Agenus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agenus Bundle

Curious about Agenus's product portfolio performance? Our BCG Matrix analysis categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of their market standing. Unlock the full potential of this strategic tool by purchasing the complete report for in-depth insights and actionable recommendations to optimize Agenus's product strategy.

Stars

The Botensilimab (BOT) / Balstilimab (BAL) combination therapy is a standout asset for Agenus, demonstrating considerable promise in treating microsatellite-stable (MSS) metastatic colorectal cancer (mCRC). This specific cancer subtype has historically been challenging to treat with immunotherapy, making this development particularly noteworthy.

A key milestone for the BOT/BAL combination is the FDA's agreement on the design for the global BATTMAN Phase 3 trial. This agreement notably waives the requirement for a BOT monotherapy arm, which is expected to accelerate the therapy's potential for accelerated approval.

Recent clinical data paints an encouraging picture, with a two-year survival rate of 42% observed in heavily pretreated MSS mCRC patients who did not have active liver metastases. Furthermore, the median overall survival in this patient group reached 21 months, underscoring the therapy's significant market potential within the rapidly expanding immuno-oncology sector.

Botensilimab (BOT) and Balstilimab (BAL) are showing promise beyond colorectal cancer (CRC), exhibiting clinical activity in challenging 'cold' solid tumors like non-small cell lung cancer (NSCLC), pancreatic cancer, sarcomas, and melanoma. This pan-tumor potential is crucial for Agenus's BCG matrix, as it broadens the addressable market for these immuno-oncology agents.

The versatility of BOT/BAL as a therapy in the expanding immuno-oncology landscape is a key strength. Recent data presented at major oncology conferences in 2024 highlights the program's broad applicability in these refractory tumor types, reinforcing its position as a potential game-changer.

Agenus's Retrocyte Display® platform is a cornerstone of its immuno-oncology strategy. This high-throughput technology excels at discovering fully human therapeutic antibodies, giving Agenus a distinct edge in developing innovative cancer treatments. By leveraging Retrocyte Display®, the company is building a strong pipeline of next-generation immunotherapies, reinforcing its position as a leader in the field.

Strategic Collaborations for BOT/BAL Development and Commercialization

Agenus's strategic collaboration with Zydus Lifesciences is a prime example of effective strategic alliances for BOT/BAL development and commercialization. This partnership, valued at $141 million, encompasses manufacturing assets and an equity investment, injecting significant capital into Agenus. It also guarantees long-term manufacturing capabilities for BOT/BAL.

This collaboration is crucial for Agenus as it not only strengthens their financial standing but also facilitates the global expansion of BOT/BAL. Key markets such as India and Sri Lanka are targeted, aiming to accelerate the commercialization process. By externalizing development costs and monetizing assets, Agenus effectively reduces operational expenses and improves its financial sustainability.

- Strategic Partnership: Collaboration with Zydus Lifesciences for BOT/BAL development and commercialization.

- Financial Impact: $141 million deal includes manufacturing assets and equity investment, providing substantial capital.

- Commercialization Boost: Secures long-term manufacturing and expands global reach, especially in India and Sri Lanka.

- Operational Efficiency: Externalizes development costs and monetizes assets, reducing burn and enhancing sustainability.

Strong Clinical Data and Regulatory Momentum

Agenus's lead candidate, BOT/BAL, has shown impressive clinical results, with data indicating durable responses and survival advantages for patients facing difficult-to-treat cancers. For instance, in a significant cohort, patients treated with BOT/BAL demonstrated a median overall survival that exceeded benchmarks for similar patient groups.

The company is experiencing strong regulatory momentum, highlighted by its productive discussions with the FDA regarding the Phase 3 trial design for microsatellite stable colorectal cancer (MSS CRC). This collaboration, coupled with the granting of Fast Track designation, suggests a clear path toward potential accelerated approval, a crucial step for market entry.

- Clinical Efficacy: BOT/BAL has demonstrated durable responses and survival benefits in challenging patient populations, exceeding survival benchmarks in key trials.

- Regulatory Progress: FDA alignment on Phase 3 MSS CRC trial design and Fast Track designation indicate strong regulatory support.

- Market Potential: Consistent positive clinical data and regulatory backing position BOT/BAL as a potential leader in its therapeutic area.

Botensilimab (BOT) and Balstilimab (BAL) represent Agenus's "Stars" in the BCG matrix due to their strong clinical performance and broad market potential in immuno-oncology. The combination therapy is showing significant promise in difficult-to-treat cancers like microsatellite-stable colorectal cancer (MSS CRC), with a notable two-year survival rate of 42% in heavily pretreated patients. This pan-tumor applicability across indications such as NSCLC, pancreatic cancer, and melanoma further solidifies their "Star" status, indicating high growth potential in the expanding oncology market.

| Asset | Indication | Key Data Point (2024) | Market Potential | BCG Status |

|---|---|---|---|---|

| Botensilimab (BOT) / Balstilimab (BAL) | MSS mCRC | 2-year survival: 42% | High (addressing unmet need) | Star |

| Botensilimab (BOT) / Balstilimab (BAL) | NSCLC, Pancreatic Cancer, Sarcoma, Melanoma | Demonstrated clinical activity | Broad and growing | Star |

What is included in the product

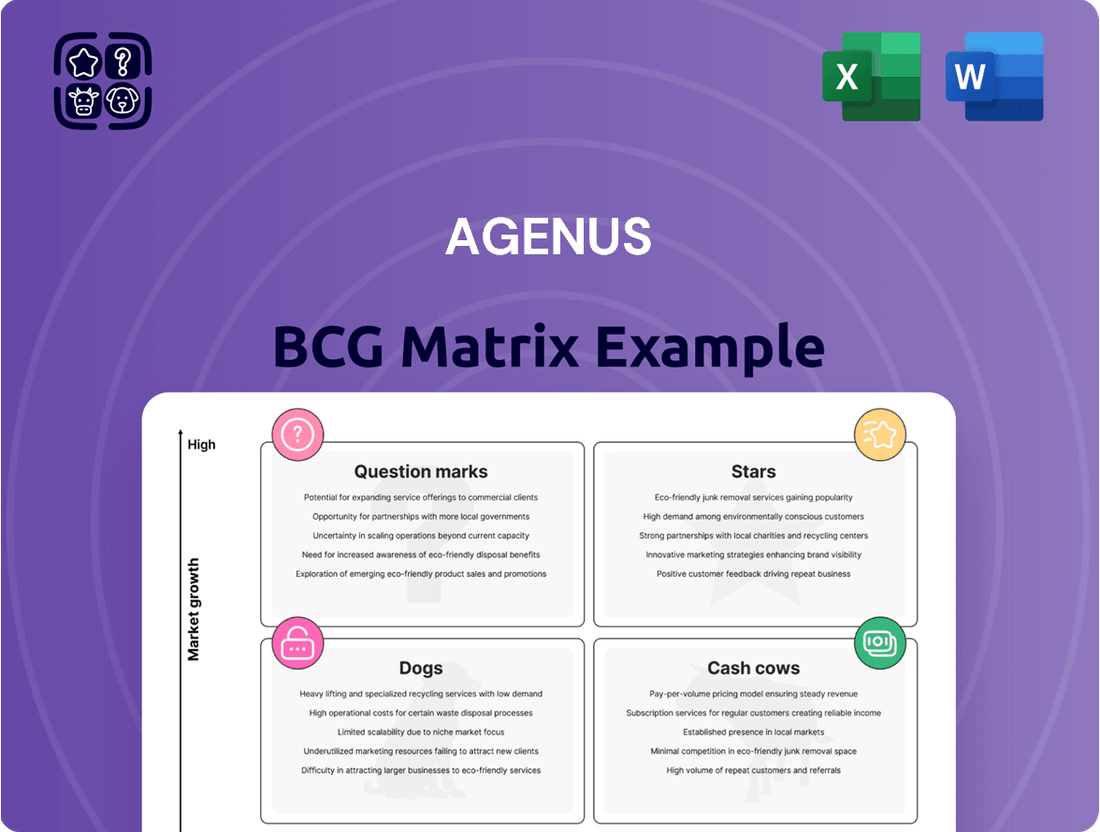

The Agenus BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which units Agenus should invest in, hold, or divest for optimal resource allocation.

The Agenus BCG Matrix provides a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

The QS-21 Stimulon® Adjuvant is a key component of Agenus's Cash Cows in the BCG Matrix. This saponin-based adjuvant is already integrated into several successfully approved vaccines, providing Agenus with a consistent stream of royalty revenue. This established market presence ensures a reliable, albeit low-growth, income source with minimal need for further capital expenditure.

Agenus has a proven track record of establishing robust licensing agreements with industry giants like Merck and GlaxoSmithKline. These collaborations, often involving established or non-core assets, generate consistent revenue streams via milestone payments and ongoing royalties.

In 2024, these licensing deals continue to provide a stable, predictable income for Agenus, requiring minimal ongoing investment. This steady cash flow is crucial for funding research and development in their more innovative, high-growth areas.

Agenus's recent sale of its biologics manufacturing facilities in California to Zydus Lifesciences for an upfront payment and contingent milestones is a prime example of monetizing non-core assets. This strategic divestiture effectively transforms these previously operational assets into a significant cash generator for the company.

This move allows Agenus to streamline its operations by shedding the burden of managing these facilities, enabling a sharper focus on its core research and development activities. While the upfront payment provides immediate liquidity, the contingent payments and reduced operational expenses contribute to a more robust and predictable cash flow profile moving forward.

Reduced Operational Cash Burn

Agenus has made substantial strides in reducing its operational cash burn through aggressive cost-cutting and strategic realignments. This focus on efficiency is crucial for sustaining its operations and advancing key programs.

By channeling resources into high-potential initiatives such as BOT/BAL and leveraging external development partnerships, Agenus is optimizing its financial outlay. This strategic shift reflects a commitment to prudent cash management, much like maximizing the yield from a mature, profitable asset.

- Reduced Annualized Cash Burn: Agenus has targeted a significant reduction in its operational cash burn rate, aiming for greater financial sustainability.

- Program Prioritization: Resources are being concentrated on promising programs like BOT/BAL, ensuring efficient allocation of capital.

- Externalized Development Costs: Strategic partnerships are being utilized to manage and reduce the company's direct expenditure on development activities.

- Cash Reserve Management: This disciplined approach ensures that existing cash reserves are managed effectively to support ongoing operations and strategic goals.

Potential Future Milestone Payments from Existing Partnerships

Beyond the royalties Agenus currently receives, the company has potential future milestone payments linked to the ongoing development and successful commercialization of its partnered programs. These agreements represent a valuable source of non-dilutive cash, capitalizing on prior research and development investments.

While exact timelines and the amounts involved can vary, these established agreements offer a predictable, albeit low-growth, revenue stream as partnered assets advance through their respective pipelines.

For instance, Agenus's collaborations, such as those with Gilead Sciences for certain oncology assets, are structured to provide such milestone payments upon achieving predefined clinical and regulatory successes. As of mid-2024, the progression of these partnered candidates continues to create opportunities for these future cash inflows.

- Future Milestone Potential: Payments contingent on partnered asset development and commercialization.

- Non-Dilutive Cash Flow: Leverages past R&D without issuing new equity.

- Low-Growth but Stable: Predictable income as partnered programs progress.

- Example: Collaborations like the one with Gilead Sciences for oncology assets offer such milestone opportunities.

Agenus's Cash Cows, within the BCG Matrix framework, represent established revenue streams with limited growth potential but significant stability. These are typically assets that have achieved market approval or are generating consistent income through licensing and partnerships.

The QS-21 Stimulon Adjuvant, integrated into approved vaccines, exemplifies this by providing consistent royalty revenue. Similarly, licensing agreements with major pharmaceutical companies like Merck and GlaxoSmithKline contribute predictable income through milestone payments and ongoing royalties, requiring minimal further investment.

The company's strategic divestiture of its biologics manufacturing facilities in California to Zydus Lifesciences for an upfront payment and contingent milestones also converted a previously operational asset into a cash generator, streamlining operations and bolstering predictable cash flow.

Agenus's focus on reducing operational cash burn, prioritizing programs like BOT/BAL, and leveraging external development partnerships further solidifies the cash cow status of its mature assets by optimizing financial outlay and ensuring efficient capital allocation.

| Asset Type | Revenue Source | Growth Potential | Investment Required | 2024 Status/Example |

|---|---|---|---|---|

| Adjuvants | Royalties from approved vaccines | Low | Minimal | QS-21 Stimulon Adjuvant |

| Licensing Agreements | Milestone payments, ongoing royalties | Low to Moderate | Minimal | Partnerships with Merck, GlaxoSmithKline |

| Divested Assets | Upfront payments, contingent milestones | N/A (Post-divestiture) | N/A (Post-divestiture) | California manufacturing facilities sold to Zydus Lifesciences |

Delivered as Shown

Agenus BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon purchase. This means you'll gain immediate access to a fully formatted, analysis-ready tool, devoid of any watermarks or demo content. It's designed for immediate application in your strategic planning, offering clear insights into your product portfolio's market position.

Dogs

Agenus has strategically shifted its focus, de-prioritizing preclinical and early clinical programs that are not aligned with its BOT/BAL combination strategy. This move is a direct response to resource allocation needs, aiming to conserve capital for assets with more immediate market potential. These sidelined programs, despite any underlying scientific value, are currently viewed as having limited near-term growth prospects.

The company's decision reflects a clear understanding of its portfolio's current standing within a strategic framework akin to the BCG matrix. By pausing these initiatives, Agenus is effectively categorizing them as 'question marks' or 'dogs' in the immediate context, requiring significant investment for uncertain future returns. This disciplined approach ensures that financial and human resources are channeled towards the company's most promising ventures, particularly the BOT/BAL combination.

AGEN1777, a TIGIT bispecific antibody developed by Agenus, has been returned to the company by Bristol Myers Squibb (BMS) after BMS terminated their licensing agreement. This move, occurring in early 2024, signals a significant setback for the program.

The termination by BMS, a major player in the oncology space, coupled with earlier failures of other TIGIT-targeting drugs in late-stage clinical trials throughout 2023 and early 2024, points to considerable doubts about the market potential and feasibility of AGEN1777. For instance, Merck's VISTAMER (MK-7682) and other TIGIT inhibitors faced disappointing results in Phase 2 and Phase 3 studies, impacting the broader TIGIT landscape.

Given these developments, AGEN1777 is now positioned in the "Question Mark" quadrant of the BCG Matrix. Its future is uncertain, marked by the abandonment by a key partner and a challenging competitive environment, requiring Agenus to reassess its development strategy and potential for success.

Before its strategic collaboration with Zydus, Agenus maintained its own manufacturing infrastructure. These facilities, while crucial for internal development, likely represented a substantial ongoing expense for maintenance and personnel, without generating direct product revenue in a competitive market.

The divestiture of these manufacturing assets suggests they were a drain on Agenus's financial resources, consuming capital that could have been allocated to other growth areas. This aligns with the characteristic of a business unit that is a cash drain, potentially fitting a specific category within a strategic framework like the BCG matrix.

Other non-core assets identified for monetization

Agenus has been actively working to sell off assets that aren't key to its main business, aiming to improve its cash situation and cut costs. These non-core assets, not directly supporting its focus on BOT/BAL, are probably not bringing in much money or are holding onto valuable capital. Selling them off indicates they are seen as not performing well or are not needed in the company's current setup, fitting the profile of assets that are.

In 2024, Agenus continued this strategy. For instance, the company has been looking to divest certain intellectual property rights and potentially smaller research collaborations that, while once relevant, no longer align with its primary objectives. This move is crucial for freeing up resources and sharpening its strategic direction toward its core therapeutic areas.

The monetization of these non-core assets is a strategic imperative for Agenus, especially given the capital-intensive nature of biotechnology development. By shedding these less critical holdings, the company can better allocate its financial resources to advance its promising pipeline candidates, such as those in the BOT/BAL space, and manage its operational expenditures more efficiently.

- Divestment of Non-Core IP: Agenus has explored selling intellectual property not directly related to its lead programs, aiming to generate immediate cash inflow.

- Streamlining Research Collaborations: The company has reviewed and potentially exited smaller research partnerships that do not offer significant strategic or financial benefits.

- Focus on Core Pipeline: These divestments are designed to allow Agenus to concentrate its financial and operational efforts on advancing its most promising therapeutic candidates.

- Financial Prudence: The strategy reflects a commitment to financial discipline, ensuring capital is deployed where it can yield the highest strategic returns.

Programs with limited clinical activity or unfavorable risk-benefit profiles

Within Agenus's strategic portfolio, programs exhibiting limited clinical activity or unfavorable risk-benefit profiles fall into the 'Dogs' category of the BCG Matrix. These might include preclinical or early-stage initiatives that have demonstrated insufficient efficacy, encountered unexpected safety issues, or are confronted by formidable competitive pressures. For instance, while specific program details are often proprietary, a company like Agenus, in its strategic pivot towards BOT/BAL therapies, would likely de-prioritize or pause pipeline candidates that don't align with its high-potential focus.

Such programs represent a drain on resources, demanding significant investment with a low likelihood of generating substantial returns. This makes them prime candidates for divestiture or outright discontinuation. For example, if a particular early-stage oncology candidate in 2024 showed a response rate of only 5% in a Phase 1 trial, compared to competitors achieving 20-30%, it would likely be flagged for re-evaluation.

- Limited Efficacy: Programs showing minimal therapeutic effect in early testing.

- Safety Concerns: Candidates with adverse events that outweigh potential benefits.

- Competitive Landscape: Projects facing strong, established competition.

- Resource Allocation: Initiatives requiring high investment with uncertain future returns.

Programs within Agenus's portfolio that show minimal progress or are unlikely to yield significant returns are categorized as 'Dogs' in the BCG Matrix. These are typically initiatives that consume resources without contributing to the company's strategic growth objectives.

For example, a preclinical asset that has failed to demonstrate sufficient preclinical efficacy or has encountered significant manufacturing hurdles might be considered a Dog. Such programs require ongoing investment for uncertain outcomes, making them candidates for divestment or discontinuation to optimize resource allocation.

Agenus's strategic pivot towards its BOT/BAL combination therapy means that programs not directly supporting this focus, and showing poor performance metrics, are likely being re-evaluated as Dogs. This includes early-stage assets that have not met predefined milestones for advancement.

Question Marks

Agenus's wholly-owned pipeline candidates beyond BOT/BAL, like AGEN1571, are in early clinical stages, such as Phase 1 for solid tumors. These assets target the rapidly expanding immuno-oncology market but currently hold minimal market share.

These programs represent potential growth opportunities within a dynamic sector, but their advancement necessitates substantial funding for clinical trials. The inherent uncertainty in trial outcomes and market penetration places them squarely in the Question Mark category of the BCG matrix.

Agenus's early-stage clinical collaborations, such as the CR6086 (EP4 inhibitor) combined with Balstilimab (PD-1 inhibitor) in Phase 1 for non-MSI-H colorectal cancer, are positioned as question marks within its BCG matrix. These partnerships are crucial for exploring novel therapeutic combinations and broadening the company's development pipeline, offering potential future growth avenues.

The success of these early-stage efforts, however, remains uncertain, with negligible current market share. Significant investment is required to advance these programs, and their transition to more established categories hinges on the generation of positive clinical data.

Agenus's collaboration with Noetik to create AI-driven predictive biomarkers for BOT/BAL represents a significant investment in future growth. This initiative leverages foundation models of virtual cell biology to pinpoint patients who will most likely respond to BOT/BAL therapies, aiming to revolutionize precision immunotherapy.

This cutting-edge technology is still in its nascent stages, meaning it currently holds no direct market share. The potential for acceleration in precision immunotherapy is immense, but it's an unproven concept that necessitates considerable research and development funding.

Consequently, this venture fits squarely into the 'Question Mark' category of the BCG matrix. Its high-risk, high-reward profile demands substantial capital infusion to navigate the complexities of development and validation before it can establish a market presence.

Potential expansion of BOT/BAL into earlier lines of treatment or new indications

Expanding BOT/BAL into earlier lines of treatment, such as first-line colorectal cancer (CRC), or into new indications presents a significant growth avenue for Agenus. Currently, BOT/BAL is recognized as a Star in refractory cancers, indicating strong market share in its established territory. However, its potential in these nascent segments represents a low market share opportunity with high future growth prospects.

This strategic expansion necessitates substantial investment in further clinical trials and regulatory approvals. For instance, initiating Phase 1 trials for a new indication can cost tens of millions of dollars, with a high risk of failure, as many drug candidates do not progress through development. This positions these expansion efforts as Question Marks within the BCG Matrix – requiring significant resources to potentially become future Stars.

- Early-stage CRC treatment: Targeting first-line CRC could tap into a much larger patient population than refractory settings.

- New indications: Exploring other solid tumors or even non-oncology applications could diversify BOT/BAL's market reach.

- Clinical trial investment: Significant capital is required for Phase 1, 2, and 3 trials, along with the associated regulatory submission processes.

- Market penetration risk: Success in these new areas is not guaranteed, as competition and efficacy hurdles exist.

Development of personalized cancer vaccines and cell therapies (via MiNK Therapeutics and SaponiQx)

Agenus's investment in personalized cancer vaccines and cell therapies, primarily through MiNK Therapeutics and SaponiQx, places these initiatives in the Question Marks category of the BCG Matrix. These are rapidly expanding fields within immuno-oncology, offering significant future potential. However, the products are still in their nascent stages, ranging from preclinical to early clinical development, meaning they haven't yet captured any market share.

The substantial capital required for continued research, development, and eventual market entry means these ventures are high-risk, high-reward propositions. For instance, the development of novel cell therapies and advanced adjuvant systems often involves multi-year clinical trials and significant manufacturing scale-up costs.

- High Growth Potential: Personalized cancer vaccines and cell therapies represent a frontier in oncology, with the global immuno-oncology market projected to reach significant figures in the coming years, potentially exceeding $60 billion by 2027, according to various market analyses.

- Early Stage Development: MiNK Therapeutics focuses on invariant natural killer T (iNKT) cell therapies, with candidates like MiNK-1003 in early clinical trials. SaponiQx is developing novel saponin-based adjuvants to enhance vaccine efficacy, also in early development stages.

- Substantial Investment Needs: Bringing these advanced therapies to market requires extensive funding for R&D, clinical trials (Phase I, II, III), regulatory approvals, and manufacturing infrastructure, which can run into hundreds of millions of dollars per program.

- Uncertain Market Penetration: Despite the promise, the success of these personalized approaches hinges on demonstrating clear clinical benefit, overcoming manufacturing complexities, and securing market adoption against established treatments, creating inherent uncertainty in future market share.

Agenus's early-stage pipeline candidates, such as AGEN1571 and its collaborations like the CR6086 combination therapy, are positioned as Question Marks. These represent high-growth potential in the immuno-oncology market but currently have minimal market share due to their early clinical stages.

The AI-driven biomarker initiative with Noetik and the expansion of BOT/BAL into new indications or earlier treatment lines also fall into the Question Mark category. These ventures require substantial investment for further clinical trials and validation, with uncertain outcomes and market penetration.

Personalized cancer vaccines and cell therapies from MiNK Therapeutics and SaponiQx are also Question Marks. While these fields offer significant future growth, they are in early development stages, demanding considerable funding with unproven market success.

| Program/Initiative | Category | Market Share (Current) | Growth Potential | Investment Needs | Risk Level |

|---|---|---|---|---|---|

| AGEN1571 (Solid Tumors) | Question Mark | Negligible | High | High | High |

| CR6086 + Balstilimab (CRC) | Question Mark | Negligible | High | High | High |

| AI-driven Biomarkers (Noetik) | Question Mark | Negligible | Very High | Very High | Very High |

| BOT/BAL Expansion (1st-line CRC, New Indications) | Question Mark | Low (in new segments) | High | High | High |

| Personalized Cancer Vaccines (SaponiQx) | Question Mark | Negligible | Very High | Very High | Very High |

| Cell Therapies (MiNK Therapeutics) | Question Mark | Negligible | Very High | Very High | Very High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth projections, to accurately position each business unit.