Agenus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agenus Bundle

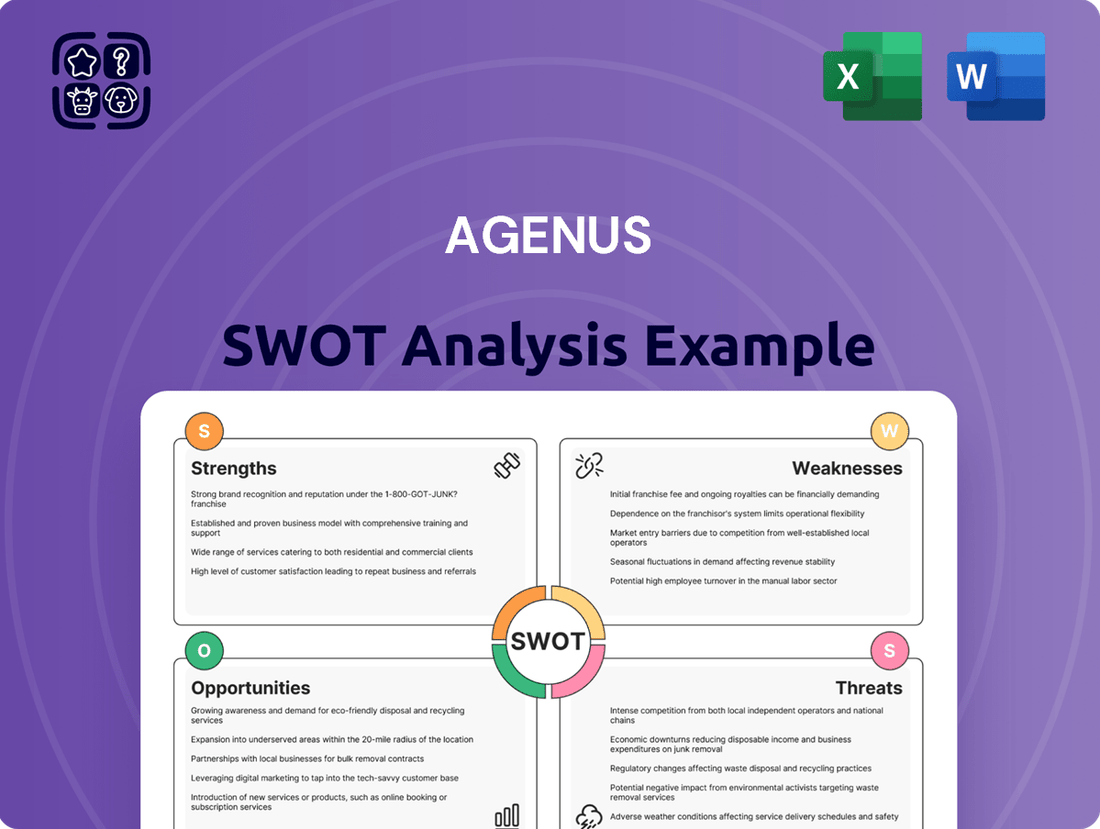

Agenus's SWOT analysis reveals promising strengths in its innovative immunotherapy pipeline and strategic partnerships, but also highlights critical challenges in clinical trial progression and market competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate the complex biotech landscape.

Want the full story behind Agenus's potential and pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Agenus's proprietary Retrocyte Display platform is a cornerstone of its strength, enabling the efficient discovery and development of novel antibody-based therapeutics. This in-house technology allows for the creation of a robust pipeline of immuno-oncology candidates, giving them a competitive edge.

The company's unique approach, powered by its platforms, facilitates the development of differentiated mechanisms designed to amplify immune responses against cancer. This technological advantage is crucial for creating therapies with distinct advantages in a crowded market.

The botensilimab/balstilimab (BOT/BAL) combination is showing remarkable results, especially in difficult-to-treat cancers like microsatellite stable (MSS) colorectal cancer, often referred to as 'cold' tumors. This is a significant advantage for Agenus.

Recent presentations at key medical conferences in 2024 and 2025 have highlighted the program's ability to achieve lasting responses and impressive survival rates in patients who haven't benefited from standard therapies. This clinical success is a major strength for Agenus's primary drug candidate.

Agenus's strength lies in its robust and diverse pipeline, extending well beyond its key BOT/BAL programs. This comprehensive collection includes a variety of immunological agents such as checkpoint inhibitors, immune activators, and tumor microenvironment conditioning agents. Furthermore, their ownership of MiNK Therapeutics adds a significant cell therapy component to this broad portfolio.

This extensive range of therapeutic candidates across different modalities serves to significantly de-risk the company's development strategy. By not solely relying on a single product, Agenus cultivates multiple pathways for future growth and potential commercial success. For instance, as of early 2024, Agenus had multiple clinical-stage assets beyond BOT/BAL, including candidates targeting novel immune checkpoints and pathways.

Strategic Collaborations and Partnerships

Agenus has a strong track record of forging strategic collaborations with major pharmaceutical and biotechnology companies. Recent partnerships, such as those with Zydus Lifesciences and Noetik, build upon a history of successful alliances with giants like GlaxoSmithKline, Merck, Incyte, and Janssen. These agreements are vital, bringing in significant financial backing and expanding Agenus's operational capabilities.

These partnerships are more than just financial infusions; they grant Agenus access to critical resources and expertise that accelerate its drug development pipeline. For instance, collaborations can provide advanced manufacturing capabilities and entry into wider global markets. They also facilitate the integration of cutting-edge technologies, such as AI-driven biomarker discovery, which is crucial for identifying and developing novel cancer therapies.

- Financial Support: Collaborations provide essential capital for research and development, de-risking early-stage projects.

- Market Access: Partnerships with established players offer Agenus pathways to broader patient populations and commercialization channels.

- Technological Advancement: Alliances enable access to specialized expertise and innovative platforms, like AI for biomarker identification, enhancing therapeutic discovery.

- Operational Synergies: Collaborations can include manufacturing support and shared development responsibilities, streamlining the path to market.

Experienced Leadership and Strategic Focus

Agenus benefits from a seasoned leadership team boasting significant experience within the pharmaceutical and biotechnology industries, which bolsters its strategic direction. This depth of knowledge is crucial for navigating the complex landscape of drug development and commercialization.

The company's strategic focus is further evidenced by recent key personnel additions, including a Chief Development Officer specifically tasked with advancing its BOT/BAL programs. This appointment clearly signals a commitment to prioritizing these core assets and expediting their journey toward regulatory submission and market availability.

- Experienced Leadership: The management team possesses deep industry knowledge, critical for effective decision-making in biotech.

- Strategic Prioritization: Recent hires demonstrate a clear focus on advancing key programs like BOT/BAL.

- Regulatory Pathway Acceleration: The company aims to speed up the process for getting its core products to market.

Agenus's proprietary Retrocyte Display platform is a significant strength, facilitating the efficient discovery of novel antibody-based therapeutics and building a robust immuno-oncology pipeline. This in-house technology allows for the creation of differentiated mechanisms designed to amplify immune responses against cancer, providing a competitive edge in a crowded market.

The botensilimab/balstilimab (BOT/BAL) combination is demonstrating remarkable efficacy, particularly in difficult-to-treat cancers like microsatellite stable (MSS) colorectal cancer. Presentations in 2024 and 2025 have showcased lasting responses and impressive survival rates in patients who previously did not respond to standard therapies, highlighting the clinical success of this key asset.

Agenus possesses a broad and diversified pipeline beyond its core BOT/BAL programs, encompassing checkpoint inhibitors, immune activators, and tumor microenvironment modulators. The acquisition of MiNK Therapeutics further strengthens this with a cell therapy component, significantly de-risking its development strategy by not relying on a single product for future growth.

Strategic collaborations are a key strength, with recent partnerships with companies like Zydus Lifesciences and Noetik building on a history of alliances with major players such as GlaxoSmithKline and Merck. These agreements provide vital financial backing and enhance operational capabilities, accelerating drug development and expanding market access.

| Platform | Key Program | Clinical Stage (as of early 2024) | Collaboration Examples |

|---|---|---|---|

| Retrocyte Display | BOT/BAL Combination | Multiple clinical trials ongoing | Zydus Lifesciences, Noetik, GlaxoSmithKline, Merck |

| Other Immuno-Oncology Candidates | Various stages, including early clinical | Incyte, Janssen | |

| Cell Therapy (via MiNK Therapeutics) | Various Cell Therapy Candidates | Early to mid-stage clinical development |

What is included in the product

Delivers a strategic overview of Agenus’s internal and external business factors, highlighting its strengths in immunotherapy, weaknesses in development timelines, opportunities in novel drug targets, and threats from competition and regulatory hurdles.

Agenus's SWOT analysis provides a clear framework to identify and leverage internal strengths and external opportunities, mitigating the pain of uncertainty in the competitive biotech landscape.

Weaknesses

Agenus has faced a persistent challenge with consistent net losses, reporting a substantial $232.3 million for the full year 2024. This ongoing financial strain underscores the inherent difficulties in the capital-intensive biotechnology industry, where research and development costs are significant.

While the first quarter of 2025 showed an improvement with a net loss of $26.4 million, down from the previous year's comparable period, it still reflects the company's struggle to reach profitability. These continued losses place considerable pressure on Agenus's financial stability, necessitating stringent resource management and a clear path toward revenue generation.

Agenus's declining cash position presents a significant weakness. The company's consolidated cash balance stood at $18.5 million at the close of Q1 2025, a notable decrease from $40.4 million at the end of 2024. This reduction underscores the ongoing need for Agenus to actively pursue additional funding or explore asset monetization strategies to maintain its operational capacity and progress its clinical development programs.

A significant portion of Agenus's reported revenue stems from non-cash royalty agreements, signaling a reliance on licensing rather than direct product sales. This structure highlights the company's ongoing development stage, as substantial product-driven revenue remains elusive. For instance, in the first quarter of 2024, Agenus reported $1.2 million in royalty revenue, a key component of its total revenue, but this is largely derived from past collaborations rather than current product commercialization.

Past Regulatory Setbacks

Agenus has encountered significant hurdles with regulatory agencies, notably the FDA's decision to prevent accelerated approval for BOT/BAL in MSS colorectal cancer, citing insufficient Phase 2 data. These regulatory roadblocks can cause substantial delays in bringing products to market, inflate development expenditures, and create apprehension among investors. Successfully navigating intricate regulatory landscapes remains a critical factor for Agenus's future growth.

These past regulatory setbacks highlight a key weakness. For instance, the FDA's stance on BOT/BAL in MSS colorectal cancer, which was based on Phase 2 data, directly impacted Agenus's commercialization timeline. Such events can lead to:

- Delayed product launches

- Increased R&D spending to generate further data

- Erosion of investor confidence, potentially affecting stock performance and access to capital

High Operational Cash Burn

Agenus faces a significant challenge with its high operational cash burn, a persistent concern despite ongoing efforts to curb spending. The company's strategic goal is to reduce this burn rate to an annualized figure of around $50 million by the middle of 2025. This ongoing expenditure is largely driven by the substantial investments required for its research and development pipeline, particularly for late-stage clinical trials.

The continuous need for capital to fund these critical development stages puts pressure on Agenus's financial resources. Effectively managing and further decreasing this cash burn is paramount to ensuring the company has a sufficient financial runway to achieve its developmental milestones.

- High Operational Cash Burn: Agenus continues to experience a significant operational cash burn, a key weakness.

- Target Burn Rate: The company aims to reduce its annualized operational cash burn to approximately $50 million by mid-2025.

- R&D Investment: Sustaining costly research and development, especially for late-stage clinical trials, is a major driver of this burn.

- Financial Runway: Efficiently managing and reducing the cash burn rate is crucial for extending the company's financial runway.

Agenus's reliance on royalty revenue, rather than direct product sales, highlights its developmental stage and the difficulty in generating substantial commercial income. For example, in Q1 2024, royalty revenue was a key component of total revenue, but this income is primarily from past collaborations, not current product commercialization.

The company's ongoing net losses, totaling $232.3 million for the full year 2024, demonstrate a persistent struggle for profitability. While Q1 2025 saw a reduced net loss of $26.4 million, this still indicates a significant need to improve financial performance and secure a sustainable revenue model.

A significant weakness for Agenus is its declining cash position, with consolidated cash falling to $18.5 million by the end of Q1 2025, down from $40.4 million at the end of 2024. This reduction necessitates active pursuit of additional funding to maintain operations and advance its clinical programs.

Regulatory setbacks, such as the FDA's decision against accelerated approval for BOT/BAL in MSS colorectal cancer due to insufficient Phase 2 data, represent critical weaknesses. These issues can cause substantial delays in market entry, increase development costs, and negatively impact investor confidence.

| Financial Metric | Full Year 2024 | Q1 2025 |

| Net Loss | $232.3 million | $26.4 million |

| Consolidated Cash | $40.4 million (End of 2024) | $18.5 million (End of Q1 2025) |

| Royalty Revenue (Q1 2024) | $1.2 million | N/A |

Same Document Delivered

Agenus SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Agenus has a clear opportunity to leverage accelerated approval pathways for its BOT/BAL combination therapy, especially for challenging conditions such as metastatic colorectal cancer. This expedited route could significantly shorten the time to market, potentially unlocking substantial revenue streams sooner than anticipated.

Positive clinical trial results and active engagement with regulatory bodies like the FDA and EMA bolster the prospects for a successful accelerated approval filing. This regulatory momentum is a critical component of Agenus's strategic plan for the near future.

Agenus's BOT/BAL program demonstrates promising activity in various 'cold' tumors, such as pancreatic cancer, gastroesophageal cancer, sarcomas, and triple-negative breast cancer. This broad clinical utility presents a significant opportunity for market expansion.

By initiating further clinical trials and seeking regulatory approvals for these additional indications, Agenus can tap into a much larger patient base and address critical unmet medical needs. This diversification is key to unlocking substantial long-term value for the company.

Agenus is actively pursuing strategic partnerships and licensing deals, aiming to secure substantial capital and enhance its operational capabilities. These collaborations are crucial for funding ongoing research and development initiatives.

A prime example of this strategy is the recent agreement with Zydus Lifesciences, which involved asset sales and a royalty arrangement. This partnership is expected to provide Agenus with both immediate financial benefits and long-term revenue streams.

Such strategic alliances offer a pathway to reduce financial risk, accelerate product development timelines, and expand the company's global market presence. This approach diversifies funding sources beyond traditional equity financing.

Monetization of Non-Core Assets

Agenus is actively monetizing non-core assets to strengthen its financial standing. A prime example is the strategic sale of its manufacturing infrastructure in California, a move designed to boost its cash reserves and trim operational costs. This allows the company to concentrate its efforts and capital on advancing its core drug development initiatives.

This strategy of divesting non-essential assets is crucial for generating non-dilutive capital, meaning funds raised without issuing new shares that could dilute existing shareholder ownership. By freeing up capital, Agenus gains greater financial flexibility.

The ongoing monetization of assets offers several key benefits:

- Enhanced Cash Position: Selling assets directly increases the company's available cash.

- Reduced Operating Expenses: Shedding infrastructure lowers ongoing maintenance and operational overheads.

- Focus on Core Business: Resources are redirected to high-priority drug development projects.

- Improved Balance Sheet: Monetization can lead to a stronger financial profile, potentially attracting further investment.

Advancements in AI-Enabled Biomarker Discovery

Agenus's collaboration with Noetik to develop AI-powered predictive biomarkers for BOT/BAL is a prime opportunity to enhance precision immunotherapy. This strategic move aims to speed up the identification of patients who will respond best to Agenus's therapies by utilizing virtual cell models and extensive tumor data.

By harnessing advanced AI, Agenus can refine patient selection for its clinical trials and treatments. This approach is expected to boost the effectiveness of their immunotherapies and streamline the development process. For instance, in 2024, the global AI in drug discovery market was valued at approximately $1.5 billion and is projected to grow significantly, highlighting the increasing adoption of such technologies.

- Accelerated Patient Identification: AI can sift through vast datasets to pinpoint patients with specific genetic or molecular profiles likely to benefit from Agenus's treatments.

- Improved Clinical Trial Success Rates: By selecting more responsive patient populations, the likelihood of positive trial outcomes increases, potentially reducing development timelines and costs.

- Enhanced Therapeutic Efficacy: Targeting treatments to the right patients ensures that the therapies are used where they are most likely to be effective, maximizing patient benefit.

Agenus's BOT/BAL combination therapy shows promise in 'cold' tumors, potentially broadening its market reach beyond current indications. The company's focus on strategic partnerships, such as the one with Zydus Lifesciences, is designed to inject capital and accelerate development.

Monetizing non-core assets, like the California manufacturing facility, bolsters Agenus's cash reserves and allows for greater focus on its core drug development pipeline. The collaboration with Noetik to implement AI for predictive biomarkers is a key opportunity to refine patient selection and improve immunotherapy outcomes.

| Opportunity Area | Key Initiative | Potential Impact | Data Point/Example |

|---|---|---|---|

| Regulatory Pathways | Leveraging accelerated approval for BOT/BAL | Faster market entry, earlier revenue generation | Focus on metastatic colorectal cancer and other challenging indications. |

| Market Expansion | Treating 'cold' tumors | Access to larger patient populations, addressing unmet needs | Pancreatic cancer, gastroesophageal cancer, sarcomas, triple-negative breast cancer. |

| Strategic Partnerships | Securing capital and operational enhancement | Reduced financial risk, accelerated development, global reach | Zydus Lifesciences agreement for asset sales and royalties. |

| Asset Monetization | Divesting non-core assets | Increased cash, reduced expenses, focus on core business | Sale of California manufacturing infrastructure. |

| AI Integration | AI-powered predictive biomarkers with Noetik | Improved precision immunotherapy, enhanced patient selection | Global AI in drug discovery market valued at ~$1.5 billion in 2024. |

Threats

The immuno-oncology landscape is fiercely competitive, with major pharmaceutical players and well-capitalized biotech companies actively developing comparable treatments. This crowded market environment can exert downward pressure on pricing, complicate efforts to gain market traction, and necessitate substantial differentiation to secure market share.

Even with encouraging clinical trial results, Agenus faces significant hurdles in securing regulatory approval for its innovative treatments. The company's history with the FDA indicates that expedited approval pathways are not a certainty, and shifts in regulatory personnel or directives could introduce unforeseen complications to their timelines and submission demands.

These potential delays pose a substantial risk to Agenus's financial health and investor confidence. For instance, if a key therapy's approval is pushed back by a year, it could mean a significant loss of projected revenue, impacting cash flow and the ability to fund ongoing research and development. As of early 2024, Agenus reported approximately $100 million in cash and cash equivalents, making timely revenue generation from approved products crucial.

Agenus, as a clinical-stage biotech, faces a significant hurdle in its need for substantial capital. This funding is critical for advancing its research, conducting vital clinical trials, and ultimately bringing its therapies to market. As of the first quarter of 2024, Agenus reported a cash and cash equivalents balance of approximately $74.9 million, which, while substantial, must support ongoing operations and development pipelines.

Clinical Trial Failures

Clinical trial failures represent a significant threat to Agenus. The company's future success, particularly with its BOT/BAL pipeline, is directly tied to positive results in its ongoing and upcoming studies. A setback, such as unexpected side effects, insufficient efficacy, or failing to meet key trial objectives, could drastically alter Agenus's trajectory, potentially causing substantial drops in its stock value and even leading to the abandonment of promising programs.

The inherent risks associated with clinical trials cannot be overstated. For instance, in the broader oncology drug development landscape, the failure rate for drugs entering Phase 1 trials is estimated to be around 90%. For Agenus, this translates to a substantial hurdle for each candidate. The company's financial health and investor confidence are particularly vulnerable to these outcomes, as demonstrated by historical market reactions to clinical trial news across the biopharmaceutical sector.

- High Failure Rates: Historically, a large percentage of drug candidates fail during clinical development, with many setbacks occurring in later-stage trials.

- Impact on Valuation: Negative clinical trial results can lead to sharp declines in Agenus's market capitalization, affecting its ability to secure further funding.

- Pipeline Dependency: Agenus's reliance on specific pipeline assets, like BOT/BAL, means that failures in these key programs pose a more significant threat than for diversified companies.

- Regulatory Hurdles: Even with positive trial data, regulatory approval is not guaranteed, adding another layer of risk to the development process.

Market Acceptance and Reimbursement Challenges

Securing widespread market acceptance and favorable reimbursement for Agenus's novel immuno-oncology treatments remains a significant hurdle, even post-regulatory approval. Payers often implement restrictions based on cost-effectiveness analyses or specific patient demographics, which can directly impede patient access and, consequently, revenue generation. For instance, in 2024, the average cost of novel cancer therapies can exceed $150,000 per year, placing immense pressure on reimbursement decisions.

Agenus must proactively demonstrate the clear clinical superiority and tangible economic advantages of its therapies to achieve broad market penetration in a crowded oncology landscape. This involves robust real-world evidence generation and clear value propositions for both healthcare providers and payers. The competitive environment in immuno-oncology is intense, with numerous established players and emerging biotechs vying for market share throughout 2024 and into 2025.

- Market Acceptance: Overcoming physician and patient inertia towards new treatment modalities is crucial.

- Reimbursement Restrictions: Payers may limit coverage to specific patient subgroups or require extensive prior authorization.

- Cost-Effectiveness Data: Demonstrating a favorable cost-benefit ratio compared to existing standards of care is essential for payer negotiations.

- Value Demonstration: Agenus needs to show improved outcomes and reduced overall healthcare costs to gain payer confidence.

The intense competition within the immuno-oncology sector presents a significant threat, as Agenus must differentiate its offerings in a crowded market. This competitive pressure can lead to pricing challenges and make it difficult to capture substantial market share, especially with large pharmaceutical companies also developing similar treatments. As of early 2024, Agenus was navigating this landscape with approximately $74.9 million in cash and cash equivalents, underscoring the need for efficient market penetration to sustain operations and fund further development.

Clinical trial failures represent a critical risk for Agenus, given its reliance on pipeline assets like BOT/BAL. A single negative outcome in a key study could severely impact its valuation and future prospects. For context, the biopharmaceutical industry generally sees a high failure rate, with estimates suggesting around 90% of drug candidates entering Phase 1 trials do not reach market approval. This inherent risk directly affects investor confidence and the company's ability to secure necessary capital for ongoing research and development.

Securing broad market acceptance and favorable reimbursement for Agenus's novel therapies is another substantial threat. Payers often impose restrictions based on cost-effectiveness, potentially limiting patient access and revenue. With the average cost of novel cancer therapies in 2024 exceeding $150,000 annually, demonstrating clear clinical superiority and economic advantages is paramount for Agenus to navigate these payer negotiations effectively and achieve widespread adoption of its treatments.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Agenus's official financial filings, comprehensive market intelligence reports, and expert commentary from industry analysts to ensure a robust and accurate SWOT assessment.