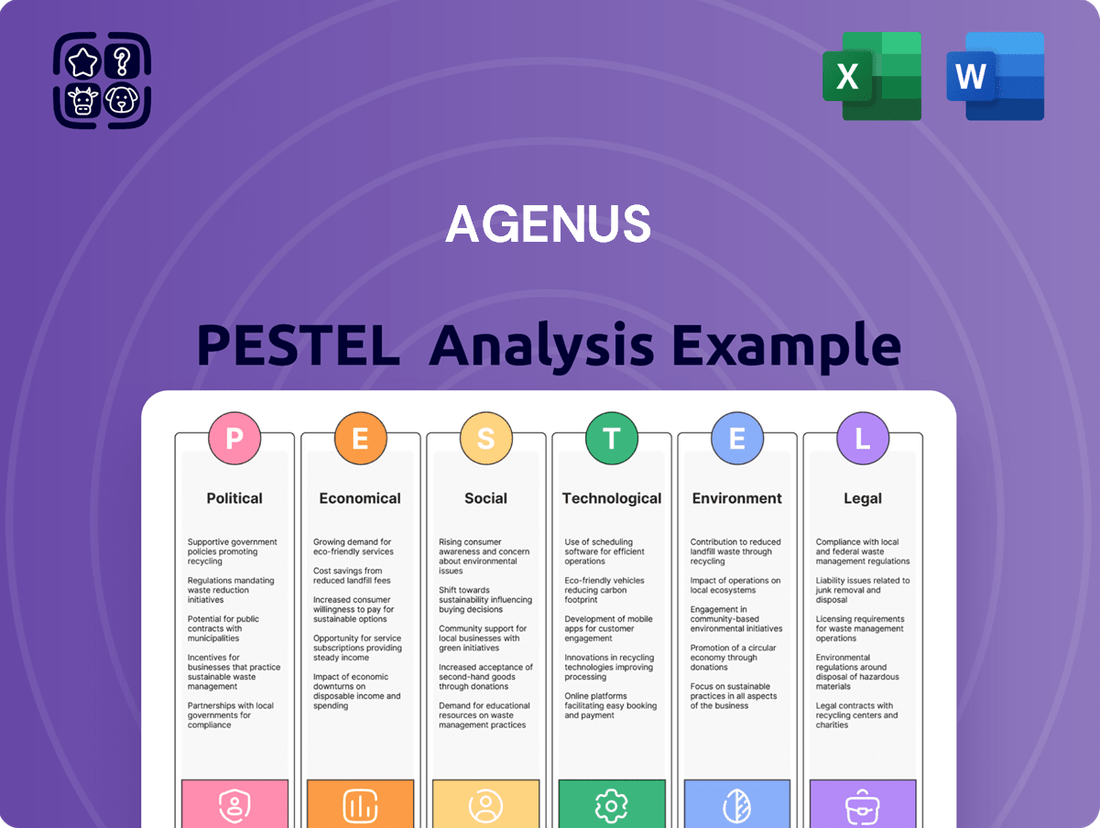

Agenus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agenus Bundle

Unlock the critical external factors shaping Agenus's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your investment strategy and anticipate market shifts. Download the full PESTLE analysis now for a decisive competitive advantage.

Political factors

Government healthcare policies, particularly in key markets like the US and Europe, profoundly shape the biotechnology landscape. Shifts in healthcare expenditure, drug pricing controls, and reimbursement frameworks directly affect Agenus's revenue potential and its ability to bring immuno-oncology treatments to patients. For instance, the US Inflation Reduction Act of 2022 introduced Medicare drug price negotiations, a policy that could influence future pricing strategies for biopharmaceutical companies.

Furthermore, government funding for cancer research and development acts as a vital catalyst, speeding up the discovery and progression of novel therapies through clinical trials. In 2023, the US National Institutes of Health (NIH) allocated billions to cancer research, demonstrating a commitment that can significantly benefit companies like Agenus by supporting early-stage scientific advancements and providing opportunities for collaboration.

The regulatory landscape, overseen by bodies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), significantly influences the time and expense involved in launching new pharmaceuticals. Agenus's ability to successfully navigate these intricate approval processes, particularly leveraging expedited pathways for novel oncology treatments, is crucial for its market entry.

For instance, the FDA's Oncology Center of Excellence actively seeks to expedite the development and review of promising cancer therapies. Agenus's pipeline, with candidates like AGEN1181 in Phase 2 trials for various solid tumors, directly benefits from such initiatives if they meet the criteria for breakthrough therapy designation. However, any tightening of regulatory standards or increased oversight from these agencies could introduce obstacles to Agenus's product development timelines and associated costs.

Global trade policies and geopolitical tensions significantly influence Agenus's operational landscape. For instance, ongoing trade disputes and shifting alliances can disrupt the import of critical raw materials and the export of finished products, impacting Agenus's supply chain efficiency. The company's reliance on international markets for both research collaboration and product distribution means that changes in tariffs or trade agreements, such as those impacting the biotech sector in 2024, directly affect its cost structure and market access.

Restrictions on international collaboration and evolving intellectual property (IP) protection laws present substantial challenges. In 2024, several countries have been strengthening their IP enforcement, which is beneficial for Agenus’s innovations. However, a rise in protectionist policies or differing legal frameworks across key markets, like the EU and Asia, could complicate Agenus's global R&D efforts and licensing agreements, potentially hindering its ability to secure vital partnerships and expand its market reach.

Intellectual Property Protection Enforcement

The robustness of intellectual property (IP) protection and its enforcement is paramount for Agenus, a biotechnology firm deeply invested in R&D for its innovative therapies and platforms. Strong patent laws safeguard their competitive edge and justify the significant capital allocated to research and development. For instance, in 2024, the global biopharmaceutical market's reliance on IP protection remains a cornerstone, with patent expirations continuing to drive market dynamics and the introduction of biosimilars, underscoring the need for vigilant IP management.

Weakening IP enforcement or increased legal challenges to patent rights worldwide could significantly jeopardize Agenus's market position and its ability to recoup R&D investments. This is particularly relevant as the company advances its pipeline, aiming for commercialization of novel immunotherapies. The World Intellectual Property Organization (WIPO) reported in 2024 that patent filings in the health sector remain a significant portion of global innovation, highlighting the ongoing importance of IP in this field.

- Global IP Landscape: In 2024, countries are reviewing and updating their IP laws to balance innovation incentives with public access, impacting biopharma patent strategies.

- Enforcement Challenges: Biotech firms like Agenus face ongoing challenges in enforcing patents against infringers, particularly in emerging markets with varying legal frameworks.

- R&D Investment Protection: The strength of patent protection directly influences Agenus's capacity to attract investment for its costly and lengthy drug development process.

- Competitive Advantage: Robust IP rights are essential for Agenus to maintain exclusivity for its proprietary technologies and therapies, differentiating them from competitors.

Government Support for Biotechnology Innovation

Government initiatives and incentives play a crucial role in fostering innovation within the biotechnology sector, directly impacting companies like Agenus. These can include substantial tax credits for research and development (R&D) and targeted grants for specific disease areas, which can significantly accelerate the development of novel treatments and expand market opportunities.

A politically supportive environment for scientific advancement is paramount. For instance, the U.S. government's commitment to boosting life sciences through programs like the National Institutes of Health (NIH) funding, which saw an budget of approximately $47.5 billion for fiscal year 2024, directly fuels the research Agenus relies on. Furthermore, policies aimed at streamlining regulatory approval processes for innovative therapies can drastically reduce time-to-market, a critical factor in the competitive biotech landscape.

- R&D Tax Credits: Many governments offer significant tax credits for R&D expenses, lowering the cost of innovation for biotech firms. For example, the U.S. R&D Tax Credit can offset a substantial portion of qualifying research expenditures.

- Government Grants: Funding opportunities from agencies like the NIH or the Biomedical Advanced Research and Development Authority (BARDA) provide crucial capital for early-stage research and development of new therapies.

- Regulatory Environment: Favorable regulatory pathways, such as fast-track designations for promising drugs, can expedite the approval process, allowing companies to bring life-saving treatments to market more quickly.

- National Health Priorities: Governments often align funding and policy with national health priorities, creating specific opportunities for companies developing treatments for prevalent diseases.

Government policies on drug pricing and reimbursement directly impact Agenus's revenue streams. For example, the Inflation Reduction Act of 2022 in the US, which allows Medicare to negotiate drug prices, could affect the profitability of future Agenus products. Similarly, evolving healthcare expenditure trends in major markets like Europe in 2024 will shape market access and adoption rates for new immuno-oncology therapies.

Government funding for R&D is a critical driver for biotech innovation. In 2024, agencies like the NIH continue to allocate substantial resources to cancer research, creating opportunities for companies like Agenus to secure grants and advance their pipeline. Favorable regulatory pathways, such as expedited review by the FDA for novel oncology treatments, are also vital for reducing time-to-market.

Geopolitical stability and international trade agreements influence Agenus's global operations and supply chain. Trade disputes or protectionist policies in 2024 could disrupt the import of essential materials or the export of finished products, impacting cost structures and market reach. Strong intellectual property protection is also crucial for safeguarding R&D investments and maintaining a competitive edge.

The regulatory approval process, managed by bodies like the FDA and EMA, significantly dictates the timeline and cost of bringing new therapies to market. Agenus's success hinges on its ability to navigate these complex regulations, potentially leveraging expedited pathways for its promising immuno-oncology candidates in development.

What is included in the product

This Agenus PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives designed to equip stakeholders with the knowledge to navigate market complexities and strategic planning.

Provides a clear, actionable overview of external factors impacting Agenus, enabling proactive strategy adjustments to mitigate risks and capitalize on opportunities.

Economic factors

Global economic growth significantly shapes healthcare expenditure. In 2024, the International Monetary Fund projected a 3.2% global growth rate, a figure that directly impacts how much governments, insurers, and individuals can allocate to healthcare. This spending is crucial for companies like Agenus, as economic slowdowns can curb investment in novel therapies, potentially hindering market penetration and sales of their innovative treatments. Conversely, a healthy economy generally translates to increased access to advanced medical solutions.

Biotechnology research and development is incredibly expensive, and Agenus's progress in bringing new treatments to market hinges on consistent funding. For instance, in 2023, the company reported $132.5 million in R&D expenses, underscoring the significant capital required.

The economic climate directly impacts Agenus's funding opportunities. Access to venture capital, private equity, and the public markets, along with the prevailing cost of capital, are critical determinants of the company's ability to finance its ongoing pipeline development and clinical trials.

The pharmaceutical sector, including companies like Agenus, is under significant scrutiny concerning drug pricing. In 2024, continued legislative efforts and public demand for more affordable medications are expected to shape market dynamics, potentially impacting Agenus's revenue if its novel therapies face pricing ceilings or increased negotiation leverage from payers.

Reimbursement trends are a critical factor for Agenus's commercial success. As of early 2025, major health systems and private insurers are refining their coverage decisions for advanced therapies, including immunotherapies. Agenus's ability to secure favorable reimbursement for its pipeline candidates will directly influence market access and adoption rates, with evolving value-based care models becoming increasingly important for securing payment.

Competition and Market Dynamics

The immuno-oncology landscape is intensely competitive, featuring a mix of large pharmaceutical players and nimble biotechnology firms. Agenus's economic success hinges on its capacity to distinguish its therapeutic offerings, capture market share, and compete effectively on both efficacy and safety profiles. Competitors' pricing strategies also present a significant economic consideration.

For instance, by the end of 2023, the global immuno-oncology market was valued at approximately $60 billion and is projected to reach over $150 billion by 2030, indicating substantial growth and, consequently, heightened competition. Agenus must navigate this dynamic environment by demonstrating clear advantages in its product pipeline.

- Market Share Capture: Agenus's ability to secure a meaningful share of the growing immuno-oncology market is directly tied to its competitive positioning.

- Efficacy and Safety Benchmarks: Outperforming existing treatments in clinical trials is crucial for market adoption and pricing power.

- Competitor Pricing Strategies: Understanding and reacting to how competitors price similar therapies will impact Agenus's revenue potential.

- Pipeline Differentiation: Unique mechanisms of action or novel drug combinations can provide a vital competitive edge.

Inflation and Supply Chain Costs

Inflationary pressures significantly impact Agenus's operational expenses. Rising costs for raw materials, essential for drug manufacturing, and the increasing expense of conducting clinical trials directly affect profitability. For instance, the US Consumer Price Index (CPI) saw a notable increase throughout 2023 and into early 2024, indicating sustained inflationary trends that would naturally translate to higher input costs for companies like Agenus.

Global supply chain disruptions pose a dual threat to Agenus: increased costs and project delays. These disruptions can affect the timely procurement of specialized chemicals, equipment, and even personnel needed for research and development, potentially pushing back critical milestones in their drug development pipeline. The lingering effects of global events in 2022 and 2023 continued to create volatility in shipping costs and component availability well into 2024.

- Rising Material Costs: Inflation directly increases the price of chemicals, reagents, and other supplies vital for Agenus's research and manufacturing processes.

- Increased Clinical Trial Expenses: Higher inflation translates to greater costs for patient recruitment, site management, and data collection in clinical trials.

- Supply Chain Volatility: Disruptions lead to unpredictable shipping costs and potential shortages of critical components, impacting production schedules and overall project timelines.

- Impact on Profitability: The combination of higher operating costs and potential delays can squeeze Agenus's profit margins and affect its ability to invest in future research.

Economic growth directly influences healthcare spending, with global growth projected at 3.2% for 2024 by the IMF, impacting investment in new therapies. Agenus's substantial R&D expenses, amounting to $132.5 million in 2023, highlight the critical need for consistent funding from venture capital, private equity, and public markets. The company must also navigate pricing pressures and evolving reimbursement models for advanced immunotherapies, as payers refine coverage for these treatments in 2025.

Inflationary pressures, evidenced by sustained increases in the US CPI through 2023 and early 2024, raise Agenus's operational costs for raw materials and clinical trials. Simultaneously, global supply chain disruptions, continuing from 2022-2023 into 2024, increase costs and risk project delays for essential components and personnel.

| Factor | 2023 Data | 2024 Projection/Trend | Impact on Agenus |

| Global Economic Growth | N/A | 3.2% (IMF Projection) | Influences healthcare expenditure and investment in R&D. |

| R&D Expenses | $132.5 million | Ongoing | Requires significant capital for pipeline development. |

| Inflation (US CPI) | Increased | Sustained trend into early 2024 | Raises operational costs for materials and trials. |

| Supply Chain Disruptions | Lingering effects | Continued volatility | Increases costs and risks project delays. |

| Immuno-oncology Market Value | ~$60 billion (end of 2023) | Projected >$150 billion by 2030 | Indicates growth but heightened competition. |

Same Document Delivered

Agenus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Agenus PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing Agenus's Political, Economic, Social, Technological, Legal, and Environmental landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external factors impacting Agenus.

Sociological factors

The world's population is getting older. By 2050, projections indicate that over 1.5 billion people will be aged 65 and older, a substantial increase from roughly 700 million in 2020. This demographic shift directly correlates with a higher incidence of cancer, as the risk of developing most cancers increases with age. For instance, the American Cancer Society reported that in 2023, an estimated 1.9 million new cancer cases were diagnosed in the United States, with a significant portion occurring in older adults.

This growing prevalence of cancer in an aging demographic presents a robust and expanding market for oncology treatments. Agenus, with its strategic focus on immuno-oncology, is well-positioned to capitalize on this trend. Immuno-oncology therapies aim to harness the patient's own immune system to fight cancer, addressing a critical unmet medical need, particularly in an older patient population that often has complex health profiles and may not respond as well to traditional treatments.

The growing voice of patient advocacy groups is a significant sociological force, especially in oncology. These organizations, often fueled by personal experiences, actively campaign for faster approval and broader access to innovative treatments. For Agenus, this translates into a potentially more receptive environment for its novel immuno-oncology therapies, as patient demand can accelerate market acceptance and influence regulatory bodies.

Public awareness surrounding cancer and its treatment landscape has also surged, driven by media coverage and educational initiatives. This heightened awareness empowers patients to seek out and demand cutting-edge options. Agenus's focus on cellular therapies and personalized medicine aligns well with this trend, as informed patients are more likely to explore and advocate for treatments like those in Agenus's pipeline.

Societal expectations for fair access to cutting-edge medical care, particularly for novel cancer therapies, are increasingly shaping healthcare policy and influencing how companies like Agenus approach pricing. This means Agenus might feel compelled to make its treatments available to a wider range of patients, which could affect how they price their products and how they distribute them.

For instance, in 2024, many developed nations are seeing continued public discourse around healthcare affordability, with patient advocacy groups actively campaigning for lower costs of innovative treatments. This pressure could lead Agenus to explore tiered pricing models or partnerships to broaden accessibility, potentially impacting their profit margins but also expanding market reach.

Lifestyle Factors and Disease Prevalence

Shifting lifestyle patterns and environmental exposures are significantly impacting cancer rates, particularly among younger populations. For instance, the incidence of colorectal cancer has been observed to be increasing in individuals under 50. This trend highlights a critical area where Agenus can focus its research and development, addressing emerging public health concerns and unmet medical needs.

Understanding these evolving lifestyle factors is crucial for Agenus to strategically align its R&D pipeline. By identifying specific cancers with rising prevalence due to these societal changes, the company can better target its therapeutic development. This proactive approach ensures that Agenus is positioned to address the most significant challenges in oncology.

- Rising Colorectal Cancer in Younger Demographics: Studies indicate a concerning upward trend in colorectal cancer diagnoses among adults under 50, a demographic previously considered low-risk.

- Lifestyle Influences: Factors such as dietary habits, sedentary lifestyles, and obesity are increasingly linked to the development of various cancers, including those affecting younger individuals.

- Environmental Factors: Exposure to certain environmental toxins and pollutants may also play a role in altering cancer prevalence and contributing to disease development across different age groups.

- Agenus's Strategic Focus: By analyzing these sociological shifts, Agenus can prioritize research into novel treatments for cancers driven by modern lifestyle and environmental pressures.

Public Perception of Biotechnology and Gene Therapies

Public perception significantly shapes the adoption of advanced medical treatments. For Agenus, a company focused on immuno-oncology and gene therapies, public acceptance of gene editing and cell therapies is crucial. A positive outlook, fueled by clear communication about safety and efficacy, directly impacts patient willingness to try these innovative approaches.

Recent surveys indicate a growing, albeit cautious, optimism towards biotechnology. For instance, a 2024 Pew Research Center report found that while a majority of Americans express some level of comfort with gene editing for treating diseases, concerns about unintended consequences persist. This sentiment highlights the need for Agenus to prioritize transparent communication and demonstrate successful patient outcomes to build trust.

- Growing Acceptance: Public comfort with gene editing for disease treatment is increasing, with a significant portion of the population viewing it favorably for therapeutic purposes.

- Trust is Key: Patient willingness to adopt gene and cell therapies is directly linked to their trust in the technology and the companies developing it.

- Information Gap: A need exists for clearer, more accessible information to address public concerns and foster broader understanding of the benefits and risks.

- Impact on Market: Positive public sentiment is a vital driver for Agenus's market penetration and long-term growth in the competitive biotech landscape.

The aging global population is a significant driver for Agenus, as cancer incidence rises with age. By 2050, over 1.5 billion people are projected to be 65 or older, increasing the demand for oncology treatments. Patient advocacy groups are also increasingly vocal, pushing for faster approvals and wider access to innovative therapies like Agenus's immuno-oncology treatments.

Public awareness of cancer and its treatments is growing, empowering patients to seek advanced options. Agenus's focus on cellular and personalized medicine aligns with this trend. Societal expectations for equitable access to cutting-edge care also influence pricing strategies, potentially leading Agenus to explore tiered pricing or partnerships to broaden accessibility.

Shifting lifestyles and environmental exposures are contributing to rising cancer rates in younger populations, such as the increase in colorectal cancer among those under 50. This presents an opportunity for Agenus to focus R&D on emerging public health concerns. Public perception of advanced therapies like gene editing is also evolving, with a growing, though cautious, optimism. Transparent communication about safety and efficacy is crucial for Agenus to build trust and drive adoption of its novel treatments.

Technological factors

Rapid advancements in understanding the immune system's role in fighting cancer directly fuel Agenus's core business. The company's focus on immuno-oncology means that breakthroughs in this field are critical for its pipeline and competitive positioning.

Continuous innovation in checkpoint inhibitors, cell therapies, and cancer vaccines is paramount. For instance, the immuno-oncology market was valued at approximately $150 billion in 2023 and is projected to grow significantly, presenting opportunities for companies like Agenus to leverage new scientific discoveries.

Artificial intelligence and machine learning are dramatically speeding up drug discovery and development. These technologies are key in identifying potential drug targets, sifting through vast numbers of compounds, and even designing more effective clinical trials. For instance, Agenus's partnership with Noetik aims to create AI-powered predictive biomarkers, showcasing their commitment to leveraging AI for more efficient research.

Breakthroughs in genomic sequencing and proteomics are revolutionizing our understanding of cancer. These advancements, coupled with sophisticated bioinformatics, are key to identifying new biomarkers and therapeutic targets. For Agenus, this means a stronger foundation for developing personalized medicine strategies.

Biomanufacturing and Process Innovation

Advances in biomanufacturing are crucial for Agenus, directly impacting the cost and efficiency of producing their antibody-based therapeutics and cell therapies. Innovations like continuous manufacturing, which streamlines production by eliminating batch processing steps, are gaining traction. For instance, companies in the biopharma sector are increasingly investing in these advanced manufacturing platforms to reduce lead times and improve scalability.

Process optimization, including the adoption of green chemistry principles, is also a key technological factor. This involves developing more sustainable and environmentally friendly production methods, which can also lead to cost savings through reduced waste and energy consumption. Agenus's ability to leverage these technological advancements will be instrumental in its competitive positioning in the rapidly evolving immuno-oncology market.

The biopharmaceutical industry saw significant investment in advanced manufacturing technologies in 2024, with reports indicating a substantial increase in capital expenditure on automation and single-use systems. This trend is expected to continue through 2025 as companies seek to enhance flexibility and speed up the delivery of novel therapies.

- Continuous Manufacturing: Streamlines production, reduces costs, and improves scalability for biologics.

- Green Chemistry: Focuses on sustainable and environmentally friendly production processes, minimizing waste and energy usage.

- Automation and Single-Use Systems: Increasing adoption in biopharma for enhanced flexibility and faster therapy delivery.

Data Analytics and Digital Health Platforms

The increasing volume of health data and the rise of digital health platforms present significant opportunities for Agenus. These technologies can streamline clinical trial processes, improve the collection of real-world evidence, and enhance patient tracking. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, offering Agenus avenues to refine its research and development efforts.

By integrating advanced data analytics, Agenus can gain deeper insights into treatment efficacy and patient responses. Digital platforms facilitate the real-time monitoring of patients, leading to quicker identification of potential issues and better overall trial management. This data-driven approach is crucial for optimizing therapeutic development and understanding market dynamics more effectively.

- Enhanced Clinical Trials: Data analytics can optimize patient selection and trial design, potentially reducing trial timelines and costs.

- Real-World Evidence (RWE): Digital platforms enable the capture of RWE, which is increasingly important for regulatory submissions and market access, with the RWE market expected to reach over $100 billion by 2028.

- Patient Monitoring: Remote patient monitoring tools integrated into digital health platforms can improve adherence and provide continuous data on patient well-being, supporting Agenus's immunotherapy development.

Technological advancements in immuno-oncology are fundamental to Agenus's growth, with the market valued at approximately $150 billion in 2023 and poised for substantial expansion. Innovations in AI and machine learning are accelerating drug discovery, as seen in Agenus's collaboration with Noetik to develop AI-powered predictive biomarkers. Breakthroughs in genomic sequencing and proteomics are crucial for identifying new therapeutic targets and advancing personalized medicine strategies.

The biopharmaceutical sector saw significant investment in advanced manufacturing, including automation and single-use systems, in 2024, a trend expected to continue into 2025. These technologies enhance production flexibility and speed up therapy delivery. Continuous manufacturing and green chemistry principles are also key, aiming to streamline production, reduce costs, and promote sustainability.

Digital health platforms and advanced data analytics are transforming clinical trials and patient monitoring. The global digital health market, valued at around $200 billion in 2023, offers Agenus opportunities to improve RWE capture and trial efficiency. Optimized patient selection and real-time monitoring through these platforms can lead to faster development cycles and better therapeutic outcomes.

Legal factors

Robust patent protection is crucial for Agenus to secure its innovative immuno-oncology therapies and proprietary research. As of early 2024, Agenus held a significant portfolio of patents covering its core technologies, including its MiNK Therapeutics platform, which is vital for maintaining its competitive edge.

The dynamic nature of patent law, particularly concerning advancements like CRISPR gene editing and AI-driven drug discovery, presents both opportunities and challenges. Navigating these evolving legal frameworks is essential for Agenus to protect its intellectual property and continue attracting the substantial investment needed for clinical development and market entry.

Agenus navigates a stringent regulatory landscape, where agencies like the U.S. Food and Drug Administration (FDA) dictate rigorous standards for drug approval and clinical trial conduct. The company's ability to meet evolving requirements, such as those outlined in the 21st Century Cures Act, directly impacts its research and development timelines and associated expenditures. For instance, the FDA's accelerated approval pathway, while offering faster market access for promising therapies, still demands robust post-market studies, adding to ongoing compliance burdens.

Agenus navigates a stringent regulatory landscape, particularly concerning healthcare compliance and anti-kickback statutes. These laws, designed to prevent fraudulent practices and ensure fair competition in the pharmaceutical sector, mandate strict adherence in marketing and promotional activities. Failure to comply can result in substantial fines and damage to the company's reputation.

The financial repercussions of non-compliance are significant. For instance, in 2024, the Department of Justice reported billions of dollars in settlements related to healthcare fraud and abuse, highlighting the high stakes involved. Agenus must maintain robust internal controls and training programs to mitigate these risks and ensure all operations align with federal and state regulations.

Data Privacy and Cybersecurity Laws

Agenus operates within a complex legal landscape, particularly concerning data privacy and cybersecurity. Given the highly sensitive nature of patient data collected during clinical trials and throughout its commercial operations, the company must adhere to rigorous regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Failure to comply can result in significant fines and reputational damage. For instance, in 2023, the EU saw substantial GDPR fines, with some companies facing penalties in the tens of millions of euros for data breaches and mishandling personal information.

Maintaining robust cybersecurity measures is paramount for Agenus. This is not only to protect proprietary research and development information but also to safeguard the integrity and confidentiality of patient data. The threat of cyberattacks on healthcare and biotechnology firms remains high, with ransomware attacks and data breaches frequently reported. In 2024, cybersecurity spending in the healthcare sector is projected to continue its upward trend, reflecting the critical need for advanced protective measures. A breach could compromise ongoing trials, expose patient identities, and lead to severe legal repercussions.

- GDPR Fines: In 2023, GDPR fines across the EU exceeded €1.5 billion, highlighting the strict enforcement of data privacy.

- HIPAA Violations: The U.S. Department of Health and Human Services regularly levies fines for HIPAA violations, with penalties often reaching hundreds of thousands or millions of dollars depending on the severity and scope of the breach.

- Cybersecurity Investment: Global cybersecurity spending in healthcare was estimated to reach over $125 billion in 2023 and is expected to grow significantly through 2025.

- Data Breach Impact: The average cost of a data breach in the healthcare industry in 2023 was reported to be around $10.10 million, underscoring the financial risks.

Product Liability and Litigation Risks

As a biotechnology firm, Agenus faces inherent product liability risks. This stems from the nature of developing novel therapies where unexpected adverse events or unmet efficacy claims can lead to significant litigation. For instance, in 2023, the pharmaceutical industry saw a substantial number of product liability lawsuits filed, with settlements often reaching millions of dollars, highlighting the financial exposure.

Effective legal strategies and robust risk management are therefore critical for Agenus. This includes rigorous clinical trial protocols, transparent communication regarding potential risks, and comprehensive insurance coverage. The company's ability to navigate these legal complexities directly impacts its financial stability and reputation within the market.

- Product Liability Exposure: Agenus’s novel therapies carry the risk of litigation due to potential adverse events or efficacy disputes.

- Litigation Impact: Successful lawsuits can result in substantial financial penalties and damage to the company's reputation.

- Risk Mitigation: Strong legal frameworks, thorough clinical testing, and transparent communication are essential for managing these risks.

- Industry Trend: The biotechnology sector, in general, continues to face scrutiny and potential litigation regarding drug safety and effectiveness.

Agenus must navigate evolving intellectual property laws, particularly concerning gene editing and AI in drug discovery, to protect its innovations. Robust patent protection, as evidenced by its significant portfolio in early 2024, is vital for maintaining its competitive edge and attracting investment for clinical development.

Regulatory compliance is paramount, with agencies like the FDA setting strict standards for drug approval and clinical trials. Meeting these evolving requirements, such as those in the 21st Century Cures Act, directly affects Agenus's development timelines and costs, with pathways like accelerated approval still demanding extensive post-market surveillance.

Data privacy laws like GDPR and HIPAA are critical due to the sensitive patient information Agenus handles. Non-compliance can lead to substantial fines, as seen with multi-million euro GDPR penalties in the EU in 2023, and necessitates strong cybersecurity measures, with healthcare cybersecurity spending projected to exceed $125 billion in 2023.

Product liability risks are inherent in developing novel therapies, with potential litigation from adverse events or efficacy disputes. The pharmaceutical industry faced numerous product liability lawsuits in 2023, often resulting in multi-million dollar settlements, underscoring the need for rigorous risk management and insurance.

| Legal Factor | Relevance to Agenus | 2023-2025 Data/Trends |

|---|---|---|

| Intellectual Property | Protecting novel immuno-oncology therapies and research platforms. | Continued evolution of patent law for gene editing and AI-driven discovery. |

| Regulatory Compliance | Adherence to FDA standards for drug approval and clinical trials. | Increased focus on post-market studies for accelerated approvals; 21st Century Cures Act compliance. |

| Data Privacy & Cybersecurity | Safeguarding sensitive patient data under GDPR and HIPAA. | Significant GDPR fines in EU (e.g., €1.5B+ in 2023); Healthcare cybersecurity spending over $125B in 2023. |

| Product Liability | Mitigating risks from potential adverse events or efficacy claims in novel therapies. | High volume of product liability lawsuits in pharma in 2023, with substantial settlements. |

Environmental factors

The pharmaceutical sector, including companies like Agenus, is under growing scrutiny to implement sustainable manufacturing. This involves reducing energy consumption, water usage, and greenhouse gas emissions throughout the production lifecycle. For instance, the industry's overall carbon footprint is a significant concern, with efforts focused on optimizing supply chains and adopting renewable energy sources.

Agenus, as a participant in this industry, is tasked with minimizing waste, particularly chemical byproducts from its research and development activities. Responsible management of these materials is crucial to prevent environmental contamination. The company is also expected to explore and integrate greener production methods, potentially leading to more efficient and less resource-intensive processes in the future.

Pharmaceutical manufacturing, including that of companies like Agenus, is inherently energy-intensive, leading to a significant carbon footprint. This process often requires substantial electricity for research, development, and production facilities, contributing to greenhouse gas emissions.

As global efforts to combat climate change intensify, Agenus, like its peers, can anticipate increased scrutiny regarding its energy consumption. Regulatory bodies and investors are pushing for greater transparency and actionable plans to reduce environmental impact, potentially requiring a transition towards renewable energy sources.

For instance, the biopharmaceutical industry's energy use is a growing concern, with some estimates suggesting it contributes a notable percentage to overall industrial energy demand. Companies are thus exploring ways to improve energy efficiency and adopt cleaner energy alternatives to meet evolving environmental standards and stakeholder expectations.

Drug manufacturing, including Agenus's operations, is water-intensive, demanding substantial resources for processes and cooling. In 2024, the pharmaceutical industry globally faced increasing scrutiny over water consumption, with some regions experiencing shortages. Agenus must therefore invest in water-saving technologies and efficient usage protocols to mitigate operational risks and maintain regulatory compliance.

Wastewater generated from Agenus's facilities requires sophisticated treatment to remove chemical residues and biological contaminants before discharge. Environmental agencies worldwide, including the EPA in the US, are tightening discharge limits. For instance, by 2025, stricter regulations on pharmaceutical pollutants in wastewater are anticipated, necessitating advanced treatment systems to avoid penalties and environmental damage.

Supply Chain Environmental Impact

The environmental footprint of Agenus's supply chain, encompassing everything from sourcing raw materials to delivering final products, is increasingly under scrutiny. This includes the energy consumption and waste generation at manufacturing sites and the emissions from transporting goods globally.

To mitigate these impacts, Agenus may need to actively partner with its suppliers to encourage and implement more sustainable operational practices. This collaboration is crucial for reducing greenhouse gas emissions and minimizing the overall environmental burden across the entire value chain.

For instance, the pharmaceutical industry, in general, has been focusing on reducing its carbon footprint. A 2024 report indicated that the sector's transportation and logistics alone contribute significantly to its emissions. Agenus's efforts could include optimizing shipping routes, exploring lower-emission transport options, and encouraging suppliers to adopt renewable energy sources.

- Focus on sustainable sourcing: Evaluating suppliers based on their environmental performance and commitment to eco-friendly practices.

- Logistics optimization: Implementing strategies to reduce emissions from transportation, such as consolidating shipments and utilizing more fuel-efficient carriers.

- Waste reduction initiatives: Working with partners to minimize waste generation throughout the production and distribution processes.

Biodiversity and Biosecurity Considerations

As a biotechnology firm like Agenus, understanding and managing biodiversity and biosecurity is paramount. This involves careful stewardship of biological materials used in research and development, ensuring no unintended harm to ecosystems.

Adherence to strict biosecurity protocols is crucial to prevent the accidental release of biological agents. This includes robust containment measures for genetically modified organisms (GMOs) and compliance with international and national regulations governing their use and containment. For instance, the U.S. Department of Agriculture (USDA) Animal and Plant Health Inspection Service (APHIS) sets guidelines for biotechnology, which Agenus would need to follow.

Responsible management of biological waste is another key environmental factor. Proper sterilization and disposal methods are essential to mitigate any environmental risks associated with research byproducts. In 2023, the global biotechnology market was valued at approximately $1.37 trillion, highlighting the significant economic activity and the corresponding responsibility to operate sustainably.

- Biodiversity Impact: Agenus must assess and minimize any potential negative effects its research activities might have on local or global biodiversity, particularly when working with novel biological entities.

- Biosecurity Protocols: Implementing and maintaining stringent biosecurity measures are essential to safeguard against the accidental release of biological materials, ensuring containment and preventing ecological disruption.

- GMO Regulations: Compliance with regulations concerning genetically modified organisms, such as those overseen by the EPA and FDA in the U.S., is critical for Agenus's operations.

- Waste Management: Environmentally sound practices for handling and disposing of biological waste are necessary to prevent contamination and protect environmental health.

Agenus, like other companies in the life sciences, faces increasing pressure to adopt sustainable practices, particularly concerning energy and water usage. The biopharmaceutical industry's energy demands are significant, contributing to a notable carbon footprint, with a 2024 report highlighting transportation and logistics as major emission sources. Stricter regulations on wastewater discharge are also anticipated by 2025, necessitating advanced treatment systems.

The company must also manage its supply chain's environmental impact, from raw material sourcing to product delivery, and actively engage suppliers in adopting greener practices. Biodiversity and biosecurity are critical considerations, requiring strict containment for genetically modified organisms and adherence to regulations like those from the USDA APHIS.

| Environmental Factor | Impact on Agenus | Mitigation Strategies |

|---|---|---|

| Energy Consumption | High energy use in R&D and manufacturing contributes to carbon footprint. | Invest in energy-efficient technologies, explore renewable energy sources. |

| Water Usage | Water-intensive processes in manufacturing and cooling. | Implement water-saving technologies, optimize usage protocols. |

| Wastewater Management | Need for sophisticated treatment of chemical and biological contaminants. | Upgrade wastewater treatment systems to meet anticipated stricter discharge limits by 2025. |

| Supply Chain Emissions | Emissions from transportation and logistics are a significant concern. | Optimize shipping routes, use fuel-efficient carriers, encourage supplier sustainability. |

| Biodiversity & Biosecurity | Potential impact on ecosystems from biological materials and GMOs. | Adhere to strict biosecurity protocols, comply with GMO regulations (e.g., USDA APHIS). |

PESTLE Analysis Data Sources

Our Agenus PESTLE Analysis is built on a robust foundation of data from leading financial news outlets, regulatory bodies, and market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, and societal trends impacting the biotechnology sector.