ACADIA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACADIA Bundle

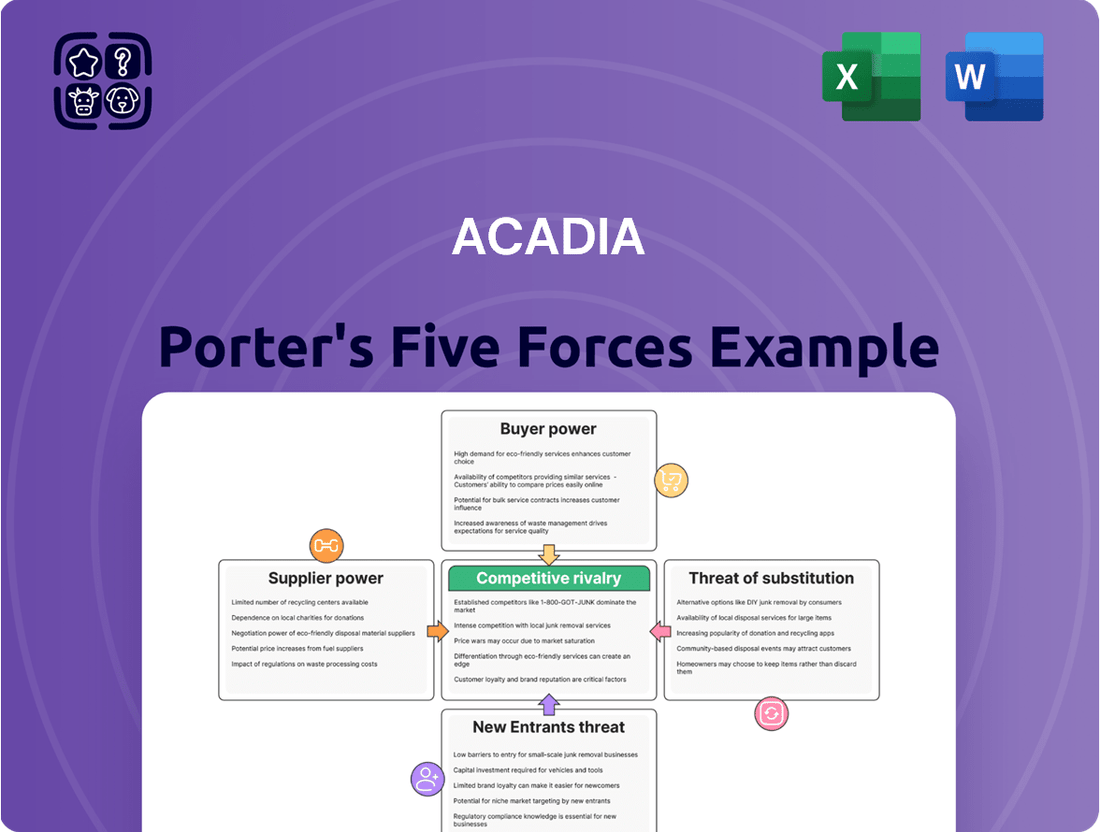

ACADIA's competitive landscape is shaped by several potent forces, including the bargaining power of its buyers, the intensity of rivalry among existing competitors, and the constant threat of new entrants. Understanding these dynamics is crucial for any strategic evaluation of the company.

The threat of substitute products and the bargaining power of suppliers also play significant roles, influencing ACADIA's pricing strategies and operational costs. A thorough examination of these elements reveals the underlying pressures ACADIA faces.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ACADIA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ACADIA Pharmaceuticals' reliance on a limited number of specialized suppliers for critical active pharmaceutical ingredients (APIs) and raw materials significantly heightens supplier bargaining power. This dependency means these suppliers can wield considerable influence, particularly when finding and qualifying alternative sources is a complex and time-consuming process.

The scarcity of readily available or easily substitutable components for ACADIA's central nervous system disorder treatments further amplifies this supplier leverage. If these specialized materials are difficult to source, suppliers can command higher prices or dictate more favorable terms.

Geopolitical shifts and ongoing supply chain disruptions, issues that remained prominent throughout 2025, compound these risks. Such volatility can lead to unexpected cost increases for ACADIA or, more critically, disruptions in the supply of essential materials needed for drug production.

ACADIA, like many in the biopharmaceutical sector, relies heavily on Contract Research and Manufacturing Organizations (CROs/CMOs) for critical R&D and production stages. This reliance grants these specialized service providers significant leverage, as their unique expertise and infrastructure are often indispensable.

The bargaining power of CROs/CMOs is amplified in niche areas, such as Central Nervous System (CNS) indications, where a limited number of organizations possess the requisite specialized capabilities and established regulatory success. For instance, the global CRO market was valued at approximately $60 billion in 2023 and is projected to grow substantially, indicating strong demand and pricing power for established players.

Upstream suppliers that control crucial intellectual property, such as patents for specific drug compounds or unique manufacturing techniques, can wield significant bargaining power over ACADIA Pharmaceuticals. This control means ACADIA might face substantial hurdles, including high switching costs and potential legal entanglements, if it attempts to change suppliers, directly impacting its operational flexibility and cost structure.

Skilled Labor and Scientific Expertise Shortages

The biopharmaceutical industry, including specialized fields like central nervous system (CNS) disorders, continues to grapple with significant talent shortages. This is particularly acute in emerging areas such as digital logistics and the manufacturing of advanced therapies. For a company like ACADIA, this scarcity directly translates into increased bargaining power for the limited pool of highly skilled scientific and technical professionals and specialized consulting firms. These experts are critical for ACADIA's research and development pipeline and its ability to bring new treatments to market.

This talent gap means that individuals with sought-after skills can command higher salaries and more favorable contract terms. For instance, a report from BioPharma Dive in late 2023 highlighted that demand for process development scientists with experience in cell and gene therapy manufacturing outstripped supply by a considerable margin, leading to compensation packages that could be 20-30% higher than for more general roles.

- Talent Scarcity: Shortages are pronounced in digital logistics and advanced therapy production roles within the biopharma sector.

- Increased Bargaining Power: This scarcity empowers individual scientists, researchers, and specialized consulting firms.

- Impact on ACADIA: These skilled professionals are crucial for ACADIA's R&D and commercialization success.

- Compensation Trends: Demand for specialized skills can drive up compensation, impacting operational costs.

Regulatory Compliance Requirements

Regulatory compliance significantly enhances the bargaining power of suppliers to ACADIA. For instance, adherence to FDA regulations for pharmaceutical manufacturing involves rigorous quality control, extensive documentation, and specialized facilities, with compliance costs often running into millions of dollars. Similarly, the EMA’s stringent Good Manufacturing Practice (GMP) standards require continuous investment in process validation and quality assurance systems.

These high barriers to entry, driven by complex regulatory landscapes, naturally limit the pool of qualified suppliers. Consequently, suppliers who have already invested heavily to meet and maintain these demanding standards are in a stronger position to negotiate terms with ACADIA, knowing that alternative compliant suppliers are scarce.

- High Compliance Costs: Suppliers face substantial expenses for meeting regulatory standards like FDA and EMA.

- Limited Supplier Pool: Fewer companies can afford or manage the complexity of regulatory adherence.

- Increased Negotiating Power: Compliant suppliers leverage their unique position to influence pricing and terms with ACADIA.

- Quality and Safety Assurance: Regulatory adherence ensures a baseline level of quality and safety, which ACADIA relies upon.

The bargaining power of suppliers for ACADIA Pharmaceuticals is elevated due to the specialized nature of their products and services. This includes critical APIs, complex manufacturing processes, and highly skilled talent, all of which are not easily substituted. The significant investment required for regulatory compliance further restricts the supplier base, giving existing compliant suppliers greater leverage in negotiations.

| Factor | Impact on ACADIA | Supporting Data/Trend (2024/2025) |

| Specialized Inputs | Increased supplier leverage due to unique requirements. | Limited number of suppliers for CNS disorder APIs; high switching costs. |

| Talent Scarcity | Empowers skilled professionals and specialized firms. | Demand for biopharma talent outstripping supply; higher compensation for specialized roles. |

| Regulatory Hurdles | Restricts supplier pool, enhancing power of compliant providers. | Millions invested by suppliers for FDA/EMA compliance; fewer qualified alternatives. |

| CRO/CMO Dependence | Leverage for service providers with niche expertise. | Global CRO market growth indicates strong demand and pricing power for established players. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ACADIA's unique position in the biopharmaceutical industry.

Instantly identify competitive threats and opportunities with a clear, visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Healthcare payers, encompassing government programs like Medicare and Medicaid, along with private insurers, wield substantial bargaining power. This influence stems from their critical role in determining drug reimbursement and placement on formularies. In 2024, payers are intensifying their focus on cost containment, driven by escalating drug prices and evolving healthcare policies.

This increased scrutiny translates into more rigorous evaluations of a drug's therapeutic and economic value. Payers are implementing stricter utilization management protocols and actively negotiating for rebates or entering into value-based agreements. For instance, in the US, Medicare Part D spending on prescription drugs reached an estimated $226 billion in 2023, highlighting the scale of payer influence on pharmaceutical markets.

Pharmacy Benefit Managers (PBMs) wield significant power over drug manufacturers like ACADIA by acting as crucial intermediaries. They manage drug formularies, negotiate prices with pharmaceutical companies and pharmacies, and influence which drugs are covered by insurance plans.

The consolidation within the PBM industry, with giants like CVS Caremark, Express Scripts (Cigna), and Optum Rx dominating, amplifies their bargaining power. This concentration allows them to leverage economies of scale and demand significant rebates and discounts from drugmakers. For instance, in 2024, PBMs continue to be a major force in dictating market access and pricing for specialty drugs, a category ACADIA's products often fall into.

ACADIA must contend with PBMs' ability to exclude drugs from preferred formularies or impose restrictive prior authorization requirements if negotiated price concessions are not met. This can severely limit a drug's market penetration and revenue potential, making favorable formulary placement a critical negotiation point.

Large hospital systems and integrated delivery networks wield significant purchasing power, enabling them to negotiate favorable terms and influence which medications are stocked and prescribed. For instance, in 2023, the top 20 largest hospital systems in the U.S. accounted for a substantial portion of healthcare spending, giving them considerable leverage over pharmaceutical manufacturers like ACADIA.

While individual physicians make prescribing decisions, these are often guided by institutional formularies and cost-effectiveness analyses implemented by these powerful healthcare entities. This indirect influence means that ACADIA’s sales volumes for drugs like Nuplazid can be significantly impacted by the purchasing strategies and formulary decisions of these major hospital providers.

Patient Access and Affordability Concerns

While individual patients have limited direct power to negotiate drug prices with ACADIA, their concerns about access and affordability significantly impact demand. High out-of-pocket costs, often influenced by insurance formularies and co-pays, can lead to patients delaying or foregoing treatment. This indirect pressure on pharmaceutical companies to manage pricing and demonstrate value is a key aspect of customer bargaining power.

The ability of patients to access and afford medications, influenced by factors like insurance coverage and deductibles, indirectly affects ACADIA's sales. If patients struggle with affordability, they may seek less expensive alternatives or simply not adhere to prescribed treatments. This can prompt payers, such as insurance companies, to push for lower prices or favor competing drugs, thereby increasing customer bargaining power.

- Patient Non-Adherence: Reports from 2024 indicate that approximately 20% to 30% of patients do not adhere to their prescribed medication regimens, with cost being a significant contributing factor.

- Payer Influence: Health insurers, acting on behalf of patient groups, often negotiate bulk discounts and formulary placements, directly impacting which drugs are readily accessible and affordable to patients.

- Demand Elasticity: For conditions where multiple treatment options exist, patient sensitivity to price can increase demand elasticity, giving them more leverage to seek out more affordable alternatives.

Existence of Treatment Guidelines and Clinical Pathways

The existence of treatment guidelines and clinical pathways significantly impacts customer bargaining power for companies like ACADIA. When medical societies and healthcare organizations develop these guidelines, they can steer prescribing habits. If ACADIA's drugs aren't favored within these established pathways, or if cheaper alternatives are suggested, it directly limits customer adoption. This can lead to reduced sales volume and a smaller market share for ACADIA.

For instance, in 2024, a significant portion of healthcare providers are increasingly relying on evidence-based clinical pathways to guide treatment decisions. A study indicated that over 70% of oncologists, a key market for neurological treatments, reported that clinical guidelines heavily influence their prescribing choices. This trend empowers customers, as they can leverage these guidelines to negotiate prices or demand products that align with established protocols. ACADIA's ability to demonstrate the value and efficacy of its treatments within these frameworks is therefore crucial for maintaining its market position and mitigating customer bargaining power.

- Influence of Guidelines: Clinical practice guidelines developed by medical societies and healthcare organizations can significantly influence prescribing behavior.

- Market Position: If ACADIA's products are not favorably positioned within these guidelines, or if less expensive alternatives are recommended, customer adoption can be limited.

- Impact on Sales: This limited adoption directly affects sales volume and market share for ACADIA.

- Provider Reliance: In 2024, a substantial percentage of healthcare providers rely on clinical pathways to guide treatment decisions, amplifying customer bargaining power.

The bargaining power of customers, particularly payers like government programs and private insurers, remains a significant force in the pharmaceutical industry, impacting companies like ACADIA. These entities control formulary access and reimbursement, directly influencing drug adoption and pricing. In 2024, payers are aggressively pursuing cost containment strategies, driven by rising drug expenditures, which amplifies their negotiation leverage.

Pharmacy Benefit Managers (PBMs) act as powerful intermediaries, consolidating demand and negotiating substantial rebates, further concentrating customer power. The market dominance of major PBMs like Optum Rx and CVS Caremark in 2024 means they can significantly impact ACADIA's market access and pricing for specialty medications. Failure to meet PBM demands for price concessions can lead to restrictive formulary placement or exclusion, severely limiting a drug's commercial success.

Large integrated healthcare systems also exert considerable influence through their purchasing volume and formulary management. While individual patient affordability concerns might not directly translate into price negotiations, they indirectly empower payers and PBMs to seek lower prices for ACADIA's products, especially when alternative treatments exist.

| Customer Segment | Bargaining Power Factors | Impact on ACADIA | 2024 Data/Trend |

|---|---|---|---|

| Payers (Medicare, Medicaid, Private Insurers) | Control over formularies, reimbursement rates, focus on cost containment | Limits market access, drives price negotiations, influences uptake | Intensified cost containment efforts, higher scrutiny on drug value |

| Pharmacy Benefit Managers (PBMs) | Consolidated purchasing, rebate negotiation, formulary influence | Dictates market access and pricing, demands discounts | Continued dominance by major PBMs, strong negotiation leverage |

| Integrated Healthcare Systems | Bulk purchasing power, institutional formulary decisions | Influences prescribing patterns, stocking decisions | Significant portion of healthcare spending, leverage over manufacturers |

| Patients (Indirectly) | Affordability concerns, treatment adherence | Creates pressure for lower prices from payers, impacts sales volume | Cost remains a key factor in patient non-adherence (approx. 20-30% in 2024) |

Same Document Delivered

ACADIA Porter's Five Forces Analysis

This preview showcases the complete ACADIA Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the industry. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no surprises. This comprehensive analysis meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within ACADIA's operating environment. The insights provided are ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

The Central Nervous System (CNS) disorder market is a battlefield dominated by established pharmaceutical giants. Companies like Biogen and Roche, with their vast R&D war chests, already command significant market share and possess robust pipelines, making it tough for newer entrants to gain a foothold.

These large players leverage their extensive sales forces and deep pockets to push their existing CNS therapies, often creating a high barrier to entry. For instance, in 2024, major pharmaceutical companies continued to invest billions in CNS research and development, with many having multiple late-stage clinical trials underway for various neurological and psychiatric conditions.

Their established brand recognition and existing relationships with healthcare providers further intensify the rivalry, as they can effectively promote new treatments and secure favorable reimbursement. This existing infrastructure and market penetration mean that any new therapy must offer a substantial clinical advantage to even be considered.

ACADIA Pharmaceuticals faces intense competition from numerous companies advancing drugs for central nervous system (CNS) disorders. This rivalry is particularly pronounced in indications like Parkinson's disease psychosis and Alzheimer's disease psychosis, where multiple players are vying for market share. For instance, the Parkinson's disease psychosis market, estimated to reach billions by 2030, sees companies like Lundbeck and Otsuka with competing pipeline assets.

The competitive landscape is further amplified by the swift progress in gene therapies and other innovative mechanisms targeting CNS conditions. Emerging therapies from both established biopharmaceutical giants and nimble smaller firms are constantly entering the development pipeline. This dynamic environment means ACADIA must continually innovate and execute effectively to maintain its competitive edge in these critical therapeutic areas.

The central nervous system (CNS) disorder market is a significant and growing area, with projected sales expected to exceed $80 billion by 2025. This robust growth potential is a magnet for competition, as many companies recognize the substantial unmet medical needs within this sector.

The allure of this expanding market, especially within therapeutic areas such as multiple sclerosis (MS) and psychiatric disorders, fuels intense rivalry. Numerous pharmaceutical and biotech firms are actively developing and launching new treatments, creating a crowded competitive landscape.

This high level of competition translates into aggressive marketing and pricing strategies. Companies are compelled to differentiate their offerings and secure market share, often through significant investment in research and development and strategic promotional campaigns.

Product Differentiation and Therapeutic Advantages

Competitive rivalry in the pharmaceutical sector, particularly for ACADIA, is intensely fueled by product differentiation and demonstrated therapeutic advantages. Companies strive to offer treatments with superior efficacy, better safety profiles, or greater patient convenience than existing options.

ACADIA's key products, Nuplazid and Daybue, exemplify this, competing on their unique mechanisms of action and their specific FDA-approved indications. For instance, Nuplazid was the first drug approved for Parkinson's disease psychosis. However, maintaining a competitive edge demands continuous innovation to fend off new market entrants and advancements within competitor pipelines.

- Product Differentiation: Competition hinges on offering unique therapeutic benefits, such as improved efficacy or a more favorable safety profile.

- ACADIA's Position: Nuplazid and Daybue are positioned based on their distinct mechanisms and FDA-cleared uses.

- Innovation Imperative: Ongoing research and development are crucial for staying ahead of emerging treatments and new market entrants.

- Market Dynamics: The need for continuous innovation is driven by the dynamic nature of the pharmaceutical landscape and pipeline advancements from rivals.

Intellectual Property and Patent Expirations

The strength of intellectual property, particularly patents, is a cornerstone of the biopharmaceutical industry. ACADIA's competitive landscape is significantly shaped by the lifecycle of its innovations. For instance, the patent situation surrounding Nuplazid has been a focal point, with challenges potentially paving the way for increased competition.

Impending patent expirations for key drugs, whether ACADIA's own or those of its competitors, directly fuel competitive rivalry. As patents lapse, the market opens for generic and biosimilar manufacturers to introduce lower-cost alternatives. This dynamic can rapidly erode market share and profitability for the originator company.

- Patent Expirations: The expiration of patents for blockbuster drugs historically leads to a significant increase in generic competition, often reducing drug prices by 80-90%.

- Nuplazid Litigation: Legal challenges to ACADIA's patents, such as those concerning Nuplazid, can create uncertainty and potentially accelerate the entry of biosimilar competitors, intensifying rivalry.

- Market Share Erosion: Following patent expiry and the introduction of generics, originator drugs can experience a rapid decline in market share, sometimes losing over 50% within the first year of generic availability.

- R&D Investment Impact: The pressure from patent cliffs necessitates continuous innovation and investment in research and development to replenish the product pipeline and offset anticipated revenue losses.

Competitive rivalry within the CNS disorder market is fierce, driven by a constant influx of new therapies and the established dominance of large pharmaceutical players. Companies like ACADIA Pharmaceuticals must continually innovate to differentiate their products, as demonstrated by Nuplazid's unique position as the first drug for Parkinson's disease psychosis. The market is characterized by aggressive marketing and pricing, with billions invested annually in R&D, creating a high barrier to entry for newcomers.

The threat of generic competition looms large as key patents approach expiration. For example, the patent landscape for established CNS drugs, including those within ACADIA's portfolio, directly influences market dynamics. Patent expiries can lead to rapid market share erosion for originator drugs, with prices often dropping by 80-90% after generic entry. This necessitates a continuous focus on pipeline development to offset potential revenue losses.

The sheer number of companies developing treatments for conditions like Parkinson's disease psychosis, where multiple pipeline assets are in play, intensifies this rivalry. Emerging gene therapies and novel mechanisms of action further accelerate the pace of innovation, compelling firms to secure significant clinical advantages to gain traction.

The CNS market is projected for substantial growth, with sales expected to surpass $80 billion by 2025, attracting significant investment and competition. Therapeutic areas such as multiple sclerosis and psychiatric disorders are particularly crowded, forcing companies to employ aggressive strategies to capture market share.

| Company | Key CNS Products/Pipeline | Therapeutic Area Focus | 2024 R&D Investment (Estimated Billions USD) |

|---|---|---|---|

| Biogen | Tecfidera, Aduhelm, Leqembi (collaboration) | Multiple Sclerosis, Alzheimer's Disease | 7.0 - 8.0 |

| Roche | Ocrevus, Xeloda, Evrysdi | Multiple Sclerosis, Oncology (CNS-related) | 8.0 - 9.0 |

| ACADIA Pharmaceuticals | Nuplazid, Daybue | Parkinson's Disease Psychosis, Rett Syndrome | 0.5 - 0.7 |

| Lundbeck | Rexulti, Brintellix | Depression, Schizophrenia, Parkinson's Disease Psychosis | 0.6 - 0.8 |

| Otsuka Pharmaceutical | Abilify, Rexulti (co-promotion) | Schizophrenia, Depression, Parkinson's Disease Psychosis | 0.7 - 0.9 |

SSubstitutes Threaten

Patients experiencing Central Nervous System (CNS) disorders, such as Parkinson's disease psychosis, often find themselves with a spectrum of alternative pharmacological treatments available, even if these aren't directly approved for the same specific condition as ACADIA's offerings.

The off-label utilization of various antipsychotics or entirely different drug classes that effectively manage symptoms can act as viable substitutes. For instance, in 2024, the market saw continued use of established antipsychotic medications for broader behavioral disturbances in neurological conditions, presenting a competitive landscape.

This accessibility to alternative therapies, even if prescribed "off-label," can exert downward pressure on pricing and market share for ACADIA's specialized treatments. The ease with which physicians can switch or supplement existing treatments with more widely available, albeit off-label, options directly impacts the perceived necessity and exclusivity of ACADIA's pipeline drugs.

Consider that in the broader CNS market, off-label prescribing is a significant factor; in 2023, estimates suggest that off-label use accounted for a substantial portion of prescriptions in certain therapeutic areas, highlighting the competitive threat from existing, albeit differently indicated, medications.

Non-pharmacological interventions present a significant threat of substitutes for ACADIA. Many central nervous system (CNS) conditions, especially psychiatric disorders, can be effectively managed or supported through therapies like psychotherapy, cognitive behavioral therapy (CBT), and lifestyle changes. For instance, the global mental health market, which includes these non-drug approaches, was valued at over USD 380 billion in 2023 and is projected to grow substantially, indicating a strong and expanding alternative to purely pharmaceutical solutions.

While not direct drug replacements, these alternative therapies can diminish the perceived necessity or dependence on pharmaceutical treatments. This shift in patient and physician preference can directly impact the demand for ACADIA's drug-based offerings, as patients may opt for or combine these interventions. Deep brain stimulation, for example, is increasingly used for conditions like Parkinson's disease, offering a technologically advanced alternative that could reduce the market share for certain CNS medications.

The threat of generic and biosimilar competition is a significant concern for ACADIA Pharmaceuticals. When patents on their drugs expire, or if a viable biosimilar pathway emerges for complex biologics like those ACADIA develops, lower-cost alternatives can rapidly erode market share. This dynamic forces price reductions, directly impacting ACADIA's revenue streams and profitability, even for innovative, first-in-class treatments.

For instance, the U.S. market for prescription drugs sees substantial price erosion upon generic entry; typically, generics capture around 90% of the market within three years of launch, often at prices 50-80% lower than the brand-name drug. While ACADIA's focus on novel treatments for neurological disorders might offer some initial protection, the increasing sophistication of biosimilar development, particularly for complex biologics, means this threat is ever-present. The economic pressure from these substitutes necessitates continuous innovation and strong lifecycle management to maintain competitive advantage.

Emerging Technologies and Gene Therapies

The threat of substitutes for ACADIA Pharmaceuticals is amplified by emerging technologies, particularly in the realm of gene therapies for Central Nervous System (CNS) disorders. These advanced treatments, while still in their nascent stages for many conditions, hold the potential to fundamentally alter disease progression or even provide cures. This poses a significant long-term risk to traditional pharmaceutical approaches. For instance, by mid-2024, significant investment and research continue to pour into gene therapy, with a substantial portion of this directed at neurological conditions, indicating a growing pipeline of potential substitutes.

While currently facing hurdles such as high development costs and limited approved indications, the disruptive nature of gene therapies cannot be overlooked. Their ability to address the root cause of diseases, rather than just managing symptoms, could lead to their eventual displacement of current small molecule or biologic treatments. The market for CNS gene therapies, though nascent, is projected for substantial growth, with estimates suggesting a CAGR well into the double digits through the end of the decade, underscoring the evolving competitive landscape.

- Gene therapy advancements in CNS disorders are a key substitute threat.

- These therapies aim for disease modification or cures, potentially replacing existing treatments.

- High costs and early-stage development are current limitations, but future potential is significant.

- The growing investment in and projected growth of the CNS gene therapy market highlight this evolving threat.

Patient Management Strategies and Supportive Care

For chronic and debilitating central nervous system (CNS) conditions, patients and their caregivers often consider a broad spectrum of management strategies beyond just pharmaceutical interventions. This means ACADIA's drug therapies aren't just up against other medications, but also against alternative approaches to care.

These substitutes can include various forms of therapy, lifestyle modifications, and even assistive technologies, all aiming to improve quality of life and manage symptoms. For instance, physical therapy and occupational therapy can play a significant role in managing motor deficits associated with neurological disorders. In 2024, the global physical therapy market was valued at approximately $65 billion, highlighting the substantial investment in non-pharmacological care.

Furthermore, palliative care and hospice services represent a significant substitute, particularly for patients with advanced or severe CNS conditions. These services focus on symptom relief and improving patient comfort, often prioritizing quality of life over disease-modifying treatments. The global palliative care market is projected to reach over $15 billion by 2028, indicating its growing importance in healthcare.

- Supportive Care: Includes physical therapy, occupational therapy, and speech therapy, which can cost patients thousands of dollars annually depending on the intensity and duration of treatment.

- Lifestyle Modifications: Dietary changes, exercise regimens, and stress management techniques are often recommended and can be implemented at little to no direct cost.

- Assistive Technologies: Devices like mobility aids, communication tools, and home automation systems can range from a few hundred to several thousand dollars, offering functional support.

- Palliative and Hospice Care: These services provide comprehensive symptom management and emotional support, with costs varying based on the level of care provided.

Beyond direct pharmacological competitors, the threat of substitutes for ACADIA's CNS treatments also encompasses non-drug interventions and supportive care. These can range from specialized therapies to assistive technologies, all aiming to enhance patient quality of life and manage symptoms, sometimes at a lower or more accessible cost.

For instance, physical and occupational therapies are crucial for managing motor deficits in neurological conditions. In 2024, the global physical therapy market was valued around $65 billion, reflecting a significant investment in these non-pharmacological alternatives that directly compete for patient and healthcare system resources.

Furthermore, palliative and hospice care offer symptom management and comfort, especially for advanced CNS diseases, acting as substitutes by prioritizing quality of life. The growing palliative care market, projected to exceed $15 billion by 2028, underscores the increasing reliance on these comprehensive support systems.

| Substitute Category | Examples | Estimated Market Size/Growth (as of 2023/2024) | Impact on ACADIA |

| Therapeutic Interventions | Physical Therapy, Occupational Therapy, Speech Therapy | Global Physical Therapy Market: ~$65 billion (2024) | Reduces perceived need for solely drug-based symptom management; potential to complement or replace some drug benefits. |

| Lifestyle & Behavioral | Dietary changes, Exercise, Stress Management | Often low direct cost to patient; highly variable adoption rates. | Can diminish reliance on pharmaceuticals if effective; patient preference can shift away from medication-centric approaches. |

| Assistive Technologies | Mobility aids, Communication devices, Home automation | Highly varied; devices can range from hundreds to thousands of dollars. | Improves functional independence, potentially reducing the burden of symptoms that drugs aim to alleviate. |

| End-of-Life Care | Palliative Care, Hospice Services | Global Palliative Care Market: Projected >$15 billion by 2028 | Focuses on symptom relief and quality of life, offering an alternative to disease-modifying treatments in advanced stages. |

Entrants Threaten

Developing novel treatments for Central Nervous System (CNS) disorders presents a formidable hurdle due to astronomical research and development (R&D) expenditures. Companies must commit billions of dollars over extended periods, often a decade or more, to navigate the complex path from initial discovery to market approval. This immense financial requirement, coupled with a notoriously high failure rate in clinical trials, acts as a powerful deterrent for potential new entrants, especially in the intricate field of CNS therapeutics.

Stringent regulatory approval processes represent a significant threat of new entrants for ACADIA. The pharmaceutical sector, especially for treatments targeting central nervous system (CNS) disorders, demands extensive clinical trials and data submission to bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, the average time to bring a new drug to market globally was estimated to be over 10 years, with development costs often exceeding $1 billion, a substantial hurdle for any aspiring competitor.

Developing treatments for central nervous system (CNS) disorders, like those ACADIA Pharmaceuticals focuses on, demands a profound grasp of intricate neurological pathways and psychiatric mechanisms. This scientific depth isn't something easily replicated. For instance, in 2024, the sheer complexity of neurodegenerative diseases continues to challenge even seasoned researchers, highlighting the specialized knowledge barrier.

Furthermore, designing and executing clinical trials for CNS conditions requires a unique skill set. This includes understanding specific patient populations, ethical considerations, and regulatory hurdles. Recruiting the right patients for these trials is also a significant undertaking, often relying on established networks of neurologists and psychiatrists. This specialized clinical expertise acts as a substantial deterrent for potential new players entering ACADIA's market space.

Intellectual Property Protection and Patent Landscape

ACADIA Pharmaceuticals, like many in the biopharmaceutical sector, relies heavily on intellectual property to maintain its competitive edge. Its approved drugs and investigational compounds are protected by a portfolio of patents, creating a significant barrier for potential new entrants. This intellectual property protection is crucial for recouping the substantial research and development investments. For instance, ACADIA's Nuplazid (pimavanserin) has patent protection extending for several years, safeguarding its market exclusivity.

New companies entering the market must contend with this intricate patent landscape. They can either invest heavily in discovering and developing entirely new molecular entities, a process that is both time-consuming and carries a high risk of failure, or they can wait for existing patents to expire. The latter strategy significantly delays market entry and often means facing established players with proven market access and sales infrastructure. As of early 2024, the average patent life remaining for drugs approved in the last five years varies by therapeutic area, but typically provides a decade or more of market exclusivity, making the waiting game a long-term proposition.

- Established patent portfolios act as a significant deterrent to new entrants in the biopharmaceutical industry.

- ACADIA's strength lies in its protected pipeline and approved therapies, like Nuplazid.

- New entrants must either innovate with novel compounds or face lengthy waits for patent expirations.

- The substantial investment and time required to navigate IP hurdles limit the threat of immediate new competition.

Market Access and Commercialization Challenges

Beyond just getting regulatory approval, new companies entering the pharmaceutical market face substantial challenges in actually getting their products to patients and getting paid for them. This includes navigating complex relationships with Pharmacy Benefit Managers (PBMs) and establishing robust sales and marketing teams capable of reaching healthcare providers.

These market access and commercialization hurdles represent significant barriers to entry. For instance, the cost of building an effective sales force can run into millions of dollars annually, and securing favorable reimbursement often involves lengthy negotiations and substantial evidence of clinical and economic value.

In 2024, the pharmaceutical industry continued to see high R&D costs and increasing pressure on drug pricing. This environment makes it particularly difficult for new entrants to establish a foothold without substantial capital and a well-defined market access strategy.

- High Cost of Commercialization: Building a specialized sales force and marketing infrastructure can cost tens of millions of dollars per drug.

- Payer Negotiation Complexity: Securing formulary placement and favorable reimbursement rates from payers and PBMs is a lengthy and often costly process.

- Evidence Generation Demands: Demonstrating real-world value and cost-effectiveness to payers requires significant investment in health economics and outcomes research (HEOR).

The threat of new entrants for ACADIA is significantly mitigated by several key factors. The immense capital required for research and development, coupled with the lengthy and uncertain regulatory approval process, creates a substantial barrier. Furthermore, ACADIA's strong patent portfolio and the specialized expertise needed for CNS drug development and commercialization further solidify its position, making it difficult for new players to challenge its market presence.

Porter's Five Forces Analysis Data Sources

Our ACADIA Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official company filings (10-K, 10-Q), industry-specific market research reports, and reputable financial news outlets to capture current competitive dynamics.