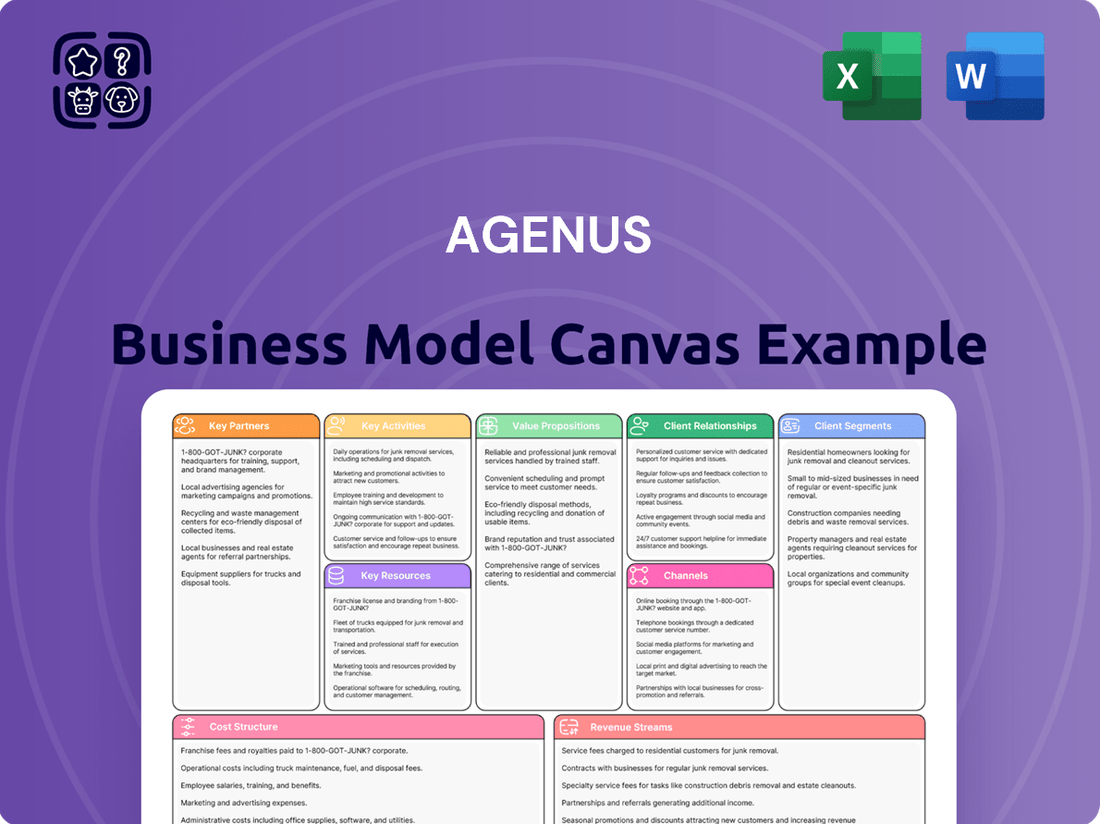

Agenus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agenus Bundle

Unlock the strategic core of Agenus's groundbreaking approach to cancer immunotherapy. This comprehensive Business Model Canvas dissects how they innovate, partner, and deliver value to patients and stakeholders. Discover the intricate details of their revenue streams and cost structure to understand their competitive edge.

Ready to gain a competitive advantage? Our full Business Model Canvas for Agenus provides a detailed, section-by-section breakdown of their operations, from key resources to customer relationships. Download it now to accelerate your own strategic planning and market analysis.

Partnerships

Agenus actively pursues strategic collaborations with major pharmaceutical firms. These alliances are vital for co-development, licensing, and eventual commercialization of its promising immuno-oncology assets.

Such partnerships are instrumental in securing essential funding, accessing specialized expertise, and gaining broader market reach. This accelerates the journey of therapies, like BOT/BAL, from development to patient access. For instance, Agenus recently partnered with Zydus Lifesciences, highlighting its strategy to leverage external capabilities.

Agenus's manufacturing strategy hinges on key partnerships, notably its transition of US biologics CMC facilities to a fee-for-service model with Zydus Lifesciences. This strategic move positions Agenus as Zydus's inaugural BioCDMO client, ensuring exclusive manufacturing of BOT/BAL.

This partnership provides Agenus with secured long-term manufacturing without the burden of operational risk. Furthermore, it unlocks significant upfront capital and potential milestone payments, bolstering Agenus's financial flexibility.

Agenus actively cultivates Research and Development Alliances with other biotechnology firms and leading academic institutions. These strategic collaborations are designed to expand the therapeutic applications of Agenus' existing clinical assets and to investigate novel combination strategies. For instance, partnerships aim to tackle immunosuppression within the tumor microenvironment, thereby enhancing the overall efficacy of immunotherapy treatments.

Key R&D alliances include those with Targovax, Oxford BioTherapeutics, and Immunogenesis. These collaborations are crucial for Agenus' strategy to broaden its pipeline and explore synergistic effects of its technologies. In 2024, Agenus continued to leverage these partnerships to accelerate the development of its immuno-oncology candidates, focusing on unmet needs in cancer treatment.

AI and Predictive Biomarker Collaborations

Agenus is forging key partnerships with AI and technology pioneers, including a notable collaboration with Noetik. This alliance focuses on developing sophisticated AI-enabled predictive biomarkers.

These collaborations leverage advanced computational models and extensive multimodal tumor data. The goal is to pinpoint patients who are most likely to respond positively to immunotherapies such as BOT/BAL, thereby accelerating the advancement of precision immunotherapy.

- AI-driven biomarker development

- Partnerships with tech leaders like Noetik

- Utilizing multimodal tumor data for patient stratification

- Accelerating precision immunotherapy

Royalty and Milestone Monetization Partners

Agenus actively monetizes its intellectual property through strategic partnerships focused on future royalty and milestone payments. These agreements provide crucial non-dilutive capital to fuel ongoing research and development.

A notable example is the 2020 agreement with Ligand Pharmaceuticals, where Agenus sold a portion of future royalties and milestones from six partnered assets. This included a share of potential royalties from BOT/BAL sales, demonstrating a clear strategy to unlock value from its pipeline.

- Monetization Strategy: Agenus partners with entities to sell future royalty streams and milestone payments from its partnered assets.

- Ligand Pharmaceuticals Deal: In 2020, Agenus secured funding by divesting a percentage of future royalties and milestones from six partnered assets, including a stake in BOT/BAL sales.

- Capital for Development: This approach provides essential capital to support ongoing clinical trials and the advancement of its innovative cancer therapies.

Agenus's Key Partnerships are multifaceted, encompassing collaborations with major pharmaceutical companies for co-development and commercialization, as seen with its BOT/BAL assets. These alliances are critical for funding, expertise, and market access, exemplified by the Zydus Lifesciences partnership which also secured Agenus's manufacturing.

Furthermore, Agenus engages in R&D alliances with biotech firms and academic institutions, such as Targovax and Oxford BioTherapeutics, to broaden its pipeline and explore synergistic therapies. The company also partners with technology leaders like Noetik to develop AI-driven predictive biomarkers for precision immunotherapy, leveraging extensive tumor data.

Agenus also monetizes its intellectual property through partnerships, like the 2020 deal with Ligand Pharmaceuticals, to sell future royalties and milestones, generating non-dilutive capital for its ongoing research and development efforts.

| Partner Type | Example Partner | Purpose | Key Benefit |

|---|---|---|---|

| Pharma Co-development | Zydus Lifesciences | Co-development, Licensing, Commercialization, Manufacturing | Secured manufacturing, upfront capital, milestone payments |

| R&D Alliance | Targovax, Oxford BioTherapeutics | Pipeline expansion, novel combination strategies | Accelerated development, exploration of synergistic effects |

| Technology Partnership | Noetik | AI-driven biomarker development | Precision immunotherapy, patient stratification |

| IP Monetization | Ligand Pharmaceuticals | Sale of future royalties and milestones | Non-dilutive capital for R&D |

What is included in the product

A detailed breakdown of Agenus's approach to developing and commercializing immuno-oncology therapies, covering its target patient populations, research and development pipeline, and strategic partnerships.

This model highlights Agenus's core value proposition of innovative cancer treatments, its distribution channels through clinical trials and potential commercialization, and its revenue streams from product sales and collaborations.

Agenus's Business Model Canvas acts as a pain point reliever by visually mapping out their complex immunotherapy development, clarifying value propositions and customer segments for improved strategic focus.

Activities

Agenus's key activities in discovery and preclinical development center on identifying new targets for immuno-oncology and advancing antibody-based therapies, cancer vaccines, and cell therapies through early-stage research and testing. This rigorous process aims to pinpoint promising drug candidates for further development.

The company utilizes its proprietary platforms to construct a strong pipeline of potential treatments, a critical step in bringing innovative cancer therapies to market. For example, in 2024, Agenus continued to advance its preclinical programs, with a focus on optimizing lead candidates for IND-enabling studies.

Agenus's key activity centers on the meticulous design, execution, and oversight of multi-phase clinical trials for its innovative drug candidates, notably the combination of botensilimab and balstilimab (BOT/BAL).

These trials are specifically designed to rigorously assess the safety and effectiveness of these novel therapies across a spectrum of challenging cancer indications, including microsatellite stable (MSS) colorectal cancer, pancreatic cancer, and gastroesophageal cancer.

For instance, Agenus reported in early 2024 that botensilimab and balstilimab demonstrated promising objective response rates in MSS colorectal cancer patients, with data from ongoing trials continuing to be pivotal for future regulatory submissions.

Agenus's key activities in regulatory affairs involve proactive engagement with agencies like the FDA to ensure clinical trial designs meet regulatory standards and to explore expedited approval pathways. This includes the meticulous preparation and submission of Biologics License Applications (BLAs) for their novel therapies.

A significant focus is placed on the regulatory strategy for their BOT/BAL program, aiming to streamline the path to market for these promising treatments. The company dedicates substantial resources to navigating complex regulatory requirements, a critical step in bringing innovative cancer immunotherapies to patients.

Strategic Business Development and Partnering

Agenus actively pursues strategic alliances to advance its pipeline, focusing on co-development, manufacturing, and commercialization efforts. These partnerships are vital for broadening market reach and accessing specialized capabilities. For instance, in 2024, the company announced a collaboration leveraging AI for biomarker discovery, aiming to enhance clinical trial efficiency and patient selection.

Securing external funding and expertise through these collaborations is a cornerstone of Agenus's strategy. By teaming up with other entities, Agenus can de-risk development programs and accelerate the journey from research to market. Recent agreements highlight a commitment to building a robust network for both manufacturing and innovative research approaches.

- Co-development and Commercialization Partnerships: Agenus forms strategic alliances to share the costs and risks associated with drug development and to expand market access for its therapies.

- Manufacturing Collaborations: The company engages in partnerships to secure reliable and scalable manufacturing capabilities, ensuring its product candidates can be produced efficiently.

- AI-Enabled Biomarker Discovery: A key focus in 2024 has been on leveraging artificial intelligence through partnerships to identify novel biomarkers, which can improve patient stratification and treatment outcomes.

- Global Footprint Expansion: Strategic partnering is instrumental in Agenus's efforts to extend its operational and commercial presence into new geographic regions.

Manufacturing and Supply Chain Optimization

Agenus actively manages the manufacturing of its innovative biological drug candidates, a critical component of its business model. This involves a strategic focus on advancing its biologics Chemistry, Manufacturing, and Controls (CMC) capabilities to ensure the consistent production of high-quality therapies.

The company prioritizes maintaining robust production processes, whether through its internal facilities or by forging key external partnerships. This dual approach guarantees a reliable supply chain for both ongoing clinical trials and anticipated future commercial needs.

A significant recent development underscoring this commitment to optimization is Agenus's strategic deal with Zydus Lifesciences. This collaboration is designed to enhance manufacturing efficiency and expand production capacity for its promising oncology pipeline, further solidifying its operational backbone.

- Manufacturing Oversight: Agenus oversees the production of its biological drug candidates, including the development and scaling of its biologics CMC capabilities.

- Quality Assurance: Ensuring the high quality of therapies for clinical trials and commercial supply is paramount, achieved through internal expertise and strategic external collaborations.

- Strategic Partnerships: The company leverages partnerships, such as the recent agreement with Zydus Lifesciences, to optimize manufacturing processes and expand capacity.

Agenus's key activities encompass the entire lifecycle of drug development, from initial discovery and preclinical research to robust clinical trial execution and regulatory navigation. This includes leveraging proprietary platforms to build a strong pipeline, with a notable focus in 2024 on advancing preclinical programs for IND-enabling studies and optimizing lead candidates. The company also actively manages manufacturing operations and strategic partnerships to ensure efficient production and broader market access.

| Key Activity | Description | 2024 Focus/Data Point |

| Discovery & Preclinical Development | Identifying targets and advancing antibody-based therapies, cancer vaccines, and cell therapies. | Optimizing lead candidates for IND-enabling studies. |

| Clinical Trials | Designing and executing multi-phase trials for novel drug candidates like BOT/BAL. | Demonstrated promising objective response rates in MSS colorectal cancer patients with BOT/BAL. |

| Regulatory Affairs | Engaging with agencies and preparing submissions for expedited approval pathways. | Streamlining regulatory strategy for the BOT/BAL program. |

| Strategic Partnerships | Forming alliances for co-development, manufacturing, and commercialization. | Announced collaboration leveraging AI for biomarker discovery. |

| Manufacturing | Managing production of biological drug candidates and advancing CMC capabilities. | Strategic deal with Zydus Lifesciences to enhance manufacturing efficiency. |

What You See Is What You Get

Business Model Canvas

The Agenus Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the final deliverable, ensuring no surprises in content or structure. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for your strategic planning and analysis.

Resources

Agenus's proprietary technology platforms are the engine driving its innovative immuno-oncology pipeline. These advanced systems are specifically designed for the discovery and development of novel antibody-based therapeutics, personalized cancer vaccines, and cutting-edge cell therapies. This technological foundation provides Agenus with a significant competitive advantage in the rapidly evolving field of cancer treatment.

Agenus's intellectual property portfolio, a cornerstone of its business model, encompasses a robust collection of patents and trade secrets. These protections are specifically tied to its promising drug candidates, such as botensilimab and balstilimab, as well as its proprietary development processes. This legal shield is vital for safeguarding its innovative therapeutic approaches and securing a distinct competitive edge in the biopharmaceutical landscape.

The strength of this intellectual property portfolio directly fuels the value derived from Agenus's licensing and collaboration agreements. By holding exclusive rights to its novel therapies and the technologies used to develop them, the company can forge strategic partnerships that generate revenue and accelerate the advancement of its drug pipeline. This forms a critical component of its strategy for commercializing its research and development efforts.

Agenus's clinical pipeline, especially its BOT/BAL combination therapy, is a core asset. This represents a significant resource, backed by accumulating robust clinical data.

The data showcases the efficacy and safety of their treatments across various cancer types. This evidence is crucial for supporting future regulatory submissions and eventual commercialization efforts.

As of mid-2024, Agenus reported positive interim data from its Phase 2 trial of BOT/BAL in patients with microsatellite stable (MSS) colorectal cancer, demonstrating a notable objective response rate.

Scientific and Medical Talent

Agenus's most critical resources are its highly skilled scientific and medical talent. These individuals are the engine behind the company's immuno-oncology advancements, encompassing drug discovery, meticulous clinical trial design, and navigating complex regulatory pathways. Their collective expertise is indispensable for pushing Agenus's innovative therapeutic programs forward.

The company's success hinges on the deep knowledge and experience of its researchers and clinical development teams. This human capital is not just a resource; it's the foundation upon which Agenus builds its future in cancer treatment. For instance, in 2024, Agenus continued to invest heavily in its scientific workforce, recognizing that specialized talent is paramount for competitive advantage in the biotech sector.

- Expertise in Immuno-Oncology: Agenus employs leading scientists with specialized knowledge in harnessing the immune system to fight cancer.

- Clinical Development Prowess: The company relies on experienced teams for designing and executing robust clinical trials, crucial for bringing new therapies to market.

- Regulatory Affairs Acumen: Skilled professionals are essential for navigating the stringent regulatory landscape, ensuring compliance and timely approvals.

- Innovation Driver: This scientific and medical talent is directly responsible for the discovery and development of Agenus's novel cancer therapies.

Financial Capital and Strategic Investments

Financial capital is the bedrock of Agenus's operations, enabling the company to pursue its ambitious research and development pipeline. This includes significant cash reserves, bolstered by equity investments from strategic partners and the successful execution of past transactions. These resources are absolutely critical for funding the lengthy and expensive processes of preclinical research, extensive clinical trials, and the day-to-day operational costs inherent in a biotechnology firm.

Recent financial maneuvers highlight the importance of these capital streams. For instance, the company secured a substantial $75 million upfront payment, along with an additional $16 million equity investment from Zydus. Such infusions are not merely supplementary; they are vital lifelines that allow Agenus to maintain its operational momentum and push forward its most promising therapeutic candidates through development stages.

- Cash on Hand: Essential for covering ongoing R&D and clinical trial expenses.

- Equity Investments: Strategic partnerships, like the one with Zydus, provide critical capital and validation.

- Strategic Transactions: Proceeds from past deals contribute to the financial war chest for future development.

- Capital Infusions: Recent funding, such as the $75 million upfront and $16 million equity from Zydus, directly supports program advancement.

Agenus's key resources are its proprietary technology platforms, robust intellectual property, a promising clinical pipeline, and its highly skilled scientific and medical talent. Financial capital, including cash reserves and strategic investments, is also critical for funding its operations and advancing its immuno-oncology programs.

The company's technology platforms are designed for the discovery and development of novel antibody-based therapeutics, personalized cancer vaccines, and cell therapies. Its intellectual property portfolio protects drug candidates like botensilimab and balstilimab, enabling licensing and collaboration agreements. The clinical pipeline, particularly the BOT/BAL combination therapy, is a core asset, supported by accumulating clinical data. As of mid-2024, Agenus reported positive interim data from its Phase 2 trial of BOT/BAL in MSS colorectal cancer.

Financial capital is essential for R&D and clinical trials. For instance, Agenus secured a $75 million upfront payment and a $16 million equity investment from Zydus in 2024, underscoring the importance of these capital streams for program advancement.

| Resource Type | Specific Asset/Capability | Significance |

|---|---|---|

| Technology Platforms | Immuno-oncology discovery and development systems | Enables creation of novel antibody therapies, cancer vaccines, and cell therapies. |

| Intellectual Property | Patents and trade secrets for drug candidates (e.g., botensilimab, balstilimab) | Protects innovation, supports licensing and collaboration revenue. |

| Clinical Pipeline | BOT/BAL combination therapy | Represents a significant therapeutic advancement with growing clinical evidence. |

| Human Capital | Expertise in immuno-oncology, clinical development, regulatory affairs | Drives drug discovery, trial execution, and regulatory navigation. |

| Financial Capital | Cash reserves, equity investments (e.g., $75M from Zydus in 2024) | Funds R&D, clinical trials, and operational expenses. |

Value Propositions

Agenus's core value centers on tackling significant unmet medical needs in oncology, particularly for patients with difficult-to-treat cancers or those who haven't benefited from existing therapies.

The company directs its efforts towards challenging indications and "cold" tumors, areas where conventional immunotherapies have historically shown limited efficacy. This focus offers a crucial glimmer of hope for patients facing dire prognoses with few or no alternative treatment avenues.

For instance, in 2024, the landscape of cancer treatment continues to evolve, with significant investment in novel immunotherapies. Agenus's approach directly addresses the persistent gap in effective treatments for a substantial patient population, aiming to improve survival rates and quality of life.

Agenus’s value proposition centers on novel immuno-oncology therapies designed for superior efficacy and safety. Botensilimab, for instance, boasts a unique mechanism intended to amplify immune responses while minimizing side effects, setting it apart from older treatments.

This differentiated approach aims to offer patients more effective and tolerable treatment options. The combination of botensilimab and balstilimab has demonstrated encouraging outcomes in challenging cancer types, underscoring its potential to address unmet medical needs.

Agenus's lead programs, such as BOT/BAL, are showing remarkable results in clinical trials, offering patients with difficult-to-treat cancers durable objective responses and longer overall survival. This translates to a substantial improvement in patient prognosis and quality of life.

Data shared at prominent medical conferences, including the American Society of Clinical Oncology (ASCO) annual meeting in 2024, highlighted these positive outcomes, validating the significant clinical benefit provided by Agenus's innovative therapies.

Comprehensive and Combination Treatment Approaches

Agenus is pioneering comprehensive and combination treatment approaches in cancer immunotherapy by integrating a diverse portfolio of antibody therapeutics, cancer vaccines, and cell therapies. This strategy aims to broaden the reach of immunotherapy to more patient groups by creating synergistic effects that can overcome tumor resistance. For instance, in 2024, Agenus reported progress in its Fc-enhanced antibody programs, designed to boost immune responses when combined with other modalities.

The company's commitment to offering more robust and complete treatment solutions is evident in its ongoing clinical trials. These trials are designed to demonstrate the enhanced efficacy of combining different therapeutic strategies, potentially leading to improved patient outcomes. Agenus's approach focuses on addressing the multifaceted nature of cancer, moving beyond single-agent treatments to provide a more holistic attack against the disease.

- Integrated Platform: Combines antibody therapies, cancer vaccines, and cell therapies for synergistic effects.

- Expanded Patient Reach: Aims to benefit larger patient populations by overcoming treatment resistance.

- Enhanced Efficacy: Focuses on delivering more potent and complete cancer treatment solutions.

Advancing Immunotherapy for 'Cold' Tumors

Agenus is dedicated to making immunotherapy effective for cancers that have traditionally not responded well to existing treatments. This means tackling so-called 'cold' tumors.

Their focus includes difficult-to-treat cancers like microsatellite-stable colorectal cancer, liver cancer (hepatocellular carcinoma), sarcomas, and triple-negative breast cancer. These are areas where current immunotherapy options often fall short.

By developing therapies that can activate the immune system against these resistant tumors, Agenus aims to broaden the reach of immunotherapy. This could fundamentally change how these challenging cancers are treated in clinical practice.

For instance, in 2024, the global immunotherapy market was valued at approximately $70 billion, with significant growth projected. Agenus’s strategy targets a substantial unmet need within this expanding market, potentially unlocking new patient populations.

- Targeting 'Cold' Tumors: Agenus is pioneering immunotherapy for cancers that are historically unresponsive to current immune checkpoint inhibitors.

- Key Cancer Types: Their efforts are concentrated on microsatellite-stable colorectal cancer, hepatocellular carcinoma, sarcomas, and triple-negative breast cancer.

- Expanding Immunotherapy Reach: Success in these challenging tumor types would significantly advance oncology practice and patient outcomes.

- Market Opportunity: The global immunotherapy market, valued at around $70 billion in 2024, presents a substantial opportunity for innovative treatments addressing unmet needs.

Agenus's value proposition hinges on developing novel immuno-oncology therapies that offer improved efficacy and safety, particularly for patients with difficult-to-treat cancers. Their integrated platform approach, combining antibodies, vaccines, and cell therapies, aims to overcome tumor resistance and expand the reach of immunotherapy to previously unresponsive patient populations.

The company's focus on challenging indications and "cold" tumors, such as microsatellite-stable colorectal cancer and hepatocellular carcinoma, addresses a significant unmet medical need. By demonstrating clinical benefit in these areas, Agenus seeks to provide meaningful improvements in survival and quality of life for a broad spectrum of cancer patients.

In 2024, Agenus continued to advance its pipeline, with key data readouts from its Fc-engineered antibody programs, including botensilimab. These advancements underscore the company's commitment to delivering more potent and complete treatment solutions in the rapidly evolving immuno-oncology landscape.

| Program | Target Indication | Key 2024 Development | Value Proposition |

|---|---|---|---|

| Botensilimab (BOT) | Various solid tumors, including MSS CRC, HCC, Sarcomas | Clinical trial data demonstrating enhanced immune response | Fc-enhanced antibody for superior efficacy and safety |

| Balstilimab (BAL) | Various solid tumors, including Cervical Cancer | Combination studies with BOT showing synergistic effects | PD-1 inhibitor designed for broad applicability |

| Combination BOT/BAL | Difficult-to-treat cancers | Positive objective response rates in clinical trials | Addresses unmet needs in "cold" tumors |

Customer Relationships

Agenus cultivates direct relationships with clinical trial sites, principal investigators, and medical professionals worldwide. This direct engagement is vital for streamlining patient recruitment, ensuring the integrity of data collection, and maintaining strict adherence to trial protocols.

These strong connections are fundamental to the successful advancement of Agenus's broad clinical development pipeline. For instance, in 2024, the company continued to expand its network of trial sites, aiming to accelerate the enrollment of patients for its promising immuno-oncology candidates.

Agenus actively engages the scientific and medical community by presenting at leading international conferences such as ASCO, ESMO, and AACR. These platforms are crucial for sharing their latest research and clinical trial data, fostering vital knowledge exchange.

Publications in respected peer-reviewed journals further solidify Agenus's standing, disseminating their findings to a global audience of researchers and clinicians. This consistent outreach builds credibility and educates key opinion leaders about their novel therapeutic approaches.

Agenus actively manages its strategic partnerships with other pharmaceutical companies, contract development and manufacturing organizations (CDMOs), and AI firms. These collaborations are crucial for advancing its pipeline and leveraging external expertise in drug development and commercialization.

The company engages in ongoing negotiation of agreements and joint strategic planning with its partners. For instance, in 2024, Agenus continued to build on its collaborations, focusing on the efficient development and potential commercialization of its immuno-oncology assets.

Effective management of these external relationships allows Agenus to access specialized capabilities and resources, thereby accelerating its drug development timelines and enhancing its overall strategic reach in the competitive biotech landscape.

Investor Relations and Shareholder Communication

Agenus prioritizes open and consistent dialogue with its investors and shareholders. This commitment is demonstrated through various channels designed to keep stakeholders well-informed.

- Financial Reporting: The company regularly publishes quarterly financial reports and makes necessary filings with the Securities and Exchange Commission (SEC), providing a clear picture of its financial health and operational progress. For instance, in their Q1 2024 earnings report, Agenus detailed their cash position and ongoing research and development expenditures.

- Investor Outreach: Agenus actively engages with the investment community through scheduled investor calls and corporate presentations. These events offer opportunities for direct interaction and detailed updates on strategic initiatives and clinical trial progress.

- Transparency and Trust: By maintaining this proactive approach to investor relations, Agenus aims to foster trust and confidence among its financial stakeholders, ensuring they are up-to-date on the company's performance and future outlook. This transparency is crucial for building long-term shareholder value.

Regulatory Authority Interaction

Agenus actively cultivates relationships with regulatory bodies such as the U.S. Food and Drug Administration (FDA). These interactions are vital for navigating the complex process of drug development and approval.

The company engages in ongoing dialogue to gain clarity on clinical trial designs and regulatory submission requirements. This proactive approach helps to streamline the path toward potential market authorization for its innovative therapies.

In 2024, Agenus continued its efforts to align development strategies with FDA guidance, aiming to accelerate the timeline for bringing new cancer treatments to patients. Effective management of these regulatory relationships is a key component of their business model, directly impacting the speed and success of commercialization.

- FDA Engagement: Continuous dialogue with the FDA for guidance on clinical development.

- Regulatory Submissions: Formal interactions for submitting applications for novel therapies.

- Compliance Assurance: Ensuring adherence to all regulations for drug approval processes.

- Market Access: Expediting the availability of new treatments through strong regulatory relationships.

Agenus fosters deep connections with clinical trial sites and medical professionals, essential for efficient patient recruitment and data integrity in its immuno-oncology programs. The company actively participates in major scientific conferences like ASCO and ESMO, sharing crucial research findings and engaging with key opinion leaders to build credibility.

Strategic partnerships with other pharmaceutical firms and CDMOs are actively managed through ongoing negotiations and joint planning, as seen in 2024's focus on collaborative asset development. Agenus also prioritizes transparency with investors through regular financial reporting and investor calls, exemplified by their Q1 2024 earnings update detailing R&D expenditures.

Furthermore, Agenus maintains robust relationships with regulatory bodies like the FDA, ensuring alignment on clinical trial designs and submission requirements to expedite the path to market for its innovative cancer therapies, a key focus throughout 2024.

Channels

Agenus leverages a global clinical trial network, acting as a vital channel to reach patients and administer its innovative therapies. This network is instrumental in enrolling participants and gathering essential data, directly delivering the company's value proposition.

The expansive geographic reach of this network is critical for efficient patient recruitment across diverse populations. In 2024, Agenus continued to build and manage these relationships, aiming to accelerate the development timelines for its promising oncology treatments.

Agenus leverages scientific and medical conferences as a critical channel to share key data and updates on its innovative oncology pipeline. These gatherings are essential for direct engagement with oncologists, researchers, and other healthcare professionals, directly influencing clinical practice and advancing scientific dialogue within the field.

In 2024, Agenus presented data at prominent events like the American Society of Clinical Oncology (ASCO) Annual Meeting, showcasing advancements in their personalized neoantigen vaccines and antibody-based therapies. These presentations are crucial for building scientific credibility and fostering collaborations within the oncology community.

Peer-reviewed publications are a cornerstone for Agenus, acting as a vital channel to share its research. These publications validate the company's scientific findings and clinical data with the wider medical community. For instance, in 2024, Agenus continued to publish results from its ongoing clinical trials, showcasing advancements in its immuno-oncology pipeline.

By disseminating detailed analyses in prestigious journals, Agenus builds essential scientific credibility. This process ensures that oncologists, researchers, and regulatory bodies have access to robust evidence supporting the efficacy and safety of its therapeutic candidates. The rigorous review process inherent in these publications underpins the scientific foundation of Agenus's innovative treatments.

Partner Commercial and Distribution Networks

Agenus plans to utilize the established commercial and distribution infrastructure of its strategic partners for future product launches. This approach leverages existing market access and reduces the need for Agenus to build its own extensive sales force.

A prime example is the partnership with Zydus Lifesciences. This collaboration grants Zydus exclusive rights to develop and commercialize Agenus's BOT/BAL therapies in India and Sri Lanka. Zydus's deep understanding and established presence within these specific markets are crucial for effective market penetration and patient access.

- Strategic Partnerships: Leveraging partner networks for commercialization.

- Market Expansion: Reaching new territories through collaborations like the one with Zydus Lifesciences.

- Commercial Rights: Granting partners specific rights for development and commercialization in defined regions.

- Established Presence: Utilizing partners' existing local market infrastructure for efficient distribution.

Digital and Investor Relations Platforms

Agenus leverages its official company website and a dedicated investor relations portal as primary channels for stakeholder communication. These platforms offer easy access to crucial information like financial reports, press releases, and corporate updates, ensuring transparency and broad dissemination.

Social media channels further extend Agenus's reach, allowing for timely engagement with investors, media, and the general public. This multi-channel approach facilitates broad and consistent communication regarding company performance and strategic developments.

- Website & Investor Relations Portal: Centralized hub for financial filings, SEC reports, and corporate governance information.

- Social Media Engagement: Platforms like X (formerly Twitter) and LinkedIn are used for real-time announcements and engagement with the investor community.

- Webcast Replays: Archived webcasts of earnings calls and investor presentations are available, providing ongoing access to management discussions.

- Information Dissemination: Ensures broad and timely access to material information for all stakeholders.

Agenus utilizes its global clinical trial network as a crucial channel to administer therapies and gather essential patient data. This network is key for patient enrollment, directly delivering the company's value proposition and enabling efficient recruitment across diverse populations. In 2024, Agenus focused on strengthening these relationships to accelerate the development of its oncology treatments.

Customer Segments

Agenus focuses on cancer patients with limited or no alternative treatments, particularly those with microsatellite-stable (MSS) colorectal cancer, pancreatic cancer, and triple-negative breast cancer. These patient groups often face poor prognoses and represent a significant unmet medical need.

Oncologists and clinical investigators represent a critical customer segment for Agenus. These medical professionals are the end-users who will prescribe Agenus's innovative cancer therapies once they receive regulatory approval. Their role is pivotal in driving market adoption and ensuring the successful integration of new treatments into patient care.

Furthermore, clinical investigators are essential partners in Agenus's research and development pipeline. They actively conduct and participate in the company's clinical trials, providing invaluable data and real-world insights. For instance, as of early 2024, Agenus has been actively enrolling patients in its Phase 2 trials for various immuno-oncology candidates, underscoring the direct reliance on these investigators.

Building and maintaining robust relationships with oncologists and clinical investigators is paramount for Agenus. Their feedback directly influences the refinement of treatment protocols and guides future research directions. The insights gleaned from these experts are instrumental in optimizing the efficacy and safety profiles of Agenus's therapeutic offerings, ensuring they meet the evolving needs of cancer patients.

Agenus actively engages with other pharmaceutical and biotechnology firms, seeking strategic alliances for co-development and licensing deals. These partnerships are crucial for securing non-dilutive funding, sharing the significant costs associated with drug development, and broadening market access.

A notable example of this customer engagement is the collaboration with Zydus Lifesciences, underscoring Agenus's strategy to leverage external partnerships for growth and resource optimization. Such agreements are vital in the capital-intensive biopharmaceutical sector.

Institutional and Individual Investors

Agenus targets both institutional and individual investors who are keen on the biotechnology landscape, specifically those looking for companies with promising oncology treatments and significant growth prospects. These investors provide the crucial capital that fuels Agenus's research, development, and operational activities.

To foster and maintain relationships with this vital segment, Agenus prioritizes transparent and consistent communication. This includes providing regular financial updates and comprehensive corporate communications detailing their progress and strategic direction.

- Capital Infusion: Investors' capital is the lifeblood for funding Agenus's extensive clinical trials and ongoing research initiatives.

- Market Confidence: Regular financial disclosures and positive clinical trial data, such as the ongoing development of their bispecific antibody platform, build investor confidence.

- Shareholder Value: Attracting and retaining investors directly contributes to Agenus's market capitalization and overall shareholder value.

- Strategic Partnerships: A strong investor base can also attract strategic partners and potential acquirers, further validating the company's pipeline.

Research Institutions and Academic Collaborators

Agenus actively partners with prominent research institutions and academic centers, fostering collaborations on investigator-initiated trials and cutting-edge scientific research. These alliances are crucial for advancing the understanding of Agenus's innovative therapies and uncovering novel indications or synergistic combination strategies. For instance, in 2023, Agenus announced a collaboration with the University of Pittsburgh Medical Center to investigate the potential of its neoantigen-based personalized cancer vaccines in specific solid tumor types.

These academic partnerships are instrumental in providing scientific validation and expanding the therapeutic applications of Agenus's pipeline. By engaging with leading minds in oncology research, Agenus can accelerate the development and potential approval of its treatments. The insights gained from these collaborations often lead to publications in peer-reviewed journals, further solidifying the scientific basis for their technologies.

- Academic Collaborations: Agenus engages with universities and research hospitals for clinical trials and scientific studies.

- Scientific Validation: These partnerships help confirm the efficacy and safety of Agenus's therapeutic approaches.

- Pipeline Expansion: Collaborations explore new uses and combinations for existing and developing therapies.

- Knowledge Advancement: Agenus contributes to the broader scientific understanding of immuno-oncology.

Agenus's primary customer segment consists of cancer patients, particularly those with limited or no alternative treatment options. This includes individuals diagnosed with microsatellite-stable (MSS) colorectal cancer, pancreatic cancer, and triple-negative breast cancer, all of which represent significant unmet medical needs with often poor prognoses.

Oncologists and clinical investigators are crucial intermediaries. They are the medical professionals who will ultimately prescribe and administer Agenus's therapies. Their active involvement in clinical trials, such as patient enrollment in Phase 2 trials in early 2024, directly validates and advances the company's pipeline.

Agenus also engages with other pharmaceutical and biotech firms through strategic alliances. These collaborations, like the one with Zydus Lifesciences, are vital for sharing development costs and expanding market access in the capital-intensive biopharmaceutical sector.

Investors, both institutional and individual, form another key segment. They provide the essential capital to fund Agenus's extensive research and clinical development efforts. Transparent communication regarding clinical progress, such as the development of their bispecific antibody platform, is vital for maintaining investor confidence and shareholder value.

Furthermore, Agenus partners with research institutions and academic centers, such as the University of Pittsburgh Medical Center, for investigator-initiated trials and scientific studies. These collaborations, like the one announced in 2023, provide scientific validation and explore novel therapeutic applications for their immuno-oncology treatments.

Cost Structure

Research and Development (R&D) is a substantial cost driver for Agenus, covering everything from initial drug discovery and preclinical studies to the rigorous and lengthy process of clinical trials. These expenditures are fundamental to their mission of creating innovative immuno-oncology treatments.

In 2024, Agenus continued to focus its R&D investments strategically. For instance, their lead BOT/BAL program, aimed at advancing novel therapies, received significant resource allocation to enhance efficiency and progress through critical development stages.

Clinical operations and regulatory compliance represent a significant portion of Agenus's cost structure. Managing global clinical trials, from patient recruitment and site management to rigorous data analysis and ongoing communication with agencies like the FDA, incurs substantial expenses. These investments are non-negotiable for securing drug approvals and adhering to strict healthcare regulations.

In 2024, Agenus continued to invest heavily in its clinical development programs. For instance, the costs associated with advancing its lead oncology candidates through various phases of clinical trials, including manufacturing of drug product and site payments, are a primary driver of these operational expenditures. The company's focus on optimizing trial efficiency and data integrity aims to mitigate these inherent costs while ensuring robust scientific validation.

Historically, Agenus bore significant expenses for running its biologics manufacturing sites and overseeing the supply chain for its drug candidates. For instance, in 2023, the company reported manufacturing and supply chain expenses as a component of its overall cost of revenue.

However, Agenus is actively working to decrease these direct operational costs. A key strategy involves shifting towards a fee-for-service model, which outsources manufacturing activities. This transition also includes transferring its facilities to strategic partners, such as the agreement with Zydus, to further reduce its direct involvement and associated expenses.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Agenus encompass the essential corporate overhead, executive and administrative salaries, legal counsel, finance operations, and other vital support functions necessary for running the business. These are the costs that keep the company’s engine running smoothly behind the scenes.

In 2024, Agenus has been actively pursuing strategic operational improvements and implementing rigorous cost-cutting measures. These efforts are designed to significantly reduce annualized expenditures and improve the company's cash burn rate, ultimately enhancing its financial sustainability and long-term viability.

- Corporate Overhead: Costs associated with maintaining the company's headquarters and general business operations.

- Executive & Administrative Salaries: Compensation for leadership and support staff crucial for company management.

- Legal & Finance Fees: Expenses related to legal compliance, financial reporting, and professional services.

- Operational Improvements: Strategic initiatives, including workforce adjustments, aimed at lowering overall G&A spend.

Sales, Marketing, and Commercialization Costs (Future)

As Agenus progresses towards commercializing its innovative therapies, its future cost structure will significantly shift to encompass sales, marketing, and commercialization expenses. While current outlays are heavily weighted towards research and development and securing regulatory approvals, the next phase demands investment in building a robust commercial infrastructure. This includes the critical expenses associated with establishing a dedicated sales force, executing impactful marketing campaigns, developing effective market access strategies, and setting up reliable distribution networks to ensure patient access to approved treatments.

These future costs are substantial and will directly impact the company's financial projections. For instance, building a specialized oncology sales team can cost tens of millions of dollars annually. Marketing and promotional activities for a new therapy can also run into the tens of millions, especially in competitive markets. Market access efforts, including negotiations with payers and health technology assessments, require dedicated resources and expertise. These are all essential components for successfully bringing a new therapy to market and generating revenue.

Agenus may strategically leverage partnerships to mitigate some of these future commercialization costs. Collaborating with established pharmaceutical companies or specialized commercialization partners can provide access to existing sales forces, marketing expertise, and established distribution channels. This approach can significantly reduce the upfront capital expenditure and operational burden for Agenus, allowing it to focus on its core competencies in R&D while sharing the commercialization risks and rewards.

- Future Commercialization Investment: Significant future costs will be allocated to building sales teams, marketing campaigns, market access, and distribution for approved therapies.

- Oncology Sales Force Costs: Establishing a specialized oncology sales force can represent a substantial annual expense, potentially in the tens of millions of dollars.

- Marketing and Market Access: Marketing initiatives and securing market access through payer negotiations are critical and costly components of commercialization.

- Strategic Partnerships: Collaborations can help externalize commercialization costs, leveraging partners' existing infrastructure and expertise.

Agenus's cost structure is heavily influenced by its significant investments in research and development, particularly for its immuno-oncology pipeline. Clinical trial expenses, manufacturing, and general administrative overhead also represent substantial outlays. The company is actively streamlining operations, including a strategic shift to outsource manufacturing to reduce direct costs.

Looking ahead, Agenus anticipates a significant increase in sales, marketing, and commercialization expenses as its therapies advance towards market approval. This phase will necessitate substantial investments in building commercial infrastructure, including sales forces and marketing campaigns.

In 2024, Agenus continued its strategic focus on R&D and clinical development, with significant resource allocation to its lead programs. The company is also implementing cost-reduction measures across its operations to improve financial sustainability.

A key aspect of Agenus's cost management involves transitioning from direct manufacturing to a fee-for-service model, exemplified by its agreement with Zydus, to lower operational expenses.

Revenue Streams

Royalty revenue from licensed assets represents a crucial, albeit often non-cash, income stream for Agenus. These payments are generated from partners who commercialize products developed using Agenus's proprietary technologies or intellectual property. A notable example is the 5% royalty Agenus receives on BOT/BAL sales in India and Sri Lanka from its partner Zydus.

Agenus secures revenue via upfront payments from forging new strategic collaborations and licensing deals. These initial payments inject vital capital, fueling the company's ongoing operations and crucial development initiatives.

A significant instance of this revenue stream occurred when Agenus received a $75 million upfront payment from Zydus Lifesciences. This payment was part of an agreement for the transfer of manufacturing assets, demonstrating the substantial financial impact of such strategic partnerships.

Agenus is positioned to receive significant milestone payments from its collaborators as its drug candidates advance through development. These contingent payments are triggered by the successful completion of specific development, regulatory, or commercial objectives. For instance, up to $50 million in these payments are linked to BOT/BAL production orders from Zydus, highlighting the financial upside tied to partnership success.

Equity Investments from Partners

Equity investments from partners represent a significant revenue stream for Agenus, particularly within strategic collaborations. These investments offer non-dilutive capital, directly bolstering the company's financial standing without issuing new shares that would reduce existing ownership percentages. This approach strengthens the balance sheet and provides crucial funding for ongoing research and development.

A prime example of this revenue stream in action is the partnership with Zydus Lifesciences. As part of their collaboration, Zydus Lifesciences made a $16 million equity investment in Agenus. This investment involved the purchase of Agenus shares, demonstrating a tangible financial commitment from a strategic partner.

- Non-Dilutive Capital: Equity investments from partners provide capital without diluting existing shareholder ownership.

- Balance Sheet Strengthening: These investments directly improve Agenus's financial health and stability.

- Strategic Partnership Validation: Such investments signal strong confidence and commitment from collaborators.

- Example: Zydus Lifesciences Investment: A $16 million equity investment from Zydus Lifesciences highlights this revenue stream's importance.

Fee-for-Service Manufacturing Services (Potential)

Agenus is strategically leveraging its advanced biologics CMC (Chemistry, Manufacturing, and Controls) capabilities by offering them as fee-for-service manufacturing. This pivot aims to establish a significant new revenue stream by providing essential manufacturing expertise and state-of-the-art facilities to other biopharmaceutical companies. This move is projected to unlock substantial revenue opportunities while simultaneously optimizing operational costs.

This fee-for-service model allows Agenus to monetize its manufacturing infrastructure and deep scientific knowledge. By serving external clients, Agenus can achieve higher asset utilization for its manufacturing sites, thereby improving overall financial efficiency. For instance, in 2024, the company continued to invest in its manufacturing capacity, positioning itself to meet growing demand for outsourced biologics production.

- New Revenue Generation: Monetizing existing manufacturing assets and expertise.

- Cost Optimization: Improving the utilization of facilities and reducing idle capacity.

- Market Opportunity: Addressing the increasing demand for outsourced biologics manufacturing services.

- Strategic Alignment: Focusing internal resources on core R&D while generating income from manufacturing services.

Agenus’s revenue streams are diversified, encompassing royalties from licensed products, upfront payments from new collaborations, and milestone payments tied to development progress. Equity investments from partners also provide crucial, non-dilutive capital, reinforcing financial stability.

Furthermore, Agenus is actively generating revenue through its fee-for-service biologics CMC manufacturing capabilities, capitalizing on its advanced infrastructure and expertise to serve external clients. This dual approach of internal development and external service provision is key to its business model.

| Revenue Stream | Description | Example/Data Point |

| Royalty Revenue | Payments from partners commercializing Agenus's technologies. | 5% royalty on BOT/BAL sales in India and Sri Lanka from Zydus. |

| Upfront Payments | Initial capital from new strategic collaborations and licensing deals. | $75 million upfront payment from Zydus for manufacturing asset transfer. |

| Milestone Payments | Contingent payments upon achieving development or regulatory goals. | Up to $50 million in payments linked to BOT/BAL production orders from Zydus. |

| Equity Investments | Capital received from partners purchasing Agenus shares. | $16 million equity investment from Zydus Lifesciences. |

| Fee-for-Service Manufacturing | Revenue from providing CMC manufacturing services to other biopharma companies. | Continued investment in manufacturing capacity in 2024 to meet demand. |

Business Model Canvas Data Sources

The Agenus Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and expert strategic insights. These sources are critical for accurately defining all aspects of our business operations and market positioning.