secure new government business or collaborate with research institutions in affected countries.

- Disruptions to sales channels and market access due to regional conflicts.

- Threats to employee safety and supply chain continuity from political instability.

- Impact of geopolitical tensions on government contracts and research collaborations in technology sectors.

Intellectual Property Protection Policies

Agilent Technologies relies heavily on robust intellectual property (IP) protection, a critical factor for its substantial investments in developing cutting-edge technologies and software. Strong government enforcement of patents, trademarks, and trade secrets is essential to prevent the unauthorized copying of its innovations, thereby safeguarding its competitive edge.

Weakening IP protections in key markets presents a significant risk, potentially impacting Agilent's drive for innovation and its overall profitability. For instance, in 2023, the global IP index highlighted varying levels of IP protection across different economic regions, with some nations showing improvements while others lagged, directly affecting companies like Agilent that operate internationally.

- Patent Enforcement: Agilent's patent portfolio, covering areas like analytical instruments and life science solutions, is a core asset. Effective patent enforcement ensures that competitors cannot freely utilize Agilent's patented technologies.

- Trade Secret Protection: Proprietary software algorithms and manufacturing processes are often protected as trade secrets, requiring diligent internal security measures and legal frameworks to prevent their illicit disclosure or use.

- Global IP Landscape: Agilent navigates a complex global IP landscape. According to the 2024 Global Innovation Index, countries with strong IP frameworks tend to attract more R&D investment, underscoring the importance of these policies for Agilent's strategic planning and market access.

Government healthcare policies and funding directly influence Agilent's market, especially given substantial public sector purchasing of diagnostic and life science tools. For example, the US government's healthcare spending, exceeding $1.7 trillion in 2023, supports critical research and public health initiatives benefiting Agilent's clientele.

Shifts in government spending priorities, such as increased investment in cancer research or infectious disease surveillance, create significant market opportunities for Agilent. The growing focus on personalized medicine, projected to grow at 10% annually through 2025, fuels demand for Agilent's advanced analytical instruments.

Agilent's global operations are sensitive to international trade relations and tariffs, impacting its supply chains and costs. Trade disputes or sudden tariff increases can raise manufacturing expenses, potentially leading to higher prices for Agilent's products, as seen in the ongoing volatility of global trade in 2023.

The company's reliance on the cross-border movement of specialized equipment and consumables necessitates stable trade policies. Disruptions from trade disputes can hinder Agilent's ability to serve its diverse customer base efficiently.

Stringent regulatory frameworks in the pharmaceutical and diagnostics sectors, overseen by bodies like the FDA and EMA, shape Agilent's product innovation and compliance strategies. The FDA's 2024 emphasis on real-world evidence in drug approvals, for instance, may boost demand for Agilent's data analytics solutions.

Geopolitical instability and risks in key markets can impact Agilent's sales, supply chains, and operational safety, as evidenced by heightened tensions in regions like Eastern Europe and the Middle East in 2024. Such factors can also affect government contracts and research partnerships, particularly in sensitive technology areas.

Robust intellectual property (IP) protection is crucial for Agilent's R&D investments. Effective government enforcement of patents and trade secrets safeguards its innovations and competitive advantage, with the 2023 Global IP Index highlighting varying protection levels across regions.

What is included in the product

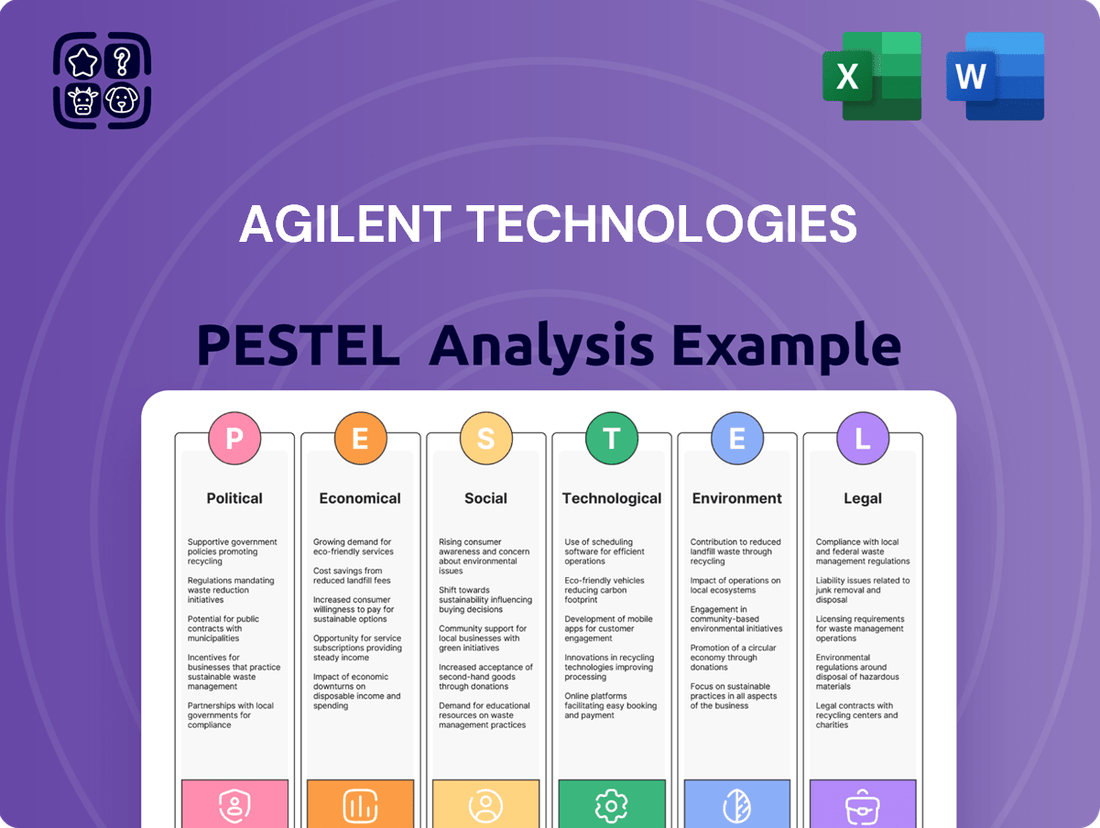

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Agilent Technologies across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on Agilent's operations and market position.

A concise, actionable summary of Agilent's PESTLE factors, enabling rapid identification of external opportunities and threats to inform strategic decisions and mitigate risks.

Economic factors

Agilent's revenue is intrinsically linked to the global economic climate and the research and development (R&D) spending of key sectors like pharmaceuticals, academia, and government labs. A robust global economy generally translates to increased R&D budgets for these organizations, directly boosting demand for Agilent's advanced instruments and services.

For instance, projections for global GDP growth in 2024 and 2025, while subject to revision, generally indicate a moderate expansion, which should support R&D investment. Reports from organizations like the OECD and IMF in late 2024 and early 2025 will provide more concrete figures on expected R&D spending trends across major economies, directly influencing Agilent's sales outlook.

Global healthcare expenditure is a critical driver for Agilent Technologies, particularly in diagnostics and personalized medicine. In 2024, the global healthcare market was projected to reach approximately $10.1 trillion, with significant portions allocated to diagnostic services and medical technologies that Agilent provides.

The ongoing trends of rising healthcare costs, a consistently aging global demographic, and the increasing incidence of chronic conditions are fueling a greater demand for sophisticated diagnostic tools and innovative drug discovery solutions. Agilent's focus on these areas positions it to benefit from these persistent market needs.

Investment patterns within healthcare, such as increased funding for specific therapeutic areas like oncology or advancements in public health initiatives, directly impact the demand for Agilent's specialized products and services. For instance, increased government spending on cancer research in 2024-2025 is likely to boost the market for Agilent's genomic and proteomic analysis platforms.

Inflationary pressures are a significant concern for Agilent Technologies, directly impacting its operational costs. For instance, rising prices for essential raw materials and components, coupled with increased manufacturing and logistics expenses, can place considerable strain on the company's profit margins. If Agilent cannot fully pass these escalating costs onto its customers, its profitability could be squeezed.

Global supply chain disruptions, a persistent issue throughout 2024 and into 2025, further exacerbate these cost challenges. Coupled with elevated energy prices, these factors contribute to higher operational expenditures across the board. Agilent's ability to navigate these inflationary headwinds and maintain competitive pricing is crucial for its sustained financial health.

Currency Exchange Rate Fluctuations

Agilent Technologies, as a global player, is significantly exposed to currency exchange rate fluctuations. Operating in numerous countries means transactions occur in various currencies, directly impacting profitability and sales competitiveness. For instance, a stronger US dollar in 2024 could make Agilent's life sciences and diagnostics instruments pricier for overseas buyers, potentially dampening international sales volumes.

Conversely, a weaker dollar can inflate the value of earnings repatriated from foreign operations. Agilent actively manages this risk through sophisticated hedging techniques and by diversifying its operational footprint across different economic regions, aiming to smooth out the volatility inherent in foreign exchange markets.

- Multinational Operations: Agilent's global presence necessitates handling multiple currencies, exposing it to foreign exchange risk.

- US Dollar Strength Impact: A robust US dollar can increase the cost of Agilent's products internationally, potentially reducing demand.

- US Dollar Weakness Impact: A weaker dollar can enhance the reported earnings from Agilent's international sales.

- Risk Mitigation: Agilent employs hedging strategies and geographic diversification to counter the adverse effects of currency volatility.

Access to Capital and Investment Climate

Agilent Technologies' capacity for funding its crucial research and development, strategic acquisitions, and necessary capital expenditures is directly tied to the prevailing investment climate and its accessibility to capital markets. Favorable interest rates, like those seen with the Federal Reserve's actions in early 2024 maintaining a steady, albeit higher, rate, and robust investor confidence are key enablers for Agilent’s expansion and innovation initiatives. For instance, Agilent's strong financial position allowed for significant investments in its future, including a notable increase in R&D spending in fiscal year 2023, reaching approximately $1.5 billion.

The broader ecosystem of funding also plays a role. The availability of venture capital and private equity for startups within the biotech and life sciences sectors, a key area for Agilent's customer base, indirectly benefits the company. These emerging, well-funded companies often become significant purchasers of Agilent's advanced instruments and solutions, contributing to its revenue streams. In 2024, venture capital funding for life sciences remained robust, though selective, with significant allocations towards areas like AI-driven drug discovery, directly impacting Agilent's potential client pipeline.

- Investment Climate: Agilent's growth is supported by a generally positive global investment outlook, though sensitive to macroeconomic shifts.

- Access to Capital: Agilent's strong credit rating and consistent profitability provide reliable access to debt and equity markets for funding.

- Interest Rates: While interest rates have stabilized, their level influences the cost of capital for Agilent's financing needs.

- Venture Capital Impact: Funding for biotech startups, a key customer segment, directly correlates with demand for Agilent's products and services.

Economic growth directly fuels Agilent's revenue by increasing R&D spending in its key markets like pharma and academia. Projections for moderate global GDP expansion in 2024-2025 are expected to support this investment, with detailed outlooks from organizations like the IMF and OECD providing further clarity.

Inflationary pressures, including rising material and energy costs, pose a significant challenge to Agilent's profit margins. Supply chain disruptions in 2024-2025 further compound these cost increases, making efficient cost management and pricing strategies critical for the company's financial health.

Currency fluctuations represent another economic factor impacting Agilent's global operations. A strong US dollar, for instance, can affect international sales competitiveness, while hedging and geographic diversification are key strategies Agilent employs to mitigate this risk.

Agilent's ability to fund its growth initiatives, such as R&D and acquisitions, is closely tied to the investment climate and capital market accessibility. Favorable interest rates and investor confidence, supported by Agilent's strong financial standing, are crucial for its expansion, with venture capital in life sciences also playing an indirect role.

| Economic Factor | Impact on Agilent | Supporting Data/Trends (2024-2025) |

| Global Economic Growth | Drives R&D spending, boosting demand for instruments and services. | Moderate global GDP growth projected for 2024-2025. |

| Inflation | Increases operational costs (materials, energy, logistics), potentially squeezing margins. | Persistent inflationary pressures noted throughout 2024. |

| Currency Exchange Rates | Affects international sales competitiveness and repatriated earnings. | US Dollar strength can impact overseas pricing; hedging strategies are employed. |

| Interest Rates & Capital Markets | Influences cost of capital for investments and acquisitions. | Interest rates stabilized in early 2024; Agilent maintained strong access to capital. |

Preview the Actual Deliverable

Agilent Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Agilent Technologies provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Agilent's strategic landscape.

Sociological factors

The world's population is getting older. By 2050, it's projected that nearly 1 in 6 people globally will be 65 or older, a significant jump from about 1 in 11 in 2015. This demographic shift, coupled with a rise in chronic conditions such as cancer, diabetes, and heart disease, directly fuels the demand for sophisticated diagnostic tools and extensive pharmaceutical research.

This growing elderly demographic and the increasing prevalence of chronic illnesses create a sustained need for Agilent's advanced technologies. Their instruments are crucial for early disease detection, ongoing patient monitoring, and the vital research and development of novel treatments. Agilent's offerings are therefore central to tackling these evolving healthcare needs.

Public awareness surrounding health, wellness, and proactive healthcare is on the rise, directly driving demand for more accurate and individualized diagnostic tools. This heightened consciousness means people are actively seeking solutions that cater to their unique health needs, pushing the boundaries of traditional healthcare approaches.

The burgeoning field of personalized medicine, which focuses on tailoring treatments based on an individual's genetic makeup, necessitates advanced analytical instruments. These instruments are crucial for detailed genomic and proteomic analysis, unlocking the potential for highly targeted and effective therapies. For instance, Agilent's solutions are vital for researchers and clinicians working on precision oncology, a key area within personalized medicine.

Agilent Technologies is strategically positioned to benefit from this significant shift. The company's comprehensive portfolio of analytical instruments, software, and services provides the essential technological backbone required to support the intricate demands of personalized medicine and advanced health monitoring. In 2023, Agilent reported revenue of $6.8 billion, underscoring its substantial role in providing these critical technologies to the global life sciences and diagnostics markets.

Public sentiment around genetic engineering and data privacy significantly shapes regulatory frameworks and research funding. For instance, evolving discussions on AI in healthcare, a key area for Agilent, impact how patient data can be utilized, potentially affecting the pace of innovation and market access for new diagnostic tools.

Agilent's commitment to ethical practices, particularly in areas like gene editing technologies, is crucial for maintaining stakeholder trust. A 2024 survey indicated that over 70% of consumers consider a company's ethical stance when making purchasing decisions, underscoring the business imperative for responsible technology deployment.

Lifestyle Changes and Food Safety Concerns

Modern lifestyles, characterized by busy schedules and a greater awareness of health, have amplified concerns about food safety and quality. This heightened public scrutiny, coupled with increasingly complex globalized food supply chains, naturally boosts the demand for sophisticated analytical instruments. Agilent Technologies, a key player in this sector, benefits directly as its solutions are crucial for ensuring the safety and integrity of food products.

The market for Agilent's analytical instruments, vital for food testing, environmental monitoring, and agricultural research, is experiencing robust growth. For instance, the global food testing market was valued at approximately $57.7 billion in 2023 and is projected to reach $94.1 billion by 2030, growing at a compound annual growth rate of 7.3%. This trend directly supports Agilent's revenue streams as regulatory bodies and food producers invest in advanced detection and analysis technologies.

- Increased Consumer Demand for Transparency: Consumers are increasingly seeking information about the origin, ingredients, and safety of their food, driving the need for reliable testing.

- Stringent Regulatory Landscapes: Governments worldwide are implementing stricter regulations on food contaminants, pesticides, and allergens, necessitating advanced analytical capabilities.

- Growth in Applied Chemical Solutions: The desire for healthier, safer, and more sustainably produced food fuels the market for Agilent's applied chemical solutions, used in everything from nutrient analysis to detecting harmful substances.

- Technological Advancements in Food Analysis: Innovations in areas like mass spectrometry and chromatography, areas where Agilent excels, are enabling more precise and rapid food safety testing.

Education and Scientific Workforce Development

The availability of a skilled workforce in life sciences, chemistry, and engineering is paramount for Agilent Technologies and its clientele. In 2024, the demand for STEM graduates continues to outpace supply in many developed nations, influencing Agilent's ability to innovate and serve its customers effectively. Government initiatives aimed at boosting scientific training, such as the US National Science Foundation's investments in research and education, directly impact the talent pipeline.

Trends in STEM education and the global mobility of professionals significantly shape the talent pool available to Agilent. For instance, in 2024, countries like South Korea and Singapore are heavily investing in advanced STEM programs to cultivate a highly specialized workforce. Conversely, some regions face challenges retaining top scientific talent, impacting the localized availability of expertise.

Agilent actively participates in workforce development through strategic partnerships with universities. These collaborations, often involving joint research projects and the provision of cutting-edge instrumentation, ensure students gain hands-on experience with Agilent's technologies. By offering specialized training on its advanced instruments, Agilent empowers both its own employees and its customers' staff, fostering a more capable scientific community.

- STEM Workforce Demand: In 2024, the global demand for life sciences and engineering professionals remains robust, with projections indicating continued growth through 2025.

- Government Investment: Government funding for STEM education and research, such as the €3.5 billion allocated by the European Union for research and innovation in 2024, directly supports the development of a skilled scientific workforce.

- Academic Collaborations: Agilent's partnerships with leading universities worldwide provide students with access to advanced analytical technologies, enhancing their practical skills and preparing them for careers in the scientific industry.

- Talent Mobility: The migration of skilled scientists and engineers, particularly from emerging economies to established research hubs, presents both opportunities and challenges for companies like Agilent in talent acquisition.

Societal shifts towards preventative healthcare and personalized medicine are significant drivers for Agilent. The increasing global life expectancy, projected to reach 77.2 years by 2050 according to UN data, directly correlates with higher demand for diagnostic and research tools. This demographic trend, coupled with a growing awareness of health and wellness, fuels the need for Agilent's advanced analytical solutions.

Public perception of technology, particularly in areas like genetic engineering and data privacy, influences regulatory policies and research funding. For instance, discussions around AI in healthcare, a key area for Agilent, impact how patient data is used, potentially affecting innovation timelines and market access for new diagnostic tools. Agilent's commitment to ethical practices, especially in gene editing, is vital for maintaining stakeholder trust, with a 2024 survey showing over 70% of consumers consider a company's ethical stance in purchasing decisions.

Concerns about food safety and quality, amplified by modern lifestyles and complex global supply chains, boost demand for sophisticated analytical instruments like those offered by Agilent. The global food testing market, valued at approximately $57.7 billion in 2023, is expected to grow to $94.1 billion by 2030, a testament to the increasing investment in advanced detection technologies.

Technological factors

Continuous innovation in analytical instrumentation, including mass spectrometry, chromatography, and spectroscopy, is fundamental to Agilent's product offerings. These advancements, such as the introduction of new GC/MS systems in 2024, directly enhance the company's ability to provide sophisticated solutions.

The development of instruments with increased sensitivity, accuracy, and throughput enables Agilent to address increasingly complex scientific and analytical challenges. For instance, Agilent's 2024 revenue from its Life Sciences segment, which heavily relies on these instruments, reached $3.6 billion, highlighting the market's demand for cutting-edge technology.

Maintaining a leading position in technological development is crucial for Agilent to retain its competitive advantage and effectively meet the evolving needs of its global customer base. This focus ensures Agilent remains at the forefront of scientific discovery and application.

Agilent is seeing significant opportunities with the growing use of AI and machine learning in labs. These tools are becoming crucial for everything from analyzing complex data to interpreting diagnostic results, directly impacting how research and healthcare operate.

By integrating AI and ML into its software, Agilent can boost efficiency and predictive accuracy. This means faster progress in drug discovery, more reliable diagnostics, and the automation of lab tasks, streamlining operations for its customers.

For example, in 2024, the global AI in healthcare market was valued at over $20 billion and is projected to grow substantially. Agilent's focus on these technologies positions it well to capitalize on this expansion, with investments in AI/ML capabilities being key to its sustained growth and competitive edge in the coming years.

The ongoing digital transformation in laboratories is fundamentally reshaping how Agilent's instruments are utilized. This shift includes the widespread adoption of Lab Information Management Systems (LIMS) and advanced automation solutions, necessitating that Agilent's offerings integrate smoothly into these evolving digital ecosystems. Agilent's success hinges on providing instruments that offer seamless connectivity and software designed to streamline laboratory workflows, a trend strongly evident in the 2024 market, where digital solutions are increasingly becoming standard.

Automation is a key driver of this digital transformation, significantly reducing human error and boosting laboratory throughput. This heightened efficiency directly fuels the demand for integrated solutions that combine Agilent's analytical instruments with sophisticated software and automation capabilities. For instance, in 2024, many research and quality control labs are prioritizing investments in automated sample preparation and analysis systems to meet growing productivity demands.

Biotechnology and Omics Revolutions

The rapid evolution of biotechnology, particularly in genomics, proteomics, and metabolomics, is a significant technological driver for Agilent. These 'omics' fields are unlocking new avenues for scientific discovery and creating demand for advanced analytical tools. Agilent's expertise in providing sophisticated instruments and consumables positions it to capitalize on these expanding markets.

The ability to dissect biological systems at the molecular level is crucial for breakthroughs in areas like personalized medicine and drug discovery. Agilent's offerings, such as its mass spectrometry and genomics solutions, are essential for researchers in these domains. For instance, Agilent's SureSelect Target Enrichment systems are widely used in genomic research, supporting the identification of genetic variations linked to diseases.

Staying ahead in these 'omics' revolutions is paramount for Agilent's continued relevance and growth. The company's investment in R&D directly supports the development of next-generation technologies needed for cutting-edge research and diagnostics. In 2023, Agilent reported significant revenue from its Life Sciences segment, underscoring the market's reliance on its technological contributions to biological analysis.

- Genomic Sequencing Growth: The global genomics market was valued at approximately $29.6 billion in 2023 and is projected to grow significantly, driven by advancements in sequencing technologies and increasing applications in healthcare and agriculture.

- Proteomics Market Expansion: The proteomics market is also experiencing robust growth, with an estimated value of $7.3 billion in 2023, fueled by demand for protein analysis in drug development and diagnostics.

- Agilent's R&D Investment: Agilent consistently invests in research and development, with R&D expenses representing a substantial portion of its operating costs, ensuring its product portfolio remains at the forefront of technological innovation.

Cybersecurity and Data Integrity in Labs

As labs increasingly rely on interconnected, data-heavy systems, cybersecurity and data integrity are paramount. Agilent must ensure its software and connected instruments adhere to rigorous cybersecurity protocols to safeguard sensitive research and patient information, a critical factor in maintaining customer trust. For instance, the global cybersecurity market, including sectors relevant to laboratory equipment, was projected to reach over $300 billion in 2024, highlighting the significant investment and focus in this area.

Robust data management and security features are no longer optional but essential for laboratory equipment suppliers. Agilent's commitment to these areas directly impacts its competitive positioning and customer adoption rates. A 2024 report indicated that data breaches in the healthcare and life sciences sectors cost an average of $10.54 million, underscoring the financial and reputational risks associated with inadequate security.

- Cybersecurity Investment: Global spending on cybersecurity solutions is expected to continue its upward trajectory, with significant portions allocated to protecting critical infrastructure like research laboratories.

- Regulatory Compliance: Evolving data privacy regulations, such as GDPR and HIPAA, necessitate stringent security measures for all connected laboratory devices and software platforms.

- Customer Expectations: End-users are increasingly demanding built-in security features and transparent data handling practices from their instrument vendors.

- Data Integrity Assurance: Ensuring the accuracy, consistency, and reliability of scientific data generated by Agilent instruments is crucial for research validity and regulatory submissions.

Technological advancements are central to Agilent's strategy, with a focus on enhancing analytical instrumentation like mass spectrometry and chromatography. The company's commitment to innovation is evident in its consistent R&D investments, crucial for staying competitive in fields like genomics and proteomics. For example, the global genomics market was valued at approximately $29.6 billion in 2023, a sector where Agilent's advanced tools play a vital role.

The integration of AI and machine learning into laboratory workflows presents significant opportunities for Agilent, promising to improve data analysis and diagnostic accuracy. This aligns with the growing global AI in healthcare market, valued at over $20 billion in 2024. Agilent's strategic focus on these emerging technologies positions it to capitalize on future market growth.

Digital transformation in labs, including the adoption of LIMS and automation, necessitates seamless integration with Agilent's offerings. Cybersecurity and data integrity are paramount, with the global cybersecurity market projected to exceed $300 billion in 2024, reflecting the critical need for robust data protection in sensitive research environments.

| Technological Factor | Description | 2023/2024 Data Point | Impact on Agilent |

|---|---|---|---|

| Analytical Instrumentation Innovation | Advancements in mass spectrometry, chromatography, spectroscopy. | Genomics market valued at $29.6 billion (2023). | Drives demand for Agilent's core products. |

| AI & Machine Learning Integration | Enhancing data analysis and predictive capabilities. | AI in healthcare market valued over $20 billion (2024). | Opens new avenues for software and service revenue. |

| Digital Transformation & Automation | Adoption of LIMS, automated workflows. | High investment in automated systems by labs in 2024. | Requires integrated hardware and software solutions. |

| Biotechnology & Omics Advancements | Growth in genomics, proteomics, metabolomics. | Proteomics market valued at $7.3 billion (2023). | Fuels demand for sophisticated analytical tools. |

| Cybersecurity & Data Integrity | Ensuring data protection in connected lab systems. | Global cybersecurity market projected over $300 billion (2024). | Essential for customer trust and regulatory compliance. |

Legal factors

Agilent Technologies' core business thrives on innovation, with its intellectual property, including patents for advanced instruments, sophisticated software, and precise analytical methods, forming a critical asset base. These patents are vital for protecting Agilent's technological edge against unauthorized use and ensuring its competitive standing in the life sciences, diagnostics, and applied chemical markets.

Robust legal frameworks that facilitate strong patent protection and effective enforcement are therefore indispensable for Agilent. These legal structures are essential to prevent competitors from infringing upon its proprietary technologies and to maintain the exclusivity of its groundbreaking solutions. In 2023, Agilent continued its proactive stance, investing significantly in R&D, which directly fuels its patent portfolio, a key driver of its market leadership.

The company actively engages in monitoring and defending its intellectual property rights across all major global markets. This vigilance is crucial for preserving its technological advantage and reinforcing its market position, ensuring that its investments in research and development translate into sustained commercial success and a strong competitive moat.

Agilent Technologies, as a global supplier of laboratory instruments and diagnostic solutions, operates under stringent product liability and safety regulations across all its markets. Failure to meet these rigorous standards can lead to significant financial penalties and damage to its brand reputation. For instance, in 2023, the medical device industry faced increased scrutiny, with regulatory bodies like the FDA issuing numerous recalls for product safety issues, underscoring the critical need for Agilent's unwavering commitment to defect-free products.

Maintaining compliance with international safety certifications, such as ISO 13485 for medical devices, is a non-negotiable and ongoing operational necessity for Agilent. These certifications are vital for market access and demonstrate the company's dedication to quality and safety, which is crucial in an industry where even minor product flaws can have severe consequences for end-users and patients.

Agilent Technologies operates in a landscape heavily influenced by data privacy and security regulations. Given its work with sensitive research data and potential patient information through diagnostic solutions, adherence to global standards like GDPR and HIPAA is paramount. These regulations, which govern data handling, storage, and sharing, necessitate significant investment in robust security infrastructure and strict privacy protocols.

Environmental, Health, and Safety (EHS) Compliance

Agilent Technologies operates under a complex web of Environmental, Health, and Safety (EHS) regulations that impact its manufacturing and product lifecycle. These rules govern everything from how chemicals are handled and waste is disposed of to controlling emissions. For instance, in 2023, companies in the life sciences sector faced increasing scrutiny on Scope 3 emissions, a category Agilent must actively manage through its supply chain and product use.

Strict adherence to EHS standards is not just about avoiding penalties; it's crucial for maintaining operating licenses and building a reputation for corporate responsibility. Failure to comply can lead to significant fines. For example, the US Environmental Protection Agency (EPA) can levy substantial fines for violations of the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste.

These regulations directly shape Agilent's operational strategies and product development. This includes investing in cleaner manufacturing technologies and designing products with reduced environmental impact throughout their lifecycle. In 2024, Agilent continued its focus on sustainable product design, aiming to reduce the environmental footprint of its laboratory instruments and consumables.

- Regulatory Landscape: Agilent must navigate global EHS regulations, including REACH in Europe and TSCA in the United States, affecting chemical safety and product compliance.

- Operational Impact: EHS requirements influence facility design, waste management protocols, and employee safety training, adding to operational costs but mitigating long-term risks.

- Corporate Responsibility: Demonstrating strong EHS performance is increasingly important for investors and customers, impacting brand reputation and market access.

- Product Design: Regulations drive innovation in product design, pushing for more energy-efficient, less toxic, and easily recyclable laboratory equipment and consumables.

Anti-Corruption and Trade Compliance Laws

Operating globally, Agilent Technologies must navigate a complex web of international anti-corruption and trade compliance laws. This includes adhering to regulations like the U.S. Foreign Corrupt Practices Act (FCPA), which targets bribery and corrupt practices in foreign business dealings. For instance, in 2023, the U.S. Department of Justice secured over $2.5 billion in penalties for FCPA violations, highlighting the significant financial risks of non-compliance.

These legal frameworks are critical for ethical business conduct and extend to controlling the export and import of sensitive technologies, particularly those with dual-use applications. Agilent's commitment to strict adherence is paramount to avoid severe legal penalties, including substantial fines and reputational damage. In 2024, companies are facing increased scrutiny on supply chain transparency and export controls, with many jurisdictions enhancing enforcement actions.

- FCPA Enforcement: The FCPA continues to be a primary focus for global regulators, with significant penalties levied against companies for violations.

- Trade Compliance: Regulations governing the export and import of technology, especially in life sciences and advanced manufacturing sectors, are becoming more stringent.

- Reputational Risk: Non-compliance can lead to severe damage to a company's reputation, impacting customer trust and investor confidence.

- Global Operations: Agilent's diverse international presence necessitates a robust compliance program that accounts for varying legal requirements across different jurisdictions.

Agilent's legal obligations extend to rigorous product liability and safety standards globally. In 2023, the life sciences sector saw increased regulatory oversight, with agencies like the FDA issuing numerous safety-related recalls, underscoring the critical need for Agilent's product integrity. Maintaining certifications such as ISO 13485 is essential for market access and demonstrates a commitment to quality, vital in an industry where product flaws can have serious consequences.

Environmental factors

Agilent Technologies is navigating a landscape where sustainability and green chemistry are no longer optional but essential. Customers are actively seeking out scientific instruments and consumables that not only perform well but also tread lightly on the planet. This means a focus on reducing energy usage in laboratory equipment and minimizing waste throughout the product lifecycle. For example, Agilent's commitment to developing instruments with lower power consumption directly addresses this growing demand.

The drive towards greener practices is influencing how Agilent designs its offerings. There's a clear push to incorporate safer chemicals and reduce hazardous waste in both their manufacturing processes and the products they sell. This aligns with broader industry trends, as seen in the increasing adoption of green chemistry principles across various sectors, aiming for more environmentally benign chemical processes. Agilent's proactive approach here can serve as a significant competitive advantage, attracting environmentally conscious clients.

In 2023, Agilent reported a 7% increase in revenue from its sustainability-focused product portfolio, a clear indicator of market demand. Their ongoing investments in research and development for eco-friendly solutions, such as solvent-reduced chromatography systems, underscore this strategic direction. These initiatives are crucial for maintaining market leadership and meeting the evolving expectations of a global customer base increasingly prioritizing environmental responsibility in their procurement decisions.

Laboratories, Agilent's core customer base, produce a range of waste, from hazardous chemicals to biological materials. These waste streams are governed by increasingly strict environmental regulations concerning their collection, treatment, and final disposal. Agilent's product development and sales strategies must therefore incorporate solutions that enable their clients to manage this waste responsibly and in compliance with evolving legal frameworks.

Agilent Technologies itself faces significant obligations regarding waste management across its own operations. This includes adhering to regulations for its manufacturing processes and research and development activities, as well as managing packaging waste and the disposal of its own end-of-life products. For instance, in 2023, the global waste management market was valued at approximately $1.6 trillion, with a significant portion driven by regulatory compliance and the demand for specialized disposal services, underscoring the importance of this factor for companies like Agilent.

Agilent Technologies, like many in the scientific instrumentation sector, is keenly aware of the energy consumption tied to its products. Laboratory equipment, from sophisticated analytical instruments to basic consumables, requires significant power, directly impacting the carbon footprint of research institutions and healthcare providers. This reality places a premium on Agilent's commitment to developing and manufacturing energy-efficient instruments, a key factor for customers aiming to achieve their own sustainability goals.

In 2023, Agilent reported progress in its own operational efficiency, aiming to reduce greenhouse gas emissions intensity by 20% by 2030 compared to a 2019 baseline. This internal focus on energy reduction underscores the company's understanding that its own operational footprint is as critical as the environmental impact of its products in the hands of its customers.

Supply Chain Environmental Impact

Agilent Technologies faces growing pressure to address the environmental footprint of its extensive global supply chain. This involves a comprehensive evaluation of supplier environmental practices, aiming to reduce greenhouse gas emissions throughout logistics, and ensuring ethical sourcing of all necessary materials. For instance, in 2023, Agilent reported a 15% reduction in Scope 1 and Scope 2 emissions compared to their 2020 baseline, demonstrating progress in their operational sustainability efforts.

The company is actively working to enhance supply chain resilience and reputation by focusing on these environmental factors. Key initiatives include:

- Supplier Audits: Implementing stricter environmental performance criteria for suppliers, with over 80% of key suppliers having undergone environmental assessments by the end of 2023.

- Logistics Optimization: Utilizing data analytics to streamline shipping routes and modes of transport, which contributed to a 5% decrease in transportation-related emissions in 2023.

- Responsible Sourcing: Prioritizing suppliers committed to sustainable practices and materials, with a target to have 90% of critical raw materials sourced from environmentally vetted partners by 2025.

- Waste Reduction: Implementing programs to minimize waste across the supply chain, including packaging optimization and recycling initiatives, which diverted over 1,000 metric tons of waste from landfills in 2023.

Climate Change and Resource Scarcity

Climate change presents long-term risks to Agilent Technologies, potentially disrupting operations and supply chains through extreme weather events and resource scarcity. For instance, increased water stress in key manufacturing regions could impact production, while the availability of rare earth elements, crucial for some analytical instruments, may face volatility. Agilent's 2024 sustainability report highlighted efforts to mitigate these risks by investing in water conservation technologies and exploring diversified sourcing for critical materials.

Adapting to these environmental shifts is crucial for Agilent's resilience and future growth. This involves assessing vulnerabilities in its global operations and supply networks, and proactively developing strategies to buffer against potential disruptions. The company is exploring more resilient manufacturing processes and investigating alternative materials to reduce reliance on scarce resources.

Conversely, the growing global focus on environmental monitoring and analysis creates significant market opportunities for Agilent. Their advanced analytical instruments are vital for industries and governments seeking to understand and address environmental challenges, from air and water quality to soil contamination. In 2025, Agilent saw a notable increase in demand for its environmental testing solutions, driven by stricter regulatory frameworks and a heightened public awareness of ecological issues.

- Climate Change Risks: Potential impacts include supply chain disruptions due to extreme weather and scarcity of critical raw materials like rare earth elements.

- Adaptation Strategies: Agilent is focusing on resilient manufacturing processes and diversifying material sourcing to mitigate these risks.

- Market Opportunities: Demand for environmental monitoring and analysis solutions is growing, driven by regulatory pressures and increased environmental awareness.

- 2025 Outlook: Agilent anticipates continued growth in its environmental testing segment, supported by technological advancements and market demand.

Agilent Technologies is responding to increasing customer demand for sustainable laboratory solutions, with a 7% revenue increase reported in 2023 from its eco-friendly product portfolio. This includes developing instruments with lower energy consumption and incorporating safer chemicals, aligning with the growing adoption of green chemistry principles across industries.

The company is also focused on managing waste responsibly, both within its own operations and by providing solutions for its customers to comply with stringent environmental regulations. In 2023, Agilent reported diverting over 1,000 metric tons of waste from landfills through its own initiatives.

Agilent is actively addressing its supply chain's environmental footprint, with over 80% of key suppliers undergoing environmental assessments by the end of 2023. This focus on logistics optimization and responsible sourcing contributed to a 5% decrease in transportation-related emissions in 2023.

The company is also preparing for climate change risks, such as resource scarcity, by investing in water conservation and diversifying material sourcing. Simultaneously, Agilent is capitalizing on market opportunities in environmental monitoring and analysis, anticipating continued growth in this segment through 2025.

| Environmental Factor | Agilent's Response/Initiative | Key Data/Impact (2023-2025) |

|---|---|---|

| Sustainability Demand | Developing energy-efficient instruments, safer chemicals. | 7% revenue increase from sustainable products (2023). |

| Waste Management | Providing customer solutions for regulatory compliance. | Diverted >1,000 metric tons of waste from landfills (2023). |

| Supply Chain Footprint | Supplier environmental assessments, logistics optimization. | >80% key suppliers assessed (2023); 5% reduction in transport emissions (2023). |

| Climate Change Adaptation | Investing in water conservation, diversifying material sourcing. | Exploring resilient manufacturing and alternative materials. |

| Market Opportunities | Growth in environmental testing solutions. | Anticipated continued growth through 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Agilent Technologies is built on a foundation of comprehensive data, drawing from official government publications, reputable market research firms, and leading financial news outlets. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.