Adyen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Adyen's marketing success is built on a powerful foundation of Product, Price, Place, and Promotion. This analysis delves into how their innovative payment solutions, competitive pricing, strategic global reach, and targeted communication create a formidable market presence.

Discover the intricate details of Adyen's marketing mix and unlock actionable insights for your own business strategy. Get the full, editable analysis today and elevate your understanding of effective market execution.

Product

Adyen's Global End-to-End Payment Platform is its core product, offering a unified solution for businesses to manage payments across online, mobile, and in-store channels. This platform handles everything from payment acceptance and acquiring to fraud prevention and settlement, simplifying complex payment ecosystems for merchants.

This integrated approach allows businesses to process transactions globally with a single integration, reducing operational overhead and improving customer checkout experiences. In 2024, Adyen reported processing a substantial volume of transactions, reflecting the platform's widespread adoption by major global brands seeking efficient payment infrastructure.

Unified Commerce Solutions are a cornerstone of Adyen's offering, directly addressing the Product element of the marketing mix. This platform integrates payments across online, in-app, and physical store environments, providing merchants with a single, comprehensive view of customer interactions and transaction data. This seamless integration is crucial for creating consistent customer journeys and streamlining operations.

By unifying these touchpoints, Adyen empowers businesses to understand their customers better, leading to more personalized experiences and improved operational efficiency. For example, in 2023, Adyen reported a significant increase in transaction volumes, underscoring the growing demand for integrated payment solutions that support diverse sales channels.

Adyen's Advanced Risk Management and Fraud Prevention is a cornerstone of its offering, integrating AI-driven tools like RevenueProtect and Adyen Uplift directly into its payment platform. These solutions don't just block fraud; they work in real-time to analyze transaction data, aiming to boost successful payment approvals.

This intelligent approach helps businesses significantly reduce losses from fraudulent transactions while simultaneously improving their overall checkout conversion rates. For instance, Adyen reported that its RevenueProtect solution can decrease chargebacks by up to 30% for its clients, a tangible benefit for merchants operating in the current digital landscape.

Diverse Global Payment Methods

Adyen's diverse global payment methods are a cornerstone of its offering, enabling businesses to connect with customers worldwide. The platform seamlessly integrates major credit and debit cards, alongside a vast selection of popular local payment options crucial for regional market penetration. For instance, in Europe, SEPA Direct Debit remains a significant method, while in Asia, Alipay and WeChat Pay are indispensable.

This comprehensive approach extends to digital wallets, with support for Apple Pay and Google Pay readily available, reflecting evolving consumer behavior. By offering such a broad spectrum, Adyen empowers merchants to reduce checkout friction and capture sales from a wider customer base, a critical factor in today's interconnected economy. In 2024, the global digital payments market is projected to reach over $1.5 trillion, highlighting the immense opportunity this payment diversity unlocks.

- Global Reach: Access to over 200 payment methods.

- Local Relevance: Integration of region-specific payment preferences.

- Digital Wallet Integration: Support for leading mobile payment solutions.

- Market Expansion: Facilitating cross-border commerce and increased conversion rates.

Embedded Financial s and Innovation

Adyen goes beyond basic payment processing by offering advanced financial products. These include issuing services, allowing businesses to create their own branded payout cards or accounts, and embedded finance solutions for platforms. This innovation empowers clients to integrate financial services directly into their existing ecosystems, creating seamless customer experiences and new revenue streams.

The company's commitment to innovation is evident in its continuous investment in new technologies. For instance, Adyen has introduced proprietary hardware like the SFO1 multimedia terminal, enhancing in-person payment experiences. Furthermore, AI-driven solutions such as Intelligent Payment Routing are being deployed to optimize transaction success rates and reduce costs for merchants.

These embedded financial capabilities and ongoing technological advancements are crucial for Adyen's 4P's marketing mix, specifically within the Product element. By expanding its financial product suite and investing in cutting-edge technology, Adyen strengthens its value proposition and differentiates itself in a competitive market. For example, in 2024, Adyen reported a 22% increase in total payment volume, reaching €736 billion, underscoring the market's positive reception to its expanded offerings.

- Embedded Finance: Enables clients to offer branded cards and accounts, fostering deeper customer relationships.

- Issuing Services: Provides the infrastructure for businesses to manage their own payment card programs.

- Innovation Investment: Development of new hardware like the SFO1 terminal and AI solutions like Intelligent Payment Routing.

- Market Growth: Adyen's total payment volume grew by 22% in 2024, reaching €736 billion, reflecting strong demand for its enhanced product offerings.

Adyen's product strategy centers on a unified, end-to-end payment platform that simplifies global commerce for businesses. This platform integrates online, mobile, and in-store payments, offering a single solution for acquiring, processing, and settling transactions. The company's commitment to innovation is evident in its AI-driven fraud prevention tools and its expansion into embedded finance and issuing services.

| Product Feature | Description | 2024/2025 Data/Impact |

|---|---|---|

| Unified Commerce Platform | Seamless payment integration across all channels (online, in-app, POS). | Facilitates consistent customer experiences and operational efficiency. Adyen's total payment volume reached €736 billion in 2024, a 22% increase, reflecting strong adoption. |

| Advanced Risk Management | AI-powered fraud detection and prevention (e.g., RevenueProtect). | Reduces chargebacks by up to 30% and improves checkout conversion rates. |

| Global Payment Methods | Support for over 200 payment methods, including local preferences and digital wallets. | Enables businesses to capture wider customer bases and reduce checkout friction in the growing global digital payments market, projected over $1.5 trillion in 2024. |

| Financial Products & Innovation | Issuing services, embedded finance, and proprietary hardware. | Empowers clients with new revenue streams and enhanced payment experiences. Adyen continues to invest in AI solutions like Intelligent Payment Routing. |

What is included in the product

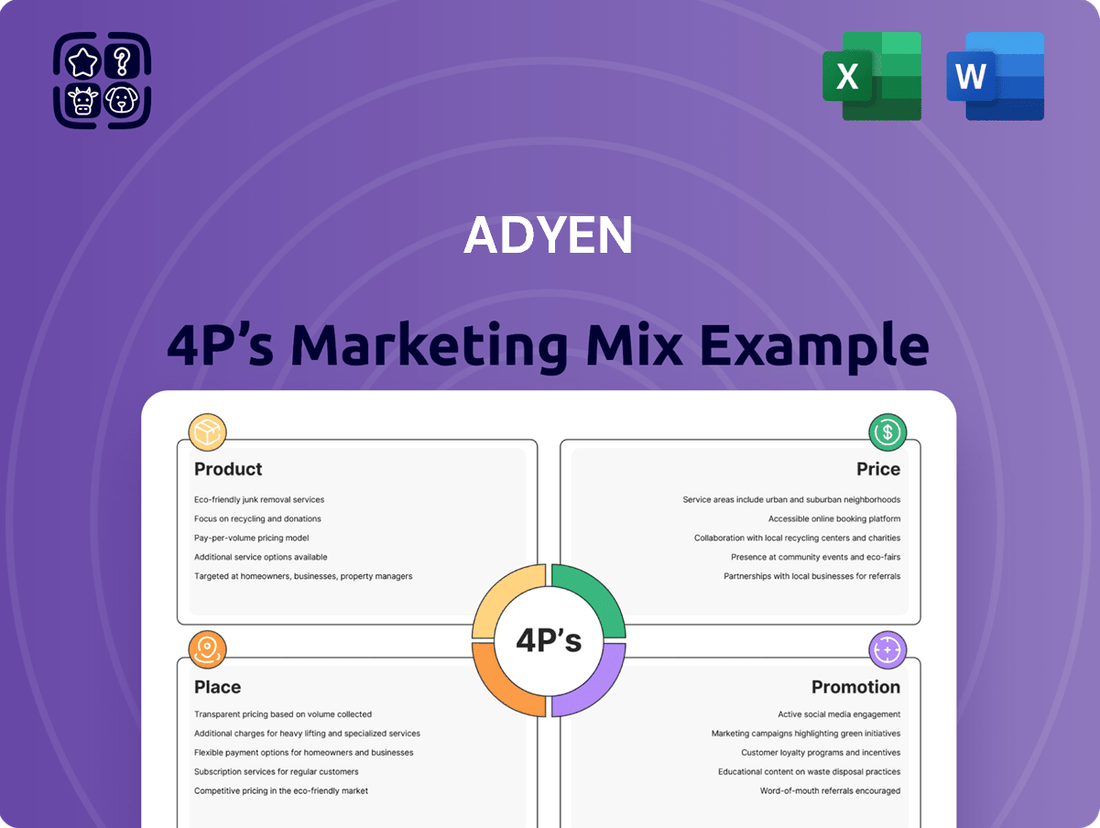

This analysis provides a comprehensive breakdown of Adyen's marketing strategies, examining its Product, Price, Place, and Promotion elements to offer insights into its market positioning and competitive advantages.

Simplifies complex marketing strategies by presenting Adyen's 4Ps in a clear, actionable framework.

Eliminates the confusion of fragmented marketing efforts by offering a cohesive view of Adyen's approach.

Place

Adyen's core 'place' in its marketing mix is its unified global platform, offering clients direct access to a vast array of payment methods and card networks. This direct connection bypasses traditional intermediaries, streamlining the payment process. For instance, Adyen processed a significant volume of transactions for its merchants, with gross merchandise volume (GMV) reaching €606.5 billion in 2023, demonstrating the scale and reach of its platform.

Adyen boasts an extensive international presence, with offices strategically located in over 30 cities across the globe. This physical footprint is vital for supporting its vast international client base and navigating diverse regional payment ecosystems.

This widespread network ensures Adyen can offer localized support and gain deep insights into specific market payment preferences and regulations. For instance, their presence in key markets like the United States, Europe, and Asia Pacific allows them to tailor solutions for businesses operating across these varied landscapes.

As of late 2024, Adyen serves merchants in over 150 countries, underscoring the necessity of this robust international infrastructure to facilitate seamless cross-border transactions and provide dedicated client assistance wherever they operate.

Adyen's approach to reaching enterprise and platform clients is a direct one, prioritizing deep integration and tailored solutions. This strategy allows them to build strong partnerships with high-volume businesses, fostering growth through expanded relationships within their existing customer base.

This direct engagement model is crucial for servicing complex needs, as evidenced by Adyen's continued success in onboarding major global brands. For instance, in 2024, Adyen reported significant growth in its enterprise segment, with transaction volumes from its largest clients showing a robust upward trend, underscoring the effectiveness of this focused distribution.

Omnichannel Integration Points

Adyen's platform acts as a crucial integration point, unifying all payment experiences whether a customer is shopping online, in a physical store, or through a mobile app. This seamless connection simplifies the technical complexities for merchants, allowing them to manage payments efficiently across every channel.

This unified approach streamlines operations and enhances the customer journey. For instance, Adyen reported processing a significant volume of transactions for its merchants, with total payment volume (TPV) reaching €606.7 billion in 2023, a substantial increase from €500 billion in 2022. This growth highlights the platform's capability to handle diverse and integrated payment needs.

- Centralized Payment Hub: Adyen consolidates online, in-store, and in-app payments onto a single platform.

- Simplified Merchant Integration: This unified system reduces technical complexity for businesses operating across multiple sales environments.

- Enhanced Customer Experience: Consistent and secure payment processing across all touchpoints improves customer satisfaction and loyalty.

- Scalability and Growth: Adyen's infrastructure supports significant transaction volumes, evidenced by its TPV growth, enabling merchants to scale their operations seamlessly.

API-Driven Accessibility

Adyen's product offering is fundamentally built around its robust API-driven accessibility. This allows businesses to integrate payment processing directly into their platforms, offering unparalleled flexibility. For instance, Adyen's unified commerce solution, powered by these APIs, enables a seamless experience across online and in-store channels. In 2024, over 80% of Adyen’s transaction volume was processed through its APIs, highlighting this core strength.

This technical accessibility is crucial for Adyen's scalability and market reach. Businesses of all sizes, from burgeoning startups to global enterprises, can leverage Adyen's infrastructure without extensive custom development. This API-first approach supports diverse business models, from e-commerce giants to subscription services, ensuring Adyen can cater to a wide array of client needs. By Q3 2025, Adyen reported supporting over 3,500 merchants with complex, API-driven payment flows.

- API-First Design: Adyen's core product is its set of flexible APIs.

- Seamless Integration: Businesses can embed payment capabilities directly into their systems.

- Scalability: The API architecture supports varying transaction volumes and business models.

- Market Reach: Over 80% of Adyen's 2024 transaction volume was API-driven.

Adyen’s place in the market is defined by its unified, global platform that grants clients direct access to numerous payment methods and card networks, bypassing intermediaries. This streamlined approach is evident in their substantial transaction volumes, with gross merchandise volume (GMV) reaching €606.5 billion in 2023. Their extensive international presence, with offices in over 30 cities, ensures localized support and deep market insights, enabling them to serve merchants in over 150 countries as of late 2024.

| Aspect | Description | Key Data/Fact |

|---|---|---|

| Platform | Unified global payment processing | GMV: €606.5 billion (2023) |

| Reach | International presence and market coverage | Offices in 30+ cities; Serves 150+ countries (late 2024) |

| Distribution | Direct engagement with enterprise and platform clients | Focus on deep integration and tailored solutions |

| Integration | Seamless omnichannel payment experience | TPV: €606.7 billion (2023), up from €500 billion (2022) |

What You Preview Is What You Download

Adyen 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Adyen's 4P's Marketing Mix provides actionable insights into their product, price, place, and promotion strategies. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Adyen's 'Unlocking Business Value' campaigns highlight how their integrated payment, data, and financial solutions drive growth. For instance, their platform enables businesses to streamline checkout processes, which can significantly reduce cart abandonment rates. In 2024, many businesses reported seeing a 10-15% increase in conversion rates after implementing Adyen's optimized payment flows.

Adyen heavily emphasizes its technological prowess in its promotional efforts, highlighting continuous investment in cutting-edge solutions. This includes showcasing AI-powered tools such as Adyen Uplift, designed to optimize conversion rates, and Intelligent Payment Routing, which aims to secure higher authorization rates. These innovations position Adyen as a forward-thinking leader in the fintech space.

By demonstrating its commitment to advanced technology, Adyen effectively communicates its ability to provide merchants with sophisticated payment solutions. For instance, Adyen reported a 23% year-over-year increase in revenue for Q1 2024, partly driven by the adoption of its innovative platform by a growing number of global businesses seeking to enhance their payment processing capabilities.

Adyen leverages customer success stories and strategic partnerships as a key promotional tool, showcasing its capabilities through collaborations with industry giants like Meta, Uber, H&M, eBay, and Microsoft. These high-profile associations act as powerful testimonials, demonstrating the robustness and scalability of Adyen's payment platform for businesses of all sizes.

By highlighting these successful relationships, Adyen effectively communicates its value proposition, building trust and credibility within the market. For instance, Uber's continued reliance on Adyen for its global payment infrastructure underscores the platform's ability to handle massive transaction volumes and complex payment flows, a critical factor for growth-stage companies.

Thought Leadership and Industry Reports

Adyen actively cultivates thought leadership through the release of insightful industry reports and research. For instance, their 2025 Hospitality and Travel Report delves into critical sector trends and evolving consumer spending habits, showcasing Adyen's deep understanding of payment dynamics.

This strategic approach positions Adyen as a go-to expert within the payments ecosystem, effectively drawing in a discerning audience of financially-literate decision-makers. Such content serves to educate and inform potential clients and partners about the future of commerce.

Key highlights from their thought leadership often include:

- Data-driven insights into consumer payment preferences and merchant challenges.

- Future-focused analysis projecting shifts in digital payments and cross-border commerce.

- Case studies demonstrating successful payment strategies implemented by leading businesses.

- Expert commentary on regulatory changes and technological advancements impacting the payments industry.

Investor Relations and Financial Communications

Adyen’s investor relations and financial communications are vital for building trust and transparency with its stakeholders. Regular press releases, comprehensive annual reports, and informative earnings calls serve as key promotional avenues. These channels are meticulously crafted to inform investors and financial professionals about Adyen's financial health, strategic advancements, and forward-looking plans.

These communications are designed to foster confidence by providing clear insights into Adyen's performance and strategic direction. For instance, Adyen's 2023 annual report highlighted a significant increase in total processed volume, reaching €739.5 billion, up 23% from 2022, demonstrating robust growth. Such data points are crucial for investors assessing the company's market position and future potential.

- Financial Performance: Adyen consistently provides detailed financial results, including revenue growth and profitability metrics, to keep investors informed.

- Strategic Milestones: Key developments, such as new market entries or significant product launches, are communicated to showcase strategic progress.

- Future Outlook: Guidance and commentary on market trends are offered to help investors understand Adyen's anticipated trajectory.

- Transparency: Open communication channels, including Q&A sessions during earnings calls, are maintained to address investor queries directly.

Adyen's promotional strategy centers on showcasing its integrated payment, data, and financial solutions as drivers of business growth. Campaigns emphasize how their platform streamlines checkout, leading to reduced cart abandonment. For example, in 2024, businesses reported conversion rate increases of 10-15% after adopting Adyen's optimized payment flows.

Technological innovation is a core promotional pillar, with Adyen highlighting investments in AI-powered tools like Adyen Uplift for conversion optimization and Intelligent Payment Routing to boost authorization rates. This positions them as a fintech leader. Their Q1 2024 revenue, up 23% year-over-year, partly reflects the adoption of these advanced solutions by global businesses.

Customer success stories and strategic partnerships with major companies like Meta, Uber, and H&M serve as powerful testimonials, demonstrating Adyen's platform robustness and scalability. Uber's continued use of Adyen for its global payment infrastructure, for instance, underscores its capacity to handle massive transaction volumes.

Adyen also cultivates thought leadership through industry reports, such as their 2025 Hospitality and Travel Report, which analyzes sector trends and consumer spending. This deepens their market understanding and positions them as an expert, attracting decision-makers by providing data-driven insights and future-focused analysis.

Price

Adyen primarily employs an Interchange++ pricing model, celebrated for its clarity. This approach dissects the total cost into three core elements: the interchange fee, determined by the card issuer; the scheme fee, levied by the card network; and Adyen's own processing markup. For instance, in 2024, interchange fees can range from 0.2% to 2.5% depending on card type and region, while scheme fees typically fall between 0.1% and 0.5%.

Adyen's transparent and itemized fees, particularly through their Interchange++ model, offer significant value. This approach breaks down costs into interchange fees, scheme fees, and Adyen's own markup, giving merchants unparalleled clarity. For example, interchange fees, which go to the card-issuing banks, can range from 0.2% to over 2% depending on the card type and transaction, while scheme fees from Visa or Mastercard typically add another 0.1% to 0.5%.

This detailed breakdown allows businesses to accurately forecast their payment processing expenses. Knowing the exact cost of each transaction component empowers merchants to optimize their pricing strategies and identify potential savings. In 2024, businesses are increasingly scrutinizing all operational costs, and Adyen's fee structure directly addresses this demand for financial predictability.

Adyen’s pricing strategy significantly lowers the barrier to entry for businesses by eliminating setup and monthly fees. This pay-per-transaction model, as opposed to fixed monthly costs, means businesses only pay for actual processing volume. For instance, many traditional payment processors might charge anywhere from $25 to $200 per month plus setup fees, which Adyen completely bypasses.

Volume-Based Discounts and Custom Negotiations

For enterprises processing substantial transaction volumes, Adyen provides a pathway to customized pricing structures, including volume-based discounts. This tiered pricing model allows for a reduction in the acquirer markup fee, making Adyen a more economical choice for high-volume merchants. For example, a large e-commerce platform processing millions of transactions monthly could see its per-transaction cost decrease substantially compared to a smaller business.

This negotiation capability is a key differentiator for Adyen, particularly for businesses operating at scale. The ability to tailor rates means that as a merchant’s transaction volume grows, their cost per transaction can shrink, directly impacting profitability. This is crucial for businesses where even small percentage savings on high volumes translate into significant financial benefits.

Consider these points regarding Adyen's volume-based pricing:

- Negotiated Rates: High-volume merchants can engage in direct negotiations with Adyen to secure more favorable transaction fees.

- Tiered Discounts: Adyen’s pricing structure often includes volume tiers, where processing more transactions unlocks lower acquirer markup rates.

- Cost Efficiency at Scale: This approach ensures that Adyen’s services become increasingly cost-effective as a business expands its payment processing needs.

- Competitive Advantage: For large enterprises, securing these negotiated rates can provide a significant competitive edge by reducing operational overhead.

Additional Service-Specific Charges

While Adyen's core payment processing fees are generally transparent, the company implements additional charges for specific services and transaction types. These fees are designed to cover the costs associated with specialized functions and risk management, ensuring clarity for their clients.

These service-specific charges can include:

- Refund Processing Fees: A nominal fee may apply for each refund processed through the Adyen platform.

- Chargeback Fees: Charges are levied when a customer disputes a transaction, requiring Adyen to manage the chargeback process.

- Currency Conversion Fees: For cross-border transactions, Adyen applies a fee for currency conversion services.

- Value-Added Services: Certain optional services, such as Revenue Protect for fraud prevention, incur separate fees.

For example, in 2024, Adyen's fee structure typically includes a small percentage plus a fixed fee for standard transactions, with additional charges for services like refunds or chargebacks. While specific percentages vary based on client agreements and transaction volumes, these additional charges are clearly detailed in their service agreements, allowing businesses to accurately forecast their payment processing costs.

Adyen's pricing, centered on Interchange++, offers merchants unparalleled transparency by itemizing interchange, scheme, and Adyen's markup fees. This model eliminates setup and monthly charges, adopting a pay-per-transaction approach that significantly lowers the barrier to entry. For high-volume clients, Adyen provides negotiated, tiered pricing with volume-based discounts, making it increasingly cost-effective as transaction volumes grow.

| Fee Component | Typical Range (2024) | Description |

|---|---|---|

| Interchange Fee | 0.2% - 2.5% | Set by the card-issuing bank, varies by card type and region. |

| Scheme Fee | 0.1% - 0.5% | Charged by card networks like Visa or Mastercard. |

| Adyen Markup | Negotiable/Tiered | Adyen's processing fee, often reduced for high-volume merchants. |

| Additional Services | Variable | Fees for refunds, chargebacks, currency conversion, and value-added services. |

4P's Marketing Mix Analysis Data Sources

Our Adyen 4P's Marketing Mix Analysis leverages a comprehensive blend of data, including Adyen's official press releases, investor relations materials, and their public-facing website. We also incorporate insights from reputable fintech industry reports and analyses of their partner ecosystem to understand their strategic positioning.