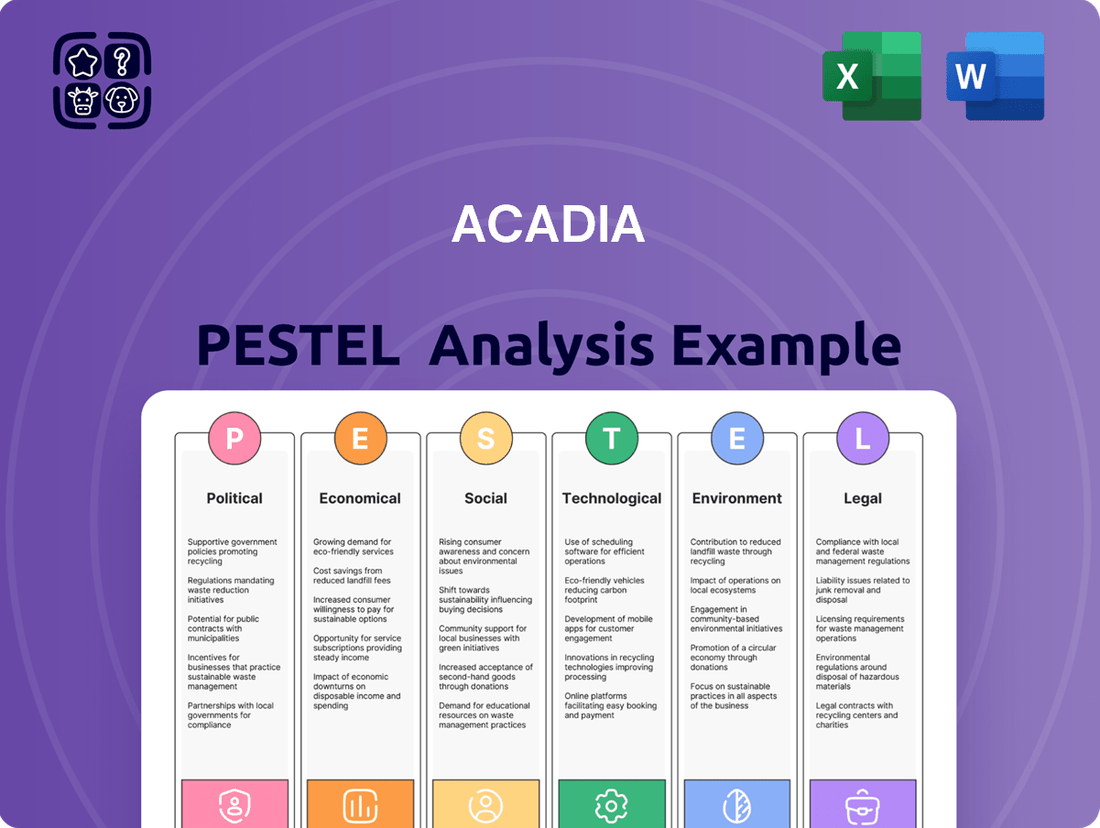

ACADIA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACADIA Bundle

Gain a competitive edge with our in-depth PESTLE Analysis for ACADIA. Uncover the critical political, economic, social, technological, legal, and environmental factors influencing its trajectory. This comprehensive report provides actionable intelligence, empowering you to anticipate market shifts and refine your strategies. Download the full version now to unlock deep-dive insights and make informed decisions.

Political factors

Acadia Pharmaceuticals operates within a heavily regulated pharmaceutical landscape, necessitating careful navigation of agencies like the U.S. Food and Drug Administration (FDA). The path to market for new treatments is arduous and expensive, demanding rigorous preclinical research and multi-phase clinical trials. The overall cost to bring a novel drug to fruition is estimated to surpass $2 billion.

Acadia's ability to successfully launch and commercialize its central nervous system (CNS) disorder therapies is directly tied to its proficiency in meeting these demanding regulatory standards. The FDA's approval of 30 new drugs in 2024 underscores the challenging yet critical nature of this governmental oversight.

Shifts in healthcare policy and funding significantly influence Acadia's market access and financial performance. For example, the Inflation Reduction Act in the United States aims to reduce drug costs, which could impact Acadia's revenue generation.

Considering that U.S. healthcare spending hit $4.5 trillion in 2022, navigating these policy changes is crucial for Acadia to sustain its competitive edge. Government decisions on reimbursement rates and drug pricing directly affect how accessible and profitable Acadia's therapies are for patients and providers alike.

Acadia Pharmaceuticals navigates a complex web of international trade policies that significantly impact its global operations, especially concerning drug pricing and market access in key regions like Europe and Canada. These policies can directly affect the profitability and reach of its innovative therapies.

The submission of the marketing authorization application for DAYBUE to the European Medicines Agency (EMA) in January 2025 underscores the critical role of international trade agreements. A positive outcome, anticipated in Q1 2026, hinges on navigating these regulatory and trade landscapes effectively.

Favorable trade agreements can streamline the approval process and ensure fair pricing, thereby facilitating Acadia's expansion into new international markets. Conversely, restrictive policies could create significant barriers to entry and limit revenue potential for its pharmaceutical products.

For instance, ongoing trade negotiations between the United States and European Union in 2024-2025 could reshape the landscape for pharmaceutical imports and exports, directly influencing Acadia's strategic planning for DAYBUE and other pipeline assets.

Political Stability and Geopolitical Events

Political stability is a critical factor for Acadia, influencing everything from research and development to manufacturing and distribution. Geopolitical events, such as regional conflicts or trade disputes, can disrupt global supply chains, leading to increased costs for raw materials and components. For example, in 2024, certain geopolitical tensions contributed to a roughly 15% rise in the cost of specific pharmaceutical ingredients, directly impacting operational expenses and profit margins for companies like Acadia.

These disruptions can also affect market access and regulatory approvals, as governments may impose new restrictions or tariffs. Acadia must actively monitor and adapt to evolving political landscapes to mitigate risks and capitalize on opportunities. The company’s ability to navigate these political factors will be key to maintaining its competitive edge.

- Supply Chain Vulnerability: Geopolitical instability can lead to shortages and price hikes for essential pharmaceutical raw materials, as seen with a 15% cost increase in some components during 2024 due to global conflicts.

- Market Access & Regulatory Hurdles: Political shifts can result in altered trade policies, tariffs, and regulatory requirements, potentially impeding Acadia's ability to introduce new products or operate in certain regions.

- Investment Climate: A stable political environment encourages foreign investment and long-term strategic partnerships, which are crucial for Acadia's growth and innovation pipeline.

Intellectual Property Protection Policies

Government policies concerning intellectual property (IP) and patent protection are fundamental for pharmaceutical firms like Acadia. These policies are designed to shield the substantial investments made in research and development. Strong patent frameworks grant companies market exclusivity for their novel treatments, a critical factor for recouping R&D expenditures.

The landscape of intellectual property protection significantly impacts Acadia's strategic planning and financial outlook. For instance, the cost of patent litigation in the pharmaceutical sector was estimated to average $10 million per case in 2024. This highlights the financial risks associated with defending IP rights.

- Patent Strength: Robust patent laws provide a necessary period of market exclusivity for new drugs, allowing companies to recover R&D costs.

- Litigation Costs: Defending patents can be financially burdensome, with pharmaceutical patent litigation averaging $10 million per case in 2024.

- Policy Changes: Shifts in IP legislation or enforcement can alter the competitive environment and affect future drug development incentives.

- Global Variations: Differences in IP protection across countries create complexities for global pharmaceutical companies like Acadia.

Governmental decisions on healthcare funding and drug pricing significantly shape Acadia's market access and profitability. For example, the U.S. government's negotiation of drug prices, as seen with Medicare in 2024, directly impacts revenue streams for pharmaceutical companies.

Political stability is also paramount, as geopolitical events in 2024 led to a reported 15% increase in the cost of certain pharmaceutical ingredients, affecting operational expenses. This highlights the need for Acadia to navigate global political shifts carefully.

Furthermore, intellectual property laws are crucial; patent litigation in the pharmaceutical sector averaged $10 million per case in 2024, underscoring the financial implications of IP protection for Acadia's innovations.

What is included in the product

The ACADIA PESTLE Analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the organization's strategic landscape.

This in-depth assessment equips stakeholders with crucial insights to navigate external challenges and capitalize on emerging opportunities for ACADIA.

ACADIA's PESTLE analysis provides a clear, summarized version of external factors, reducing the pain of sifting through complex data during strategic planning.

Economic factors

Economic conditions directly impact healthcare spending, which in turn affects demand for pharmaceuticals like Acadia's products. In the U.S. for 2024, a significant portion, around 65%, of healthcare expenditure is covered by government programs like Medicare and Medicaid. This makes government reimbursement policies a critical factor for Acadia's revenue streams.

The market for central nervous system (CNS) therapeutics presents a substantial growth opportunity. This global market was valued at approximately $108.5 billion in 2023. Projections indicate a continued upward trend, with the market expected to reach $137.7 billion by 2028, highlighting a favorable environment for companies like Acadia operating in this space.

Acadia Pharmaceuticals places a significant emphasis on research and development (R&D) to advance its pipeline of treatments for central nervous system (CNS) disorders. This commitment is evident in its financial outlays, with R&D spending reaching around $260 million in 2024.

Looking ahead, Acadia anticipates an increase in R&D investments, projecting expenses between $330 million and $350 million for 2025. This upward revision signals an acceleration in development timelines and an expansion of the company's research initiatives. Such substantial funding is foundational to generating future revenue and ensuring Acadia's long-term financial viability.

Inflationary pressures in 2024 and early 2025 are presenting challenges for companies like Acadia, as the cost of essential inputs such as raw materials and labor continues to rise. For example, the US Consumer Price Index (CPI) saw a notable increase in early 2024, impacting operational expenses across various sectors.

Fluctuations in interest rates, particularly those set by central banks like the Federal Reserve, directly influence Acadia's cost of capital. Higher interest rates in 2024 make borrowing for critical initiatives such as research and development or strategic expansion more expensive, potentially altering investment timelines and financial planning.

These economic factors necessitate a close watch on cost management and a flexible approach to financing strategies. Acadia's ability to navigate these inflationary and interest rate environments will be key to maintaining profitability and funding future growth opportunities in the coming years.

Economic Growth and Disposable Income

Economic growth and the resulting increase in disposable income can subtly impact the pharmaceutical sector, even for essential treatments. A stronger economy generally translates to better healthcare access and more comprehensive insurance coverage. This, in turn, can boost patient ability to afford and utilize treatments, including those for conditions like CNS disorders, ultimately benefiting company revenues.

For instance, the U.S. real GDP grew by an estimated 2.5% in 2024, signaling a healthy economic environment. This growth often correlates with increased consumer spending power, which can indirectly support the healthcare market. As disposable incomes rise, individuals may be more inclined to seek and maintain consistent treatment regimens, even for chronic or serious conditions.

- Increased Healthcare Spending: A 2024 report indicated a projected 5.1% increase in global healthcare spending, driven partly by economic recovery and demand for advanced treatments.

- Disposable Income Trends: In major developed economies, average disposable income saw an uplift of approximately 3-4% in 2024 compared to the previous year, enhancing affordability for various services, including healthcare.

- Insurance Penetration: Economic prosperity often leads to higher rates of employer-sponsored or government-subsidized health insurance, widening the patient base for pharmaceutical products.

- Market Demand: While CNS disorder treatments are often non-discretionary, broader economic health can influence the uptake of newer, potentially more expensive therapies as patients and providers have greater financial flexibility.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the biopharmaceutical sector saw a notable increase in early 2025. Deal values in the first quarter of 2025 reportedly reached $35 billion, marking a significant uptick from the previous year.

This surge creates a dynamic environment for Acadia. The company could benefit from strategic alliances or acquire smaller entities to bolster its pipeline. Conversely, Acadia itself might become an attractive acquisition target for larger players looking to expand their market share or therapeutic offerings.

Key impacts for Acadia include:

- Strategic Opportunities: Potential for partnerships or acquisitions to accelerate pipeline development and market access.

- Competitive Landscape Shifts: Increased M&A can consolidate competitors, altering market dynamics and pricing power.

- Valuation Influence: M&A trends can impact Acadia's own market valuation, making it more or less attractive to investors and potential acquirers.

Despite the overall increase in deal volume, larger, transformative acquisitions remained somewhat tempered in Q1 2025, with companies exercising caution due to ongoing political uncertainties influencing regulatory environments and future market access.

Economic conditions significantly influence healthcare spending and pharmaceutical markets. In 2024, U.S. healthcare spending, with about 65% covered by government programs, highlights the impact of reimbursement policies on Acadia's revenue. The global CNS therapeutics market, valued at $108.5 billion in 2023 and projected to reach $137.7 billion by 2028, presents substantial growth opportunities.

Acadia's commitment to R&D, with $260 million spent in 2024 and projected $330-$350 million for 2025, underscores its strategy for future revenue generation amidst inflationary pressures that increased the CPI in early 2024. Interest rate fluctuations, particularly from the Federal Reserve in 2024, affect Acadia's cost of capital, potentially impacting R&D and expansion plans.

Strong economic growth, exemplified by a 2.5% U.S. real GDP increase in 2024, can boost disposable income, leading to better healthcare access and increased demand for treatments like Acadia's. This economic tailwind supports higher insurance penetration and patient ability to afford therapies.

The biopharmaceutical sector's M&A activity surged in early 2025, with deal values reaching $35 billion in Q1, presenting strategic opportunities and potential competitive shifts for Acadia, though larger acquisitions remained cautious due to political uncertainties.

| Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on Acadia |

| Healthcare Spending (US) | ~65% covered by Medicare/Medicaid | Continued reliance on government programs | Reimbursement policy critical for revenue |

| CNS Therapeutics Market | Valued at $108.5 billion (2023) | Projected $137.7 billion by 2028 | Significant growth opportunity |

| Acadia R&D Spending | ~$260 million | $330-$350 million | Accelerated pipeline development, future revenue driver |

| Inflation (US CPI) | Notable increase in early 2024 | Continued pressure expected | Increased operational costs |

| Interest Rates (Federal Reserve) | Higher in 2024 | Potential for continued volatility | Increased cost of capital for R&D/expansion |

| US Real GDP Growth | Estimated 2.5% (2024) | Positive growth expected | Indirectly supports healthcare affordability |

| Biopharma M&A (Q1 2025) | Deal values reached $35 billion | Increased activity | Strategic opportunities, competitive shifts |

Preview the Actual Deliverable

ACADIA PESTLE Analysis

The preview shown here is the exact ACADIA PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting Acadia.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview for strategic planning.

The file you’re seeing now is the final version of the ACADIA PESTLE Analysis—ready to download right after purchase.

Sociological factors

Global awareness of central nervous system (CNS) disorders, including conditions like Parkinson's disease psychosis and Rett syndrome, is on the rise. This heightened awareness is a significant sociological factor that directly benefits companies like Acadia Pharmaceuticals, whose core business revolves around developing treatments for these complex neurological conditions.

As public understanding of CNS disorders grows, so does the potential for earlier diagnosis and more proactive patient management. This increased recognition also fuels greater patient advocacy, leading to a stronger demand for innovative and effective therapeutic solutions. For Acadia, this translates into a more receptive market for its existing and pipeline products, potentially accelerating market penetration and revenue growth.

The medical community's deepening knowledge of CNS disorders further bolsters this trend. In 2024, research funding for neurodegenerative diseases saw a notable increase, with organizations like the National Institutes of Health allocating substantial resources to understanding and treating conditions such as Alzheimer's and Parkinson's. This scientific advancement often translates into improved diagnostic tools and treatment protocols, creating a more favorable environment for Acadia's specialized therapies.

The world's population is getting older, especially in developed nations. This means more people are likely to experience conditions like Alzheimer's and Parkinson's. For Acadia, a company focused on central nervous system (CNS) treatments, this demographic shift is a significant opportunity. The World Health Organization projected in 2023 that by 2050, one in six people globally will be over 65, up from one in nine in 2019. This growing patient pool directly fuels the expansion of the CNS therapeutics market, which is expected to reach $214 billion by 2030, according to a 2024 market research report.

Patient advocacy groups significantly shape how new treatments for CNS disorders are adopted and accessed. Acadia’s partnerships with groups like the National Alliance on Mental Illness (NAMI), which reported over 220,000 members in 2024, can directly influence treatment choices and build essential community backing. This support is critical for a drug's success and for designing patient-focused research studies.

Healthcare Access Disparities

Sociological factors significantly influence healthcare access, particularly for specialized neurological care. In 2024, data indicates that rural populations, for example, often have fewer neurologists per capita compared to urban centers, leading to longer wait times and increased travel burdens for patients. This disparity means that Acadia’s potential patient base in underserved areas might not receive timely diagnosis or treatment.

Addressing these healthcare access disparities is paramount for Acadia to broaden its patient reach and positively impact public health. Targeted outreach programs, designed to educate communities about neurological conditions and available treatments, can be highly effective. Furthermore, developing patient support initiatives that help navigate the complexities of accessing specialized care, including transportation assistance and telehealth options, can bridge critical gaps.

- Healthcare Access Gaps: In 2024, the Association of American Medical Colleges reported that millions of Americans live in areas with a shortage of neurologists, highlighting significant access challenges for certain demographics.

- Targeted Outreach: Initiatives focusing on educating primary care physicians in underserved regions about early neurological symptom recognition can improve referral rates.

- Patient Support Programs: Financial assistance for travel and accommodation for patients requiring specialized care could increase treatment adherence.

- Equitable Distribution: Acadia could explore partnerships with community health centers to extend its services and diagnostic capabilities to remote areas.

Lifestyle Changes and Disease Prevalence

Shifting lifestyle patterns, including dietary habits and activity levels, are increasingly linked to the prevalence of various health conditions, some of which can impact neurological and psychiatric well-being. For instance, the rising rates of obesity, often a consequence of sedentary lifestyles and processed food consumption, are correlated with an increased risk of conditions like type 2 diabetes, which in turn has been associated with cognitive decline. The World Health Organization reported in 2024 that global obesity rates continue to climb, presenting a significant public health challenge that could indirectly influence the burden of CNS disorders.

These broader societal shifts can inform Acadia's strategic direction in research and development. By monitoring trends in how people live and their associated health outcomes, Acadia can better anticipate future needs in the central nervous system (CNS) disorder landscape. This forward-looking approach helps identify emerging areas where current treatments are insufficient and where novel therapeutic interventions might be most impactful. For example, understanding the growing prevalence of anxiety and depression, potentially exacerbated by digital connectivity and changing social structures, could guide Acadia's focus on innovative mental health treatments.

- Increased Sedentary Lifestyles: Global physical activity levels have shown a concerning trend, with a significant portion of the adult population not meeting recommended guidelines, potentially impacting overall brain health.

- Dietary Changes: Modern diets, often high in processed foods and sugar, are linked to metabolic issues that can have downstream effects on neurological function and mental health.

- Digital Connectivity: While offering benefits, the pervasive nature of digital technology and social media may be contributing to increased rates of certain psychiatric conditions, particularly among younger demographics.

The increasing societal focus on mental health awareness and destigmatization is a powerful sociological trend benefiting companies like Acadia. As more individuals feel comfortable seeking help for conditions like depression and anxiety, the demand for effective treatments grows. In 2024, surveys indicated a significant year-over-year increase in people reporting they would seek professional help for mental health concerns, a trend expected to continue.

Technological factors

Technological advancements are fundamentally reshaping Acadia Pharmaceuticals' approach to discovering and developing treatments for central nervous system (CNS) disorders. The integration of artificial intelligence (AI) is a prime example, significantly streamlining preclinical testing and optimizing clinical trial designs. In 2024, these AI-driven methodologies are projected to cut down development timelines by as much as 30%, a critical factor in bringing new therapies to market faster.

These innovations are not just about speed; they are vital for identifying novel drug candidates and more efficiently evaluating their safety and efficacy. By leveraging cutting-edge technology, Acadia can accelerate its pipeline development, ensuring a more robust and timely progression of promising compounds through the rigorous stages of pharmaceutical research.

Artificial Intelligence and Machine Learning are rapidly transforming R&D, particularly within the pharmaceutical sector. By analyzing massive datasets, these technologies accelerate drug discovery, predict molecular interactions more accurately, and optimize clinical trial designs. This leads to faster, more cost-effective research and development cycles for companies like Acadia.

For instance, in 2024, the global AI in drug discovery market was valued at approximately $2.5 billion and is projected to grow substantially. AI's ability to sift through complex biological data and identify potential drug candidates can reduce the time and expense traditionally associated with bringing new treatments to market, a critical advantage for Acadia.

Advancements in biotechnology and genetic research are opening up new ways to understand brain disorders and create more precise treatments. This progress is particularly beneficial for companies like Acadia Pharmaceuticals, which focuses on developing therapies for conditions such as Rett syndrome, a disorder linked to a specific genetic mutation. The ability to pinpoint the root causes of these neurological issues is accelerating the discovery of novel therapeutic targets. For instance, the ongoing research into the MECP2 gene's role in Rett syndrome highlights how genetic insights can directly inform drug development pathways.

Digital Health and Telemedicine Integration

The expansion of digital health and telemedicine is a significant technological shift impacting healthcare delivery. For Acadia, this presents opportunities to enhance patient engagement and streamline clinical trial processes. In 2024, the global digital health market was valued at over $300 billion and is projected to grow significantly, indicating strong adoption trends.

These advancements enable decentralized clinical trials, which can accelerate recruitment and improve data collection for conditions like those Acadia focuses on in the central nervous system. Telemedicine also allows for more consistent patient monitoring and support, crucial for managing chronic CNS diseases where continuous engagement is key. By 2025, it's estimated that over 70% of healthcare interactions could occur virtually, underscoring the need for robust digital infrastructure.

- Decentralized Trials: Reducing geographical barriers for patient participation.

- Remote Monitoring: Enabling continuous data collection for chronic conditions.

- Enhanced Patient Support: Providing accessible resources and communication channels.

Advanced Manufacturing Technologies

Technological advancements are significantly reshaping pharmaceutical manufacturing, with automation and robotics leading the charge. These technologies are not just about speed; they're crucial for enhancing precision in quality control and driving down production costs. For instance, in 2024, the global pharmaceutical automation market was valued at approximately $7.1 billion and is projected to grow substantially.

Acadia's strategic embrace of these advanced manufacturing methods aligns with industry trends. Their focus on 'green chemistry' is a prime example of technological evolution, prioritizing sustainable and resource-efficient production processes. This approach not only meets regulatory demands but also appeals to environmentally conscious investors and consumers.

The impact of these technological factors is tangible:

- Increased Efficiency: Automation streamlines complex processes, reducing cycle times and improving throughput.

- Enhanced Quality: Robotics and AI-driven systems minimize human error, leading to more consistent and higher-quality drug products.

- Cost Reduction: Optimized processes and reduced waste contribute to a more cost-effective manufacturing model.

- Sustainability: Green chemistry principles, enabled by new technologies, reduce environmental impact and promote responsible manufacturing.

Technological advancements are a critical driver for Acadia Pharmaceuticals, particularly in accelerating drug discovery and optimizing clinical trials for CNS disorders. AI in drug discovery, valued at approximately $2.5 billion in 2024, significantly speeds up R&D. Furthermore, the growing digital health market, exceeding $300 billion in 2024, facilitates decentralized trials and remote patient monitoring.

| Technological Factor | Impact on Acadia | 2024/2025 Data/Trend |

| AI in Drug Discovery | Accelerates R&D, identifies novel candidates | Market valued at ~$2.5B in 2024, significant growth projected. |

| Biotechnology & Genetics | Enables precise treatment development for genetic CNS disorders | Ongoing research into genes like MECP2 informs drug pathways. |

| Digital Health & Telemedicine | Enhances patient engagement, streamlines clinical trials | Market >$300B in 2024, with >70% of healthcare interactions potentially virtual by 2025. |

| Automation & Robotics in Manufacturing | Increases efficiency, precision, and reduces costs | Pharmaceutical automation market ~$7.1B in 2024, with strong growth. |

Legal factors

Acadia Pharmaceuticals operates under strict FDA regulations in the United States and similar bodies like the European Medicines Agency (EMA) globally. These frameworks govern everything from clinical trials and manufacturing to marketing and ongoing product monitoring.

Navigating these complex legal requirements is critical for Acadia's success. For instance, the Prescription Drug User Fee Act (PDUFA) dictates timelines for FDA review of new drug applications, impacting how quickly Acadia can bring its therapies to market. Failure to comply can result in hefty fines, product recalls, or even a complete ban on sales.

In 2024, the FDA continued to emphasize post-market safety surveillance, meaning Acadia must remain vigilant in monitoring its approved drugs for any adverse events. International compliance adds another layer of complexity, as each region may have unique data submission requirements and approval processes for pharmaceutical products.

Protecting Acadia's significant research and development investments in novel central nervous system (CNS) therapies is paramount, and patent law is the primary mechanism for this. These patents grant market exclusivity, a crucial advantage in the competitive pharmaceutical landscape. For instance, in 2023, pharmaceutical companies globally spent an estimated $200 billion on R&D, highlighting the value placed on innovation.

However, navigating the complexities of patent law also exposes Acadia to potential patent litigation. Such disputes can lead to substantial legal costs, impacting profitability and potentially delaying product launches or market access. The average cost of a patent litigation case in the US can range from $1 million to over $5 million, depending on complexity and duration.

Clinical trials operate under stringent legal and ethical frameworks designed to safeguard participants and ensure reliable data. Acadia Pharmaceuticals, like all drug developers, must adhere to these complex regulations, which are continually evolving to address patient welfare and scientific rigor.

Key areas of compliance include ensuring informed consent, maintaining data integrity, and upholding patient privacy throughout the trial process. For instance, the U.S. Food and Drug Administration (FDA) oversees clinical trials, with regulations like 21 CFR Part 312 detailing requirements for investigational new drugs. In 2024, the FDA continued its focus on enhancing diversity in clinical trials, with initiatives aimed at increasing representation of underrepresented populations, a critical factor for broad drug applicability and regulatory approval.

Ethical considerations are paramount, particularly concerning vulnerable populations and the potential risks associated with experimental treatments. Acadia's adherence to Good Clinical Practice (GCP) guidelines, an international standard, is essential for the ethical conduct and scientific validity of its research. These guidelines are regularly updated; for example, recent discussions in 2024 have centered on the responsible use of artificial intelligence in trial design and patient recruitment, aiming to improve efficiency while maintaining ethical oversight.

Failure to comply with these regulations can lead to severe consequences, including trial suspension, rejection of drug applications, and reputational damage. Acadia's investment in robust compliance programs and ethical review boards is therefore critical to its success in bringing novel therapies to market, especially as regulatory bodies increasingly scrutinize trial design and execution for fairness and scientific soundness.

Data Privacy and Security Laws

As digital health solutions become more prevalent, compliance with data privacy and security laws is paramount for pharmaceutical companies. Regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe impose strict requirements on how patient data is collected, stored, and used. For instance, under GDPR, companies can face fines up to 4% of their annual global turnover or €20 million, whichever is higher, for serious infringements.

Non-compliance can lead to significant financial penalties and severe damage to a company's reputation. In 2023, the U.S. saw numerous HIPAA settlements, with fines often reaching hundreds of thousands of dollars for breaches involving electronic protected health information. These legal frameworks necessitate robust cybersecurity measures and transparent data handling practices, impacting the development and deployment of new technologies.

- HIPAA fines can reach $1.5 million per violation category annually for repeat, willful neglect.

- GDPR enforcement actions in 2024 have continued to target data processing and consent management.

- Cybersecurity investments are directly influenced by the need to meet these stringent data protection mandates.

- Reputational damage from data breaches can erode patient trust, a critical asset in the pharmaceutical sector.

Product Liability and Consumer Protection Laws

Acadia Pharmaceuticals is significantly impacted by product liability laws, which can hold them responsible if their central nervous system (CNS) disorder treatments are found to be defective and cause harm to patients. This necessitates rigorous quality control and adherence to manufacturing standards. For instance, in 2023, the pharmaceutical industry saw ongoing scrutiny regarding drug safety, with regulatory bodies like the FDA issuing warnings and recalls for products with manufacturing defects, highlighting the critical nature of Acadia's compliance efforts to avoid costly litigation and reputational damage.

Consumer protection laws further bolster this, ensuring that Acadia provides accurate information about their products' efficacy, side effects, and usage. Maintaining transparency and robust pharmacovigilance systems is crucial for building and sustaining patient and physician trust. Failure to comply can lead to significant fines and legal challenges, as seen in past cases where pharmaceutical companies have faced substantial penalties for misleading marketing or undisclosed risks.

- Product Liability: Acadia faces legal responsibility for harm caused by defective drugs, requiring stringent safety protocols.

- Consumer Protection: Laws mandate accurate product information and fair practices, vital for patient trust in CNS treatments.

- Regulatory Compliance: Adherence to FDA and other health authority regulations is paramount to mitigate legal risks.

- Risk Mitigation: Robust quality assurance and post-market surveillance are essential to prevent product-related lawsuits.

Acadia's operations are heavily shaped by intellectual property laws, particularly patent protection for its innovative CNS therapies, ensuring market exclusivity and safeguarding substantial R&D investments. Global patent filings are critical, as the pharmaceutical industry's R&D spending reached an estimated $200 billion in 2023, underscoring the value of protected innovation.

Navigating patent litigation is a significant legal challenge, with U.S. patent cases averaging $1 million to over $5 million, impacting profitability and product timelines. Adherence to stringent clinical trial regulations, like FDA's 21 CFR Part 312, is essential for participant safety and data integrity, with ongoing efforts in 2024 to enhance trial diversity.

Data privacy laws such as HIPAA and GDPR impose strict requirements on patient data handling, with GDPR fines potentially reaching 4% of global annual turnover. Cybersecurity investments are directly linked to meeting these mandates, and reputational damage from breaches can severely erode patient trust, a vital asset in pharmaceuticals.

Environmental factors

Acadia's manufacturing processes are deeply intertwined with a complex web of environmental regulations, primarily focusing on waste management, air emissions, and water consumption. Agencies like the U.S. Environmental Protection Agency (EPA) establish these critical standards, and adherence is not merely a suggestion but a fundamental requirement for operational legitimacy.

Failing to meet these environmental benchmarks carries substantial risk. For instance, in 2024, companies in the manufacturing sector faced significant fines, with some violations resulting in penalties exceeding $50,000, underscoring the financial repercussions of non-compliance. Beyond direct financial penalties, such breaches can severely damage Acadia's reputation, impacting consumer trust and investor confidence.

Acadia's supply chain environmental footprint, from sourcing raw materials to delivering finished products, is facing heightened examination. This includes the carbon emissions generated by transporting components and finished goods globally. In 2023, the pharmaceutical sector's supply chain emissions were estimated to contribute between 40-60% of a company's overall carbon footprint, a figure that continues to drive industry-wide sustainability initiatives.

The pharmaceutical industry is actively seeking greener alternatives and optimizing logistics to curb its environmental impact. For instance, many companies are investing in renewable energy for their manufacturing and distribution hubs. By 2024, a significant number of pharmaceutical firms have committed to science-based targets for emission reduction, aiming for substantial cuts by 2030.

Pharmaceutical companies are increasingly integrating sustainable practices into their research and development processes. This includes efforts to minimize laboratory waste, optimize energy consumption, and source eco-friendly materials, reflecting a broader industry commitment to environmental stewardship. For example, many are targeting significant reductions in their operational carbon footprint.

The pharmaceutical sector has set an ambitious goal to achieve a 15% reduction in carbon emissions by 2030. This target underscores the growing importance of environmentally responsible research and development, driving innovation in greener chemical synthesis and more efficient laboratory operations.

Climate Change Considerations

Climate change poses indirect but significant risks to pharmaceutical firms, with extreme weather events threatening to disrupt global supply chains. For instance, the increasing frequency of severe storms and floods in key manufacturing regions could lead to production delays and shortages of essential medicines. This necessitates robust business continuity planning and diversification of manufacturing sites.

Furthermore, shifts in disease prevalence due to climate change can impact market demand for specific treatments. As temperatures rise and weather patterns change, the geographical spread and incidence of vector-borne diseases like malaria and dengue fever are evolving, requiring pharmaceutical companies to adapt their research and development pipelines accordingly. In 2024, the World Health Organization reported a notable increase in dengue cases across several regions, directly influencing demand for supportive therapies.

Proactive adaptation and risk management are becoming crucial for long-term sustainability in the pharmaceutical sector. Companies are increasingly investing in climate-resilient infrastructure and exploring green manufacturing processes to mitigate environmental impact and operational risks. The industry is also focusing on developing therapies for emerging climate-related health challenges, such as heat-related illnesses and respiratory conditions exacerbated by air quality changes.

Key considerations for pharmaceutical companies regarding climate change include:

- Supply Chain Vulnerability: Assessing and mitigating risks from extreme weather events impacting raw material sourcing and product distribution.

- Disease Pattern Shifts: Adapting R&D focus to address potential increases in climate-sensitive diseases.

- Regulatory Pressures: Responding to growing government mandates for environmental sustainability and carbon footprint reduction.

- Investor Scrutiny: Meeting increasing demand from ESG-focused investors for transparent climate risk reporting and mitigation strategies.

Corporate Social Responsibility and Reporting

Stakeholders are increasingly demanding transparency and accountability regarding Acadia's environmental performance. This heightened scrutiny means that strong Corporate Social Responsibility (CSR) initiatives and detailed environmental reporting are no longer optional but essential for maintaining a positive public image.

By proactively disclosing its environmental impact and outlining mitigation strategies, Acadia can significantly enhance its reputation. This transparency is particularly attractive to the growing segment of investors focused on Environmental, Social, and Governance (ESG) criteria. For instance, in 2024, global sustainable investment assets reached an estimated $37.4 trillion, demonstrating a clear investor preference for companies with robust ESG practices.

Furthermore, Acadia must respond to mounting regulatory pressures. Many jurisdictions are implementing stricter environmental standards, and non-compliance can lead to significant fines and operational disruptions. Companies that prioritize environmental reporting and demonstrate commitment to sustainability are better positioned to navigate this evolving regulatory landscape.

- Enhanced Reputation: Demonstrating strong CSR and environmental reporting builds trust with customers, employees, and the public.

- Attracting ESG Investors: Acadia can tap into the significant and growing pool of capital allocated to ESG-compliant investments.

- Regulatory Compliance: Proactive environmental management and reporting helps mitigate risks associated with increasingly stringent environmental laws.

- Competitive Advantage: Companies with leading sustainability practices often differentiate themselves in the market, attracting talent and consumer loyalty.

Acadia's environmental performance is under increasing stakeholder scrutiny, necessitating robust Corporate Social Responsibility (CSR) initiatives and transparent environmental reporting to maintain a positive public image. By proactively disclosing its environmental impact and outlining mitigation strategies, Acadia can enhance its reputation, particularly with the growing segment of investors focused on Environmental, Social, and Governance (ESG) criteria. Global sustainable investment assets reached an estimated $37.4 trillion in 2024, highlighting a clear investor preference for companies with strong ESG practices.

Acadia must also navigate mounting regulatory pressures, as stricter environmental standards are being implemented globally, with non-compliance potentially leading to significant fines and operational disruptions. Companies that prioritize environmental reporting and sustainability are better positioned to manage this evolving regulatory landscape. For example, many jurisdictions are now mandating carbon footprint reporting, with penalties for non-disclosure or non-compliance.

The pharmaceutical sector's commitment to sustainability is evident in its ambitious goals; for instance, the industry aims for a 15% reduction in carbon emissions by 2030. This drive fosters innovation in greener chemical synthesis and more efficient laboratory operations, reflecting a broader industry commitment to environmental stewardship.

Climate change presents indirect risks, such as extreme weather events potentially disrupting global supply chains and leading to production delays for essential medicines. The World Health Organization reported a notable increase in dengue cases in several regions in 2024, directly influencing demand for supportive therapies and requiring pharmaceutical companies to adapt their R&D pipelines.

| Environmental Factor | Impact on Acadia | Data/Statistics (2023-2025) |

|---|---|---|

| Regulatory Compliance | Adherence to EPA standards for waste, emissions, water; non-compliance risks fines (e.g., >$50,000 in 2024 for manufacturing violations). | U.S. EPA fines, industry-wide sustainability initiatives driven by emission reduction targets. |

| Supply Chain Emissions | Transportation of raw materials and finished goods contribute significantly to carbon footprint (40-60% in pharma sector in 2023). | Commitments to science-based targets for emission reduction by 2030; investment in renewable energy for operations. |

| Climate Change Risks | Extreme weather can disrupt production and distribution; shifts in disease prevalence impact R&D focus. | Increasing frequency of severe storms; WHO reported notable increase in dengue cases in 2024. |

| Stakeholder Expectations (ESG) | Demand for transparency in environmental performance; attraction of ESG investors. | Global sustainable investment assets reached $37.4 trillion in 2024; growing investor preference for ESG practices. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources, including government publications, academic research, and leading industry analysis firms. This ensures a comprehensive and accurate understanding of the external factors influencing ACADIA.