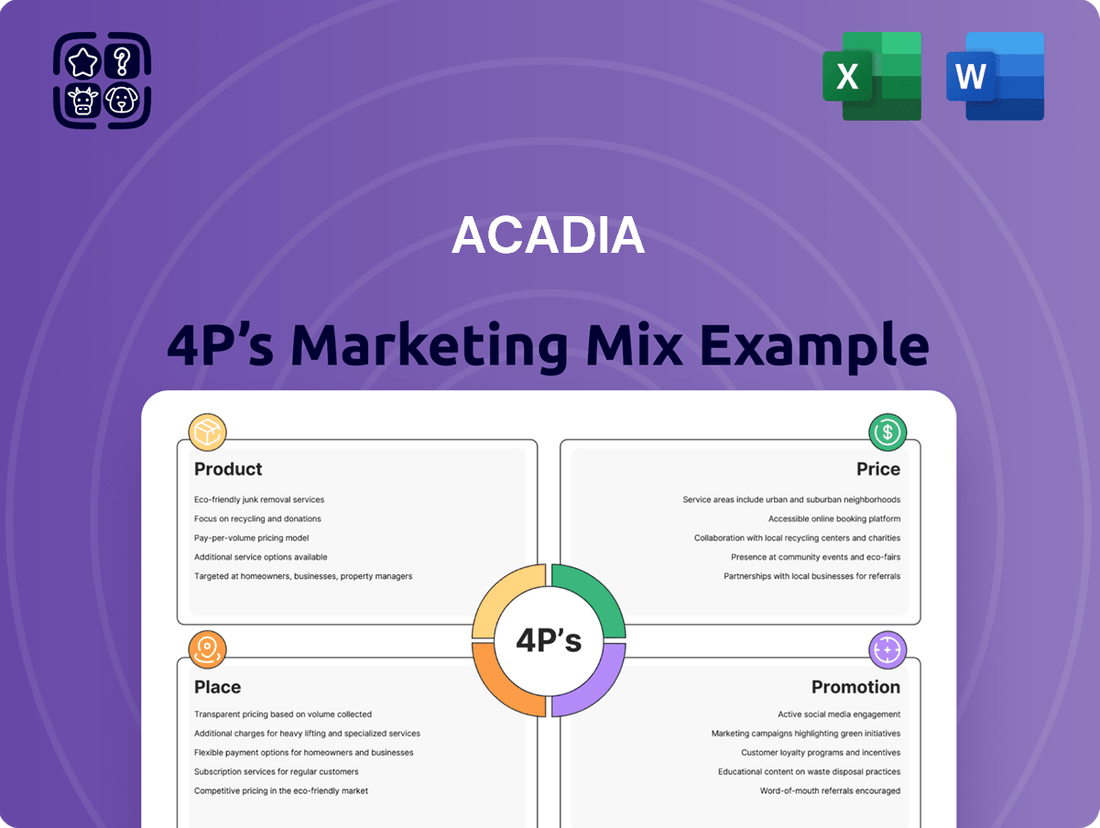

ACADIA Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACADIA Bundle

Uncover the strategic brilliance behind ACADIA's marketing success with our comprehensive 4Ps analysis. We'll dissect their product innovation, competitive pricing, strategic distribution, and impactful promotional campaigns to reveal the core drivers of their market dominance. This isn't just a summary; it's a blueprint for understanding how ACADIA captivates its audience and achieves its objectives.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis covering ACADIA's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable insights to elevate their own marketing efforts.

Explore how ACADIA’s product strategy, pricing decisions, distribution methods, and promotional tactics synergize to drive unparalleled success in the market. Get the full analysis in an editable, presentation-ready format to leverage its power for your own strategic planning.

Product

ACADIA Pharmaceuticals is laser-focused on creating groundbreaking treatments for central nervous system (CNS) disorders, aiming to fill critical gaps in patient care. Their efforts are concentrated on neurological and psychiatric conditions where current options are insufficient.

The company's product pipeline is designed to make a tangible difference for individuals battling severe CNS ailments, offering new hope and improved quality of life. For instance, ACADIA's Nuplazid (pimavanserin) has been a significant innovation, being the first drug approved by the FDA specifically to treat hallucinations and delusions associated with Parkinson's disease psychosis.

In 2024, ACADIA reported net sales of Nuplazid reaching $534.7 million for the first nine months, demonstrating strong market adoption. This highlights the company's capability to bring valuable therapies to market and meet physician and patient demand.

ACADIA's commitment extends to ongoing research and development, with a keen eye on expanding the utility of existing therapies and exploring new targets within the CNS landscape, reinforcing their position as a leader in this specialized therapeutic area.

Nuplazid, with its active ingredient pimavanserin, stands as a groundbreaking therapy, holding the distinction of being the sole FDA-approved medication specifically designed to combat the hallucinations and delusions characteristic of Parkinson's disease psychosis (PDP). This unique positioning in the market underscores its vital role in addressing a significant unmet medical need for patients experiencing these debilitating symptoms.

Acadia Pharmaceuticals has reported robust commercial success for Nuplazid. For the fourth quarter of 2024, the product achieved net sales of $162.9 million. This strong quarterly performance contributed to a substantial full-year 2024 net sales figure of $609.4 million, showcasing the drug's growing market presence and financial impact.

The impressive sales figures for Nuplazid in 2024 are attributed to a combination of factors, including an increase in the number of units sold and an improvement in the average net selling price. This indicates a growing patient base utilizing the therapy and a favorable pricing strategy that reflects its therapeutic value.

DAYBUE (trofinetide) represents a significant advancement as the first and only FDA-approved therapy for Rett syndrome, a rare neurodevelopmental disorder. Its availability for both adult and pediatric patients aged two and above addresses a critical unmet medical need, positioning it as a cornerstone therapy.

The product's commercial performance underscores its market impact, with full-year 2024 net product sales soaring to $348.4 million. This figure signifies remarkable growth, demonstrating a substantial 97% increase over the previous year's sales. Such robust revenue expansion highlights strong market adoption and the therapeutic value patients and physicians perceive in DAYBUE.

Robust Clinical Pipeline Expansion

ACADIA Pharmaceuticals is demonstrating significant commitment to expanding its product offerings through a robust clinical pipeline. Beyond its current commercial successes, the company is actively developing several promising drug candidates across various therapeutic areas. This strategic expansion aims to address unmet medical needs and diversify ACADIA's revenue streams in the coming years.

The company's pipeline includes differentiated programs targeting significant neurological and psychiatric conditions. For instance, ACP-101 is being investigated for Prader-Willi Syndrome, a rare genetic disorder. ACP-204 is in development for psychosis associated with Alzheimer's Disease and Lewy Body Dementia, conditions with a substantial patient population and limited treatment options.

Further pipeline advancements include ACP-211 for major depressive disorder, a condition impacting millions globally, and ACP-711 for Essential Tremor, a common neurological condition. ACADIA is also exploring ACP-2591 for Rett Syndrome and Fragile X Syndrome, both rare but severe neurodevelopmental disorders, highlighting a broad therapeutic focus. As of early 2024, ACADIA reported investing over $500 million in research and development, with a significant portion allocated to these late-stage and mid-stage pipeline assets.

- ACP-101: Prader-Willi Syndrome

- ACP-204: Alzheimer's Disease Psychosis, Lewy Body Dementia Psychosis

- ACP-211: Major Depressive Disorder

- ACP-711: Essential Tremor

- ACP-2591: Rett Syndrome, Fragile X Syndrome

Strategic Focus on Unmet Medical Needs

ACADIA's product strategy hones in on addressing significant unmet medical needs, aiming to develop treatments for conditions lacking effective therapies. This approach is designed to create a robust and diversified product pipeline.

By targeting these areas, ACADIA seeks to unlock substantial market potential, provided their pipeline candidates achieve successful development and commercialization. For instance, Nuplazid (pimavanserin), approved for Parkinson's disease psychosis, addresses a critical need where few options existed.

The company's commitment to high unmet medical needs is evident in its ongoing clinical trials. As of mid-2024, ACADIA is advancing multiple programs, including those in Alzheimer's disease psychosis and Rett syndrome, areas with considerable patient populations and limited therapeutic alternatives.

- Targeting High Unmet Needs: ACADIA prioritizes conditions with significant patient populations and few or no approved treatments.

- Portfolio Diversification: This strategic focus helps build a varied product pipeline, reducing reliance on a single therapy.

- Market Opportunity: Successful development of pipeline candidates in these areas offers substantial commercialization potential.

- Example: Nuplazid: Represents a successful application of this strategy, providing a treatment for Parkinson's disease psychosis.

ACADIA's product strategy centers on developing therapies for central nervous system disorders with significant unmet medical needs. Nuplazid, their flagship product, is the first and only FDA-approved treatment for hallucinations and delusions associated with Parkinson's disease psychosis. In 2024, Nuplazid achieved net sales of $609.4 million, reflecting strong market penetration and therapeutic value.

The company's portfolio also includes DAYBUE (trofinetide), the first and only FDA-approved therapy for Rett syndrome, a rare neurodevelopmental disorder. DAYBUE generated $348.4 million in net product sales for full-year 2024, marking a substantial 97% increase year-over-year.

ACADIA's robust pipeline further solidifies its product focus, with ongoing development in areas like Alzheimer's disease psychosis, major depressive disorder, and essential tremor, aiming to address broad patient populations with limited treatment options.

| Product | Indication | 2024 Net Sales | Year-over-Year Growth |

| Nuplazid | Parkinson's Disease Psychosis | $609.4 million | N/A (New indications may impact growth comparisons) |

| DAYBUE | Rett Syndrome | $348.4 million | 97% |

What is included in the product

This analysis offers a comprehensive examination of ACADIA's marketing strategies, dissecting its Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for effective decision-making.

Place

ACADIA Pharmaceuticals employs a direct-to-healthcare provider sales model, leveraging a specialized sales force to connect with key prescribers like neurologists and psychiatrists. This strategy is crucial for educating physicians on their sophisticated central nervous system (CNS) disorder treatments, detailing efficacy and proper administration. For instance, during the first quarter of 2024, ACADIA reported net sales of $130.7 million, a significant portion of which is driven by the effectiveness of this focused sales outreach. This direct engagement is vital for communicating the nuances of treatments such as NUPLAZID, which requires thorough understanding for optimal patient outcomes and market penetration.

ACADIA Pharmaceuticals leverages specialty pharmacies and robust distributor networks to ensure their complex neurological treatments reach patients precisely and safely. These channels are critical for managing the cold chain, patient support programs, and regulatory compliance inherent in their product portfolio. In 2023, the U.S. specialty pharmacy market was valued at approximately $320 billion, highlighting the significant infrastructure ACADIA taps into.

ACADIA is strategically broadening its global reach, with a keen focus on internationalizing DAYBUE (trofinetide). This expansion is a critical component of its marketing strategy, aiming to capture new markets and diversify revenue streams.

The company has filed for Marketing Authorization with the European Medicines Agency (EMA), with expectations of approval in the first quarter of 2026. This submission marks a significant step towards making DAYBUE available to patients in Europe.

Furthermore, ACADIA has already launched Managed Access Programs in several European nations. These programs are designed to provide early access to DAYBUE, laying the groundwork for its first revenues outside the United States, which are projected to begin in 2025.

This proactive international development is crucial for ACADIA's long-term growth and its commitment to bringing DAYBUE to a wider patient population across the globe.

Inventory and Supply Chain Management

ACADIA's success hinges on its ability to manage inventory and its supply chain for specialized central nervous system (CNS) medications. This requires meticulous planning to ensure these often temperature-sensitive drugs reach patients without interruption. The company's strategy likely involves robust forecasting to match production with anticipated demand for products like NUPLAZID, which is used to treat hallucinations and delusions associated with Parkinson's disease psychosis.

Efficient supply chain operations are paramount in the pharmaceutical sector, particularly for ACADIA's niche products. Disruptions can have significant consequences for patient care and brand reputation. By maintaining optimal inventory levels and streamlining distribution, ACADIA can enhance product availability and reduce the risk of stockouts.

Key aspects of ACADIA's inventory and supply chain management might include:

- Cold Chain Integrity: Ensuring the consistent maintenance of required temperatures for sensitive biologics and specialized medications throughout transit and storage.

- Demand Forecasting Accuracy: Utilizing advanced analytics to predict market demand for its drugs, minimizing both excess inventory and shortages.

- Supplier Reliability: Partnering with trusted suppliers for raw materials and manufacturing components to guarantee consistent quality and timely delivery.

- Distribution Network Optimization: Strategically managing distribution channels to ensure efficient and timely delivery to pharmacies, hospitals, and ultimately, patients.

In 2023, the global pharmaceutical supply chain faced ongoing challenges, including raw material shortages and logistical bottlenecks, underscoring the importance of resilient supply chain strategies for companies like ACADIA. Effective inventory management aims to balance the costs of holding stock against the risks of stockouts, a crucial consideration for high-value, specialized medicines.

Patient Access Programs and Support

ACADIA Pharmaceuticals actively works to ensure patients can access its treatments through robust patient access programs. These initiatives are crucial for bridging the gap between a prescribed medication and a patient's ability to receive it, tackling common hurdles like cost and complex logistics.

These programs are a vital component of ACADIA's 'Place' strategy, extending the reach of its therapies beyond traditional distribution channels. By addressing financial burdens and streamlining the process of obtaining medication, ACADIA aims to maximize treatment adherence and positive patient outcomes. For example, in late 2023, many pharmaceutical companies reported significant investments in patient support services, with estimates suggesting these programs help millions of patients annually access critical medications.

Key aspects of ACADIA's patient access and support often include:

- Financial Assistance Programs: Offering co-pay support, deductibles assistance, and free drug programs for eligible patients.

- Hub Services: Providing case management and navigation support to help patients through the process of getting their medication approved and delivered.

- Education and Resources: Supplying patients and caregivers with information about their condition and treatment.

- Insurance Support: Assisting patients with understanding their insurance coverage and appealing denied claims.

Place, as a part of ACADIA's marketing mix, focuses on ensuring their specialized CNS medications are accessible to the right patients through carefully selected channels. This includes a direct sales force targeting healthcare providers and the utilization of specialty pharmacies for precise delivery and patient support.

ACADIA is also expanding its global footprint, aiming to bring treatments like DAYBUE to international markets, with significant progress in Europe projected for 2025-2026. Robust patient access programs are integral to this strategy, overcoming financial and logistical hurdles to maximize treatment adherence.

The company's operational efficiency in supply chain management and inventory control is crucial for maintaining the integrity and availability of its sensitive neurological treatments. This ensures consistent product delivery to patients.

ACADIA's Place strategy is further defined by its international expansion efforts, particularly with DAYBUE. The company has filed for Marketing Authorization with the EMA, anticipating approval in Q1 2026, and has already initiated Managed Access Programs in several European countries, with projected first revenues outside the U.S. starting in 2025.

What You See Is What You Get

ACADIA 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final ACADIA 4P's Marketing Mix analysis you’ll receive right after purchase. This preview showcases the complete and ready-to-use content, ensuring no surprises. You are viewing the exact version of the detailed breakdown of Acadia's Product, Price, Place, and Promotion strategies. This comprehensive analysis will be yours to own and utilize immediately upon completing your order.

Promotion

ACADIA Pharmaceuticals, Inc. (ACAD) concentrates its promotional efforts on healthcare professionals (HCPs) who manage patients with central nervous system (CNS) disorders. This strategic focus ensures resources are directed towards the prescribers most likely to utilize their treatments.

The company actively engages the medical community through its Medical Science Liaison (MSL) program, which provides scientific exchange and education. In 2023, ACADIA reported significant investment in its medical affairs capabilities, underscoring the importance of this targeted outreach.

Participation in key medical conferences, such as the American Academy of Neurology (AAN) Annual Meeting, remains a cornerstone of ACADIA's strategy. These events offer platforms to present new data and engage directly with physicians, with attendance often exceeding 10,000 professionals in relevant fields.

Furthermore, ACADIA prioritizes publishing clinical trial results and real-world evidence in peer-reviewed scientific journals. This commitment to scientific dissemination reinforces their therapeutic offerings and builds credibility within the medical community, with a steady stream of publications expected throughout 2024 and 2025.

ACADIA is actively working to expand market share for NUPLAZID through focused consumer activation campaigns. These initiatives are designed to re-educate caregivers about the often-overlooked symptoms of Parkinson's disease psychosis. By increasing awareness, ACADIA aims to foster earlier diagnoses and encourage more patients to seek treatment, driving demand for NUPLAZID.

Acadia Pharmaceuticals leverages public relations to spotlight critical unmet needs within central nervous system (CNS) disorders. This strategy aims to educate the public and healthcare professionals about conditions such as Rett syndrome and Parkinson's disease psychosis, fostering a deeper understanding of these often-complex diseases.

By actively promoting disease awareness, Acadia not only supports the patient community but also indirectly positions its therapeutic solutions. For instance, their ongoing efforts to shed light on the challenges faced by individuals with Parkinson's disease psychosis, a condition affecting a significant portion of Parkinson's patients, are crucial for driving dialogue and potential treatment adoption.

In 2024, the company continued to engage in initiatives that highlight the patient journey and the scientific advancements needed to address these neurological conditions. Such campaigns are vital for building a favorable corporate image and ensuring that Acadia's contributions to treating severe CNS disorders are recognized, potentially impacting market perception and access.

Digital Marketing and Online Presence

ACADIA actively utilizes digital marketing and its online presence to connect with healthcare professionals and patient communities. This strategy aims to broadly disseminate information regarding their products and the diseases they address, providing accessible resources and support.

In 2024, the digital advertising spend in the pharmaceutical sector saw a significant increase, with companies allocating a substantial portion of their marketing budgets online. This trend is expected to continue into 2025 as digital channels prove effective in reaching targeted audiences.

- Broader Reach: Digital platforms enable ACADIA to connect with a wider audience of healthcare providers and patients than traditional marketing methods alone.

- Information Dissemination: Online resources serve as a key channel for sharing detailed product information and educational content about specific disease states.

- Accessibility and Support: ACADIA leverages its online presence to offer accessible information and support services to patients managing chronic conditions.

- Engagement Metrics: In 2024, engagement rates on medical professional platforms saw a notable uptick, indicating the growing importance of digital touchpoints for information sharing and relationship building.

Investor and R&D Day Presentations

ACADIA's Investor and R&D Day presentations are crucial for communicating their strategic direction and scientific advancements to financial stakeholders. These events effectively function as a promotional platform, detailing the company's drug pipeline and identifying key long-term value drivers. For instance, during recent presentations, ACADIA highlighted promising clinical trial data for their Alzheimer's disease candidate, ACADIA-201, aiming to build investor confidence.

These presentations underscore ACADIA's dedication to research and development, crucial for attracting investment and solidifying their standing in a competitive biopharmaceutical market. Such events showcase the company's commitment to innovation, a critical factor for sustained growth. In 2024, ACADIA's R&D Day focused on their CNS pipeline, projecting potential market penetration for new therapies.

The detailed scientific updates and financial projections shared during these days are designed to reinforce ACADIA's market position. By transparently outlining their progress and future plans, they aim to attract capital and foster partnerships. For example, updates on their schizophrenia drug development program have historically driven significant investor interest.

These events serve a dual purpose: informing the financial community and promoting the company's innovative capabilities. They allow ACADIA to directly communicate their vision for addressing unmet medical needs and generating future revenue streams. The company's 2025 outlook, presented at their latest R&D Day, emphasized continued investment in neuroscience research.

Key takeaways from ACADIA's recent Investor and R&D Days include:

- Showcase of a robust pipeline, particularly in CNS disorders.

- Emphasis on long-term value creation through innovation.

- Attracting investment by demonstrating commitment to R&D.

- Reinforcing market position with scientific and financial transparency.

ACADIA's promotional strategy centers on educating healthcare professionals and raising disease awareness. Their Medical Science Liaison program and participation in key medical conferences like the AAN Annual Meeting facilitate direct engagement with prescribers.

The company also utilizes digital marketing and public relations to disseminate information about their products and CNS disorders, aiming to improve patient outcomes and drive demand. This approach is supported by a commitment to publishing scientific data in peer-reviewed journals.

ACADIA's Investor and R&D Days serve as crucial platforms to communicate their pipeline, scientific advancements, and long-term value drivers to financial stakeholders, reinforcing their position in the biopharmaceutical market.

| Promotional Tactic | Target Audience | Key Objective | 2024/2025 Focus |

|---|---|---|---|

| Medical Science Liaisons (MSLs) | Healthcare Professionals (HCPs) | Scientific exchange and education | Continued investment in medical affairs |

| Medical Conferences (e.g., AAN) | HCPs | Present data, engage physicians | Showcasing new clinical data |

| Disease Awareness Campaigns | Public, Caregivers, HCPs | Educate on CNS disorders, drive diagnosis | Focus on Parkinson's disease psychosis, Rett syndrome |

| Digital Marketing/Online Presence | HCPs, Patients | Disseminate information, offer support | Increased digital ad spend, engagement metrics |

| Investor/R&D Days | Financial Stakeholders | Communicate strategy, pipeline, value drivers | Highlighting CNS pipeline, R&D investment |

Price

Acadia's pricing for specialized central nervous system (CNS) medications like NUPLAZID and DAYBUE is firmly anchored in a value-based strategy. This approach directly correlates the price to the substantial clinical advantages and enhanced quality of life these treatments provide for individuals facing severe, often incapacitating diseases.

For instance, the list price of DAYBUE (trofinetide) for Rett syndrome, a rare neurological disorder, was established at approximately $350,000 per year in 2023, reflecting the significant unmet need and the therapy's ability to address a complex condition with limited alternatives. This pricing acknowledges the considerable burden of disease and the potential for substantial patient benefit.

Pricing strategies for Acadia's products, particularly for high-cost pharmaceuticals, necessitate deep engagement with insurance providers and government healthcare programs. This collaborative process aims to secure broad reimbursement, a critical step for ensuring patient access. For instance, in 2024, pharmaceutical companies are increasingly focusing on value-based agreements with payers, where reimbursement is tied to patient outcomes, reflecting a shift in how drug pricing is negotiated.

The negotiation process involves demonstrating the clinical and economic value of Acadia's treatments to entities like Medicare and private insurers. Achieving favorable reimbursement rates directly impacts a product's market penetration and affordability for patients. As of early 2025, discussions around drug pricing reform continue, with a focus on transparency and fairness, which will likely influence how Acadia approaches these crucial negotiations.

ACADIA Pharmaceuticals actively monitors its competitive environment, tracking both established treatments and new developments. This helps them strategically position their offerings in the market. For instance, NUPLAZID enjoys a distinct advantage as the sole FDA-approved therapy for Parkinson's disease psychosis (PDP).

The introduction of DAYBUE into the Rett syndrome market necessitates a keen focus on competitive pricing. ACADIA must carefully consider how its pricing strategy will stack up against other potential or existing treatments for this condition.

Financial Performance and Revenue Guidance

ACADIA's financial performance, particularly its revenue from key products like NUPLAZID and DAYBUE, directly shapes its capacity for pricing adjustments. The company's projected total revenues for 2025, estimated to fall between $1.03 billion and $1.095 billion, suggest a robust financial standing that underpins its pricing strategies.

This financial strength allows ACADIA to maintain competitive yet profitable pricing for its pharmaceutical offerings, reflecting the value and market demand for its products. The revenue generated by NUPLAZID and DAYBUE is critical in funding further research, development, and commercialization efforts.

- Projected 2025 Total Revenues: $1.03 billion - $1.095 billion.

- Key Revenue Drivers: NUPLAZID and DAYBUE sales performance.

- Impact on Pricing: Strong revenue supports pricing flexibility and power.

- Financial Health Indicator: Projected revenue growth signals market acceptance and commercial success.

Gross-to-Net Ratio Management

Acadia manages its gross-to-net (GTN) ratio, a key metric reflecting the difference between gross sales and net realized revenue after accounting for discounts, rebates, and other chargebacks. This management is crucial for understanding the true profitability of its pharmaceutical products.

For 2025, Acadia anticipates a stable GTN ratio for NUPLAZID, projected to be between 22.5% and 25.5%. This suggests a consistent strategy in managing net realized prices for this important therapy.

Similarly, DAYBUE's GTN ratio is forecast to remain within a narrow band of 21.5% to 24.5% for 2025. This stability in the GTN for both key products highlights Acadia's predictable approach to pricing and commercial operations.

The company's focus on maintaining these GTN ranges indicates a deliberate effort to ensure predictable revenue streams and effective cost management within its commercialization efforts.

- NUPLAZID 2025 Projected GTN: 22.5% - 25.5%

- DAYBUE 2025 Projected GTN: 21.5% - 24.5%

- GTN Management Focus: Discounts, rebates, chargebacks, and other price adjustments

- Implication: Predictable net realized pricing and revenue

Acadia's pricing strategy for its CNS medications centers on value, directly linking cost to the significant clinical benefits and improved quality of life these treatments offer. For 2024 and 2025, the company continues to navigate complex payer negotiations, aiming for broad reimbursement to ensure patient access.

The list price for DAYBUE, around $350,000 annually as of 2023, reflects the unmet need in Rett syndrome. Acadia's financial health, with projected 2025 revenues between $1.03 billion and $1.095 billion, supports its pricing power and ability to invest in future research.

Managing the gross-to-net (GTN) ratio is crucial for Acadia. For 2025, NUPLAZID's GTN is expected between 22.5% and 25.5%, while DAYBUE's is projected for 21.5% to 24.5%, indicating stable net realized pricing.

| Product | 2023 List Price (Annual) | Projected 2025 GTN Range | Key Value Proposition |

|---|---|---|---|

| NUPLAZID | N/A (Established Product) | 22.5% - 25.5% | Sole FDA-approved therapy for Parkinson's disease psychosis (PDP) |

| DAYBUE | ~$350,000 | 21.5% - 24.5% | Addresses Rett syndrome, a rare neurological disorder with limited alternatives |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages official company disclosures, direct website information, and verified industry reports. We meticulously gather data on product offerings, pricing strategies, distribution channels, and promotional activities to ensure accuracy.