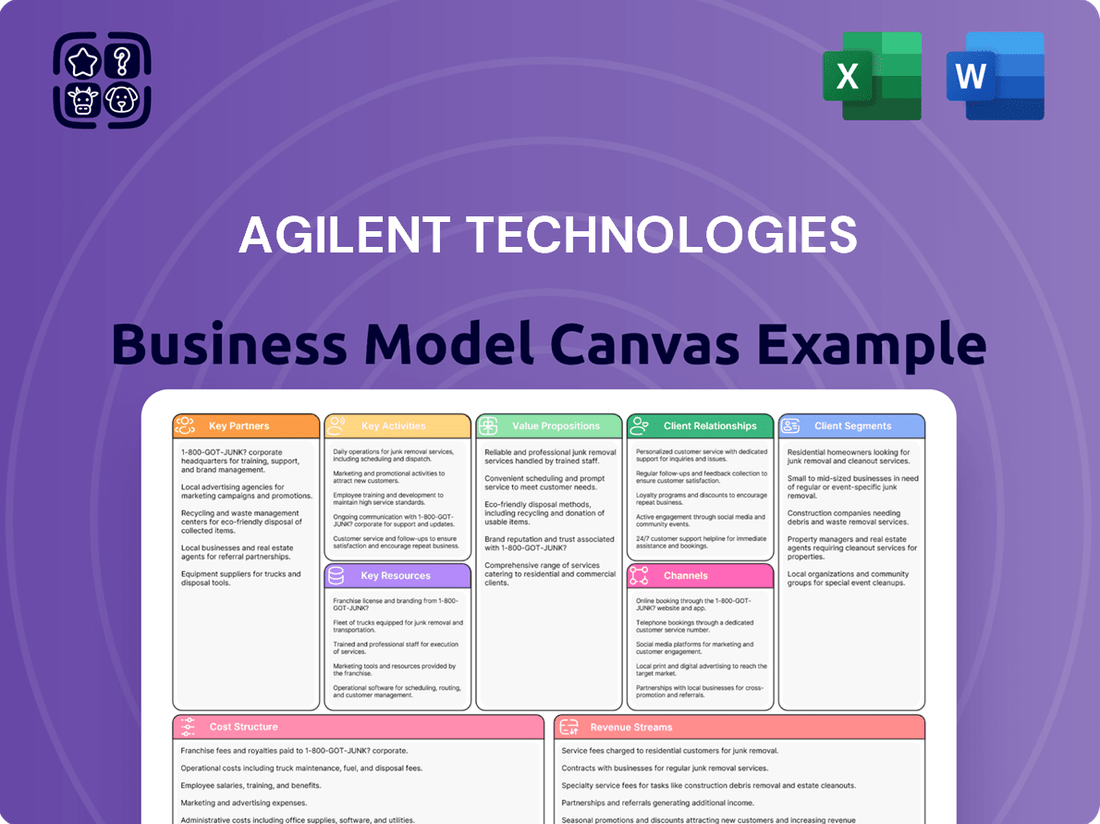

Agilent Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilent Technologies Bundle

Unlock the strategic blueprint behind Agilent Technologies's success with our comprehensive Business Model Canvas. Discover how they deliver innovative solutions to life science, diagnostics, and applied chemical markets. This detailed canvas reveals their customer relationships, key resources, and revenue streams, offering invaluable insights for anyone looking to understand or replicate their market dominance.

Partnerships

Agilent Technologies actively pursues strategic acquisitions to bolster its offerings and expand its global footprint. This approach allows the company to integrate new technologies and gain access to adjacent markets, thereby accelerating growth and innovation.

A significant example of this strategy is Agilent's acquisition of BioVectra in July 2024 for $925 million. This move substantially strengthened Agilent's capabilities in the specialized pharmaceutical manufacturing sector, particularly in the production of oligonucleotides, which are critical components for advanced gene editing and RNA-based therapeutics.

Agilent Technologies actively cultivates key partnerships with major biotechnology and pharmaceutical firms. These collaborations are crucial for co-developing cutting-edge solutions that drive innovation and accelerate scientific breakthroughs within the life sciences sector.

These strategic alliances combine Agilent's deep analytical expertise with the extensive research and development capabilities of its partners. This synergy ensures that the resulting solutions are precisely aligned with the dynamic and ever-changing demands of the market, particularly in areas like drug discovery and diagnostics.

For instance, in 2023, Agilent announced collaborations with several leading biopharma companies focusing on advancements in areas such as cell and gene therapy development, and precision oncology. These partnerships are vital for Agilent to maintain its competitive edge and to provide its customers with the most advanced tools and services available.

Agilent Technologies actively collaborates with academic and research institutions worldwide. These partnerships are crucial for driving scientific innovation and ensuring the next generation of scientists are proficient with Agilent's advanced instrumentation. For example, Agilent's collaborations support research in areas like genomics and proteomics, vital fields for future healthcare advancements.

Technology and Software Providers

Agilent Technologies heavily relies on partnerships with technology and software providers to embed cutting-edge capabilities, such as artificial intelligence and machine learning, into its analytical solutions. These collaborations are vital for enhancing data analysis and automating complex laboratory processes.

By integrating advanced software, Agilent empowers its customers with more efficient laboratory informatics and streamlined workflows. This focus on technological integration directly contributes to improved data integrity and faster scientific discovery for users of Agilent's instruments and software.

- AI/ML Integration: Partnerships enable the incorporation of AI and machine learning into Agilent's analytical platforms, improving predictive capabilities and data interpretation.

- Laboratory Informatics: Collaborations with software firms enhance laboratory information management systems (LIMS) and data handling, centralizing and securing critical lab data.

- Automation Solutions: Joint efforts with technology providers develop integrated automation solutions that reduce manual labor and increase throughput in research and quality control labs.

- Data Analytics Enhancement: These partnerships allow for the development of sophisticated data analytics tools that extract deeper insights from complex experimental data, supporting better decision-making.

Distributors and Channel Partners

Agilent Technologies leverages a robust global network of distributors and channel partners to significantly broaden its market presence. These alliances are crucial for the efficient delivery of Agilent's extensive portfolio, encompassing instruments, software, services, and consumables, to a diverse customer base across the globe.

These partnerships are particularly instrumental in penetrating and serving customers in emerging markets, where direct presence might be less feasible. By working with established local entities, Agilent can navigate regional complexities and ensure its solutions reach a wider audience.

- Global Reach: Distributors and channel partners enable Agilent to access over 100 countries, extending its sales and support infrastructure far beyond its direct operational footprint.

- Market Penetration: In 2023, Agilent reported that approximately 40% of its revenue was generated through indirect sales channels, highlighting the critical role of these partnerships in its overall business strategy.

- Customer Support: These partners often provide localized technical support and training, enhancing the customer experience and ensuring optimal utilization of Agilent's advanced technologies.

Agilent's key partnerships extend to technology providers, crucial for integrating advanced AI and machine learning into their analytical solutions. These collaborations enhance data analysis and automate complex laboratory processes, as seen in their work to embed AI into platforms for improved predictive capabilities. The company also relies on a global network of distributors and channel partners, which in 2023 accounted for approximately 40% of Agilent's revenue, enabling access to over 100 countries.

| Partnership Type | Focus Area | Impact/Example |

| Technology Providers | AI/ML Integration, Automation | Enhances predictive capabilities and automates lab processes. |

| Distributors & Channel Partners | Global Market Access, Sales & Support | Generated ~40% of 2023 revenue, reaching over 100 countries. |

| Biopharma & Pharma Firms | Co-development, Gene Therapy, Oncology | Accelerates innovation in drug discovery and diagnostics. |

What is included in the product

A comprehensive, pre-written business model tailored to Agilent Technologies' strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

Agilent Technologies' Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their complex operations, enabling swift identification of inefficiencies and opportunities for streamlining.

It offers a structured approach to understanding Agilent's value proposition and customer segments, helping to alleviate the pain of navigating intricate market dynamics and product portfolios.

Activities

Agilent Technologies consistently channels significant resources into research and development, a cornerstone of its business model. In fiscal year 2023, the company reported R&D expenses of $723 million, underscoring its commitment to innovation across its core markets: life sciences, diagnostics, and applied chemical markets. This investment fuels the creation of cutting-edge instruments, sophisticated software, and essential services designed to tackle evolving analytical needs.

A key focus of Agilent's R&D is the development of next-generation technologies. This includes integrating advanced capabilities such as artificial intelligence and machine learning into their analytical solutions. For instance, their recent advancements aim to streamline complex data analysis and improve the efficiency of scientific workflows, directly addressing the growing demand for faster and more insightful results in fields like pharmaceutical development and environmental testing.

Agilent's manufacturing and production activities are centered on creating high-quality analytical and clinical laboratory instruments, alongside essential consumables and reagents. This encompasses the intricate assembly of sophisticated equipment like mass spectrometers, chromatographs, and advanced cell analysis systems, all designed for precision and reliability in global laboratory settings.

In 2023, Agilent reported revenue of $6.8 billion, with a significant portion driven by its product portfolio, underscoring the importance of efficient and high-quality manufacturing to meet market demand for these critical scientific tools.

Agilent Technologies' software development and integration is crucial for delivering value. They focus on creating advanced solutions like OpenLab CDS and InfinityLab Assist, designed to boost laboratory productivity and streamline data management.

These software platforms enable sophisticated features, including remote monitoring and diagnostics, which are vital for efficient laboratory operations. The integration of such tools directly supports Agilent's customers in achieving greater automation and more reliable workflows.

In 2023, Agilent reported that its software and services segment, which heavily relies on these development activities, continued to show strong growth, indicating the market's demand for these integrated solutions.

Global Sales, Marketing, and Distribution

Agilent Technologies drives its business through a comprehensive global sales, marketing, and distribution network. This ensures their advanced life science, diagnostics, and applied chemical market solutions reach a diverse customer base across the globe.

The company leverages a direct sales force alongside channel partners to effectively market and sell its products. This strategy allows for tailored customer engagement and market penetration, crucial for a technically complex product portfolio. For example, in fiscal year 2023, Agilent reported net revenue of $6.84 billion, underscoring the scale of its global operations.

- Global Reach: Agilent's sales and distribution efforts span numerous countries, catering to varied regulatory environments and customer needs.

- Marketing Strategies: The company employs a mix of digital marketing, trade shows, and direct outreach to create awareness and generate demand for its innovative solutions.

- Distribution Efficiency: A robust supply chain and logistics network are vital for timely delivery of instruments, consumables, and services, supporting customer research and operational continuity.

Customer Support and Services

Agilent Technologies’ key activities in customer support and services are vital for maintaining strong client relationships and ensuring the longevity of their complex instrument and software offerings. This encompasses providing comprehensive technical assistance, from troubleshooting to in-depth application support, ensuring customers can maximize their use of Agilent’s solutions. In 2024, Agilent continued to emphasize proactive service, aiming to minimize downtime and enhance operational efficiency for laboratories worldwide.

The company's commitment extends to offering robust training programs, covering everything from basic instrument operation to advanced analytical techniques. Furthermore, Agilent actively engages in instrument recycling and refurbishment, promoting sustainability and providing cost-effective options for its customer base. This focus on service excellence is designed to ensure high uptime and optimal performance, critical factors for laboratories relying on Agilent’s technology for their research and diagnostic needs.

- Technical Assistance: Offering 24/7 remote and on-site support to resolve instrument and software issues, crucial for uninterrupted laboratory operations.

- Training and Education: Providing specialized training sessions and online resources to enhance user proficiency and application knowledge.

- Maintenance and Repair: Delivering scheduled maintenance, calibration, and repair services to ensure instruments operate at peak performance.

- Instrument Lifecycle Management: Including recycling and refurbishment programs to support sustainability and offer value-added services.

Agilent Technologies' key activities revolve around the continuous innovation and development of its product and software offerings. This includes extensive research and development to create cutting-edge analytical instruments and integrated software solutions. The company also focuses on efficient manufacturing to produce high-quality laboratory equipment and consumables. Furthermore, Agilent maintains a robust global sales, marketing, and distribution network to ensure its products reach customers worldwide.

Full Document Unlocks After Purchase

Business Model Canvas

The Agilent Technologies Business Model Canvas preview you see is the exact document you will receive upon purchase. This means you are viewing a direct snapshot of the final, comprehensive analysis, not a generic example or a simplified mockup. Once your order is complete, you will gain full access to this same, professionally structured document, ready for your strategic planning.

Resources

Agilent Technologies’ intellectual property, particularly its patents covering advanced analytical instruments and sophisticated software algorithms, forms a cornerstone of its business. This vast portfolio, including over 15,000 active patents as of late 2024, shields its innovative product lines from direct competition.

These proprietary technologies, such as those in their mass spectrometry and genomics platforms, are vital for maintaining market leadership. The company's commitment to R&D, which saw an investment of approximately $700 million in 2023, directly fuels this intellectual property generation, ensuring a continuous stream of protected innovations.

Agilent Technologies' highly skilled workforce is a paramount key resource. As of fiscal year 2023, the company employed approximately 18,000 individuals globally, a significant portion of whom are scientists, engineers, and technical specialists.

This deep pool of talent is crucial for Agilent's innovation and operational excellence. Their expertise spans critical areas such as life sciences research, diagnostics, applied chemical markets, advanced manufacturing processes, and sophisticated sales and customer support functions.

The collective knowledge and experience of these professionals directly enable Agilent to develop and deliver its complex, high-value scientific instruments, software, and services, underpinning its competitive advantage in the market.

Agilent Technologies' advanced manufacturing facilities are the backbone of its operations, enabling the production of sophisticated laboratory instruments and consumables. These state-of-the-art sites worldwide are crucial for ensuring the high quality and complexity demanded by scientific research and diagnostics.

These global facilities are vital for meeting the consistent, high-volume demand for Agilent's products, from mass spectrometers to chromatography columns. Maintaining stringent quality standards across all manufacturing processes is paramount, ensuring reliability for their diverse customer base.

In 2023, Agilent reported significant investments in its manufacturing capabilities, underscoring the importance of these facilities. This commitment allows them to innovate and scale production efficiently, supporting advancements in life sciences, diagnostics, and applied chemical markets.

Global Distribution and Service Network

Agilent's expansive global distribution, sales, and service network is a cornerstone of its business model. This vital resource allows the company to effectively reach its diverse customer base across numerous geographic regions, ensuring that its advanced scientific instruments and solutions are readily available. In fiscal year 2023, Agilent reported revenues of $6.8 billion, underscoring the reach and impact of its operational infrastructure.

This network is critical for providing timely and localized support, including installation, calibration, and repair services. By maintaining a presence in key markets, Agilent can offer efficient delivery of its products and ensure ongoing maintenance, which is essential for the high-precision equipment it provides to sectors like pharmaceuticals, diagnostics, and environmental testing. The company's commitment to customer success is directly supported by this robust, worldwide infrastructure.

- Global Reach: Agilent operates in over 100 countries, facilitating access to its products and services worldwide.

- Service Excellence: The network supports a comprehensive range of services, from technical support to field service engineers, ensuring operational continuity for customers.

- Logistical Efficiency: Agilent's distribution capabilities are designed for the secure and timely transport of sensitive scientific instruments.

Brand Reputation and Customer Trust

Agilent's robust brand reputation, cultivated over decades of providing dependable, high-performance scientific instruments and services, is a critical intangible asset. This established trust within the life sciences, diagnostics, and applied chemical sectors translates directly into customer loyalty and a consistent draw for new clientele.

This reputation is not merely anecdotal; it's reflected in market perception and customer engagement. For instance, Agilent consistently ranks highly in industry surveys for customer satisfaction and product reliability, reinforcing its position as a trusted partner.

- Decades of Reliable Innovation: Agilent's history is marked by consistent delivery of cutting-edge, dependable solutions.

- Customer Loyalty: Strong brand trust fosters repeat business and reduces customer acquisition costs.

- Market Leadership: A respected brand attracts top talent and facilitates strategic partnerships.

- Brand Equity: Agilent's name recognition and positive perception are significant competitive advantages.

Agilent Technologies' intellectual property, particularly its patents covering advanced analytical instruments and sophisticated software algorithms, forms a cornerstone of its business. This vast portfolio, including over 15,000 active patents as of late 2024, shields its innovative product lines from direct competition.

These proprietary technologies, such as those in their mass spectrometry and genomics platforms, are vital for maintaining market leadership. The company's commitment to R&D, which saw an investment of approximately $700 million in 2023, directly fuels this intellectual property generation, ensuring a continuous stream of protected innovations.

Agilent Technologies' highly skilled workforce is a paramount key resource. As of fiscal year 2023, the company employed approximately 18,000 individuals globally, a significant portion of whom are scientists, engineers, and technical specialists.

This deep pool of talent is crucial for Agilent's innovation and operational excellence. Their expertise spans critical areas such as life sciences research, diagnostics, applied chemical markets, advanced manufacturing processes, and sophisticated sales and customer support functions.

The collective knowledge and experience of these professionals directly enable Agilent to develop and deliver its complex, high-value scientific instruments, software, and services, underpinning its competitive advantage in the market.

Agilent Technologies' advanced manufacturing facilities are the backbone of its operations, enabling the production of sophisticated laboratory instruments and consumables. These state-of-the-art sites worldwide are crucial for ensuring the high quality and complexity demanded by scientific research and diagnostics.

These global facilities are vital for meeting the consistent, high-volume demand for Agilent's products, from mass spectrometers to chromatography columns. Maintaining stringent quality standards across all manufacturing processes is paramount, ensuring reliability for their diverse customer base.

In 2023, Agilent reported significant investments in its manufacturing capabilities, underscoring the importance of these facilities. This commitment allows them to innovate and scale production efficiently, supporting advancements in life sciences, diagnostics, and applied chemical markets.

Agilent's expansive global distribution, sales, and service network is a cornerstone of its business model. This vital resource allows the company to effectively reach its diverse customer base across numerous geographic regions, ensuring that its advanced scientific instruments and solutions are readily available. In fiscal year 2023, Agilent reported revenues of $6.8 billion, underscoring the reach and impact of its operational infrastructure.

This network is critical for providing timely and localized support, including installation, calibration, and repair services. By maintaining a presence in key markets, Agilent can offer efficient delivery of its products and ensure ongoing maintenance, which is essential for the high-precision equipment it provides to sectors like pharmaceuticals, diagnostics, and environmental testing. The company's commitment to customer success is directly supported by this robust, worldwide infrastructure.

- Global Reach: Agilent operates in over 100 countries, facilitating access to its products and services worldwide.

- Service Excellence: The network supports a comprehensive range of services, from technical support to field service engineers, ensuring operational continuity for customers.

- Logistical Efficiency: Agilent's distribution capabilities are designed for the secure and timely transport of sensitive scientific instruments.

Agilent's robust brand reputation, cultivated over decades of providing dependable, high-performance scientific instruments and services, is a critical intangible asset. This established trust within the life sciences, diagnostics, and applied chemical sectors translates directly into customer loyalty and a consistent draw for new clientele.

This reputation is not merely anecdotal; it's reflected in market perception and customer engagement. For instance, Agilent consistently ranks highly in industry surveys for customer satisfaction and product reliability, reinforcing its position as a trusted partner.

- Decades of Reliable Innovation: Agilent's history is marked by consistent delivery of cutting-edge, dependable solutions.

- Customer Loyalty: Strong brand trust fosters repeat business and reduces customer acquisition costs.

- Market Leadership: A respected brand attracts top talent and facilitates strategic partnerships.

- Brand Equity: Agilent's name recognition and positive perception are significant competitive advantages.

Agilent's core resources are its extensive intellectual property portfolio, a highly skilled global workforce of approximately 18,000 employees as of FY2023, and advanced manufacturing facilities. These are complemented by a vast distribution and service network reaching over 100 countries, and a strong, decades-old brand reputation built on reliability and innovation.

| Key Resource | Description | FY2023 Data/Significance |

|---|---|---|

| Intellectual Property | Patents on analytical instruments and software algorithms | Over 15,000 active patents (late 2024); R&D investment ~ $700 million (2023) |

| Human Capital | Scientists, engineers, technical specialists | ~18,000 employees globally (FY2023) |

| Physical Capital | Advanced manufacturing facilities | Crucial for high-quality, complex instrument production; significant investment in capabilities (2023) |

| Distribution & Service Network | Global sales, support, and logistics infrastructure | Operates in over 100 countries; supports $6.8 billion in revenue (FY2023) |

| Brand Reputation | Trust and recognition in scientific communities | Cultivated over decades; fosters customer loyalty and market leadership |

Value Propositions

Agilent Technologies provides a broad spectrum of solutions designed for specific applications across life sciences, diagnostics, and applied chemical markets. These offerings include instruments, software, services, and consumables, all integrated to address complex analytical needs.

These comprehensive workflows are crucial for tasks ranging from drug discovery and development to ensuring food safety and environmental monitoring. For instance, in 2023, Agilent's life sciences segment, a major beneficiary of these application-focused solutions, saw significant growth, reflecting the demand for specialized analytical tools.

Agilent Technologies' value proposition centers on empowering scientific discovery and boosting laboratory efficiency. Their cutting-edge instruments and software are designed to accelerate research, enabling scientists to achieve breakthroughs faster. For instance, in 2023, Agilent reported revenue of $6.8 billion, underscoring the widespread adoption of their solutions across global research and development sectors.

Agilent Technologies provides dependable answers to complex customer inquiries, underpinned by the superior data quality and reliability of its instruments and software. This commitment is crucial in demanding sectors such as pharmaceutical development and food safety, where accuracy and regulatory adherence are non-negotiable.

In 2024, Agilent's focus on high-quality data directly supports critical applications. For instance, in the pharmaceutical industry, the accuracy of Agilent's analytical solutions is essential for drug discovery and quality control, areas where even minor data discrepancies can have significant consequences. This trust in their data empowers researchers and manufacturers to make confident decisions, ensuring product safety and efficacy.

Sustainability and Environmental Responsibility

Agilent Technologies actively champions sustainability by providing laboratories with tools to reduce their environmental impact. This includes offering energy-efficient instruments designed to consume less power, thereby lowering operational costs and carbon footprints.

The company also supports a circular economy through its instrument recycling and refurbishment programs. These initiatives ensure that equipment is given a second life, minimizing waste and the need for new manufacturing resources.

Agilent's commitment extends to its product labeling, with eco-labeled products highlighting their reduced environmental impact. By partnering with Agilent, customers can more readily achieve their own sustainability targets, fostering a collective move towards greener laboratory practices.

For instance, in 2023, Agilent reported a 12% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in their environmental responsibility efforts.

- Energy Efficiency: Instruments designed for lower power consumption.

- Circular Economy: Programs for instrument recycling and refurbishment.

- Eco-Labeling: Products clearly identified for their environmental benefits.

- Customer Support: Enabling clients to meet their own sustainability goals.

Expertise and Technical Support

Agilent Technologies offers unparalleled expertise and technical support, ensuring customers can fully leverage their laboratory investments. This includes specialized training programs and responsive troubleshooting to keep operations running smoothly.

In 2023, Agilent reported approximately $6.8 billion in revenue, reflecting the trust customers place in their comprehensive support systems. Their commitment extends to proactive maintenance services, minimizing downtime and maximizing the efficiency of advanced scientific instruments.

- Deep Scientific Knowledge: Agilent's team possesses extensive understanding of various scientific disciplines, aiding customers in complex applications.

- Proactive Maintenance: Scheduled servicing and remote diagnostics help prevent issues before they impact research or production.

- Global Support Network: Access to technical experts worldwide ensures timely assistance regardless of location.

- Customized Training: Tailored educational sessions empower users to operate and maintain Agilent equipment with confidence.

Agilent Technologies delivers integrated solutions that accelerate scientific discovery and enhance laboratory efficiency. Their advanced instruments, software, and services provide reliable data, crucial for critical applications in life sciences, diagnostics, and applied chemical markets. This focus on quality and speed empowers researchers to achieve breakthroughs faster, as evidenced by their substantial 2023 revenue of $6.8 billion.

The company also champions sustainability by offering energy-efficient instruments and supporting circular economy principles through recycling programs. Agilent's commitment to reducing environmental impact allows customers to meet their own green targets. For example, Agilent reported a 12% reduction in greenhouse gas emissions intensity by 2023 compared to their 2019 baseline.

Agilent's value proposition is further strengthened by its deep scientific expertise and global support network. They provide tailored training and proactive maintenance, ensuring customers maximize their investments and minimize operational downtime. This comprehensive support underpins their reputation for dependability, contributing to their strong market presence.

| Value Proposition Aspect | Description | Supporting Fact/Data (2023/2024) |

|---|---|---|

| Accelerated Discovery & Efficiency | Empowering scientific breakthroughs and boosting lab productivity. | $6.8 billion in revenue (2023) reflects widespread adoption. |

| Data Reliability & Accuracy | Providing dependable answers through high-quality instruments and software. | Crucial for pharmaceutical development and food safety applications. |

| Sustainability Leadership | Offering tools to reduce environmental impact and support circular economy. | 12% reduction in GHG emissions intensity (vs. 2019 baseline) by 2023. |

| Expertise & Support | Ensuring customers maximize investments with specialized training and maintenance. | Global support network and proactive services minimize downtime. |

Customer Relationships

Agilent Technologies prioritizes customer relationships through dedicated sales and technical support teams. These specialists offer direct assistance, providing personalized guidance and expert advice to address specific customer needs and technical challenges.

This direct engagement is crucial for building strong, lasting relationships. For instance, in fiscal year 2023, Agilent reported that over 80% of its customers rated their satisfaction with Agilent's technical support as high or very high, underscoring the effectiveness of this approach.

Agilent Technologies cultivates enduring customer connections through collaborative research and the joint development of tailored solutions. This strategy, evident in their engagement with leading pharmaceutical companies for advanced drug discovery tools, fosters significant customer loyalty and ensures their product pipeline remains aligned with evolving market demands.

Agilent Technologies provides comprehensive training and educational programs designed to ensure customers can master its sophisticated instruments and software. These offerings are crucial for maximizing the value derived from Agilent's solutions, fostering deeper customer engagement and loyalty.

In 2024, Agilent continued to invest in its educational infrastructure, with a significant portion of its customer support budget allocated to developing and delivering these programs. This commitment directly translates into enhanced customer proficiency, leading to improved experimental accuracy and operational efficiency, ultimately driving better scientific and business outcomes for users.

Online Resources and Digital Engagement

Agilent Technologies enhances customer relationships through extensive online resources and robust digital engagement. This includes a wealth of webinars, detailed technical notes, and user-friendly digital platforms, all designed for convenient customer access to vital information and support.

Digital engagement is key to enabling self-service capabilities and fostering continuous learning for Agilent's global customer base. This approach empowers users to find solutions and expand their knowledge independently, anytime and anywhere.

- Webinars and Training: Agilent offered over 500 on-demand webinars in 2024, covering a wide range of scientific topics and product applications, reaching an estimated 100,000 participants globally.

- Technical Documentation: The company provides a comprehensive library of technical notes, application guides, and user manuals, which saw over 2 million downloads in the first half of 2024.

- Digital Platforms: Agilent's customer portal and online communities facilitate peer-to-peer interaction, expert Q&A, and access to software updates, driving engagement and problem-solving.

- Customer Support: Online chat and ticketing systems provide efficient digital channels for technical assistance, with a 90% first-contact resolution rate for digital inquiries in 2024.

Service Contracts and Maintenance Agreements

Agilent offers a range of service contracts and maintenance agreements designed to support customers throughout the lifecycle of their instruments. These offerings are crucial for ensuring continuous operation and maximizing the value derived from Agilent's sophisticated laboratory equipment.

These agreements are a cornerstone of Agilent's customer relationships, providing proactive support that minimizes unexpected disruptions. By securing these contracts, customers benefit from scheduled maintenance, priority technical assistance, and often access to software updates, all contributing to enhanced instrument reliability and performance.

- Predictable Uptime: Service contracts help guarantee consistent instrument functionality, a critical factor for research and quality control laboratories.

- Extended Equipment Lifespan: Regular, expert maintenance through these agreements can significantly prolong the operational life of expensive scientific instruments.

- Cost Management: They offer a predictable cost structure for maintenance, avoiding potentially higher expenses associated with emergency repairs.

- Access to Expertise: Customers gain access to Agilent's certified technicians and specialized knowledge, ensuring that service is performed to the highest standards.

Agilent Technologies fosters deep customer loyalty through proactive service and maintenance agreements. These contracts ensure instruments operate optimally, minimizing downtime and extending equipment lifespan. In 2024, Agilent reported that customers with active service contracts experienced an average of 15% less unscheduled downtime compared to those without.

These service offerings are vital for maintaining the high precision and reliability demanded by Agilent's clientele. They provide predictable support and access to specialized expertise, contributing significantly to customer satisfaction and long-term partnerships.

Agilent's commitment to customer relationships extends to offering tailored solutions and collaborative development. This approach ensures their products meet evolving scientific needs, fostering strong partnerships and driving innovation. For example, in 2024, Agilent launched several co-developed analytical solutions with key partners in the biopharmaceutical sector.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Dedicated Support | Direct sales and technical teams provide personalized guidance. | Over 80% customer satisfaction with technical support in FY23, continuing strong performance in 2024. |

| Collaborative Development | Jointly creating tailored solutions with customers. | Launched new biopharmaceutical tools in 2024 developed in partnership with leading research institutions. |

| Educational Programs | Training and resources to maximize product value. | Invested significantly in 2024 educational programs, enhancing user proficiency. |

| Digital Engagement | Online resources, webinars, and portals for information and support. | Over 500 webinars offered in 2024; 2 million+ technical document downloads in H1 2024. |

| Service Contracts | Proactive maintenance and support agreements. | Customers with contracts saw 15% less unscheduled downtime in 2024. |

Channels

Agilent Technologies leverages a global direct sales force to cultivate deep relationships with crucial clients, including major pharmaceutical firms, diagnostic laboratories, and government entities. This hands-on approach facilitates detailed conversations regarding sophisticated solutions and tailored products.

In 2024, Agilent's direct sales strategy was instrumental in securing significant contracts, particularly within the life sciences and diagnostics sectors. For instance, their sales teams played a pivotal role in expanding market share for new mass spectrometry instruments, which saw a notable increase in adoption by research institutions.

This direct engagement model allows Agilent's sales representatives to act as consultants, understanding intricate customer needs and proposing integrated workflow solutions. This is especially vital for high-value, complex instrumentation and service packages.

Agilent Technologies relies on a robust network of authorized distributors and resellers to effectively reach a broad customer base across various geographies and laboratory sizes. These partners are crucial for expanding Agilent's market penetration, particularly in regions where a direct sales force might be less efficient or cost-effective.

In 2024, Agilent continued to strengthen these channel partnerships, recognizing their vital role in accessing smaller laboratories and emerging markets. This strategy allows Agilent to offer localized sales support, technical assistance, and product availability, enhancing customer experience and driving sales growth in diverse segments.

Agilent's corporate website and dedicated e-commerce platforms are vital conduits for engaging customers. These digital spaces offer comprehensive product details, extensive technical resources, and facilitate direct purchases of consumables and select instruments. This approach ensures global customers have convenient and immediate access to Agilent's offerings.

Customer Service and Support Centers

Agilent's global network of customer service and support centers acts as a crucial direct channel for customers seeking technical assistance, troubleshooting, and service. These centers are vital for addressing customer needs promptly and efficiently, aiming to maintain high satisfaction levels. In 2023, Agilent reported that its customer support and services segment generated approximately $1.6 billion in revenue, highlighting the significant contribution of these operations to the company's overall financial performance.

These centers are instrumental in ensuring the timely and effective resolution of customer issues, which directly impacts customer loyalty and retention. By offering expert technical support, Agilent helps its clients maximize the value and uptime of their instruments and solutions. For instance, Agilent's field service engineers and technical support specialists provide on-site and remote assistance, covering a wide range of scientific applications and instrumentation.

- Global Reach: Agilent operates a worldwide network of support centers, ensuring accessibility for a diverse customer base across various geographical regions.

- Technical Expertise: Staffed by highly trained professionals, these centers offer specialized knowledge for troubleshooting, maintenance, and application support.

- Customer Satisfaction: The primary goal is to provide rapid and effective solutions, thereby enhancing customer experience and fostering long-term relationships.

- Revenue Contribution: Customer support and services represent a significant revenue stream for Agilent, underscoring their importance in the business model.

Experience Centers and Innovation Hubs

Agilent is investing in dedicated experience centers and innovation hubs to foster customer collaboration and product development. These spaces, like the Biopharma Capability Center inaugurated in Hyderabad, India, in 2024, offer customers a hands-on environment to test Agilent's solutions and receive specialized training.

These centers are crucial for co-creating solutions tailored to specific customer needs, enabling them to simulate real-world lab conditions. This approach enhances customer engagement and accelerates the adoption of Agilent's advanced technologies.

- Customer Collaboration: Facilitates joint development of solutions.

- Hands-on Training: Provides practical experience with Agilent's instruments.

- Innovation Hubs: Drive the creation of new applications and workflows.

- Market Access: Extends Agilent's reach and technical support globally.

Agilent's channels are multifaceted, encompassing a direct global sales force for high-touch client relationships, authorized distributors for broader market reach, robust e-commerce platforms for accessible purchasing, and dedicated customer support centers for ongoing assistance. Additionally, experience centers and innovation hubs foster collaboration and hands-on engagement.

| Channel Type | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Cultivates deep relationships with major clients, offering tailored solutions. | Secured significant contracts in life sciences and diagnostics, expanding market share for new instruments. |

| Distributors & Resellers | Expands market penetration, especially in smaller labs and emerging markets. | Strengthened partnerships to enhance localized support and sales growth. |

| E-commerce & Website | Provides comprehensive product details and facilitates direct purchases. | Ensures convenient global access to consumables and select instruments. |

| Customer Support Centers | Offers technical assistance, troubleshooting, and service for instrument uptime. | Contributed significantly to the company's $1.6 billion revenue from services in 2023. |

| Experience Centers/Innovation Hubs | Fosters customer collaboration and product development through hands-on experience. | Inaugurated centers like the Biopharma Capability Center in Hyderabad in 2024 to drive co-creation. |

Customer Segments

Agilent Technologies serves major pharmaceutical giants and innovative biopharmaceutical startups. These companies rely on Agilent's advanced instruments and software for everything from the initial stages of drug discovery to the rigorous quality control required in manufacturing. For instance, in 2024, the global pharmaceutical market was valued at over $1.5 trillion, highlighting the immense scale and critical need for reliable analytical tools.

Agilent's offerings are indispensable for ensuring the safety and efficacy of new drugs. Their solutions are used to analyze complex biological samples, identify potential drug candidates, and monitor the manufacturing processes to meet strict regulatory standards. The biopharmaceutical sector, in particular, saw significant investment in R&D throughout 2024, underscoring the demand for cutting-edge technologies that Agilent provides.

Diagnostic laboratories and healthcare providers are crucial customers for Agilent, utilizing its advanced instruments and software for a wide array of medical testing. These entities, including hospitals and clinical research organizations, depend on Agilent's solutions for everything from routine disease diagnosis to complex genomic analysis. For example, Agilent's mass spectrometry and chromatography systems are essential tools in clinical chemistry labs for quantifying biomarkers, contributing to patient care.

Agilent's technologies directly enable these healthcare professionals to achieve accurate and timely health insights, which is paramount in patient management and treatment. In 2023, Agilent reported that its Life Sciences, Diagnostics and Applied Chemical Markets segment, which heavily serves these customers, saw significant revenue, underscoring the vital role these segments play in the company's overall performance. The demand for precise diagnostic tools continues to grow, driven by advancements in personalized medicine and the increasing prevalence of chronic diseases.

Government and private laboratories dedicated to food safety, water quality, and environmental monitoring represent a crucial customer segment for Agilent Technologies. These institutions rely heavily on Agilent's advanced instrumentation and validated methods to accurately detect a wide range of contaminants, from pesticides in produce to heavy metals in water sources.

Agilent’s solutions enable these laboratories to ensure strict compliance with national and international regulations, a vital aspect of protecting public health and the environment. For instance, Agilent's gas chromatography and mass spectrometry systems are indispensable tools for identifying trace levels of harmful substances, contributing to safer food supplies and cleaner water resources.

In 2024, the global market for food safety testing alone was estimated to be worth over $50 billion, with environmental testing markets also showing robust growth. Agilent's comprehensive portfolio directly addresses the critical needs of this expanding sector, providing the technology necessary for accurate and reliable analysis.

Academic and Government Research Institutions

Universities and government research agencies are key customers for Agilent Technologies, relying on its advanced instruments for groundbreaking scientific exploration. These institutions, including public health organizations, leverage Agilent's solutions for everything from basic research to critical public service missions. In 2024, Agilent continued to support numerous academic grants and collaborations aimed at advancing fields like genomics, proteomics, and environmental science, underscoring their commitment to scientific progress.

Agilent's instruments are indispensable for these academic and government entities, driving innovation across a wide range of scientific disciplines. Their work is foundational to developing new technologies and understanding complex biological and chemical processes. For example, Agilent's chromatography and mass spectrometry systems are frequently cited in research publications from leading universities worldwide, highlighting their impact on scientific discovery.

- Supporting Fundamental Research: Universities and government bodies use Agilent's tools for discovery-driven research.

- Public Health Initiatives: Agilent's technologies aid government agencies in monitoring and improving public health.

- Advancing Scientific Knowledge: These institutions are crucial for developing new applications and understanding scientific principles.

- Collaboration and Grants: Agilent actively partners with academic institutions through grants and shared research projects.

Applied Chemical and Materials Industries

Agilent Technologies serves the Applied Chemical and Materials Industries with critical solutions. This broad segment encompasses chemical manufacturing, petrochemical operations, and advanced materials science. Agilent's offerings are vital for ensuring product quality, optimizing production processes, and supporting cutting-edge research and development within these sectors.

For instance, in 2024, Agilent's analytical instruments and consumables are instrumental in quality control for specialty chemicals and polymers. These tools help manufacturers meet stringent regulatory standards and maintain batch-to-batch consistency, a crucial factor in industries where product performance directly impacts safety and efficacy. The company's focus on process analytical technology also aids in real-time monitoring, leading to improved yields and reduced waste in petrochemical refining.

- Quality Control: Agilent's chromatography and spectroscopy solutions are used to verify the purity and composition of chemicals and materials, ensuring they meet precise specifications.

- Process Monitoring: Real-time analytical tools enable manufacturers to track chemical reactions and material properties during production, allowing for immediate adjustments to optimize efficiency and output.

- Research & Development: Advanced instrumentation supports the discovery and characterization of new materials and chemical compounds, driving innovation in areas like advanced composites and sustainable chemistry.

- Regulatory Compliance: Agilent's validated methods and robust instruments help companies in these sectors adhere to global quality and safety regulations.

Agilent Technologies also caters to the needs of the Food and Beverage industry, providing essential tools for quality assurance and safety testing. This segment includes food manufacturers, agricultural producers, and regulatory bodies focused on consumer protection.

These customers rely on Agilent's analytical instruments to detect contaminants, verify nutritional content, and ensure compliance with food safety standards. For example, Agilent's solutions are critical in identifying pesticides, mycotoxins, and allergens in food products, safeguarding public health. In 2024, the global food safety testing market continued its upward trajectory, estimated to exceed $60 billion, underscoring the vital role of advanced analytical technologies.

| Customer Segment | Key Needs | Agilent's Solutions | Market Context (2024) |

| Food & Beverage Industry | Food safety, quality control, regulatory compliance | Chromatography, mass spectrometry, spectroscopy instruments; consumables; software | Global food safety testing market valued over $60 billion |

Cost Structure

Agilent Technologies dedicates substantial resources to Research and Development (R&D) as a core component of its cost structure. In fiscal year 2023, Agilent reported R&D expenses of $787 million, underscoring its commitment to innovation.

This significant investment fuels the development and enhancement of their advanced analytical instruments, sophisticated software solutions, and novel analytical techniques. These expenditures are vital for staying ahead in a rapidly advancing scientific landscape and meeting the dynamic requirements of their diverse customer base.

Manufacturing and production costs are a significant component of Agilent's business model, encompassing the expenses tied to creating their analytical instruments, consumables, and reagents. These costs include the price of raw materials, wages for factory workers, and the general overheads associated with running production facilities.

In 2023, Agilent reported Cost of Sales at $3.78 billion, reflecting the substantial investment in their manufacturing and production activities. Optimizing the efficiency of these operations is crucial for managing these expenses and maintaining profitability.

Agilent Technologies invests heavily in its global sales force, marketing campaigns, and participation in industry trade shows. These are crucial for customer engagement and product visibility. For fiscal year 2023, Agilent reported Selling, General, and Administrative (SG&A) expenses of $1.49 billion, a portion of which directly supports these sales and marketing efforts.

Maintaining a robust distribution network, both direct and indirect, is another significant cost. This ensures their analytical instruments and services reach a diverse customer base across scientific research, healthcare, and applied markets. These operational costs are vital for market penetration and sustained growth.

Service and Support Operations

Agilent Technologies dedicates significant resources to its Service and Support Operations, a crucial element in maintaining customer satisfaction and product longevity. These costs are directly tied to providing comprehensive customer service, expert technical support, and essential field service for instrument installation, ongoing maintenance, and timely repairs.

The expense of maintaining a global network of highly skilled service engineers and staffing dedicated support centers represents a substantial portion of Agilent's cost structure. For instance, in fiscal year 2023, Agilent reported that its service and support segment generated approximately $1.5 billion in revenue, underscoring the scale of operations and associated costs required to deliver these essential services.

- Staffing Costs: Salaries, benefits, and training for customer service representatives, technical support specialists, and field service engineers.

- Global Network Management: Costs associated with managing and equipping a worldwide team of service personnel, including travel, logistics, and local infrastructure.

- Parts and Inventory: Maintaining an inventory of spare parts for instrument maintenance and repair.

- Technology Investment: Investment in remote diagnostic tools, service management software, and digital platforms to enhance support efficiency.

Acquisition-Related Costs

Agilent's growth strategy heavily relies on acquisitions, which incur significant acquisition-related costs. These costs encompass the initial purchase price, as seen with the BioVectra acquisition, but also extend to the expenses associated with integrating the acquired business into Agilent's existing operations. These integration costs can include IT system consolidation, rebranding efforts, and severance packages for redundant roles.

These strategic investments, while substantial upfront, are designed to fuel long-term expansion and market share gains. For instance, the BioVectra acquisition, completed in 2022 for $1.1 billion, was aimed at bolstering Agilent's biopharmaceutical contract development and manufacturing capabilities. Such deals can temporarily impact earnings due to amortization of acquired intangibles and transaction-related expenses.

- Purchase Price: The upfront cash or stock consideration paid to acquire target companies.

- Integration Expenses: Costs related to merging operations, systems, and personnel, including IT, legal, and consulting fees.

- Transaction Fees: Expenses incurred for investment banking, legal advisory, and accounting services during the M&A process.

- Potential Short-Term Earnings Impact: Costs like amortization of acquired intangible assets and restructuring charges can temporarily reduce reported earnings.

Agilent's cost structure is dominated by its Cost of Sales, which was $3.78 billion in fiscal year 2023, reflecting the expenses of manufacturing its analytical instruments and consumables.

Significant investments in Research and Development ($787 million in FY2023) and Selling, General, and Administrative expenses ($1.49 billion in FY2023) are also key cost drivers, supporting innovation and market reach.

Service and Support operations, generating approximately $1.5 billion in revenue in FY2023, represent another substantial cost area, encompassing staffing, global network management, and parts inventory.

Acquisition-related costs, such as the $1.1 billion BioVectra deal in 2022, also contribute to the overall cost structure, though these are strategic investments for future growth.

| Cost Category | Fiscal Year 2023 (USD Millions) | Key Components |

| Cost of Sales | 3,780 | Raw materials, manufacturing labor, production overhead |

| Research & Development | 787 | New product development, technological advancements |

| Selling, General & Administrative | 1,490 | Sales force, marketing, administrative functions |

| Service & Support | (Revenue approx. 1,500) | Field service, technical support, parts inventory |

| Acquisitions | (e.g., BioVectra: 1,100 in 2022) | Purchase price, integration, transaction fees |

Revenue Streams

Agilent Technologies generates significant revenue through the direct sale of its sophisticated analytical and clinical laboratory instruments. This category includes high-value systems like chromatography, mass spectrometry, and advanced cell analysis platforms, forming the core of their product portfolio.

In fiscal year 2023, Agilent reported that its Life Sciences segment, which heavily features instrument sales, saw net sales of $3.56 billion. This highlights the substantial contribution of instrument hardware to the company's overall financial performance.

Agilent Technologies generates a significant and predictable income from selling consumables and reagents. These are the essential items, like columns and special chemicals, that customers need to keep using Agilent's laboratory instruments. This recurring revenue stream provides a solid foundation for the company's financial stability.

For instance, in fiscal year 2023, Agilent reported that consumables and services, which heavily feature these recurring sales, represented a substantial portion of their overall revenue, underscoring the importance of this segment. This ongoing demand for supplies ensures a consistent cash flow, making it a vital component of their business model.

Agilent Technologies generates revenue through the sale of licenses for its specialized software, such as laboratory information management systems (LIMS) and advanced data analysis tools. These software solutions are crucial for customers in managing scientific data efficiently.

The company also benefits from recurring revenue through subscription-based models for its software and cloud-based services. This approach ensures continuous income and allows Agilent to provide ongoing support and updates to its clients.

For the fiscal year 2023, Agilent reported that its software and services segment, which includes these revenue streams, saw significant growth. Specifically, the company's order growth in this area was approximately 5% in the fourth quarter of fiscal year 2023, indicating the increasing importance of software and subscriptions to its overall financial performance.

Service Contracts and Maintenance Fees

Agilent Technologies secures a steady income stream through service contracts and maintenance fees, covering its extensive range of analytical instruments. These agreements are crucial for ensuring instrument reliability and maximizing customer uptime, providing a predictable revenue base.

- Service Contracts: Agilent offers various service plans, from basic maintenance to comprehensive support, ensuring optimal performance of laboratory equipment.

- Extended Warranties: Customers can purchase extended warranties to cover their instruments beyond the initial warranty period, offering peace of mind and predictable repair costs.

- Maintenance Agreements: These agreements often include scheduled preventative maintenance, calibration, and access to technical support, contributing to consistent revenue.

- Revenue Contribution: In fiscal year 2023, Agilent reported that its services segment, which includes these offerings, generated approximately $1.5 billion in revenue, highlighting the significance of this revenue stream.

Biopharma Contract Development and Manufacturing Services

Agilent Technologies has strategically broadened its revenue streams by venturing into Biopharma Contract Development and Manufacturing Organization (CDMO) services. This expansion, significantly bolstered by its acquisition of BioVectra, positions Agilent to capitalize on the burgeoning biopharmaceutical sector, especially in the specialized area of oligonucleotide manufacturing.

This move diversifies Agilent's revenue base beyond its traditional instrument and consumables offerings. The CDMO segment taps into the increasing demand for outsourced development and manufacturing solutions within the life sciences industry. For instance, the global CDMO market was valued at approximately $150 billion in 2023 and is projected to grow substantially in the coming years, driven by the complexity of new drug modalities.

- Diversified Revenue: CDMO services add a new, high-growth revenue pillar for Agilent.

- Market Expansion: Entry into the biopharmaceutical CDMO market, particularly for oligonucleotides, opens up significant growth opportunities.

- Strategic Acquisition: The acquisition of BioVectra was a key enabler for this new revenue stream, bringing specialized expertise and manufacturing capabilities.

- Industry Growth: The biopharmaceutical outsourcing market is experiencing robust growth, driven by innovation and the need for specialized manufacturing.

Agilent Technologies derives revenue from instrument sales, consumables, software, services, and Biopharma CDMO offerings. Instrument sales form a core, while consumables provide recurring income. Software and services ensure ongoing customer engagement and predictable revenue.

The company's strategic expansion into Biopharma CDMO services, notably through the BioVectra acquisition, diversifies its income and taps into the growing life sciences outsourcing market.

| Revenue Stream | FY23 Contribution (Approximate) | Key Drivers |

|---|---|---|

| Instrument Sales | $3.56 billion (Life Sciences Segment) | High-value analytical and clinical lab equipment |

| Consumables & Reagents | Significant portion of overall revenue | Recurring demand for instrument operation |

| Software & Subscriptions | ~5% order growth (Q4 FY23) | LIMS, data analysis tools, cloud services |

| Services (Contracts, Maintenance) | ~$1.5 billion | Instrument upkeep, technical support, uptime |

| Biopharma CDMO | Emerging, bolstered by BioVectra | Oligonucleotide manufacturing, outsourced development |

Business Model Canvas Data Sources

The Agilent Technologies Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research reports, and internal strategic planning documents. These diverse data sources ensure each element of the canvas accurately reflects the company's operational realities and market positioning.