Agilent Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

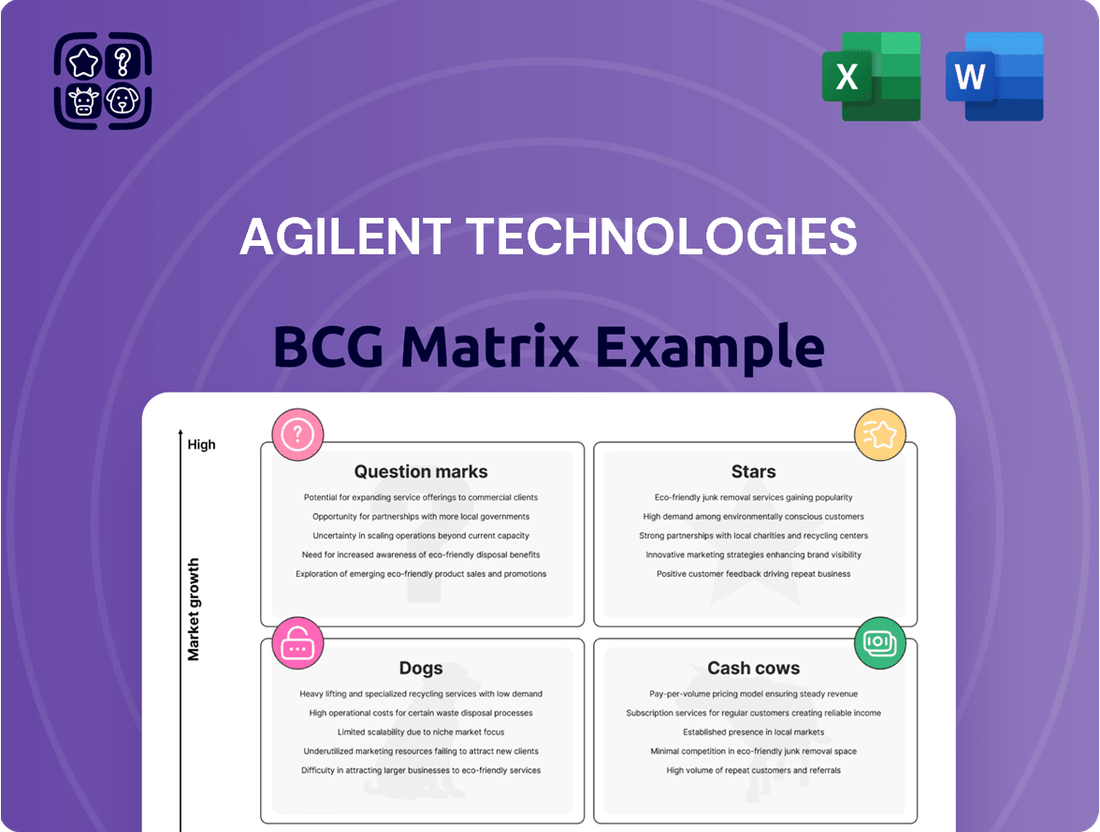

Agilent Technologies' BCG Matrix reveals a dynamic portfolio, highlighting key areas of strength and potential growth. Understand precisely which of their offerings are market leaders and which require strategic re-evaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Agilent Technologies.

The complete BCG Matrix reveals exactly how Agilent Technologies is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Agilent's PFAS testing solutions are a shining example of a star in the BCG matrix, demonstrating robust growth. Revenue in this segment saw an impressive surge of over 70% year-over-year in Q2 2025. This rapid expansion is fueled by escalating regulatory requirements globally, making it a high-growth market.

The company's investment in leading-edge tools, such as the 6495D mass spectrometer, solidifies its strong market share within this burgeoning sector. Agilent is well-positioned to capitalize on the increasing demand for accurate and efficient PFAS analysis, further cementing its star status.

Agilent Technologies' acquisition of BIOVECTRA for $925 million in 2023 was a pivotal move to bolster its contract development and manufacturing organization (CDMO) services. This expansion is especially significant in areas like biologics and highly potent active pharmaceutical ingredients (HPAPIs), catering to a market projected to reach $50 billion globally.

Agilent Technologies is making significant strategic moves in cell analysis, a dynamic segment of the life sciences market. Their continued investment, including acquisitions in emerging cell analysis technologies, highlights a commitment to this high-growth area.

Products like the Seahorse XF Flex Analyzer are key drivers of demand, particularly in academic and pharmaceutical research for advanced applications like 3D tissue studies. This positions Agilent to capture increased market share in a sector experiencing robust expansion.

Advanced LC and LC/MS Systems

Agilent's advanced LC and LC/MS systems, including the InfinityLab LC Series with the 1290 Infinity III LC, are significant growth contributors. These sophisticated instruments are designed to meet the demanding needs of various scientific fields.

The company's commitment to innovation is evident in systems like the 7010D Triple Quadrupole GC/MS System and the ExD Cell for the 6545XT AdvanceBio LC/Q-TOF. These offerings provide enhanced performance for critical applications in food safety, environmental monitoring, and biopharmaceutical analysis.

- Market Position: Agilent holds a strong position in the analytical instrumentation market, driven by its advanced LC and LC/MS technologies.

- Growth Drivers: The InfinityLab LC Series, featuring the 1290 Infinity III LC, is a key product line fueling Agilent's expansion.

- Application Focus: Enhanced capabilities for food, environmental, and biopharma sectors highlight the versatility and impact of these systems.

- Innovation Showcase: The 7010D Triple Quadrupole GC/MS System and the ExD Cell for the 6545XT AdvanceBio LC/Q-TOF exemplify Agilent's cutting-edge solutions.

Digital Ecosystem and AI-Enabled Lab Operations

Agilent Technologies is significantly enhancing its digital ecosystem, notably through its CrossLab Connect suite of digital applications. This digital push is directly contributing to growth in digital orders, reflecting a strategic shift towards integrated lab solutions.

The recent acquisition of Sigsense Technologies, a startup focused on AI-enabled lab operations, further underscores Agilent's commitment to innovation in this space. This move positions Agilent at the forefront of optimizing laboratory workflows through artificial intelligence and automation.

This strategic focus on AI and automation is crucial as it targets a high-growth technological area with rapidly increasing market adoption. By integrating advanced AI capabilities, Agilent aims to streamline operations, improve efficiency, and deliver greater value to its customers in the life sciences and diagnostics sectors.

- Digital Order Growth: Agilent's digital ecosystem, including CrossLab Connect, is a key driver for increasing digital orders.

- AI and Automation Focus: The acquisition of Sigsense Technologies highlights Agilent's investment in AI-enabled lab operations.

- Market Positioning: This strategic direction places Agilent in a high-growth technological segment with expanding market acceptance.

- Operational Optimization: The integration of AI and automation is designed to optimize lab operations for enhanced efficiency and performance.

Agilent's PFAS testing solutions are a star performer, experiencing rapid growth driven by global regulatory demands. Revenue in this segment surged over 70% year-over-year in Q2 2025, underscoring its high-growth market status.

The company's investment in advanced tools like the 6495D mass spectrometer reinforces its market leadership. Agilent is well-positioned to capitalize on the increasing need for precise PFAS analysis, solidifying its star position.

| Segment | Growth Rate | Market Position | Key Products/Drivers |

| PFAS Testing | >70% YoY (Q2 2025) | Strong Market Share | 6495D Mass Spectrometer |

| Cell Analysis | Robust Expansion | Growing Market Share | Seahorse XF Flex Analyzer |

| LC/LC-MS Systems | Significant Growth | Strong Market Position | InfinityLab LC Series, 1290 Infinity III LC |

| Digital Ecosystem (AI/Automation) | High-Growth Technological Area | Emerging Leader | CrossLab Connect, Sigsense Technologies acquisition |

What is included in the product

This BCG Matrix analysis provides strategic insights into Agilent's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

Agilent's BCG Matrix offers a clear, one-page overview to identify strategic priorities, relieving the pain of complex portfolio analysis.

Cash Cows

Agilent Technologies' chromatography and mass spectrometry instruments are firmly established as cash cows. These are critical tools for labs in pharma, biotech, and environmental testing, making them indispensable for many customers. The company's strong market share in these foundational technologies, a position it has held for years, translates directly into consistent and substantial cash generation.

In 2024, Agilent continued to benefit from the high demand for these core analytical instruments. Their broad applicability across diverse scientific fields ensures a steady revenue stream. This market leadership, built on decades of innovation and reliability, allows Agilent to leverage its strong brand and extensive customer base for predictable cash flows.

Agilent's CrossLab Group (ACG) is a prime example of a cash cow within the company's BCG Matrix. This segment, encompassing services, software, automation, and consumables, consistently generates substantial revenue and impressive operating margins for Agilent Technologies.

The recurring nature of ACG's revenue, derived from equipment maintenance, essential analytical lab consumables, and ongoing service contracts, solidifies its position as a stable, high-profit business. This recurring income stream is particularly valuable in the mature market where ACG operates.

For the fiscal year 2023, Agilent reported that its Life Sciences, Applied Markets, and Diagnostics and Genomics Groups generated approximately $6.8 billion in revenue, with ACG being a significant contributor to this overall success, demonstrating its cash-generating capabilities.

Agilent Technologies' pharmaceutical and biopharmaceutical solutions are a prime example of a Cash Cow. Their extensive range of tools, consumables, and services are crucial for drug development and manufacturing, creating strong customer loyalty due to stringent regulatory demands and the necessity for ongoing validation.

This segment represents a substantial part of Agilent's overall revenue, delivering consistent and reliable income from a well-established, yet ever-present, market need. For instance, in fiscal year 2023, Agilent reported total revenue of $6.83 billion, with its Life Sciences segment, which heavily includes pharma and biopharma, showing robust performance.

Environmental and Food Safety Analytical Solutions

Agilent's environmental and food safety analytical solutions represent a classic Cash Cow within its portfolio. These offerings, featuring established instruments and workflows, serve stable, mature markets driven by consistent regulatory demands. Agilent showcased advancements like the Advanced Dilution System (ADS 2) at Analytica 2024, underscoring their commitment to these critical applied chemical sectors.

- Market Stability: Environmental and food safety testing markets are characterized by predictable, ongoing demand due to stringent global regulations.

- Revenue Generation: Agilent's established presence and comprehensive solutions in these areas generate consistent, reliable revenue streams.

- Market Leadership: The company maintains a strong market position through continuous innovation and support for evolving analytical needs.

- Key Solutions: Products like the ADS 2 highlight Agilent's capability to provide efficient and accurate analytical workflows for these demanding applications.

Clinical and Diagnostics Market Solutions

Agilent Technologies' clinical and diagnostics market solutions are a cornerstone of its business, reflecting a mature segment where the company possesses deep expertise, particularly in in-vitro diagnostic (IVD) assay development and cancer diagnostics.

This segment acts as a cash cow, generating consistent and reliable revenue streams for Agilent. While the overall market is established, specific niches like cell analysis within diagnostics show promising growth, contributing to the segment's stable performance.

- Market Position: Agilent holds a significant presence in the clinical and diagnostics sector, leveraging its established reputation and technological capabilities.

- Revenue Generation: The company's diagnostic solutions provide a steady and predictable revenue base, characteristic of a cash cow.

- Growth Drivers: While mature, areas such as cell analysis within diagnostics offer avenues for continued, albeit moderate, expansion.

- Financial Contribution: In fiscal year 2023, Agilent's Diagnostics and Genomics Group reported revenue of $1.76 billion, underscoring its importance as a consistent revenue generator.

Agilent's chromatography and mass spectrometry instruments are firmly established as cash cows, critical tools for labs in pharma, biotech, and environmental testing. Their strong market share in these foundational technologies translates directly into consistent and substantial cash generation.

In 2024, Agilent continued to benefit from high demand for these core analytical instruments, ensuring a steady revenue stream due to their broad applicability across diverse scientific fields.

The CrossLab Group (ACG), encompassing services, software, automation, and consumables, consistently generates substantial revenue and impressive operating margins, solidifying its position as a stable, high-profit business.

Agilent's pharmaceutical and biopharmaceutical solutions are a prime example of a Cash Cow, delivering consistent and reliable income from a well-established market need.

Agilent's environmental and food safety analytical solutions represent a classic Cash Cow, serving stable, mature markets driven by consistent regulatory demands.

Agilent's clinical and diagnostics market solutions act as a cash cow, generating consistent and reliable revenue streams, with specific niches like cell analysis showing promising growth.

| Segment | FY 2023 Revenue (Billions USD) | Cash Cow Characteristics |

|---|---|---|

| Life Sciences, Applied Markets, and Diagnostics and Genomics Groups | $6.83 | High market share, mature markets, recurring revenue from services and consumables. |

| CrossLab Group (ACG) | Significant contributor to Life Sciences segment | Recurring revenue from maintenance, consumables, and service contracts; high operating margins. |

| Pharmaceutical & Biopharmaceutical Solutions | Integral part of Life Sciences segment | Strong customer loyalty, essential for drug development, steady income. |

| Environmental & Food Safety Solutions | Integral part of Applied Markets segment | Stable, mature markets, consistent regulatory demand, established workflows. |

| Clinical & Diagnostics Solutions | $1.76 (Diagnostics and Genomics Group) | Deep expertise, consistent revenue, moderate growth in areas like cell analysis. |

Delivered as Shown

Agilent Technologies BCG Matrix

The Agilent Technologies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report for your strategic planning needs. You can be confident that what you see is precisely what you will download, allowing you to seamlessly integrate this valuable business intelligence into your decision-making processes. This comprehensive BCG Matrix is designed for immediate use, empowering you to gain critical insights into Agilent's product portfolio and market positioning without any further editing or preparation required.

Dogs

While Agilent Technologies doesn't publicly label specific product lines as 'dogs', older instrument platforms or niche segments within their life sciences, diagnostics, and applied chemical markets that are experiencing declining demand or intense competition could fit this description. These products, characterized by low market share and low growth prospects, might require significant investment to revitalize or could be candidates for divestiture to free up resources for more promising ventures.

Agilent Technologies has observed a noticeable slowdown in demand within key markets like Europe and the United States for a portion of its product portfolio. This trend is particularly concerning for products that have a significant sales concentration in these specific regions and lack robust growth drivers elsewhere.

Products experiencing this regional demand softening, and failing to gain traction in other growing markets, risk being categorized as Dogs in the BCG matrix. For instance, if a particular life sciences instrument, heavily sold in Europe, sees declining orders and has limited expansion opportunities in Asia or emerging markets, its market share and growth prospects could become stagnant, fitting the Dog profile.

As of the first quarter of fiscal year 2024, Agilent reported that its Life Sciences segment, which includes many of its core instrument lines, saw revenue decline by 1% year-over-year. While not all products within this segment are dogs, this overall trend underscores the potential for certain offerings to fall into this category if they are disproportionately affected by regional economic headwinds and fail to innovate or adapt.

Agilent Technologies has a history of divesting non-core assets to sharpen its focus on more promising areas. A prime example is the spin-off of Keysight Technologies in 2014, which allowed Agilent to concentrate on its life sciences, diagnostics, and applied chemical markets.

Any current business units or product lines that exhibit low growth and a small market share, and that don't fit with Agilent's strategic direction, could be considered for future divestiture. This approach helps streamline operations and reallocate resources towards segments with greater potential for expansion and profitability.

Products with High Tariff-Related Costs

Products facing substantial tariff-related expenses, which squeeze profit margins, risk becoming dogs. This is particularly true if Agilent cannot pass these costs on through price increases, reconfigure its supply chains, or shift production to regions without tariffs. For instance, if a key component imported into the United States from China faces a 25% tariff, and Agilent's profit margin on the final product is only 15%, the tariff alone makes the product unprofitable without adjustments.

The situation becomes even more precarious if these tariff-burdened products operate in a low-growth market segment. This combination can transform them into cash traps, consuming resources without generating significant returns. In 2024, for example, the global market for certain diagnostic equipment components, heavily reliant on international sourcing, experienced a projected growth rate of only 2-3%, making it difficult to absorb rising tariff costs.

- Tariff Impact: Products with significant import duties face margin erosion.

- Offsetting Challenges: Inability to raise prices or alter supply chains exacerbates the issue.

- Market Growth: Low-growth markets for these products increase the risk of becoming cash traps.

- Example Scenario: A 25% tariff on a component with a 15% profit margin product can lead to immediate losses.

Aging Instrument Platforms with Limited Upgradability

Older generations of Agilent's analytical instrument platforms, particularly those with limited upgradability, can be classified as Dogs in the BCG Matrix. These instruments, while potentially still functional, often lack the efficiency and advanced features found in newer models. For instance, legacy mass spectrometry systems might struggle to keep pace with the sensitivity and throughput demands of modern research.

While Agilent strives for backward compatibility and upgrade paths, some older platforms may face declining sales and market relevance. This is especially true if significant technological advancements have occurred, making the older systems less competitive. The market for these aging instruments shrinks as customers opt for more capable, next-generation solutions.

- Declining Market Share: Older platforms may see their market share erode as newer, more advanced instruments gain traction.

- Limited Innovation Potential: Platforms with inherent design limitations struggle to incorporate the latest technological advancements, hindering their competitive edge.

- Reduced Profitability: As demand wanes and support costs potentially rise, the profitability of these aging instrument lines can diminish.

- Focus on Newer Offerings: Agilent's strategic focus naturally shifts to its more innovative and higher-growth product lines, potentially leading to reduced investment in legacy systems.

Products that are in low-growth markets and hold a small market share are considered Dogs in the BCG matrix. These are typically older product lines that may not have seen significant innovation or have been outpaced by competitors. Agilent Technologies, like any diversified company, likely has offerings that fit this profile, often characterized by declining sales and profitability.

In 2024, Agilent's Life Sciences segment experienced a 1% revenue decline year-over-year, highlighting that some instrument lines within this historically strong area might be facing challenges. Products that are particularly concentrated in regions with softening demand, such as parts of Europe and the U.S., and lack strong growth drivers elsewhere, are prime candidates for the Dog classification.

For instance, an older generation of analytical instruments with limited upgradeability, facing intense competition from newer technologies, would fit the Dog category. These products may consume resources for support and maintenance without contributing significantly to growth or profit, making them potential candidates for divestiture or strategic discontinuation.

The company's strategy of divesting non-core assets, as seen with the spin-off of Keysight Technologies in 2014, demonstrates a proactive approach to managing its portfolio. This suggests that any current product lines exhibiting characteristics of Dogs would be evaluated for similar strategic actions to optimize resource allocation towards higher-potential ventures.

| Product Category Example | Market Growth | Market Share | Potential BCG Status | Rationale |

|---|---|---|---|---|

| Legacy Mass Spectrometry Systems | Low | Low | Dog | Limited upgradability, outpaced by newer technologies, declining sales. |

| Specialized Diagnostic Reagents (Niche) | Low | Low | Dog | Small addressable market, high competition, limited innovation pipeline. |

| Older Generation Chromatography Columns | Low | Low | Dog | Erosion due to advanced column chemistries, reduced demand from R&D shifts. |

Question Marks

Emerging gene-editing technologies, like CRISPR, represent a dynamic frontier for Agilent. The acquisition of BIOVECTRA bolsters Agilent's capabilities in this high-growth area, though market share is still being established. This segment is a significant investment, potentially a future Star, but currently requires substantial cash outlay due to its nascent market position.

Agilent's exploration into novel AI and automation solutions for laboratories, separate from the Sigsense integration, represents a significant investment in future growth. These initiatives are designed to enhance laboratory efficiency and throughput, targeting areas with high potential for market disruption. For instance, by 2024, the global laboratory automation market was projected to reach approximately $5.4 billion, indicating a substantial opportunity for new entrants and innovative solutions.

These question mark ventures are characterized by Agilent's commitment to developing cutting-edge technologies that could redefine laboratory workflows. While the exact market share for these nascent solutions is still being established, the underlying trend of increasing demand for AI-driven efficiency in scientific research and diagnostics provides a strong foundation. Agilent's strategic positioning in these high-growth segments is crucial for its long-term competitive advantage.

Agilent's strategic partnerships in precision medicine, exemplified by its collaboration with Incyte for companion diagnostics in hematology and oncology, position it in rapidly expanding, niche markets. These ventures, while promising substantial future growth, are currently in their early stages of development and market penetration, demanding considerable capital outlay and time to capture significant market share.

Solutions for Novel Biotherapeutic Modalities

Agilent's focus on novel biotherapeutic modalities, such as advanced cell and gene therapies, positions them to capture significant market share in a rapidly expanding sector. The development of specialized analytical tools, like the Agilent ExD Cell for detailed peptide and protein analysis, directly addresses the growing need for characterization of these complex molecules. This strategic investment in cutting-edge technology, crucial for future revenue streams, may initially represent a smaller portion of Agilent's overall portfolio as these advanced solutions gain market acceptance.

The market for biotherapeutics is experiencing robust growth, with projections indicating continued expansion. For instance, the global biopharmaceutical market was valued at approximately USD 390 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 10-12% through 2030. Agilent's commitment to supporting these complex modalities through innovative solutions like the ExD Cell is a key driver for potential future success.

- Targeting High-Growth Markets: Agilent's development of technologies like the Agilent ExD Cell directly addresses the expanding biotherapeutics market, which is projected to reach hundreds of billions of dollars in the coming years.

- Initial Low Market Share: While these specialized solutions are vital for long-term growth, their initial market share might be relatively modest as the industry adopts these advanced characterization tools.

- Strategic Investment for Future Revenue: The investment in novel biotherapeutic modalities represents a strategic move to secure future revenue streams by supporting the development and analysis of next-generation medicines.

- Enhancing Analytical Capabilities: Technologies like the ExD Cell are designed to provide enhanced peptide and protein characterization, which is critical for ensuring the safety and efficacy of complex biotherapeutics.

Strategic Expansion in Emerging Geographic Markets

Agilent Technologies is strategically targeting emerging geographic markets for significant growth, doubling its investment in India and expanding its presence in other high-potential regions. These markets are projected to experience growth rates in the high teens and even higher, presenting a substantial opportunity for Agilent to expand its market share.

The company is actively investing resources to establish a strong foothold in these developing economies. This aggressive investment strategy positions these emerging markets as question marks within the BCG matrix, as their future success hinges on Agilent's ability to convert its investments into a dominant market position.

- India Investment: Agilent is doubling its investment in India, a key emerging market.

- High-Growth Potential: Emerging markets are expected to grow at rates of 15-20% or more.

- Market Share Capture: Investments are focused on capturing significant market share in these regions.

- Question Mark Status: These markets are classified as question marks due to the ongoing investment and the need to establish a dominant position.

Agilent's ventures into novel biotherapeutic modalities, such as advanced cell and gene therapies, represent a significant investment in high-growth areas. The development of specialized analytical tools, like the Agilent ExD Cell, directly addresses the increasing demand for characterization of complex molecules in this rapidly expanding sector. While these cutting-edge solutions are crucial for future revenue, their initial market share may be modest as the industry adopts these advanced technologies.

The global biopharmaceutical market was valued at approximately USD 390 billion in 2023 and is projected to grow at a CAGR of around 10-12% through 2030. Agilent's commitment to supporting these complex modalities through innovative solutions like the ExD Cell is a key driver for potential future success, positioning these as strategic question marks requiring continued investment to capture market share.

BCG Matrix Data Sources

Our Agilent Technologies BCG Matrix leverages a blend of official company financial filings, comprehensive industry market research reports, and expert analyses of market trends and growth forecasts.