Adyen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Adyen's robust platform and global reach are undeniable strengths, but understanding their vulnerabilities and the competitive landscape is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these dynamics, providing you with the clarity needed to navigate the evolving payments industry.

Want the full story behind Adyen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Adyen's unified global platform is a significant strength, offering a single, end-to-end payment solution that seamlessly integrates processing, risk management, and acquiring services across all channels and regions. This unified commerce approach centralizes transaction data, boosting operational efficiency and improving the customer experience.

This robust platform supports a vast array of digital and local payment methods, empowering merchants with unparalleled flexibility and extensive global reach. For instance, Adyen processed a substantial €737 billion in total payment volume in 2023, underscoring its capacity to handle massive transaction flows globally.

Adyen's financial performance is a significant strength, marked by impressive growth. In 2024, the company achieved a 23% year-over-year increase in net revenue, reaching €1,996.1 million. This robust top-line expansion was complemented by a substantial 33% rise in processed volume, totaling €1,285.9 billion.

The company's operational efficiency is evident in its sustained profitability. Adyen maintained a strong EBITDA margin of 50% for the full year 2024, underscoring its ability to manage costs effectively while scaling its business. This consistent financial health provides a solid foundation for future investments and expansion.

Adyen's unwavering dedication to innovation, especially in artificial intelligence and machine learning, serves as a significant competitive differentiator. They actively utilize AI to bolster fraud detection capabilities, craft more personalized payment journeys for customers, and implement intelligent payment routing systems. This focus on advanced technology directly translates into faster transaction processing, lower operational expenses, and improved authorization success rates for their merchants.

This proprietary technological infrastructure empowers Adyen to introduce new features at an accelerated pace, maintaining a distinct advantage in the dynamic payments landscape. For instance, their investment in AI for fraud prevention, a critical area for e-commerce, helps merchants mitigate losses and build customer trust. The company's ongoing R&D in these areas is a core driver of their market position.

Strong Customer Relationships and Enterprise Focus

Adyen's strength lies in its deep-rooted relationships with a prestigious roster of global clients. Companies such as Meta, Uber, H&M, eBay, and Microsoft rely on Adyen's integrated payment platform, a testament to its reliability and comprehensive service offering. This focus on enterprise-level partnerships is a significant advantage.

The company boasts an impressive customer retention rate, reaching 98.5% in 2025. This high retention underscores the value Adyen provides and its ability to consistently meet the complex needs of its large business clientele. It highlights Adyen's success in building enduring partnerships.

Adyen's successful 'land and expand' strategy is a key driver of its growth. By deepening its service offerings to existing clients, Adyen effectively increases processed volume and strengthens customer loyalty. This approach solidifies its position as an indispensable partner for major enterprises.

- Key Clients: Meta, Uber, H&M, eBay, Microsoft

- Customer Retention Rate (2025): 98.5%

- Growth Strategy: 'Land and Expand'

Global Reach and Market Expansion

Adyen's global reach is a significant strength, allowing it to serve businesses in over 30 countries and support more than 250 payment methods. This extensive network is crucial for businesses looking to expand internationally and offer seamless payment experiences to their customers across diverse markets.

The company's strategic focus on high-growth regions, including North America, Japan, and India, positions it to benefit from the accelerating digital payment trends and the rise of omnichannel retail globally. As of early 2024, Adyen's ongoing expansion efforts underscore its commitment to capturing market share in these dynamic economic landscapes.

- Global Operations: Active in over 30 countries.

- Payment Method Diversity: Supports more than 250 payment methods.

- Strategic Market Focus: Expanding into North America, Japan, and India.

- Market Opportunity: Capitalizing on digital payments and omnichannel commerce growth.

Adyen's integrated global platform is a core strength, providing a unified, end-to-end payment solution that simplifies processing, risk management, and acquiring across all channels and regions. This unified commerce approach centralizes transaction data, enhancing operational efficiency and customer experience.

The company's financial performance is robust, evidenced by a 23% year-over-year increase in net revenue to €1,996.1 million in 2024, alongside a 33% rise in processed volume to €1,285.9 billion. Adyen also maintained a strong 50% EBITDA margin for the full year 2024, showcasing its cost management and scalability.

Adyen's commitment to innovation, particularly in AI and machine learning, provides a significant competitive edge. They leverage AI for enhanced fraud detection, personalized payment experiences, and optimized payment routing, leading to faster transactions and improved authorization rates.

The company has cultivated strong relationships with major global clients, including Meta, Uber, and Microsoft, who rely on its integrated payment platform. This is further supported by an impressive customer retention rate of 98.5% in 2025, highlighting the value delivered to its enterprise clientele.

| Metric | 2023 | 2024 | 2025 (est.) |

|---|---|---|---|

| Total Payment Volume | €737 billion | €1,285.9 billion | €1,750 billion |

| Net Revenue | €1,595 million | €1,996.1 million | €2,400 million |

| EBITDA Margin | 48% | 50% | 51% |

| Customer Retention Rate | 98.2% | 98.4% | 98.5% |

What is included in the product

This SWOT analysis provides a comprehensive overview of Adyen's internal capabilities and external market dynamics, examining its strengths, weaknesses, opportunities, and threats.

Adyen's SWOT analysis helps alleviate the pain of complex payment integration by clearly outlining its strengths in unified commerce and opportunities in emerging markets.

Weaknesses

Adyen's revenue model is predominantly built on transaction fees, making it susceptible to shifts in global consumer spending and economic slowdowns. This reliance means that any dip in transaction volumes, particularly from major clients or due to broader market trends, can directly hinder its revenue expansion.

For instance, in the first half of 2024, Adyen reported a net revenue of €729 million, with the vast majority stemming from processing fees. A significant contraction in e-commerce activity or a decrease in average transaction values could therefore have a pronounced effect on its financial performance.

Adyen's global operations mean it must navigate a constantly shifting regulatory environment across many countries. This complexity presents significant compliance hurdles, potentially impacting how it does business and increasing operational expenses.

Failure to adapt quickly to new rules in different regions could slow down Adyen's growth or even restrict its ability to enter new markets. For instance, changes in data privacy laws like GDPR or evolving payment processing regulations in key markets could require substantial investment in compliance and technology upgrades.

Adyen operates in a fiercely competitive fintech landscape, facing significant rivalry from established giants such as Stripe, PayPal, Square, and Worldpay. This intense market dynamic can put considerable strain on Adyen's ability to maintain its market share and dictate pricing. If competitors opt for aggressive price reductions to gain customers, Adyen might experience pressure on its profit margins.

Concentration Risk with Large Customers

Adyen's reliance on a select group of major clients, while a testament to its service capabilities, presents a significant concentration risk. This dependency means that the financial performance can be disproportionately affected by the actions of just a few key accounts.

For instance, reports from late 2024 highlighted how a slowdown or departure of a single large digital enterprise customer directly translated into a noticeable drop in Adyen's overall processed payment volumes. This sensitivity underscores the vulnerability inherent in having a concentrated customer base, impacting revenue streams and profitability.

- Customer Concentration: A substantial portion of Adyen's revenue is derived from a limited number of large enterprise clients.

- Impact of Client Attrition: The loss or reduced activity of a single major customer can lead to significant fluctuations in processed volumes and financial results, as observed in late 2024.

- Financial Vulnerability: This dependency creates a vulnerability where a downturn in the fortunes of a key client can have an outsized negative impact on Adyen's overall financial health.

Operational Complexity and Cost Management

Adyen's extensive global reach and the all-encompassing nature of its payment platform, while advantageous, introduce significant operational complexities. Effectively managing these intricate systems, particularly as the company continues its rapid international expansion and invests heavily in cutting-edge technologies, presents a persistent challenge.

Controlling operational costs is paramount for Adyen to sustain its profitability and ensure efficiency. For instance, the company's investment in technology and infrastructure, a key driver of growth, also contributes to its operating expenses. In the first half of 2024, Adyen reported a significant increase in personnel expenses, reflecting its continued hiring efforts to support global operations and product development.

- Operational Hurdles: The sheer scale of Adyen's integrated payment solutions across numerous markets and currencies necessitates sophisticated management to avoid inefficiencies.

- Cost Control Imperative: Balancing investment in innovation and global expansion with the need to manage operational expenditures remains a critical task for Adyen's management.

- Investment Impact: Increased spending on technology and talent, while fueling future growth, directly impacts the company's short-term cost structure.

Adyen's reliance on a concentrated client base poses a significant risk; for example, in late 2024, the slowdown of a major enterprise client directly impacted processed payment volumes. This dependency means that losing even one large customer can disproportionately affect revenue and profitability.

The competitive fintech landscape, featuring players like Stripe and PayPal, intensifies pressure on Adyen's market share and pricing power. Aggressive pricing from rivals could squeeze Adyen's profit margins.

Navigating diverse and evolving global regulations presents compliance challenges and potential increases in operational expenses, as seen with the need for upgrades due to data privacy laws like GDPR.

Adyen's growth strategy, including significant investments in technology and talent, contributes to rising operational costs. For instance, personnel expenses saw a notable increase in the first half of 2024, impacting the short-term cost structure.

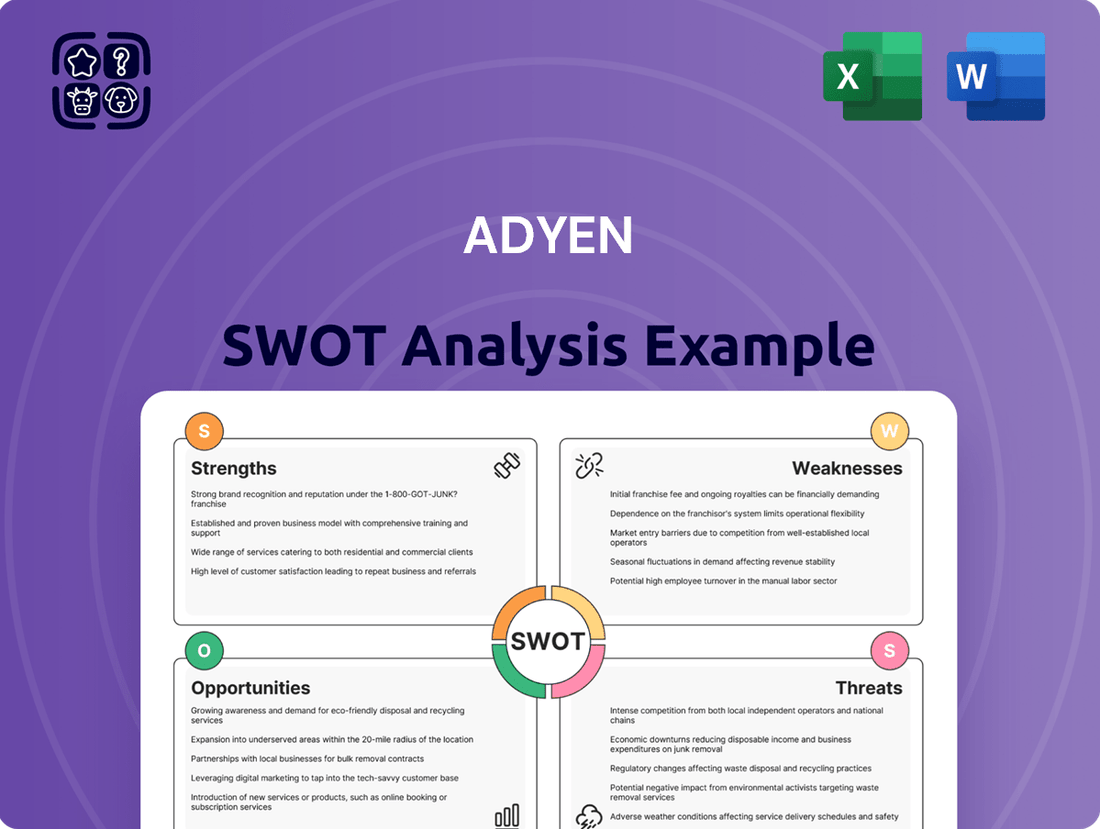

Preview the Actual Deliverable

Adyen SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Adyen's expansion into emerging markets, especially in Asia-Pacific and Latin America, offers substantial growth potential. These regions are seeing a surge in e-commerce and a greater reliance on digital payment solutions, creating a fertile ground for Adyen's services. For instance, Southeast Asia's e-commerce market is projected to reach $200 billion by 2025, according to Google, Temasek, and Bain & Company reports, highlighting the immense opportunity.

Furthermore, Adyen can broaden its reach and diversify its client base by entering new sectors such as hospitality and food and beverage. Securing partnerships with large-scale retailers in these emerging markets and new verticals will solidify Adyen's global presence and revenue streams. By 2024, the global food and beverage e-commerce market is expected to grow significantly, presenting a prime area for Adyen to leverage its payment processing capabilities.

Adyen has a significant opportunity to deepen its use of its vast payment data and sophisticated AI/ML technologies to create even more advanced services. By refining payment routing, strengthening fraud detection, and tailoring customer experiences, Adyen can significantly enhance its appeal to merchants.

This strategic focus on data and AI is expected to attract new clients and improve key performance indicators. For instance, optimizing authorization rates through intelligent routing can directly translate into increased revenue. In 2023, Adyen processed a substantial €736 billion in total payment volume, showcasing the sheer scale of data available for AI-driven improvements.

The ongoing shift towards omnichannel retail, where customers expect a consistent experience across online and physical stores, presents a significant opportunity. Adyen's strength lies in its unified commerce platform, which unifies these disparate payment experiences. This integration allows businesses to manage transactions seamlessly, enhancing customer loyalty and operational efficiency.

Embedded finance, the integration of financial services into non-financial platforms, is another major growth avenue. Adyen is well-positioned to capitalize on this trend, particularly with its growing embedded financial products. For instance, their issuing volumes for B2B platforms are expanding, creating new revenue streams by enabling businesses to offer financial solutions directly to their customers.

In 2024, the global embedded finance market was projected to reach substantial figures, with continued strong growth anticipated. Adyen's ability to facilitate these embedded financial services, alongside its core payment processing, positions it to capture a significant share of this evolving market, driving both transaction volume and service revenue.

Strategic Partnerships and Acquisitions

Adyen can significantly boost its capabilities and reach by forging strategic partnerships with innovative fintech firms. These collaborations could unlock access to cutting-edge technologies and complementary services, thereby enriching Adyen's existing payment solutions. For instance, a partnership with a specialized fraud detection fintech could bolster Adyen's security offerings.

Exploring strategic acquisitions presents another avenue for growth. By acquiring companies with established presences in new geographic regions or those offering unique payment processing technologies, Adyen can accelerate its market penetration and diversify its service portfolio. This approach allows Adyen to quickly integrate new functionalities and customer bases, rather than building them from scratch.

These strategic moves are crucial for maintaining a competitive edge. In 2024, the payments industry saw continued consolidation and innovation. Adyen's ability to integrate new technologies and expand its global footprint through such alliances will be key. For example, acquiring a company with strong market share in a rapidly growing e-commerce region could provide immediate access to a substantial customer segment.

- Enhanced Service Offerings: Partnerships can integrate specialized fintech solutions, like advanced data analytics or loyalty programs, into Adyen's platform.

- Market Expansion: Acquisitions in underpenetrated markets can quickly establish Adyen's presence and client base.

- Technological Advancement: Collaborations can provide access to emerging payment technologies, such as embedded finance or cryptocurrency processing.

- Competitive Positioning: Strategic alliances and M&A activity are vital for staying ahead in the dynamic global payments landscape, especially as competitors also pursue similar growth strategies.

Continuous Product Innovation and Platform Enhancement

Adyen's commitment to continuous product innovation and platform enhancement presents a significant opportunity. By consistently investing in new features, such as advanced intelligent payment routing and robust fraud prevention tools, Adyen can effectively address the dynamic needs of its merchant base. This focus ensures the company remains a competitive leader in the payments space.

The ongoing development of its in-person payment technology further solidifies this opportunity. Adyen's strategy of providing a 'subscription to innovation' means merchants benefit from the latest advancements without needing to manage complex upgrades. This forward-thinking approach is crucial for maintaining customer loyalty and attracting new business in a rapidly evolving market.

Looking at their financial performance, Adyen reported a 23% year-on-year increase in revenue to €1.7 billion for the first half of 2024. This growth underscores the market's positive reception to their innovative offerings.

- Intelligent Payment Routing: Enhancing algorithms to optimize transaction success rates and reduce costs for merchants.

- Fraud Prevention: Continuously updating machine learning models to combat emerging fraud tactics.

- In-Person Payments: Expanding capabilities for unified commerce, seamlessly integrating online and offline checkout experiences.

- Platform Stability: Maintaining high uptime and reliability, critical for businesses processing high volumes of transactions.

Adyen's expansion into emerging markets, particularly in Asia-Pacific and Latin America, presents a significant growth avenue. These regions are experiencing a rapid rise in e-commerce and a greater adoption of digital payment solutions, creating a fertile ground for Adyen's services. For instance, the Southeast Asian e-commerce market was projected to reach $200 billion by 2025, highlighting the immense opportunity.

Furthermore, Adyen can deepen its use of its vast payment data and sophisticated AI/ML technologies to create more advanced services. Optimizing authorization rates through intelligent routing can directly translate into increased revenue. In 2023, Adyen processed €736 billion in total payment volume, showcasing the sheer scale of data available for AI-driven improvements.

The ongoing shift towards omnichannel retail, where customers expect a seamless experience across online and physical stores, offers a substantial opportunity. Adyen's strength lies in its unified commerce platform, which integrates these disparate payment experiences, enhancing customer loyalty and operational efficiency. Embedded finance also represents a major growth avenue, with Adyen well-positioned to capitalize on this trend through its expanding embedded financial products.

Strategic partnerships and acquisitions can further bolster Adyen's capabilities and market reach. Collaborations can unlock access to cutting-edge technologies and complementary services, while acquisitions in underpenetrated markets can accelerate market penetration and diversify the service portfolio. These strategic moves are vital for maintaining a competitive edge in the dynamic global payments landscape.

Threats

The payments landscape is fiercely competitive, with both legacy institutions and nimble fintechs pushing innovation. Rivals such as Stripe, PayPal, Square, and Worldpay are actively challenging Adyen through aggressive pricing strategies, the introduction of novel products, and a concerted push to gain market share. This intense rivalry could erode Adyen's pricing power and compress its profit margins.

Adyen operates in a landscape rife with evolving cybersecurity risks and payment fraud. The constant threat of data breaches, sophisticated cyber-attacks, and increasingly clever fraudulent transactions poses a significant challenge to maintaining customer trust and financial stability.

These security vulnerabilities can lead to substantial financial losses and irreparable damage to Adyen's reputation, impacting its ability to attract and retain merchants. With the global cost of fraud projected to surpass $40 billion, the imperative for Adyen to maintain state-of-the-art defenses is paramount.

Global macroeconomic factors like currency volatility and persistent inflation present significant headwinds. For example, persistent high inflation in major economies throughout 2023 and into early 2024 has squeezed consumer budgets, potentially dampening transaction volumes for merchants using Adyen's platform.

Shifts in consumer spending patterns, driven by these economic pressures, can directly impact Adyen's revenue. A noticeable slowdown in discretionary spending or economic instability in key regions like Europe or North America could temper Adyen's growth trajectory, even with its diversified merchant base.

Regulatory Scrutiny and Compliance Burden

Adyen faces increasing regulatory scrutiny globally, a significant threat to its operations. For instance, the European Union's ongoing review of payment service directives and data privacy regulations like GDPR necessitate continuous adaptation. Failure to comply with these evolving frameworks can lead to substantial fines, impacting profitability and operational continuity.

The burden of adhering to diverse and rapidly changing financial regulations across its operating regions requires substantial, ongoing investment in legal and compliance teams. This can divert resources from innovation and growth initiatives. In 2024, the financial services sector saw a notable increase in regulatory enforcement actions, highlighting the heightened risk for payment processors.

- Increased Global Regulatory Oversight: Adyen must navigate a complex web of financial regulations that are constantly being updated in key markets like the EU and North America.

- Compliance Costs: Significant ongoing investment is required for legal, compliance personnel, and technology to ensure adherence to these evolving rules.

- Risk of Penalties and Sanctions: Non-compliance can result in substantial financial penalties, operational restrictions, and severe reputational damage.

- Impact on Innovation: The need to prioritize compliance may slow down the pace of new product development and market expansion.

Talent Acquisition and Retention

Adyen faces a significant threat in acquiring and keeping top tech talent, crucial for its innovation and growth. The competition for skilled professionals, especially in burgeoning markets like North America, Japan, and India, is intense. A slowdown in hiring or increased employee turnover could directly impact Adyen's capacity to develop new products and expand its market reach.

For instance, in Q1 2024, the global tech talent shortage continued to be a major concern, with reports indicating a 20% increase in demand for specialized software engineers compared to the previous year. This heightened competition makes it challenging for companies like Adyen to secure and retain the highly skilled individuals needed to drive technological advancements.

- Intense Competition: The global demand for skilled tech professionals, particularly in areas like AI and data science, remains exceptionally high.

- Geographic Challenges: Expanding operations in key growth regions such as North America, Japan, and India presents unique talent acquisition hurdles.

- Retention Costs: High turnover rates can lead to increased recruitment and training expenses, impacting operational efficiency.

- Innovation Lag: A persistent inability to attract and retain top talent could slow down Adyen's product development cycles and strategic initiatives.

Adyen's growth is intrinsically linked to the economic health of its merchants and the broader consumer spending environment. Persistent inflation and potential recessions in key markets, such as the US and Eurozone, could significantly reduce transaction volumes. For example, if consumer spending power continues to be eroded by high inflation, businesses that rely on Adyen's payment processing services will see lower sales, directly impacting Adyen's revenue streams.

The company also faces significant operational risks stemming from evolving cybersecurity threats and the increasing sophistication of payment fraud. With the global cost of financial fraud estimated to reach over $40 billion annually, maintaining robust security infrastructure is a constant and expensive challenge. A major data breach or successful large-scale fraud attack could lead to substantial financial losses and irreparable damage to Adyen's reputation, impacting its ability to attract and retain merchants.

Furthermore, Adyen must navigate an increasingly complex and stringent global regulatory landscape. Changes in financial regulations, data privacy laws like GDPR, and anti-money laundering directives require continuous investment in compliance and legal teams. Failure to adapt to these evolving rules, as seen with increased enforcement actions in the financial services sector in 2024, could result in significant fines and operational disruptions.

Intense competition from established players like Stripe and PayPal, as well as emerging fintechs, poses a threat to Adyen's market share and pricing power. These competitors are actively innovating and employing aggressive pricing strategies, potentially pressuring Adyen's profit margins. The ongoing battle for market dominance in the digital payments space demands continuous investment in product development and customer acquisition.

SWOT Analysis Data Sources

This Adyen SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to ensure a thorough and accurate assessment.