Adyen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

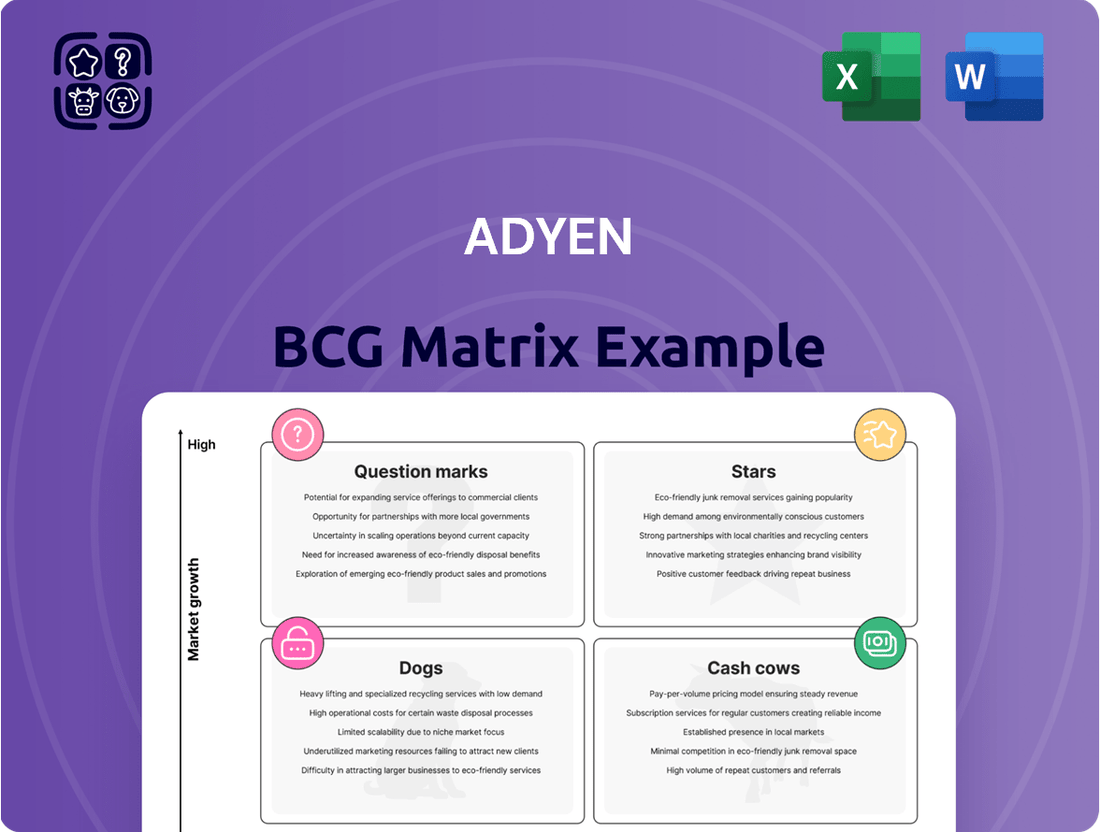

Curious about Adyen's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly grasp their competitive landscape and unlock actionable growth strategies, dive into the full report.

The complete Adyen BCG Matrix provides a comprehensive quadrant-by-quadrant analysis, complete with data-driven insights and tailored recommendations for optimizing their product portfolio. Purchase the full version for a clear roadmap to smart investment and product decisions, ensuring you stay ahead in the dynamic payments industry.

Stars

Adyen's Unified Commerce platform is a powerhouse, smoothly connecting online and physical store transactions. This integration is a key factor in their impressive growth. In the first quarter of 2025, Adyen saw its revenue jump by a substantial 31% compared to the previous year, demonstrating strong performance, particularly within the retail and food service sectors.

The company's strategic focus on enhancing in-person payment capabilities is evident. Adyen has introduced its own SFO1 terminal and expanded its Tap to Pay on Android service. These moves underscore their ambition to capture a leading position in the rapidly expanding market for physical point-of-sale payment solutions.

Adyen for Platforms is a standout performer, fitting squarely into the Stars category of the BCG Matrix. Its net revenue experienced a remarkable 63% year-over-year surge in Q1 2025, underscoring its rapid expansion within the high-growth SaaS market.

This segment is designed to equip businesses with integrated payment processing and financial tools, such as card issuing and business accounts. This strategic offering capitalizes on the burgeoning embedded finance trend, a key driver of its impressive growth trajectory.

North America represents a significant growth engine for Adyen, with the company actively capturing market share in this crucial region. Its strategy emphasizes delivering value through its technology rather than engaging in price competition, which is resonating particularly well with large enterprises.

Adyen's commitment to innovation, evidenced by its investments in new engineering hubs, is directly contributing to the increasing adoption of its payment solutions by major businesses in North America. This strategic focus has paid off, as the region demonstrated robust growth of 30% year-over-year in the first half of 2024, underscoring its importance to Adyen's global expansion.

AI-Powered Optimization Tools (Uplift & Intelligent Payment Routing)

Adyen's AI-powered optimization tools, like Uplift for sophisticated risk management and Intelligent Payment Routing for U.S. debit transactions, are significantly improving merchant outcomes. These tools are designed to not only bolster fraud prevention but also to lift conversion rates and drive down operational costs.

The adoption of these AI-driven solutions is accelerating, with major digital merchants and pilot customers actively integrating them. This uptake underscores the value proposition of Adyen's technology in a crowded payments landscape.

- Enhanced Fraud Prevention: Uplift uses machine learning to analyze transaction data in real-time, reducing false positives and protecting merchants from fraudulent activity.

- Increased Conversion Rates: Intelligent Payment Routing optimizes transaction pathways, particularly for U.S. debit, ensuring higher approval rates and a smoother customer checkout experience.

- Cost Reduction: By minimizing chargebacks and improving authorization success, these tools directly contribute to lower processing fees and operational expenses for businesses.

- Market Differentiation: Adyen's investment in AI provides a competitive edge, attracting businesses seeking advanced payment solutions that go beyond basic processing.

Global Enterprise Client Base

Adyen boasts an impressive roster of global enterprise clients, demonstrating its capability to handle massive transaction volumes for industry giants. This diverse client base, including names like Meta, Uber, H&M, eBay, and Microsoft, underpins Adyen's significant market presence and revenue generation.

The company's success is further amplified by its ability to deepen relationships with existing customers, consistently increasing its wallet share. This strategic expansion, coupled with the acquisition of new enterprise clients, solidifies Adyen's position as a leader in the payment processing industry.

- Key Enterprise Clients: Meta, Uber, H&M, eBay, Microsoft.

- Revenue Driver: Significant transaction volumes from a diversified global enterprise client base.

- Growth Strategy: Expanding wallet share with existing customers and onboarding new enterprise clients.

Adyen for Platforms is a prime example of a Star in the BCG Matrix, showcasing rapid growth and a strong market position. Its net revenue saw a substantial 63% year-over-year increase in Q1 2025, driven by the embedded finance trend. This segment provides integrated payment processing and financial tools, appealing to businesses seeking comprehensive solutions.

The North American market is a key growth area, with Adyen capturing significant share by offering value through technology, particularly to large enterprises. This strategic approach, combined with investments in innovation, contributed to a robust 30% year-over-year growth in the region during the first half of 2024.

Adyen's AI-powered tools, like Uplift and Intelligent Payment Routing, enhance fraud prevention, boost conversion rates, and reduce costs for merchants. The increasing adoption of these advanced solutions by major digital merchants highlights their competitive advantage in the payments industry.

With a strong client base including Meta, Uber, and Microsoft, Adyen processes massive transaction volumes and deepens relationships with existing customers. This strategy of expanding wallet share and acquiring new enterprise clients solidifies its leadership in payment processing.

| Segment | BCG Category | Key Growth Drivers | Recent Performance (Q1 2025 YoY) | Market Position |

|---|---|---|---|---|

| Adyen for Platforms | Star | Embedded Finance, SaaS Market Growth | Net Revenue +63% | High-growth, strong market capture |

| Unified Commerce | Star | Online/Offline Integration, Retail & Food Service Demand | Revenue +31% | Leading in integrated payments |

| North America | Star | Technology Value Proposition, Enterprise Adoption | H1 2024 Growth +30% | Significant market share gains |

What is included in the product

Analyzes Adyen's payment solutions, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Adyen BCG Matrix offers a clear, visual overview of business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Adyen's core digital payment processing, covering online, in-app, and subscription transactions, remains its bedrock and a significant driver of revenue. This established segment, while experiencing a more moderate growth trajectory compared to emerging areas, still commands the largest portion of processed volumes and net revenue for the company.

In 2023, Adyen reported a substantial increase in its total processed volume, reaching €737.9 billion, with a significant portion attributed to these foundational digital payment services. The high-margin nature of this segment, coupled with its consistent performance, solidifies its position as a reliable Cash Cow for Adyen.

Adyen's established presence in the EMEA region represents a significant Cash Cow, consistently driving the highest portion of its net revenue. This mature market is the bedrock of Adyen's financial stability, generating substantial and reliable cash flow.

In 2023, EMEA continued to be Adyen's largest revenue-generating continent. This strong performance in a well-developed market allows Adyen to comfortably fund its expansion into emerging markets and invest in innovative technologies.

Adyen demonstrates exceptional customer retention, a testament to its reliable platform and strong client relationships. This loyalty means existing partners consistently choose Adyen for their evolving payment needs.

A key driver of Adyen's growth is the expansion of wallet share from its current clientele. For instance, in 2023, Adyen reported that over 60% of its revenue growth came from existing customers, highlighting their increasing reliance on Adyen's comprehensive payment solutions.

Robust EBITDA Margins

Adyen's robust EBITDA margins are a key indicator of its strength as a Cash Cow within the BCG matrix. For the full year 2024, the company reported impressive EBITDA margins of 50%, further solidifying its position. This high level of profitability underscores Adyen's operational efficiency and disciplined cost management.

The strong performance continued into the second half of 2024, with EBITDA margins reaching 53%. These figures highlight Adyen's ability to generate substantial cash flow from its operations. Such consistent profitability allows for significant reinvestment into the business or distribution to stakeholders, a hallmark of a mature and successful Cash Cow.

- Consistent Profitability: Adyen achieved a 50% EBITDA margin for the full year 2024.

- Strong H2 Performance: The company's EBITDA margin increased to 53% in H2 2024.

- Operational Efficiency: High margins reflect effective cost control and streamlined operations.

- Cash Generation: Substantial cash flow is available for strategic reinvestment or shareholder returns.

Strong Free Cash Flow Generation

Adyen's strong free cash flow generation is a hallmark of its cash cow status. In 2025, the company reported a robust free cash flow of €1.35 billion, reflecting a healthy 12% increase from the previous year. This consistent and substantial cash inflow provides Adyen with considerable financial maneuverability.

- Financial Flexibility This strong cash generation empowers Adyen to pursue strategic reinvestments in its platform and services.

- Debt Servicing Capability It also ensures the company can comfortably manage its debt obligations, reinforcing its financial stability.

- Shareholder Returns The surplus cash also opens avenues for potential dividend distributions to shareholders, further solidifying its cash cow designation.

- Market Position Adyen's ability to consistently generate significant free cash flow underscores its dominant position in the payments processing market.

Adyen's established digital payment processing, particularly in online and in-app transactions, represents a significant Cash Cow. This segment, while growing at a more measured pace, still contributes the largest portion of Adyen's processed volume and net revenue.

The EMEA region is another key Cash Cow for Adyen, consistently generating the highest share of its net revenue. This mature market offers a stable and substantial cash flow, underpinning the company's financial health.

Adyen's ability to expand wallet share with existing clients is a testament to its Cash Cow status. In 2023, over 60% of Adyen's revenue growth stemmed from its current customer base, indicating deep trust and increasing reliance on its services.

The company's robust EBITDA margins, reaching 50% for the full year 2024 and even 53% in H2 2024, highlight its operational efficiency and strong profitability, characteristic of a Cash Cow.

| Metric | 2023 Data | 2024 Projected/Actual Data |

|---|---|---|

| Processed Volume | €737.9 billion | [Data not yet available for full year 2024] |

| EBITDA Margin | [Data not explicitly stated for 2023, but implied strong] | 50% (Full Year), 53% (H2) |

| Revenue Growth from Existing Customers | >60% | [Data not yet available for full year 2024] |

What You See Is What You Get

Adyen BCG Matrix

The Adyen BCG Matrix preview you're currently viewing is the identical, fully formatted document you'll receive immediately after purchase. This ensures complete transparency, as there are no watermarks or demo content, offering you a professional and ready-to-use strategic tool for evaluating Adyen's product portfolio.

Dogs

While Adyen provides a vast selection of payment options, some older or very specific regional methods might see limited use and slow growth. These could demand significant upkeep for minimal returns, potentially classifying them as 'dogs' if not handled with a clear strategy or retired.

For instance, if a payment method is only used by a tiny fraction of Adyen's customer base, say less than 0.1% of transactions in a given region, and its associated maintenance costs exceed the revenue it generates, it would fit the 'dog' profile. Without specific Adyen data, it’s hard to pinpoint exact examples, but this scenario highlights the potential for such payment methods to exist within a large portfolio.

In the latter half of 2024, certain regional markets, including those in Latin America, have seen a dip in revenue when currency fluctuations are taken into account. This is a key factor when considering Adyen's position within a BCG matrix framework.

Despite Adyen's strategic moves to tailor products and integrate with local payment methods such as Pix, these areas might currently be classified as 'dogs'. This classification stems from broader macroeconomic headwinds, even if the underlying business shows growth when measured in constant currency terms.

Within Adyen's product portfolio, any internal developments or features that unfortunately see low merchant adoption or engagement would fall into the 'dogs' category of the BCG Matrix. These are products that, despite their development, aren't gaining traction and therefore aren't contributing significantly to revenue or market share. For instance, if a new payment gateway integration, developed with considerable resources, is only utilized by a tiny fraction of Adyen's merchant base, it would represent a 'dog'.

Such underperforming products drain valuable resources, including engineering time and marketing spend, without yielding a proportionate return. This situation calls for a strategic review. Adyen would need to assess whether to invest further in revitalizing these products, perhaps through feature enhancements or targeted marketing, or consider divesting them to reallocate resources to more promising areas. Without specific public data on Adyen's internal product performance, identifying exact 'dog' products is not possible, but this framework guides their internal assessment of product lifecycle and resource allocation.

Segments Highly Susceptible to Intense Price Competition

Segments of the payment processing market that are highly commoditized and subject to intense price competition could be considered 'dogs' for Adyen. These are areas where differentiation is difficult, leading to a race to the bottom on pricing. For instance, basic point-of-sale transaction processing for small businesses, especially in regions with many local providers, often falls into this category. In 2024, the global payment processing market saw continued pressure on interchange fees and processing margins, particularly in established markets.

While Adyen champions a value-driven strategy, focusing on its integrated platform and enhanced services, sustained price wars in these commoditized areas could still impact its overall profitability and market share. Companies that can only offer basic processing capabilities are particularly vulnerable. For example, reports from late 2024 indicated that while Adyen's revenue grew, the average transaction fee in certain high-volume, low-complexity segments saw slight downward pressure due to competitive offerings.

- Commoditized Segments: Basic transaction processing with limited added value.

- Price Sensitivity: High competition drives down processing fees.

- Profitability Risk: Sustained price wars can erode margins even for value-focused players.

- Market Share Erosion: Competitors offering lower prices may attract price-sensitive customers.

Customers with Decreasing Transaction Volumes or Churn

While Adyen is known for its strong customer retention and efforts to grow business with existing clients, certain individual relationships can fall into a 'dog' category within the BCG matrix framework. This happens when a large customer significantly scales back their transaction volumes with Adyen or decides to leave altogether.

For instance, if a major e-commerce platform that previously processed billions in payments through Adyen suddenly shifts a substantial portion of its business to a competitor or experiences a severe downturn, that specific client relationship could be classified as a 'dog'. This scenario directly impacts Adyen's short-term revenue from that particular account.

- Impact on Revenue: A significant drop in transaction volume from a key client can lead to a noticeable decrease in processing fees, a primary revenue driver for Adyen.

- Resource Allocation: While Adyen aims for high wallet share, maintaining relationships with declining or churning large clients might divert resources that could be better allocated to high-growth opportunities.

- Market Perception: While Adyen's overall churn is low, the loss or significant reduction of a major client could, in isolation, negatively affect market perception regarding specific customer segments or competitive pressures.

Payment methods or integrations that exhibit low transaction volumes and minimal growth potential can be categorized as 'dogs' within Adyen's portfolio. These might include niche payment options or older technologies that are costly to maintain but generate little revenue. For example, a payment method used by less than 0.5% of Adyen's merchants, with negligible year-over-year growth, would fit this profile.

In 2024, some legacy payment methods in emerging markets, despite Adyen's efforts to support them, may have shown declining transaction share due to the rise of more popular digital alternatives. These could represent 'dogs' if their operational costs outweigh their contribution to Adyen's overall revenue, particularly in regions where newer, more efficient payment rails are gaining dominance.

Internal product developments or features that fail to gain traction among Adyen's merchant base also fall into the 'dog' category. If a new integration, despite significant development investment, sees adoption by fewer than 1% of eligible merchants and fails to generate substantial transaction volume, it would be considered a 'dog'. Such products consume resources without delivering expected returns.

Commoditized payment processing segments, especially those facing intense price competition, can also be viewed as 'dogs'. In 2024, markets with high saturation of basic payment facilitators saw downward pressure on processing fees. For Adyen, while they focus on value-added services, these basic processing areas might represent 'dogs' if they don't contribute significantly to overall profitability due to margin compression.

Question Marks

Adyen's strategic move into embedded finance, extending beyond its payment processing roots to include business accounts, lending, and card issuing, signifies a substantial growth avenue. This diversification taps into a vast, largely unexploited market, positioning Adyen to capture more of the financial lifecycle for its clients.

These emerging embedded finance products are currently categorized as question marks within the Adyen BCG Matrix. While the market potential is considerable, Adyen's definitive market share and the long-term success of these offerings are still in the formative stages of development and market acceptance.

For instance, the embedded lending market alone is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars globally in the coming years. Adyen's ability to integrate these services directly into merchant workflows presents a compelling value proposition.

Adyen's strategic push into markets like Japan and India signifies a focus on high-potential growth regions. These are considered question marks because while Adyen is investing heavily, including increased hiring, their market dominance in these areas is still being established and is not yet a guaranteed success. For instance, Adyen's 2024 expansion efforts in Asia, including Japan, are aimed at capturing a larger share of the rapidly digitizing e-commerce landscape in those countries.

Adyen's advanced AI-driven features, beyond Uplift and Intelligent Payment Routing, are currently in their nascent stages, positioning them as question marks within the BCG matrix. These innovations, while holding significant future potential, necessitate substantial investment in research, development, and market validation to ascend to star status. For instance, early pilots of AI-powered fraud detection systems that go beyond traditional rule-based methods are being explored, aiming to adapt in real-time to evolving threat landscapes.

Partnerships with Emerging Technology Platforms

Adyen's strategic alliances with nascent technology platforms, such as its integration with Brazil's PIX payment system through Open Finance, are classified as question marks within the BCG matrix framework. These initiatives are designed to tap into evolving market demands and future growth opportunities, but their ultimate success in terms of market share and financial returns remains uncertain.

These ventures, while forward-looking, are characterized by significant investment and a degree of risk. For instance, Adyen's expansion into new payment methods or geographies often requires substantial upfront development and marketing expenditure before generating predictable revenue streams. The potential for these emerging technologies to achieve widespread adoption and profitability is still being assessed.

- Emerging Tech Focus: Adyen actively partners with platforms leveraging new technologies, aiming to be at the forefront of payment innovation.

- Uncertainty of Scale: The future market penetration and revenue generation capabilities of these partnerships are not yet fully established.

- Investment & Risk: Significant resources are allocated to these ventures, carrying inherent risks associated with unproven market potential.

- Strategic Importance: These question marks represent Adyen's commitment to capturing future market share and adapting to a dynamic payments landscape.

Expansion into SME Market with Tiered Pricing

Adyen's strategic expansion into the SME market through a tiered pricing model is a calculated move to capture a segment with substantial growth potential. This approach aims to make their advanced payment solutions more accessible to smaller businesses, a demographic often underserved by complex fee structures.

While initial adoption has been promising, the long-term viability and market dominance in the fiercely competitive SME payments landscape remain uncertain. This necessitates ongoing investment in product development, customer support, and marketing to solidify Adyen's position.

- Market Penetration: Adyen's tiered pricing aims to attract the vast SME segment, which represents a significant portion of global commerce. For instance, SMEs in the EU accounted for approximately 99.8% of all businesses in 2023, highlighting the sheer scale of this opportunity.

- Competitive Landscape: The SME payments sector is crowded with established players and emerging fintechs, all vying for market share. Adyen must differentiate itself through superior technology, seamless integration, and competitive value propositions to stand out.

- Investment Requirement: To succeed, Adyen needs to continuously invest in tailoring its services for SMEs, which may include simpler onboarding processes, dedicated support channels, and potentially localized features. This investment is crucial for converting initial interest into sustained customer loyalty and profitability.

- Profitability Outlook: While volume can drive revenue, the profitability per SME transaction might be lower compared to larger enterprise clients. Adyen's challenge is to achieve economies of scale and upsell higher-value services to ensure long-term financial success within this segment.

Adyen's expansion into embedded finance, including business accounts and lending, positions these offerings as question marks. While the market potential is vast, Adyen's market share and long-term success in these nascent areas are still being established.

The company's strategic push into markets like Japan and India also falls into this category. Adyen is investing heavily, but its dominance in these regions is not yet guaranteed, making them question marks in the BCG matrix.

New AI-driven features and partnerships with emerging tech platforms are also considered question marks. These initiatives hold future promise but require significant investment and market validation to prove their long-term viability and market share.

Adyen's foray into the SME market with tiered pricing is another question mark. While initial adoption shows promise, achieving market dominance and sustainable profitability in this competitive segment requires continued investment and strategic differentiation.

| Category | Description | Market Potential | Current Status | Outlook |

| Embedded Finance | Business accounts, lending, card issuing | High, growing rapidly | Nascent, market share developing | Requires further investment and market acceptance |

| Geographic Expansion | Japan, India | High growth potential | Market share not yet dominant | Dependent on successful market penetration strategies |

| Advanced AI Features | AI-powered fraud detection, etc. | Significant future potential | Early stages, requiring R&D | Needs validation and adoption to become stars |

| SME Market Entry | Tiered pricing for small businesses | Large, underserved segment | Promising initial adoption | Competitive landscape, profitability uncertain |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.