Adyen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adyen Bundle

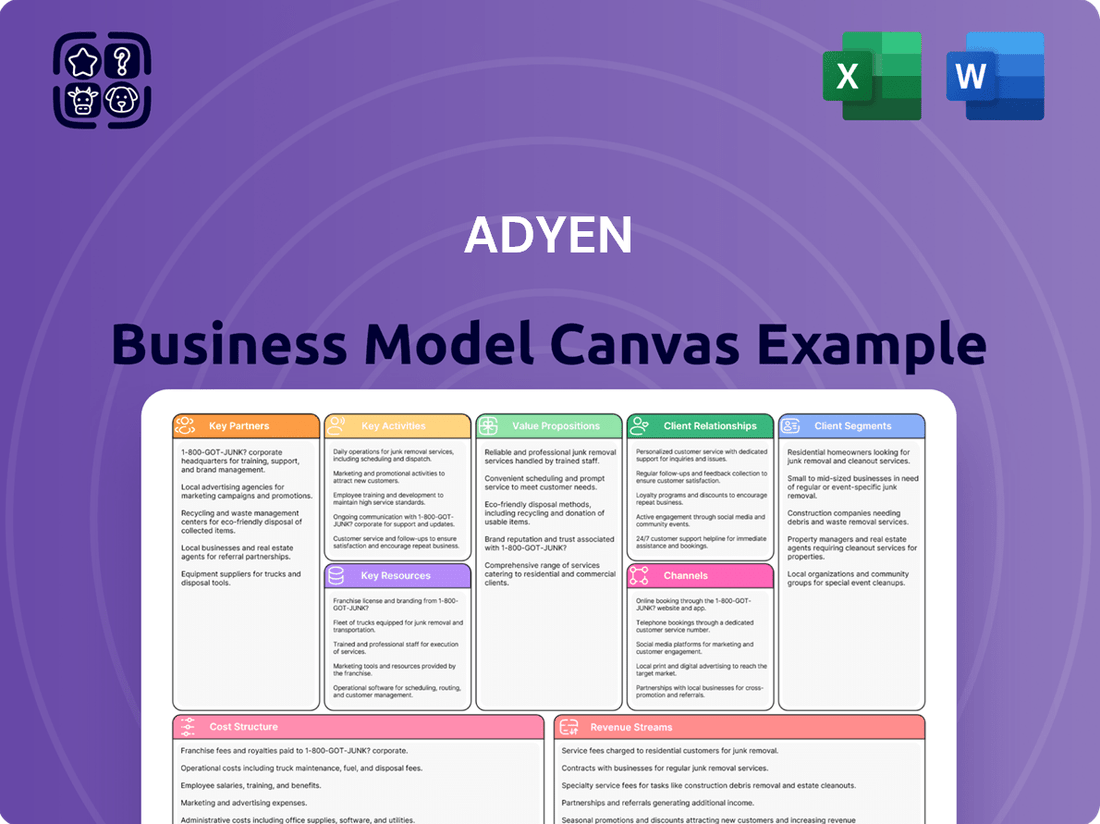

Curious about Adyen's innovative approach to payments? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their strategic advantage.

Discover the core components that drive Adyen's success, from key partnerships to cost structures, all within our detailed Business Model Canvas. This is your chance to gain actionable insights into a leading fintech player.

Ready to unlock the secrets of Adyen's operational excellence? Download the full Business Model Canvas to explore their channels, customer relationships, and key resources, empowering your own strategic planning.

Partnerships

Adyen's key partnerships with card networks like Visa and Mastercard are foundational, allowing for efficient global transaction processing. In 2024, Adyen continued to leverage these direct connections to facilitate billions of transactions worldwide, underscoring the critical nature of these relationships for its core business.

Furthermore, Adyen strategically partners with a wide array of local payment methods. This includes popular options such as SEPA Direct Debit in Europe, Alipay in China, and Pix in Brazil, which are vital for offering merchants comprehensive payment solutions and reaching diverse customer bases across different regions.

Adyen’s strategic alliances with leading e-commerce platforms, such as Shopify, are crucial. These integrations embed Adyen's payment capabilities directly into the platforms, simplifying adoption for merchants. For example, Shopify reported over 1.7 million merchants actively using its platform in 2023, representing a significant potential customer base for Adyen.

Adyen's collaborations with regional and global financial institutions are critical for its acquiring services. These partnerships enable faster settlements and direct bank account payments, a key component of their payment processing capabilities.

Working with banks ensures Adyen remains compliant with diverse local regulations across its operating markets. This is vital for smooth cross-border transactions and maintaining trust with merchants and consumers.

These banking relationships allow Adyen to optimize payment routing, leading to greater efficiency and reduced costs. For instance, in 2023, Adyen processed €739 billion in total payment volume, highlighting the scale and importance of these financial partnerships.

Strategic Business Alliances

Adyen cultivates strategic business alliances across diverse industries to enhance its payment offerings and market reach. For instance, its partnership with Atlas in Singapore's food and beverage sector exemplifies this, providing specialized payment solutions tailored to that industry's needs.

These collaborations are pivotal for Adyen, acting as gateways to new customer segments and unlocking novel revenue streams. By integrating with businesses that have established market presence, Adyen can efficiently expand its footprint.

- Atlas Partnership: Adyen's collaboration with Atlas in Singapore's F&B sector highlights its strategy to offer industry-specific payment solutions.

- Market Expansion: Such alliances are crucial for Adyen's geographical and sector-specific market penetration.

- Revenue Diversification: These partnerships directly contribute to diversifying Adyen's revenue sources by tapping into new customer bases.

- Customer Acquisition: Strategic alliances facilitate access to new customer segments that might otherwise be challenging to reach directly.

Fraud and Risk Management Solution Providers

Adyen collaborates with specialized fraud and risk management solution providers to bolster its own AI-driven fraud prevention. These partnerships are crucial for offering merchants a more comprehensive and robust security layer, ultimately aiming to maintain high authorization rates and protect against evolving fraud tactics. For instance, by integrating advanced machine learning models from these partners, Adyen can identify and mitigate complex fraud patterns that might otherwise go undetected.

These collaborations allow Adyen to offer a layered defense against financial crime. By leveraging external expertise and technology, Adyen can expand its fraud detection capabilities beyond its internal systems. This strategic approach ensures merchants benefit from a wider array of security tools, fostering trust and enabling smoother transactions.

- Enhanced Fraud Detection: Partnerships bring specialized AI and machine learning capabilities to Adyen's platform, improving the accuracy and speed of fraud identification.

- Broader Security Coverage: Collaborations with providers focusing on different risk vectors, such as account takeovers or synthetic identity fraud, create a more holistic security ecosystem for merchants.

- Improved Authorization Rates: By reducing false positives and accurately identifying legitimate transactions, these partnerships help maintain higher approval rates for merchants, directly impacting revenue.

- Adaptability to New Threats: The dynamic nature of fraud necessitates continuous innovation; partnerships allow Adyen to quickly integrate new anti-fraud technologies and adapt to emerging threats.

Adyen's key partnerships with card networks like Visa and Mastercard are foundational, allowing for efficient global transaction processing. In 2024, Adyen continued to leverage these direct connections to facilitate billions of transactions worldwide, underscoring the critical nature of these relationships for its core business.

Furthermore, Adyen strategically partners with a wide array of local payment methods, such as SEPA Direct Debit in Europe and Pix in Brazil, vital for offering merchants comprehensive payment solutions and reaching diverse customer bases across different regions.

Adyen’s strategic alliances with leading e-commerce platforms, like Shopify, embed its payment capabilities directly, simplifying adoption for merchants. In 2023, Shopify reported over 1.7 million active merchants, representing a significant potential customer base.

Collaborations with specialized fraud and risk management solution providers bolster Adyen's AI-driven fraud prevention. These partnerships are crucial for offering merchants a more comprehensive and robust security layer, aiming to maintain high authorization rates and protect against evolving fraud tactics.

| Partnership Type | Key Partners | Impact | 2023 Data/Context |

| Card Networks | Visa, Mastercard | Global transaction processing, direct connections | Facilitated billions of transactions |

| Local Payment Methods | SEPA Direct Debit, Alipay, Pix | Expanded payment options, regional reach | Essential for diverse customer bases |

| E-commerce Platforms | Shopify | Simplified merchant adoption, embedded solutions | Shopify had over 1.7 million active merchants in 2023 |

| Fraud Prevention Providers | Specialized AI/ML providers | Enhanced security, higher authorization rates | Bolsters AI-driven fraud prevention capabilities |

What is included in the product

A comprehensive, pre-written business model tailored to Adyen's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects Adyen's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Adyen's Business Model Canvas offers a clear, actionable framework to address the complex pain points of global payment processing.

It provides a visual roadmap for businesses to streamline their payment infrastructure, reducing friction and enhancing customer experience.

Activities

Adyen's core activity centers on orchestrating a massive flow of payments for businesses worldwide, covering online, in-app, and physical retail environments. This intricate process ensures transactions are authorized smoothly and funds are settled efficiently across diverse markets.

In 2023, Adyen processed a staggering €737 billion in gross merchandise volume, a significant increase from previous years, highlighting its expanding reach and the sheer scale of its payment processing capabilities.

The company's expertise lies in managing complex, cross-border transactions, optimizing authorization rates to minimize declined payments, and providing businesses with a unified platform for all their payment needs.

Adyen's core activities include the development and ongoing enhancement of sophisticated AI-driven fraud detection and risk management systems, exemplified by their RevenueProtect and Uplift solutions. These powerful tools meticulously examine transactions in real-time, swiftly identifying and neutralizing fraudulent behaviors to safeguard both merchants and their clientele.

In 2023, Adyen reported that its fraud detection tools successfully blocked $2.1 billion in fraudulent transactions, a testament to the effectiveness of their risk management strategies. This proactive approach is crucial for maintaining trust and ensuring a secure payment environment.

Adyen's commitment to platform innovation is a cornerstone of its strategy. In 2024, the company continued to pour resources into enhancing its unified commerce platform, ensuring it stays ahead of the curve in a rapidly changing payments landscape. This focus on development allows Adyen to offer merchants cutting-edge solutions.

A key aspect of this innovation involves the integration of artificial intelligence. Adyen is actively developing AI-driven payment optimization tools designed to improve authorization rates and reduce fraud for its clients. This technological advancement is crucial for merchants looking to maximize their revenue and streamline operations.

Furthermore, Adyen is not shying away from hardware innovation. The introduction of new terminals, such as the SFO1, demonstrates their dedication to providing a complete, integrated payment experience. These hardware advancements are designed to be user-friendly and robust, supporting seamless transactions across various touchpoints.

Global Market Expansion and Localization

Adyen actively expands its global reach, with a significant focus on high-growth markets like North America. This strategic expansion is crucial for supporting clients with international operations.

A core activity involves adapting the Adyen platform to seamlessly handle a vast array of currencies and local payment preferences. This ensures Adyen can serve businesses operating in diverse international landscapes. In 2023, Adyen reported significant growth in its North American operations, demonstrating the success of its expansion strategy.

- Global Footprint Expansion: Adyen's commitment to growing its presence in key regions, particularly North America, is a primary driver for its business model.

- Payment Method Localization: The platform's ability to support a wide spectrum of local payment methods and currencies is essential for facilitating cross-border transactions for its clients.

- Client Support for International Operations: These activities directly empower Adyen's clients to manage and grow their businesses across multiple countries and payment ecosystems.

Customer Relationship Management and Support

Adyen prioritizes building enduring connections with its enterprise clientele, emphasizing a collaborative approach to innovation and offering specialized assistance. The company actively seeks to grasp and fulfill the unique requirements of major merchants, thereby cultivating loyalty and increasing its penetration within their payment ecosystems.

This focus on customer relationships is a cornerstone of Adyen's strategy, driving repeat business and organic growth. For instance, in 2023, Adyen reported a significant increase in its customer base, with many of its largest clients expanding their use of Adyen's platform across multiple channels and geographies.

- Dedicated Account Management: Providing each enterprise client with a dedicated point of contact to ensure seamless communication and proactive problem-solving.

- Customer-Driven Innovation: Incorporating client feedback directly into product development cycles to create solutions that address real-world merchant challenges.

- Proactive Support: Offering 24/7 technical and operational support to minimize downtime and optimize payment processing performance for large-scale operations.

- Strategic Partnership: Working closely with clients to understand their evolving business needs and offering tailored payment solutions that support their growth objectives.

Adyen's key activities revolve around developing and maintaining its unified payments platform, which includes advanced fraud detection and risk management tools. The company also focuses on expanding its global reach, particularly in North America, and localizing its payment offerings to cater to diverse markets.

A significant portion of Adyen's efforts is dedicated to fostering strong relationships with its enterprise clients through dedicated support and customer-driven innovation, ensuring their payment needs are met effectively.

In 2023, Adyen processed €737 billion in gross merchandise volume, showcasing the scale of its operations and the trust placed in its platform by businesses worldwide.

The company's investment in AI-driven solutions is a critical activity, with its fraud detection tools blocking $2.1 billion in fraudulent transactions in 2023, demonstrating their robust security capabilities.

| Key Activity | Description | 2023 Data/Impact |

|---|---|---|

| Platform Development & Enhancement | Building and improving the unified payments platform, including AI-driven fraud detection. | Continued investment in AI for authorization rates and fraud reduction. |

| Global Expansion | Increasing presence in key regions, with a strong focus on North America. | Significant growth reported in North American operations. |

| Client Relationship Management | Providing dedicated support and incorporating client feedback into product development. | Increase in customer base, with existing clients expanding platform usage. |

| Payment Method Localization | Supporting a wide range of local payment methods and currencies. | Essential for facilitating cross-border transactions for clients. |

Delivered as Displayed

Business Model Canvas

The Adyen Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured content and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is processed, you'll gain immediate access to this exact file, ready for your strategic analysis and planning.

Resources

Adyen's proprietary technology platform is the bedrock of its operations, unifying payment processing, risk management, and acquiring into a single, end-to-end solution. This integrated approach streamlines complex financial workflows for businesses. In 2023, Adyen processed a significant €603.7 billion in total payment volume, a testament to the platform's scalability and efficiency.

This unified platform offers a distinct competitive advantage, simplifying payment operations for merchants and providing them with deep, actionable data insights. By consolidating these critical functions, Adyen enables businesses to manage their entire payment ecosystem through one interface, fostering greater control and transparency.

Adyen's extensive global network, featuring direct connections to major card schemes like Visa and Mastercard, alongside over 250 local payment methods, is a cornerstone of its business. This infrastructure, built over years, allows for seamless and efficient processing of payments worldwide.

These direct links are crucial for enabling Adyen to offer unified commerce solutions, facilitating cross-border transactions with greater speed and lower costs for merchants. In 2024, Adyen continued to expand its reach, onboarding more regional payment options to cater to diverse consumer preferences.

Adyen's extensive dataset, encompassing billions of payment transactions, combined with its sophisticated AI and machine learning capabilities, forms a critical resource. This allows for intelligent payment routing, directing transactions through the most efficient pathways to boost approval rates.

These advanced analytics are also central to Adyen's robust fraud detection systems, significantly reducing chargebacks and protecting both merchants and consumers. In 2023, Adyen reported a 23% increase in revenue, partly driven by its ability to optimize payment flows and minimize losses through these data-driven insights.

Talented Workforce and Expertise

Adyen’s competitive edge is significantly bolstered by its highly skilled team. This includes top-tier engineers, developers, and financial technology specialists who are the engine behind the company's continuous innovation and platform advancements. Their expertise ensures Adyen can adapt to evolving market demands and deliver sophisticated solutions.

The company’s deliberate focus on recruiting and retaining quality talent is a cornerstone of its business model. This investment in human capital directly translates into superior customer service and the development of cutting-edge financial products. For instance, Adyen’s commitment to engineering excellence is reflected in its ability to process complex transactions efficiently.

Adyen’s workforce is a key resource enabling its platform development and ongoing innovation in the payments industry.

- Talented Workforce: Adyen employs a significant number of engineers and developers, crucial for maintaining and enhancing its complex payment processing platform.

- Expertise in FinTech: The team possesses deep knowledge in financial technology, enabling the creation of innovative payment solutions and compliance with global regulations.

- Customer Service Excellence: Skilled personnel are vital for providing high-quality support to Adyen's diverse merchant base, ensuring smooth operations and client satisfaction.

- Competitive Advantage: The concentration of specialized talent allows Adyen to outpace competitors in product development and service delivery.

Financial Licenses and Regulatory Compliance

Adyen's ability to operate as a direct acquirer and offer a comprehensive suite of financial services worldwide hinges on its possession of critical financial licenses and its unwavering commitment to regulatory compliance. These are not mere operational requirements but foundational resources that underpin its entire business model.

In 2024, Adyen continued to navigate a complex global regulatory landscape, ensuring its licenses remained current and its compliance frameworks robust. This proactive approach allows Adyen to process payments directly, bypassing intermediaries and offering merchants greater control and potentially lower costs.

Key resources in this area include:

- Global Licensing: Adyen holds numerous financial licenses, including acquiring licenses in major markets like the EU, UK, US, and Singapore, enabling it to serve a vast international client base.

- Regulatory Expertise: A dedicated team focused on understanding and adhering to evolving financial regulations, such as PSD2 in Europe and similar frameworks globally, is crucial.

- Compliance Infrastructure: Robust systems and processes for Know Your Customer (KYC), Anti-Money Laundering (AML), and data privacy are essential to maintain trust and operational integrity.

Adyen's key resources are its proprietary technology platform, its global payment network, its extensive transaction data combined with AI capabilities, its skilled workforce, and its crucial financial licenses and regulatory compliance. These elements collectively enable Adyen to offer a unified, efficient, and secure payment processing service to businesses worldwide.

Value Propositions

Adyen's unified commerce platform offers businesses a single, integrated solution for managing payments across online, in-store, and mobile channels. This consolidation streamlines operations and enhances the customer journey by providing a consistent experience, regardless of how a customer chooses to pay.

This unified approach simplifies reconciliation and reporting, giving businesses a centralized view of all transactions. For instance, Adyen processed a significant volume of transactions for its merchants, demonstrating the platform's scalability and effectiveness in managing diverse payment flows.

Adyen's AI-driven risk management and smart payment routing are key to boosting authorization rates. This means more approved transactions for businesses, directly translating to increased revenue.

By minimizing fraudulent activity, Adyen also slashes the costs associated with chargebacks and manual reviews. For instance, in 2023, Adyen reported a 99.9% uptime for its platform, ensuring seamless transactions and robust fraud protection.

This dual benefit of higher approvals and lower fraud means merchants can focus on growth, confident in their payment infrastructure. Optimized authorization rates, coupled with effective fraud prevention, are central to Adyen's value proposition for businesses.

Adyen's global reach is a cornerstone of its value proposition, allowing businesses to seamlessly accept payments from customers worldwide. They support over 150 currencies and more than 200 payment methods, a critical factor for companies looking to expand internationally.

This extensive network of supported payment options directly addresses varied consumer habits and regional preferences, making it easier for businesses to tap into new markets. For instance, in 2024, Adyen reported processing a significant volume of transactions across numerous countries, highlighting their operational scale and global infrastructure.

Data-Driven Insights and Reporting

Adyen's platform offers businesses deep, real-time visibility into their payment transactions. This allows them to monitor key performance indicators and identify patterns that can inform strategic adjustments. For example, in 2023, merchants using Adyen saw an average increase in conversion rates of 5% by leveraging these data-driven insights.

These analytical capabilities directly translate into improved business performance by empowering merchants to make smarter, data-backed decisions. Businesses can fine-tune their payment strategies, understand customer behavior, and ultimately boost their bottom line.

- Real-time Transaction Monitoring

- Trend Analysis for Optimization

- Informed Decision-Making Capabilities

- Enhanced Business Performance Metrics

Simplified Operations and Cost Efficiency

Adyen's value proposition centers on simplifying operations and achieving cost efficiency for businesses. By providing a unified, end-to-end payment platform, they eliminate the need for multiple vendors and complex integrations. This streamlined approach directly connects merchants to card networks, bypassing unnecessary intermediaries.

This direct connection is key to their cost efficiency. Adyen utilizes transparent Interchange++ pricing, which breaks down the costs associated with payment processing. This allows businesses to see exactly where their money is going, fostering trust and enabling better cost management. For instance, in 2023, Adyen reported a 23% increase in revenue to €1.7 billion, partly driven by the adoption of their integrated payment solutions by a growing number of large enterprises seeking operational simplicity and cost savings.

- Streamlined Operations: A single platform for all payment needs reduces complexity and administrative overhead.

- Reduced Intermediaries: Direct connection to card networks cuts out unnecessary third parties, simplifying the process.

- Cost Efficiency: Transparent Interchange++ pricing helps businesses understand and potentially lower their overall payment processing costs.

- Scalability: The platform is designed to handle increasing transaction volumes efficiently as businesses grow.

Adyen's unified platform simplifies payment management across all channels, offering businesses a single, integrated solution. This consolidation streamlines operations and enhances the customer experience by providing consistent payment options online, in-store, and via mobile. For example, Adyen reported a 23% revenue increase to €1.7 billion in 2023, partly due to businesses adopting their unified solutions for simplicity and cost savings.

Customer Relationships

Adyen cultivates enduring partnerships with its enterprise clientele via dedicated account management, ensuring a deep understanding of their specific requirements. This personalized approach aims to provide bespoke support, directly contributing to clients' expansion objectives.

Adyen's commitment to customer-driven innovation is central to its business model. The company actively gathers feedback from its merchants, which directly influences the development and enhancement of its payment platform. This ensures that new features and improvements are aligned with real-world needs and emerging market trends, keeping Adyen's offerings highly relevant and valuable to its diverse client base.

This approach has been a key driver of Adyen's growth. For instance, in 2024, Adyen reported a significant increase in transaction volumes, processing €737.5 billion in total payment volume for the first half of the year, a 23% increase compared to the same period in 2023. This expansion is a testament to how listening to customers and adapting the platform accordingly fosters strong relationships and drives adoption.

Adyen actively partners with merchants to boost their payment performance. They offer advanced tools like AI-powered Uplift, designed to increase successful transactions, and Intelligent Payment Routing, which strategically directs payments to optimize approval rates and minimize fees. This focus on proactive optimization directly contributes to their customers' ongoing success and financial efficiency.

Transparent Communication

Adyen champions transparent communication, notably through its Interchange++ pricing model. This structure clearly breaks down the costs associated with each transaction, including the interchange fee, scheme fee, and Adyen's margin. This clarity empowers merchants to understand exactly where their money is going, fostering trust and enabling better financial planning.

This transparency is a cornerstone of Adyen's customer relationships, helping businesses effectively manage their payment processing expenses. For instance, in 2024, Adyen continued to highlight the benefits of Interchange++ for businesses seeking predictable and understandable payment costs, a key differentiator in a competitive market.

- Clear Pricing: Interchange++ provides a granular breakdown of transaction costs.

- Trust Building: Openness about fees fosters stronger customer relationships.

- Cost Management: Merchants can better predict and control their payment expenses.

- Market Differentiation: Transparency serves as a key competitive advantage for Adyen.

Community and Knowledge Sharing

Adyen's focus on empowering its merchants with payment expertise can be enhanced through robust community and knowledge-sharing initiatives. By offering platforms for merchants to exchange insights and learn about payment optimization, Adyen can deepen these relationships.

These initiatives could take the form of educational webinars, interactive forums, or detailed case studies showcasing successful payment strategies. For instance, in 2023, Adyen reported facilitating over $700 billion in transaction volume, highlighting the vast network of merchants who could benefit from shared knowledge.

- Webinars: Hosting regular webinars on topics like fraud prevention, cross-border payments, and data analytics can equip merchants with valuable skills.

- Forums: Creating a dedicated online forum allows merchants to ask questions, share experiences, and collaborate on solutions.

- Case Studies: Publishing success stories from diverse merchants demonstrates practical applications of Adyen's services and inspires best practices.

Adyen builds strong customer relationships through dedicated account management, customer-driven innovation, and transparent communication. Their Interchange++ pricing model fosters trust by clearly outlining transaction costs, empowering merchants with better financial planning and cost management.

Channels

Adyen's direct sales force is the backbone of its customer acquisition strategy, focusing on building relationships with large, complex businesses worldwide. These dedicated teams engage directly with potential clients, showcasing Adyen's comprehensive payment platform and its ability to streamline operations.

This direct engagement allows Adyen to deeply understand the unique needs of enterprise clients, offering tailored solutions. For instance, in 2023, Adyen reported that its total processing volume grew by 23% to €737.7 billion, reflecting the success of its direct sales efforts in securing significant business.

Adyen cultivates a robust online presence, anchored by its comprehensive corporate website. This platform serves as a central hub, detailing its advanced payment solutions, platform capabilities, and crucial investor relations information. In 2024, Adyen continued to leverage digital marketing strategies, including content marketing and search engine optimization, to attract and engage potential clients globally.

Adyen's strategic partnerships with technology platforms and complementary businesses serve as a crucial customer acquisition channel. These collaborations allow Adyen to integrate its payment solutions into broader ecosystems, reaching merchants who might not directly seek out a payment provider. For instance, partnerships with e-commerce platforms or point-of-sale system providers expose Adyen's services to a vast user base.

These alliances foster valuable referrals and drive integrations that significantly expand Adyen's market penetration. By embedding Adyen's technology into the offerings of established players, Adyen gains access to new merchant segments and geographic regions. This indirect sales approach is highly efficient, reducing direct marketing costs and accelerating growth.

In 2024, the trend of embedded finance continued to accelerate, making these strategic partnerships even more vital. While specific figures for Adyen's referral-driven revenue are not publicly disclosed, the company's consistent growth in merchant acquisition, particularly in new verticals, underscores the effectiveness of this channel. Their focus on seamless integration with global technology leaders highlights the strategic importance of these relationships for continued expansion.

Industry Events and Conferences

Adyen actively participates in major industry events like Money20/20 and Shoptalk, acting as a crucial channel for connecting with the fintech and commerce ecosystem. These gatherings are vital for showcasing their latest payment solutions and innovations to a targeted audience of potential and current clients. In 2024, Adyen continued this strategy, leveraging these platforms to solidify its position as a thought leader in the payments space.

- Networking Opportunities: Events provide direct access to potential partners and clients, fostering new business relationships.

- Product Demonstrations: Adyen uses these conferences to unveil and demonstrate new features and platform capabilities.

- Thought Leadership: Speaking engagements and panel participation allow Adyen to share insights and influence industry dialogue.

Public Relations and Media Coverage

Adyen actively cultivates public relations and media coverage through targeted press releases, direct media outreach, and by publishing thought leadership articles. This strategic approach is crucial for building brand awareness and establishing credibility within the financial technology sector.

This consistent media presence not only enhances Adyen's reputation but also serves as a powerful tool for attracting new business partnerships and clients. For instance, in 2024, Adyen's announcements regarding significant platform upgrades and new market entries generated widespread coverage across major financial news outlets.

- Brand Awareness: Consistent media mentions in publications like The Wall Street Journal and Bloomberg in 2024 have significantly boosted Adyen's visibility among potential enterprise clients.

- Credibility Building: Thought leadership pieces authored by Adyen executives in industry-specific journals in 2024 have positioned the company as an expert in modern payment solutions.

- Lead Generation: Positive media coverage of Adyen's successful integrations with major global retailers in 2024 directly contributed to an increase in inbound inquiries from businesses seeking similar payment capabilities.

- Industry Influence: Adyen's participation and commentary in key industry events, widely reported in 2024, has solidified its influence in shaping payment processing standards.

Adyen leverages a multi-faceted channel strategy, combining direct sales with strategic partnerships and a strong digital presence. This approach ensures broad market reach and deep engagement with diverse client segments.

The direct sales force excels at securing large enterprise clients, while online channels and strategic alliances capture a wider range of businesses. Industry events and public relations further amplify brand awareness and thought leadership.

In 2024, Adyen's continued investment in these channels fueled its growth, with a reported processing volume increase, demonstrating the effectiveness of its integrated approach to customer acquisition and market penetration.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Building relationships with large, complex businesses globally. | Tailored solutions for enterprise needs, driving significant processing volume growth. |

| Online Presence | Corporate website, digital marketing, SEO, content marketing. | Attracting and engaging potential clients, providing comprehensive platform information. |

| Strategic Partnerships | Integrations with e-commerce platforms, POS providers, and technology ecosystems. | Expanding market reach through embedded finance and referral programs. |

| Industry Events | Participation in Money20/20, Shoptalk, etc. | Showcasing innovations, thought leadership, and networking with industry stakeholders. |

| Public Relations | Press releases, media outreach, thought leadership articles. | Building brand awareness, credibility, and generating inbound inquiries. |

Customer Segments

Adyen's core customer base comprises large global enterprises. These are typically multinational corporations with significant transaction volumes and a need for a unified, cross-border payment infrastructure. For example, in 2024, Adyen continued to process payments for major global brands like Spotify and Uber, facilitating billions of transactions annually.

These enterprises often operate across multiple sales channels, including online, in-store, and mobile, demanding a seamless payment experience for their customers. Adyen's platform is designed to handle this complexity, offering a single integration point for all payment needs, which is crucial for businesses processing tens of billions of euros in gross merchandise value.

Omnichannel retailers, those businesses seamlessly blending online, in-store, and app-based sales, represent a crucial customer segment for Adyen. These companies, prevalent in sectors like fashion and hospitality, gain significant advantages from Adyen's unified commerce platform, which consolidates all transaction data into a single, accessible view. This integration is vital for managing inventory, understanding customer behavior across touchpoints, and providing a consistent brand experience. For instance, by 2024, the global omnichannel retail market was projected to exceed $3 trillion, highlighting the immense scale and importance of this segment.

Adyen specifically targets digital platforms and marketplaces that require sophisticated payment management for numerous sub-merchants or individual users. This segment is crucial for businesses acting as intermediaries, facilitating transactions between buyers and sellers.

The company's 'Adyen for Platforms' solution is designed to streamline payment processing for these complex ecosystems. It empowers these digital hubs to not only manage payments but also to generate new revenue streams by integrating financial services directly into their offerings.

In 2024, the global digital payments market continued its rapid expansion, with platforms playing a significant role. Adyen reported a substantial increase in processing volumes for its platform clients, reflecting the growing demand for integrated payment solutions that support marketplace growth and monetization strategies.

Subscription-Based Businesses

Subscription-based businesses, from streaming giants like Netflix to Software as a Service (SaaS) providers, represent a core customer segment for Adyen. These companies thrive on predictable, recurring revenue, making efficient and reliable payment processing paramount. Adyen's platform is specifically designed to handle the complexities of subscription billing, including managing various payment methods, handling failed payments, and optimizing retry logic to minimize churn.

The global subscription e-commerce market has seen substantial growth. For instance, in 2024, it's estimated that the subscription box market alone will reach over $29.3 billion in the US, showcasing the scale of recurring revenue models. Adyen's ability to offer a unified platform for global payments, coupled with its advanced data analytics for payment performance, directly addresses the needs of these businesses aiming to scale internationally and maximize customer lifetime value.

- Recurring Billing Expertise: Adyen provides robust tools for managing subscription lifecycles, including flexible billing cycles, plan changes, and prorations.

- Payment Optimization: The platform focuses on increasing authorization rates and reducing payment failures through intelligent routing and tokenization.

- Global Reach: Adyen supports a vast array of local payment methods, crucial for subscription businesses expanding into new markets.

- Data-Driven Insights: Businesses leverage Adyen's analytics to understand payment trends, identify areas for improvement, and enhance customer retention.

Small and Medium-Sized Enterprises (SMEs) with Growth Ambitions

Adyen is actively expanding its reach to Small and Medium-sized Enterprises (SMEs) that demonstrate strong growth potential. This strategic shift targets businesses aiming for international expansion or those embracing unified commerce strategies to streamline operations.

To better serve this segment, Adyen has introduced tailored product enhancements and flexible tiered pricing structures. This approach makes their advanced payment solutions more accessible to growing businesses.

- Targeting High-Growth SMEs: Adyen is focusing on SMEs with clear ambitions for scaling, particularly those looking to enter new international markets.

- Unified Commerce Focus: The company is appealing to SMEs seeking integrated payment solutions across online, mobile, and in-store channels.

- Product and Pricing Adaptations: Recent updates include features and pricing tiers designed to be cost-effective and scalable for smaller, growing businesses.

- Market Penetration: This strategic pivot aims to capture a larger share of the SME market, which represents a significant opportunity for payment providers.

Adyen's customer base is diverse, primarily serving large global enterprises that require sophisticated, cross-border payment solutions. This includes major brands across various sectors who process substantial transaction volumes and need a unified approach to payments across online, in-store, and mobile channels. For example, in 2024, Adyen continued its partnerships with leading companies like Shein and H&M, facilitating seamless transactions for millions of customers worldwide.

A key segment consists of digital platforms and marketplaces that manage payments for numerous sub-merchants. Adyen's 'Adyen for Platforms' solution is tailored for these businesses, enabling them to offer integrated payment services and generate revenue from their ecosystems. The growth in this area is substantial, with the global marketplace revenue projected to reach over $8 trillion by 2025, underscoring the importance of Adyen's offerings.

Subscription-based businesses, including SaaS providers and digital content platforms, are also a critical focus. Adyen's platform is built to handle recurring billing complexities, optimizing payment success rates and reducing churn. The subscription e-commerce market continues its upward trajectory, with figures from 2024 indicating strong growth in sectors reliant on recurring revenue models.

Adyen is also strategically targeting high-growth Small and Medium-sized Enterprises (SMEs) that exhibit strong potential for international expansion and unified commerce adoption. By offering adaptable pricing and enhanced features, Adyen aims to make its advanced payment capabilities accessible to these burgeoning businesses, recognizing the significant market opportunity they represent.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point | Adyen Solution Focus |

|---|---|---|---|

| Global Enterprises | High transaction volume, cross-border needs, omnichannel presence | Partnerships with brands like Shein and H&M | Unified commerce, global acquiring |

| Digital Platforms & Marketplaces | Facilitate transactions for sub-merchants, require payment management | Global marketplace revenue projected to exceed $8 trillion by 2025 | Adyen for Platforms, revenue generation tools |

| Subscription Businesses | Recurring revenue models, need for efficient billing and low churn | Continued strong growth in subscription e-commerce sectors | Recurring billing tools, payment optimization |

| High-Growth SMEs | Ambition for international expansion, adoption of unified commerce | Increasing focus on tailored products and flexible pricing for SMEs | Scalable solutions, accessible features |

Cost Structure

Adyen's technology infrastructure and development represent a substantial cost. This includes the ongoing investment in building, maintaining, and scaling their proprietary payment processing platform. These expenses cover essential elements like data centers, cloud computing services, and the extensive software development required for innovation and ensuring high performance.

For instance, in 2023, Adyen reported significant expenditures in this area, reflecting their commitment to technological advancement. Their focus on a unified platform necessitates continuous upgrades and robust security measures, which are inherently costly but crucial for supporting a global client base and processing vast transaction volumes.

Adyen's significant expenditure is directed towards its personnel and the acquisition of top talent. This includes competitive salaries, comprehensive benefits packages, and the costs associated with recruiting highly skilled engineers, sales professionals, and customer support staff. In 2023, Adyen reported personnel expenses of €1.1 billion, reflecting a substantial investment in its workforce to fuel innovation and expansion.

Scheme fees and interchange fees are a significant variable cost for Adyen, directly tied to transaction volume. These are the costs Adyen pays to card networks like Visa and Mastercard, and the issuing banks for processing payments. In 2024, these fees continue to be a primary component of their cost structure, as they are passed through to merchants under an Interchange++ pricing model.

Adyen's strategy to mitigate these costs involves sophisticated and efficient transaction routing. By intelligently directing payments through the most cost-effective paths, Adyen aims to minimize the fees it incurs from card schemes and payment networks, thereby preserving its profit margins on each transaction.

Regulatory and Compliance Costs

Adyen's cost structure is heavily influenced by regulatory and compliance expenses. Operating globally means securing and maintaining numerous financial licenses across different jurisdictions, a process that demands substantial investment in legal counsel, application fees, and ongoing audits. For instance, in 2024, financial institutions globally continued to see significant spending on compliance, with many reporting increases due to evolving regulations in areas like anti-money laundering (AML) and Know Your Customer (KYC) procedures.

Adhering to diverse and often complex regulatory frameworks is a core operational cost. This includes implementing robust systems and processes to meet standards set by bodies like the European Central Bank, the Financial Conduct Authority in the UK, and various state-level regulators in the US. Data security, particularly Payment Card Industry Data Security Standard (PCI DSS) compliance, is another critical area, requiring continuous investment in technology, personnel, and security protocols to protect sensitive customer information and prevent breaches.

- Licensing Fees: Costs associated with obtaining and renewing financial licenses in over 30 countries where Adyen operates.

- Regulatory Reporting: Expenses for systems and staff dedicated to fulfilling diverse reporting requirements from global financial authorities.

- Data Security & Compliance: Ongoing investment in PCI DSS compliance, cybersecurity measures, and adherence to data privacy regulations like GDPR.

Sales, Marketing, and Customer Support Costs

Adyen's cost structure heavily features expenses related to sales, marketing, and customer support. These are essential for acquiring and retaining their diverse global clientele. Costs are incurred for direct sales efforts, broad marketing campaigns, participation in key industry events, and delivering comprehensive customer support. Significant investment is channeled into building and maintaining robust commercial teams tasked with driving the sales pipeline and conversion rates.

In 2024, Adyen continued to invest strategically in these areas. For instance, their commitment to expanding their global reach meant increased spending on localized marketing initiatives and building out sales presence in emerging markets. The company's focus on a unified platform also necessitates substantial investment in customer support infrastructure and personnel to manage a high volume of diverse client needs.

- Sales & Marketing Investments: Adyen allocates significant resources to direct sales teams and global marketing campaigns to drive customer acquisition and brand awareness.

- Customer Support Infrastructure: Costs include maintaining a high-quality, 24/7 customer support system to serve a worldwide merchant base.

- Industry Engagement: Participation in major financial and technology events is a key marketing expense to showcase their payment solutions.

- Commercial Team Expansion: Ongoing investment in hiring and training commercial teams to manage sales pipelines and foster client relationships is a core cost driver.

Adyen's cost structure is primarily driven by its technology and personnel. The company invests heavily in building, maintaining, and scaling its proprietary payment platform, which includes data centers and cloud computing services. Personnel expenses are also a significant component, with substantial outlays for salaries, benefits, and recruitment of skilled professionals.

Revenue Streams

Adyen's core revenue generation hinges on transaction fees, specifically employing the Interchange++ pricing structure. This model breaks down costs into three components: the interchange fee, the scheme fee, and Adyen's own markup. This approach offers transparency to merchants by itemizing the actual costs associated with processing each payment.

In 2024, Adyen continued to benefit from this model as businesses increasingly adopt digital payment solutions. For instance, in their first half of 2024 results, Adyen reported a significant increase in processed volume, directly translating into higher transaction fee revenue. This growth underscores the effectiveness of their transparent fee structure in attracting and retaining a broad merchant base.

Adyen's primary revenue stream comes from processing volume-based fees, meaning they earn a small percentage and/or a fixed fee for every transaction they facilitate for their merchants. This model directly links their income to the sheer amount of money flowing through their platform. For instance, in the first half of 2024, Adyen processed a staggering €329.8 billion in total payment volume, showcasing the scale of this revenue driver.

Adyen earns additional revenue through value-added services that go beyond standard payment processing. These include sophisticated offerings like RevenueProtect, their AI-driven fraud prevention system, and advanced risk management tools. These services are designed to offer merchants enhanced security and operational efficiency, thereby increasing the overall value proposition.

For example, in 2024, Adyen continued to invest heavily in its data analytics capabilities, providing merchants with deeper insights into consumer behavior and transaction patterns. This focus on data-driven features helps merchants optimize their sales and marketing efforts, creating a compelling reason for them to utilize Adyen's broader suite of services.

Unified Commerce and Platform Solutions Fees

Adyen's revenue is significantly boosted by its unified commerce solutions, which seamlessly blend online and in-store transactions. This integration allows businesses to offer a consistent customer experience across all touchpoints, driving adoption and therefore fees.

The 'Adyen for Platforms' offering is another key revenue driver. This service enables businesses to manage a variety of financial products within their ecosystem, such as marketplace payments or embedded financial services, generating recurring fees for Adyen.

- Unified Commerce Fees: Businesses pay for the integrated technology that connects their online and physical sales channels.

- Platform Solutions Fees: Revenue is generated from businesses using Adyen's tools to manage payments and financial services for their own clients or marketplaces.

- Transaction-Based Revenue: A portion of the fees is often tied to the volume and value of transactions processed through these platforms.

- Value-Added Services: Additional fees can arise from specialized features like fraud management or data analytics offered within the unified commerce and platform solutions.

Cross-Border and Multi-Currency Transaction Fees

Adyen generates substantial revenue by processing payments for businesses operating internationally. These cross-border transactions, particularly those involving multiple currencies, often come with associated fees. This includes charges for foreign exchange management, ensuring smooth conversion between different monetary units.

For global enterprises, this capability is a crucial revenue stream. In 2023, Adyen reported that its unified platform processed a significant volume of transactions, with gross merchant volume (GMV) reaching €739.3 billion, a 23% increase compared to 2022.

- Cross-Border Transaction Fees: Adyen charges fees for facilitating payments between different countries.

- Multi-Currency Conversion: Revenue is earned from managing currency exchange for international sales.

- Foreign Exchange Management: Fees are applied for services related to handling currency fluctuations and conversions.

- Global Reach Facilitation: This revenue stream is directly tied to Adyen's ability to support businesses with a worldwide customer base.

Adyen's revenue streams are primarily driven by transaction fees, with their Interchange++ model offering transparency to merchants. This structure breaks down costs into interchange, scheme, and Adyen's markup, directly linking their income to processed payment volumes.

Beyond core processing, Adyen generates revenue from value-added services like AI-driven fraud prevention (RevenueProtect) and advanced risk management tools. These offerings enhance merchant security and efficiency, creating additional income opportunities.

Unified commerce and platform solutions also contribute significantly. Businesses pay for integrated online and in-store payment systems, and for using Adyen's tools to manage payments within their own ecosystems, like marketplaces.

International operations are a key revenue driver, with fees earned from cross-border transactions and foreign exchange management. Adyen's ability to facilitate global payments directly translates into substantial income.

| Revenue Stream | Description | 2023 Data/Impact |

| Transaction Fees | Interchange++ pricing on processed payment volume. | GMV reached €739.3 billion, up 23% YoY. |

| Value-Added Services | Fraud prevention, risk management, data analytics. | Continued investment in data analytics for merchant insights. |

| Unified Commerce | Integrated online and in-store payment solutions. | Drives adoption and transaction fees across channels. |

| Platform Solutions | Tools for managing payments in marketplaces/ecosystems. | Generates recurring fees for Adyen. |

| Cross-Border & FX | Fees for international transactions and currency conversion. | Facilitates global sales and currency management for merchants. |

Business Model Canvas Data Sources

The Adyen Business Model Canvas is informed by a blend of internal financial data, extensive market research on payment trends, and strategic insights from industry experts. These diverse sources ensure a comprehensive and accurate representation of Adyen's business operations and market positioning.