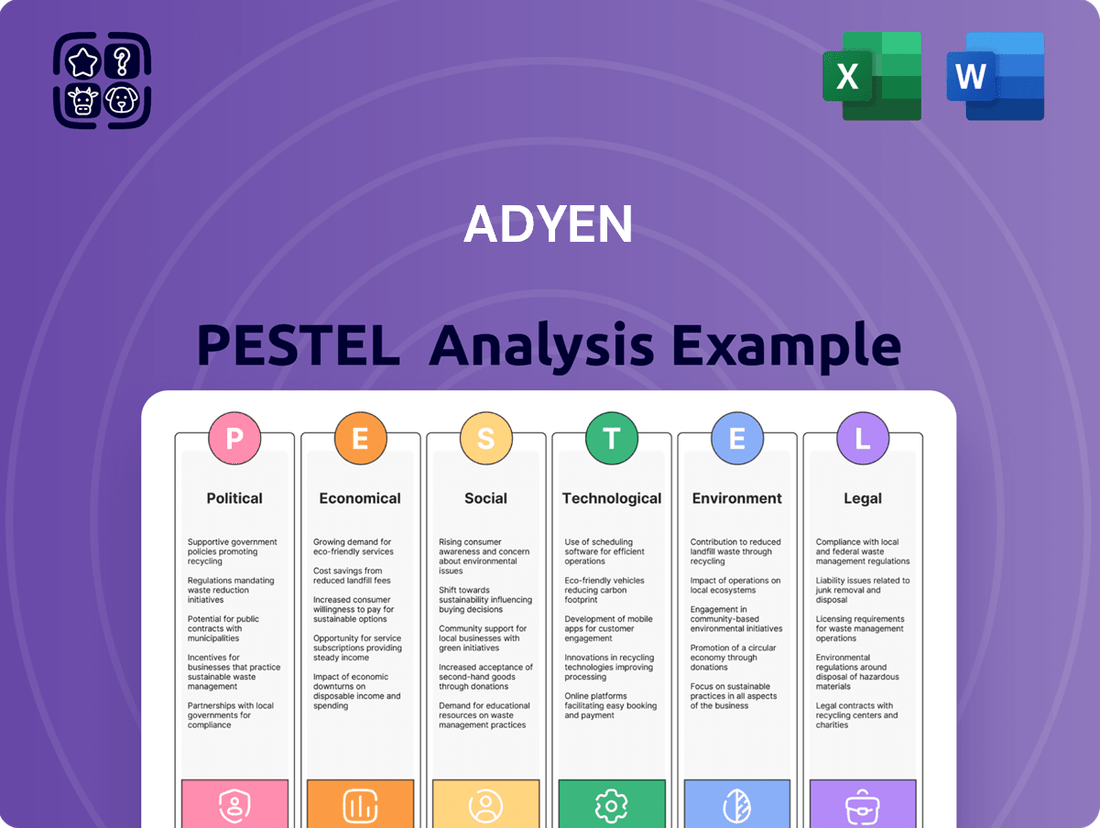

Adyen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

Navigate the complex global landscape impacting Adyen with our expert PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its future. This comprehensive report is your key to unlocking strategic advantages and mitigating risks. Download the full version now for actionable intelligence to drive your own success.

Political factors

Adyen navigates a complex web of governmental regulations, particularly within the financial technology space. Changes to policies concerning data privacy, like GDPR in Europe, and anti-money laundering (AML) directives directly influence Adyen's operational costs and compliance strategies. For instance, the ongoing enforcement of the UK Online Safety Act, which impacts how payment processors manage certain transactions, requires continuous adaptation.

Global trade tensions and geopolitical instability can create headwinds for Adyen's international operations and its diverse client base. While Adyen's CFO noted in early 2024 that these tensions hadn't significantly impacted their business, ongoing economic volatility can still affect the financial health of some of their merchants.

Adyen's extensive global footprint necessitates careful navigation of varied political landscapes and potential trade barriers. These factors can directly influence the cost and ease of cross-border transactions, as well as Adyen's access to key international markets.

Data protection and privacy laws are becoming increasingly stringent worldwide, directly impacting how companies like Adyen handle sensitive payment information. Regulations such as the EU's General Data Protection Regulation (GDPR) and similar legislation in other regions mandate strict rules for data collection, processing, and storage. For instance, GDPR, which came into full effect in 2018, imposes significant fines for non-compliance, with penalties potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates continuous investment in robust security infrastructure and privacy-by-design principles to maintain customer trust and avoid substantial financial repercussions.

Government Support for Fintech Innovation

Government initiatives play a crucial role in shaping the fintech landscape for companies like Adyen. Many governments are actively promoting digital transformation and innovation within the financial sector. For instance, the European Union's Payment Services Directive 2 (PSD2) has fostered greater competition and innovation by requiring banks to open up access to customer data with their consent, benefiting payment providers.

Regulatory sandboxes, a key government support mechanism, allow fintech firms to test new products and services in a controlled environment with regulatory oversight. The UK's Financial Conduct Authority (FCA) sandbox, launched in 2016, has been instrumental in nurturing early-stage fintech innovation. By 2024, over 200 firms had participated in the FCA's sandbox programs, many of which operate in the payments space, creating a more fertile ground for Adyen's expansion and the adoption of its technologies.

Conversely, excessive bureaucracy or a lack of clear regulatory frameworks can impede Adyen's growth. Stringent or unclear regulations regarding data privacy, anti-money laundering (AML), and Know Your Customer (KYC) requirements can increase compliance costs and slow down the rollout of new payment solutions. For example, differing data localization laws across various countries can add complexity to Adyen's global operations.

- Government funding for digital transformation initiatives, such as the UK's £100 million Digital Economy Package announced in 2022, directly supports the infrastructure and adoption of digital payment solutions.

- The continued evolution of PSD2 and similar open banking regulations across various jurisdictions, including Australia and Singapore, creates opportunities for Adyen to offer innovative payment experiences.

- The presence of well-established regulatory sandboxes in key markets like the US, UK, and Germany allows for the testing and scaling of new payment technologies, potentially benefiting Adyen's product development.

- Navigating evolving AML and KYC regulations, which saw significant updates in the EU in 2023, requires ongoing investment in compliance technology for Adyen.

Taxation Policies

Changes in corporate tax rates, the introduction of digital services taxes, or new cross-border transaction taxes in countries where Adyen operates directly affect its bottom line and how it prices its services. For example, a rise in corporate tax rates in a major market could reduce Adyen's net profit margins if not offset by other efficiencies or pricing adjustments.

Adyen's financial results are also sensitive to tax advantages or one-time tax-related gains. Favorable tax regimes can significantly bolster profitability, underscoring the strategic importance of operating in jurisdictions with advantageous tax structures. For instance, the company's effective tax rate can fluctuate based on the geographical distribution of its profits and any tax incentives it may secure.

Adyen must continuously monitor and adapt to the evolving global tax landscape to maintain optimal financial performance. This includes staying abreast of legislative changes that could impact its international operations and tax liabilities, ensuring compliance while seeking to minimize its tax burden effectively.

- Impact on Profitability: Corporate tax rate changes, digital services taxes, and cross-border transaction taxes directly influence Adyen's net income.

- Strategic Importance of Tax Regimes: Favorable tax environments can enhance Adyen's profitability and competitiveness.

- Adaptation to Evolving Policies: Proactive monitoring and adaptation to global tax policy changes are crucial for financial optimization.

Political stability and government policies significantly shape Adyen's operating environment. Evolving data privacy regulations, such as GDPR, and anti-money laundering (AML) directives directly impact compliance costs and operational strategies, requiring continuous adaptation. For instance, the UK's Online Safety Act necessitates ongoing adjustments to transaction management protocols.

Geopolitical tensions and trade disputes can create challenges for Adyen's international operations and its merchant base, though the company has noted limited direct impact as of early 2024. Nevertheless, economic volatility stemming from these factors can still affect merchant financial health.

Government initiatives promoting digital transformation, like open banking regulations such as PSD2, foster innovation and competition, creating opportunities for Adyen. Furthermore, regulatory sandboxes, exemplified by the UK's FCA program which has supported over 200 firms by 2024, provide a testing ground for new payment technologies, benefiting Adyen's product development.

| Factor | Impact on Adyen | Example/Data Point |

|---|---|---|

| Data Privacy Regulations | Increased compliance costs, need for robust security | GDPR fines up to 4% of global annual turnover or €20 million |

| Open Banking Initiatives | Opportunities for innovation and competition | PSD2 in Europe facilitating new payment experiences |

| Regulatory Sandboxes | Testing ground for new technologies | UK FCA sandbox supported over 200 firms by 2024 |

| Geopolitical Tensions | Potential headwinds for international operations | Ongoing economic volatility can affect merchant financial health |

What is included in the product

This Adyen PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting key opportunities and threats for Adyen's continued growth and market positioning.

A concise PESTLE analysis for Adyen offers a readily digestible overview of external factors, simplifying complex market dynamics for quick strategic decision-making.

Economic factors

Adyen's financial performance is intrinsically linked to the health of the global economy and the spending habits of consumers. When economies are growing and people are spending more, Adyen sees higher transaction volumes, which directly translates to increased revenue.

Despite facing some economic uncertainties, Adyen demonstrated resilience. In the first quarter of 2025, the company announced a significant 22% year-over-year rise in net revenue. This growth was fueled by strong performance across its main business areas, indicating robust underlying demand for its payment services.

A flourishing economy typically encourages more commerce, both through online channels and physical stores. This heightened commercial activity directly benefits payment processors like Adyen, as more transactions mean more business for them.

Inflation directly impacts Adyen's business by affecting consumer spending power and increasing operational costs for merchants. However, Adyen's financial projections anticipate benefiting from inflation, forecasting a 16% revenue compound annual growth rate (CAGR) from 2024 to 2034.

Interest rates play a crucial role in Adyen's profitability, particularly for its embedded finance offerings. A supportive interest rate environment has been a key growth driver for the broader embedded payments and finance market, a segment where Adyen is actively expanding.

Adyen's financial health is also reflected in its projected EBITDA margin, which is expected to reach a strong 52% in 2025, indicating efficient cost management and operational leverage in a dynamic economic landscape.

The ongoing migration to e-commerce and digital payments presents a substantial growth opportunity for Adyen. The company's core business thrives on facilitating these digital transactions, with its platform engineered to handle diverse payment methods and the complexities of unified commerce. This trend is a direct driver of Adyen's expansion.

Adyen has benefited significantly from this shift. In 2023, Adyen processed €737.5 billion in total payment volume, a 23% increase year-over-year, underscoring the robust adoption of digital payment solutions. The company's ability to integrate various payment types and offer a seamless customer experience positions it well to capture further market share as digital commerce continues its upward trajectory.

Competition and Pricing Pressures

The fintech landscape is intensely competitive, with established players like Stripe, PayPal, and Worldpay constantly vying for market share. This intense rivalry directly translates into pricing pressures for Adyen.

Adyen's value-based pricing strategy must effectively counter competitors who often prioritize aggressive cost-cutting to win over merchants. For instance, in 2023, many payment processors offered reduced transaction fees to attract new clients, putting pressure on Adyen's margins.

To sustain its profitability and competitive edge, Adyen must continuously innovate its product offerings and optimize operational efficiency. This includes investing in new technologies and streamlining processes to maintain its premium positioning while managing costs.

- Intense Competition: Key rivals include Stripe, PayPal, and Worldpay, all actively competing for merchant business.

- Pricing Pressures: Competitors' focus on cost reduction creates a challenging pricing environment for Adyen.

- Strategic Response: Adyen's value-based strategy aims to differentiate through superior technology and service, rather than solely on price.

- Margin Maintenance: Ongoing product innovation and operational efficiency are crucial for Adyen to protect its profit margins amidst this competition.

Currency Exchange Rate Fluctuations

Adyen, operating globally, faces financial impacts from currency exchange rate shifts. When revenues earned in various regions are converted back to its primary reporting currency, these fluctuations can alter the reported figures. This is a critical consideration for a company processing payments across numerous countries.

For example, in 2023, Adyen specifically highlighted an 'outsized' foreign exchange (FX) impact in Latin America. This occurred even as the company was experiencing robust growth on a constant currency basis, underscoring how currency volatility can mask underlying business performance.

- Global Operations: Adyen's extensive international presence means a significant portion of its revenue is generated in currencies other than its reporting currency, exposing it to FX risk.

- Latin America Impact: In 2023, the Latin American region experienced a notable FX headwind, affecting reported financial results despite strong underlying growth.

- Constant Currency Growth: The company's ability to grow on a constant currency basis demonstrates the resilience of its core business operations, separate from FX effects.

Economic factors significantly influence Adyen's revenue and profitability. Strong global economic growth translates to higher consumer spending and increased transaction volumes for Adyen. For instance, the company reported a 22% year-over-year rise in net revenue in Q1 2025, reflecting this positive correlation.

Inflation can impact both consumer spending power and merchants' operational costs, yet Adyen's projections suggest it could benefit, forecasting a 16% revenue CAGR from 2024 to 2034. Interest rates also play a role, particularly supporting Adyen's embedded finance growth.

The ongoing shift towards e-commerce and digital payments is a major tailwind for Adyen, as evidenced by its processing of €737.5 billion in total payment volume in 2023, a 23% increase year-over-year. This trend highlights the increasing reliance on digital transaction facilitators.

| Economic Factor | Impact on Adyen | Supporting Data (2024/2025 Projections/Recent Performance) |

|---|---|---|

| Economic Growth | Drives higher transaction volumes and revenue. | 22% YoY net revenue rise in Q1 2025. |

| Inflation | Can affect spending but Adyen anticipates benefiting. | Projected 16% revenue CAGR (2024-2034). |

| Interest Rates | Supports growth in embedded finance. | Key growth driver for embedded payments market. |

| Digitalization Trend | Increases demand for payment processing services. | €737.5 billion total payment volume in 2023 (+23% YoY). |

Preview Before You Purchase

Adyen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Adyen PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global payments industry. Understand the external forces shaping Adyen's strategic landscape and identify potential opportunities and threats.

Sociological factors

Consumers are increasingly embracing digital wallets and mobile payment solutions, a trend that directly benefits Adyen. The platform's versatility in supporting numerous payment methods aligns perfectly with this shift, making it a valuable partner for businesses serving this evolving consumer base. This growing preference for digital transactions is not a fleeting trend; it's a fundamental change in how people prefer to pay.

The trajectory for mobile payments is strong, with projections indicating significant growth. For instance, the number of proximity mobile payment users in the US is expected to hit 117.4 million by 2025. This substantial user base highlights the widespread adoption and continued expansion of mobile payment technology, underscoring its importance in the current financial landscape.

Adyen's capacity to swiftly integrate emerging payment methods is a crucial competitive advantage. As consumer habits and technological advancements continue to shape the payment ecosystem, Adyen's agility in adding new functionalities ensures its clients can offer the most convenient and up-to-date payment options, thereby enhancing customer satisfaction and driving sales.

Consumers now expect a fluid journey, blending online browsing, physical store visits, and mobile app interactions. This shift is driven by a desire for convenience and personalization, making it essential for businesses to bridge these channels effectively. For instance, a study in early 2024 indicated that over 70% of consumers use multiple channels before making a purchase.

Adyen's Unified Commerce solution directly caters to this evolving consumer behavior by enabling businesses to offer a consistent experience, whether a customer buys online and picks up in-store or browses in a physical location and completes the transaction on their phone. This integration is key to boosting client sales, with Adyen reporting significant increases in transaction volumes for merchants leveraging their omnichannel capabilities.

The growing adoption of omnichannel strategies presents a substantial runway for Adyen's market expansion. As more businesses recognize the need to unify their customer touchpoints to remain competitive, Adyen is well-positioned to capture a larger share of the payment processing market, capitalizing on this fundamental change in how people shop.

Consumer trust in the security of online transactions is absolutely foundational for any payment platform, directly impacting willingness to engage in digital commerce. Adyen's robust risk management and sophisticated fraud prevention mechanisms, including its AI-powered Uplift tool, are designed to bolster this trust by safeguarding transactions. This focus on security is not just about preventing losses; it's a key driver for increasing conversion rates by reassuring both consumers and merchants.

Demand for Personalized Payment Experiences

Modern consumers increasingly demand financial services that are precisely tailored to their unique needs and preferences. This shift is driven by a desire for convenience and a more engaging transactional journey.

Adyen directly addresses this by providing merchants with a robust platform that supports a wide array of payment methods, from traditional cards to newer digital wallets and buy-now-pay-later options. This flexibility allows businesses to cater to diverse customer segments and their preferred payment styles, thereby enhancing the overall customer experience and potentially boosting conversion rates.

- Personalization is Key: A 2024 report indicated that 70% of consumers are more likely to shop with brands that offer personalized experiences, including tailored payment options.

- Platform Adaptability: Adyen's infrastructure is designed to integrate emerging payment technologies rapidly, ensuring merchants stay ahead of evolving consumer expectations.

- Global Reach, Local Preference: The platform's ability to handle local payment preferences globally is crucial, as demonstrated by Adyen’s 2023 report showing significant growth in emerging market payment methods.

Social Responsibility and Ethical Consumerism

A growing number of consumers are increasingly influenced by a company's social and environmental impact. This trend means businesses must demonstrate a commitment to responsible practices to maintain consumer trust and loyalty.

Adyen actively addresses this by committing 1% of its annual net revenue towards UN Sustainable Development Goals. Furthermore, their 'Giving' product allows customers to easily make charitable donations during the checkout process, directly aligning with consumer desires for brands that operate with a clear sense of purpose.

- Consumer Demand: Reports from 2024 indicate that over 60% of consumers consider a brand's ethical practices when making purchasing decisions.

- Adyen's Commitment: Adyen's dedication to UN SDGs and its 'Giving' product are designed to resonate with this ethically-minded consumer base.

- Employee Involvement: The fact that Adyen employees direct these investments adds a layer of authenticity and internal buy-in to their social responsibility efforts.

Societal shifts towards digital-first engagement and a demand for seamless, personalized experiences are paramount. Consumers expect integrated journeys across online and offline touchpoints, with a significant portion, over 70% in early 2024 surveys, utilizing multiple channels before purchase.

Adyen's Unified Commerce solution directly addresses this by enabling consistent customer experiences, a strategy that has shown to boost merchant transaction volumes. The growing preference for digital wallets and mobile payments, projected to reach 117.4 million users in the US by 2025, further solidifies the need for flexible payment platforms like Adyen.

Consumer trust in online security is critical, with Adyen employing AI-powered tools to enhance fraud prevention and conversion rates. Furthermore, a growing segment of consumers, over 60% in 2024, prioritize a company's social and environmental impact, a trend Adyen addresses through its commitment to UN Sustainable Development Goals and its 'Giving' product.

| Sociological Factor | Consumer Behavior Trend | Adyen's Response/Benefit | Supporting Data/Insight |

|---|---|---|---|

| Digitalization & Convenience | Preference for digital wallets & mobile payments | Adyen's versatile platform supports numerous payment methods. | US proximity mobile payment users projected to reach 117.4 million by 2025. |

| Omnichannel Shopping | Expectation of seamless online/offline integration | Unified Commerce solution offers consistent customer experiences. | Over 70% of consumers use multiple channels before purchasing (early 2024). |

| Personalization Demand | Desire for tailored financial services | Platform flexibility allows catering to diverse customer payment styles. | 70% of consumers favor brands offering personalized payment options (2024). |

| Ethical Consumerism | Consideration of social & environmental impact | Commitment to UN SDGs and 'Giving' product. | Over 60% of consumers consider ethical practices (2024). |

Technological factors

Adyen actively integrates artificial intelligence and machine learning across its operations. These technologies are crucial for sophisticated functions like intelligent payment routing, robust fraud detection, and enhancing transaction processing speeds. This commitment to AI ensures a more efficient and secure payment ecosystem for its clients.

The increasing consumer adoption of AI in shopping is a significant trend. Adyen's own 2025 Retail Report indicates that a substantial 47% of consumers are now utilizing AI tools for their shopping activities. This highlights the growing expectation for AI-powered experiences within the retail and payments landscape.

Adyen's reliance on cloud computing is paramount for its global operations, enabling it to manage immense transaction volumes. This scalable infrastructure is the backbone of its end-to-end payment processing and direct card network connections.

In 2024, Adyen continued to invest heavily in its unified platform, emphasizing the underlying cloud infrastructure's capacity to support its expanding merchant base and increasing payment complexity. This focus ensures the platform can handle surges in demand, a critical factor for a payment processor operating across numerous markets.

Adyen's reliance on robust cybersecurity and data encryption is paramount, given the sensitive nature of payment processing. Continuous innovation in these areas is not just a competitive advantage but a fundamental requirement for trust and compliance. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the immense investment and focus on securing digital assets, a trend Adyen actively participates in.

The company's operational integrity hinges on its ability to prevent fraud and safeguard its platform from malicious activities. This commitment is deeply embedded in Adyen's business model, directly impacting its compliance with stringent financial regulations worldwide. Reports indicate that data breaches in 2024 cost businesses an average of $4.45 million, underscoring the financial imperative for Adyen to maintain state-of-the-art security measures.

Emergence of New Payment Technologies (e.g., Blockchain, Biometrics)

The financial landscape is rapidly evolving with new payment technologies. Blockchain, for instance, offers potential for streamlined reconciliation, while biometrics enhance security. Adyen has actively embraced these advancements, developing its own blockchain-based reconciliation system. This innovation aims to improve efficiency and reduce costs in financial operations.

Furthermore, Adyen has integrated biometric authentication for high-value transactions. This move addresses growing consumer demand for secure yet convenient payment methods. By leveraging technologies like fingerprint or facial recognition, Adyen is enhancing the security of its platform and building customer trust in an increasingly digital world.

The global adoption of digital payments continues to surge. In 2024, it's projected that over 1.5 trillion payment transactions will occur globally, with mobile payments alone expected to reach $1.3 trillion. This trend underscores the importance of Adyen's investment in cutting-edge payment solutions.

- Blockchain for Reconciliation: Adyen's proprietary system aims to reduce settlement times and improve transparency.

- Biometric Authentication: Expanded use for high-value transactions enhances security and user experience.

- Market Growth: The increasing global adoption of digital and mobile payments validates Adyen's strategic focus.

API-First and Platform-Based Solutions

Adyen's core strength lies in its API-first and platform-based architecture, enabling businesses to integrate a comprehensive payment solution seamlessly. This approach facilitates rapid innovation and the quick rollout of new payment methods and features, crucial for staying competitive in the fast-evolving digital commerce landscape. For instance, Adyen's 'Adyen for Platforms' solution exemplifies this by empowering marketplaces and platforms to manage payments for their sellers, streamlining operations and enhancing user experience.

This technological foundation allows Adyen to process a vast volume of transactions efficiently. In the first half of 2024, Adyen reported a significant increase in transaction volumes, processing €322.5 billion in total payment volume, a 23% increase year-over-year. This growth underscores the scalability and robustness of their API-driven platform.

- API-First Design: Enables flexible integration for merchants, allowing them to embed Adyen's payment services directly into their websites and applications.

- Platform-Based Solutions: Adyen's unified platform handles the entire payment lifecycle, from authorization to settlement, offering a single point of integration for global payments.

- Rapid Feature Deployment: The architecture supports quick updates and the introduction of new payment methods and compliance features, keeping merchants ahead of market demands.

- Scalability: Proven ability to handle massive transaction volumes, as evidenced by processing hundreds of billions of euros in payment volume annually.

Adyen's technological advancements are central to its value proposition, focusing on AI, cloud infrastructure, and robust cybersecurity. These elements are critical for efficient, secure, and scalable payment processing in a rapidly digitizing world.

The company's commitment to innovation is evident in its adoption of emerging technologies like blockchain for reconciliation and biometrics for enhanced transaction security. These integrations aim to streamline operations and meet evolving consumer expectations for seamless and safe payment experiences.

Adyen's API-first architecture underpins its ability to offer flexible payment solutions and rapidly deploy new features. This technological foundation allows for efficient handling of massive transaction volumes, as demonstrated by significant year-over-year growth in total payment volume, reaching €322.5 billion in the first half of 2024.

| Technology Area | Key Application | 2024/2025 Relevance |

|---|---|---|

| Artificial Intelligence (AI) | Intelligent payment routing, fraud detection, personalized experiences | 47% of consumers use AI in shopping (Adyen Retail Report 2025); drives efficiency and security. |

| Cloud Computing | Global transaction processing, scalability, platform reliability | Supports massive transaction volumes; essential for Adyen's unified platform. |

| Cybersecurity | Data encryption, fraud prevention, platform protection | Global cybersecurity market projected over $200 billion in 2024; data breaches cost $4.45 million on average. |

| Emerging Payments | Blockchain for reconciliation, Biometric authentication | Streamlines financial operations, enhances security and user convenience. |

| API-First Architecture | Seamless integration, rapid feature deployment, platform solutions | Facilitates quick innovation; Adyen processed €322.5 billion in H1 2024 (23% YoY growth). |

Legal factors

Adyen navigates a complex web of financial regulations and licensing demands across its global operations. As a payment processor, it must comply with stringent rules governing payment services, acquiring, and robust risk management frameworks in each jurisdiction it serves. Failure to maintain these licenses and adhere to evolving regulations, such as those impacting anti-money laundering (AML) and Know Your Customer (KYC) procedures, could severely disrupt its business.

Adyen operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, requiring rigorous customer vetting and transaction monitoring to combat financial crime. These legal mandates necessitate identity verification and the identification of beneficial owners, directly influencing Adyen's customer onboarding procedures and ongoing relationship management.

Consumer protection laws, like the European Union's Payment Services Directive 2 (PSD2), mandate strong customer authentication and dispute resolution processes, directly impacting Adyen's service design. These regulations ensure transparency and fairness in payment processing, influencing Adyen's approach to chargebacks and refunds.

Data Privacy and Security Regulations (e.g., GDPR, CCPA)

Data privacy and security are paramount for Adyen, especially with stringent regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws dictate how Adyen must handle customer data, requiring robust consent mechanisms and clear data usage policies. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Adyen's commitment to these regulations is crucial for maintaining customer trust and avoiding legal repercussions.

Adyen's operational framework must actively incorporate compliance with evolving data privacy laws. This involves not only adhering to existing mandates but also anticipating future regulatory changes. For example, as of early 2025, discussions around expanded data rights and cross-border data transfer mechanisms continue, impacting how global payment processors like Adyen manage information. Ensuring data security is not just a legal obligation but a core component of Adyen's service offering, directly influencing its reputation and ability to operate internationally.

Key compliance considerations for Adyen include:

- Data Minimization: Collecting and processing only the data strictly necessary for transactions.

- Consent Management: Obtaining explicit and informed consent for data processing activities.

- Data Subject Rights: Facilitating access, rectification, and erasure of personal data.

- Cross-Border Data Transfers: Ensuring lawful mechanisms are in place for international data movement.

Cross-Border Payment Regulations

Adyen's global operations necessitate a deep understanding of diverse cross-border payment regulations. These include stringent rules on foreign exchange, capital controls, and adherence to international sanctions regimes, which can vary significantly by country. For instance, in 2024, many nations continued to update their anti-money laundering (AML) and know-your-customer (KYC) requirements, directly impacting how payments are processed internationally.

Navigating this complex regulatory landscape is a core strength for Adyen. The company's ability to manage these varied requirements across numerous jurisdictions allows it to offer a seamless payment experience for merchants operating internationally. This capability is crucial, especially as global trade continues to evolve, with new economic partnerships and trade agreements being established throughout 2024 and projected into 2025.

- Regulatory Compliance: Adyen must stay abreast of evolving AML and KYC regulations in over 200 countries where it operates.

- Sanctions Screening: The company implements robust systems to screen transactions against global sanctions lists, a critical function in 2024 and beyond.

- Capital Controls: Adyen's infrastructure is designed to manage varying capital control measures, ensuring smooth fund flows despite national restrictions.

- FX Management: Adyen provides solutions for currency conversion, adhering to local foreign exchange regulations and market practices.

Adyen's legal framework is heavily influenced by global data privacy regulations, with GDPR and CCPA being prime examples. These laws impose strict rules on data handling, consent, and user rights, impacting Adyen's operational procedures and potentially leading to substantial fines, such as up to 4% of global annual revenue under GDPR. Staying compliant requires ongoing adaptation to evolving data protection standards, a critical aspect for maintaining customer trust and international operability.

Environmental factors

Adyen's operations, like those of any digital payments provider, are intrinsically linked to the energy consumption of its data centers and IT infrastructure. This energy usage directly contributes to its overall carbon footprint, making the management of environmental impact a crucial aspect of its business strategy.

In a significant environmental milestone, Adyen achieved carbon-negative status in 2025. This accomplishment underscores the company's proactive approach to mitigating the environmental effects of its technological operations and its broader commitment to sustainability.

Societal and regulatory demands for sustainable business operations are increasingly shaping Adyen's strategic direction. This pressure encourages the company to integrate environmental, social, and governance (ESG) principles into its core business model.

Adyen demonstrates its commitment through tangible actions, pledging 1% of its annual net revenue towards achieving UN Sustainable Development Goals. Furthermore, its role as a governing member of the Sustainability Standards Board actively promotes eco-innovation within the fintech sector.

Adyen's deployment of payment terminals for its Unified Commerce and in-store solutions inherently generates electronic waste. Responsible management of this hardware is a significant environmental consideration. The global e-waste problem is escalating, with projections indicating a continued rise in discarded electronics.

The company's commitment to sustainable practices necessitates robust recycling and disposal programs for its payment terminals. As of 2023, the global e-waste generated reached approximately 62 million metric tons, highlighting the scale of the challenge. Adyen's efforts in this area directly contribute to mitigating environmental impact.

Regulatory Pressure for Green Finance

Governments and financial regulators are increasingly pushing for green finance and sustainable investments. This trend, evident globally, encourages financial institutions to support environmentally conscious businesses and develop related financial products. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) aims to bring transparency to sustainability claims in financial products, impacting how companies report their environmental impact.

While Adyen operates as a payment processor, it could experience indirect pressure or discover opportunities to align with these green finance initiatives. This might involve supporting businesses with strong environmental, social, and governance (ESG) credentials or exploring the development of payment solutions that facilitate eco-friendly transactions. The growing emphasis on sustainability means companies are expected to demonstrate their commitment to environmental responsibility.

The push for greener practices is often amplified by consumer demand. In 2024, surveys indicated that a significant majority of consumers prefer to support brands that demonstrate a commitment to environmental sustainability. This consumer sentiment can translate into increased business for companies like Adyen that enable or partner with eco-conscious merchants.

Key aspects of this regulatory pressure include:

- Increased reporting requirements for ESG factors from financial institutions and their partners.

- Incentives for green investments, potentially creating new market opportunities for payment providers supporting sustainable businesses.

- Growing consumer expectation for businesses to adopt and demonstrate environmentally responsible practices.

Client Demand for Environmentally Conscious Partners

As businesses increasingly focus on their environmental impact, Adyen's clients are showing a growing preference for payment partners that reflect their own sustainability commitments. This trend means that payment providers demonstrating strong environmental credentials are well-positioned to attract and retain these conscious merchants.

Adyen's own commitment to sustainability, including its carbon-negative status, directly addresses this client demand. Furthermore, its 'Giving' product, which enables easy charitable donations through transactions, offers a tangible way for merchants to support environmental causes and communicate their values to their customers.

For instance, a significant portion of consumers, estimated at over 60% by some reports in late 2024, are willing to pay more for sustainable products. This consumer behavior directly influences merchant choices, pushing them to select partners like Adyen that can help them meet these evolving expectations.

- Growing Consumer Preference: Data from late 2024 indicates that over 60% of consumers are willing to pay a premium for sustainable goods, influencing merchant partnerships.

- Adyen's Differentiators: Adyen's carbon-negative operations and the 'Giving' product provide tangible benefits for merchants seeking to align with environmental values.

- Market Alignment: By supporting merchants' sustainability goals, Adyen can capture a larger share of the market as environmental consciousness becomes a key purchasing factor.

Adyen's environmental strategy is shaped by its operational footprint, particularly energy consumption in data centers and IT infrastructure, which contributes to its carbon emissions. The company achieved carbon-negative status in 2025, a significant milestone reflecting its proactive environmental management. This progress is crucial as global e-waste, including payment terminals, continues to rise, with approximately 62 million metric tons generated in 2023, underscoring the need for robust recycling programs.

Regulatory bodies and consumers are increasingly prioritizing sustainability, influencing financial markets towards green finance and eco-conscious business practices. In 2024, over 60% of consumers expressed a willingness to pay more for sustainable products, directly impacting merchant choices and their preference for payment partners like Adyen that align with these values.

| Environmental Factor | Adyen's Response/Impact | Supporting Data/Trend |

|---|---|---|

| Energy Consumption & Carbon Footprint | Adyen achieved carbon-negative status in 2025. | Focus on reducing emissions from IT infrastructure. |

| Electronic Waste (E-waste) | Implementing responsible recycling and disposal for payment terminals. | Global e-waste reached 62 million metric tons in 2023. |

| Green Finance & Consumer Demand | Clients prefer partners with sustainability commitments; Adyen's 'Giving' product supports eco-causes. | Over 60% of consumers in 2024 preferred sustainable brands and were willing to pay more. |

PESTLE Analysis Data Sources

Our Adyen PESTLE Analysis is built on a robust foundation of data from leading financial institutions, regulatory bodies, and global market research firms. We synthesize insights from economic reports, technological advancements, and societal trends to provide a comprehensive overview.