ACADIA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACADIA Bundle

Acadia's SWOT analysis reveals a company with significant potential, but understanding the full scope of its market position requires a deeper dive. While its strengths in innovation are clear, the complete picture of its competitive landscape and potential threats is crucial for informed decision-making.

Want the full story behind Acadia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research, providing actionable strategies to capitalize on opportunities and mitigate challenges.

Strengths

Acadia Pharmaceuticals boasts a strong product lineup, anchored by NUPLAZID for Parkinson's disease psychosis and DAYBUE for Rett syndrome. These flagship medications are driving substantial revenue growth, underscoring the company's commercial success and market penetration.

For the full year of 2025, Acadia projects total revenues to fall within the range of $1.03 billion to $1.095 billion. This impressive revenue forecast highlights the sustained demand and expanding market reach of their key therapeutic offerings.

ACADIA Pharmaceuticals benefits significantly from extended patent protection for its key product, NUPLAZID. Legal decisions have secured its exclusivity until 2038, a substantial extension from the original 2030 patent expiration.

This extended market exclusivity is a powerful strength, effectively safeguarding ACADIA from generic competition for its flagship therapy. Such protection is crucial for maintaining a stable revenue stream and market leadership within its therapeutic area.

The 2038 patent life for NUPLAZID provides a predictable and extended period for revenue generation, allowing ACADIA to maximize its return on investment and fund future research and development initiatives.

ACADIA Pharmaceuticals possesses a robust and continually developing pipeline of experimental treatments focused on central nervous system (CNS) and rare neurological disorders. Several of these promising candidates are currently in mid-to-late stage clinical trials, signaling significant future growth potential.

Notable among these are ACP-101, being investigated for Prader-Willi Syndrome, and ACP-204, a potential treatment for Alzheimer's disease psychosis. The progression of these drugs through clinical development, with anticipated key data readouts in late 2025 and 2026, positions ACADIA for substantial future revenue generation.

If successful, these pipeline assets could unlock an estimated $12 billion in additional annual revenue, underscoring the strategic importance and financial promise of ACADIA's research and development efforts.

Specialized Focus on Underserved CNS Disorders

ACADIA's deliberate concentration on central nervous system (CNS) disorders, including rare neurodevelopmental diseases, positions it to tackle significant unmet medical needs. This focused approach cultivates a distinct market segment, enabling the development of potentially first-in-class or best-in-class treatments. This specialization inherently minimizes direct competition from larger, more diversified pharmaceutical entities. For example, ACADIA's Nuplazid (pimavanserin) was the first drug approved by the FDA specifically for hallucinations and delusions associated with Parkinson's disease psychosis, a testament to its niche strategy.

This specialization allows ACADIA to carve out a strong market niche, aiming for therapies that are either first-in-class or best-in-class. By concentrating on areas with high unmet needs, the company can reduce the intensity of direct competition from broader pharmaceutical players. This strategic advantage is crucial in navigating the complex and competitive landscape of drug development.

- Niche Market Dominance: Focus on underserved CNS disorders allows for potential market leadership.

- Reduced Competition: Specialization limits direct battles with large pharmaceutical companies.

- Addressing Unmet Needs: Tackling rare diseases offers significant therapeutic and commercial opportunities.

- First-in-Class Potential: Innovation in specialized areas can lead to groundbreaking treatments.

Strategic Partnerships and Global Expansion Efforts

ACADIA Pharmaceuticals leverages strategic partnerships to bolster its research and development pipeline and increase market access. Collaborations with companies like Neuren Pharmaceuticals and Stoke Therapeutics are key to advancing its innovative therapies.

The company is actively pursuing global expansion for its product DAYBUE. This includes submitting a marketing authorization application to the European Medicines Agency (EMA) and initiating managed access programs in Europe, aiming to tap into international markets beyond North America.

- Strategic Alliances: Partnerships with Neuren Pharmaceuticals and Stoke Therapeutics enhance R&D capabilities and drug development.

- Global Market Entry: DAYBUE's marketing authorization application submitted to the EMA signals a significant step in European expansion.

- Managed Access Programs: Initiation of these programs in Europe allows for early patient access and market familiarization prior to full approval.

- Expanded Commercial Reach: These global efforts aim to significantly broaden the commercial potential for ACADIA's key products.

ACADIA's strong market position is built on its successful commercialization of NUPLAZID and DAYBUE, which are driving significant revenue growth. The company projects 2025 revenues between $1.03 billion and $1.095 billion, reflecting sustained demand for its key therapies.

A major strength is the extended patent protection for NUPLAZID until 2038, shielding it from generic competition and ensuring a stable revenue stream. This long exclusivity period is vital for maximizing ROI and funding future R&D.

The company's robust pipeline, with candidates like ACP-101 and ACP-204 in late-stage trials, holds substantial future growth potential, with estimates suggesting these could generate an additional $12 billion in annual revenue if successful.

ACADIA's strategic focus on underserved CNS disorders allows it to target niche markets, potentially leading to first-in-class or best-in-class treatments and minimizing direct competition from larger pharmaceutical firms.

| Product | Indication | Patent Expiry (Extended) | Projected 2025 Revenue Contribution (Illustrative) |

|---|---|---|---|

| NUPLAZID | Parkinson's Disease Psychosis | 2038 | Significant driver |

| DAYBUE | Rett Syndrome | N/A (Newer Product) | Growing contributor |

What is included in the product

Delivers a strategic overview of ACADIA’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to inform future growth.

ACADIA's SWOT analysis offers a structured framework, eliminating the pain of disorganized strategic thinking and enabling clear identification of actionable insights.

Weaknesses

Acadia Pharmaceuticals' current financial strength is heavily tied to a narrow product base, with NUPLAZID and DAYBUE forming the backbone of its revenue. In 2023, NUPLAZID net sales reached $474.3 million, while DAYBUE generated $125.1 million. This concentration, while indicative of successful product launches, presents a significant vulnerability. A downturn in sales for either of these key therapies, perhaps due to market shifts or competitive pressures, could disproportionately impact Acadia's overall financial performance. For instance, if a new entrant offered a superior treatment for Parkinson's disease psychosis or Rett syndrome, it could quickly erode market share for Acadia's established products.

Developing innovative central nervous system (CNS) drugs is a very expensive undertaking, and ACADIA Pharmaceuticals consistently faces substantial research and development (R&D) expenses. This financial commitment is crucial for advancing their pipeline, but it directly impacts profitability.

The company's R&D costs saw an increase in the first quarter of 2025, continuing a trend of significant investment. In 2024, ACADIA's total R&D spending amounted to approximately $303.2 million, highlighting the considerable resources dedicated to drug discovery and development.

These high R&D expenditures necessitate continuous capital investment to sustain progress, especially as their drug candidates move through various clinical trial stages. Managing these costs while pursuing groundbreaking therapies is a key challenge for ACADIA.

ACADIA Pharmaceuticals, like many biopharmaceutical companies, faces significant risks associated with clinical trial outcomes. The biopharma sector is notoriously prone to high failure rates, meaning a substantial portion of drug candidates do not make it to market. For ACADIA, the success of its current and future pipeline is paramount to its growth trajectory; a major setback in a late-stage trial, for instance, could erode investor trust and severely impact anticipated revenues.

Intense Competition in CNS Market

The central nervous system (CNS) disorder market is incredibly crowded. Many pharmaceutical giants are actively competing for a significant slice of this market. ACADIA, while holding patent protection for its drug NUPLAZID, faces the ongoing threat of new, potentially more effective treatments or alternative therapies being introduced by rivals. This competitive pressure could gradually diminish NUPLAZID's market share, even with its specialized focus on specific CNS conditions.

Consider these points regarding the competitive landscape:

- Market Saturation: The CNS market is characterized by a high number of existing treatments and a constant influx of new drug candidates.

- R&D Investment: Competitors are heavily investing in research and development to identify novel therapies for neurological and psychiatric disorders, posing a direct threat to ACADIA's existing products.

- Pipeline Competition: Several companies are developing drugs targeting similar patient populations or mechanisms of action as NUPLAZID, potentially leading to direct competition once approved.

- Pricing Pressures: Intense competition can also lead to pricing pressures, impacting ACADIA's revenue and profitability for NUPLAZID.

Cash Burn and Financial Management

Acadia Pharmaceuticals, despite its robust cash reserves, faces a significant challenge in managing its substantial cash outflow driven by ongoing operations and considerable investments in research and development. The company's commitment to advancing its pipeline and expanding its commercial reach necessitates a high rate of cash utilization, presenting a key financial hurdle.

For instance, in the first quarter of 2024, Acadia reported a net cash used in operating activities of $154.9 million. This burn rate highlights the capital-intensive nature of pharmaceutical development and commercialization. Effectively balancing this cash consumption with the need to fund ambitious growth strategies, including potential acquisitions or further clinical trials, is paramount for sustained financial health and future success.

- High Operating Expenses: Significant costs associated with clinical trials, manufacturing, and sales infrastructure contribute to a substantial operating cash burn.

- R&D Investment: Continued investment in a diverse pipeline, including promising early-stage assets, requires significant capital allocation, impacting near-term cash flow.

- Commercialization Costs: Launching and supporting new products, such as DAYVIGO, incurs considerable marketing and sales expenses, further increasing cash utilization.

- Working Capital Management: Efficiently managing inventory, accounts receivable, and accounts payable is crucial to mitigate the impact of cash burn on overall liquidity.

Acadia's reliance on a limited product portfolio, primarily NUPLAZID and DAYBUE, presents a significant vulnerability. In 2023, NUPLAZID sales were $474.3 million and DAYBUE generated $125.1 million, highlighting this concentration. A decline in demand for either drug due to market shifts or new competition could severely impact overall financial performance.

The company faces substantial research and development (R&D) expenses, crucial for pipeline advancement but impacting profitability. In 2024, R&D spending was approximately $303.2 million, a testament to the capital-intensive nature of CNS drug development. These ongoing costs require continuous investment, posing a challenge for sustained progress.

Acadia is exposed to the inherent risks of clinical trial failures, a commonality in the biopharmaceutical sector. A setback in a late-stage trial could erode investor confidence and significantly affect projected revenues, given the paramount importance of pipeline success for growth.

The competitive CNS market, with numerous established players and emerging therapies, poses a constant threat to Acadia's market share. Intense competition can also lead to pricing pressures, potentially affecting revenue and profitability for key products like NUPLAZID.

Acadia's strong cash reserves are offset by a high cash outflow due to operations and R&D investments. In Q1 2024, net cash used in operating activities was $154.9 million, underscoring the capital demands of pharmaceutical development and commercialization. Balancing this burn rate with growth strategies is vital.

| Weakness | Description | Supporting Data (2023/2024/Q1 2024) |

| Product Concentration | Heavy reliance on a few key drugs. | NUPLAZID: $474.3M (2023 sales); DAYBUE: $125.1M (2023 sales). |

| High R&D Expenses | Significant investment required for pipeline development. | R&D spending approx. $303.2M (2024); Q1 2025 R&D costs increased. |

| Clinical Trial Risk | Potential for drug candidates to fail in development. | High failure rates common in biopharma; pipeline success is critical for growth. |

| Competitive Market | Intense competition in the CNS disorder space. | Many competitors investing heavily in R&D for similar patient populations. |

| Cash Burn Rate | High outflow due to operations and R&D. | Net cash used in operating activities: $154.9M (Q1 2024). |

Same Document Delivered

ACADIA SWOT Analysis

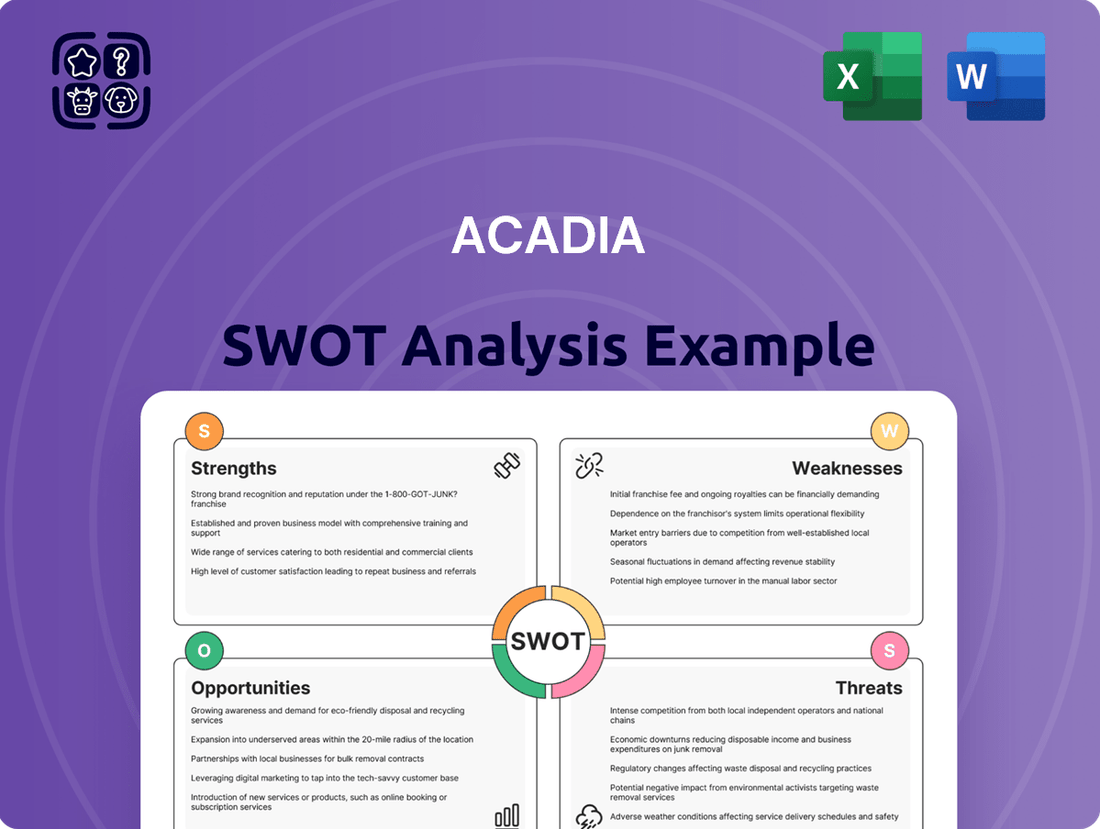

The file shown below is not a sample—it’s the real ACADIA SWOT analysis you'll download post-purchase, in full detail. You can see the comprehensive breakdown of Acadia's Strengths, Weaknesses, Opportunities, and Threats. This preview gives you a clear understanding of the quality and depth of information provided. Purchase unlocks the entire in-depth version for your strategic planning needs.

Opportunities

ACADIA possesses a significant opportunity to broaden the reach of its current and developing drugs by seeking approval for new therapeutic indications. This strategy can tap into previously unaddressed patient groups, thereby diversifying revenue sources and enhancing market penetration. For instance, the company's drug candidate ACP-101 is currently in development for Prader-Willi Syndrome, a rare genetic disorder.

Furthermore, ACP-204 is undergoing evaluation for its efficacy in treating psychosis associated with Alzheimer's disease and Lewy Body Dementia. These specific areas represent substantial unmet medical needs, offering the potential to significantly expand ACADIA's market presence and financial returns. The successful development and approval in these new indications could unlock substantial patient populations and create new, significant revenue streams for the company.

Acadia's submission of the Marketing Authorization Application for DAYBUE to the European Medicines Agency is a pivotal step towards international expansion. This move opens the door for broader market access beyond North America, potentially tapping into a significant patient population in Europe. By initiating managed access programs, Acadia is laying the groundwork for Daybue's availability and adoption in new territories.

Expanding commercial presence globally presents a substantial opportunity to grow DAYBUE sales. Penetrating markets like Europe, where rare disease treatments are increasingly prioritized, can significantly boost Acadia's revenue streams. Diversifying its geographic footprint is crucial for long-term stability and growth, reducing reliance on any single market.

ACADIA's CEO has signaled a more aggressive approach to external innovation, aiming to invigorate its drug pipeline through strategic acquisitions and partnerships. This strategy aligns with the company's stated goal of accelerating drug discovery and expanding its therapeutic offerings. For instance, in late 2023, ACADIA announced a collaboration with BioXcel Therapeutics to develop and commercialize BioXcel's neuroscience pipeline candidates, showcasing a commitment to external opportunities.

Leveraging Direct-to-Consumer Campaigns

ACADIA's direct-to-consumer (DTC) campaigns present a significant opportunity for growth, particularly for products like NUPLAZID. By continuing to invest in these initiatives, ACADIA can foster deeper patient engagement and capture a larger share of the market.

Effective DTC marketing and patient education are crucial for increasing diagnosis rates and driving the adoption of ACADIA's therapies. This is especially true for conditions that are often diagnosed late, where awareness campaigns can make a substantial difference. For instance, in 2024, ACADIA reported that DTC efforts contributed to a notable increase in physician inquiries regarding Parkinson’s disease psychosis (PDP), a key indication for NUPLAZID.

- Increased Patient Awareness: DTC campaigns can educate patients about underdiagnosed conditions, prompting them to seek medical advice.

- Enhanced Physician Engagement: By driving patient conversations, DTC efforts indirectly boost physician awareness and prescribing habits.

- Market Share Expansion: Direct engagement with patients can lead to greater product adoption and a stronger competitive position.

- Data-Driven Campaign Optimization: ACADIA can leverage campaign performance data to refine messaging and target audiences for maximum impact.

Advancements in Neuroscience Research

Ongoing advancements in neuroscience research are creating significant opportunities for companies like ACADIA Pharmaceuticals. A deeper understanding of complex central nervous system (CNS) disorders allows for the identification of novel therapeutic targets and the development of more precise treatments. This scientific progress directly supports ACADIA's mission to innovate within the CNS space, potentially leading to breakthrough therapies. In 2024, global spending on neuroscience research and development is projected to exceed $100 billion, highlighting the immense investment and potential in this field.

Leveraging cutting-edge scientific discoveries and technologies can position ACADIA at the forefront of CNS therapy development. This includes exploring new biological pathways, utilizing advanced drug delivery systems, and employing sophisticated diagnostic tools. Such innovation can result in highly differentiated products that address unmet medical needs, solidifying ACADIA's leadership. For instance, the market for treatments targeting neurological disorders is expected to grow substantially, reaching an estimated $200 billion by 2028, demonstrating the commercial viability of these advancements.

- Neurological Disorder Market Growth: The global market for neurological disorder treatments is projected to reach approximately $200 billion by 2028, indicating a strong demand for innovative therapies.

- CNS R&D Investment: Global investment in neuroscience research and development is anticipated to surpass $100 billion in 2024, underscoring the sector's significant financial backing.

- Targeted Therapy Development: Advancements allow for the creation of highly specific treatments, increasing efficacy and reducing side effects for patients with CNS conditions.

- Biomarker Discovery: Progress in neuroscience facilitates the identification of reliable biomarkers, improving patient selection for clinical trials and treatment personalization.

ACADIA can expand its market by seeking new therapeutic indications for its existing and developing drugs, tapping into underserved patient groups and diversifying revenue. The company's drug candidates ACP-101 for Prader-Willi Syndrome and ACP-204 for Alzheimer's-related psychosis highlight potential in areas with significant unmet needs.

Global expansion, particularly with DAYBUE's submission to the European Medicines Agency, offers access to new patient populations and revenue streams, reducing reliance on single markets.

Strategic acquisitions and partnerships, like the collaboration with BioXcel Therapeutics, are key to invigorating ACADIA's pipeline and accelerating drug discovery.

Direct-to-consumer campaigns for products like NUPLAZID enhance patient engagement and market share, as seen in 2024's increase in physician inquiries for Parkinson’s disease psychosis.

Threats

The central nervous system (CNS) and rare disease arenas are crowded with competition. Major pharmaceutical players and nimble biotechs are constantly introducing novel treatments, creating a challenging environment for ACADIA. This intense rivalry can put downward pressure on drug prices, potentially shrink market share, and make it harder for ACADIA to distinguish its offerings.

For instance, the Parkinson's disease psychosis market, where ACADIA's Nuplazid is a key player, has seen increased R&D activity from companies like Sunovion Pharmaceuticals. Similarly, the rare disease space, including Rett syndrome where ACADIA has pipeline candidates, is attracting significant investment, with companies like Acadia Pharmaceuticals itself reporting $600 million in net product sales for Nuplazid in 2023, indicating the high stakes involved.

ACADIA faces significant threats from regulatory and approval risks, as its drug development pipeline is subject to the rigorous scrutiny of bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Delays or outright rejections of key candidates, such as those in development for neurological disorders, can severely disrupt growth trajectories and financial forecasts. For instance, the FDA's advisory committee vote against the approval of ACADIA's trofinetide for Rett syndrome in early 2023, despite later approval, highlights the inherent unpredictability. Any setbacks in the ongoing development and approval processes for its current or future pipeline assets could lead to substantial financial setbacks and impact investor confidence.

While ACADIA Pharmaceuticals secured patent protection for NUPLAZID extending to 2038, the pharmaceutical landscape is inherently dynamic. The threat of patent challenges remains, as competitors may seek to invalidate or circumvent existing patents. Such challenges, if successful, could lead to earlier market entry for generic versions of NUPLAZID, significantly impacting ACADIA's revenue streams.

Moreover, even with extended protection, the eventual expiration of patents on key drugs like NUPLAZID presents a long-term threat. Once patents expire, generic manufacturers can introduce lower-cost alternatives, often leading to a substantial drop in market share and profitability for the innovator company. For instance, in 2024, several blockbuster drugs faced patent cliffs, highlighting the industry's vulnerability to this phenomenon.

Reimbursement and Pricing Pressures

Healthcare payers and governmental bodies are increasingly prioritizing cost containment, which can translate into significant pressure on drug pricing and reimbursement policies. This trend poses a direct challenge to pharmaceutical companies like ACADIA, potentially affecting their capacity to generate optimal revenue from their specialized therapies. For instance, in 2024, many health systems are implementing stricter formulary reviews and value-based purchasing agreements, aiming to curb overall pharmaceutical spending.

These reimbursement and pricing pressures can be particularly acute in newer markets where market access strategies are still being solidified, or as competitive landscapes evolve with the introduction of similar or alternative treatments. ACADIA's reliance on high-value therapies means that any adverse shifts in payer negotiations or government pricing mandates could directly impact its bottom line. Market analysis from early 2025 indicates a continued tightening of budgets across major healthcare systems globally, underscoring the persistent nature of this threat.

- Increased scrutiny on drug pricing: Payers are demanding greater evidence of cost-effectiveness for new drug approvals.

- Potential for reimbursement rate reductions: Existing reimbursement levels for ACADIA's therapies could face downward adjustments.

- Impact on market access: Stricter payer policies may hinder patient access to ACADIA's treatments, especially in emerging markets.

- Competitive pricing pressures: As competitors enter the market, ACADIA may be forced to lower prices to remain competitive.

Clinical Development Failures and Data Readout Risks

ACADIA's future growth is heavily reliant on the successful progression of its clinical pipeline, particularly for candidates like ACP-101 and ACP-204. Negative or inconclusive data from ongoing or upcoming Phase 2/3 trials presents a substantial threat. Such outcomes could trigger significant stock price declines, escalate research and development expenditures, and potentially force the abandonment of key development programs, directly hindering ACADIA's long-term growth prospects.

The inherent risks in clinical development mean that even well-positioned drugs can fail to meet efficacy or safety endpoints. For instance, in the broader biopharmaceutical sector, clinical trial failure rates for drugs entering Phase 2 trials are estimated to be around 60%, and for Phase 3, approximately 30%. Should ACADIA encounter similar setbacks in its ongoing or planned studies, the financial and strategic repercussions could be severe.

- Clinical Trial Setbacks: A negative readout for ACP-101 or ACP-204 could lead to substantial stock price volatility.

- Increased R&D Costs: Failed trials necessitate additional investment to understand the failure or to pivot research efforts.

- Pipeline Contraction: The discontinuation of promising assets directly impacts the company's future revenue streams and market position.

- Investor Confidence Erosion: Repeated clinical failures can significantly damage investor sentiment, making future capital raising more challenging.

ACADIA faces the threat of intense competition in its target markets, particularly in CNS disorders and rare diseases. Major pharmaceutical companies and emerging biotechs are continually innovating, potentially pressuring ACADIA's market share and pricing power. For example, the Parkinson's disease psychosis market, where Nuplazid is a key product, sees ongoing R&D from competitors like Sunovion Pharmaceuticals.

SWOT Analysis Data Sources

This ACADIA SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and informed industry expert opinions. These diverse sources ensure a well-rounded and accurate assessment of ACADIA's strategic position.