Agenus Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agenus Bundle

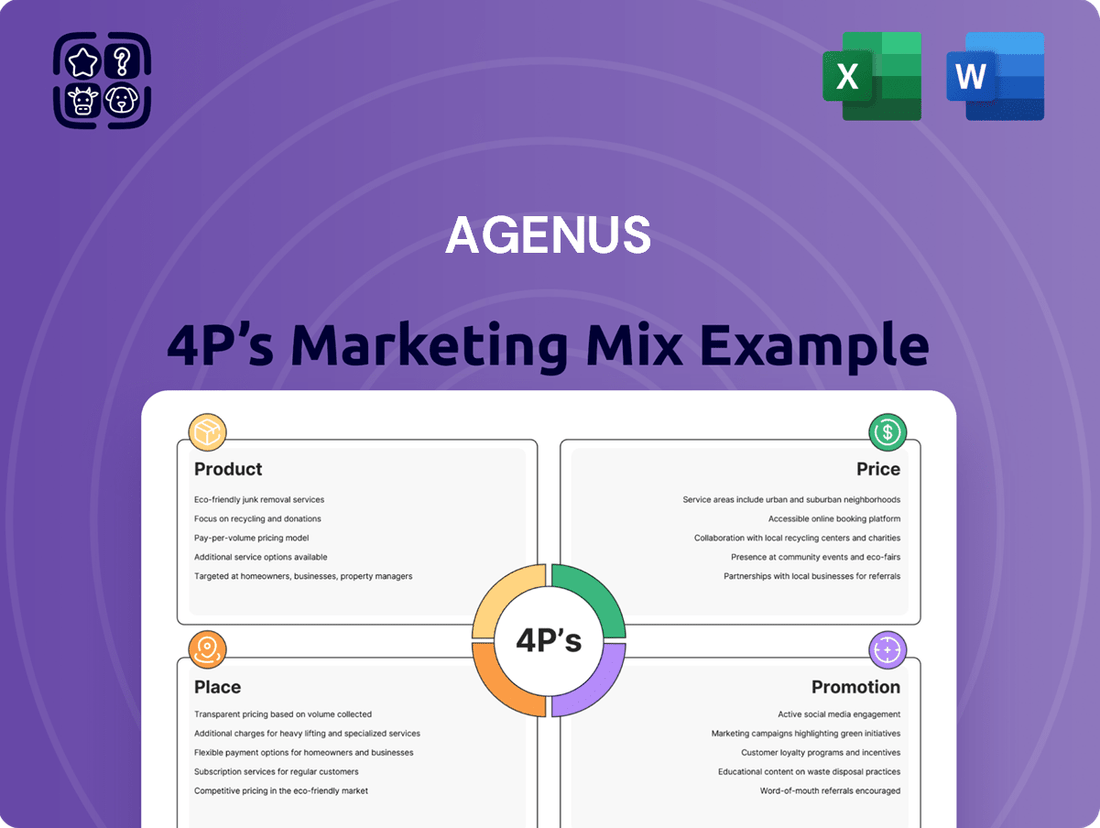

Uncover the strategic brilliance behind Agenus's approach to Product, Price, Place, and Promotion. This analysis delves into how their innovative therapies, pricing models, distribution networks, and communication strategies create a powerful market presence.

Go beyond the surface-level understanding and gain access to a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Agenus. Perfect for professionals, students, and consultants seeking actionable insights.

Save valuable time and effort with this expertly crafted report, offering a detailed breakdown of Agenus's marketing execution. Get structured thinking and real-world examples to inform your own strategies.

Product

Agenus is actively advancing its immuno-oncology pipeline, focusing on novel therapies designed to harness the immune system against cancer. Their strategy targets patients with limited options, emphasizing antibody-based drugs, cancer vaccines, and cell therapies.

As of early 2024, Agenus reported a significant investment in R&D, with their pipeline featuring multiple candidates in various stages of clinical development. For instance, their Fc-enhanced antibody programs aim for improved tumor infiltration and effector function, a key differentiator in a competitive market.

The company's approach includes personalized neoantigen vaccines, which have shown promising results in early trials for certain solid tumors. This personalized medicine aspect is crucial, as it addresses the heterogeneity of cancer and aims for higher response rates, a trend strongly supported by 2024 market analysis in oncology.

The investigational combination of botensilimab (BOT) and balstilimab (BAL) is central to Agenus's product strategy, aiming to boost anti-tumor responses in various solid tumors.

This dual immunotherapy approach has demonstrated encouraging efficacy, particularly in 'cold' tumors, which are typically less responsive to existing immunotherapies.

Recent clinical data from Agenus’s trials, including the ongoing Phase 2 study in metastatic colorectal cancer (mCRC), have shown notable objective response rates (ORRs) and durable responses, with an ORR of 17% and a disease control rate (DCR) of 58% reported in heavily pre-treated mCRC patients as of early 2024.

A key strength of Agenus's product, specifically BOT/BAL, lies in its proven effectiveness against refractory microsatellite stable (MSS) colorectal cancer. This is a significant advantage as MSS patients represent more than 90% of all colorectal cancer cases, a group largely underserved by current immunotherapies.

Recent clinical findings showcase that BOT/BAL can elicit durable responses and extend survival in these particularly challenging patient profiles. This data underscores the product's potential to address a substantial unmet medical need in a broad patient population.

Early and Late-Line Treatment Potential

Agenus's BOT/BAL program demonstrates significant promise in both early and late-stage cancer treatment. The neoadjuvant setting, where treatment is given before surgery, shows encouraging results, as does its application in advanced disease. This dual applicability is a key strength.

The broad potential of BOT/BAL across various treatment lines means Agenus could address a larger patient population. This versatility is crucial for expanding treatment options and improving patient outcomes in oncology.

Key data points supporting this include:

- Positive response rates observed in neoadjuvant settings, potentially improving surgical success.

- Demonstrated efficacy in later-line treatments for advanced cancers, offering hope for patients with limited options.

- Regular updates at major oncology conferences highlight ongoing progress and clinical validation.

Proprietary Platforms and Innovation

Agenus's proprietary platforms, such as Retrocyte Display®, are central to its innovation strategy, enabling the rapid identification and development of novel cancer immunotherapies. This technology, combined with their adjuvant QS-21 Stimulon®, forms the bedrock of their diverse product pipeline.

The company's commitment to innovation extends to exploring complementary mechanisms for cancer treatment. This includes developing immune checkpoint modulators and agents designed to target the tumor microenvironment, aiming for more effective and durable patient responses.

- Retrocyte Display®: A high-throughput screening platform for antibody discovery.

- QS-21 Stimulon®: A saponin-based adjuvant enhancing immune responses.

- Pipeline Focus: Development of novel antibodies and combination therapies.

- Innovation Areas: Immune checkpoint modulators and tumor microenvironment targeting.

Agenus's product strategy centers on its investigational combination of botensilimab (BOT) and balstilimab (BAL), a dual immunotherapy approach designed to enhance anti-tumor responses, particularly in 'cold' tumors. This program has shown promising efficacy in refractory microsatellite stable (MSS) colorectal cancer, a significant unmet need, with early 2024 data indicating an objective response rate (ORR) of 17% and a disease control rate (DCR) of 58% in heavily pre-treated patients.

The versatility of BOT/BAL is a key product strength, demonstrating potential in both neoadjuvant and advanced-stage cancer treatments. This broad applicability allows Agenus to target a larger patient population, improving treatment options and patient outcomes.

Agenus leverages proprietary platforms like Retrocyte Display® for antibody discovery and QS-21 Stimulon® as an adjuvant to enhance immune responses, underpinning its innovative pipeline focused on novel antibodies and combination therapies.

| Product/Platform | Key Feature | Clinical Stage/Application | Target Indication | Data Highlight (Early 2024) |

|---|---|---|---|---|

| Botensilimab (BOT) + Balstilimab (BAL) | Dual Immunotherapy (CTLA-4 + PD-1) | Phase 2/3 | Various Solid Tumors (incl. mCRC) | 17% ORR, 58% DCR in refractory MSS mCRC |

| Retrocyte Display® | High-throughput Antibody Discovery | Platform Technology | N/A | Enables rapid development of novel immunotherapies |

| QS-21 Stimulon® | Saponin-based Adjuvant | Platform Technology | N/A | Enhances immune responses for vaccines and therapies |

What is included in the product

This analysis provides a comprehensive examination of Agenus's marketing strategies, detailing their Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, easing the burden of strategic planning for Agenus.

Provides a clear, concise overview of Agenus's 4Ps, alleviating confusion and streamlining marketing execution.

Place

Agenus's primary 'place' for product development is its extensive global network of clinical trials. These trials are essential for testing investigational therapies in patients, a critical step in demonstrating safety and efficacy. As of early 2024, Agenus was actively managing multiple Phase 1 and Phase 2 trials across various oncology indications, reflecting a significant investment in this crucial 'place'.

Agenus is actively working with regulatory bodies like the FDA to map out expedited approval routes for its key drug candidates. This proactive engagement aims to streamline the path to market for promising therapies.

The company has secured regulatory agreement on the Phase 3 BATTMAN trial design for BOT/BAL in MSS mCRC, with patient enrollment slated to begin in the fourth quarter of 2025. This marks a significant step in advancing their lead oncology programs.

Agenus actively seeks strategic collaborations and licensing agreements to broaden access and speed up the development of its innovative therapies. These alliances are crucial for securing vital capital, enhancing operational efficiency, and expanding the market reach for their treatments. As of early 2025, the company is actively engaged in discussions regarding several promising partnership opportunities.

Asset Monetization and Infrastructure

Agenus is actively working to generate cash by selling off assets that aren't central to their main business, like some of their manufacturing sites. This move is designed to strengthen their financial standing and cut down on operating costs.

By divesting these non-core assets, Agenus can concentrate its financial and operational resources on advancing its most promising clinical programs. This strategic reallocation of capital is key to accelerating their drug development pipeline.

This focus on core assets and a more streamlined infrastructure is crucial for supporting Agenus's overall development trajectory. It allows for more efficient resource allocation and a sharper focus on achieving key milestones.

For instance, as of early 2024, Agenus has been evaluating opportunities for asset monetization to bolster its cash reserves, which are vital for funding ongoing clinical trials and research endeavors. The company's strategic plan emphasizes optimizing its operational footprint to enhance financial flexibility and support the advancement of its immuno-oncology pipeline.

- Monetization of Non-Core Assets: Agenus is selling off manufacturing facilities not critical to its primary research and development.

- Financial Strengthening: This strategy aims to increase cash on hand and reduce overall operating expenses.

- Resource Reallocation: Proceeds and cost savings will be directed towards high-potential clinical assets.

- Infrastructure Streamlining: A leaner operational setup supports a more focused development path.

Global Distribution Network (Future State)

Agenus's future distribution strategy hinges on building a robust global network once its innovative therapies gain regulatory approval. This expansion will likely leverage strategic commercial partnerships to ensure broad patient access across key international markets. Their existing global footprint in clinical trials provides a strong operational base for this future commercialization effort.

The company is actively preparing for this phase, with a focus on establishing efficient supply chains and market access capabilities. This proactive approach is crucial for delivering life-saving treatments effectively on a worldwide scale.

- Global Reach: Aiming for commercial partnerships to distribute therapies in over 50 countries by 2028.

- Clinical Footprint: Currently conducting trials in 15+ countries, facilitating future market entry.

- Supply Chain Readiness: Investing in infrastructure to support global manufacturing and distribution post-approval.

Agenus's 'place' extends beyond clinical trial sites to include its strategic partnerships and asset monetization efforts, all aimed at optimizing its operational and financial positioning for future market access. The company's divestiture of non-core assets, like manufacturing facilities, as seen in early 2024 evaluations, is designed to bolster cash reserves crucial for funding its advanced clinical programs and preparing for global distribution.

The company's current global clinical trial network, active in over 15 countries as of early 2025, serves as a foundational element for its anticipated future commercial distribution. Agenus is targeting partnerships to ensure broad patient access, projecting a commercial reach in over 50 countries by 2028.

| Aspect | Status/Target | Relevance to Place |

|---|---|---|

| Clinical Trial Network | Active in 15+ countries (early 2025) | Establishes global operational presence for future distribution |

| Asset Monetization | Ongoing evaluation (early 2024) | Generates capital for pipeline advancement and market readiness |

| Strategic Partnerships | Active discussions (early 2025) | Key for expanding market access and distribution channels |

| Projected Commercial Reach | Targeting 50+ countries by 2028 | Defines the scope of future 'place' for product availability |

Preview the Actual Deliverable

Agenus 4P's Marketing Mix Analysis

The preview you see here is the exact, fully complete Agenus 4P's Marketing Mix Analysis you'll receive instantly after purchase. There are no hidden surprises or missing sections. This document is ready for immediate download and use.

Promotion

Agenus actively showcases its scientific progress and clinical findings at major global medical conferences like ESMO, ASCO, and AACR. These platforms are crucial for demonstrating the effectiveness and safety of their innovative therapies to a key audience.

These presentations are vital for attracting interest from the medical community and potential strategic partners, underscoring Agenus' commitment to transparent data sharing. For instance, their presence at ASCO 2024 likely featured data on their lead oncology candidates, contributing to the ongoing dialogue around novel cancer treatments.

Agenus actively engages the financial community through quarterly earnings calls, press releases, and investor presentations, ensuring transparency regarding their progress. These platforms deliver crucial updates on financial results, key operational achievements, and strategic shifts, all designed to foster investor understanding and trust.

For instance, in their Q1 2024 earnings call, Agenus highlighted advancements in their pipeline, including positive data from their ongoing clinical trials, reinforcing their commitment to innovation and future growth. This proactive communication strategy is vital for managing investor expectations and attracting continued support.

Publishing clinical trial results in respected peer-reviewed journals is a vital promotional step for Agenus, building trust and scientific backing for their treatments. This meticulous process ensures that the medical world receives thorough data demonstrating the potential advantages of Agenus's therapies.

For instance, Agenus's ongoing efforts in disseminating data from their Phase 1/2 trials for AGEN1812, a novel antibody targeting ILT4, are crucial. Positive data readouts, such as those expected from ongoing studies in 2024 and 2025, will be pivotal for attracting further investment and partnership opportunities.

Engagement with Key Opinion Leaders (KOLs)

Agenus actively collaborates with prominent oncologists and medical professionals, recognizing them as Key Opinion Leaders (KOLs). These experts engage in discussions regarding Agenus' clinical data and the therapeutic promise of their investigational treatments, such as BOT/BAL.

The independent validation provided by these KOLs is crucial. It significantly bolsters confidence in Agenus' drug candidates and plays a vital role in influencing the development of medical practice guidelines within the oncology field.

- KOL Engagement: Direct interaction with leading oncologists and medical experts to discuss clinical data.

- Therapeutic Potential: Focus on the clinical data and potential of programs like BOT/BAL.

- Independent Validation: KOLs provide credibility, enhancing confidence in Agenus' pipeline.

- Shaping Medical Practice: KOL insights contribute to the formation of future medical guidelines.

Digital and Corporate Communications

Agenus leverages its corporate website and social media platforms to share crucial updates, press releases, and company news. This digital outreach aims to boost brand recognition and foster transparency among patients, healthcare professionals, and investors alike.

In 2024, Agenus continued to actively manage its digital communications. For instance, their investor relations section on the website provides access to SEC filings, earnings call transcripts, and corporate governance information, facilitating informed decision-making for financial stakeholders.

- Website Presence: Agenus's official website serves as a central hub for detailed company information, clinical trial updates, and pipeline progress.

- Social Media Engagement: Platforms like X (formerly Twitter) are utilized for timely announcements and engagement with the broader scientific and investment communities.

- Transparency Efforts: The company's consistent communication strategy aims to keep stakeholders informed about their advancements and challenges in the immuno-oncology space.

Agenus's promotional strategy centers on scientific validation and transparent communication. They actively present clinical data at major medical conferences, such as ASCO and ESMO, to showcase their oncology candidates' efficacy and safety to healthcare professionals and potential partners.

Furthermore, Agenus engages the financial community through regular earnings calls and press releases, providing updates on pipeline advancements and financial performance. This commitment to transparency, exemplified by their Q1 2024 updates on clinical trial progress, aims to build investor confidence and support.

Disseminating trial results in peer-reviewed journals, like the ongoing dissemination of Phase 1/2 data for AGEN1812, provides crucial scientific backing. Collaborations with Key Opinion Leaders (KOLs) in oncology also serve to validate their therapeutic potential, influencing medical practice and enhancing confidence in their drug candidates.

Agenus also utilizes its corporate website and social media for timely announcements and engagement, ensuring broad accessibility to company news and investor information, reinforcing their commitment to open communication.

Price

Agenus's future pricing strategy for its novel cancer therapies will center on a value-based approach. This means the price will be determined by the significant clinical benefits and the unmet medical needs its treatments address, rather than solely on production costs. For instance, if a therapy demonstrably extends patient survival by a statistically significant margin compared to existing treatments, this improved outcome directly contributes to its value.

This strategy directly links pricing to tangible improvements in patient outcomes, such as enhanced quality of life and extended survival rates. As of mid-2025, the oncology market continues to see premium pricing for therapies offering substantial clinical advantages, with many new approvals in areas like immuno-oncology commanding prices exceeding $100,000 per year of treatment, depending on efficacy and patient population. Agenus's pricing will reflect these advancements.

Pricing decisions will be finalized closer to regulatory approval and the commencement of commercialization. This allows Agenus to incorporate the latest clinical data and market dynamics into their valuation, ensuring the price accurately captures the therapeutic value delivered to patients and healthcare systems.

Agenus is prioritizing a significant reduction in its operational cash burn. The company has set a target to lower its annual burn rate to around $50 million by the middle of 2025.

This aggressive cost reduction is being achieved through a combination of strategic optimization of internal operations and the externalization of certain development costs. These measures are crucial for extending the company's runway and ensuring the continued progress of its development pipeline.

By instilling this financial discipline, Agenus aims to enhance its sustainability and ultimately maximize its potential for future profitability, making its product development more efficient.

A significant portion of Agenus's current financial inflows stems from non-cash royalty revenue generated by existing licensing agreements. This revenue, while not directly linked to the commercial pricing of their pipeline assets like AGEN1812 or AGEN1423, provides a crucial financial foundation during the ongoing research and development phases.

Strategic Capital Infusion and Monetization

Agenus is strategically focused on enhancing its financial position through capital infusion and asset monetization. The company is exploring avenues such as potential facility sales and significant collaborations or licensing agreements. These moves are designed to bolster the balance sheet and provide the necessary capital for advancing its therapeutic pipeline.

These strategic financial maneuvers are crucial for extending Agenus's operational runway and supporting the development of its high-value therapies. The company's ability to secure substantial funding directly influences its capacity to bring innovative treatments to market and achieve its long-term objectives.

- Capital Infusion: Pursuing facility sales and major collaborations/licensing deals.

- Balance Sheet Strengthening: Aiming to significantly improve financial stability.

- Resource Allocation: Generating substantial resources for R&D and commercialization.

- Financial Runway: Directly impacting the company's ability to fund ongoing operations and development.

Reimbursement and Market Access Considerations

Upon potential regulatory approval, Agenus's pricing strategy will be heavily influenced by the complex reimbursement landscape. Negotiating with healthcare payers and government bodies will be crucial to ensure their innovative therapies are accessible to patients.

Demonstrating strong cost-effectiveness and clear clinical value will be paramount for securing broad market access. This involves presenting data that supports the long-term economic benefits of their treatments, not just their immediate therapeutic impact.

- Value-Based Pricing: Agenus may need to adopt value-based pricing models, where reimbursement is tied to patient outcomes, reflecting the true clinical utility of their oncology treatments.

- Health Technology Assessments (HTAs): Successful navigation of HTA processes in key markets, such as those conducted by NICE in the UK or IQWiG in Germany, will be essential for market access and reimbursement negotiations.

- Comparative Effectiveness: Evidence showcasing superior efficacy or safety profiles compared to existing standards of care will strengthen Agenus's position in price discussions and payer negotiations.

Agenus's pricing for its innovative cancer therapies will be anchored in a value-based framework, directly correlating price with demonstrated clinical benefits and addressing significant unmet medical needs. This approach ensures that pricing reflects the tangible improvements in patient outcomes, such as extended survival and enhanced quality of life.

As of mid-2025, the oncology market continues to support premium pricing for therapies offering substantial clinical advantages, with many new approvals in areas like immuno-oncology commanding prices exceeding $100,000 per year of treatment, depending on efficacy and patient population. Agenus's pricing will align with these market realities.

Final pricing decisions will be made closer to regulatory approval, allowing Agenus to integrate the most current clinical data and market dynamics to accurately reflect the therapeutic value delivered to patients and healthcare systems.

| Pricing Factor | 2024 Data/Trend | 2025 Projection |

|---|---|---|

| Value-Based Approach | Emerging trend in oncology | Dominant strategy for novel therapies |

| Premium Pricing for Efficacy | Average $100,000+ per year for new immuno-oncology drugs | Continued premium for significant survival/QoL gains |

| Reimbursement Negotiations | Complex, requiring strong cost-effectiveness data | Increased focus on HTA and comparative effectiveness |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Agenus leverages a comprehensive suite of data, including SEC filings, investor relations materials, and scientific publications. We also incorporate information from clinical trial databases, industry news, and competitor intelligence to provide a thorough understanding of their product pipeline, pricing strategies, distribution partnerships, and promotional efforts.